Economic Development : May 2025 UPSC Current Affairs | Indian Economy for UPSC CSE PDF Download

China’s Export Restrictions on Critical Minerals

Why in News?

India is currently in discussions with China regarding the recent export restrictions imposed on germanium, a critical mineral essential for semiconductor production. China, which accounts for over half of the global supply of germanium, has limited its exports, significantly affecting Indian industries reliant on these imports. These restrictions are part of China's broader strategy to safeguard its national security, respond to U.S. tariffs, and assert greater control over global supply chains.

Key Takeaways

- China's export restrictions on germanium are impacting Indian industries.

- Critical minerals are essential for modern technologies, including renewable energy and electronics.

Additional Details

- What are Critical Minerals? Critical minerals, such as copper, lithium, nickel, cobalt, and rare earth elements, are vital components in various energy technologies, including wind turbines, electricity networks, and electric vehicles.

- India has identified 30 critical minerals, including germanium, and is increasingly dependent on imports, particularly from China, which dominates the processing of these minerals globally.

- These minerals are crucial for the advancement of renewable energy technologies, which are essential for achieving global “Net Zero” commitments. With India's electric vehicle (EV) market projected to grow at a compound annual growth rate (CAGR) of 49% until 2030, the demand for critical minerals and advanced chemistry cell (ACC) batteries is expected to increase significantly.

- Furthermore, these minerals are integral to innovation in artificial intelligence, robotics, and space technology, aligning with India's Atmanirbhar Bharat vision for technological self-reliance.

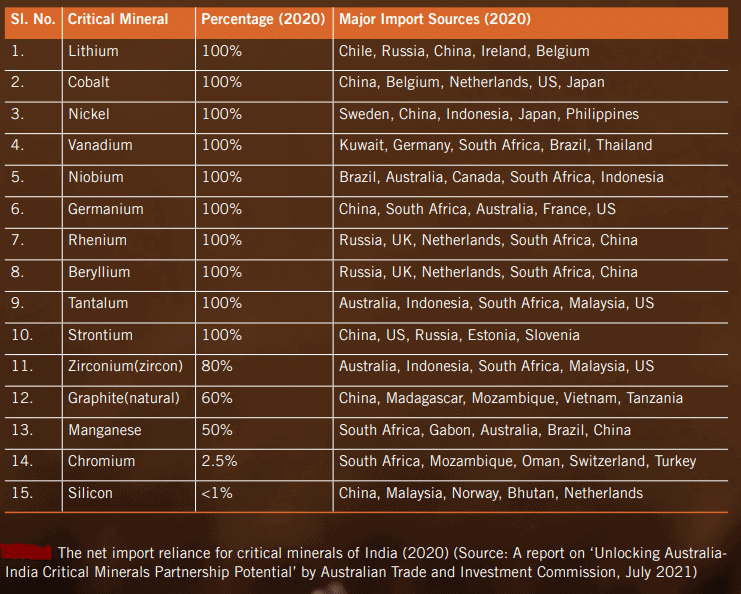

India’s Dependence

India heavily relies on imports for critical minerals, especially from China. These minerals are vital for various industries, including pharmaceuticals, semiconductors, and aerospace.

Major Applications and Availability of Critical Minerals in India

Conclusion

The ongoing export restrictions by China highlight the critical importance of securing access to essential minerals for India’s technological and industrial growth. As global demand for these resources continues to rise, India's strategic response will be crucial in ensuring sustainable development and self-reliance.

One State-One RRB

Why in News?

The fourth phase of the Regional Rural Bank (RRB) consolidation under the ‘One State-One RRB’ (OS-OR) plan has been initiated in 10 states and one Union Territory, resulting in a further reduction in the number of RRBs in India. This initiative aims to enhance operational viability and efficiency. However, there are ongoing concerns regarding staffing, technology integration, and regional risks.

Key Takeaways

- The OS-OR policy consolidates multiple RRBs within a state into a single entity.

- This consolidation is based on recommendations from the Dr. Vyas Committee (2001) and has been ongoing since 2005.

- As of March 2021, RRBs have decreased from 196 in 2005 to 43.

- Phase 4 aims to reduce RRBs to 28, with each having an authorized capital of Rs 2,000 crore.

Additional Details

- What is the One State-One RRB Policy: This policy is a reform by the Department of Financial Services to merge multiple RRBs in a state into one, enhancing financial efficiency and stability.

- Phases of Consolidation:

- Phase 1 (FY 2006 – FY 2010): Merged RRBs sponsored by the same bank, reducing the number from 196 to 82.

- Phase 2 (FY 2013 – FY 2015): Merged RRBs across different sponsor banks, reducing the count from 82 to 56.

- Phase 3 (FY 2019 – FY 2021): Focused on the OS-OR principle, consolidating RRBs in larger states and reducing their number.

- Phase 4 (FY 2025 Onwards): Aims to consolidate RRBs further, enhancing their capital base and operational capabilities.

- Impact: In FY 2023-24, RRBs achieved their highest-ever net profit of Rs 7,571 crore, indicating improved operational efficiency and profitability.

What Challenges Persist Despite the Consolidation of RRBs?

- Despite the positive outcomes of the OS-OR policy, challenges remain. RRBs continue to face high operational costs, with a cost/income ratio of 77.4% and a wages/operating expenses ratio of 72% in 2023-24, highlighting inefficiencies.

- The consolidation also raises concerns about concentration risk, as a single RRB now bears the financial burden from regional agricultural downturns, which was previously distributed among multiple RRBs.

- Furthermore, the complex ownership structure involving central and state governments, sponsor banks, and multiple regulatory authorities complicates governance and slows decision-making processes.

- The economic viability of the consolidated RRBs must also consider regional economic, demographic, and geographic factors to avoid a one-size-fits-all approach.

Conclusion

While the One State-One RRB policy presents opportunities for enhanced efficiency and profitability within RRBs, careful consideration of operational challenges and regional dynamics is essential for its long-term success.

India-UK Free Trade Agreement

Why in News?

Recently, India and the UK successfully finalized a Free Trade Agreement (FTA) after approximately three years of negotiations. The Indian Prime Minister announced that both countries have reached a mutually beneficial agreement, which also includes a Double Contribution Convention.

Key Takeaways

- The FTA aims to promote trade by easing regulations and setting rules that affect both goods and services.

- Negotiations began in January 2022 and included 14 rounds until the agreement was concluded in May 2025.

Timeline of India-UK FTA Negotiations

- May 2021: Launch of the Enhanced Trade Partnership (ETP) by Prime Ministers Narendra Modi and Boris Johnson.

- January 2022: Formal launch of FTA negotiations in New Delhi.

- January 2022 – January 2025: A total of 14 negotiation rounds were held.

- March 2024: Negotiations paused due to Indian general elections.

- February 2025: Talks resumed after an eight-month hiatus.

- May 6, 2025: Conclusion of FTA negotiations and the Double Contribution Convention pact.

Reasons for the Need of India-UK FTA

- Post-Pandemic Supply Chain Diversification: Companies in the West recognized the risks associated with over-reliance on China, leading to a 'China-plus one' trade strategy.

- UK's Post-Brexit Economic Strategy: The UK's exit from the European Single Market necessitated new trade agreements, with India presenting a valuable alternative market.

- UK's Domestic Economic Pressures: Facing a cost of living crisis, the FTA promises cheaper imports and more export opportunities.

- India's Strategy after RCEP Exit: After opting out of the RCEP in 2019, India sought to pursue bilateral trade agreements, like the one with the UK.

Key Highlights of the UK-India Free Trade Agreement

- Tariffs:

- 99% of Indian goods exported to the UK will face zero tariffs.

- India will reduce tariffs on 90% of UK tariff lines, with 85% becoming zero-duty within ten years.

- Trade Boost: Expected increase in bilateral trade by £25.5 billion annually by 2040.

