Economic Development: August 2024 Current Affairs | General Test Preparation for CUET UG - CUET Commerce PDF Download

CSR Expenditure 2023

Why in news?

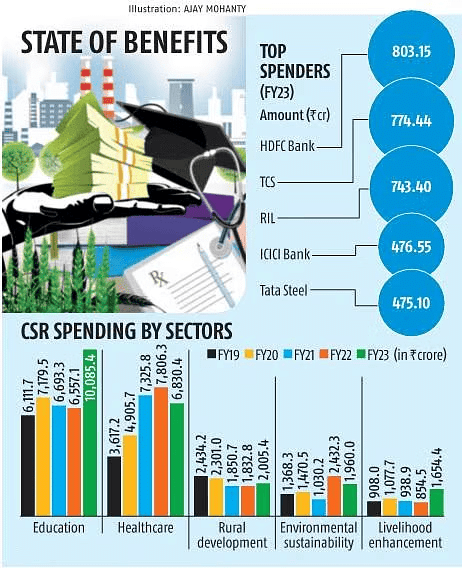

Recently, government data revealed that education received the highest share of corporate social responsibility (CSR) expenditure in FY23, with Rs 10,085 crore allocated. This ignited debate about uneven spending of CSR in a few sectors and regions.

Recent Developments in CSR Expenditure

- Total CSR expenditure increased from Rs 26,579.78 crore in FY22 to Rs 29,986.92 crore in FY23.

- The number of CSR projects rose from 44,425 to 51,966.

- Companies outside the public sector contributed 84% of the total CSR spend.

Sector Wise Expenditure

- Education accounted for one-third of the CSR spend in FY23.

- CSR spending on vocational skills rose slightly to Rs 1,164 crore in FY23 from Rs 1,033 crore the previous year.

- Technology incubators received the lowest amount, with only Rs 1 crore in FY23 compared to Rs 8.6 crore in the previous year.

- Health, rural development, environmental sustainability, and livelihood enhancement also received significant CSR funds.

- Animal welfare surged from Rs 17 crore in FY15 to over Rs 315 crore in FY23.

- CSR expenditure under the Prime Minister Relief Fund dropped to Rs 815.85 crore in FY23, down from Rs 1,698 crore in FY21 and Rs 1,215 crore in FY22.

- Contribution to disaster management fell by 77%, followed by slum development at 75%.

Region Wise Expenditure

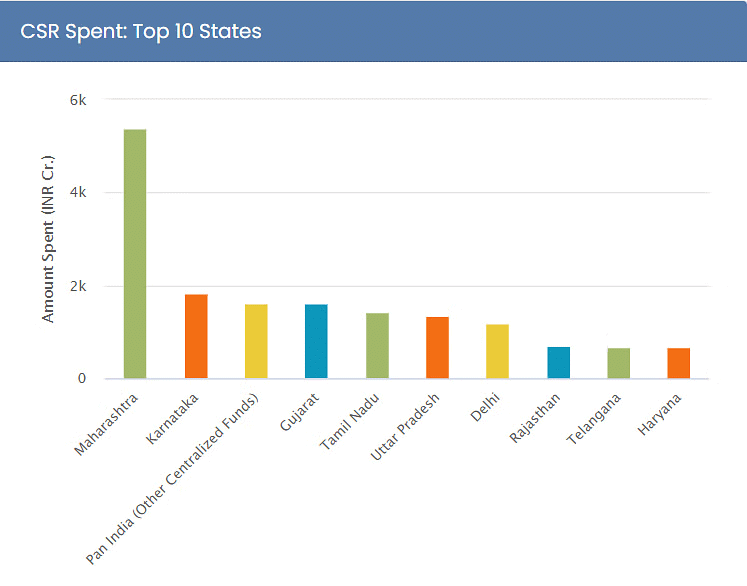

- Maharashtra, Karnataka, and Gujarat received the most CSR spending.

- North East states, Lakshadweep, and Leh and Ladakh received the least CSR funding.

What is CSR?

- Corporate Social Responsibility (CSR) is a corporate initiative to evaluate and take responsibility for the company's impact on the environment and social welfare.

- It is a self-regulating business model that helps a company be socially accountable.

- By practicing CSR, companies become aware of their economic, social, and environmental impacts.

- India is the first country to mandate CSR spending under clause 135 of the Companies Act, 2013, establishing a framework for identifying potential CSR activities.

- Unlike India, most countries have voluntary CSR frameworks; Norway and Sweden have moved to mandatory CSR provisions after starting with voluntary models.

Applicability

- CSR provisions apply to companies meeting any of the following criteria in the preceding financial year:

- Net worth over Rs. 500 crore

- Turnover over Rs. 1,000 crore

- Net profit over Rs. 5 crore

- Such companies must spend at least 2% of their average net profits from the last three financial years on CSR activities.

Types of Corporate Social Initiatives

- Corporate Philanthropy: Donations to charity via a corporate foundation.

- Community Volunteering: Company-organized volunteer activities.

- Socially-responsible Business Practices: Producing ethical products.

- Cause Promotions and Activism: Company-funded advocacy campaigns.

- Cause-based Marketing: Donations to charity based on sales.

- Corporate Social Marketing: Company-funded behavior-change campaigns.

Eligible Sectors

- CSR activities cover various initiatives, including:

- Eradicating hunger and poverty

- Promoting education and gender equality

- Combating diseases like HIV/AIDS

- Ensuring environmental sustainability

- Contributing to government relief funds (e.g., PM CARES, PM Relief Fund) for socio-economic development and welfare of disadvantaged groups.

Issues Pertaining to CSR Compliance

- Geographical Disparity in CSR Spending: Spending is concentrated in industrial states like Maharashtra, Gujarat, Karnataka, and Tamil Nadu, while North Eastern states receive comparatively less funding.

- CSR Allocation Trends: Data reveals nearly 75% of CSR funds are concentrated in three sectors: education, health (including sanitation and water), and rural poverty, while livelihood enhancement has very low spending.

- PSU vs Non-PSU Spending: Non-PSUs contribute 84% of total CSR spending, highlighting a significant difference in expenditure between the two sectors.

- Strategic Misalignment in CSR: Many companies prioritize profit margins over genuine social impact, undermining the true purpose of CSR.

- Finding Right Partners: Challenges in identifying effective partners and selecting impactful, scalable, and self-sustaining projects persist.

- Issues of Transparency: Companies express concerns about the lack of transparency from local implementing agencies regarding program disclosures, audit issues, impact assessments, and fund utilization.

Ways to Enhance the Effectiveness of CSR Expenditure

- Enhancing CSR Engagement and Oversight: Aligning CSR with local government programs like the Aspirational Districts Programme can boost community participation and engagement.

- Address Sectoral and Geographical Disparity: Invest in higher education and impactful technological and environmentally-friendly projects focusing on skill development and livelihood enhancement.

- PSU vs Non-PSU Spending Disparity: Encourage increased contributions and promote joint CSR initiatives between PSUs and non-PSUs.

- Company Roles and Governance: Conduct regular reviews, set clear objectives, and update governance roles. Establish new SOPs for fund utilization, impact assessments, and detailed checklists.

Conclusion

- To maximize the impact of CSR, companies should move beyond mere compliance to embrace strategic alignment with local government programs.

- Addressing sectoral and regional disparities, ensuring transparency, and fostering stronger collaborations between PSUs and non-PSUs will enhance CSR effectiveness.

- Investing in innovative, scalable projects can drive sustainable social change and contribute to India's long-term socio-economic development.

Mains Question

Q: Describe how Corporate Social Responsibility can become a financing arm to address the socio-economic issues of society?

RBI Highlights Deposit Challenges and Tightens HFC Liquidity Norms

Why in News?

Recently, the Reserve Bank of India (RBI) Governor has urged banks to develop innovative product offerings to boost deposit growth. This comes in response to a slower deposit growth rate compared to the surge in credit demand, which poses potential risks to the banking sector's liquidity. In another development, the RBI has tightened liquidity norms for housing finance companies (HFCs), aligning them with regulations for non-banking financial companies (NBFCs), to strengthen the financial stability of these institutions.

