Cost of Capital | Management Optional Notes for UPSC PDF Download

| Table of contents |

|

| Introduction |

|

| Identifying Components of Cost Of Capital |

|

| Factoring Weighted Marginal Cost of Capital |

|

| Importance of Cost of Capital |

|

| Opportunity Cost of Capital |

|

| Summary |

|

Introduction

Businesses aim for profitability and necessitate identifying the most suitable sources of funds to fulfill their day-to-day financial requirements. This entails a thorough evaluation of various sources where the cost of capital is minimized while ensuring adequate returns to meet investor expectations. Investors may opt for investments in the form of equity shares, debentures, specified term loans, or a combination thereof, which significantly influences the company's capital structure. As finance managers, individuals are tasked with prioritizing the cost of capital and selecting the appropriate financing medium that yields the expected rate of return, thereby maximizing shareholder wealth.

Identifying Components of Cost Of Capital

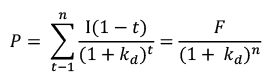

- Cost remains a crucial determinant in identifying and selecting a "source of finance." It can be defined as "the rate of discount that equates the present value of expected payments to that source of finance with the net proceeds received from that source of finance." This concept is elaborated as follows:

- Cost of Debentures: The cost of capital for debt refers to the returns expected by potential investors of debt securities from the firm. Specifically, the cost of a debenture is the discount rate that equates the net proceeds from the issue of debentures to the expected cash outflows in the form of interest and principal repayments.

Where,

Kd = Post-tax cost of debenture capital,

I = Annual interest payment per debenture

t = Corporate tax rate, F = Redemption price per debenture P = Net amount realised per debenture, and n = Maturity Period

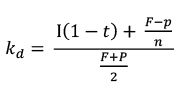

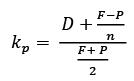

We can also calculate cost of debenture using short cut method

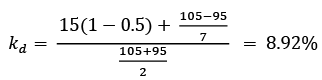

Example 1: ABC Limited issues 15% debentures of face value Rs.100 each, redeemable at the end of 7 years at coupon rate premium of five percent. In case the company gets Rs.95 for each debenture while the rate of corporate tax rate remains 50%, evaluate the cost of the debenture for ABC ltd.?

Example 1: ABC Limited issues 15% debentures of face value Rs.100 each, redeemable at the end of 7 years at coupon rate premium of five percent. In case the company gets Rs.95 for each debenture while the rate of corporate tax rate remains 50%, evaluate the cost of the debenture for ABC ltd.?

Solution: Given I = Rs.15, t = 0.5, P = Rs.95, n = 7 years; and F = Rs.105,

Cost of Term Loans

It stands equated to the interest rate multiplied by (1 – Tax rate). The Interest earned on term loans is also liable for taxation.

kt = I(1 – t)

Where, I = Interest rate,

t = Tax rate

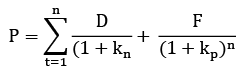

Cost of Preference Capital

It (k) is defined as “that discount rate which equates the proceeds from preference capital issue to the payments associated with the same i.e., dividend payment and principal payments”. This can be understood for the below formula:

Where, kp = Cost of preference capital,

D = Preference dividend per share payable annually,

F = Redemption price,

P = Net amount realized per share; and

n = Maturity period.

An approximation formula given below can also be used.

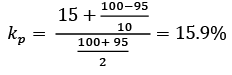

Example 2: XYZ Ltd., issues 15% preference shares of the face value of Rs.100 each redeemable post ten years. If the resultant per share amounts to INR 95, evaluate the cost of preference capital.

Solution: Given that D = Rs. 15, F = Rs. 100, P = Rs.95 and n = 10 years

Cost of Equity Capital

Several approaches like the Dividend Forecast Approach, Capital Asset Pricing Approach, Earnings-Price Ratio Approach, and the Bond Yield Plus Risk Premium Approach are developed for estimating the cost of equity capital.