- Key UK Sectors Benefiting:

- Alcohol: Tariffs on whisky and gin will decrease from 150% to 75%, and eventually to 40% over ten years.

- Automobiles: Import tariffs on UK cars will be reduced to 10% under a quota.

- Key Indian Sectors Benefiting: Labour-intensive exports such as textiles, leather, marine products, and engineering goods.

- Mobility & Services:

- Introduction of around 100 new annual visas for Indian professionals, especially in IT and healthcare.

- Exemption from social security contributions for skilled Indian workers in the UK for three years.

Significance of the India–UK FTA for India

- The deal is expected to double bilateral trade by 2030, currently valued at about $60 billion.

- Strengthens strategic ties post-Brexit, enhancing India’s role in the UK’s “Global Britain” strategy.

- For the first time, India is opening highly protected sectors like automobiles to tariff reductions.

- Boosts exports and domestic industries by eliminating tariffs on various sectors.

- Enhances workforce mobility and competitiveness for Indian professionals.

Challenges in the India-UK FTA Negotiations

- Limited Marginal Gains for India: Many Indian exports to the UK already enjoyed low or zero tariffs, limiting additional benefits from the FTA.

- Services and Work Permits: The agreement allowed only around 100 new work visas, which fell short of India’s expectations.

- UK’s Proposed Carbon Tax: The UK aims to impose a carbon border tax, which could affect Indian metal product exports.

- Farmers' Opposition in India: Farmers have expressed concerns that the FTA may harm local producers by allowing cheaper UK goods into the market.

Way Forward

- Early Implementation: Ensuring swift ratification and operationalization of the FTA to unlock its benefits.

- Empower MSMEs: Strengthening India’s micro, small, and medium enterprises to enable participation in bilateral trade.

- Bilateral Investment Treaty (BIT): Prioritizing a BIT with the UK to provide legal clarity and boost investor confidence.

- Export Diversification: Promoting value-added exports and enhancing competitiveness through government support.

The India–UK FTA marks a significant milestone in economic relations between the two nations. Its success will hinge on effective implementation and supportive policies.

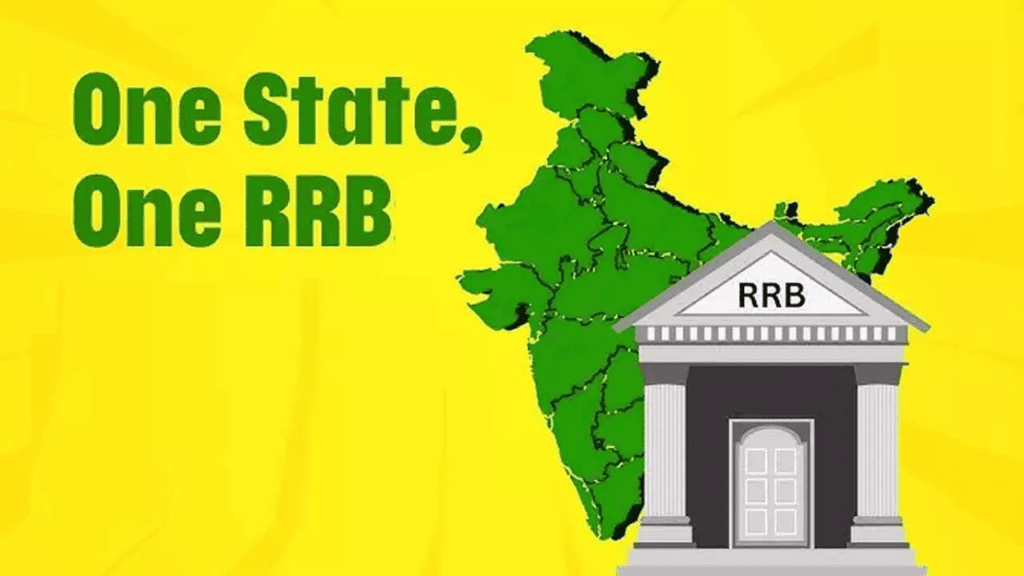

Human Development Report 2025

Why in News?

India has been ranked 130th out of 193 countries and territories in the Human Development Report (HDR), titled 'A Matter of Choice: People and Possibilities in the Age of AI,' released by the United Nations Development Programme (UNDP). The report highlights that while India has made consistent progress, inequality continues to hinder its human development achievements.

Key Takeaways

- Global HDI growth has stalled, marking the smallest increase since 1990, excluding the crisis years of 2020-2021.

- Iceland ranks first in HDI with 0.972, whereas South Sudan ranks last at 0.388.

- Inequality is growing, with high-HDI countries advancing while low-HDI countries stagnate.

- About 20% of people globally use AI tools; 60% believe AI will create new job opportunities, while half fear job displacement.

Additional Details

- India’s HDI Ranking: India improved from 133rd in 2022 to 130th in 2023, with an HDI value increase from 0.676 to 0.685, remaining in the 'medium human development' category.

- Regional Comparison: Compared to its neighbors, India ranks below China (78), Sri Lanka (89), and Bhutan (125), while on par with Bangladesh (130).

- Progress in Key Areas:

- Life Expectancy: Increased from 58.6 years in 1990 to 72 years in 2023, supported by health initiatives.

- Education: Mean years of schooling rose to 13 years; however, quality remains a concern.

- National Income: GNI per capita rose from USD 2,167 in 1990 to USD 9,046 in 2023, with significant poverty reduction.

- AI Skills Growth: India is emerging as a global leader in AI, with a significant increase in AI researchers remaining in the country.

- Challenges Impacting India’s HDI:

- Inequality has reduced India’s HDI by 30.7%, one of the highest in the region.

- Gender disparities persist, with female labor force participation at 41.7% and political representation lagging.

How can Artificial Intelligence Contribute to Human Development?

- Enhancing Productivity and Economic Growth: AI is projected to boost productivity significantly, with 70% of global respondents optimistic about its impact.

- Improving Access to Healthcare: AI improves diagnostic accuracy and streamlines clinical workflows, enhancing healthcare delivery.

- Transforming Education: AI supports personalized learning and helps educators track student progress effectively.

- Empowering Governance: AI enhances public service delivery and promotes transparency in government operations.

- Addressing Inequality: AI tools can bridge service delivery gaps for marginalized communities.

How can India Address its Human Development Challenges?

- Gender Equality: Implement the 106th Constitutional Amendment and promote women’s entrepreneurship through financial schemes.

- Address Inequality: Strengthen inclusive initiatives like the Mahatma Gandhi National Rural Employment Guarantee Act to combat rising inequality.

- Improve Health and Education: Increase investment in primary healthcare and enhance teacher training and educational tools.

- Leverage AI for Inclusion: Utilize AI for services like e-health monitoring and promote digital and financial inclusion.

Conclusion

India's gradual rise in HDI showcases its long-term investments in people-centric development. However, to realize its full human potential, India must confront inequality directly as a strategic priority for sustainable progress. The 2025 HDR emphasizes that inclusion is essential for human development.

Mains Question:

Q: Assess India's position in the global human development context. What are the challenges and opportunities for India in improving its HDI ranking?

India’s Livestock Sector

Why in News?

India’s livestock sector is crucial for rural livelihoods and nutrition, making animal health a major national priority. As World Veterinary Day 2025 celebrated the theme “Animal Health Takes a Team,” it highlighted the essential role of veterinarians and the increasing necessity for a One Health approach in addressing zoonotic risks.

Key Takeaways

- India boasts the world's largest livestock population, vital for agriculture, rural livelihoods, and economic growth.

- The livestock sector contributes significantly to the GDP and employs about 8.8% of the population.

- India is a leading global producer of milk, eggs, and meat, with substantial contributions to nutritional security.

Additional Details

- Livestock Data: According to the Livestock Census (2019), India has a total livestock population of 535.78 million.