What are the Concerns Regarding Deposit Growth?

- Lending vs. Deposit Growth: The credit-deposit ratio has reached its highest in 20 years, with bank deposits growing at 11.1% year-on-year compared to credit growth of 17.4%. The growth of bank deposits has not kept pace with the surge in loan demand, creating a widening gap between credit and deposit growth.

- Reliance on Short-Term Deposits: Banks are increasingly using short-term deposits and other liability instruments to meet credit demand, potentially leading to structural liquidity challenges.

- Shift to Alternative Investments: Households are moving their savings from bank deposits to mutual funds, stocks, insurance, and pension funds. This shift, along with declining net financial assets (from 11.5% of GDP in 2020-21 to 5.1% in 2022-23) and surging inflation, contributes to slower deposit growth.

- Regulatory Requirements: A portion of mobilised deposits is tied up in regulatory requirements like the Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR), leaving banks with fewer lendable funds and increasing competition for deposits.

- Increased Competition: Banks face competition not only from each other but also from high-return equity-linked products. Investors are increasingly shifting to equity markets due to strong performance and rising financial literacy.

- Impact on Liquidity Risk Management: Banks have attempted to bridge the credit-deposit gap by relying more on Certificates of Deposit (CDs). However, this increases their sensitivity to interest rate movements and complicates liquidity risk management, making the system more vulnerable to market fluctuations.

Need for Prudent Liquidity Management

- Proactive liquidity management is essential. The RBI is reviewing the Liquidity Coverage Ratio (LCR) framework to address these emerging challenges, with plans for public consultations to refine the approach.

What Strategies Can Banks Use to Increase Deposit Growth?

- Focus on Core Business: The Finance Minister of India emphasised that banks should concentrate on their primary functions of deposit mobilisation and lending, stressing that these activities are the "bread and butter" of banking. Expanding branch networks, especially in underserved or rural areas, can help banks tap into new customer segments, increasing overall deposit inflows.

- Innovative Deposit Mobilisation: Banks were encouraged to be aggressive in deposit mobilisation by offering attractive and innovative products, leveraging the liberty given by the RBI to manage interest rates. The Finance Minister urged banks to avoid relying heavily on bulk deposits and instead focus on small savers, which are critical for sustainable banking operations.

- Flexible Products: Banks can consider reducing the lock-in period for tax-saving fixed deposits from five years to three years, making them more competitive with alternative investment options like mutual funds and equity-linked savings schemes (ELSS).

- Incentives and Promotions: Offer attractive interest rates, bonuses, or cash incentives for new deposits to attract customers. Offering higher interest rates on savings accounts and fixed deposits can attract more deposits, especially from risk-averse customers who prefer stable returns over potentially higher, but uncertain, returns from equities.

- Technology: Banks can use data analytics to offer personalised savings and deposit products, making it easier for customers to manage and grow their savings. Mobile banking apps with user-friendly interfaces and financial planning tools can encourage more deposits.

- Customer Engagement: Strengthening customer relationships through targeted marketing campaigns and loyalty programs can encourage existing customers to increase their deposits and attract new customers. Conducting financial literacy programs that educate customers about the importance of savings and the safety of bank deposits can help in increasing deposit growth.

What are the RBI's New Liquidity Norms for HFCs?

- New Liquidity Requirements: HFCs that raise public deposits will now need to maintain higher liquid assets to ensure financial stability. The liquid asset requirement has been increased from 13% to 15% in stages: HFCs must raise liquid assets to 14% by 1 January 2025, further increasing to 15% by July 2025.

- Credit Rating Requirement: HFCs will now be required to obtain a minimum investment-grade credit rating at least once a year to continue accepting public deposits. If an HFC's credit rating falls below the required grade, it will not be permitted to renew existing deposits or accept new ones until the rating improves. This measure ensures that only financially sound HFCs can accept public deposits, reducing the risk to depositors.

- Public Deposit Tenure: The maximum tenure for public deposits at HFCs has been reduced from ten years to five years. Existing deposits with maturities beyond five years will be allowed to mature according to their original terms, but new deposits cannot exceed the five-year limit. This reduction in tenure helps mitigate long-term liquidity risks.

- Deposit Ceiling: The RBI has lowered the ceiling on the quantum of public deposits that an HFC can hold, from three times to 1.5 times its net owned funds (NoF). HFCs holding deposits above this new limit will not be allowed to accept new deposits or renew existing ones until they comply with the revised ceiling. This measure aims to prevent over-leveraging by HFCs, ensuring they maintain a healthy balance between their liabilities and assets.

- Alignment with NBFC Regulations: Previously, HFCs operated under more relaxed prudential norms compared to NBFCs, particularly in terms of deposit acceptance. The RBI's new guidelines aim to eliminate these discrepancies, treating HFCs similarly to deposit-taking NBFCs. This alignment addresses the uniform regulatory concerns associated with deposit acceptance across all NBFC categories.

Mains Question

Q: Evaluate the impact of the shift from traditional bank deposits to alternative investment avenues on the Indian financial system. What measures can banks take to retain and attract deposits?

Chinese Technicians for Indian Manufacturing

Problem with India’s Blocking of the Chinese

- Rajesh Kumar Singh, the Secretary of the Department for Promotion of Industry and Internal Trade, recently acknowledged that there is a significant skill gap between Chinese and Indian factory supervisors and workers.

- A shoe manufacturer based in Vellore pointed out that Chinese professionals are very productive and can produce 150 items using the same resources that Indian workers use to make 100 items.

- The chairman of the Engineering Export Promotion Council of India has also called for more visas for Chinese technicians.

- Indian companies across various sectors, including footwear, textiles, engineering, and electronics, have bought machines from China but struggle to use them effectively without assistance from Chinese workers.

- Leaders of Indian industry associations have been reminding government officials that many machines remain unused and that export orders are not being fulfilled.

- Gautam Adani's solar manufacturing facility is also waiting for visas for Chinese workers.

- The official recognition of India's large skill gap is both significant and notable.

- It is rare to see such clear understanding that even low-tech, labour-intensive production needs a lot of expertise.

- Over the last 40 years, China has developed this expertise and has become the world’s manufacturing hub.

- Chinese experts are often more affordable than those from other countries.

- However, while the Indian government does not have many restrictions on foreign experts, it limits Chinese workers due to national security concerns.

- This is a significant issue.

- The presence of Chinese workers can help India establish a position at the bottom of the global skill ladder.

- These positions are becoming more competitive, and India needs to act quickly.

- Despite the government’s slow progress in granting more visas to Chinese workers, it is crucial to address the real problem: the poor state of Indian education.

- Despite the excitement surrounding India's potential, the world is not waiting for the country to catch up.

- Without foreign technical help and significant improvements to domestic education, India will struggle to achieve job-rich prosperity.

Discouraging Visa Prospects

- In 2019, Chinese nationals received 2,00,000 visas, but the numbers fell sharply after deadly clashes between Indian and Chinese troops in 2020.

- Indian officials accused the Chinese of violating visa conditions and laundering money to evade India’s tax laws.

- Last year, the number of visas to Chinese personnel was down to 2,000.

- A security-driven mindset has taken root.

- This year, even the meagre 1,000 visas for Chinese electronics professionals are stuck in a “pipeline”, undergoing “intensive screening”.

- Despite positive noises by Commerce and Industry Ministry officials, a cabinet Minister, who chose to remain anonymous, tempered expectations.

- “Visas,” the Minister said, “will be issued for Chinese technicians and businessmen only after screening with assurance that travel conditions will not be violated”.

- Such “screening” might well kill this initiative with a thousand cuts.

Integrating Foreign Knowledge

- East Asian economic history shows that foreign knowledge is crucial for growth, but it is most effective when paired with well-educated local workers.

- In India, the poor education system makes reliance on foreign expertise even more critical.

- During the 1980s, South Korean companies purchased foreign machinery to take apart and learn from it.

- By that time, Korea had a strong educational system in place for nearly 30 years and needed very little help from others.