Dividend Forecast Approach

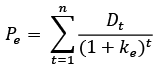

According to the dividend forecast approach, “the intrinsic value of an equity stock is equal to the sum of the present values of the dividends associated with it”, i.e.:

Where, 𝑃e = Price per equity share,

𝐷e = Expected dividend per share at the end of one year, and

𝑘e = Rate of return required by the equity shareholders

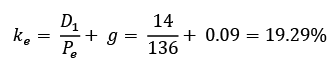

Example 3: The market price per share for a year is INR 14/- and the expected DPS is INR 14 and is poised to grow at nine percent per annum. Calculate the cost of the equity capital to the enterprise?

Solution: Given that Di = Rs.14, P. = Rs.136, g = 9%

The cost of equity capital (ke) will be:

Capital Asset Pricing Model (CAPM) Approach

This approach determines the cost of equity using the following equation:

ki = Rr + 𝛽i (Rm - Rf)

Where,

ki = return required on security i,

Rf = Risk-free rate of return,

𝛽i = Beta of security i; and

Rm = Rate of return on market portfolio.

The CAPM illustrates the relationship between the required rate of return or the cost of capital and the non-diversifiable or relevant risk of the firm, as reflected in its index of non-diversifiable risk, i.e., Beta.

For instance, if the risk-free rate of return is ten percent, the firm's beta is 1.5, and the return on the market portfolio is 12.5%, the cost of equity using the CAPM model is calculated as follows:

ki = 10% + [1.5 x (12.5% - 10%) = 13.75%.

Bond Yield plus Risk Premium Approach

This approach is based on the premise that the return required by investors is directly related to a company's risk profile, as reflected in the return earned by bondholders. However, since equity investors bear higher risk than bondholders, their return should also be higher. Therefore, the return is calculated as:

- Yield on the long-term bonds of the company + Risk premium.

The risk premium is a subjective figure determined after considering the various operating and financial risks faced by the firm.

Earnings Price Ratio Approach

This approach suggests that the cost of equity can be calculated as:

E1/P

Where:

- E1 = Expected EPS for the next year; and

- P = Current market price per share.

- E1 can be calculated by multiplying the current EPS by (1 + Growth rate).

Cost of Retained Earnings and Cost of External Equity

A firm's earnings can either be reinvested or paid as dividends to shareholders. When a firm retains a portion of its earnings for future growth, shareholders expect compensation from the firm for using that money. Consequently, the cost of retained earnings simply represents the expected return for shareholders from the firm's common stock.

i.e., Kr = Ke

It is always lower than the cost of issuing new common stock due to the absence of flotation costs associated with new issuances.

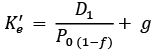

The cost of external equity arises when various flotation costs are involved in acquiring equity. It is the minimum rate of return that a firm must achieve on the net funds generated while meeting the return expectations of investors. The Dividend Capitalization Model can be understood through the following formula when evaluating the cost of external equity:

Where, 𝐾'e Cost of external equity,

Di = Dividend expected at the end of year 1,

𝑃0 Current market price per share,

g = Constant growth rate applicable to dividends; and

f = Floatation costs as a percentage of the current market price.

Since other approaches don’t factor in the floatation costs, the following formula meets the criterion (though on approximation): 𝐾'e = 𝑘e /(1 -𝑓)

Where ke = Rate of return required by the equity investors,

𝐾'e = Cost of external equity; and

f = Floatation costs as a percentage of the current market price.

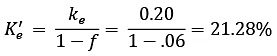

Example 4: Sigma Limited acquired/obtained INR one crore as retained earnings and another one crore as external equity arising from fresh issuance of equity shares. The expected rate of return by the equity investors is 20% while the cost of external equity issuance is six percent? Calculate the “cost of retained earnings and the cost of external equity”?

Solution: Cost of retained earnings:

kr = ke i.e., 20%.

