Economic Development: September 2024 UPSC Current Affairs | Indian Economy for UPSC CSE PDF Download

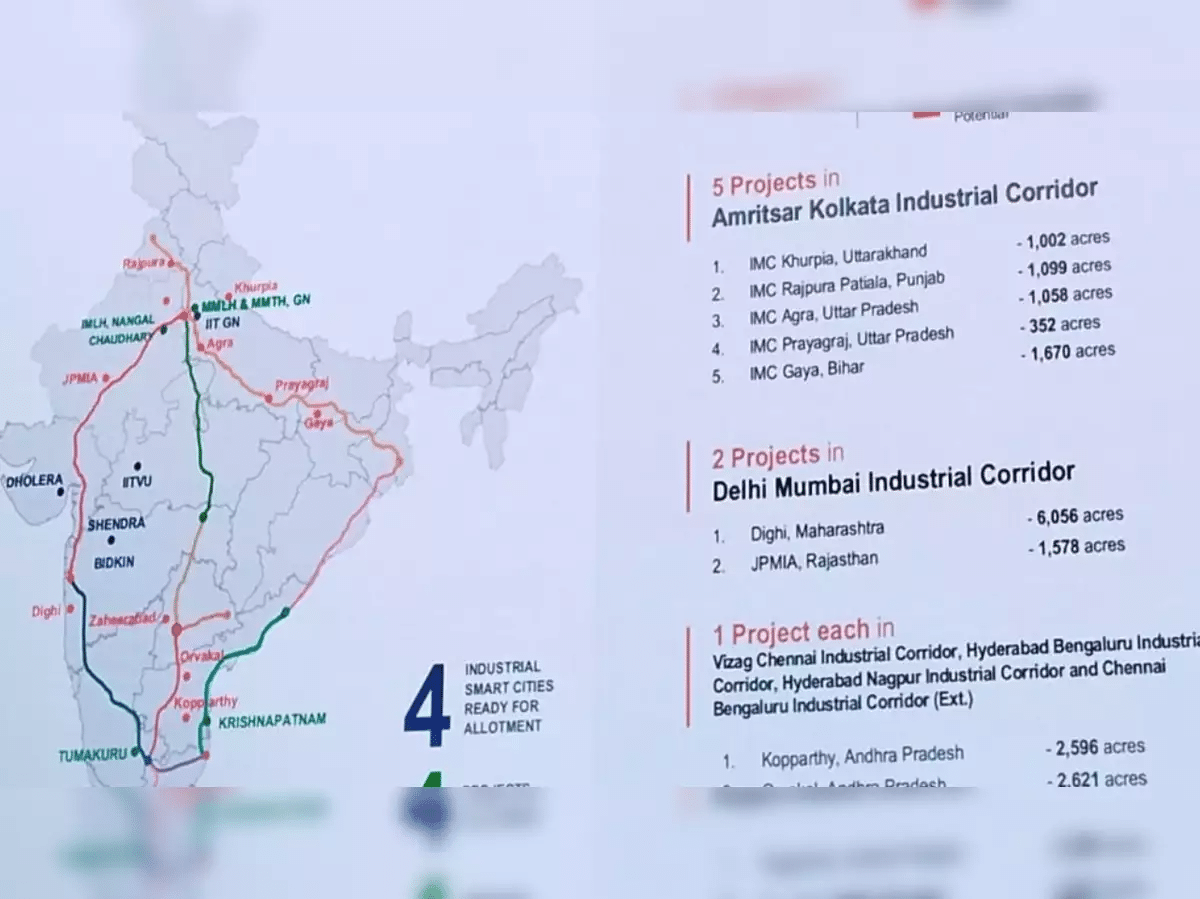

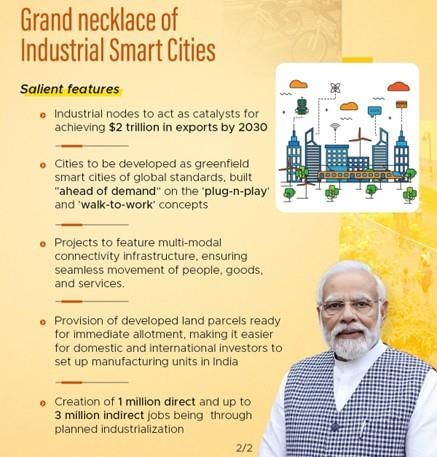

Government Approved 12 New Industrial Smart Cities

Why in news?

Recently, the Union Cabinet, under the leadership of the Prime Minister, has approved the establishment of 12 industrial smart cities across 6 major industrial corridors in 10 states as part of the National Industrial Corridor Development Programme. The selected states for these industrial projects include Uttarakhand, Punjab, Maharashtra, Kerala, Uttar Pradesh, Bihar, Telangana, Andhra Pradesh, and Rajasthan.

What is an Industrial Smart City?

- Definition: An industrial smart city is an urban area that utilizes advanced technologies and data analytics to improve the efficiency of industrial operations while promoting sustainable development.

- Aims: These smart industrial cities are designed to attract foreign investment, enhance domestic manufacturing, and create employment opportunities.

- Objectives: The goal of developing new industrial cities in India is to fortify the nation's position in global value chains by providing investors with land that is ready for allotment.

- Urban Concepts: The initiative aims to incorporate modern urban features such as 'plug-and-play' industrial parks, which offer fully equipped infrastructure for businesses to commence operations immediately, and 'walk-to-work' strategies that encourage living near workplaces to reduce car dependency.

Road Map for Development:

- The cities will be developed under the National Industrial Corridor Development Programme (NICDP), which aims to create advanced industrial cities capable of competing with top global manufacturing and investment destinations.

- NICDP is designed to cultivate a thriving industrial ecosystem by attracting investments from both large anchor industries and Micro, Small, and Medium Enterprises (MSMEs).

- The first industrial corridor, the Delhi-Mumbai Industrial Corridor, was initiated in 2007.

- The programme is overseen by the National Industrial Corridor Development and Implementation Trust (NICDIT) and the National Industrial Corridor Development Corporation Limited (NICDC).

- These new industrial nodes will feature integrated residential and commercial areas, functioning as self-sustaining urban environments.

- The government plans to collaborate with Invest India, the national investment promotion and facilitation agency, to market these projects.

- A Special Purpose Vehicle (SPV) will be established to implement the parks, with a three-year completion timeline subject to state cooperation.

What are the Key Features of the Approved Industrial Smart Cities?

- Alignment with National Economic Goals: The development of these smart cities corresponds with the government's ambition to achieve USD 2 trillion in exports by 2030.

- Integration with the PM Gati-Shakti National Master Plan: Projects will incorporate multi-modal connectivity infrastructure to facilitate the smooth movement of people, goods, and services, which is vital for enhancing logistical efficiency and optimizing supply chains across the country.

- Connectivity: The cities will form part of a ‘necklace of industrial cities’ along the Golden Quadrilateral, boosting connectivity and industrial development.

- Significance: These initiatives are expected to attract Foreign Direct Investment (FDI) from countries such as Singapore and Switzerland, generate approximately 10 lakh direct jobs and up to 30 lakh indirect jobs, with an estimated investment potential of Rs 1.5 lakh crore.

- The cities are designed to promote sustainability through the integration of ICT-enabled utilities and green technologies, aiming to minimize environmental impact while providing readily available land parcels to attract both domestic and international investors, thus enhancing India's position in global value chains.

What are the Challenges Associated with Industrial Smart Cities Development?