- They obtained foreign knowledge mainly through the machines they acquired.

- China began to grow rapidly in the early 1980s, but its education system was not as strong as Korea's.

- Nonetheless, the quality and reach of China's primary education, established during the Communist era, set the stage for quick development, as noted in a World Bank report in 1981.

- To improve local skills, Deng Xiaoping, known for his economic reforms and the Tiananmen Square incident, sent top policymakers abroad for learning and sought foreign investors to introduce global knowledge to China.

- The combination of local and foreign knowledge was powerful, helping China become a major manufacturing hub in the world.

- Meanwhile, India focused on building more schools and getting more children enrolled. However, various surveys show that these schools often fail to provide a proper education.

- According to Eric Hanushek from Stanford University, a leading expert on the link between education quality and economic growth, only about 15% of Indian school students have the basic reading and math skills needed in a global economy, while 85% of Chinese children possess these skills.

- China has continued to advance; since 2018, Chinese students have outperformed others in the Programme for International Student Assessment (PISA), conducted by the OECD.

- Ongoing PISA tests and internal assessments in China show that more and more children are reaching world-class learning levels.

- India took part in the 2009 PISA evaluation but withdrew after a disappointing performance.

The Red Queen Race

- China, despite its challenges, has grasped an essential lesson from the Red Queen in Lewis Carroll's Through the Looking Glass.

- To remain where you are, you need to run twice as fast.

- To move ahead, you must run even faster.

- Chinese universities rank among the world's best, especially in computer science and mathematics.

- Chinese scientists are making significant progress in applied sciences that are important for industrial growth.

- As a global leader in electric vehicles and solar technology, China is poised to make major strides in artificial intelligence.

- Indian and global leaders appear to struggle to learn from China's experience.

- Economists Rohit Lamba and Raghuram Rajan have wrongly lost faith in creating jobs in India for the vast global market for labor-intensive products.

- They suggest that India should focus on developing jobs in technology-driven service exports.

- This idea overlooks the limited scope of high-quality education in Indian universities.

- Historian Mukul Kesavan highlights the decline of Delhi University, reminding us that Indian leadership is damaging some of its finest institutions.

The Reality in India

- Martin Wolf from the Financial Times believes that India, despite its challenges in educating children and providing dignified jobs for its large population, is set to become a global economic superpower.

- India has largely missed the China-plus-one opportunity.

- Mexico, because of its strategic location, and Vietnam, with its good location and skilled workforce, took advantage of this situation when barriers were placed on Chinese products.

- In fact, foreign investors are turning away from India, and India's labour-intensive manufactured exports account for only 1.3% of the global market share.

- The growth of India's technology-related service exports during the COVID-19 pandemic has significantly slowed down.

- Many graduates from the Indian Institutes of Technology are having a hard time finding jobs.

- Individuals who once held entry-level jobs in Bengaluru's IT sector, such as support and basic coding roles, are now looking for work in the gig economy.

- The number of IT jobs has declined from its peak of just over five million in 2023, which is quite small compared to a working-age population of one billion and a workforce of 600 million.

- If India's focus on national security and self-reliance prevents the granting of visas for necessary foreign experts, India risks missing another chance for a fresh start.

- With problems in both school and university education, along with an overvalued rupee, the chances for growth in labour-intensive manufactured exports will diminish.

- India needs to improve its human capital instead of holding onto unrealistic ideas about its role in the global economy.

- The global competition is becoming more intense, and as time goes on, more opportunities will close while many people wait for dignified jobs.

Decline in Work Demand Under MGNREGA

Why in news?

According to the Ministry of Rural Development, work demand under the Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS) fell sharply in July 2024.

Current State of Demand for Work

Approximately 22.80 million individuals sought work under the scheme in July, reflecting a 21.6% decline from the same period in 2023.

These individuals represented 18.90 million households, a decrease of 19.5% year-over-year and 28.4% compared to June 2024.

On a month-to-month basis, the number of people seeking work dropped by 33.4%.

In July 2024, fewer individuals submitted work demands in key states like Tamil Nadu, Andhra Pradesh, Karnataka, and Telangana.

Reasons for Decline in Demand for Work

- Strong Economic Activity: Demand under MGNREGS typically decreases when better-paying job opportunities arise due to a robust economy, which grew at an impressive rate of 8.2% in FY 2023-24.

- The International Monetary Fund (IMF) projects India to be the fastest-growing major economy, with growth rates of 7% in FY 2024-25 and 6.5% in 2025-26, both surpassing the global average.

- Impact of Monsoon: The monsoon season often leads to significant migration of rural workers to their villages for crop sowing, thereby reducing the demand for unskilled jobs under MGNREGS. In 2024, plentiful seasonal rains in July helped alleviate the 11% rainfall deficit observed in June.

What is Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS)?

- About: MGNREGS is one of the largest work guarantee programs globally, launched in 2005 by the Ministry of Rural Development.

- The scheme guarantees 100 days of work each financial year for adult members of rural households willing to perform unskilled manual labor at the statutory minimum wage.

- Implementation Agency: The Ministry of Rural Development oversees the implementation of this scheme in collaboration with state governments.

- Major Features: The legal guarantee of MGNREGS ensures that any rural adult can request work and must receive it within 15 days. If this is not fulfilled, an unemployment allowance is provided.

- Priority is given to women, ensuring that at least one-third of the beneficiaries are women who have registered and requested work.

- Section 17 of Mahatma Gandhi NREGA, 2005 mandates the Gram Sabha to conduct social audits of works undertaken under the scheme.

- Objective: The scheme aims to enhance the purchasing power of rural residents, particularly for semi-skilled or unskilled workers living below the poverty line, and seeks to bridge the economic gap between rich and poor in India.

Current Status

- Budget Allocation: For the financial year 2023-24, the government allocated approximately Rs 73,000 crore to MGNREGS, an increase from previous years to accommodate the rising demand for employment.

- Employment Generation: In FY 2022-23, MGNREGS provided over 300 crore person-days of work, with around 11 crore households participating in the scheme.

- Wage Payments: The Centre announced a 3-10% increase in wage rates for MGNREGS workers for FY 2024-25, raising the average wage from Rs 261 in FY 2023-24 to Rs 289.

- Project Focus: The scheme has increasingly targeted sustainable development initiatives, such as water conservation, afforestation, and rural infrastructure enhancement, with over 60% of the works related to natural resource management.

What are the Challenges with the Implementation of the MGNREGS?

- Concerns Over Minimum Wage Determination: A panel from the Ministry of Rural Development has expressed concerns that the minimum wage determination under MGNREGS is based on the Consumer Price Index for Agricultural Labourers, which may not accurately represent the diverse types of work performed by MGNREGS workers. They recommend using the Consumer Price Index-Rural instead, as it is more relevant and reflects higher costs of living, including education and healthcare.

- Poor Planning & Administrative Skill: Many panchayats, except in states like Karnataka and West Bengal, lack experience in managing large-scale programs. The Comptroller and Auditor General (CAG) has pointed out inadequate administrative capacity among village panchayat members.

- Lack of Adequate Manpower: There is insufficient administrative and technical staff at the Block and Grama Panchayat levels, which hampers effective planning, monitoring, and transparency.

- Difficulty in Funding the Scheme: The significant increase in the MGNREGS budget raises concerns about long-term sustainability and funding sources, especially with a declining tax-to-GDP ratio impacting financing.

- Discrimination: While MGNREGA promotes equal pay, there are still instances of discrimination against women and marginalized groups. Some states show high enrollment of women, while others have low participation due to systemic biases.

- Corruption & Irregularities: High levels of corruption lead to minimal funds reaching intended beneficiaries, with issues such as fake job cards for non-existent workers resulting in considerable financial losses.

Way Forward

- Increase of Entitled Work Days: Although the full 100 days of employment has not been provided annually, the Parliament Committee and activist groups have strongly recommended increasing the guaranteed work days for each household from 100 to 150, providing a more substantial safety net for rural populations throughout the year.

- Capacity Building: Implement training programs for panchayat members to enhance planning and implementation skills, along with establishing clear guidelines and best practices for effective program management.

