Employee Stock Option and Buy-Back of Securities | Commerce & Accountancy Optional Notes for UPSC PDF Download

What is ESOP?

- Definition of ESOPs: ESOPs, or Employees Stock Ownership Plans, is a generic term encompassing a range of instruments and incentive schemes provided to a company's employees.

- Evolution of ESOPs: Over time, ESOPs have evolved into various forms, with the term covering most types of share-based payments extended to employees.

- Types of Share-Based Payments: Share-based payments within the ESOP framework can include Employee Stock Option Plans (ESOP), Employee Stock Purchase Plans (ESPPs), and Stock Appreciation Rights.

- Focus on Employees Stock Options Plans: ESOP, specifically as "Employees Stock Options Plans," represents one mode of share-based payment within the broader ESOP umbrella.

- Definition of Stock Option: A stock option is defined as "a right, but not an obligation, granted to an employee as part of the employee stock option scheme, allowing them to apply for shares of the company at a pre-determined price."

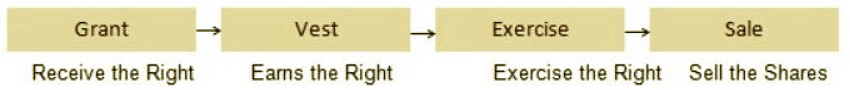

ESOP's Cycle

An option is first granted to an employee and after a specific period (when exercised) vests with the employee. This period is referred to as the vesting period.

Vesting Period = Period between vesting and granting

How much cost to be recognized in profit and Loss statement?

- Through there is no accounting standard on share based payment however Institute of Chartered accountant has issued a guidance note to establish uniform principle and practice for accounting.

- In accordance to the guidance note the cost of services received in a share based payment is required to be recognised over vesting period with a corresponding credit to an appropriate equity account say,'stock option outstanding account'.

How Cost of service is determined?

Fair value of shares determined on grant date should be used as a cost of service received.

Accounting Treatment at various stages of cycle

At the time of Grant

The Company should recognise an amount for the service received during the vesting period based upon the best available estimate of number of shares expected to vest and should revise estimate if necessary.

Example: At the beginning of year 1, an enterprise grants 300 options to each of its 1,000 employees. The contractual life (comprising the vesting period and the exercise period) of options granted is 6 years. The other relevant terms of the grant are as below:

Vesting Period: 3 years

Exercise Period: 3 years

Expected Life: 5 years

Exercise Price: 50

Market Price: 50

Expected forfeitures per year 3%

The fair value of options, calculated using an option pricing model, is 15 per option. Actual forfeitures, during the year 1, are 5 per cent and at the end of year 1, the enterprise still expects that actual forfeitures would average 3 per cent per year over the 3-year vesting period. During the year 2, however, the management decides that the rate of forfeitures is likely to continue to increase, and the expected forfeiture rate for the entire award is changed to 6 per cent per year. It is also assumed that 840 employees have completed 3 years vesting period.

Suggested Accounting Treatment

Year 1

- At the grant date, the enterprise estimates the fair value of the options expected to vest at the end of the vesting period as below:

No. of options expected to vest = 300 x 1,000 x 0.97 x 0.97 x 0.97 = 2,73,802 options

Fair value of options expected to vest = 2,73,802 options x 15 = 41,07,030 - At the balance sheet date, since the enterprise still expects actual forfeitures to average 3 per cent per year over the 3-year vesting period, no change is required in the estimates made at the grant date. The enterprise, therefore, recognises one-third of the amount estimated at (1) above (i.e., ` 41,07,030/3) towards the employee services received by passing the following entry:

Employee compensation expense A/c Dr. 13,69,010

To Stock Options Outstanding A/c 13,69,010

Between Grant and Vesting

Year 2

- At the end of the financial year, management has changed its estimate of expected forfeiture rate from 3 per cent to 6 per cent per year. The revised number of options expected to vest is 2,49,175 (3,00,000 x .94 x .94 x .94). Accordingly, the fair value of revised options expected to vest is 37,37,625 (2,49,175 x ` 15). Consequent to the change in the expected forfeitures, the expense to be recognised during the year are determined as below:

Revised total fair value = 37,37,625

Revised cumulative expense at the end of year 2 = (₹37,37,625 x 2/3) = 24,91,750

Expense already recognized in year 1 = 13,69,010

Expense to be recognized in year 2 = 11,22,740 - The enterprise recognizes the amount determined at (1) above (i.e., 11,22,740) towards the employee services received by passing the following entry:

Employee compensation expense A/c Dr. 11,22,740

To Stock Options Outstanding A/c 11,22,740

Upon Vesting

Year 3

- At the end of the financial year, the enterprise would examine its actual forfeitures and make necessary adjustments, if any, to reflect expense for the number of options that vested. Considering that 840 employees have completed three years vesting period, the expense to be recognized during the year is determined as below:

No. of options vested = 840 x 300 = 2,52,000

Fair value of options actually vested (Rs. 2,52,000 x Rs. 15) = Rs. 37,80,000

Expense already recognized Rs. 24,91,750

Expense to be recognized in year 3 Rs. 12,88,250 - The enterprise recognises the amount determined at (1) above towards the employee services received by passing the following entry:

Employee compensation expense A/c Dr. Rs. 12,88,250

To Stock Options Outstanding A/c Rs. 12,88,250

Method of Accounting Valuation of ESOP under IGAAP

There are two methods of doing ESOP valuation Intrinsic value method and. fair value method.

Intrinsic value method

- Definition of Intrinsic Value: The intrinsic value is the surplus amount determined by subtracting the exercise price of an ESOP from the current market price of the share.

- Example Illustration: For instance, if a company grants an ESOP with a current market price (CMP) of INR 110 and an exercise price of INR 80, the intrinsic value would be INR 30.

- No Intrinsic Value Scenario: However, if the CMP drops to INR 50, rendering it lower than the exercise price, there would be no intrinsic value. In such a case, the options could not be exercised and would instead lapse.

Fair value method

The fair value of an ESOP is estimated using an option pricing model like the Black Scholes Merton or a Binomial Model.

Factors considered in option pricing model

- Exercise Price:

- Refers to the price at which the option will be exercised.

- Life of the Option:

- The estimated duration for which stock options are expected to remain valid.

- The enterprise can determine the expected life based on a weighted average for the entire employee group or subgroup, considering detailed data on employees' exercise behavior.

- Current Price of Shares:

- The existing market price of the shares.

- Expected Volatility:

- For listed companies, historical volatility of their own shares should be considered.

- Unlisted companies are advised to consider volatility as zero but can alternatively use the volatility of a similar listed company.

- Dividend Yield:

- Companies must estimate the future dividend yield rate.

- Historical dividend yield can be utilized to predict the expected future dividend yield.

- Risk-Free Interest Rate:

- The risk-free interest rate is the implied yield on zero-coupon government securities or bonds and is applicable for the entire life of the option.

Which method is more appropriate?

Fair value method is considered more appropriate as it takes into various factors like time value, interest rate, volatility etc. These factors are not considered under Intrinsic value method.

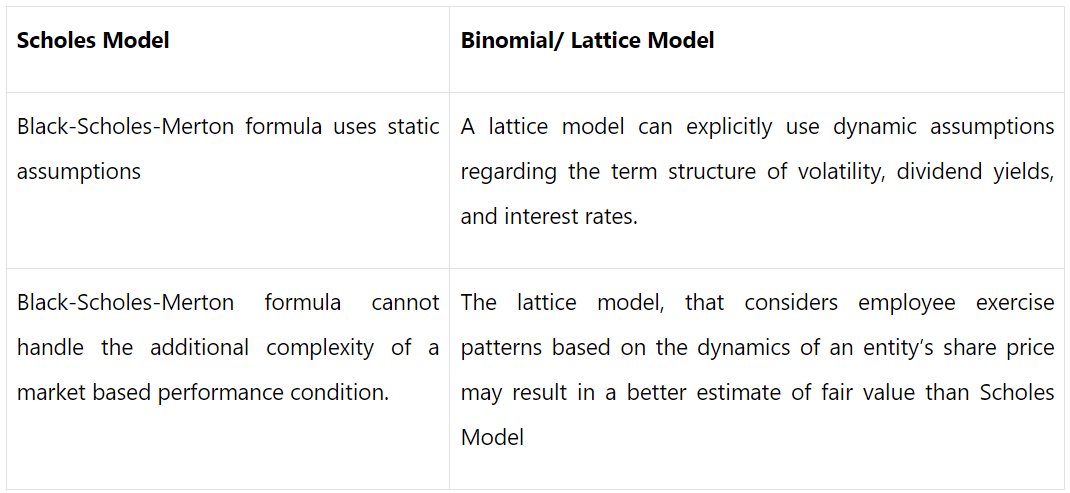

Comparison of Black Scholes and Binomial Model

The longer the term of the option and the higher the dividend yield, the larger the amount by which the binomial lattice model value may differ from the Black-Scholes-Merton value.

