Cost Accounting: Records and Processes, Cost Ledger and Control Accounts | Management Optional Notes for UPSC PDF Download

Introduction

- The financial accounting system is designed to record the monetary aspects of business transactions, focusing on specific objectives. In contrast, the cost accounting system serves its unique set of objectives. Both systems collect transactions from common invoices, vouchers, or receipts used in financial accounting. Costs are then organized based on functions, departments, or products. While real and nominal accounts play a direct role in determining product costs, personal accounts and cash or bank accounts are not directly associated with cost ascertainment.

- In the maintenance of a cost accounting system, specific records are kept to document day-to-day transactions. Unlike financial accounting, cost accounting does not necessarily require adherence to a double-entry system. Cost books are typically maintained under two systems: I] Non-integral or non-integrated cost accounting, and II] Integral or integrated cost accounting. The integrated system combines cost and financial accounts, whereas the non-integrated system keeps these records separately.

Non-Integrated Accounting System

- It is an accounting system where separate ledgers are maintained for cost and financial accounts by accountants. This system focuses on recording transactions related to the product or service being provided, particularly those linked to sales, production, and other factors managed within the factory.

- Notably, the non-integrated system addresses notional expenses, such as rent or interest on capital tied up in stock. Accounting for notional rent facilitates comparisons between factories, whether owned or rented, while recognizing interest on capital tied up in stock informs store and works managers about the financial implications of holding stock.

- A distinctive characteristic of the non-integrated system is its reduced number of accounts compared to financial accounting. This reduction is due to the exclusion of purchases, expenses, and balance sheet items like fixed assets, debtors, and creditors. Excluded items are represented by an account known as the cost ledger control account.

Principal Ledgers

Under the non-integrated system of accounting, various subsidiary books are maintained to record specific aspects of business transactions. These subsidiary books help in detailed tracking and control of different elements within the organization.

Here are some subsidiary books commonly maintained in a non-integrated accounting system:

- Stores Ledger:

- Records both the quantity and amount of receipts, issues, and the balance of materials and supplies.

- Includes all store accounts for effective inventory management.

- Payroll and Wage Analysis Book:

- Records wages based on clock cards, time tickets, and piecework tickets.

- Provides a basis for accurate recording of labor-related transactions.

- Job Ledger:

- Records material costs, wages, and overheads associated with a specific job.

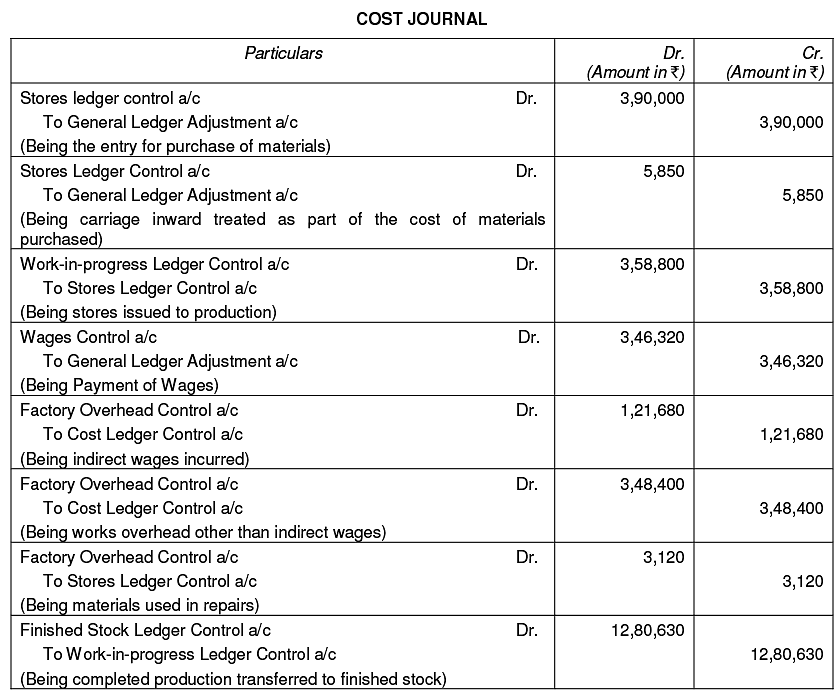

- Essential for tracking and analyzing costs related to individual projects or jobs.

