Indian Polity & Governance - 4 | Current Affairs & Hindu Analysis: Daily, Weekly & Monthly - UPSC PDF Download

| Table of contents |

|

| Manual Scavenging |

|

| Fertiliser Challenge |

|

| MPLAD Scheme |

|

| PMFME Scheme |

|

Manual Scavenging

Why in News?

Recently, the Ministry of Social Justice and Empowerment informed that a total of 971 people lost their lives while cleaning sewers or septic tanks since 1993.

- Earlier, the Union Cabinet approved the extension of the tenure of the National Commission for Safai Karamcharis (NCSK) for three years beyond 31st March, 2022. The major beneficiaries would be the Safai Karamcharis and identified manual scavengers in the country.

What is Manual Scavenging?

- Manual scavenging is defined as “the removal of human excrement from public streets and dry latrines, cleaning septic tanks, gutters and sewers”.

What are the Reasons for the Prevalence of Manual Scavenging?

- Indifferent Attitude: A number of independent surveys have talked about the continued reluctance on the part of state governments to admit that the practice prevails under their watch.

- Issues due to Outsourcing: Many times local bodies outsource sewer cleaning tasks to private contractors. However, many of them fly-by-night operators, do not maintain proper rolls of sanitation workers. In case after case of workers being asphyxiated to death, these contractors have denied any association with the deceased.

- Social Issue: The practice is driven by caste, class and income divides. It is linked to India’s caste system where so-called lower castes are expected to perform this job. In 1993, India banned the employment of people as manual scavengers (The Employment of Manual Scavengers and Construction of Dry Latrines (Prohibition) Act, 1993), however, the stigma and discrimination associated with it still linger on. This makes it difficult for liberated manual scavengers to secure alternative livelihoods.

What are the Steps taken to tackle the Menace of Manual Scavenging?

- The Prohibition of Employment as Manual Scavengers and their Rehabilitation (Amendment) Bill, 2020: It proposes to completely mechanise sewer cleaning, introduce ways for ‘on-site’ protection and provide compensation to manual scavengers in case of sewer deaths. It will be an amendment to The Prohibition of Employment as Manual Scavengers and their Rehabilitation Act, 2013. It is still awaiting cabinet approval

Fertiliser Challenge

Why in News?

- India is facing the challenge of meeting its requirement of fertilizer supply which has been disrupted ahead of kharif sowing in the wake of Russia’s invasion of Ukraine.

How much fertilizer does India consume?

- India consumed about 500 LMT of fertilizer per year in the last 10 years.

- The Centre’s fertiliser subsidy bill is set to soar by 62% over the budgeted amount to Rs 1.3 lakh crore in FY21.

- Between 2018-19 and 2020-21, India’s fertiliser imports increased almost 8% to 20.33 million tonnes from 18.84 million tonnes.

- India, the top importer of urea, is a major buyer of Diammonium Phosphate (DAP) needed to feed its huge agriculture sector which employs about 60% of the country’s workforce and accounts for 15% of USD2.7 trillion economy.

Need of Large Quantities of Fertilisers

- The agricultural output of India has increased every year, and the country’s need for fertilisers has also increased.

- Despite imports, gaps remain between requirements and availability after indigenous production targets haven’t been met.

What is Fertilizer Subsidy?

About

- The government pays a subsidy to fertiliser producers to make this critical ingredient in agriculture affordable to farmers.

- This allows farmers to buy fertilisers at below market rates.

- Subsidy on Urea: The Centre pays subsidy on urea to fertiliser manufacturers on the basis of cost of production at each plant and the units are required to sell the fertiliser at the government-set Maximum Retail Price (MRP).

- Subsidy on Non-Urea Fertilisers: The MRPs of non-urea fertilisers are decontrolled or fixed by the companies. The Centre, however, pays a flat per-tonne subsidy on these nutrients to ensure they are priced at “reasonable levels”.

- Examples of non-urea fertilisers: Di-Ammonium Phosphate (DAP), Muriate of Potash (MOP).

- All Non-Urea based fertilisers are regulated under Nutrient Based Subsidy Scheme.

What has been the Impact of Pandemic on Fertiliser Supply?

- The pandemic has impacted fertiliser production, import and transportation across the world during the last two years.

- China, who is the major fertiliser exporter, has gradually reduced their exports in view of a dip in production.

- This has impacted countries such as India, which sources 40–45% of its phosphatic imports from China.

- Besides, there has been a surge in demand in regions like Europe, America, Brazil and Southeast Asia.

- Demand has increased, but supply has been constrained.

What are the Related Government Initiatives and Schemes?

1. Neem Coating of Urea

- The Department of Fertilizers (DoF) has made it mandatory for all the domestic producers to produce 100% urea as Neem Coated Urea (NCU).

