UPSC Exam > UPSC Notes > Indian Economy for UPSC CSE > Mind Map: Insurance in India

Mind Map: Insurance in India | Indian Economy for UPSC CSE PDF Download

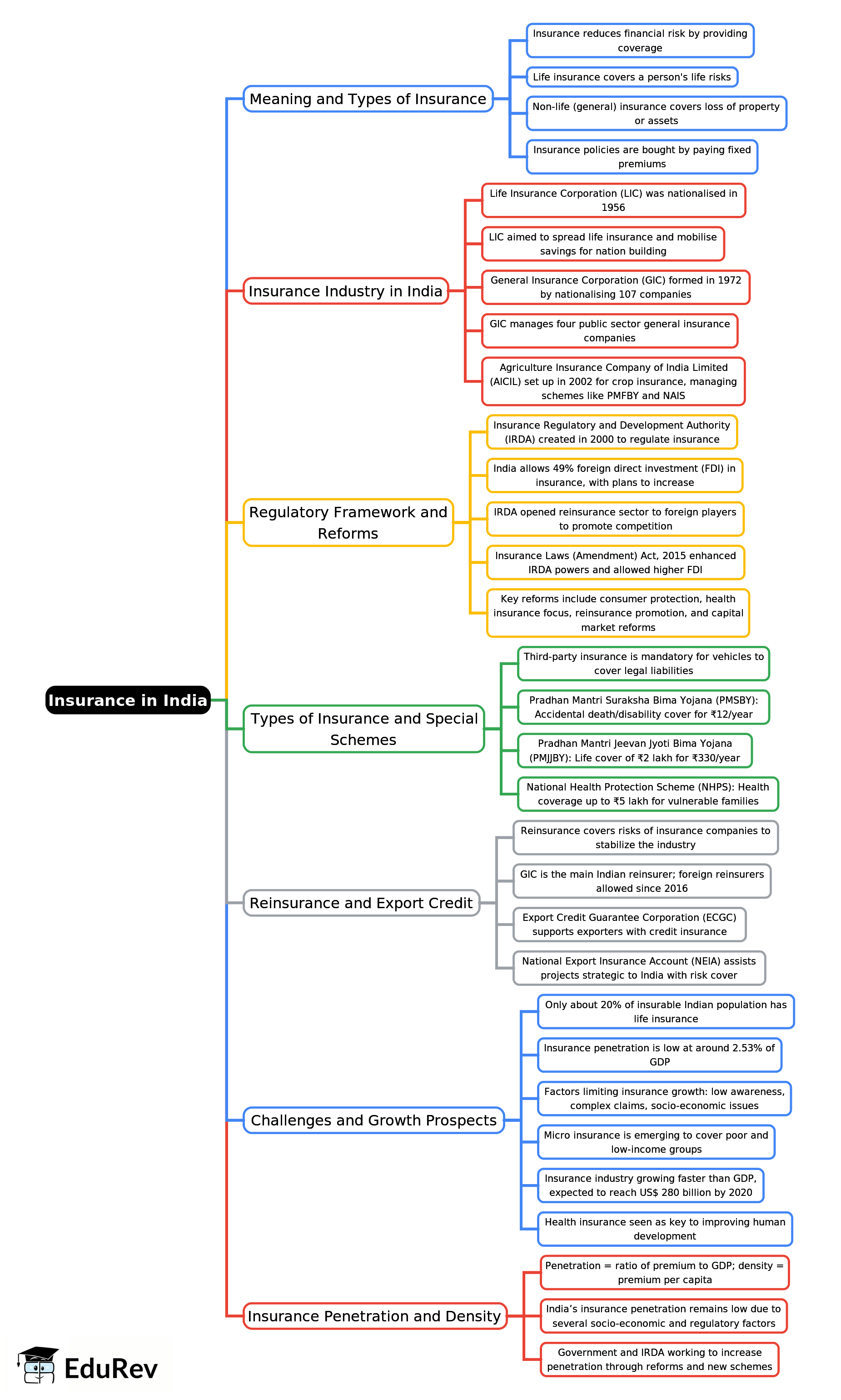

Insurance in India - 1

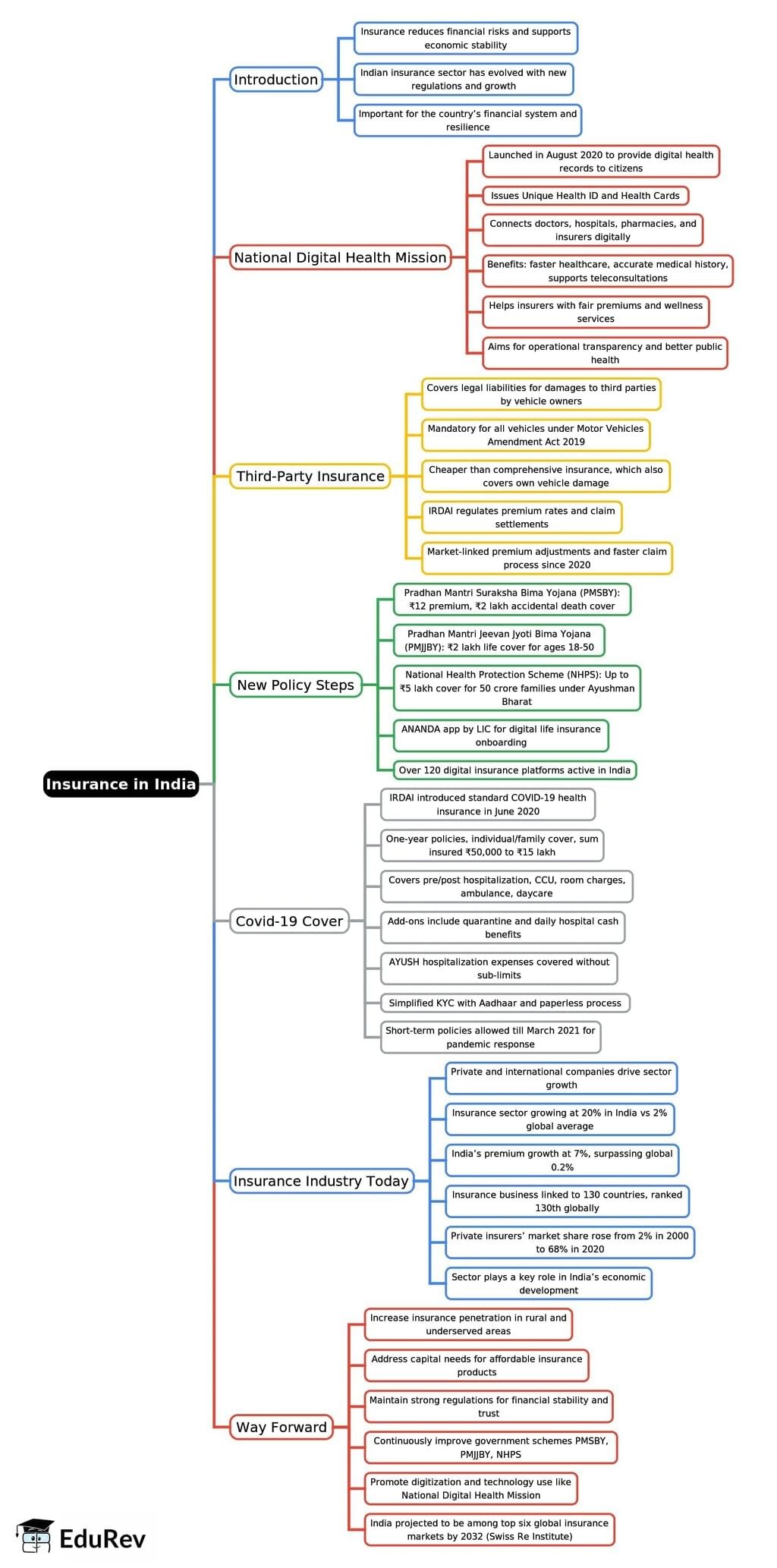

Insurance in India - 2

The document Mind Map: Insurance in India | Indian Economy for UPSC CSE is a part of the UPSC Course Indian Economy for UPSC CSE.

All you need of UPSC at this link: UPSC

|

108 videos|425 docs|128 tests

|

FAQs on Mind Map: Insurance in India - Indian Economy for UPSC CSE

| 1. What is the significance of the Insurance Regulatory and Development Authority of India (IRDAI) in the Indian insurance sector? |  |

Ans. The Insurance Regulatory and Development Authority of India (IRDAI) was established to regulate and promote the insurance industry in India. Its primary role includes ensuring the financial health of insurance companies, protecting policyholders' interests, and promoting fair competition within the sector. The IRDAI sets the guidelines for the operations of insurance companies, oversees the licensing of insurers, and monitors their financial performance to maintain stability and consumer confidence in the industry.

| 2. How has the insurance penetration in India changed over the years? |  |

Ans. Insurance penetration in India, which refers to the ratio of insurance premiums to the country's GDP, has seen significant growth over the years. Initially, insurance penetration was low due to limited awareness and access to insurance products. However, various reforms and initiatives, including the liberalization of the insurance sector and the introduction of innovative products, have contributed to an increase in penetration levels. Today, efforts to enhance financial literacy are ongoing, aiming to increase coverage among the population.