- Finished Goods Stock Ledger:

- Records the receipt of finished goods from the production department.

- Tracks sales and maintains the stock of finished goods in terms of both quantity and value.

- Standing Order Ledger:

- Records overheads incurred for standing orders.

- Helps in monitoring and controlling fixed and recurring expenses.

- Debtors’ Ledger:

- Contains personal accounts of all trade debtors.

- Tracks transactions, outstanding balances, and payments related to customers.

- Creditors’ Ledger:

- Contains personal accounts of all trade creditors.

- Records transactions, outstanding amounts, and payments related to suppliers.

Control Accounts

Under the non-integrated accounting system, several crucial accounts are maintained to facilitate effective control and tracking of various financial aspects.

Here are the key accounts in a non-integrated accounting system:

- General Ledger Adjustment Account:

- Also known as the cost ledger control account or nominal ledger control account.

- Records transactions with a single entry, and contra entries appear in financial books.

- Captures income and expenditure transactions originating in financial accounts, eventually transferred to cost accounts.

- Total of this account equals the total of all balances of impersonal accounts.

- On the credit side, records opening balances of materials, work in progress, and finished stock, expenses of material, wages, and overheads, returns of materials to the supplier, sales income, and balancing entries of the profit and loss account and closing stock.

- Stores Ledger Control Account:

- Debited with the purchase of materials for the stores.

- Credited with issues of material.

- Wages Control Account:

- Records accrued and paid wages.

- Captures the allocation of wages.

- Work in Progress Control Account:

- Includes all direct materials, direct wages, direct expenses, special purchases, and expenses related to work in progress.

- Finished Goods Stock Ledger Control Account:

- Represents transactions from the finished goods stock ledger in total.

- Selling, Distribution, and Administration Overhead Control Account:

- Represents selling, distribution, and administration overheads.

These accounts play a critical role in systematically organizing and summarizing financial information related to materials, labor, overheads, and various other components. The meticulous recording and control of transactions in these accounts contribute to effective cost management and financial decision-making within the organization.