- The benefits of use of NCU are as under:

- Improvement in soil health.

- Reduction in usage of plant protection chemicals.

- Reduction in pest and disease attack.

- An increase in yield of paddy, sugarcane, maize, soybean, Tur/Red Gram.

- Negligible diversion towards non-agricultural purposes.

- Due to slow release of Nitrogen, Nitrogen UseEfficiency (NUE) of Neem Coated Urea increases resulting in reduced consumption of NCU as compared to normal urea.

2. New Urea Policy (NUP) 2015

Objectives of the policy are:

- To maximize indigenous urea production.

- To promote energy efficiency in the urea units.

- To rationalize the subsidy burden on the Government of India.

3. New Investment Policy-2012

- The Government announced New Investment Policy (NIP)-2012 in January, 2013 and made amendments in 2014 to facilitate fresh investment in the urea sector and to make India self-sufficient in the urea sector.

4. Policy on Promotion of City Compost

- Approved a policy on promotion of City Compost, notified by the DoF in 2016 granting Market Development Assistance of Rs. 1500/- for scaling up production and consumption of city compost.

- To increase sales volumes, compost manufacturers willing to market city compost were allowed to sell city compost in bulk directly to farmers.

- Fertilizer companies marketing city compost are covered under the Direct Benefit Transfer (DBT) for Fertilizers.

5. Use of Space Technology in Fertilizer Sector

- DoF commissioned a three year Pilot Study on “Resource Mapping of Rock Phosphate using Reflectance Spectroscopy and Earth Observations Data” by National Remote Sensing Centre under ISRO, in collaboration with Geological Survey of India (GSI) and the Atomic Mineral Directorate (AMD).

6. The Nutrient Based Subsidy (NBS) Scheme:

- It has been implemented from April 2010 by the DoF.

- Under NBS, a fixed amount of subsidy decided on an annual basis, is provided on each grade of subsidized Phosphatic & Potassic (P&K) fertilizers depending on its nutrient content.

- It aims at ensuring the balanced use of fertilizers, improving agricultural productivity, promoting the growth of the indigenous fertilizers industry and also reducing the burden of Subsidy.

MPLAD Scheme

Why in News?

- Recently, the Ministry of Finance has revised the Member of Parliament Local Area Development Scheme (MPLADS) rules, where the interest that the fund accrues will be deposited in the Consolidated Fund of India. ¾ So far, the interest accrued on the fund used to be added to the MPLADS account and could be used for the development projects.

What is Consolidated Fund of India?

- All revenues received by the Government by way of taxes like Income Tax, Central Excise, Customs and other receipts flowing to the Government In connection with the conduct of Government business i.e. Non-Tax Revenues are credited Into the Consolidated Fund constituted under Article 266 (1) of the Constitution of India.

- Similarly, all loans raised by the Government by issue of Public notifications, treasury bills (internal debt) and loans obtained from foreign governments and International institutions (external debt) are credited into this fund.

- All expenditure of the government Is incurred from this fund and no amount can be withdrawn from the Fund without authorization from the Parliament.

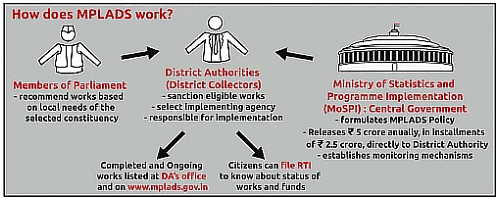

What is MPLAD Scheme?

About

- It is a Central Sector Scheme which was announced in December 1993.

Objective

- To enable MPs to recommend works of developmental nature with emphasis on the creation of durable community assets in the areas of drinking water, primary education, public health, sanitation and roads, etc. primarily in their Constituencies.

- Since June 2016, the MPLAD funds can also be used for implementation of the schemes such as Swachh Bharat Abhiyan, Accessible India Campaign (Sugamya Bharat Abhiyan), conservation of water through rain water harvesting and Sansad Aadarsh Gram Yojana, etc.

Implementation

- The process under MPLADS starts with the Members of Parliament recommending works to the Nodal District Authority.

- The Nodal District concerned is responsible for implementing the eligible works recommended by the Members of Parliament and maintaining the details of individual works executed and amount spent under the Scheme.

Functioning

- Each year, MPs receive Rs. 5 crore in two instalments of Rs. 2.5 crore each. Funds under MPLADS are non-lapsable.

- Lok Sabha MPs have to recommend the district authorities projects in their Lok Sabha constituencies, while Rajya Sabha MPs have to spend it in the state that has elected them to the House.

- Nominated Members of both the Rajya Sabha and Lok Sabha can recommend works anywhere in the country.