- Technological Integration and Infrastructure: Updating outdated urban industrial infrastructure to support IoT devices, high-speed internet, and data centers requires considerable investment and presents logistical challenges, especially in older cities.

- Data Privacy and Security: Protecting extensive amounts of data collected from smart devices against breaches necessitates robust security measures and ongoing monitoring.

- Funding and Investment: Attracting substantial financial investment from public or private sources is challenging, requiring stakeholders to be convinced of the long-term benefits and return on investment (ROI).

- Public Acceptance and Awareness: It is essential to address citizen concerns regarding privacy, job losses due to automation, and lifestyle changes through effective communication and education to ensure the success of industrial smart city initiatives.

- Governance and Policy Issues: Managing changes in local laws, regulations, and policies can be time-consuming and politically sensitive, complicating the implementation of smart city projects.

Way Forward

- Regulatory Reforms: Streamlining and digitizing administrative processes, harmonizing regulations across government levels, and enhancing transparency in decision-making are necessary to increase efficiency, lower business burdens, and build investor trust.

- Efficient Land Acquisition: Creating land banks to expedite acquisition processes, ensuring fair compensation to minimize disputes, and employing innovative methods like land pooling are essential steps.

- Sustainable Development: Conducting comprehensive environmental assessments, promoting sustainable business practices, and investing in crucial infrastructure are vital for successful development.

- Skill Development and Workforce Training: Establishing vocational training centers, collaborating with industries for specialized training programs, and providing incentives for businesses to invest in employee development are key to addressing skill shortages in industrial parks.

- Public-Private Partnerships: To maximize the benefits of developing industrial smart cities, fostering public-private partnerships that equitably share risks and rewards while ensuring governance transparency and accountability is essential.

Changing Food Consumption Patterns in India

Why in news?

Why in news?

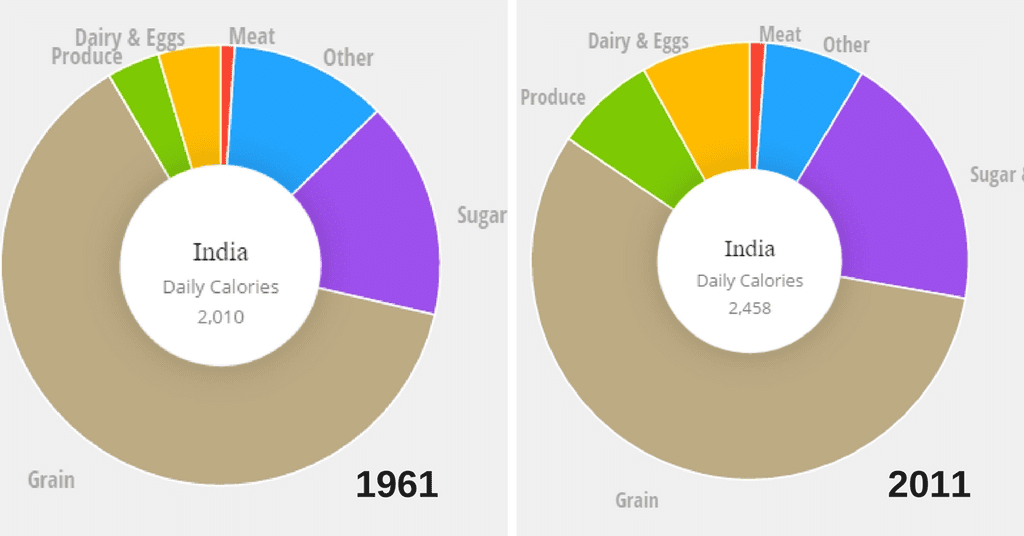

Recently, a working paper published by the Economic Advisory Council to the Prime Minister (EAC-PM) reveals that for the first time since 1947, the average household expenditure on food in India has dropped to less than half of total household spending. The report, titled 'Changes in India’s Food Consumption and Policy Implications: A Comprehensive Analysis of Household Consumption Expenditure Survey 2022-23 and 2011-12', investigates the evolving patterns of food consumption in the country.

Key Findings of the Report:

- The proportion of total household expenditure on food has significantly decreased in both rural and urban regions across all states and Union Territories.

- This marks the first instance in modern India where households allocate less than half of their monthly budgets to food.

- Spending on cereals has notably declined in both rural and urban settings, particularly among the poorest 20% of households.

- The reduction in cereal expenditure has allowed families to diversify their diets, increasing their spending on milk, fruits, eggs, fish, and meat.

- Greater dietary diversity, especially among the poorest 20%, indicates improved infrastructure, transport, and storage, making fresh produce, dairy, and meats more accessible and affordable.

- Despite the rise in dietary diversity, the average daily intake of essential micronutrients like iron and zinc has decreased from 2011-12 to 2022-23, particularly from cereals.

- Nonetheless, the observed increase in dietary variety among low-income groups reflects successful food security policies by the Indian government, which provide free food grains to vulnerable populations.

Implications for Various Policies:

- Agricultural Policy and Food Security: The transition from cereals to more fruits, dairy, eggs, fish, and meat necessitates a revision of agricultural policies to enhance support for these food types. This shift raises questions regarding the necessity of price support mechanisms like the Minimum Support Price (MSP), which predominantly focuses on cereals.

- Welfare Policies: Welfare initiatives such as the Pradhan Mantri Garib Kalyan Yojana (PMGKY), which provides free food grains, have served as a fiscal stimulus. By reducing cereal expenses, these programs have enabled households, particularly the bottom 50%, to invest more in a diverse diet, thereby improving dietary variety.

- Nutrition and Micronutrient Policy: The findings underscore the importance of promoting dietary diversity within nutrition policies. While cereal fortification to enhance iron intake has yielded limited results in combating anemia, a focus on varied diets could prove more beneficial. This includes improving consumer education and access to a range of nutritious foods.

- Targeted Nutritional Interventions: The significant disparities in micronutrient consumption and dietary diversity among different income groups and states highlight the necessity for targeted interventions. Even within wealthier demographics, many individuals exhibit inadequate iron intake and dietary variety, elevating their anemia risk. Tailoring nutrition programs to address these specific needs could yield better outcomes.

Effect of Shifting Food Expenditure Patterns on Health and Nutrition Strategies:

- Nutritional Balance and Health Outcomes: The increased diversity in diets is likely to enhance overall nutritional balance, potentially addressing micronutrient deficiencies and contributing to improved health outcomes.

- Policy Adjustments: The changes in expenditure patterns require a reassessment of agricultural and food security policies. Policymakers may need to bolster the production and supply chains of diverse foods to meet emerging demands and ensure food security.

- Focus on Dietary Diversity: This shift underscores the need to emphasize dietary diversity within health and nutrition strategies. Continued improvements in infrastructure—such as storage and transportation—are essential for facilitating access to a variety of nutritious foods.

- Government agencies should revise dietary guidelines to align with evolving food consumption trends and highlight the significance of dietary diversity.

Differential Benefits of Rural Electrification

Why in News?

Recently, a study based on the 2011 census examined the effects of the 'Rajiv Gandhi Grameen Vidyutikaran Yojana (RGGVY)' programme, which aimed to electrify over 400,000 villages across India. RGGVY (launch-2005) was renamed as the Deen Dayal Upadhyay Gram Jyoti Yojana (DDUGJY) in 2014.

What are the Key Highlights of the Study?

- Disproportionate Benefits to Larger Villages:

- Larger villages, those with around 2,000 inhabitants, experienced significantly greater economic advantages from complete electrification compared to smaller villages of approximately 300 people.

- Smaller villages showed a "zero return" on electrification even after 20 years.

