UPSC Exam > UPSC Notes > Indian Economy for UPSC CSE > GS3 PYQ (Mains Answer Writing): Budget

GS3 PYQ (Mains Answer Writing): Budget | Indian Economy for UPSC CSE PDF Download

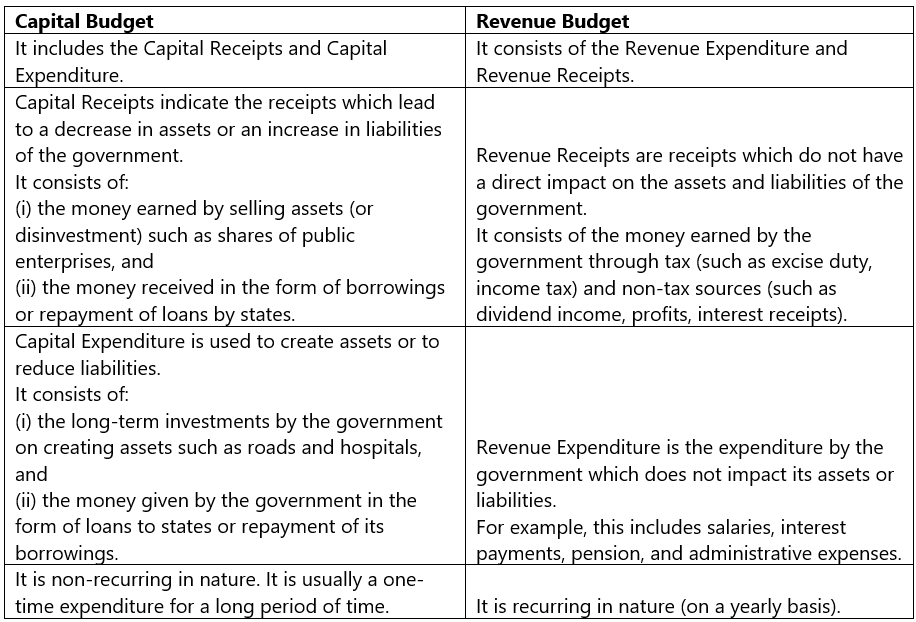

Distinguish between Capital Budget and Revenue Budget. Explain the components of both these Budgets (UPSC GS3 Mains)

Introduction

According to Article 112 of the Indian Constitution, the Union Budget of a year is referred to as the Annual Financial Statement (AFS). It is a statement of the estimated receipts and expenditure of the Government in a financial year (which begins on 01 April of the current year and ends on 31 March of the following year).

Objectives of Budget:

- Reallocation of resources

- Reducing inequalities in income and wealth

- Contributing to economic growth

- Bringing economic stability

- Managing public enterprises

Components of government budgets:

TOPICS covered - revenue and capital expenditure

The document GS3 PYQ (Mains Answer Writing): Budget | Indian Economy for UPSC CSE is a part of the UPSC Course Indian Economy for UPSC CSE.

All you need of UPSC at this link: UPSC

|

108 videos|431 docs|128 tests

|

Related Searches