- Monitoring: Establish robust monitoring mechanisms to track fund allocation and project outcomes. Utilize technology, such as mobile apps and online portals, to improve accountability.

- Updated Wage Determination: Revise the minimum wage determination process to better reflect the living conditions faced by MGNREGS workers, ensuring that wage rates are regularly updated to keep pace with inflation and local economic conditions.

Mains Question

Q: Discuss the role of the Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS) in generating employment in rural areas. What challenges are associated with the scheme?

Rising Costs for Senior Citizens Under Ayushman Bharat

Why in News?

Recently, the Union Ministry of Health and Family Welfare released data highlighting significant trends in the Ayushman Bharat Health Insurance Scheme (PM-JAY). This information underscores the increasing financial burden of providing healthcare to the elderly, particularly those aged 70 years and above.

Significant Elderly Admissions

- The data reveals that out of nearly 6.2 crore approved hospital admissions until January 2024, 57.5 lakh were senior citizens aged 70 years and above.

- Government expenditure on treatments under the scheme totaled Rs 79,200 crore over the past six years, with approximately Rs 9,900 (14%) crore allocated specifically for treating individuals aged 70 and over.

- Elderly patients often require more intensive and costly treatments due to chronic conditions and multiple comorbidities, complicating treatment and increasing the likelihood of costly intensive care unit (ICU) care and extended hospital stays.

State Variability

- The proportion of elderly admissions varied widely among states, with Maharashtra (20.49%) and Kerala (18.75%) having the highest rates, while Tamil Nadu (3.12%) had the lowest.

- Despite lower admission rates in Tamil Nadu, the cost of treatment per elderly patient remains high.

- Only four states/UT—Goa, Ladakh, Lakshadweep, and Jharkhand—showed a higher proportion of hospital admissions for older individuals compared to the total money spent on them.

Concerns

- According to the Longitudinal Ageing Study in India (LASI), India's population over the age of 60 years is estimated to increase from 8.6% in 2011 to 19.5% by 2050, with the absolute number tripling from 103 million in 2011 to 319 million in 2050.

- The government's plan to expand Ayushman Bharat aims to include all individuals over 70 years, regardless of economic status, which could add nearly 4 crore new beneficiaries to the programme.

- The current allocation of Rs 7,300 crore for the scheme, with only a Rs 100 crore increase from the previous budget, raises concerns about the adequacy of funding for such an expansion.

- As healthcare costs for the elderly continue to rise, the scheme's sustainability and its ability to provide comprehensive coverage to all senior citizens will be a critical area of focus for policymakers.

- Health-seeking behaviour is more prevalent among older, relatively affluent individuals, leading to a higher likelihood of policy utilisation and increased costs.

- Experts warn that the cost of covering this demographic is likely to be higher than covering the poorest 40% across all age groups.

What are the Key Highlights About Ayushman Bharat Scheme?

About

- Ayushman Bharat, launched as a flagship scheme of the Government of India, is a significant step towards achieving Universal Health Coverage (UHC).

- Recommended by the National Health Policy of 2017, this scheme aims to meet the Sustainable Development Goals (SDGs), particularly the commitment to "leave no one behind."

Key Components

- Health and Wellness Centres (HWCs): Announced in 2018, the creation of 1,50,000 HWCs aims to transform existing Sub Centres and Primary Health Centres, delivering Comprehensive Primary Health Care including maternal and child health, non-communicable diseases, and free essential drugs and diagnostic services.

- Pradhan Mantri Jan Arogya Yojana (PM-JAY): It is the world's largest health assurance scheme, providing Rs. 5 lakh coverage per family per year for secondary and tertiary care hospitalisation, targeting over 12 crore poor and vulnerable families, covering approximately 55 crore beneficiaries, based on the Socio-Economic Caste Census 2011 (SECC 2011). PM-JAY subsumed the Rashtriya Swasthya Bima Yojana (RSBY) and the Senior Citizen Health Insurance Scheme (SCHIS), expanding its reach and impact.

- Implementation: Ayushman Bharat National Health Protection Mission Agency (AB-NHPMA) manages the scheme at the national level. States and UTs are advised to implement the scheme through a dedicated State Health Agency (SHA), which can operate through an insurance company, a trust/society, or an integrated model.

- Impact: The scheme is expected to significantly reduce Out-of-Pocket Expenditure for healthcare by covering nearly 40% of the population, including secondary and tertiary hospitalizations. With coverage up to Rs. 5 lakh per family, the scheme ensures access to quality healthcare, leading to improved health outcomes.

Way Forward

Targeted Interventions: Develop specialised packages addressing common geriatric conditions to optimise resource allocation. Emphasise preventive healthcare and early intervention to reduce the severity of illnesses among the elderly.

Financial Sustainability: Increased budgetary allocation for Ayushman Bharat, especially for geriatric care. Explore public-private partnerships to share the financial burden.

Focus on Preventive Healthcare: Implement preventive healthcare measures targeting chronic conditions, ultimately lowering overall healthcare costs. Promote community health programs that encourage regular check-ups and early detection of health issues, especially in rural areas where access to healthcare is limited.

Mains Question

Q: Discuss the challenges presented by India's ageing population in the context of the Ayushman Bharat Health Insurance Scheme.

RBI’s 50th Monetary Policy Committee Meeting

Why in news?

In its first meeting after the Union Budget, the Reserve Bank of India's Monetary Policy Committee (MPC) decided to maintain the policy repo rate at 6.50% for the ninth consecutive meeting. This decision was made with the intent of controlling inflation. Among the six members of the MPC, four supported this decision.

What is Monetary Policy Committee (MPC)?

- The MPC is established under Section 45ZB of the amended RBI Act of 1934.

- The central government is authorized to form a six-member MPC.

- This committee's primary role is to determine the policy interest rate necessary to meet the inflation target.

- The inaugural MPC was formed in September 2016.

Members of MPC

- The MPC consists of the RBI Governor, who serves as the ex officio chairperson.

- The Deputy Governor responsible for monetary policy.

- An officer from the Bank nominated by the Central Board.

- Three individuals appointed by the central government.

Functions of MPC

- Setting Policy Interest Rates: The primary task is to establish the policy interest rates, particularly the repo rate.

- Inflation Targeting: The government has set an inflation target of 4% with a tolerance of +/- 2%.

- Economic Analysis and Forecasting: The MPC conducts detailed analyses and forecasts of various economic indicators such as inflation, GDP growth, and employment.

- Decision-Making: The MPC meets a minimum of four times a year to assess the monetary policy stance.

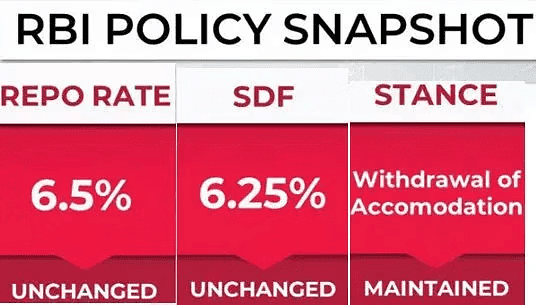

Policy rates remained unchanged

- The MPC has decided to keep the policy repo rate at 6.50%.

- The repo rate is the interest rate at which the RBI lends to commercial banks to address short-term funding shortages.

- The standing deposit facility (SDF) rate is maintained at 6.25%, while the marginal standing facility (MSF) rate and the bank rate are set at 6.75%.

- The SDF allows banks to deposit excess liquidity with the RBI without collateral.

- The MSF provides a way for banks to borrow from the RBI in emergencies when inter-bank liquidity is low.

- The MPC will focus on withdrawing accommodation to ensure inflation aligns with the target while supporting economic growth.

Food prices drive inflation

- Headline inflation was steady at 4.8% in April and May but rose to 5.1% in June.

- This inflation is primarily driven by food prices, which remain persistent.

- Core inflation, which excludes food and fuel, has moderated, while fuel prices are experiencing deflation.