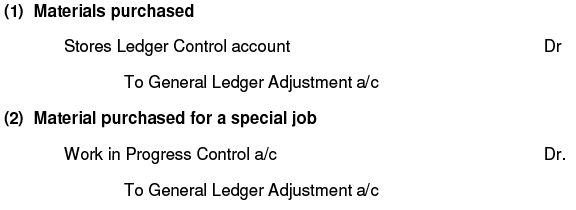

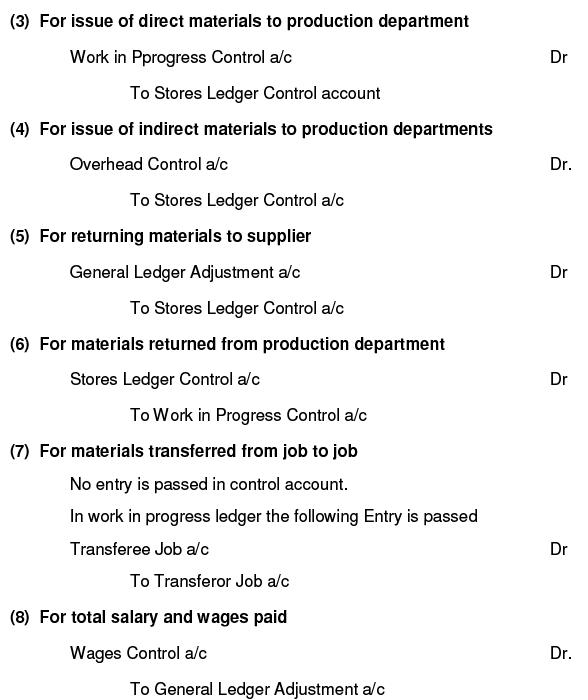

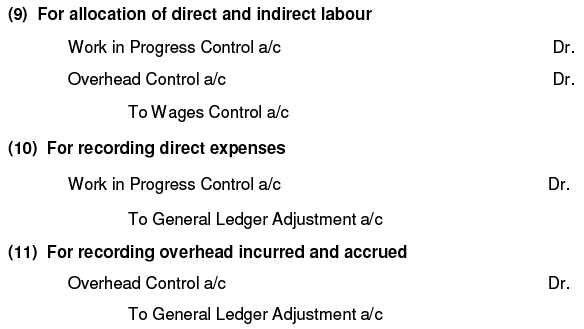

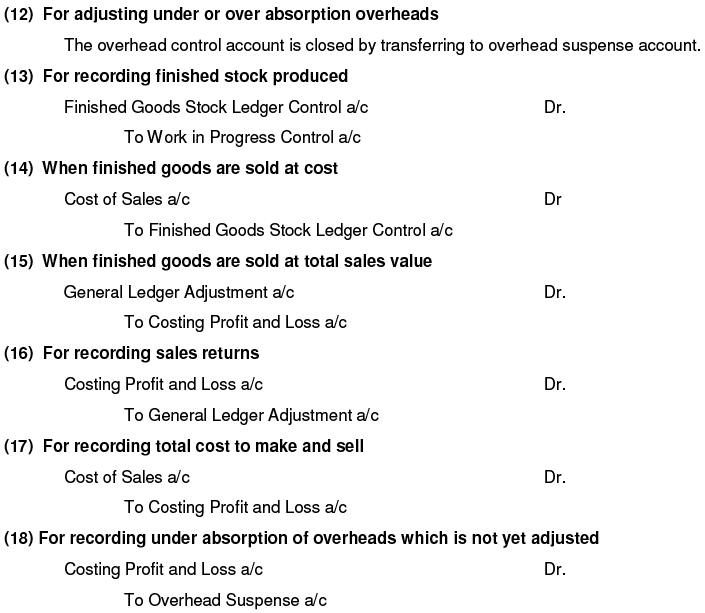

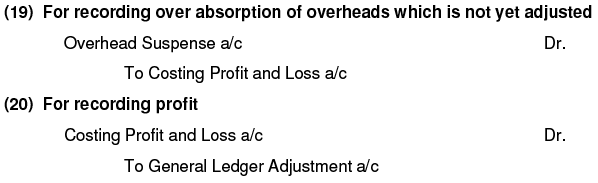

Entries to Record Transactions under Non-Integrated System

Advantages of Non-Integrated Accounting

The integrated accounting system offers several advantages:

- It promotes coordination among different sections of the accounts department, aligning efforts towards a common goal of achieving high efficiency.

- Simplification of accounting procedures is possible, and centralization can enhance organizational control.

- The system provides a conducive environment for the introduction of mechanized accounting.

- The likelihood of overlooking any expense is eliminated under this system.

- Data can be obtained promptly as cost accounts are directly posted from the original entry books.

- The system ensures an automatic check on the accuracy of cost data, preventing the omission of legitimate expenditures and providing reliable information for managerial decisions.

- Integrated accounting broadens the accountant's perspective.

- The maintenance of this system is flexible, as it is not mandatory by statute.

Limitations of Non-integrated Accounting

Here are some limitations of the integrated accounting system:

- The system does not record financial transactions beyond the incurred costs.

- Transactions that involve payments other than costs are not encompassed by the system, such as losses on fixed assets.

- Discrepancies commonly exist between the profits reported by the cost accounting system and those reported by the financial accounting system.

Integrated (integral) Accounting System

- Integrated Accounting refers to a system where accounts are consolidated, and only a single set of accounts is maintained for both cost and financial records. This approach eliminates the need for separate accounting records for cost and financial accounting, streamlining the process. By adopting integrated accounting, a company can forego maintaining distinct Profit and Loss Accounts for financial and cost accounting systems, opting instead for a unified Profit and Loss Account.

- This system provides comprehensive information for determining the cost of each unit and facilitates the preparation of a balance sheet in compliance with legal requirements. Moreover, it offers the necessary information for the needs of both the costing and finance departments. Unlike some accounting systems, Integrated Accounting does not involve the preparation of a General Ledger Control Account.

Benefits of Integrated Accounting System

The advantages of an Integrated Accounting System include:

- Elimination of the need for reconciliation due to the maintenance of a single set of accounting records.

- Simplified account maintenance, reducing unnecessary complications.

- Prevention of discrepancies in reported profit figures, ensuring consistency.

- Realization of economies of scale through savings in bookkeeping and general accounting procedures.