- In contrast, larger villages reported a notable return of 33%, with a 90% likelihood that the benefits would surpass the costs associated with electrification.

- Impact on Per-Capita Monthly Expenditure:

- The per-capita monthly expenditure in smaller villages revealed minimal changes post-electrification, indicating limited economic benefits.

- Conversely, larger villages experienced a substantial increase in per-capita monthly expenditure, which doubled due to full electrification, translating to approximately Rs 1,428 (about USD 17) per month.

What is Deen Dayal Upadhyaya Gram Jyoti Yojana (DDUGJY)?

- About:

- DDUGJY is a rural electrification initiative by the Ministry of Power (MoP) aimed at providing continuous 24x7 electricity supply in rural regions, aligning with the government's broader vision of ensuring energy access for all.

- Components of the DDUGJY:

- To ensure judicious distribution of electricity to both agricultural and non-agricultural consumers.

- Metering of distribution transformers, feeders, and consumers to minimize electricity losses and enhance efficiency.

- Establishment of microgrids and off-grid systems to guarantee electricity access in remote and isolated areas.

- Nodal Agency:

- The Rural Electrification Corporation Limited (REC) acts as the nodal agency responsible for the implementation of DDUGJY under the overall guidance of the Ministry of Power.

What are Other Initiatives for Electrification?

Saubhagya Scheme

- Integrated Power Development Scheme (IPDS)

- Ujwal Discom Assurance Yojana (UDAY)

- GARV (Grameen Vidyutikaran) App

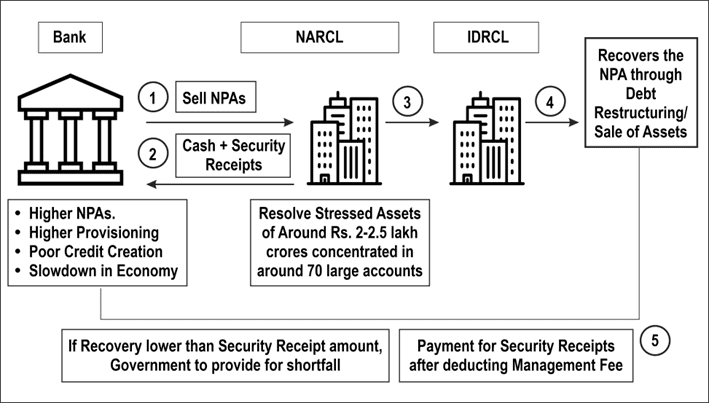

Concerns in Asset Reconstruction Companies (ARCs)

Why in News?

Recently, Asset Reconstruction Companies (ARCs) have encountered a decline in growth due to Non-Performing Assets (NPAs) dropping to a 12-year low of 2.8% as of March 2024. Ratings agency Crisil forecasts that the assets under management (AUM) of ARCs will contract by 7-10% in 2024-25, following a stagnant phase in 2023-24.

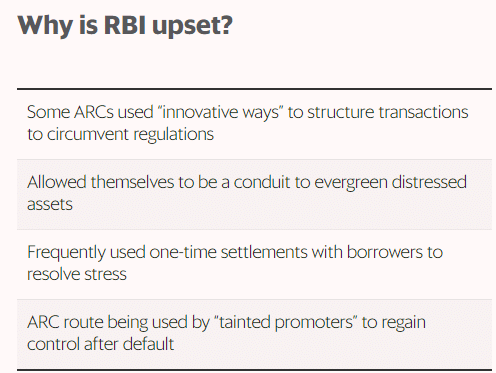

What are the Concerns of Asset Reconstruction Companies (ARCs)?

- Low Business Potential: The reduction in new non-performing corporate assets has compelled ARCs to shift their focus towards smaller and less lucrative retail loans. However, there has not been a significant rise in retail NPAs, which limits ARCs' growth opportunities.

- Increased Investment Mandate: In October 2022, the Reserve Bank of India (RBI) mandated that ARCs must invest at least 15% of bank investments in security receipts or 2.5% of the total issued security receipts, whichever is higher.

- Net Owned Funds Requirements: The RBI raised the minimum net owned funds requirement for ARCs from Rs 100 crore to Rs 300 crore in October 2022. This adjustment aims to ensure ARCs have strong balance sheets but has placed additional constraints on their capital management, with many struggling to meet the new Rs 300 crore requirement, potentially leading to mergers or exits.

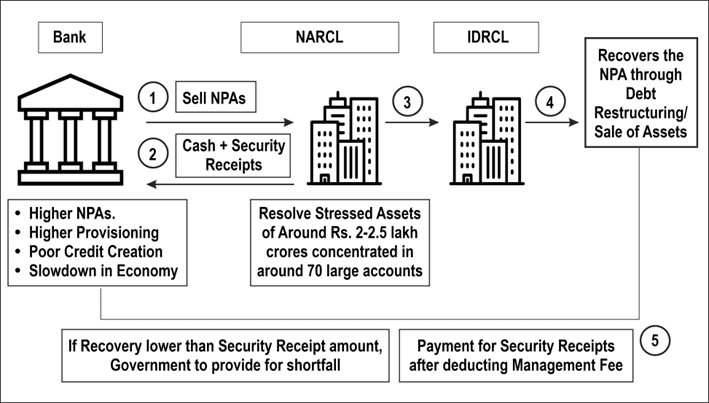

- Competition from NARCL: The creation of the state-owned National Asset Reconstruction Company Ltd (NARCL) poses a significant threat, as it provides guarantees from the government, making its offerings more attractive to financial institutions.

- Regulatory Challenges: The RBI has mandated that ARCs require approval from an independent advisory committee for all settlement proposals. This requirement has caused delays in settlement approvals, particularly for retail loans, as advisory committees are cautious to avoid future scrutiny.

- Trust Deficit: There appears to be a trust deficit between the RBI and ARCs. The RBI has raised concerns that certain transactions may enable defaulting promoters to regain control of their assets, which violates Section 29A of the Insolvency and Bankruptcy Code (IBC), prohibiting defaulting promoters from bidding on their insolvent firms.

What are ARCs?

- About: An Asset Reconstruction Company (ARC) is a specialized financial institution that purchases debts from banks at an agreed value and works to recover these debts along with associated securities.

- Background of ARCs: The concept of ARCs was introduced by the Narsimham Committee – II in 1998, leading to their establishment under the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 (SARFAESI Act, 2002). Currently, there are 27 ARCs registered with the RBI, including notable entities like NARCL, Edelweiss ARC, and Arcil.

- Registration and Regulation of ARCs: An ARC must be registered under the Companies Act, 2013, and must also obtain registration from the RBI as per Section 3 of the SARFAESI Act. They operate according to guidelines issued by the Reserve Bank of India.

- Funding for ARCs: The funds required to purchase NPAs can be sourced from Qualified Buyers (QBs), which include entities like insurance companies, banks, state financial and industrial development corporations, and registered asset management companies.

Working of the ARCs:

- Asset Reconstruction: This process involves acquiring the rights to loans, advances, debentures, bonds, guarantees, or other credit facilities from banks or financial institutions for recovery purposes. ARCs typically purchase distressed loans at a discount, either in cash or through a combination of cash and security receipts, which can be redeemed within eight years.

- Securitisation: This entails acquiring financial assets by issuing security receipts to Qualified Buyers.

What Measures Can Be Taken to Address the Challenges Faced by ARCs?

- Diversification of Asset Portfolios: ARCs should explore opportunities beyond traditional corporate and retail loans, potentially in sectors like infrastructure, MSMEs, and other stressed sectors that present recovery potential.