- Although inflation is decreasing, the pace of this disinflation is uneven and slow, indicating a significant distance remains to reach the target.

GDP forecast

- The MPC projects real GDP growth for 2024-25 at 7.2%.

- Quarterly growth projections are: Q1 at 7.1%, Q2 at 7.2%, Q3 at 7.3%, and Q4 at 7.2%.

- For the first quarter of 2025-26, GDP growth is forecasted at 7.2% as well.

Transaction limit for tax payments via UPI hiked from Rs 1 lakh to Rs 5 lakh

- The RBI has announced an increase in the transaction limit for tax payments through UPI from Rs 1 lakh to Rs 5 lakh per transaction.

- This change aims to simplify tax payments for consumers, as UPI has become the preferred digital payment method.

- Raising the UPI limit for tax payments will enhance the tax-collection system, reduce collection costs, and improve convenience for taxpayers.

Creation of repository of digital lending apps

- The RBI is establishing a public repository of digital lending applications to protect customers from fraudulent activities in the financial services sector.

- This initiative aims to regulate unauthorized digital lending and safeguard consumers from falling victim to fraud.

Focus more on deposit mobilisation via innovative product

- The RBI Governor has expressed concern over the trend of household savings moving away from banks towards alternative investments.

- As of July 12, while deposits grew by 11.7%, credit growth surged by 15.5%.

- The Governor urged banks to attract deposits by offering innovative products and leveraging their branch networks to avoid potential liquidity issues.

Can’t ignore food inflation pressures

- The Economic Survey for 2023-24 suggested excluding food prices from headline inflation calculations.

- This was proposed because food prices are keeping CPI-based inflation high and delaying necessary interest rate cuts by the RBI.

- However, the RBI Governor stressed that food inflation, which makes up about 46% of the CPI basket, cannot be overlooked due to its substantial impact on public welfare and overall inflation.

- While temporary spikes in food inflation may be disregarded, the MPC must remain alert to persistent food price increases to prevent impacts on other economic sectors.

- The National Statistical Office (NSO) is conducting a survey to reassess the CPI basket, which may affect future decisions on the weight of food, fuel, and core components in calculating headline inflation.

NARCL Aims to Acquire Rs 2 Trillion Stressed Assets by FY26

Why in News?

The National Asset Reconstruction Company Ltd (NARCL), a government-supported bad bank, has set an ambitious goal to acquire stressed assets totaling Rs 2 trillion by the fiscal year 2026. This follows its notable achievement of acquiring Rs 1 trillion worth of distressed assets in FY24, showcasing a proactive stance towards tackling non-performing assets (NPAs) within the Indian banking sector.

What is a Bad Bank?

- Definition: Bad banks are specialized asset reconstruction companies that purchase, manage, and recover bad loans from commercial banks, enabling them to liquidate these transferred assets. This mechanism provides a safety net for banks, allowing them to offload non-performing loans and concentrate on healthier lending practices.

- Historical Context: The concept of bad banks originated in the 1980s, with institutions like Grant Street National Bank acquiring bad assets from Mellon Bank. The idea gained traction during the 2008 financial crisis, with countries such as Sweden, Germany, and France adopting similar approaches to manage bad debts.

- India's First Bad Bank: NARCL was established in 2021 to tackle the issue of bad assets within public sector banks, a proposal that was initially suggested in the Economic Survey of 2016. This initiative aligns with global trends to stabilize financial systems burdened by distressed loans.

Advantages

- Centralized management of NPAs enhances efficiency in asset resolution.

- Freeing up capital currently tied up in bad loans allows banks to lend to more creditworthy customers.

- Government backing can bolster confidence in banks, improving their capital buffers and overall financial stability.

Disadvantages

Transferring bad assets to a government entity may simply shift burdens within the public sector, possibly leading to taxpayer liabilities for any losses.

Government interventions might discourage prudent lending practices among banks, risking a recurrence of past issues.

Current Challenges for Bad Banks

- Price Discovery: Bad banks often struggle to accurately price bad loans and forecast future liabilities.

- Finding Buyers: Selling distressed asset portfolios can be difficult, especially without established market mechanisms or precedents. Economic downturns can further depress asset values, limiting potential buyers.

What is NARCL?

- Overview: NARCL is designed as a bad bank to cleanse the financial system of distressed loans, promoting bank stability and a healthier economic environment. Announced in the Union Budget 2021-22, it primarily focuses on large loans exceeding Rs 500 crore.

- Operational Structure: Initial setbacks arose from the Reserve Bank of India's concerns over the proposed framework, leading to a revised setup where NARCL acquires and aggregates bad loan accounts from banks. The India Debt Resolution Co. Ltd (IDRCL) is tasked with managing the resolution process under a unique arrangement with NARCL.

- Functions of NARCL: Purchase distressed loans from commercial banks. Manage and sell these assets in the market through bidding processes, such as the Swiss Challenge, to recover funds and liquidate the transferred assets.

- Funding and Ownership: NARCL's acquisition strategy entails paying 15% of the agreed loan value in cash, with the remaining 85% covered by government-backed security receipts. State-owned banks maintain a 51% stake in NARCL, while the rest is owned by private banks.

Challenges Facing NARCL

- Operational Inefficiencies: The dual structure of NARCL and IDRCL has led to inefficiencies. While NARCL retains decision-making power, IDRCL handles resolutions, resulting in a complex and costly operational framework.

- Pricing Discrepancies: Significant differences in pricing expectations between NARCL and banks hinder transactions, as banks often find NARCL's offers unsatisfactory.

- High Operational Costs: The dual existence of NARCL and IDRCL has inflated operational costs, compounded by NARCL's reliance on external consultants and a slow due diligence process.

Potential Solutions for NARCL's Challenges

- Combining NARCL and IDRCL could streamline operations, reduce costs, and enhance efficiency by eliminating redundant functions.

- Implementing performance-linked incentives could attract skilled professionals and improve asset resolution effectiveness.

- Establishing investor-friendly policies would encourage both domestic and foreign investor participation in asset resolution.

- Creating a secondary market for distressed assets could enhance liquidity and facilitate price discovery.

Mains Question

Q: What is a 'bad bank,' and what role does it play in managing non-performing assets (NPAs) within the banking sector?

GST on Health and Life Insurance in India

Why in News?

Recently, the discussion surrounding the Goods and Services Tax (GST) on health and life insurance has intensified, especially after opposition leaders protested against the 18% GST imposed on insurance premiums. This tax has significantly increased the cost of premiums, making insurance less affordable for many people, which has led to debates in Parliament and among industry stakeholders.

What is the Current State of Health Expenditure in India?

- Higher Medical Inflation: India's healthcare expenditure is being closely examined, with medical inflation projected to be around 14% by the end of 2023.