- Milk, Meat, and Egg Production: India ranks first in milk production, contributing 24.76% of global output, and is a key player in egg and meat production.

- Contribution to GDP: The livestock sector grew at a CAGR of 12.99% from 2014-15 to 2022-23, accounting for 5.50% of India’s Gross Value Added (GVA).

- Nutritional Security: Livestock products provide essential protein, with the dairy sector representing two-thirds of total livestock output value.

- Exports: Livestock product exports rose by over 10% to reach USD 3.64 billion during April-December 2024.

- Poverty Alleviation: More than 50% of rural women are involved in livestock activities, aiding in income and financial independence.

- Cultural Importance: Livestock holds cultural and religious significance, strengthening community ties and preserving traditions.

Challenges Facing the Livestock Sector

- Low Productivity: Livestock productivity, particularly in dairy, meat, and poultry, remains below global standards. For instance, the average annual cattle milk productivity in India was 1,777 kg/animal, significantly lower than the global average of 2,699 kg.

- Infrastructure Issues: The sector faces challenges such as poor breed quality, inadequate feeding, and a lack of veterinary services, leading to high post-harvest losses and limited market access.

- Climate Risks: Climate change impacts livestock productivity, while livestock farming contributes to methane emissions and environmental degradation.

- Health Risks: Zoonotic diseases like avian influenza and foot-and-mouth disease pose significant threats, with 60% of infectious diseases being zoonotic.

- Lack of R&D: Insufficient research in livestock genetics, nutrition, and disease control hinders progress in the sector.

Measures for Improvement

- Breed Improvement and Nutrition Enhancement: Promoting genetic upgrades through selective breeding and improved fodder management can enhance productivity.

- Strengthening Veterinary Services: Improving access to veterinary care and incentivizing veterinarians to work in rural areas is essential.

- R&D and Technology Adoption: Increased investment in research and adopting sustainable farming practices is critical for growth.

- Improving Infrastructure: Enhancing cold chains, storage facilities, and market linkages can facilitate better access and pricing for farmers.

- Adopting One Health Approach: Integrating human, animal, and environmental health is vital for tackling zoonotic diseases.

- The livestock sector is integral to India’s economy, rural livelihoods, and food security. Strategic initiatives such as breed improvement, enhanced veterinary services, and a One Health approach are essential for fostering sustainability and enhancing overall performance in the sector.

Mains Question

Q: Discuss recent trends in livestock production in India and assess the impact of government initiatives on the sector.

NITI Aayog Report on MSMEs in India

Why in News?

NITI Aayog has recently published a report titled “Designing a Policy for Medium Enterprises,” which outlines a strategic roadmap aimed at transforming medium enterprises into significant contributors to India’s economic growth.

Key Takeaways

- Definition of Medium Enterprises: These are classified as enterprises with an investment in plant and machinery or equipment not exceeding ₹50 crore and a turnover not exceeding ₹250 crore.

- Proportion within MSMEs: Only 0.3% of all registered MSMEs qualify as medium enterprises, despite the sector comprising over 6 crore units.

- Economic Impact: The MSME sector contributes 29% to India’s GDP, with medium enterprises accounting for almost 40% of MSME exports.

- Job Creation: Medium enterprises are crucial for generating formal, skilled employment, as MSMEs employ over 60% of India’s workforce.

Additional Details

- Key Government Initiatives:

- Udyam Registration Portal (2020): Simplifies MSME registration and promotes formalization.

- PM Vishwakarma Scheme (2023): Supports traditional artisans with credit and training.

- Prime Minister’s Employment Generation Programme (PMEGP): Financial assistance for self-employment.

- SFURTI (2005): Revives traditional industries through cluster-based organization.

- Public Procurement Policy (2012): Mandates 25% of government purchases from MSEs.

- Challenges Faced by Medium Enterprises:

- Access to Finance: Limited financial products tailored to their needs.

- Technology Lag: Insufficient adoption of advanced manufacturing technologies.

- Weak R&D Ecosystem: Lack of institutional support for innovation.

- Testing Infrastructure Deficit: Absence of sector-specific testing facilities.

- Skilling Mismatch: Training programs misaligned with industry needs.

- Digital Fragmentation: Difficulty in navigating government resources.

- Recommendations from NITI Aayog:

- Tailored Financial Solutions: Introduce working capital financing schemes linked to turnover.

- Technology Integration: Upgrade Technology Centers to promote Industry 4.0 solutions.

- R&D Promotion: Establish an R&D cell within the Ministry of MSME.

- Cluster-Based Testing Infrastructure: Develop sector-focused testing facilities.

- Custom Skill Development: Align training programs with specific enterprise needs.

- Centralized Digital Portal: Create a sub-portal for easier access to government schemes.

Conclusion, by providing inclusive policies and strategic support, medium enterprises can emerge as vital engines of innovation, export growth, and job creation, playing a crucial role in realizing the vision of Viksit Bharat by 2047.

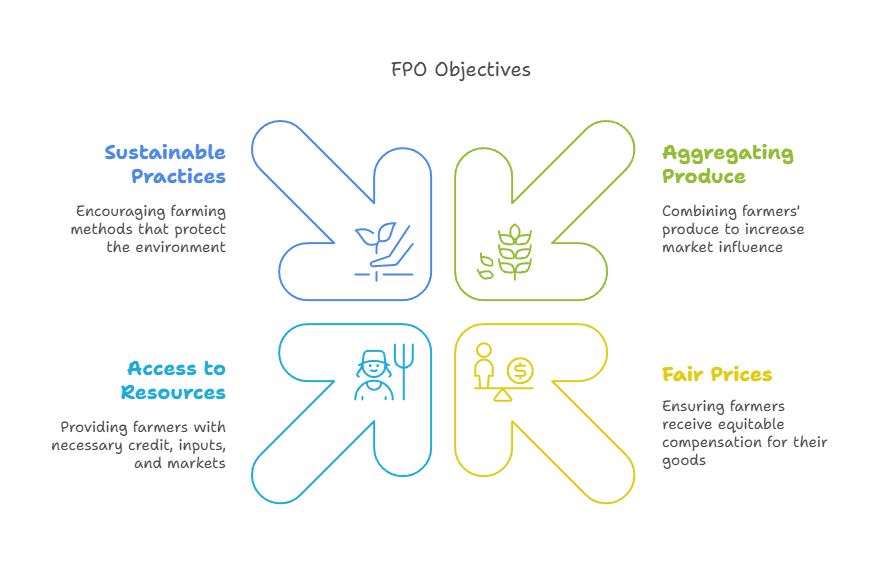

Farmers Producer Organisation

Why in News?

The development of Farmer Producer Organizations (FPOs) has been a critical step towards empowering small farmers in India. Despite the government's significant investment in FPOs, their progress has been slower than anticipated.

Key Takeaways

- FPOs are designed to help small farmers improve their bargaining power and market access.

- Currently, 45,000 FPOs are registered in India, but only 16,000 comply with regulatory requirements.

- Only 4,000 FPOs have secured working capital loans, indicating limited financial support.

Additional Details

- Definition of FPO: An FPO is a type of producer organization consisting of farmers, which can be registered under various acts such as the Companies Act, 2013, and the Societies Registration Act, 1860. It aims to facilitate better input purchases and fair pricing.

- Objectives & Need: With 87% of Indian farmers being small and marginal, FPOs aim to mitigate risks from weather and market fluctuations, ensuring better price realization and reduced costs.

- Current Status: Despite the number of registered FPOs, the average net profit per FPO is only Rs 3 lakh, which is insufficient to significantly boost farmer incomes.

- Challenges: FPOs face obstacles like a lack of one-size-fits-all solutions, limited market linkages, thin margins, reliance on middlemen, and insufficient social capital.