- Improving Regulatory Transparency and Collaboration: ARCs should enhance cooperation with the RBI and other regulatory bodies to ensure transparent operations and adherence to guidelines. Establishing a standard code of conduct could foster trust and accountability.

- Enhancing Efficiency in Settlements: To mitigate delays caused by mandatory approvals from independent advisory committees, ARCs can leverage technology, such as AI-driven analytics, to expedite evaluations while ensuring compliance.

- Adopting Strategic Competition with NARCL: Private ARCs should differentiate their services by providing specialized solutions tailored to niche markets or focusing on quicker recovery mechanisms.

India Plans USD 15 Billion for Chipmaking

Why in news?

The Indian government has sanctioned four semiconductor manufacturing projects with an investment of nearly Rs 1.5 lakh crore. In an age characterized by rapid technological evolution, semiconductors are essential for powering devices from smartphones to sophisticated computing systems. Acknowledging the strategic significance of semiconductor production, India is making considerable efforts to establish its own chipmaking sector, with a substantial investment of $15 billion aimed at enhancing self-sufficiency and reducing reliance on international supply chains.

The semiconductor value chain:

- Pre-competitive research constitutes 15-20% of the global value chain.

- Design accounts for 50% of the value addition.

- Front-end processes (wafer fabrication) contribute 24% value.

- The remaining value is derived from back-end processes (assembly, testing, and packaging) along with electronic design automation (EDA) and core intellectual property (IP) which provide essential software support, tools, and raw materials.

The Importance of Chipmaking

- Semiconductors serve as the foundation of contemporary electronic devices, being integral to computing, telecommunications, and even critical infrastructure.

- The global demand for semiconductors has surged, fueled by rapid technological advancements and the increasing need for digital transformation across various sectors.

- The COVID-19 pandemic has highlighted vulnerabilities in global supply chains, leading to significant semiconductor shortages and underlining the necessity for localized manufacturing.

India’s $15 Billion Initiative

- The Indian government is investing $15 billion to cultivate a robust semiconductor ecosystem. This initiative is designed to attract international semiconductor manufacturers, bolster domestic capabilities, and ensure a consistent chip supply for various industries.

- Incentives and Subsidies:

- The government is providing financial incentives and subsidies aimed at enticing major global semiconductor firms to establish manufacturing operations in India.

- These incentives encompass capital expenditures, research and development costs, and operational expenses.

- Infrastructure Development:

- Investment in cutting-edge infrastructure is critical, covering semiconductor fabrication plants (fabs), testing and packaging facilities, and specialized research institutions.

- Developing such infrastructure is vital for creating a supportive environment for semiconductor production.

- Skill Development:

- Establishing a skilled workforce proficient in advanced semiconductor technologies is essential.

- The initiative includes programs aimed at training engineers, researchers, and technicians in semiconductor design and manufacturing.

- Research and Innovation:

- Collaboration with leading academic and research institutions is encouraged to stimulate innovation in semiconductor technology.

- This includes investing in pioneering research, promoting patents, and supporting startups within the semiconductor sector.

Strategic Objectives

- Reducing Import Dependence:

- India currently relies significantly on imports for its semiconductor needs.

- Building domestic manufacturing capabilities will decrease this reliance and enhance national security by ensuring a stable supply of essential components.

- Boosting Economic Growth:

- The semiconductor industry has the potential to deliver substantial economic advantages, including job creation, enhancing technological capabilities, and stimulating related sectors like electronics manufacturing.

- Strengthening Global Position:

- By positioning itself as a semiconductor manufacturing hub, India aims to become a significant player in the global semiconductor supply chain, attracting investments and fostering international partnerships.

Challenges and Considerations

- High Capital Investment:

- Establishing semiconductor fabrication plants requires substantial financial investment and advanced technological expertise.

- Securing ongoing financial commitment and strategic alliances will be essential.

- Technological Complexity:

- Semiconductor manufacturing involves intricate processes and rigorous quality controls.

- Acquiring the necessary technological expertise and upholding high standards will present significant challenges.

- Global Competition:

- India will encounter competition from established semiconductor manufacturing countries such as Taiwan, South Korea, and China.

- It will be crucial for India to differentiate itself with unique value propositions and efficient operations.

Future outlook:

- The outlook for chipmaking in India is optimistic, with several global semiconductor leaders showing interest in establishing operations in the country.

- Collaborative initiatives, ongoing innovation, and supportive government policies will be pivotal in achieving the vision of a self-sufficient semiconductor industry.

- As India advances on this path, it stands to gain not only economic and strategic benefits but also a significant role in the evolving global technology landscape.

Conclusion

- India's $15 billion initiative to develop a semiconductor industry is a strategic effort aimed at enhancing self-sufficiency, promoting economic growth, and securing a vital position in the global semiconductor market.

- Despite existing challenges, the potential rewards of a strong domestic semiconductor industry are enormous.

- Through sustained effort and strategic planning, India could emerge as a major contender in the global semiconductor arena, fostering innovation and technological progress.

India Becomes Net Importer of Maize

Why in News?

India's recent initiative to enhance ethanol production using corn has resulted in the country shifting from being a prominent maize exporter in Asia to becoming a net importer. This transition is significantly impacting local industries that rely on corn and is altering the dynamics of the global maize supply chain.

India’s Transition to Net Maize Importer

- Ethanol Policy Impact: The Indian government aims to increase ethanol content to 20% by 2025-26, driving up maize demand for ethanol production.

- Biofuel Policy Support: The 2018 National Policy on Biofuels promotes maize and grain-based ethanol production to meet rising demands.

- Climate Influence on Crop Selection: Recent drought conditions have reduced sugarcane availability for ethanol, leading to a greater emphasis on maize.

- Production Expansion: In the 2023-24 season, India's maize production reached 34.6 million tonnes, with goals to double this volume to bridge the supply-demand gap.

- Shift Impacting Agriculture: The focus on maize for ethanol has led to India’s first significant maize imports in many years.

- Primary Industry Consumers: Traditionally, India's poultry and starch sectors consumed large quantities of maize but now find themselves competing with ethanol producers for resources.

- Economic Pressures: Increased demand for maize has driven local prices above international levels, putting pressure on poultry industries that depend on maize.

- Feed Cost Crisis: Rising maize costs contribute significantly to production expenses, leading to financial challenges for poultry businesses.

- Calls for Regulatory Changes: The All India Poultry Breeders Association is pushing for the removal of import duties on genetically modified maize to alleviate feed costs.

- Agricultural Adjustments: Farmers are increasing maize cultivation to take advantage of high prices, but small-scale farmers must adapt their production based on market changes.

- Export to Import Shift: Once a major maize exporter, India now imports maize primarily from Myanmar and Ukraine, affecting global market prices.

- Market Reactions: The heightened demand for maize in India has led to an increase in global maize prices, changing traditional trade patterns.

- Supply Chain Shifts: Traditional maize importers who relied on India are now sourcing maize from South America and the USA due to inflated prices in India.

Strategies to Boost Maize Production

- Tailored Agricultural Enhancements: India's diverse agricultural zones require specific innovations to enhance maize yields.

- Biotech Adoption for Resilience: Introducing biotech traits that resist pests, like the fall armyworm, and planting high-yield hybrids could greatly boost productivity.

- Water-Efficient Crop Alternatives: Transitioning from water-intensive crops such as rice to maize can conserve water resources and improve yields, especially in regions like Punjab, Haryana, and Western UP.

- Supportive Policies for Growth: Implementing supportive measures like reasonable Minimum Support Prices (MSP) and assured procurement through large cooperatives could encourage extensive maize cultivation.