| 3. What types of insurance are available in India and what are their key features? |  |

Ans. In India, there are primarily two types of insurance: life insurance and general insurance. Life insurance provides financial protection to beneficiaries upon the policyholder's death, while general insurance covers non-life aspects, including health, motor, property, and travel insurance. Key features of life insurance include premium payments, policy tenure, and sum assured, while general insurance focuses on coverage limits, exclusions, and claim processes. Both types aim to mitigate risks and provide financial security.

| 4. What role does technology play in transforming the insurance industry in India? |  |

Ans. Technology is playing a transformative role in the Indian insurance industry by enhancing customer experience and streamlining operations. Insurers are increasingly adopting digital platforms for policy issuance, claims processing, and customer service. Innovations such as artificial intelligence, big data analytics, and blockchain are being utilized to assess risks more accurately, offer personalized products, and reduce fraud. This shift not only improves efficiency but also makes insurance more accessible to a broader audience.

| 5. What are the main challenges faced by the insurance sector in India? |  |

Ans. The insurance sector in India faces several challenges, including low awareness and understanding of insurance products among the general public. Additionally, inadequate regulatory frameworks and compliance issues can hinder growth. Other challenges include competition from unregulated entities, high operational costs, and the need for continuous innovation to meet changing consumer needs. Addressing these challenges is crucial for the sustainable development of the insurance industry in India.

Related Searches