To strengthen FPOs for sustainable agriculture, it is essential to focus on creating iconic FPOs with capable leadership, developing knowledge resources, training local professionals, and encouraging value addition through processing and branding. Addressing these challenges will be crucial in ensuring their long-term viability and success.

Global Wind Report 2025

Why in News?

The Global Wind Energy Council (GWEC) has indicated that the projected wind capacity will only meet 77% of the targets set for 2030, which poses a significant risk to achieving net-zero emissions and the goals outlined in the Paris Agreement to limit global warming to below 2°C, with a preference for 1.5°C.

Key Takeaways

- In 2024, a total of 117 GW of new wind capacity was installed globally, an increase from 116.6 GW in 2023, resulting in a cumulative global capacity of 1,136 GW.

- China dominated the global wind market in 2024, contributing 70% of the new capacity, followed by the United States, Brazil, India, and Germany as top markets.

- Onshore wind capacity in Africa and the Middle East doubled in 2024, with Uzbekistan, Egypt, and Saudi Arabia emerging as notable success stories.

- Only 8 GW of offshore wind capacity was installed globally in 2024, representing a 26% decrease from the previous year.

Challenges

- Policy and Regulatory Issues: Instabilities in key markets and delays in project permitting.

- Infrastructure Gaps: Insufficient investment in grid upgrades.

- Financial and Market Pressures: Factors such as inflation, high interest rates, trade protectionism, and ineffective renewable energy auction systems challenge growth.

- Need to Scale-up: At COP28 in Dubai, nations committed to tripling renewable capacity by 2030, necessitating annual wind installations of 320 GW to meet climate goals.

Status of Wind Energy in India

- Total Wind Power Capacity: As of March 31, 2025, India's cumulative installed wind power capacity reached 50.04 GW, with 4.15 GW added in FY 2024-25, up from 3.25 GW in FY 2023-24.

- Global Standing: India ranks fourth in total installed wind power capacity, following China, the United States, and Germany.

- State-wise Distribution: Gujarat, Karnataka, and Tamil Nadu are the leading wind energy-producing states in India.

- Domestic Manufacturing Capacity: India has a strong wind turbine manufacturing industry with an annual capacity of approximately 18,000 MW.

- Offshore Wind Energy Potential: The National Institute of Wind Energy estimates a potential of 35 GW for offshore wind energy.

Challenges in Wind Energy Production in India

- Land Acquisition Complexities: Each wind turbine requires 7-8 acres of land, and slow conversion of agricultural land to non-agricultural use leads to delays.

- Non-modernized Grid: High-potential sites in Rajasthan, Gujarat, and coastal Tamil Nadu lack adequate transmission infrastructure, increasing energy costs.

- Policy Inconsistencies: The withdrawal of incentives such as Accelerated Depreciation and Generation-Based Incentives has created uncertainty in the market.

- Supply Chain Challenges: While domestic manufacturing capacity exists, blade availability is a concern, leading to reliance on imports.

- E-waste Problem: Disposal of outdated components like control systems, inverters, and batteries is challenging due to hazardous materials, complicating recycling efforts.

How to Strengthen Wind Energy Production in India?

- Strengthen Policy Framework: Simplifying land acquisition processes and implementing a uniform national wind policy can help accelerate growth.

- Provision for Land Bank: Establishing a land bank would secure conflict-free land, reduce delays, and enhance investor confidence.

- Boost Offshore Wind Potential: Collaborating with countries like Denmark and the United Kingdom can accelerate offshore turbine installation.

- Hybrid Wind-Solar Projects: Integrating wind and solar technologies can optimize land use and ensure more stable power generation.

- Financial & Market Innovations: Promoting funding through green bonds and leveraging carbon credit mechanisms can support investments in wind energy.

- Domestic Manufacturing: Launching a Production Linked Incentive (PLI) scheme for wind energy equipment can bolster local manufacturing capabilities.

- Focus on Emerging Technologies: Exploring floating wind turbines and promoting green hydrogen integration can enhance renewable energy generation.

India's wind energy sector demonstrates significant progress but continues to face challenges such as infrastructure gaps and policy inconsistencies. To meet net-zero goals, India must scale up offshore capacity, strengthen policies, promote hybrid projects, and invest in innovative solutions like floating turbines and green hydrogen integration.

Mains Question

Q: Discuss the key challenges facing India’s wind energy sector and suggest measures to overcome them to achieve the country’s renewable energy targets.

Annual Survey of Services Sector Enterprises

Why in News?

The Ministry of Statistics and Programme Implementation has published findings from a pilot study aimed at addressing critical data gaps in India's incorporated service sector, which has not been covered by existing surveys such as the Annual Survey of Unincorporated Sector Enterprises. This study included service sector enterprises registered under the Companies Act and the Limited Liability Partnership Act. The results indicated that 82.4% of these enterprises were Private Limited Companies, followed by Public Limited Companies and Limited Liability Partnerships, each accounting for 8%.

Key Takeaways

- The services sector contributed approximately 55% to India's Gross Value Added (GVA) in FY 2024-25, up from 50.6% in FY 2014.

- The sector employs around 30% of India's workforce, spanning diverse industries such as IT, finance, healthcare, education, tourism, and retail.

- India's services exports reached USD 280.94 billion during April-December 2024, with significant contributions from telecommunications, computer, and information services.

- From April 2000 to December 2024, the services sector attracted USD 116.72 billion in Foreign Direct Investment (FDI), making up about 16% of total FDI inflows.

- The sector plays a critical role in urbanization and the Digital India initiative, particularly through advancements in FinTech and digital payments.

Additional Details

- Importance of Services Sector: The services sector is vital for employment generation, global trade, and integration with other sectors. Its growth is essential for the overall economic health of the country.

- Challenges Faced: Major challenges include skill gaps among the workforce, high levels of informal employment, global competition, infrastructure deficits, and vulnerabilities stemming from the pandemic.

- Addressing Challenges: Recommendations include upskilling programs to enhance employability, strengthening global competitiveness through trade agreements, and improving digital infrastructure.

In conclusion, the services sector is crucial for India's economy, contributing significantly to employment and global trade. However, challenges such as skill shortages, informal employment, and global competition need to be addressed to enhance the sector's resilience and inclusivity.

Growth in CSR Spending

About Corporate Social Responsibility (CSR) in India

Corporate Social Responsibility (CSR) integrates social and environmental considerations into business operations. In India, the CSR framework is established by Section 135 of the Companies Act, 2013, which mandates eligible companies to contribute towards societal development.

- Eligibility Criteria for CSR: The CSR law applies to companies that meet any of the following criteria: a net worth of ₹500 crore or more, an annual turnover of ₹1,000 crore or more, or a net profit of ₹5 crore or more in the previous financial year.

- CSR Spend Requirement: Eligible companies must allocate at least 2% of their average net profit from the previous 3 years towards CSR activities.

- Penalty for Non-Compliance: Penalties are imposed if companies fail to meet the 2% CSR spend requirement and do not transfer the unspent amount to a specified fund.

- CSR Registration: Companies intending to undertake CSR activities must register with the Registrar of Companies. This ensures their CSR initiatives comply with the legal framework and are monitored.

Evolution of CSR in India

Corporate Social Responsibility (CSR) has evolved from a philanthropic activity to a strategic business approach, integrating societal and environmental concerns into business practices.

- Early Stages (1950s-1970s): CSR was initially viewed as a moral obligation, with businesses focusing on charities and basic community needs without strategic alignment.

- Expanding Dimensions (1980s-1990s): In the 1980s and 1990s, CSR adopted the Sustainable Impact Nexus; people, planet, profit, focusing on ethics and sustainability, which marked a shift towards long-term strategies.

- 21st Century Comprehensive Approach: CSR is central to business strategy, emphasising human rights, labour rights, environmental sustainability, and transparency. Companies incorporate CSR for long-term value.