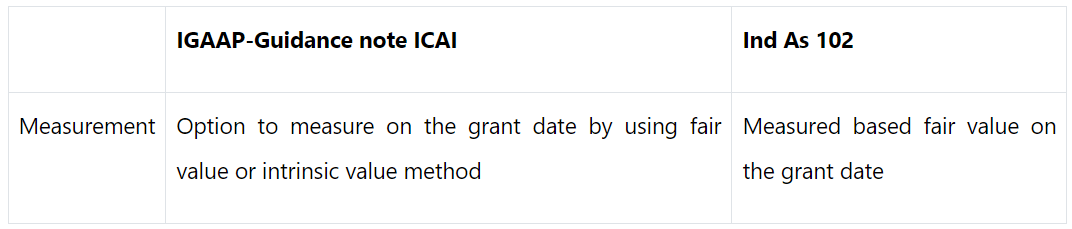

Comparison IGAAP and IND AS -ESOP Valuation

Conclusion

ESOP valuation plays crucial role in the success of the ESOP Scheme. ESOP valuation effects EPS of the Company and higher valuation may result into higher tax pay-out by employees as a perquisite and may turn ESOP scheme unattractive thus appropriate planning is required.

Buy-Back of Securities

Introduction

The process in which a company acquires its own shares using funds from free reserves, securities premium, or proceeds from any shares or securities is termed as share buyback. Sections 77A, 77AA, and 77B of the Companies (Amendment) Act, 1999 provide the legal framework for companies to engage in the buyback of their shares, subject to specific conditions. These conditions will be elaborated upon in the following section.

Conditions for Buy Back of Shares

- The Articles of Association of the company authorize buy back of shares.

- The special resolution is to be passed in the General Meeting of the company.

- The buy back of shares should not exceed 25% of the paid-up capital and free reserves of the company.

- After such buy back, the debt equity ratio should not exceed 2:1.

- From the 12 months of the date of passing the resolution, the buy back should be completed.

- All the buy back shares should be fully paid-up.

- A declaration of the company should be filed with the Registrar of the Companies and Securities Exchange Board of India in the form of an affidavit.

- The securities should be listed at the Stock Exchange of India.

- Within seven days of the last date of completion of buy back, the company shall extinguish or physically destroy such shares.

- Company shall not make further issue of shares within a period of 24 months, except the issue of bonus shares after completing the buy back of shares.

- The buy back cannot be done through a subsidiary or investment company.

Motives of buy back of shares

There may be various objectives of buy back of shares. Some of them are as follow:

- Return the surplus cash to shareholders.

- Enhance the Earning Per Share (EPS).

- Convey the view of the management to investors

- Stabilize the market price of the share of the company.

- Raise the promoters’ voting power without spending any amount.

- Word off a hostile takeover threat.

- Move towards a desirable Capital Structure.

SEBI guidelines

SEBI has made certain regulations in 1998, in relation to the buy back of shares, which are as follows:

- Buy back of shares cannot be done through negotiated deals. Therefore, the company is required to make public announcements through one national English daily newspaper, one national Hindi daily, and one national language daily where the registered office of the company is situated.

- Buy back should be permissible:

- From the existing shareholders on a proportionate basis.

- From the open market.

- From the old lot of holders.

- By purchasing the shares issued to employees of the company pursuant to the scheme of stock option or sweat equity.

- Buy back offer should remain open for a minimum of 15 days and a maximum of 30 days.

- The maximum price of buy back should be determined by the shareholders through the special resolution of the shareholders or through a special resolution of the board of directors.

- If the tendered shares are more than the number of shares to be bought back, the buy back should be done on a proportionate basis.

Methods of buy back of shares

There are two methods of buy back. Let us discuss both the methods in detail.

Tender Method

In this method, company preparing the buy back fixes the price at which it is prepared to buy back. If number of shares offered for buy back by the shareholders at this price exceeds the total number of shares determined by the company to be bought back, then shares shall be bought from each shareholder proportionately. In this method, promoters may also offer their shares for buy back provided proper disclosures are made. Under this method, price offered by company will be at a premium over the prevalent market price in order to act as an incentive to the shareholders to offer their shares for buy back.

Example: Current market price of shares of X Ltd. Rs. 40

Numbers of shares announced to be bought back by company of X Ltd. 2, 00,000

Buy Back price announced by company Rs. 50

Number of shares offered for buy back at Buy Back Price 8, 00,000

Solution: As only 2,00,000 shares have been announced to be bought back proportionately i.e. only 25% of each shareholder's offering will be accepted by the company for buy back.

