Green Hydrogen & Fuel Cells | Science & Technology for UPSC CSE PDF Download

| Table of contents |

|

| Introduction |

|

| Fuel Cells: Technology and Applications |

|

| India’s Initiatives and Role |

|

| Global Context and Trends |

|

| Challenges, Future Prospects, and Significance |

|

Introduction

Green hydrogen and fuel cells are key to decarbonizing hard-to-abate sectors like steel, cement, and heavy transport, reducing India’s reliance on fossil fuels (50% of energy mix in 2025). Green hydrogen is produced via electrolysis, splitting water into hydrogen and oxygen using renewable electricity, unlike grey hydrogen (from natural gas, emitting CO2). Fuel cells, particularly Proton Exchange Membrane (PEM) types, use hydrogen to generate electricity with water as the only byproduct, offering high efficiency (50–60% vs. 30–40% for combustion engines). India’s NGHM, backed by ₹19,744 crore, aims to produce 5 MMT of green hydrogen by 2030, supported by 125 GW of additional renewable capacity. Global hydrogen demand is projected to reach 150 MMT by 2030, with India positioning itself as an export hub.

Green Hydrogen: Technology and Production

Technology

Electrolysis: Uses electricity to split water (H₂O) into hydrogen (H₂) and oxygen (O₂). Types:

Alkaline Electrolysers: Mature, cost-effective, used in large-scale projects.

Proton Exchange Membrane (PEM) Electrolysers: High efficiency, compact, suited for variable renewable inputs.

Solid Oxide Electrolysers (SOE): Emerging, high-temperature systems for industrial use.

Renewable Integration: Solar and wind power (e.g., India’s 97.86 GW solar capacity) drive electrolysis, ensuring zero-carbon output.

Other Methods: Green hydrogen can also be produced via biomass gasification or photoelectrochemical processes, but electrolysis dominates.

Production Process

Inputs: Renewable electricity, water (9 liters/kg of hydrogen).

Output: 1 kg of hydrogen yields ~33 kWh energy; scalable for industrial needs.

Efficiency: Current systems achieve 60–80% efficiency; advancements aim for 85% by 2030.

Derivatives: Green ammonia (for fertilizers) and green methanol (for shipping) produced from green hydrogen.

Advantages

Zero Emissions: No CO2 during production or use, unlike grey hydrogen (10 kg CO2/kg H₂).

Versatility: Used in transport (fuel cell vehicles), industry (steel, cement), and power (grid storage).

Energy Storage: Stores excess renewable energy, addressing solar/wind intermittency.

Export Potential: Global demand (e.g., EU, Japan) offers economic opportunities.

Challenges

High Costs: ₹300–400/kg vs. ₹150/kg for grey hydrogen; needs scale to compete.

Infrastructure: Limited pipelines, storage, and refueling stations; high-pressure or cryogenic storage is costly.

Water Demand: Large-scale production requires significant water (e.g., 45 billion liters for 5 MMT).

Electrolyser Supply: 80% imported (mainly China) in 2024, challenging self-reliance.