- Biofuel and Food Security Synergy: Producing distiller's dried grains with soluble (DDGS) from ethanol production aligns with the E20 ethanol blending target, promoting a sustainable cycle of food, feed, and fuel production.

- Known scientifically as Zea mays L., maize is often called the "queen of cereals" due to its high yield potential.

- It is a key global grain, with the United States recognized as the leading producer known for its high productivity.

- Maize is used across various sectors, playing a crucial role in the production of food, animal feed, and numerous industrial products.

- It thrives in a wide range of soil types, from loamy sand to clay loam, favoring well-drained soil with high organic content and a neutral pH.

- Optimal maize productivity is found in areas with adequate drainage and low salinity.

- Ideal growth occurs with annual rainfall between 50 to 100 centimeters.

- Maize is cultivated during the Kharif, Rabi, and Spring seasons, with Kharif crops usually yielding less due to reliance on rainfed conditions and associated stresses.

- As of December 2023, India ranks as the fifth largest producer and fourteenth largest exporter of maize globally for the year 2022.

- Despite the potential for year-round cultivation, a robust seed network, and good access to seaports, domestic demand heavily influences its export capability.

- Primary Producing Regions: Major maize-producing states include Karnataka, Madhya Pradesh, Bihar, Tamil Nadu, Telangana, Maharashtra, and Andhra Pradesh.

Evolving Household Savings in India

Why in News?

Recently, the Reserve Bank of India (RBI) Deputy Governor at the Financing 3.0 Summit of the Confederation of Indian Industry (CII) highlighted that Indian households are rebuilding financial savings post-pandemic, with significant implications for the broader economy and financial system.

Current Trend in Household Savings

- Recovery of Household Savings: The net financial savings of households nearly halved from 2020-21 levels due to the unwinding of pandemic-era careful savings and a shift to physical assets like housing instead of savings.

- Households have now begun to restore their financial savings driven by rising incomes after a decline during the Covid pandemic.

- Financial assets have increased from 10.6% of Gross Domestic Product (GDP) (2011-17) to 11.5% (2017-23, excluding the pandemic year).

- Physical savings have increased to over 12% of GDP in the post-pandemic years, though this is still lower than the 16% of GDP recorded in 2010-11.

- Future Prospects

- As incomes continue to rise, households are expected to rebuild financial assets to levels similar to the early 2000s, potentially reaching around 15% of GDP.

Impact of Household Savings on the Economy

- Interest Rates: Changes in household savings behavior can influence monetary policy, including interest rates. Lower financial savings might prompt demands for higher interest rates to encourage savings, and vice versa.

- Enhanced Lending Capacity: As households regain financial strength, they are likely to become the primary net lenders in the economy, providing crucial funding for other sectors, especially as corporate borrowing needs rise.

- Corporate Sector Borrowing: The corporate sector has decreased net borrowings. However, anticipated increases in capital expenditure (capex) may lead to higher borrowing needs. With a projected rise in corporate borrowing, households are expected to fill the financing gap, supporting economic growth and investment.

- Economic Stability: Higher physical savings contribute to economic stability by diversifying investment portfolios and potentially increasing long-term wealth, though it might also limit liquidity.

- Implications for External Financing: As domestic savings rise, the need for external financing may decrease, though external debt sustainability will remain a priority. Changes in external financing composition could occur as the economy’s capacity to absorb foreign resources evolves. The public sector’s net dissaving has moderated but remains a net borrower, reflecting the need for continued fiscal policy support.

What are Household Savings?

- About: Household (HH) savings in India consist of two parts, net financial savings (NFS) and physical savings. HH NFS is arrived at after deducting financial liabilities (known as annual borrowing) from gross financial savings (GFS). GFS includes seven key areas: Currencies; deposits (bank and non-bank); insurance; provident and pension funds (P&PF), including the public provident fund (PPF); shares and debentures (S&D); claims on government (small savings); and others.

- HH physical savings primarily constitute residential real estate (accounting for about two-thirds) and machinery and equipment (owned by producers within the HH sector).

- Household Savings to GDP Ratio: It is the sum of its net financial savings to GDP ratio, physical savings to GDP ratio and gold and ornaments.

- Trends in Household Savings: There is a growing trend towards investing in riskier financial assets like stocks and debentures. A growing proportion of savings is being allocated to physical assets (real estate) rather than financial instruments.

- Pandemic and Impact on Household Savings: During the Covid-19 pandemic, households saved more due to limited spending opportunities. This resulted in a high financial savings rate (Rs 23.3 lakh crore in 2020-21). However, as restrictions eased, spending surged, reducing savings. Post-pandemic, many households have shifted their savings from financial assets to physical assets such as real estate and gold. This shift has reduced net financial savings. Net financial savings of households fell to Rs 14.2 lakh crore in 2022-23 from Rs 17.1 lakh crore in 2021-22. This is a notable drop from Rs 23.3 lakh crore in 2020-21. Savings in real estate and gold have surged, with physical asset savings reaching Rs 34.8 lakh crore and gold savings hitting Rs 63,397 crore in 2022-23. Many households overextended financially to purchase homes, often with high Equated Monthly Instalment (EMI) payments and reduced liquidity. Increasing expenses for healthcare and education have further squeezed household savings. The younger generation prioritizes lifestyle and experiences over savings, encouraged by easy online shopping and borrowing options, leading to a further decline in Household Savings and contributing to an increase in household debt.

- Household Debt: It is defined as all liabilities of households (including non-profit institutions serving households) that require payments of interest or principal by households to the creditors at a fixed date in the future.

What are the Initiatives Related to Household Savings?

- Sukanya Samriddhi Account Scheme

- Senior Citizens’ Savings Scheme

- Kisan Vikas Patra Scheme

- Mahila Samman Savings Certificate

- Employees Provident Fund (EPF)

- National Pension System (NPS)

- Public Provident Fund (PPF) and National Savings Certificate (NSC)

- Post Office Monthly Income Scheme (POMIS): It is a Government of India-backed small savings scheme that allows residents of India above 10 years of age to invest a specific amount monthly. It has a 5-year lock-in period, and premature withdrawal is allowed after one year with a penalty. Income from the scheme is not subject to Tax Deduction at Source (TDS).

Initiatives for Preservation of Indigenous Cattle Breeds

Why in News?

The National Institute of Animal Biotechnology (NIAB) is implementing several initiatives aimed at the preservation and sustainable growth of the livestock sector.

What are NIAB’s Initiatives for Conservation of Indigenous Cattle Breeds?

- Genetic Sequencing of Indigenous Cattle: NIAB employs Next Generation Sequencing (NGS) technology along with genotyping methods to uncover molecular signatures for registered cattle breeds. These signatures are crucial for accurately identifying and preserving the purity of indigenous cattle breeds, thereby safeguarding their unique genetic traits.

- Vaccine Development: The institute is concentrating on creating advanced vaccines to combat diseases like brucellosis. This initiative aims to enhance animal health and mitigate economic losses. The vaccine development aligns with the 'BioE3 (Biotechnology for Economy, Environment, and Employment)' policy, which focuses on improving biomanufacturing processes.

- Advanced Research and Models: NIAB is dedicated to developing bio-scaffolds for tissue repair and drug delivery. These scaffolds are constructed from natural and 3D-printed materials, providing a base where cells and growth factors can be integrated to form substitute tissues. A notable achievement includes the creation of a bovine lung cell-based 3D model for screening tuberculosis drugs and for disease modeling.