Benefits of CSR Funding in India

Social Impact

- Education: CSR funding has significantly improved education, particularly in underserved and rural areas, bridging the education gap and empowering future generations. E.g., TCS invested in rural digital education, helping communities access quality education.

- Healthcare: CSR investments have enhanced healthcare infrastructure and supported public health initiatives, especially in rural regions, improving health outcomes. E.g., Reliance Industries focused on rural healthcare and COVID relief initiatives.

- Environmental Sustainability: CSR has played a key role in promoting environmental sustainability, with investments in renewable energy and conservation projects. E.g., ONGC’s investments in renewable energy align with India’s climate goals.

Economic Impact

- Corporate Profits: CSR spending is linked to profitability, as companies leverage success to contribute to society, promoting business growth and social welfare. E.g., HDFC Bank’s CSR investment of ₹945 crore highlights the connection between profits and CSR.

- Job Creation and Skill Development: CSR initiatives in skill development have enhanced employability in rural areas, boosting livelihoods and economic growth. E.g., HDFC Bank’s financial literacy programs have empowered rural communities.

Governance Impact

- Enhanced Transparency: CSR committees have ensured efficient fund management, promoting better outcomes. E.g., 990 companies formed CSR committees to provide better transparency in fund allocation.

- Efficient Fund Management: The transfer of unspent CSR funds to the Unspent CSR Account ensures that funds are efficiently utilised for future projects. E.g., unspent funds are transferred for future use.

Sector-Specific Impact

- National Heritage Preservation: CSR funding has supported the preservation of national heritage, enhancing cultural pride & promoting tourism. E.g., TCS played a role in preserving national monuments.

- Infrastructure and Community Development: CSR has funded infrastructure and healthcare projects, particularly in underserved areas, contributing to inclusive development.

Societal Impact

- Improved Quality of Life: CSR investments in education, healthcare, and sustainability have directly improved the quality of life for millions of Indians. E.g., CSR investments in education and healthcare have improved access to services.

- Community Empowerment: CSR has empowered local communities, providing access to resources, skills, and opportunities, thus fostering social inclusion. E.g., many CSR programs focus on women’s empowerment and skill development.

Challenges to CSR Funding in India

- Regional and Sectoral Disparity: CSR spending remains concentrated in a few developed states (like Maharashtra, Tamil Nadu) and sectors (mainly education and health), leaving backwards states and critical areas like the environment neglected.

- Lack of Transparency and Impact Assessment: Many companies do not disclose detailed CSR activities, making it difficult to track outcomes, build public trust, or ensure accountability.

- Superficial CSR and Greenwashing: Some firms view CSR as a mere statutory obligation, engaging in superficial projects for branding rather than achieving meaningful social or environmental impact.

- Weak Community Participation: CSR initiatives often exclude local communities from decision-making, leading to a mismatch between actual needs and project execution.

- Poor Coordination and Strategic Gaps: Lack of cooperation between corporations, NGOs, and local bodies leads to duplication of efforts and reduces the effectiveness of CSR projects.

Way Forward

- Develop a Centralised CSR Platform: Establish a national repository for States to list priority projects, enabling companies to align CSR funds with real needs in underserved regions like Aspirational Districts.

- Enhance Community Participation: Ensure CSR projects are planned and implemented with active involvement of local communities, district administration, and public representatives for better outcomes.

- Prioritise Sectoral Balance and Environmental Focus: Mandate companies in resource-intensive sectors to allocate 25% of CSR funds to environmental restoration and climate resilience.

- Strengthen Monitoring and Impact Assessment: Make third-party audits mandatory; integrate CSR spending details into financial audits to increase transparency, accountability, and reduce greenwashing.

- Foster Collaboration with NGOs and Government Agencies: Promote partnerships among companies, NGOs, and government to avoid duplication, maximise reach, and achieve greater social impact.

Targeting Higher Growth Rate for India

How India can become a $5 trillion Economy by 2029?

- With an average growth rate of 6.8 per cent for the medium term, India presents a significant economic opportunity. India has a history of accelerating its growth. Prior to the Covid-19 outbreak, the average annual GDP growth rate was 6.6% as opposed to 6.3% in the decade before.

- India has seen periods of growth at or around 8% annually, most notably between the fiscal years 2004 and 2008. However, these were years of “growth sprint”. India is anticipated to have the fastest-growing large economy in fiscal 2023, rising at a rate of 7% per year.

5 trillion-dollar Economy Relevance For UPSC Exam

- The applicants have up to this point read a significant number of papers discussing how to grow India’s economy to a 5 trillion dollar one. For the UPSC mains, it is a crucial subject, hence candidates should thoroughly prepare for it.

- We will give you enough material to use as practice in this article so you can do well on the UPSC main examination GS paper 3.

Indian Economy Growth Expectations in 2023

- The Indian economy is expected to grow at a 6.8 per cent annual rate during the next five years, with labour contributing 10%, capital 52%, and efficiency 38% of the increase. The need for capital will be crucial, and the odds are in favour of a sustained uptick in the private sector investment cycle. By the end of the fiscal year 2023, investment as a percentage of GDP had already risen to a decade-high 34%.

- The government has been in charge of raising the investment ratio thus far. Infrastructure and manufacturing are becoming more important in the new growth paradigm.

- The Union Budget increased capital spending in high-multiplier infrastructure segments by roughly a third. However, due to pressures for fiscal reduction, this support for capex will start to decline in the years to come. With improved bank sheets, cash reserves, and low leverage, the private sector’s contribution to investments is expected to increase.

Is India still on track to becoming a $5 trillion Economy?

- India should be quite proud of itself. When the $5 trillion goal was first proposed in 2019, it felt like a far-off fantasy. Now, it appears as though India is eager to accomplish it despite adversity like never before. The country’s economy has grown to be the fifth largest in the world, with a GPD of $3.5 trillion in 2022.

- There may be some speed bumps on the next road. The International Monetary Fund (IMF) has lowered its earlier forecast of 7.4% GDP growth for India for the fiscal year 2023 to 6.8%. The World Bank and the OECD are two such major organisations that have revised their growth forecasts.

- The impact of the global economic slowdown, according to Japanese brokerage company Nomura, might cause India’s economy to grow by roughly 7% in FY23 but decelerate to 5.2% in FY24.

Factors in Favour of India’s Growth

India has proven to be resilient in the face of these difficulties. There are numerous things that are in its favour.

- Strong relationships and a diversified economy: Over the past 50 years, India’s economy has expanded steadily. The economy is broadly diversified, and it has productive trade ties with other nations.

- Technology adoption: India has a huge thirst for embracing new technologies. The adoption rate has increased in the manufacturing and finance industries. This increased output while lowering production costs and raising production quality. These elements boosted profitability, which led to higher investments in innovation.

- Offshoring opportunity: Covid-19 sparked a long-term movement towards remote teams in the workplace ethos. This benefits India because it is more affordable for corporations from developed countries to collaborate with Indian citizens.

- Young population: With 356 million young people, India has the greatest youth population in the world. With a working population of 64%, India not only has a growing GDP and per capita income but also a sizable client base that businesses may successfully target.

- Renewable energy: India’s installed electrical capacity already derives about 40% of its power from non-fossil fuel sources. With this conversion to renewable energy, both businesses and consumers will pay less, and the nation will be less dependent on imports.

- According to many experts, India is best positioned to weather the economic headwinds predicted for the world in 2023. Despite revised growth estimates, India is still expected to have the fastest-growing economy in 2023 and will continue to confidently work towards the $5 trillion goal.

Indian Economy in 2023

- In fiscal 2023, India is expected to grow at a pace of 7%, making it the major economy with the fastest rate of growth. We’ve quite effectively recovered from the pandemic.