Cost of external equity raised by the company:

Now,

The Concept Of Weighted Average Cost Of Capital

The weighted arithmetic average of the costs associated with different financial resources utilized by a company is referred to as its cost of capital. Determining WACC involves the following defined process:

- Identifying the implied cost of the various sources of finance (A).

- Evaluating the corresponding weights associated with the available sources of finance (B).

- Multiplying A and B and summing up these weighted costs.

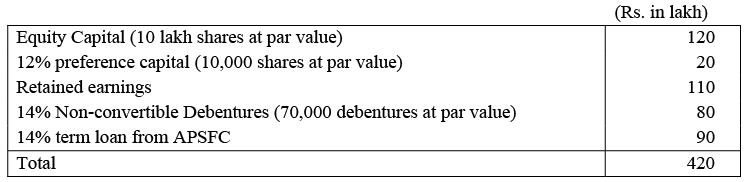

To illustrate the calculation of the weighted average cost of capital, let us consider the following illustration:

Example 5: Perfect Ltd., has the following capital structure:

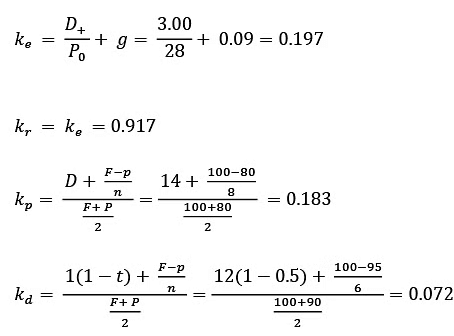

Each share’s market price is INR 28/-. Expected dividend per share is INR 3/- and would grow at nine percent. Issued preference shares can be redeemed post 8 years at par and are currently quoted at Rs.80 per share on the stock exchange. The debentures are redeemable after 6 years at par and their current market quotation is INR 95 per share. The firm’s applicable tax rate is fifty percent. Calculate WACC?

Solution: We will adopt a three-step procedure to solve this problem.

Step 1: We shall define the symbols ke, kr, kp, kd and ki to denote the costs of equity, retained earnings, preference capital, debentures, and term loans respectively.

𝑘i 1(1-t) = 0.15(1-05) = 0.075

Step 2: Determine the weights associated with various sources of finance.

The weights can be applied by:

- Utilizing book values of the sources of finance in the firm’s capital structure.

- Allocating weights (based on present value) to the firm’s different sources of finance.

- Allocating the planned financing in the capital budget for the next period.

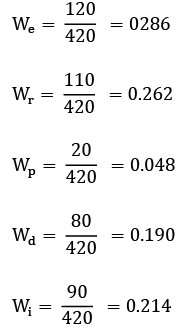

As previously, we will denote the weights of the various sources of finance using symbols We, Wr, Wp, Wd, and Wi.

Step 3:

WAC = Weke + Wrkr + Wpkp + Wdkd + Wiki

= (0.286 x 0.1 97) + (0.262 x 0.197) + (0.048 x 0.183) + (0.190 x 0.072) + (0.214 x 0.075)

WAC = 0.147 or 14.7%.