- Promoting Sustainable Bio-Economy: NIAB's efforts are in accordance with six thematic areas defined by the Department of Biotechnology (DBT) aimed at fostering a circular bio-based economy that emphasizes alternative proteins and sustainable manufacturing practices.

- Alternatives to Antibiotics: The institute plans to leverage bacteriophages and their lytic proteins as alternatives to conventional antibiotics, targeting bacteria such as staphylococci, E. coli, and streptococci. Bacteriophages are viruses that specifically infect and replicate within bacterial cells, effectively killing them. Lytic proteins derived from phages represent a new class of enzyme-based antibiotics known as enzymobiotics.

- Biomarkers for Nutritional Stress: NIAB has developed biomarkers, including metabolites and proteins, that can be used for the early detection of nutritional stress in cattle. Such stress can lead to reduced productivity and infertility within the population.

- Community Outreach and Sustainable Farming: The institute encourages sustainable livestock farming through community engagement initiatives such as MILAN, which connects with livestock farmers to showcase new technologies and practices.

What are Government Schemes for Development of the Livestock Sector?

- Rashtriya Gokul Mission

- Animal Husbandry Infrastructure Development Fund (AHIDF)

- National Animal Disease Control Programme

- National Artificial Insemination Programme

- National Livestock Mission

- National Kamdhenu Breeding Centre

DICGC Overcharging Commercial Banks

Why in news?

The Deposit Insurance and Credit Guarantee Corporation (DICGC), a subsidiary of the Reserve Bank of India (RBI), is facing scrutiny regarding its premium structure, which seems to overcharge commercial banks while favoring cooperative banks. This situation has raised concerns about the fairness and effectiveness of the existing system, leading to calls for a reevaluation of the premiums based on the risk profiles of various banking institutions.

How are the Commercial Banks Being Overcharged for Deposit Insurance?

- Disproportionate Premium Burden: DICGC collects 94% of premiums from commercial banks, which account for only 1.3% of net claims, while cooperative banks contribute 6% of premiums yet claim 98.7% of net claims. Since its inception in 1962, commercial banks have filed gross claims of ₹295.85 crore, with net claims totaling ₹138.31 crore, whereas cooperative banks have filed gross claims of ₹14,735.25 crore, with net claims amounting to ₹10,133 crore. This disparity indicates that well-managed commercial banks are subsidizing the higher risks associated with cooperative banks.

Implications for Overcharging Commercial Banks:

- High Compliance Costs: The uniform premium rate of 12 paise per ₹100 insured, irrespective of risk profile, imposes significant compliance costs on commercial banks. This can detrimentally affect their operational efficiency and profitability, ultimately hindering their ability to lend and serve customers effectively.

- Inequitable Risk Assessment: Commercial banks, which generally operate with lower risk profiles, are penalized with higher premiums, undermining the principles of risk evaluation that should dictate insurance pricing.

- Impact on Financial Stability: Elevated premiums may decrease financial stability for commercial banks, as they might need to transfer these costs to depositors and borrowers, potentially resulting in higher loan interest rates and lower returns for depositors, adversely affecting the overall banking ecosystem.

- Encouragement of Poor Management Practices: By compelling commercial banks to absorb the costs associated with cooperative bank failures, the current structure may unintentionally encourage poor management practices within cooperative banks, as the repercussions of defaults are shifted to more stable institutions.

What are the Key Facts About DICGC?

- About: DICGC was established in 1978 following the merger of the Deposit Insurance Corporation (DIC) and the Credit Guarantee Corporation of India Ltd. (CGCI) after the Deposit Insurance and Credit Guarantee Corporation Act, 1961 was enacted by Parliament. It provides deposit insurance and credit guarantee for banks in India and is wholly owned by the Reserve Bank of India (RBI).

Funds Managed by DICGC:

- Deposit Insurance Fund: This fund offers insurance to bank depositors if a bank fails financially and cannot pay its depositors, leading to liquidation. It is funded by premiums collected from banks.

- Credit Guarantee Fund: This fund provides guarantees that offer specific remedies to creditors if their debtors default.

- General Fund: This encompasses DICGC's operational expenses and any surplus from its operations.

What is the Deposit Insurance Scheme of DICGC?

- Limit for Deposit Insurance: Currently, each depositor is entitled to a maximum claim of ₹5 lakh per account as insurance cover. This amount is referred to as 'deposit insurance.' Depositors with amounts exceeding ₹5 lakh have no legal recourse to recover their funds in the event of a bank failure.

- Premium for the Insurance: The premium has been increased from 10 paise for every ₹100 deposit to a maximum of 15 paise. Banks pay this insurance premium to the DICGC, which cannot be passed on to depositors. Insured banks are required to pay advance insurance premiums to the corporation semi-annually, based on their deposits as of the end of the previous half year.

- Coverage: All banks, including regional rural banks, local area banks, and foreign banks with branches in India, are mandated to obtain deposit insurance from the DICGC. However, primary cooperative societies are not insured by the DICGC.

- Types of Deposits Covered: DICGC provides insurance for all bank deposits such as savings, fixed, current, and recurring deposits, with specific exceptions including deposits from foreign governments, Central/State governments, inter-bank deposits, and any amounts exempted by the corporation with prior approval.

- Need of Deposit Insurance:

- Recent troubles faced by depositors in accessing funds from banks, such as Punjab & Maharashtra Co-operative (PMC) Bank, Yes Bank, and Lakshmi Vilas Bank, have highlighted the importance of deposit insurance.

Why is there a Need to Reevaluate Deposit Insurance Premiums by DICGC?

- Proposal: There has been a recommendation to reduce the premium for commercial banks from 12 paise to 3 paise per ₹100 insured, potentially relieving these banks of around ₹20,000 crore by FY26. Conversely, premiums for cooperative banks could remain at 12 paise or even increase to 15 paise.

- Benefits:

- Risk-Based Premiums: Adjusting premiums to reflect the risk profiles of banks sends a clear message that insurance costs should align with actual risk.

- Economic Efficiency: Lower compliance costs for commercial banks can enhance their operational efficiency, benefiting depositors.

- Encouraging Good Management: By not penalizing well-managed banks, the system fosters better banking practice

7 New Schemes to Boost Farmer Income

Why in News?

In a significant move to enhance the livelihood of farmers, the Union Cabinet has sanctioned seven schemes with a substantial financial outlay. These schemes aim to uplift agricultural practices and ensure a better quality of life for farmers across India.

Digital Agriculture Mission Scheme

- About: The Digital Agriculture Mission (DAM) is designed to leverage technology for the enhancement of farmers' livelihoods, structured around Digital Public Infrastructure (DPI).

- Outlay: The total budget allocated for this mission is Rs 2,817 crores.

India Enterprise Architecture (IndEA) Framework

- Overview: IndEA serves as a strategic framework that enables both governmental and private entities to develop IT architectures that transcend organizational limits.

- Unity in Diversity: The framework promotes the principle of "Unity in Diversity" in e-Governance, allowing independent development of Enterprise Architectures by various governmental bodies.

- e-Governance Standard: Officially recognized as an e-Governance standard by the Ministry of Electronics and Information Technology (MeitY) in October 2018.

- IndEA 2.0: The evolved version, IndEA 2.0, aims to facilitate collaborative IT architecture design across organizations, focusing on strategic and rational digitization efforts.

- Pillars:It consists of two foundational pillars:

- Agri Stack: A digital platform created by the Ministry of Agriculture & Farmers Welfare, Agri Stack integrates high-quality data to improve agricultural outcomes. It enhances farmers' access to credit, quality inputs, personalized advice, and market opportunities, while streamlining government efficiency in implementing benefit schemes.