- However, the economy is hampered by the looming global recession and the full manifestation of the lag impact of interest rate hikes since May 2022. CRISIL predicts that India will consequently slow down and see 6% growth in fiscal 2024. Below is a discussion of the suggested activities for the primary, secondary, and tertiary sectors of the economy.

Primary Sectors of Indian Economy

- Indian economy is, predominantly, an agricultural economy. According to the Economic Survey 2020-21, 60% of the people are still engaged in the agriculture sector, but the agricultural GVA hovers around 18%.

- However, in these trying times of COVID, agriculture is the only silver lining showing a growth of 3.4%. Agriculture, broadly, has 3 stages—pre-production, production, and, post-production. Check here for detailed information about the Primary Sectors of the Indian Economy.

Pre-production

In the pre-production stage, the focus should be on:

- Increasing the number of farmers who are members of FPOs (Farmer Producer Organisations), as 86% of our farmers fall into the small and marginal categories;

- Providing affordable and high-quality seeds through programmes like Kharif Strategy 2021;

- Providing irrigation facilities through river interlinking projects and programmes like PMKSY (Pradhan Mantri Krishi Sinchai Yojana);

- Providing price assurance through programmes like PM-AASHA (Pradhan Mantri Annadata Aay Sanrakshan Abhi).

Production

During the production phase, focus should be placed on:

- Reducing the use of fertilisers by implementing programmes like the Paramparagat Krishi Vikas Yojana;

- The mechanisation of farms through programmes like SMAM (Sub-Mission on Agricultural Mechanisation);

- Crop insurance provided by programmes like the Pradhan Mantri Fasal Bima Yojana (PMFBY);

- Using precision farming and other climate-resilient agriculture techniques.

Post-production

In the post-production stage, the focus should be on:

- Implementing the Shanta Kumar Committee’s recommendation to build storage facilities;

- Improving forward and backward linkages through the use of programmes like PM-FME and SAMPADA;

- Concentrating on agricultural exports through the adoption of the Agricultural Export Policy, 2018;

- In addition, through programmes like the National Livestock Mission, Mission for Integrated Development of Horticulture, and PMMSY (Pradhan Mantri Matsya Sampada Yojana), the focus should be on animal husbandry, horticulture, and pisciculture.

Secondary Sectors of Indian Economy

Since the LPG reforms, our nation’s manufacturing industry has had problems. The PMI indicator clearly shows how terrible reality is. The MSME sector, which accounts for the majority of employment in our nation, is experiencing numerous difficulties and requires an urgent update.

Steps like CGTMSE (Credit Guarantee Fund Trust for Micro and Small Enterprises) are the right way to aid the cash-starved MSME. Additionally, measures like the Marketing Assistance Scheme must be strengthened to promote local products. The 4Ms — materials, machines, personnel, and methods — should serve as the foundation for the manufacturing sector’s revival.

- Material: India needs to develop into a global industrial powerhouse on the material front, but this would require persistent government action.

- Machine: On the machine front, the world is embracing Industry 4.0, therefore we must take action to convert our conventional factories into smart ones.

- Manpower: In today’s technologically advanced culture, having a trained workforce is now a requirement, which emphasises the significance of programmes like SANKALP and STRIVES.

- Methods: To enable the standardisation of products with lower manufacturing costs, traditional and antiquated methods need to be updated. These actions will boost our investment ratio while concurrently lowering the incremental capital-output ratio or ICOR.

Tertiary Sectors of Indian Economy

- The government must also support the services sector. Prompt Corrective Action and the EASE agenda are two strategies that should be used to get the banking industry back on track. Additionally, we must work to integrate technical and vocational education and make it applicable to the workplace. In order to lower people’s out-of-pocket expenses, the National Health Policy recommends raising health spending to 2.5% of GDP.

- India is also fortunate to have a vast variety of tourist attractions. Through programmes like PRASAD (Pilgrimage Rejuvenation and Spiritual Augmentation Drive) and HRIDAY (National Heritage City Development and Augmentation Yojana), we must thus reap its benefits without damaging the environment.

- Additionally, infrastructure need an upgrade, which the National Infrastructure Pipeline appropriately emphasises. Start-ups urgently require protection and encouragement, and programmes like Start-up India, which exempts angel investors from paying income taxes, and the Start-up India Seed Fund Scheme will help to keep the nation’s economy strong.

Government Initiatives to Make India $5 Trillion Economy

- The Government’s roadmap for making India a $5 trillion economy comprises focusing on growth at the macro level and complementing it with all-inclusive welfare at the micro level, promoting digital economy and fintech, technology-enabled development, energy transition and climate action and relying on a virtuous cycle of investment and growth. The Government’s Road Map was put into effect in 2014.

- The major reforms including Goods and Services Tax (GST), Insolvency and Bankruptcy Code (IBC), a significant reduction in the corporate tax rate, the Make in India and Start-up India strategies, and Production Linked Incentive Schemes, among others, have been implemented.

- The Government has also focused on a capex-led growth strategy to support economic growth and attract investment from the private sector, increasing its capital investment outlay substantially during the last three years. Central Government’s capital expenditure has increased from 2.15 per cent of GDP in 2020-21 to 2.7 per cent of GDP in 2022-23.

- The Union Budget 2023-24 has taken further steps to sustain the high growth of India’s economy. These include a substantial increase in capital investment outlay for the third year in a row by 33 per cent to ₹10 lakh crore (3.3 per cent of GDP). Direct capital investment by the Centre is also complemented by Grants-in-Aid to States for the creation of capital assets.

- The ‘Effective Capital Expenditure’ of the Centre was accordingly budgeted at ₹13.7 lakh crore (4.5 per cent of GDP) for 2023-24. This strong push given by the government is also expected to crowd in private investment and propel economic growth.

Vision of a USD 5 Trillion Indian Economy

- By breaking down the drivers of medium-term prospects into the contributions of capital, labour, and efficiency, growth accounting offers a valuable framework for analysing such prospects. We anticipate that the Indian economy will expand at a 6.8% annual rate over the next five years, with 52% of that growth coming from capital, 38% from efficiency, and 10% from labour.

- Capital will be the key and stars are aligning for a sustainable lift in the private sector investment cycle. Investment as a percentage of GDP has already touched a decadal high of 34 per cent in fiscal 2023. So far, the onus to lift the investment ratio has been shouldered by the government. The growth model is changing to an infrastructure and manufacturing-driven one.

2025 World Economic Outlook Report

- The IMF World Economic Outlook measures global instability as higher than levels observed during the COVID-19 pandemic period.

- The economic instability which the world faced during lockdowns and disrupted supply chains with widespread joblessness now originates from worldwide trade wars coupled with inflationary pressures, geopolitical turmoil and market fluctuations that endanger worldwide economic development.

- Market distrust leads to business uncertainty about future plans while economic stabilizers find their tasks becoming increasingly difficult for policymakers.

- The reports provided by the IMF spotlight major problems that include below-forecasted economic expansion together with increasing debt pressures along with diminishing market confidence among consumers.

- Countries need to implement vital financial strategies to stop prolonged economic failures because economic ambiguity keeps growing.

- A thorough analysis examines how the IMF evaluates current economic conditions against pandemic-era conditions along with determining major instability factors and evaluating methods to build strong worldwide economic stability.

Understanding Economic Uncertainty

- Market and financial circumstances prove unpredictable when government, business organizations and private citizens need to make decisions.

- The economic stability of the future depends heavily on this force because it shapes trade policies and market investments while affecting global economic stability.

Definition and Key Indicators

- When decision-makers both inside and outside businesses doubt financial outcomes for future time periods economic uncertainty emerges.

- Key indicators that reflect economic uncertainty are market stock stability and nation-wide GDP trends as well as rising price instability and fast governmental policy changes.

- Market sentiments along with purchasing decisions become weak when people face increased uncertainty resulting in decreased international trade volumes.