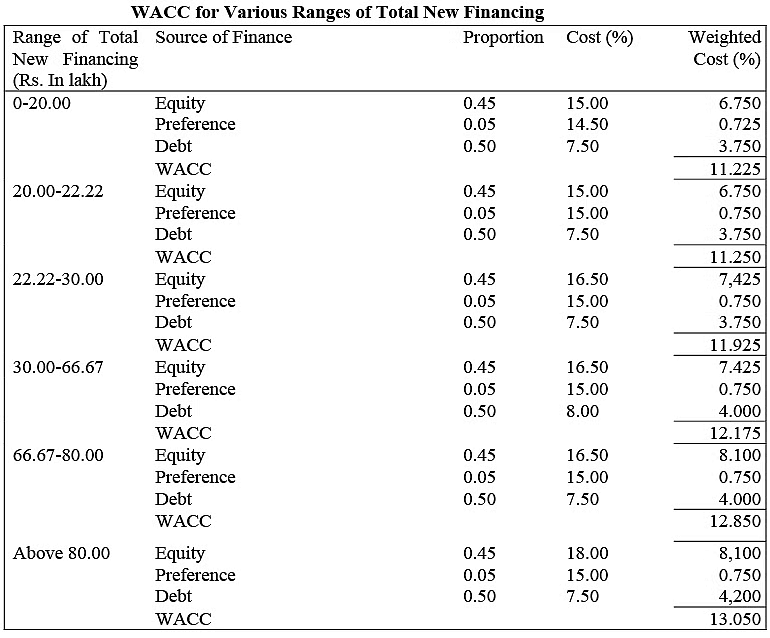

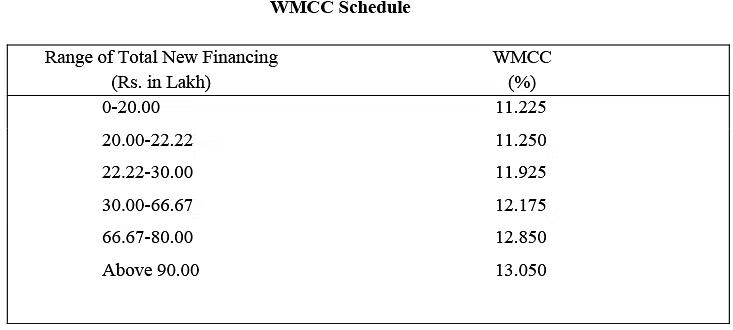

Factoring Weighted Marginal Cost of Capital

When determining the concept of cost of capital, we typically assume that the risk profile and financing policy of the firm remain constant. However, in practice, this is rarely the case. As a firm explores more financing options, the Weighted Average Cost of Capital (WACC) tends to increase. The schedule that illustrates the relationship between additional financing and WACC is referred to as the "Weighted Marginal Cost of Capital (WMCC) schedule." The process for determining this schedule involves the following steps:

- Estimating the cost for each individual financing source, taking into account different levels of usage.

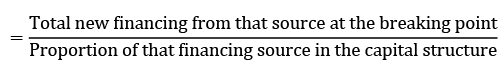

- Post ascertaining the ratio of different sources of finance in the new capital structure, calculate the levels of total new financing at which the cost of various sources would change. These levels, known as ‘breaking points’, be calculated as: Breaking Point on Account of a Source

- Find WACC for various ranges of total financing between the breaking points.

- Tabulate WACC for each level of total new financing. This would be the ‘weighted marginal cost of capital (WMCC) schedule’.

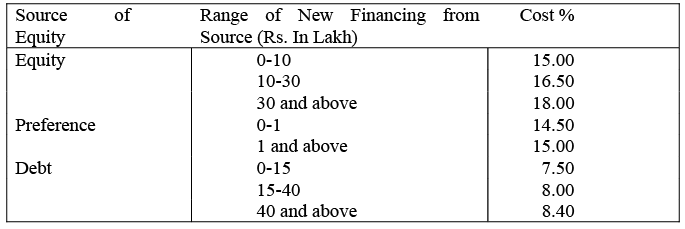

Example 6: JB Ltd. Company intends to utilize its equity, preference, and debt capital in the proportions listed in the table below:

- Equity: 0.45

- Preference: 0.05

- Debt: 0.50

The costs associated with these financial sources at different levels of financing usage can be determined as follows:

Prepare WMCC Schedule.