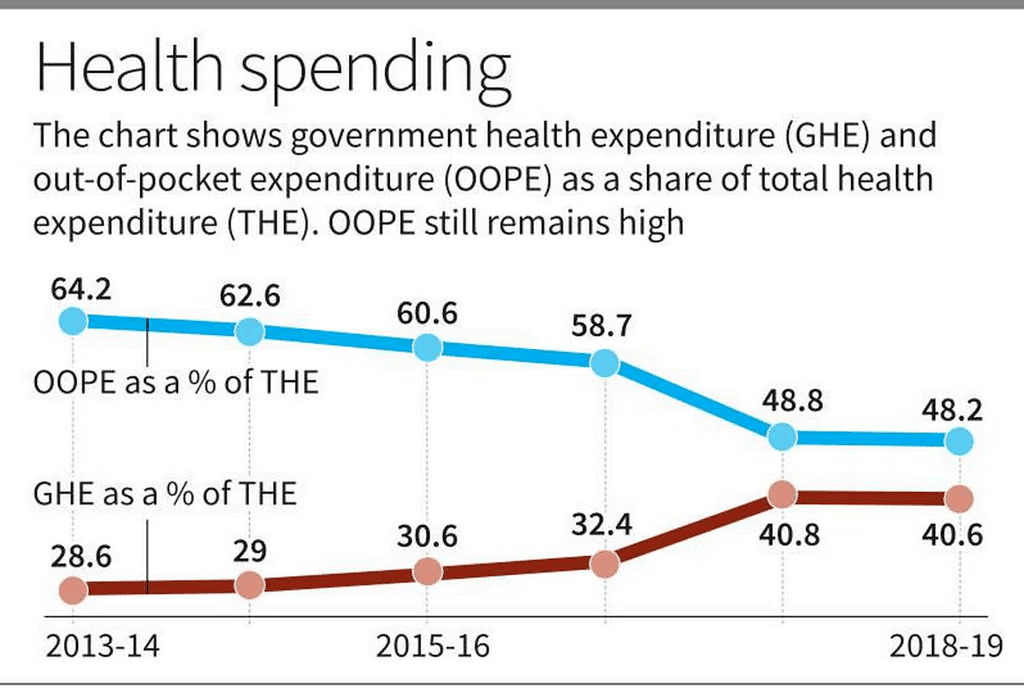

- Higher Out-of-Pocket Expenditure (OOPE): The OOPE remains high at approximately 39.4% of the Total Health Expenditure (THE) for 2021-22, as reported by National Health Accounts (NHA) data. This figure has decreased from 62.6% in 2014-15, but in states like Uttar Pradesh, OOPE can reach as high as 71.3%.

- Marginal Increase in Government Health Expenditure (GHE): The GHE share has grown from 28.6% in 2013-14 to 40.6% in FY19, with GHE as a percentage of GDP increasing by 63% from 2014-15 to 2021-22, rising from 1.13% to 1.84% of GDP.

- Share of Health Expenditure in GDP: In 2019-20, India's Total Health Expenditure was estimated at Rs. 6,55,822 crores, constituting 3.27% of the GDP and about Rs. 4,863 per capita. In contrast, the United States allocates approximately 18% of its GDP to healthcare, while countries like Germany and France spend around 11-12%

Why is there Need to Reduce GST on Health and Life Insurance Premiums?

- Insurance as a Basic Necessity: Health insurance is essential for providing financial safety during unforeseen events, and thus it should not be taxed heavily.

- Affordability Issues: The 18% GST on insurance premiums substantially raises costs for policyholders. In some instances, health insurance premiums have surged by up to 50%, making it hard for many to sustain their policies.

- Global Comparison: India's GST on insurance is among the highest globally. Countries like Singapore and Hong Kong do not impose such taxes, making their insurance options more appealing and affordable.

- Impact on Insurance Penetration: The high GST rate contributes to low insurance penetration in India, recorded at just 4% in 2022-23, compared to a global average of around 7%. Reducing GST could promote broader insurance uptake, aligning with the goal of "Insurance for All by 2047."

- Economic Growth: Taxing insurance premiums can hinder the growth of the insurance sector, which is crucial for economic stability and personal financial security.

What can be the Downsides of Removing GST on Life and Health Insurance?

- Revenue Loss for Governments: The 18% GST on life and health insurance generates significant revenue for both federal and state governments. Eliminating this tax could result in budget shortfalls, impacting funding for public health services and initiatives.

- Increased Burden on Other Taxpayers: To offset the lost revenue, governments might have to raise other taxes, putting additional pressure on taxpayers.

- Potential for Increased Prices: While removing GST might lower costs for consumers, healthcare providers may raise prices to maintain revenue, which could negate the intended benefits.

Way Forward

- GST Review: The government should contemplate a review of the GST on health and life insurance premiums to enhance affordability and stimulate penetration rates. A parliamentary committee, led by a former Minister of State for Finance, has suggested lowering the GST on health and term insurance to decrease premiums and promote policy uptake.

- Capital Support to Insurance Sector: The parliamentary committee recommends that the Reserve Bank of India issue "on-tap" bonds to meet the capital needs of the insurance sector, estimated between Rs. 40,000 to 50,000 crore. "On-tap bonds" are available for purchase at any time, not restricted to specific offerings or auctions.

- More Public Investments in Healthcare: Increased public investment in healthcare in developing countries has shown that higher spending correlates with greater utilization of services. Making healthcare more affordable can unleash latent demand, allowing more individuals to access necessary care.

- Investments in More Medical Colleges: To reduce costs beyond a few premier institutions like AIIMS, there should be encouragement for investments in additional medical colleges, which may help lower costs and improve healthcare quality.

- Policy Reforms: Implementing policy reforms aimed at reducing medical inflation and controlling healthcare expenses can enhance the affordability of health insurance. Additionally, providing incentives to insurers could foster competition and innovation, leading to further cost reductions.

Mains Question:

Q: What are the challenges related to the healthcare sector in India? What steps can be taken to make health services more affordable?

Government Push For Infrastructure Projects

Why in News?

Recently, the Cabinet Committee on Economic Affairs, led by the Prime Minister, has approved eight National High-Speed Corridor projects under the Public-Private Partnership (PPP) Model. These initiatives are anticipated to generate approximately 4.42 crore mandays of both direct and indirect employment.

What are the Approved Eight National High Speed Corridor Projects?

- Agra-Gwalior high-speed corridor

- Tharad-Deesa-Mehsana-Ahmedabad corridor

- Guwahati Ring Road

- Nashik Phata-Khed corridor

- Kharagpur-Moregram corridor

- Ayodhya Ring Road

- Raipur-Ranchi corridor

- Kanpur Ring Road

Investment Models

- Build-Operate-Transfer (BOT)

- Hybrid Annuity Model (HAM)

- Engineering, Procurement, and Construction (EPC) Model

What is the Government’s Road Map for Infrastructure Development?

- Focus on Public-Private Partnerships (PPP): The government emphasizes the development of projects through PPP investment models, which allow private entities to take on investment risks and manage the construction and maintenance of highways.

- Amendments to Concession Agreements: The government has revised the Model Concession Agreement to attract private investors by introducing more favorable compensation, longer concession periods, and termination payments.

- Introduction of Construction Support: A new mechanism will allow the National Highways Authority of India (NHAI) to pay up to 40% of the total project cost in ten installments based on progress, improving financial viability for developers.

Economic Impact of High Speed Corridor Projects:

- The projects are designed to enhance regional economies, particularly benefiting states such as West Bengal and those in the North East by improving connectivity and reducing transportation costs.

Progress in Highway Construction in India:

- The length of National Highways has expanded from 0.91 lakh km in 2013-14 to 1.46 lakh km in 2024.

- The average annual construction of National Highways has surged approximately 2.4 times, rising from about 4,000 km in 2004-14 to around 9,600 km in 2014-24.

- The total capital investment in National Highways, including private investments, has increased sixfold from Rs. 50,000 Crore in 2013-14 to about Rs. 3.1 Lakh Crore in 2023-24.

- The government has adopted a corridor-based approach to highway infrastructure development, emphasizing consistent standards, user convenience, and logistical efficiency.

What are the Challenges to Infrastructure Development in India?

- Physical Infrastructure: Significant challenges include land acquisition, which often involves complex resettlement and compensation issues. Additionally, funding large-scale projects is difficult due to limited government resources and economic hurdles that hinder private investment.

- Political and Regulatory Risk: This includes various approvals needed throughout the project cycle, community opposition, changing regulations, and breaches of contract terms. In India, the denial of government payments against contractual agreements is likely to affect future investment decisions.

- Geographical Challenges: India's varied topography, including mountains and rivers, poses unique engineering challenges. Extreme weather events like cyclones and floods can disrupt projects and escalate costs.

- Corruption and Inefficiency: Bureaucratic red tape, corruption, and a lack of transparency can lead to project delays, increased costs, and poor-quality outcomes.

- Policy Inconsistencies: Conflicting policies and regulations can create an uncertain environment, discouraging private sector participation.

- Digital Divide: India faces challenges in enhancing its digital infrastructure, especially in rural areas with limited access to technology and the internet. There are also concerns about cybersecurity and privacy that require robust regulations.

What Steps can be Taken for Infrastructure Development in India?

- Investment in Social Infrastructure: Investing in areas like education, public health, and sanitation can enhance workforce productivity and improve overall quality of life, fostering a stronger economy.