- Time-saving benefits, as there is no requirement to maintain two separate sets of books.

Pre-Requisites for an Integral Accounting System

The following principles should be considered when developing such a system:

- Determine the level of integration required. Some organizations may find it satisfactory to integrate only up to the prime cost or factory cost stage, while others may integrate the entire set of records where cost and financial accounts are indistinguishable.

- The chosen degree of integration will dictate the classification of expenditure. Expenditure is classified based on function, such as office expenses or selling expenses, rather than by nature. Control accounts are maintained for each cost element, and a suitable coding system should be in place to serve both financial and cost accounting needs.

- Provide the cost office with comprehensive details of items posted to the control accounts at regular intervals. The cost office will then handle this information according to the prevailing costing system.

- Minimize the level of detail recorded in the ledger. Comprehensive information about each department or process is maintained in tabulations created by the cost office. These tabulations, sometimes referred to as third entries, are distinct from the double-entry system.

- Establish an agreed routine for handling accruals, prepaid expenses, and other necessary adjustments when preparing interim accounts.

- Ensure perfect coordination between the staff responsible for financial and cost aspects to facilitate the efficient processing of accounting documents.

Essential Features of Integral Accounting

The integral accounting system exhibits the following key characteristics:

- It records financial transactions that are not typically required for cost accounting. In addition to recording internal costing transactions, prepayments and accruals are documented.

- Stores transactions are documented in the stores control account. This account is debited with the cost of stores purchased, with a corresponding credit to either cash or sundry creditors, depending on whether the purchase is made for cash or on credit.

- The wages control account is debited with the wages paid, and a contra credit is recorded in the cash or bank account.

- Overhead expenses are debited to the overhead control account, with a corresponding credit given to the cash or bank account or sundry creditors.

- Transactions related to material, labor costs, and overheads are posted in the stores, wages, and overhead control accounts after conducting suitable cost analyses. At the end of the period, the totals are transferred to work-in-progress accounts by crediting various control accounts. The day-to-day cost analysis, known as "making third etc.," is not actual ledger entries but serves as a form of cost analysis.

- All advance payments are credited, and accruals are debited to their respective control accounts through contra entries in the prepayments and accrual accounts.

- Capital asset accounts are debited, and respective control accounts are credited during the cost analysis of capital expenditure.

It is essential to recognize that integrated accounts share similarities with both non-integrated and financial systems of accounting. In the non-integrated system, no personal or real accounts are prepared, and all entries pass through the general ledger adjustment account. In the financial accounting system, there is no foundation for the cost accounting. In the integrated system of accounting, personal and real accounts are prepared, and there exists a foundation for the cost accounting system.

For Example, The same entry when passed through the three systems of accounting look like:

Solved Examples

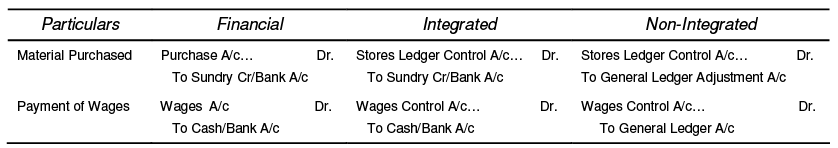

Example 1: Pass Journal Entries in the Cost Books [non-integrated systems] for the following transactions.

(a) Materials worth ₹50,000 returned to stores from job

(b) Gross total wages paid ₹96,000.

(c) Employer’s contribution to PF and State Insurance amount to ₹4000.

(d) Wages analysis book detailed ₹40,000 direct labour,

(e) ₹24,000 towards indirect factory labour

(f) ₹20, 000 towards salaries to office staff and ₹16,000 for salaries to selling and distribution staff.