Open Market Purchases

(A) Buyback Through Stock Exchange:

- This method involves the company repurchasing its shares through stock exchanges for cancellation until the maximum intended quantity is reached. Regulatory compliance is mandatory in this approach.

- The special resolution, authorizing the buyback decision, must specify the maximum buyback price.

- Promoters and those controlling the company are not allowed to offer their shares for buyback through this method.

- Share buyback, in this case, is exclusively conducted on stock exchanges with electronic trading facilities, utilizing the 'all or none' order matching mechanism.

(B) Buyback Through Book Building:

- This method, also known as 'Dutch Auction,' determines the buyback price based on shareholders' assessments of a fair share price for the buyback. Shareholders quote price ranges and the corresponding number of shares they are willing to offer for repurchase.

- Regulatory compliance set by SEBI includes:

- The special resolution authorizing the buyback decision should specify the maximum buyback price.

- There should be a minimum of thirty bidding centers, each equipped with at least one electronically linked computer terminal.

- The final buyback price, being the highest accepted, is paid to all shareholders whose shares are accepted for repurchase.

Advantages of buy back of shares

There are various advantages of buy back of shares. Some of them are as follow:

- Under the buy back process, the companies having large amount of free reserves are free to use funds to acquire the shares and other specified securities.

- Buy back of shares helps the promoters to formulate an effective defense strategy against hostile takeovers.

- Through buy back of shares, the company avails the advantage of servicing reduced capital base with high dividend yield.

Escrow Account

Escrow is a contract or bond deposited with the third person by whom it is delivered to the guarantee on the fulfillment of some conditions. For the purpose of buy back, the company has to open the Escrow Account consisting of:

- Cash deposited with the commercial bank.

- Bank guarantee in favour of the merchant banker.

- Deposit of acceptable securities with the appropriate margin.

- Combination of 1, 2, 3 with the merchant banker with an amount equal to 25% of the consideration payable, if consideration is not more than 100 crores plus 10% of the consideration exceeding 100 crores.

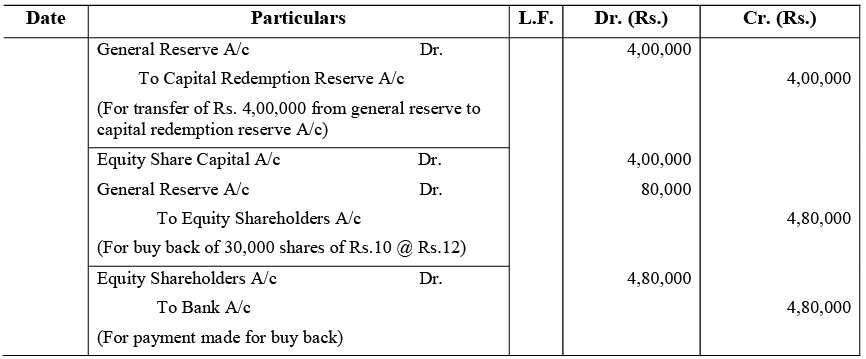

Accounting for the buy-back of shares

There are following journal entries which need to be passed at the time of buy back of shares.

For the purpose of buy back, if fresh issue of shares is made Bank A/c Dr.

To Share Application and Allotment A/c

For transfer of Capital A/c

Share Application and Allotment A/c Dr. To Share Capital A/c

If the buy back is done at par or at face value

Share Capital A/c Dr. (with the nominal value of Shares re-purchased)

To Bank A/c

If the buy back is done at premium

Share Capital A/c Dr. (with the nominal value of Shares repurchased)

General Reserve/Securities Premium A/c Dr. (with the additional amount)

To Bank A/C (with the total) (with the total)

If the buy back is done at discount

Share Capital A/c Dr. (with the nominal value of Shares repurchased)

To Bank A/c (with the amount paid)

To Capital Reserve A/c (with the amount of discount)

If the buy back is made out of free reserves, the nominal value of shares to be transferred to Capital Redemption Reserve, Free reserves will also include securities premium

Free Reserves A/c Dr.

To Capital Redemption Reserve A/c

Examples

Example 1: A Ltd purchases 40,000 Equity shares of Rs. 10 each at Rs. 12 per share and no fresh issue was made for this purpose. Pass journal entries.