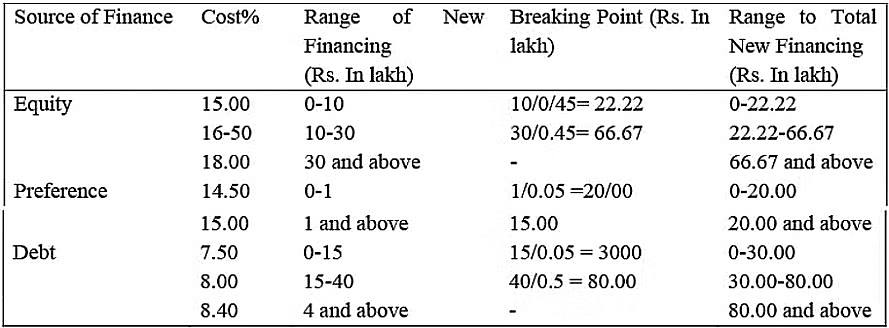

Calculation of Breaking Point

Importance of Cost of Capital

- The cost of capital holds immense significance as a financial metric used to assess the opportunity costs of business investments, thereby aiding in the enhancement of planned investments. It is closely associated with the opportunity cost of investing in a particular firm. A thorough evaluation of such business decisions empowers investors to make well-informed choices, thereby increasing the likelihood of profitability.

- This term can also be conceptualized as the potential return an investment could have generated if allocated elsewhere. Essentially, it represents the opportunity cost of capital had the same funds been invested in an alternative venture. It encapsulates the "real" cost of capital, reflecting the earnings foregone by choosing one investment over another. Furthermore, it encompasses the financing expenses incurred by a company when procuring funds through borrowing, equity financing, or bond issuance to support significant projects or investments.

- As it varies depending on the circumstances, it is termed as the cost of capital and is typically expressed as an annual interest rate, such as 7%. Milton H. Spencer defined it as "the minimum required rate of return necessary for a firm to undertake an investment." Ezra Solomon characterized it as the "minimum required rate of earnings or the threshold rate for capital expenditure." According to L. J. Gitman, "The cost of capital represents the rate of return that a firm must achieve on its investments to maintain the market value of the firm unchanged."

- Cost of capital represents the potential return rate that a firm could have earned if it invested in an alternative option with similar risk, such as purchasing an ancillary unit for backward integration of business operations, instead of making large investments like installing a power plant or replacing old machinery. For this reason, some economists equate the cost of capital with the opportunity cost for a firm investing financial capital in significant business projects or investments. It remains a crucial accounting and financial management tool used by corporate professionals to compare and make well-informed decisions, ensuring better returns on investments and facilitating the allocation of funds for higher yields.

Significance of Cost of Capital:

- Investment Evaluation: A core function of evaluating the cost of capital is assessing the attractiveness of a project. This evaluation is multi-perspective, as the cost of capital can be calculated using various methods to determine a "cut-off rate." A project may be deemed worthy of investment if the resulting rate of return exceeds the cost of capital, making the latter a prerequisite for making optimal investment decisions.

- Designing Debt Policy: Cost of capital plays a crucial role in deciding investment and financing policy decisions, particularly in designing a firm's debt policy. The proportionate distribution of debt and equity in the capital structure aims to support investor returns by minimizing the firm's cost of capital. A higher equity and lower debt ratio are typically favorable, as leverage capacity can be utilized to deploy cash when needed.

- Project Appraisal: The cost of capital is also a preferred tool for assessing project acceptability. When comparing multiple investment decisions, a project with a higher internal rate of return (IRR) than the cost of capital is considered worthwhile. Additionally, the composition of assets (fixed and current) is determined by the cost of capital.

- The cost of capital model considers implicit costs as "opportunity costs not earned." Explicit costs, on the other hand, represent the capital investments made by firms, which are returned to investors and shareholders through share price appreciation and dividends. Accounting professionals frequently utilize the cost of capital tool to evaluate project financing costs or similar investment decisions.

- On the lower end, any investments made by an investor or firm must generate a minimum return rate in line with the expectations of shareholders and lenders. Failure to meet this benchmark would diminish their interest in the project investment. In essence, the cost of capital serves as a benchmark that any investment opportunity must meet or exceed in terms of financial returns.