Ans:

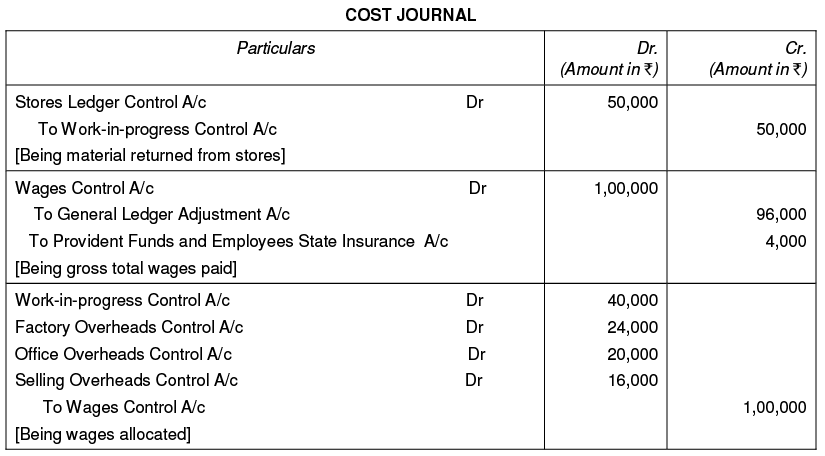

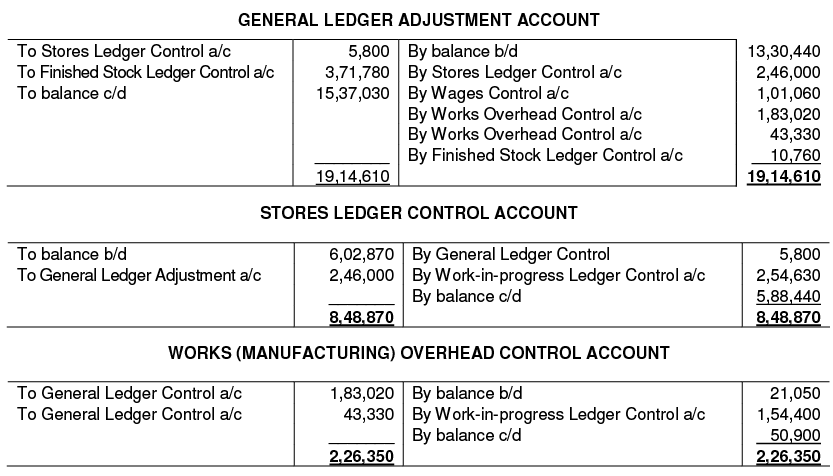

Example 2: The following figures have been ascertained from the costing records. You are required to pass the necessary entries in the cost journal. Assume that a system of maintaining control accounts prevails in the organisation.

Ans:

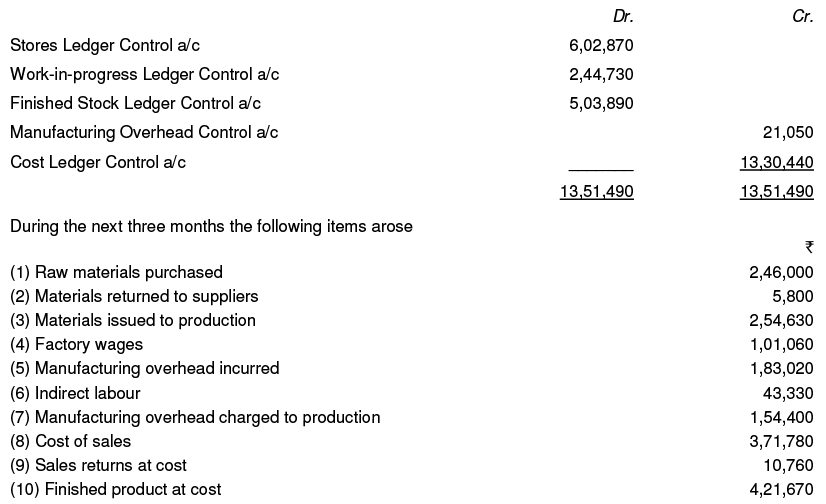

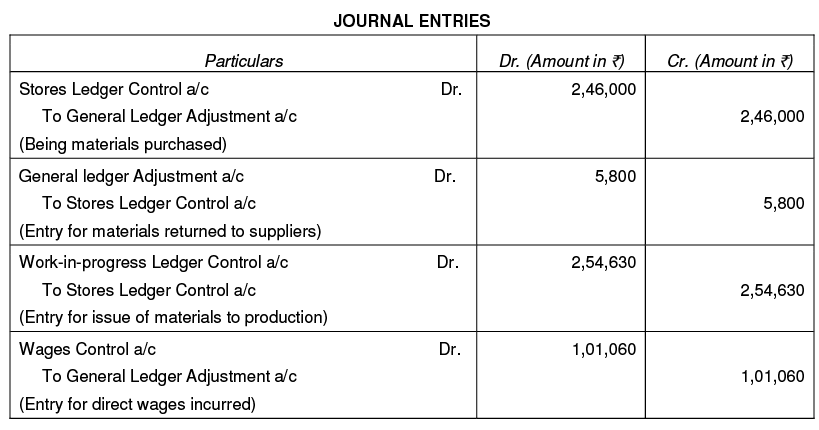

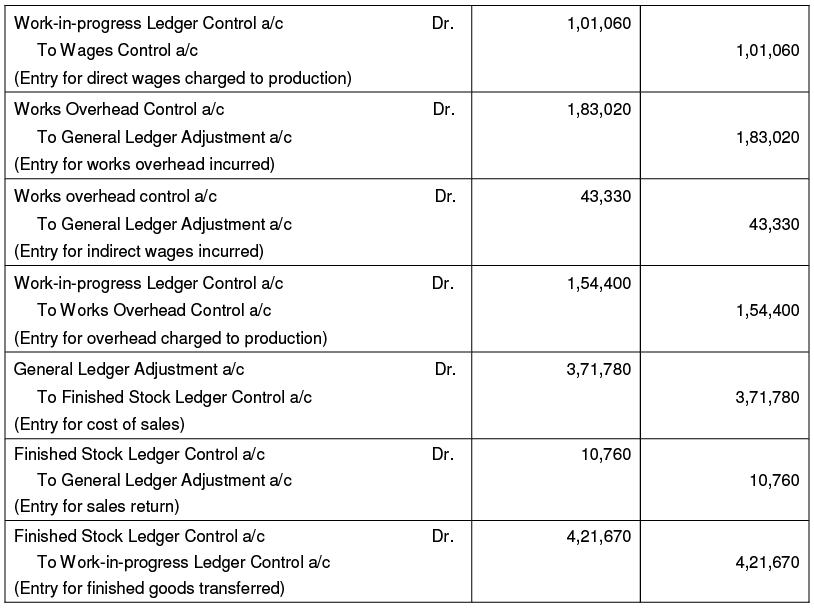

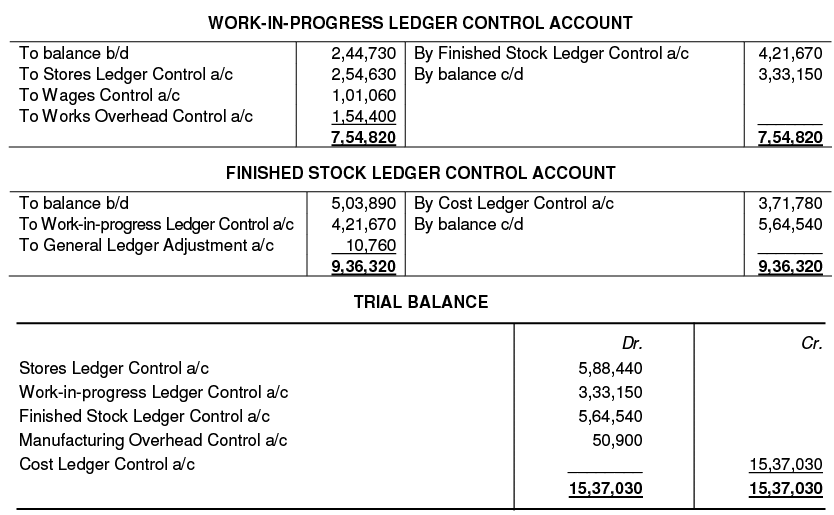

Example 3: As at 31st March 2014, the following balances existed in a company’s cost ledger:

Pass the necessary entries, open ledger accounts and prepare trial balance.

Ans:

FAQs on Cost Accounting: Records and Processes, Cost Ledger and Control Accounts - Management Optional Notes for UPSC

| 1. What is a non-integrated accounting system? |  |

| 2. What are principal ledgers in an accounting system? |  |

| 3. What are control accounts in accounting? |  |

| 4. How are transactions recorded in a non-integrated accounting system? |  |

| 5. What is an integrated accounting system? |  |