- Increased Public-Private Partnerships (PPPs): The government can collaborate with the private sector to finance, design, construct, and operate infrastructure projects.

- Improved Project Planning and Implementation: Streamlining project planning and execution can help ensure timely and budget-compliant completion of projects.

- Implementation of Innovative Financing Solutions: The government can explore infrastructure bonds and other innovative financing options to secure additional funding for development.

- Encouraging Foreign Direct Investment (FDI): Creating a favorable regulatory environment can attract foreign investments into infrastructure development.

- Building Human Capital: Focus on enhancing human capital through job training, quality education, and infrastructure research can support development efforts. Key initiatives include Skill India and Pradhan Mantri Kaushal Vikas Yojana (PMKVY).

- Effective Regulation: Establishing and enforcing regulations can ensure the quality and safety of infrastructure projects, including standards for materials and safety requirements.

Mains Question:

Q: What are the obstacles to infrastructure development in India and what actions can be taken to address this?

World Development Report 2024

A recent World Bank report titled "World Development Report 2024: The Middle Income Trap" has highlighted significant challenges faced by over 100 countries, including India, in achieving high-income status in the coming decades.

Middle Income Trap

- India is among 100 countries, including China, at risk of falling into the "middle income trap," where countries struggle to transition from middle-income to high-income status.

- India is at a crucial juncture, benefiting from favorable demographics and advancements in digitalization, but faces a tougher external environment compared to the past.

- India's aim to become a developed nation by 2047 requires a comprehensive approach that enhances overall economic performance instead of focusing on isolated sectors.

- Since 1990, only 34 middle-income economies have transitioned to high-income status, often due to special circumstances like European Union integration or oil reserves.

- Diminishing returns on physical capital challenge middle-income countries in sustaining economic growth.

- While low-income countries can build physical capital and improve basic education, middle-income countries face diminishing returns as they invest further.

- Increasing saving and investment rates alone will not suffice; addressing factors beyond physical capital is crucial.

- Despite having relatively high capital endowments, middle-income economies struggle with productivity issues, indicating that physical capital is not the main barrier to growth.

- The World Bank criticizes many middle-income countries for relying on outdated economic strategies focused primarily on expanding investment.

Global Economic Impact

- Middle-income countries are home to six billion people, representing 75% of the global population, and generate over 40% of global Gross Domestic Product (GDP).

- The success or failure of these countries in achieving high-income status will significantly impact global economic prosperity.

Per Capita Income Disparity

- India, identified as the fastest growing major economy, would take 75 years for its per capita income to reach a quarter of the US income levels if current trends continue.

- China would take over 10 years, Indonesia nearly 70 years, and India 75 years to achieve a quarter of US income per capita.

Challenges and Risks

- Middle-income countries face significant obstacles, including ageing populations, rising debt, geopolitical and trade frictions, and environmental concerns.

- These countries risk failing to achieve reasonably prosperous societies by mid-century if current trends persist.

Strategic Recommendations

3i Strategy- Phase 1: Focus on investment for low-income countries.

- Phase 2: Investment and infusion of foreign technologies for lower-middle-income countries.

- Phase 3: Investment, infusion, and innovation for upper-middle-income countries.

- The report highlights South Korea as an example, which started with a per capita income of USD 1,200 in 1960 and reached USD 33,000 by 2023 by sequentially adopting the 3i strategy.

Policy Recommendations:

- To become a developed nation, India requires a comprehensive approach that enhances overall economic performance and focuses on horizontal policies rather than vertical debates (e.g., manufacturing vs. services).

- Improving education and skills is vital for better absorption of technology and innovation.

- Strengthening connections between universities and industries can enhance knowledge transfer.

- India shows potential in technology preparedness, but greater dynamism in firms is needed to effectively absorb and utilize these technologies.

- The prevalence of microenterprises suggests barriers exist for productive firms to grow due to policies favoring smaller firms.

What is the Middle Income Trap?

- The middle-income trap is a situation where a country, after reaching middle-income status, struggles to transition to high-income status.

- This commonly occurs when economic growth slows down after an initial period of rapid progress, leaving the country stuck at a middle-income level.

- The World Bank defines the middle-income trap as economic stagnation occurring when a country's GDP per capita reaches about 10% of the United States level, approximately USD 8,000 currently.

- Low-income countries often experience rapid growth when transitioning to middle-income levels, benefiting from low wages, cheap labor, and basic technology catch-up.

- At the middle-income stage, stagnation can occur due to the exhaustion of initial growth drivers, institutional weaknesses, income inequality, and lack of innovation.

Current Status:

- By the end of 2023, 108 countries were classified as middle-income, with GDP per capita between USD 1,136 and USD 13,845.

- These countries house 75% of the global population and generate over 40% of global GDP, contributing to more than 60% of carbon emissions.

- Until 2006, the World Bank categorized India as a low-income nation.

- In 2007, India transitioned to the lower-middle-income group and has remained classified as such since then.

- Economists observe that India’s growth has been sluggish at lower-middle-income levels, with per capita income stuck between USD 1,000 and USD 3,800, primarily benefiting the top 100 million people, raising concerns about sustainability.

What Challenges Must India Overcome to Improve the Income Status?

Income Inequality:- India grapples with high levels of consumption inequality, with a Gini index of around 35 over the past two decades.

- This inequality limits broad-based economic growth and hinders inclusive development.

- Despite significant strides in reducing extreme poverty between 2011 and 2019, the pace of poverty reduction has slowed, especially post the Covid-19 pandemic, indicating ongoing struggles to address deep-seated economic disparities.

Balancing Growth and Inflation:

- Higher interest rates aimed at controlling inflation can dampen demand and impact economic growth.

- India needs to manage monetary policy effectively to balance growth with inflationary pressures.

- Strategic fiscal management is crucial to support growth without exacerbating inflation.

Income Per Capita:

- India’s per capita income is significantly below the upper-middle-income threshold of USD 4,256.

- To achieve high-income status, substantial growth in per-capita income is essential over the coming years.

- India is projected to approach a USD 7 trillion economy by FY31, requiring a sustained 6.7% average annual growth rate to transition to upper-middle-income status.

Labor Force Participation:

- Despite improvements in employment indicators, concerns remain about job quality, real wage growth, and low participation of women in the labor force.

- These issues affect overall economic productivity and inclusivity of growth.

- The Economic Survey 2023-24 notes that India needs to generate nearly 78.5 lakh non-farm jobs annually until 2030 to cater to the rising workforce.

Economic Diversification:

- Mining, manufacturing, construction, and services are key growth drivers.

- India must ensure continued diversification to avoid over-reliance on any single sector.

- India aims for the manufacturing sector to contribute over 20% of GDP by FY31, relying on global competitiveness, enhanced value chains, and green transitions.

Environmental and Climate Resilience:

- India's aspiration to achieve high-income status by 2047 must align with its goal of net-zero emissions by 2070.

- Balancing economic growth with climate resilience is complex, requiring significant investments in green technologies and sustainable practices.

- The growth path must be resilient to climate impacts while delivering broad-based benefits to the population.

What are the Factors Supporting India's Improvement in Income Status?

Global Offshoring:

- Increased outsourcing of services, such as software development and customer service, to India is expected to boost employment.

- Acceptance of work-from-home models could potentially double employment in outsourced jobs to over 11 million by 2030, with global spending on outsourcing projected to grow from USD 180 billion to around USD 500 billion annually.

Digitalization:

- Initiatives like India's Aadhaar program and IndiaStack (Digital Public Infrastructure) are driving digital transformation and enabling greater financial inclusion.

- India's credit-to-GDP ratio could rise from 57% to 100% in the next decade, with consumer spending expected to double from USD 2 trillion to USD 4.9 trillion, particularly in non-grocery retail.

Energy Transition:

- Significant investments in renewables, including biogas, ethanol, green hydrogen, wind, solar, and hydroelectric power, are underway.

- Daily energy consumption is expected to increase by 60%, reducing reliance on imported energy and improving living conditions.