Fuel Cells: Technology and Applications

Technology

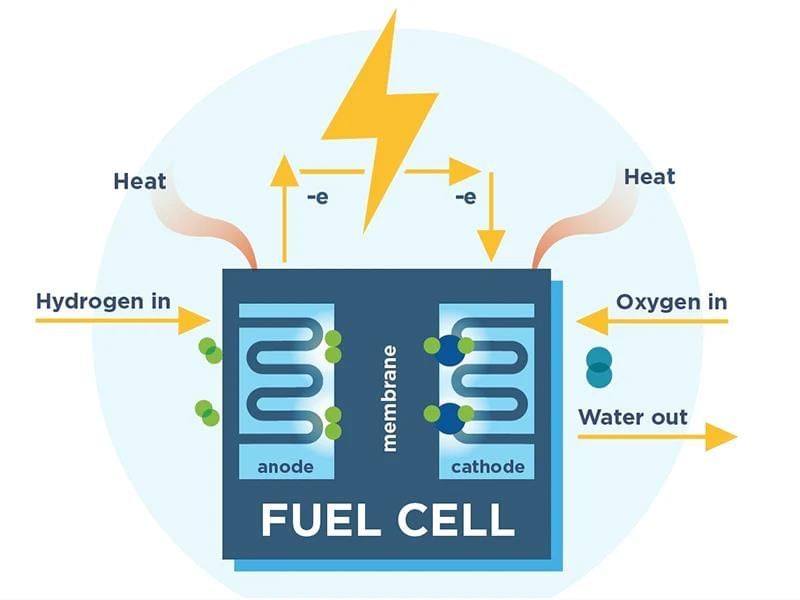

Principle: Electrochemical devices convert hydrogen (or fuels like methanol) into electricity, with water and heat as byproducts.

Types:

PEM Fuel Cells: Common for vehicles, high efficiency, operate at 60–80°C.

Solid Oxide Fuel Cells (SOFC): High-temperature (800–1,000°C), suited for stationary power.

Alkaline Fuel Cells (AFC): Used in space missions, less common commercially.

Molten Carbonate Fuel Cells (MCFC): For large-scale power plants.

Components: Anode, cathode, electrolyte (e.g., PEM membrane), and catalyst (often platinum, increasing costs).

Applications

Transport: Fuel cell electric vehicles (FCEVs) for buses, trucks, and trains (e.g., India’s first hydrogen train pilot, 2024).

Stationary Power: Backup power for hospitals, data centers; grid-scale energy storage.

Portable Power: For remote areas, military, or disaster relief.

Industrial: Decarbonizing steel, cement, and chemical production.

Advantages

High Efficiency: 50–60% vs. 30–40% for internal combustion engines.

Zero Emissions: Only water as byproduct, ideal for urban transport.

Flexibility: Scalable from small devices (kW) to large plants (MW).

Reliability: Continuous power with hydrogen supply, unlike batteries.

Challenges

Cost: Platinum catalysts and membranes raise costs (~₹10 lakh/kW for PEM fuel cells).

Infrastructure: Limited hydrogen refueling stations; only 5 operational in India (2025).

Durability: Fuel cell lifespan (5,000–10,000 hours) needs improvement for heavy-duty use.

Supply Chain: Reliance on imported components (e.g., membranes from Japan, US).

India’s Initiatives and Role

National Green Hydrogen Mission (NGHM)

Launch: January 4, 2023, with ₹19,744 crore until 2029-30.

Targets:

5 MMT green hydrogen production by 2030.

125 GW additional renewable capacity.

60 GW electrolyser capacity.

₹8 lakh crore investment, 6 lakh jobs.

Components:

SIGHT Programme: ₹17,490 crore for electrolyser manufacturing and hydrogen production incentives (₹50/kg, decreasing annually).

Green Hydrogen Hubs: Two hubs by 2026 (Gujarat, Andhra Pradesh) for integrated production and use.

Pilot Projects: ₹455 crore for low-carbon steel, ₹496 crore for mobility, ₹115 crore for shipping.

Policy Support: Waiver of interstate transmission charges for renewable energy used in hydrogen production; banking and open access for projects.

Progress (as of 2025)

Capacity: 0.5 MMT production capacity established, mainly for fertilizers and refineries.

Key Achievements:

First green hydrogen plant at Jorhat, Assam (2024).

SECI issued tenders for 1 MMT production capacity (2025).

10 mobility pilots (buses, trucks) launched in 2025.

Fuel Cell Development: BARC and ISRO lead R&D; hydrogen train pilot operational in Haryana (2024).

Private Sector: Reliance, Adani, and NTPC investing in electrolyser plants; 5 GW capacity under construction.

International Collaborations

India-Japan (2024): MoU for green ammonia exports; joint R&D on fuel cells for shipping.

India-US: iCET initiative (2025) supports fuel cell manufacturing for mobility.

International Solar Alliance (ISA): Integrates solar-powered electrolysis for green hydrogen.