Examples of Cost of Capital

To better understand this important financial concept, let's consider two scenarios:

- Cost of Capital for Investing: From an investing perspective, the cost of capital is the difference between the investment made and the investment not made. Both investment proposals are carefully evaluated based on the cost of capital, and the decision to invest in one is made accordingly. For instance, let's consider a stock market or real estate investor planning to invest ten lakh rupees in a business opportunity. The opportunity cost is the difference between the actual profit earned (Opportunity "A") and the potential profit that could have been earned (Opportunity "B"). If the investor earned a 5% profit on Opportunity "A" but could have earned 8% on Opportunity "B," the actual cost of capital is the difference between the two profits (3%).

- Cost of Capital for Business: In the context of business, the primary objective related to the cost of capital is to enhance the rate of return. Lucrative business proposals play a crucial role, often causing good investment proposals to lose out to excellent ones. Prioritization is key, as investments are withdrawn when returns weaken or better investment opportunities become available.

Opportunity Cost of Capital

This form of cost is described as "the additional return on investment that a business gives up when it chooses to allocate funds to an internal project rather than investing cash in a marketable security." Therefore, if the projected return on an internal investment is lower than the expected return from a marketable security, the investor would opt out of the internal opportunity and consider other security options.

Example of the Opportunity Cost of Capital:

- Consider a company planning expansion with a new manufacturing facility. The company's top management anticipates earning a 10% return on the long-term perspective for a ₹10 crore investment. However, they have another investment option: investing the same funds in the existing manufacturing plant, where they anticipate a 12% long-term yield from stocks. Opting for the second option of investing in stocks appears more lucrative. This concept requires careful assessment due to its significant implications. Investment projects need to estimate variations in returns, considering potential delays but lucrative returns.

- This increases the risk associated with long-term investments, prompting investors to explore alternative fund deployment options. For instance, while management may confidently anticipate a 10% return from the extended manufacturing capacity, there could be significant uncertainty regarding the variability of returns on stock investments, potentially yielding negative returns initially. This underscores the need to evaluate the opportunity cost of capital from different perspectives, considering various uncertainties and incorporating relevant information, rather than relying solely on a straightforward calculation.

Summary

The company is obligated to provide investors with a satisfactory return on their investments. This cost of capital for the firm represents the "minimum rate of return that it must achieve on its investments to meet the expectations of various types of investors." According to L. J. Gitman, "the cost of capital is the rate of return a firm must earn on its investments to maintain the market value of the firm unchanged." This concept is particularly useful in the following areas:

- Investment evaluation,

- Designing debt policy, and

- Project appraisal.

The cost of capital comes in two forms:

- Implicit cost, which can be equated to the opportunity cost, and Explicit cost, which represents the actual expenses firms may incur as capital investments, ensuring returns to investors through appreciated stock prices or generous dividend payouts. The opportunity cost of capital is "the additional return on investment that a business gives up when it chooses to allocate funds to an internal project, rather than investing cash in a marketable security." The key components of capital structure include Equity Capital, Preference Capital, Debentures, and Term Loans.

- The cost of a debenture is defined as "the discount rate that equates the net proceeds from the issuance of debentures to the expected cash outflows in the form of interest and principal repayments." The cost of term loans is calculated as the interest rate multiplied by (1 – Tax rate). The cost of a redeemable preference share (ko) is defined as "the discount rate that equates the proceeds from the issuance of preference capital to the associated payments." According to the constant dividend model, the cost of equity is calculated as:

Ke = D/P

As per the constant dividend growth model, cost of equity is calculated as:

As per CAPM, cost of equity is calculated as:

Ke = Rf + (Rm - Rf) 𝛽

FAQs on Cost of Capital - Management Optional Notes for UPSC

| 1. What is the cost of capital and why is it important? |  |

| 2. How is the cost of capital calculated? |  |

| 3. What is the opportunity cost of capital? |  |

| 4. How does the cost of capital impact investment decisions? |  |

| 5. How does the cost of capital affect a company's overall financial performance? |  |