Historical Context and Evolution

- Financial markets throughout history repeatedly faced elevated uncertainty during essential global disruptions such as the Great Depression and the 2008 recession alongside COVID-19.

- Economic uncertainty during the COVID period mainly originated from health disruptions yet the current period's instability results from trade wars together with geopolitical tensions and inflationary issues.

Types of Economic Uncertainty

- Policy Uncertainty where Governments' changing regulations, taxation, and monetary policies affects the economy.

- Categories of economic uncertainty include the unpredictable movements of stock prices together with inflation rates and commodity prices.

- The worldwide economies experience economic instability because of several elements including geopolitical battles and supply chain breakdowns together with planetary weather systems risks.

Impact on Businesses and Individuals

- The rise of uncertainty leads investors to hold back money from entering the market while simultaneously causing employment instabilities and resulting in consumer caution.

- When uncertainty strikes financial markets become unstable while business expansion rates decline and economic growth rates slow down.

- The financial stability of people deteriorates and their purchasing ability declines while job markets shrink.

Strategies for Mitigating Economic Uncertainty

- Governments together with organizations use strategies which include strengthening monetary policies together with diversifying investment portfolios and improving global cooperation to prevent economic risks.

- Open government systems coupled with flexible policies act as the foundation for controlling financial situations during times of uncertainty.

- The on-going transformations in economic uncertainty require organizations to take active measures which will enhance their stability and achieve sustainable worldwide economic growth.

The IMF’s Latest Findings

- World economic expectations facing rising uncertainties have become the main focus of the recent International Monetary Fund (IMF) World Economic Outlook report.

- The study confirms that global financial instability has grown more severe because of different linked elements which create substantial difficulties for worldwide policy decision makers.

Global Growth Forecast and Projections

- The IMF predicts global growth rates will fall below expectations since multiple nations must reduce their economic projection forecasts.

- The United States alongside the Eurozone together with other developed economies will see modest growth yet emerging markets must deal with inflationary issues along with debt burdens.

Inflationary Pressures and Central Bank Responses

- Rising prices in major economies continue as a principal finding resulting from higher commodity rates and interrupted supply networks together with workforce deficits.

- The worldwide financial institutions have applied harsh interest rate adjustments in their efforts to manage inflation which subsequently produced elevated financing expenses and hindered investment activities.

Impact of Geopolitical Tensions on Economic Stability

- Geopolitical clashes together with trade disturbances emerge as main agents which produce economic instability according to the report.

- The increasing political disputes among major economic powers has caused extreme turbulence in energy markets which in turn affects the functioning of worldwide supply networks and pushes up consumer prices.

- The economic instability became more severe due to disruptions in resource-exporting regions across the world.

Debt Crisis and Fiscal Challenges

- Numerous countries now have growing debt challenges because they have elevated their public debt to support expanded social services and economic aid packages.

- The International Monetary Fund explains that nations with excessive debt risks lowered economic expansion until they change their financial management systems to stabilize their economies.

Policy Recommendations and Future Outlook

- The IMF advises nations to follow coordinated policy measures which combine fiscal discipline along with supply chain diversification through specific monetary instruments.

- Economic stability depends on both coordinated international initiatives and stable regulatory systems to achieve sustainable financial recovery through unpredictable conditions.

Comparison with the COVID-19 Era

- Economic volatility in 2025 exceeded previous records and outdid what was observed during the COVID-19 pandemic.

- Today's economic turbulence produced different effects from the COVID-19 pandemic since it started from geopolitical conflicts along with inflationary pressures and trade wars.

Economic Disruptions during COVID-19

- The COVID-19 period included extreme conditions such as; disrupted supply chains along with recession caused by lockdowns and job market joblessness.

- Nations made decisions that combined medical crisis management with financial instability which resulted in extreme government fiscal stimulus measures.

- Business operations stopped, financial markets displayed extreme volatility and public confidence reached its lowest point.

Shift in Uncertainty Drivers

- Modern uncertainty exists beyond pandemic-related lockdown concerns because it derives from trade wars and geopolitical tensions as well as elevated inflation rates and energy problems.

- The difficulties of today differ substantially from those encountered during pandemic recovery because the present challenges create intricate networks of interconnected problems.

Market Reactions and Investment Trends

- The COVID-19 pandemic led central banks to take strong measures including providing stimulus support and cutting interest rates to preserve market stability.

- High inflation levels across international economies during 2025 brought about central bank policy choices which reduced growth speed and created news alerts among investors.

Employment levels

- The main cause of employment reductions during the COVID-19 pandemic came from residential closures in combination with international travel restrictions and falling consumer spending.

- The present labor market faces challenges because wages have increased while automated systems expand and industries change direction.

- Business interests operate with caution as worldwide trade uncertainties cause them to postpone expansions.

Future Uncertainty and Policy Response

- Economic resilience has become the primary government priority as they establish long-term policy plans instead of temporary stimulus measures.

- Future economic stability requires structural reforms alongside diplomatic solutions and market stability strategies because the current situational unpredictability exceeds recovery plans from COVID-19.

Major Drivers of Economic Uncertainty in 2025

- The combination of numerous economic factors in 2025 creates unprecedented market volatility that causes widespread economic instability everywhere.

- Multiple factors including trade wars and inflation rises alongside geopolitical tensions combined with changes in monetary policies lead to increased economic unpredictability that stems from affecting all sectors including financial institutions and organizational operations.

Supply Chain Disruptions and Trade Wars

- Major economies now face severe economic trade disruptions because of their increasing protectionist measures and trade tariff conflicts.

- Leading nations involved in trade warfare have generated higher import expenses while interrupting their supply networks together with decreasing worldwide investment flow.

- Company adjustments become more challenging as a result of which operations face higher risks while economic confidence weakens.

Inflation and Interest Rate Volatility

- Worldwide central banks struggled with ongoing inflation so they forced themselves to use aggressive monetary tightening which altered both customer behaviour and investment patterns.

- The inflation-control aim of higher interest rates leads to increased borrowing costs that hinder business expansion and makes people doubt financial stability will remain stable.

Geopolitical Tensions and Energy Crisis

- Current geopolitical strife consisting of border conflicts as well as resource control disputes has caused major disruptions to world energy operations.

- The disruption in key oil and gas-producing regions generates increased energy costs along with rising inflation rates and market variations which obstruct economic growth.

Debt Burdens and Fiscal Policy Challenges

- The economic condition of numerous states continues to deteriorate from rising national debt which compels governments to undertake austerity programs and fiscal restructuring to achieve stability.

- The unpredictability of global markets arises from high debt levels because they reduce funding for public programs and social programs as well as economic recovery initiatives.

Technological Disruptions and Labor Market Shifts

- Economic transformations brought about by AI along with automation now reshape the way workers perform their jobs.

- The positive effects of innovative approaches on operational efficiency coexist with negative consequences that create unemployment and work instability which threatens the economic stability of the future.

Implications for Global Economies

- The financial instability of 2025 produced substantial effects on worldwide economies which led to changes in trade operations, financial policy frameworks and business investment procedures.

- The volatile financial situation forces both governments and businesses to create new strategies toward stability and growth because nations struggle to adjust to these unstable market conditions.

Impact on Developed Economies

- High inflation rates and deliberate monetary policy measures taken by central banks are responsible for reduced GDP expansion in major developed countries such as the United States alongside the European Union as well as Japan.

- The rise in interest rates contributes to higher borrowing expenses that decrease company capital expenditures and consumer outlays besides causing negative effects on the stock exchange.

- Bureaucracies struggle to develop policies between their need to reduce inflation and their aim to boost economic expansion thus creating many confusing and unpredictable choices.

Effects on Emerging Markets

- Indian and Brazilian economies together with Southeast Asian countries face distinctive problems from currency movements which combine with trade obstacles and increasing debt problems.

- The ongoing inflation has cut down consumer purchasing ability which has caused industrial expansion to decelerate.