IAEA Support: India shares fuel cell expertise for small-scale applications in Global South.

Recent Developments

Budget 2025-26: ₹5,400 crore for electrolyser manufacturing, hub development, and fuel cell pilots.

Pilot Expansion: 10 new FCEV pilots for urban transport (2025).

Manufacturing: PLI scheme added 2 GW domestic electrolyser capacity in 2024; 5 GW planned by 2027.

Global Engagement: India hosted G20 Energy Transition Working Group (2024), promoting green hydrogen standards.

Global Context and Trends

Market Growth: Global hydrogen demand projected at 150 MMT by 2030; green hydrogen market to reach USD 500 billion by 2050.

Key Players:

EU: REPowerEU targets 20 MMT green hydrogen by 2030; Germany leads in fuel cell vehicles.

China: 1 MMT green hydrogen capacity (2025); operational thorium MSR supports hydrogen production.

US: $7 billion for hydrogen hubs; NuScale SMRs for electrolysis by 2029.

Japan: World leader in FCEVs (e.g., Toyota Mirai); targets 800,000 FCEVs by 2030.

Trends (2025): Focus on green ammonia for shipping, hydrogen pipelines, and fuel cell integration with renewables. IAEA’s 2024 hydrogen forum emphasized SMR-powered electrolysis.

Challenges, Future Prospects, and Significance

Challenges

High Costs: Green hydrogen (₹300–400/kg) and fuel cells (₹10 lakh/kW) need scale to compete with grey hydrogen and batteries.

Infrastructure: Limited pipelines (500 km in India vs. 5,000 km in EU) and refueling stations (5 vs. 1,000 globally).

Import Dependence: 80% of electrolysers and fuel cell components imported, challenging Aatmanirbhar Bharat.

Water Scarcity: 5 MMT production requires 45 billion liters of water, straining resources in arid regions.

Safety: Hydrogen’s flammability requires explosion-proof storage and transport systems.

Future Prospects

Cost Reduction: Economies of scale and PLI schemes aim to reduce green hydrogen costs to ₹150/kg by 2030.

Infrastructure: 2,000 km hydrogen pipelines planned by 2030; 50 refueling stations by 2027.

Domestic Manufacturing: 60 GW electrolyser capacity by 2030; fuel cell production to scale via private partnerships.

Export Potential: Green ammonia exports to EU and Japan by 2030, leveraging India’s low-cost renewables.

Integration: SMRs and thorium reactors (2030s) to power electrolysis, enhancing efficiency.

Significance for India

Energy Security: Reduces fossil fuel imports (₹12 lakh crore in 2024), supporting 1.4 billion population.

Climate Goals: Cuts 50 MMT CO2 annually by 2030, aligning with net-zero by 2070 and SDG 13.

Economic Impact: Creates 6 lakh jobs; contributes to $1 trillion renewable economy by 2035.

Global Leadership: NGHM and ISA position India as a hydrogen hub, strengthening G20 and UNFCC roles.

Green hydrogen and fuel cells are pivotal to India’s clean energy transition, decarbonizing industries, transport, and power systems. The NGHM, with 0.5 MMT capacity and pilot projects, leverages India’s 208 GW renewable base to achieve 5 MMT by 2030. Fuel cell advancements, led by BARC and private players, support mobility and stationary applications. Recent developments, like the 2025-26 budget and international ties, signal strong momentum. Addressing challenges like costs, infrastructure, and imports will ensure success.

|

90 videos|491 docs|209 tests

|

FAQs on Green Hydrogen & Fuel Cells - Science & Technology for UPSC CSE

| 1. What are fuel cells and how do they work? |  |

| 2. What initiatives has India taken to promote green hydrogen and fuel cells? |  |

| 3. How does green hydrogen differ from traditional hydrogen production methods? |  |

| 4. What are the global trends in the adoption of fuel cells and green hydrogen? |  |

| 5. What are the main challenges facing the development of fuel cells and green hydrogen? |  |