- Central Core of Agri Stacks: This includes a comprehensive farmers registry, village land maps registry, and crop sown registry.

- Krishi Decision Support System (DSS):A satellite-based platform aiding farmers in crop management through data insights from RISAT-1A and VEDAS. Components include:

- Geospatial data

- Drought and flood monitoring

- Weather and satellite data

- Groundwater and water availability data

- Crop yield and insurance modeling

Digital Agricultural Mission Provisions

- Soil profile analysis

- Digital crop estimation

- Digital yield modeling

- Connectivity for crop loans

- Integration of modern technologies like AI and Big Data

- Marketplace connections for farmers

- Access to new knowledge via mobile platforms

Crop Science for Food and Nutritional Security Scheme

- Budget: This scheme has a financial allocation of Rs 3,979 crore.

- Objective: Aimed at preparing farmers for climate resilience and ensuring food security by 2047, it focuses on enhancing the nutritional value of crops and advancing agricultural research and education.

- Pillars:The scheme comprises the following pillars:

- Research and education

- Management of plant genetic resources

- Genetic enhancement for food and fodder crops

- Improvement of pulse and oilseed crops

- Enhancement of commercial crops and research on insects, microbes, and pollinators

Strengthening Agricultural Education, Management and Social Sciences Scheme

- Outlay: The scheme has a total budget of Rs 2,291 crore.

- Aim: This initiative is aligned with the New Education Policy 2020, aiming to equip future agricultural professionals with necessary skills to tackle current challenges.

- Technology Incorporation: The scheme promotes the use of advanced technologies such as AI, Big Data, and remote sensing while encouraging natural farming and climate resilience.

Sustainable Livestock Health and Production Scheme

- Outlay: Approved with a budget of Rs 1,702 crore.

- Objective: This scheme aims to boost farmers' income through livestock and dairy production.

- Components:The initiative focuses on:

- Animal health management and veterinary education

- Dairy production and technology development

- Nutrition and development of small ruminants

Sustainable Development of Horticulture Scheme

- Budget: Allocated Rs 860 crore to enhance farmers’ income through diverse horticultural crops cultivation.

- Focus: This scheme supports the development of tropical, subtropical, temperate, root, tuber, bulbous crops, as well as commercial and medicinal plants.

Strengthening of Krishi Vigyan Kendra (KVK’s) Scheme

- Financial Allocation: Rs 1,202 crore has been earmarked for strengthening KVKs.

- Significance of KVKs: KVKs are vital components of the National Agricultural Research System (NARS), which includes a broad network of institutions dedicated to agricultural research and development.

- Role: KVKs are crucial in disseminating knowledge and best practices to farmers, aimed at enhancing their productivity and income. The strengthening initiative ensures farmers have access to the latest agricultural techniques and innovations.

Natural Resource Management Scheme

- Outlay: The scheme has a budget of Rs 1,115 crore.

- Significance: This initiative is essential for ensuring the long-term sustainability of agricultural practices while also safeguarding the environment. The government aims to promote sustainable resource management to secure the future of Indian agriculture.

Why rice-wheat need to be de-hyphenated

Why in News?

India's wheat production is currently facing significant challenges while rice is experiencing a surplus. Traditionally, economists and policymakers have grouped these two grains together, viewing them through the lens of a cereal surplus and a lack of agricultural diversity. However, the realities of these crops have diverged significantly in recent years.

Surplus problem in Rice

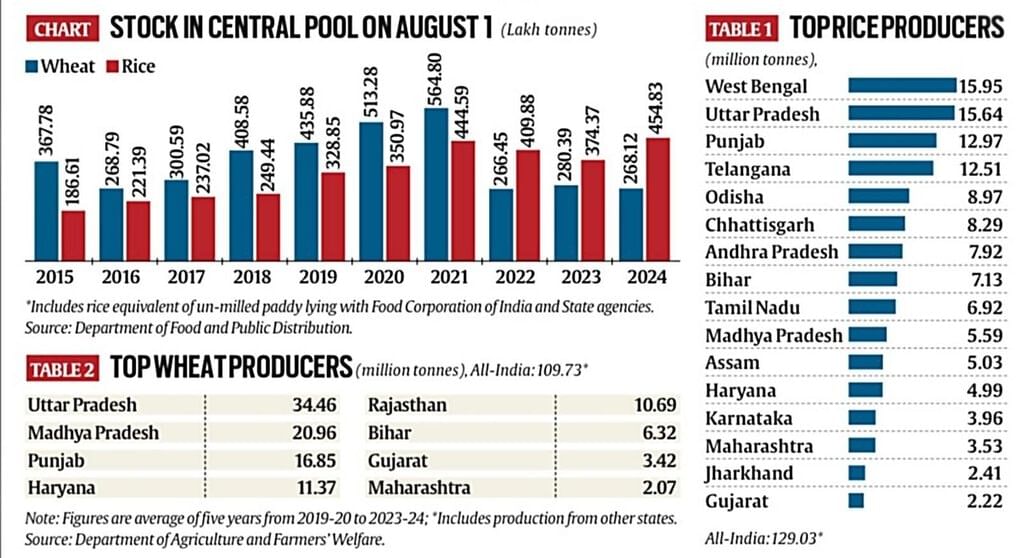

- Rice has been exported in large quantities, with 21.21 million tonnes shipped in 2021-22, 22.35 million tonnes in 2022-23, and 16.36 million tonnes expected in 2023-24. Despite these record exports, rice stocks in government warehouses reached a historic high of 45.48 million tonnes as of August 1.

- Conversely, wheat exports have drastically decreased from 7.24 million tonnes in 2021-22 to just 0.19 million tonnes in 2023-24, prompting the Indian government to impose a ban on wheat exports in May 2022. Current wheat stock levels in the central pool are at their lowest for this date in recent history, with only 26.81 million tonnes available.

- Typically, wheat stocks are lower than rice at this time of year because wheat is harvested and sold from April to June, while the main rice crop is harvested in October. However, rice stock levels have exceeded those of wheat in the last three years.

Several factors have contributed to the growing disparity between rice and wheat stocks:

- Geographical Diversity: Rice is grown during both monsoon and winter-spring seasons across a variety of states, with 16 states producing over 2 million tonnes each. In contrast, wheat has a single cropping season and is primarily produced in just eight states, concentrated in northern and central India.

- Irrigation and Support: The expansion of irrigation and assured minimum support prices have significantly boosted rice production, particularly in states like Telangana, which increased its output from 4.44 million tonnes to 16.63 million tonnes between 2014-15 and 2023-24.

- Climate Vulnerability: Wheat production has become increasingly susceptible to shorter, warmer winters and unpredictable weather patterns, likely due to climate change. Recent spikes in temperature during critical growth periods have adversely affected wheat yields.

- Meanwhile, India's wheat consumption continues to grow, with per capita monthly consumption reported at 3.9 kg in rural areas and 3.6 kg in urban regions, amounting to approximately 65 million tonnes for a population of 1.425 billion.

- Demand for processed wheat products such as whole grain flour (atta) and semolina (sooji) is on the rise, driven by their use in various traditional and fast food items. However, similar innovation and demand are not evident in rice-based processed products.

- Wheat Grain Composition: Whole wheat grain consists of three parts: the bran (14% of the kernel weight), the germ (2.5%), and the endosperm (83%), which is rich in starch and gluten. Atta, made from whole wheat, retains all these components, while maida (refined flour) lacks essential nutrients due to the refining process.