- The energy transition creates new demand for electric solutions, driving investment growth and a virtuous cycle of jobs and income.

Manufacturing Sector:

- Corporate tax cuts, investment incentives, and infrastructure spending are propelling capital investments.

- Manufacturing's share of GDP is projected to rise from 15.6% to 21% by 2031, potentially doubling India's export market share.

- India continues to open its economy to global investors by raising Foreign Direct Investment limits, removing regulatory barriers, and improving the business environment.

- India’s 14 Production Linked Incentive Schemes (PLI) have the potential to boost production, employment, and economic growth significantly over the next five years.

Services Sector:

- The services sector is expected to grow at 6.9% between FY2025 and FY2031, remaining the dominant driver of India's growth.

Economic Size:

- India's GDP is projected to double from USD 3.5 trillion to over USD 7 trillion by 2031.

- The Bombay Stock Exchange is expected to grow at 11% annually, reaching a market capitalization of USD 10 trillion by 2030.

- Projections indicate that India will become the world's third-largest economy by 2031.

- According to the International Monetary Fund (IMF), India's current GDP per capita is around USD 2,850, placing it in the lower-middle-income category, but projections show it could reach USD 4,500 by 2031.

Consumption and Income Distribution:

- Rising income levels can significantly increase overall consumption.

- Increased per capita income and economic growth will enhance domestic consumption.

- Consumer spending is expected to double from USD 2 trillion in 2022 to USD 4.9 trillion by the end of the decade, with notable gains in non-grocery retail, leisure, and household goods.

What Strategies Should India Adopt to Avoid the Middle-Income Trap?

Address Income Inequality:- Implement policies to ensure a more equitable distribution of wealth, including progressive taxation and increased social spending.

- Strengthen social safety nets and support systems to reduce disparities between different income groups and regions.

Enhance Economic Diversification:

- Focus on diversifying the economy beyond traditional sectors by investing in emerging industries such as technology, renewable energy, and advanced manufacturing.

- Encourage development in economically lagging regions to prevent over-reliance on specific areas and distribute economic benefits more evenly.

Increase Productivity and Innovation:

- Foster innovation through investments in research and development and support tech-driven industries to enhance productivity.

- Improve education and skills to meet modern economic demands, with an emphasis on vocational training and higher education.

Support Local Manufacturing and Production:

- Encourage local manufacturing via policies like PLI schemes, making essential goods more affordable and competitive.

- Utilize local skills and resources by promoting manufacturing in states with potential but lower costs, addressing regional disparities and unemployment.

Foster Inclusive Growth:

- Prioritize the production and distribution of essential goods such as food, healthcare, and education, making them affordable for all segments of the population.

- Implement policies that create job opportunities and improve living standards across diverse regions and communities.

Strengthen Economic Institutions and Governance:

- Enhance the efficiency and transparency of economic institutions to reduce corruption and ensure effective resource utilization.

- Undertake structural reforms to streamline regulations, ease the business environment, and attract investments.

Focus on Sustainable Development:

- Align economic growth strategies with environmental sustainability goals by investing in green technologies.

- Develop strategies to mitigate climate change impacts and build resilience in vulnerable sectors.

Promote Financial Inclusion:

- Enhance financial inclusion by improving access to credit and financial services for small businesses and individuals in underserved areas.

- Utilize digital platforms to increase financial inclusion and improve the efficiency of financial transactions.

Mains Question

Q: Evaluate the criticism by the World Bank on outdated economic strategies used by many middle-income countries. What alternative strategies should India adopt to avoid the middle-income trap?

Sovereign Gold Bond Scheme

Why in News?

Recently, the Union Government announced a reduction of the import duty on gold from 15% to 6% in the Budget 2024-25. Additionally, the government is set to make decisions regarding the future of the Sovereign Gold Bonds (SGB).

What is the Sovereign Gold Bond Scheme?

- Launch: The Sovereign Gold Bond (SGB) scheme was launched in November 2015 to reduce the demand for physical gold and encourage domestic savings to be redirected into financial instruments instead of gold purchases.

- Issuance: SGBs are issued as Government of India Stocks under the Government Securities (GS) Act, 2006. The Reserve Bank of India (RBI) issues these bonds on behalf of the Government of India. They can be purchased through various channels including scheduled commercial banks (excluding small finance banks, payment banks, and regional rural banks), the Stock Holding Corporation of India Limited, Clearing Corporation of India Limited, designated post offices, and stock exchanges like the National Stock Exchange of India Limited and Bombay Stock Exchange Limited.

- Eligibility: The bonds can be purchased by resident individuals, Hindu Undivided Families (HUFs), trusts, universities, and charitable institutions.

Features

- Issue Price: The price of the gold bonds is based on the market price of gold with 999 purity (24 carats) as published by the India Bullion and Jewellers Association (IBJA), Mumbai.

- Investment Limit: Gold bonds can be purchased in multiples of one unit (1 gram), with specific limits set for different investors. Retail investors and HUFs can invest up to 4 kilograms (4,000 units) per financial year, while trusts and similar entities have a limit of 20 kilograms. The minimum investment allowed is 1 gram of gold.

- Term: These bonds have a maturity period of eight years, with an option to exit after the first five years.

- Interest Rate: The scheme offers a fixed annual interest rate of 2.5%, payable semi-annually. The interest earned on SGBs is subject to tax under the Income Tax Act, 1961.

- Benefit: SGBs can be used as collateral for loans. Moreover, individuals are exempt from capital gains tax upon redemption of SGBs. Redemption means the issuer repurchasing the bond at or before its maturity, and capital gain refers to the profit when the selling price of an asset exceeds its purchase price.

Disadvantages of Investing in SGB

- This investment is long-term, unlike physical gold, which can be sold at any time.

- Although SGBs are traded on exchanges, the trading volumes are relatively low, making it difficult to liquidate before maturity.

Commercial Cultivation of HT Basmati Rice

Why in news?

Recently, the Indian government has permitted the commercial cultivation of two non-transgenic varieties of herbicide-tolerant (HT) basmati rice: Pusa Basmati 1979 and Pusa Basmati 1985. These varieties have been developed by the Indian Council of Agricultural Research (ICAR) to foster sustainable paddy cultivation practices that conserve water and lower carbon emissions.

What are the Key Features of the New Varieties of Rice?

- These new rice varieties possess a modified AcetoLactate Synthase (ALS) gene, enabling farmers to apply Imazethapyr, a herbicide, for effective weed control.

- The mutated ALS gene prevents the herbicide from binding to ALS enzymes, allowing essential amino acid synthesis to continue unaffected.

- The ALS gene in rice is crucial for producing amino acids needed for the plant’s growth and development.

- In traditional rice plants, the herbicide inhibits ALS enzymes, disrupting amino acid production.

- This herbicide is effective against a range of weeds, including broadleaf, grassy, and sedge varieties, but it does not differentiate between the crop and other plants.

- The mutation allows these rice plants to tolerate the herbicide, effectively targeting only the weeds.

- Since the process does not involve foreign genes, these varieties are classified as non-Genetically Modified Organisms (non-GMOs).

Significance

- These HT rice varieties provide multiple advantages, including the elimination of nursery preparation, puddling, transplanting, and field flooding.

- They contribute to a reduction in methane emissions, a significant greenhouse gas, by supporting Direct Seeding of Rice (DSR).

Paddy Transplantation vs Direct Seeding of Rice (DSR)

- Paddy transplantation requires the field to be "puddled," or tilled in standing water.

- In contrast, DSR involves directly drilling pre-germinated seeds into the field using a tractor-powered machine.

- After transplanting, the plants need to be irrigated almost daily for the first three weeks to maintain a water depth of 4-5 cm.

- For the following four to five weeks, farmers continue watering every 2-3 days during the tillering stage.

- With DSR, farmers only need to level their land and provide a single pre-sowing irrigation.

- Paddy transplantation is both labor-intensive and requires significant water use.

- In contrast, DSR is more water and labor-efficient, reducing methane emissions due to shorter flooding durations and less soil disturbance.

|

164 videos|800 docs|1158 tests

|