- Developing economies which depend on foreign investments alongside exports now face financial instability risks because of trade obstacles combined with dropping global market demand patterns.

Sector-Wise Economic Impact

- The combination of manufacturing and trade operations faces challenging circumstances because supply chains experience problems together with worker shortages and rising prices for raw materials.

- Business operations focused on export suffer because of decreasing global consumer demands which create more uncertainty for these companies.

- Financial Markets experience record-high stock market volatility that leads investors to take on risk-averse behaviour thus hindering economic recovery.

- The rapid increase of digital transformation together with automated systems and artificial intelligence produces changing patterns in the workforce which generates workforce uncertainties in traditional employment industries.

Long-Term Consequences

- The IMF emphasizes that countries should pursue sustainable strategies together with financial stability and multinational teamwork to prevent forthcoming risks.

- Appropriate economic frameworks developed for future economic shocks by policymakers will create stable conditions for global economic renewal.

Policy Responses and Possible Solutions

- The world faces extreme economic instability during 2025 while governments establish various strategic initiatives to stop financial markets from collapsing and reduce future economic decreases.

- The current focus of governments together with central banks involves implementing economic strategies based on monetary and fiscal policies along with trade approaches to minimize economic threats while building trust with investors.

Monetary Policy Adjustments

- The stabilization of financial markets by central banks happens through active manipulation of interest rates for both inflation control and financial stability management.

- Federal decision-makers are fighting inflation through rate hikes but maintain enough monetary flow for businesses and consumers.

- Governments throughout the world are researching digital currencies together with fin-tech innovations as part of their effort to create a more inclusive financial environment and stabilized markets.

Fiscal Strategies for Economic Resilience

- Various governments now design stimulus packages which direct resources toward needy sectors along with job-creation programs and expanded social services.

- Debt management represents a fundamental economic issue because many governments now work on altering their debt structures to prevent financial collapses and develop sustainable economic systems.

- Long-term economic development is being advanced through combined strategies which invest in infrastructure development, green energy systems and technological innovations.

Trade Policies and Global Cooperation

- Nations are fighting economic instability through diplomat-led efforts to enhance trade connections and develop versatile foreign trade plans to minimize supply chain problems and trade disputes.

- International trade confidence rebuilds through multilateral agreements which reduce tariffs and expand regional trade pacts as well as promote transparency practices.

Private Sector and Technological Innovations

- The current uncertain market demands that businesses transform their operations through automation and AI-driven solutions combined with flexible business models.

- Government authorities deliver financial backing to foster innovation and develop digital frameworks while building cyber security defences which protect economies from future disturbances.

What is Special Assistance to States for Capital Investment Scheme?

Why in News?

The Special Assistance to States for Capital Investment Scheme is significant as it provides crucial financial support to state governments in India, enabling them to undertake various capital investment projects that are essential for economic growth.

Key Takeaways

- The scheme offers a 50-year interest-free loan to states for capital investment projects.

- States must submit project details to the Union finance ministry to access these funds.

- The allocation includes funds for PM Gati Shakti projects and digital economy initiatives.

- Interest-free loans are also aimed at incentivizing privatization of state-owned enterprises.

Additional Details

- Loan Structure: The financial assistance under this scheme is designed as a long-term, interest-free loan, specifically for capital investment projects that contribute to the state's infrastructure and economic development.

- Eligibility Criteria: To benefit from the scheme, states need to provide specific project details including the project name, capital outlay, completion timeline, and an economic justification to the finance ministry.

- Allocation Focus: The scheme prioritizes investments that support the PM Gati Shakti initiative and other productive capital investments, as well as digital infrastructure enhancements.

- Borrowing Limits: For FY23, the Central Government has set a borrowing limit of 3.5% of the GSDP for states, with an additional 0.5% available if they implement reforms in the power sector.

This scheme represents a proactive approach by the government to stimulate capital investments in states, thereby fostering economic growth and infrastructure development across India.

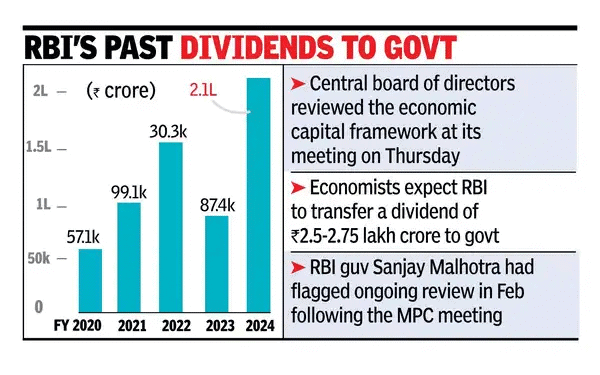

Economic Capital Framework and RBI’s Dividend Transfer

Why in News?

The Central Board of Directors of the Reserve Bank of India (RBI) has evaluated the Economic Capital Framework (ECF) to determine risk provisioning and the distribution of dividend (surplus) from the central bank to the government.

Key Takeaways

- The ECF is a structured mechanism used by the RBI to define the risk provisions and surplus that can be transferred to the Government of India.

- Recommended by the Bimal Jalan Committee in 2018 and adopted in 2019, the ECF aims to balance financial stability and surplus distribution.

- Dividend transfers from the RBI to the government are expected to rise significantly in the coming years.

Additional Details

- Economic Capital Framework (ECF): This framework helps in maintaining adequate financial buffers while allowing the RBI to transfer surplus profits to the government under Section 47 of the RBI Act, 1934.

- Contingency Risk Buffer (CRB): A financial safeguard maintained between 5.5% and 6.5% of the RBI's balance sheet to prepare for unforeseen shocks.

- The revised framework involves a review every five years to adapt to changing economic conditions, with the last review conducted in August 2024.

- Trends in Dividend Transfer: The estimated dividend transfers are projected to increase from Rs 30,307 crore in FY22 to Rs 2.5-3 lakh crore in FY25, driven by strong earnings and rising asset values.

Provisions Governing RBI’s Surplus Transfer

- RBI Act, 1934: Section 47 mandates that net profits, after necessary provisions, must be transferred to the Central Government.

- Section 48 of the Act exempts the RBI from income tax, facilitating a direct surplus transfer to the government.

- Various committees have historically assessed the adequacy of RBI's capital buffers and the quantum of surplus to be transferred to maintain a balance between capital reserves and fiscal needs.

Significance of RBI’s Surplus Transfer to Government

- Reduces Fiscal Deficit: Aids the government in achieving its fiscal target by increasing non-tax revenue.

- Enhances Revenue Generation: Acts as a crucial source for public expenditure, thereby promoting economic growth.

- Lowers Government Borrowing: Can potentially reduce borrowings by up to Rs 1 trillion, providing fiscal space for capital investments.

- Reduces Borrowing Costs: Lower borrowing needs can decrease G-Sec yields, easing the debt servicing burden on the government.

- Keeps Interest Rates in Check: Declining sovereign yields impact broader market rates, making borrowing more affordable for businesses and households.

The Economic Capital Framework fosters a balanced approach between the autonomy of the RBI and the fiscal requirements of the government. By establishing clear risk buffers and rules for surplus transfer, it enhances financial stability and promotes fiscal prudence, ultimately supporting sustainable economic growth and strengthening macroeconomic resilience.

|

173 videos|487 docs|159 tests

|

FAQs on Economic Development : May 2025 UPSC Current Affairs - Indian Economy for UPSC CSE

| 1. What are China's export restrictions on critical minerals and how do they affect global markets? |  |

| 2. What is the significance of the One State-One RRB initiative in India? |  |

| 3. What are the key features of the India-UK Free Trade Agreement (FTA)? |  |

| 4. What are the main findings of the Human Development Report 2025? |  |

| 5. How is the livestock sector contributing to India's economy according to recent reports? |  |