What are the Issues with MPLADS?

- Implementation Lapses: The Comptroller and Auditor-General of India (CAG) has flagged instances of financial mismanagement and artificial inflation of amounts spent.

- No Statutory Backing: The scheme is not governed by any statutory law and is subject to the whims and fancies of the government of the day.

- Monitoring and Regulation: The scheme was launched for promoting participatory development but there is no indicator available to measure level of participation.

- Breach of Federalism: MPLADS encroaches upon the domain of local self governing institutions and thereby violates Part IX and IX-A of the Constitution.

- Conflict with Doctrine of Separation of Powers: MPs are getting involved in executive functions.

PMFME Scheme

Why in News?

- Recently, the Ministry of Food Processing Industries and NAFED (National Agricultural Cooperative Marketing Federation of India Limited) launched Three One District One Product (ODOP) brands under the Pradhan Mantri Formalisation of Micro food processing Enterprises (PMFME) Scheme.

- The Ministry of Food Processing Industries has signed an agreement with NAFED for developing 10 brands of selected 20 ODOPs under the branding and marketing component of the PMFME scheme.

What is PMFME Scheme?

About

- Launched under Atmanirbhar Abhiyan (in 2020), it aims to enhance the competitiveness of existing individual micro-enterprises in the unorganised segment of the food processing industry and to promote formalisation of the sector and provide support to Farmer Producer Organisations, Self Help Groups, and Producers Cooperatives along their entire value chain.

- The scheme adopts the One District One Product (ODOP) approach to reap the benefit of scale in terms of procurement of inputs, availing common services and marketing of products.

- It will be implemented over a period of five years from 2020-21 to 2024-25.

Features

- One District One Product (ODOP) Approach: The States would identify food products for districts keeping in view the existing clusters and availability of raw material. The ODOP could be a perishable produce based or cereal based or a food item widely produced in an area. E.g. mango, potato, pickle, millet based products, fisheries, poultry, etc.

Other Focus Areas

- Waste to wealth products, minor forest products and Aspirational Districts.

- Capacity building and research: Academic and research institutions under MoFPI along with State Level Technical Institutions would be provided support for training of units, product development, appropriate packaging and machinery for micro units.

Financial Support

- Existing individual micro food processing units desirous of upgrading their units can avail credit linked capital subsidy at 35% of the eligible project cost with a maximum ceiling of Rs. 10 lakh per unit.

- Support would be provided through credit linked grants at 35% for development of common infrastructure including common processing facility, lab, warehouse, etc. through FPOs/ SHGs/cooperatives or state owned agencies or private enterprise.

- A seed capital (initial funding) of Rs. 40,000- per Self Help Group (SHG) member would be provided for working capital and purchase of small tools.

Funding

- It is a centrally sponsored scheme with an outlay of Rs. 10,000 crore.

- The expenditure under the scheme would be shared in 60:40 ratio between Central and State Governments, in 90:10 ratio with North Eastern and Himalayan States, 60:40 ratio with UTs with legislature and 100% by Centre for other UTs.

What is the Need of the Scheme?

- The unorganised food processing sector comprisingnearly 25 lakh units contributes to 74% of employment in the food processing sector. Nearly 66% of these units are located in rural areas and about 80% of them are family-based enterprises supporting livelihood of rural households and minimising their migration to urban areas.

- These units largely fall within the category of micro enterprises.

- The unorganised food processing sector faces several challenges which limit their performance and their growth. The challenges include lack of access to modern technology & equipment, training, access institutional credit, lack of basic awareness on quality control of products, and lack of branding & marketing skills etc.

What is NAFED?

About

- It Is an apex organisation of marketing cooper-atives for agricultural produce in India.

- It was founded on 2" October 1958 and is registered under the Multi-State Co-operative Societies Act, 2002.

- NAFED is one of the largest procurement as well as marketing agencies for agricultural products In India.

Objectives

- To organise, promote and develop marketing, processing and storage of agricultural, horticultural and forest produce.

- To distribute agricultural machinery, implements and other Inputs, undertake inter-state, import and export trade, wholesale or retail as the case may be.

- To act and assist for technical advice in agri-cultural production for the promotion and the working of Its members, partners, associates and cooperative marketing, processing and supply societies In India.

|

63 videos|5408 docs|1146 tests

|

FAQs on Indian Polity & Governance - 4 - Current Affairs & Hindu Analysis: Daily, Weekly & Monthly - UPSC

| 1. What is manual scavenging? |  |

| 2. What is the Fertiliser Challenge? |  |

| 3. What is the MPLAD Scheme? |  |

| 4. What is the PMFME Scheme? |  |

| 5. What is Indian Polity & Governance - 4? |  |