Ans:

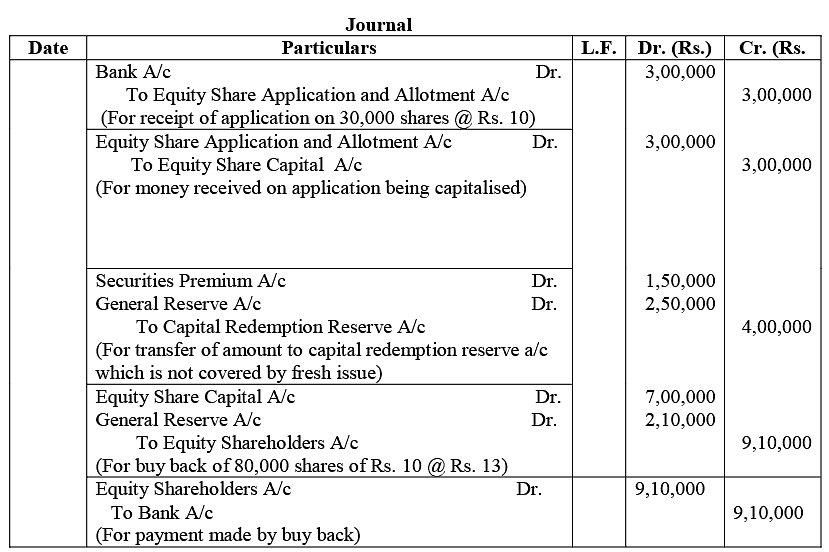

Example 2: B Ltd passed a resolution to buy back 70,000 of its fully paid equity shares of Rs. 10 each at Rs. 13 per share. For this purpose, it issued 30,000 Equity shares of Rs. 10 each at par. The company uses Rs. 1, 50,000 of its balance from Securities Premium Account apart from the adequate balance in general reserve. Pass journal entries.

Ans:

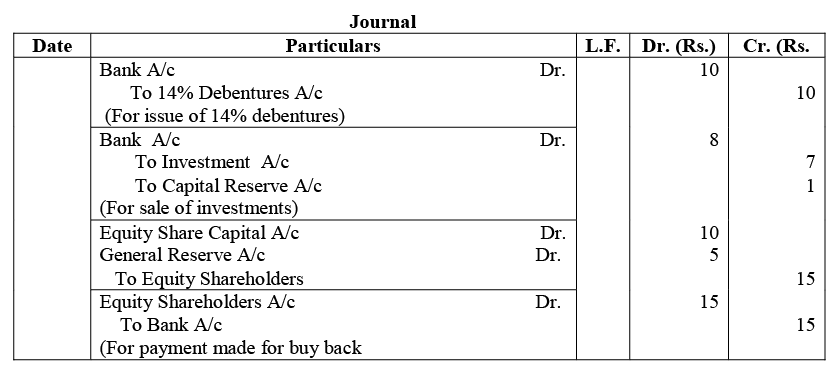

Example 3: R Ltd. decides to buy back 10% of Rs. 100 crores paid-up Equit y capital. The face value per Equity share is 10, but the market price share is Rs. 15. X Ltd. took the following steps for the buy back of its shares:

1. To issue 14% debentures of Rs. 100 each at par, face value Rs. 10 crores.

2. To utilize general reserve.

3. To sell investments of Rs. 7 crores for Rs. 8 crores.

4. To buy back the shares at the market price.

5. To immediately cancel the shares bought back.

Pass the Journal Entries.

Ans:

Summary

- The process of a company acquiring its own shares, whether from free reserves, security premium accounts, or proceeds from shares or securities, is termed as share buyback.

Several conditions govern this practice, including:- The company's articles of association must grant authorization for share buyback.

- A special resolution needs to be passed in the Annual General Meeting (AGM) of the company.

- Following buyback, the debt-equity share ratio should not exceed 2:1.

- The shares subject to buyback must be fully paid up.

- The buyback must be completed within 12 months from the date of passing the resolution.

- The securities should be listed on the Stock Exchange of India.

- There are two methods for share buyback:

- Tender method

- Open market method

- Numerous advantages accompany share buyback, such as assisting promoters in developing an effective defense strategy against hostile takeovers and enabling the company to benefit from servicing a reduced capital base with a high dividend yield. An escrow account, which involves a contract or bond deposited with a third party, is opened by the company for the purpose of buyback. This account ensures the fulfillment of certain conditions before the shares are delivered to the guarantee.

|

180 videos|153 docs

|

FAQs on Employee Stock Option and Buy-Back of Securities - Commerce & Accountancy Optional Notes for UPSC

| 1. What is ESOP? |  |

| 2. What is the accounting treatment at various stages of the ESOP cycle? |  |

| 3. What is the method of accounting valuation of ESOP under IGAAP? |  |

| 4. What are the SEBI guidelines regarding the buy-back of securities? |  |

| 5. What are the methods of buy-back of shares? |  |