Way Ahead:

- Short-Term Approach: To address rising consumption and production challenges, India may need to consider importing wheat in the short term.

- Long-Term Strategy: The government should focus on increasing per-acre yields and developing climate-resilient crop varieties. In contrast, rice production has outpaced domestic consumption.

- Export Policy Changes: It is recommended that the government lift the ban on the export of white non-basmati rice and remove the 20% duty on parboiled non-basmati rice and the $950/tonne floor price on basmati rice shipments.

| Year | Wheat Exports (mt) | Rice Exports (mt) |

|---|---|---|

| 2021-22 | 7.24 | 21.21 |

| 2022-23 | 4.69 | 22.35 |

| 2023-24 | 0.19 | 16.36 |

Strengthening India's Mineral Exploration Sector

Why in News?

The Ministry of Mines has conducted a comprehensive evaluation of the National Mineral Exploration Trust (NMET) during its sixth Governing Body meeting. The Annual Report for NMET for the fiscal year 2023-24 has been officially published.

What are the Key Developments?

- Enhancement of NGDR Portal: The National Geoscientific Data Repository (NGDR) portal is undergoing upgrades to promote efficient collaboration in geoscientific data sharing, thereby maximizing its utility for national interests.

- Reimbursement Schemes: A newly revised scheme for partial reimbursement of exploration costs has been approved, which raises the reimbursement limit for holders of Composite Licenses (CL).

- Support for Left Wing Extremism-Affected Districts and Start-ups: NMET is focused on advancing mineral exploration in areas impacted by left-wing extremism by offering 1.25 times the standard Schedule of Charges for fieldwork activities.

- Incentives for Critical and Strategic Mineral Exploration: An exploration incentive of 25% has been introduced for agencies involved in the discovery of critical and strategic minerals, encouraging more investment and effort in this vital sector.

- Encouraging State-Level Mineral Exploration: States are encouraged to establish their own State Mineral Exploration Trusts, modeled after NMET, to foster the exploration of minor minerals within their jurisdictions.

- Focus on Start-ups and Emerging Technologies: The meeting underscored the significance of encouraging start-ups in the mining industry, particularly focusing on innovations in artificial intelligence (AI), automation, and drone technology.

Central Trade Unions (CTUs) Demand for Labour Welfare

Why in News?

Recently, the Union government convened a roundtable meeting with Central Trade Unions (CTUs), addressing various labour welfare issues. Key discussions included the implementation of the four Labour Codes, reinstating the Indian Labour Conference (ILC), restoring the old pension scheme, and increasing support for the informal sector.

Key Demands of Central Trade Unions (CTUs)

1. Reinstatement of the Indian Labour Conference (ILC):

- Background: The ILC is a group made up of representatives from the government, employers, and workers. It has not had a meeting since 2015.

- Demand: Central Trade Unions (CTUs) are asking for the ILC to meet again soon to talk about important changes in labour laws and to make sure there is proper discussion on future reforms.

2. Review and Revision of the Four Labour Codes:

- Current Concerns: CTUs believe that the new Labour Codes support big companies and weaken workers' rights. Key issues include:

- Processes for hiring and firing workers have been made easier, especially for companies with less than 300 employees.

- Demand: More discussions are needed to tackle issues around job security, collective bargaining, working hours, social security, and compliance requirements.

- 3. Halt to Privatization and Disinvestment:

- Current Policy: The National Monetisation Pipeline (NMP) is focused on moving public assets to private companies.

- Demand: CTUs are against the privatization and selling off of Public Sector Undertakings (PSUs) and enterprises, including Indian Railways.

- 4. Implementation of Fair Minimum Wages:

- Current Proposal: CTUs are calling for a minimum wage of Rs 26,000 per month, based on the recommendations from the 15th ILC in 1957 and a court ruling from 1991.

- Demand: Regular updates to wages every five years, linked to inflation.

- 5. Employment Generation and Job Security:

- Current Issues: There are worries about fixed-term employment policies and the Agnipath scheme, which could harm job security.

- Demand: The withdrawal of fixed-term employment policies and compliance with ILO Convention No. 1, which supports the 8-hour workday. Additionally, there should be detailed discussions on Employment Linked Incentive schemes that aim to create two crore jobs.

- 6. Restoration of Old Pension Scheme (OPS):

- Current Status: The non-contributory OPS offers better social security for retired workers.

- Demand: Restore OPS with a minimum pension of Rs 9,000 per month for EPS 1995 members and Rs 6,000 for those not in the scheme.

Registration Provisions for Trade Unions in India

1. Requirements:

- A registered trade union must have at least 10% of the total workers or 100 workers, whichever number is smaller.

- It also needs at least 7 members from the relevant workplace or industry.

2. Exemptions:

- Armed Forces: The Armed Forces Act, 1950 limits union activities.

- Police and Law Enforcement Agencies: The Police Forces (Restriction of Rights) Act, 1966 also restricts union rights.

Indian Labour Conference (ILC)

- 1. Purpose:

- The ILC is a committee made up of three groups that gives advice to the government about worker-related issues.

- It consists of members from Central Trade Unions (CTUs), employers, and government agencies.

- 2. History:

- The first meeting took place in 1942, and it was known as the Tripartite National Labour Conference before.

Four Labour Codes

- 1. Code on Wages, 2019:

- Applies minimum wages universally.

- Ensures timely payment to uphold the "Right to Sustenance."

- 2. Industrial Relations Code, 2020:

- Establishes a framework to safeguard worker rights.

- Aims to resolve industrial disputes effectively.

- Reduces conflicts between employers and workers.

- 3. Code on Social Security, 2020:

- Expands social security schemes to different types of workers.

- Covers self-employed individuals and gig workers.

- 4. Occupational Safety, Health and Working Conditions Code, 2020:

- Concentrates on health, safety, and welfare in industries.

- Focuses on the manufacturing sector and related workplaces.

Steps Needed to Fulfill CTU Demands

- 1. Inclusive Consultation and Dialogue:

- Gather the ILC to talk about changes in labor rules, ensuring conversations include the government, employers, and unions.

- 2. Job and Social Security:

- Review the rules for fixed-term employment and assess how the Agnipath scheme affects job safety.

- 3. National Policy for Migrant Workers:

- Create a detailed national plan for migrant workers and improve the Interstate Migrant Workmen Act of 1979.

- 4. Ratification of ILO Convention:

- Agree to the ILO Convention C177 on home-based workers to guarantee fair pay, social security, and health benefits.

Conclusion

- The Central Trade Unions have raised important issues about worker welfare and rights as economic policies and labour reforms change.

- Key concerns include the necessity for proper discussions through the Indian Labour Conference (ILC).

- There is a call for a careful review of the Labour Codes to ensure they meet the needs of workers.

- Protection against privatization of jobs and services is also a major issue.

- It is vital to address these demands through inclusive dialogue and to revise employment policies accordingly.

- Support for migrant workers is essential to create fair and sustainable work conditions.

- Balancing these demands with economic goals is crucial to build a strong and fair labour market.

|

108 videos|425 docs|128 tests

|

FAQs on Economic Development: September 2024 UPSC Current Affairs - Indian Economy for UPSC CSE

| 1. What are the key features of the 12 new industrial smart cities approved by the government? |  |

| 2. How are food consumption patterns changing in India, and what are the implications? |  |

| 3. What are the differential benefits of rural electrification for different communities in India? |  |

| 4. What are the primary concerns facing Asset Reconstruction Companies (ARCs) in India? |  |

| 5. What initiatives is India undertaking to boost farmer income, and how effective are they? |  |