UPSC Exam > UPSC Notes > Indian Economy for UPSC CSE > Infographic: Inflation

Infographic: Inflation | Indian Economy for UPSC CSE PDF Download

The document Infographic: Inflation | Indian Economy for UPSC CSE is a part of the UPSC Course Indian Economy for UPSC CSE.

All you need of UPSC at this link: UPSC

|

138 videos|431 docs|128 tests

|

FAQs on Infographic: Inflation - Indian Economy for UPSC CSE

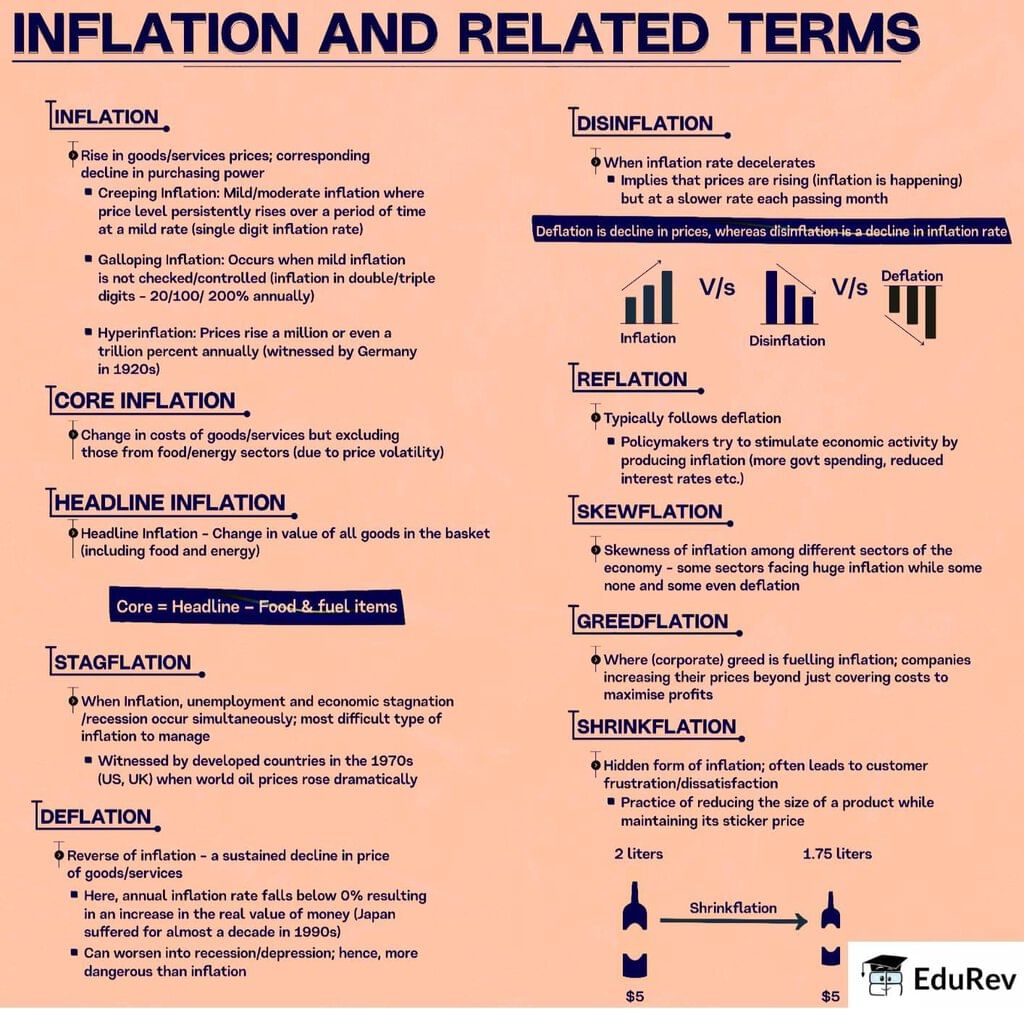

| 1. What is inflation and how is it measured? |  |

Ans. Inflation is the rate at which the general level of prices for goods and services rises, eroding purchasing power. It is typically measured using indices such as the Consumer Price Index (CPI) or the Producer Price Index (PPI). The CPI tracks changes in the price level of a basket of consumer goods and services, while the PPI measures the average changes in prices received by domestic producers for their output.

| 2. What are the main causes of inflation? |  |

Ans. The main causes of inflation can be categorized into demand-pull inflation, cost-push inflation, and built-in inflation. Demand-pull inflation occurs when demand for goods and services exceeds supply. Cost-push inflation happens when production costs rise, leading to increased prices for consumers. Built-in inflation is related to adaptive expectations, where businesses and workers expect rising prices, leading to wage increases and further price hikes.

| 3. How does inflation impact the economy? |  |

Ans. Inflation affects the economy in several ways. Moderate inflation can stimulate spending and investment, as consumers and businesses are encouraged to buy now rather than later. However, high inflation can lead to uncertainty, decreased purchasing power, and potential recession. It can also affect interest rates, as central banks may raise rates to curb inflation, which can slow economic growth.

| 4. What are the effects of inflation on individuals and households? |  |

Ans. Inflation affects individuals and households by diminishing their purchasing power, meaning they can buy less with the same amount of money. Fixed-income earners, such as retirees, are particularly vulnerable as their income does not automatically adjust with inflation. Additionally, inflation can lead to higher costs for essential goods and services, impacting overall living standards.

| 5. What measures can be taken to control inflation? |  |

Ans. To control inflation, governments and central banks can implement various measures such as tightening monetary policy by raising interest rates, reducing government spending, or implementing price controls. Increasing the supply of goods and services can also help alleviate inflationary pressures. These measures aim to balance demand and supply, stabilizing prices in the economy.

Related Searches