UPSC Exam > UPSC Notes > Indian Economy for UPSC CSE > Mind Map: Price and Inflation

Mind Map: Price and Inflation | Indian Economy for UPSC CSE PDF Download

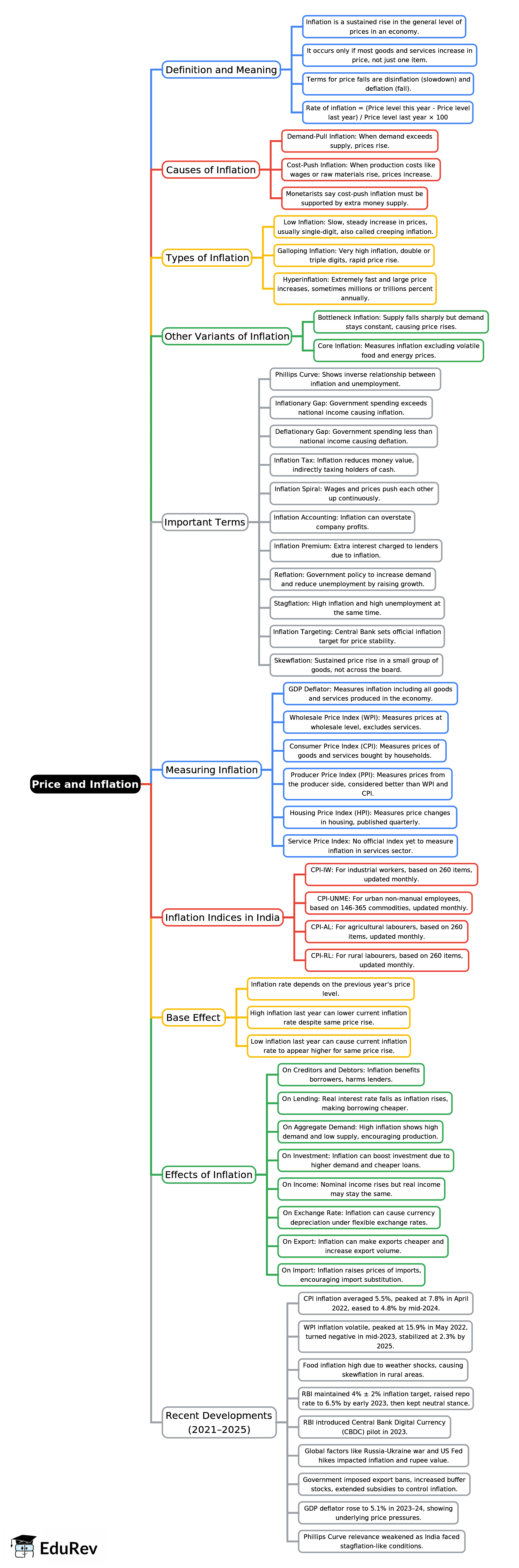

Price and Inflation - 1

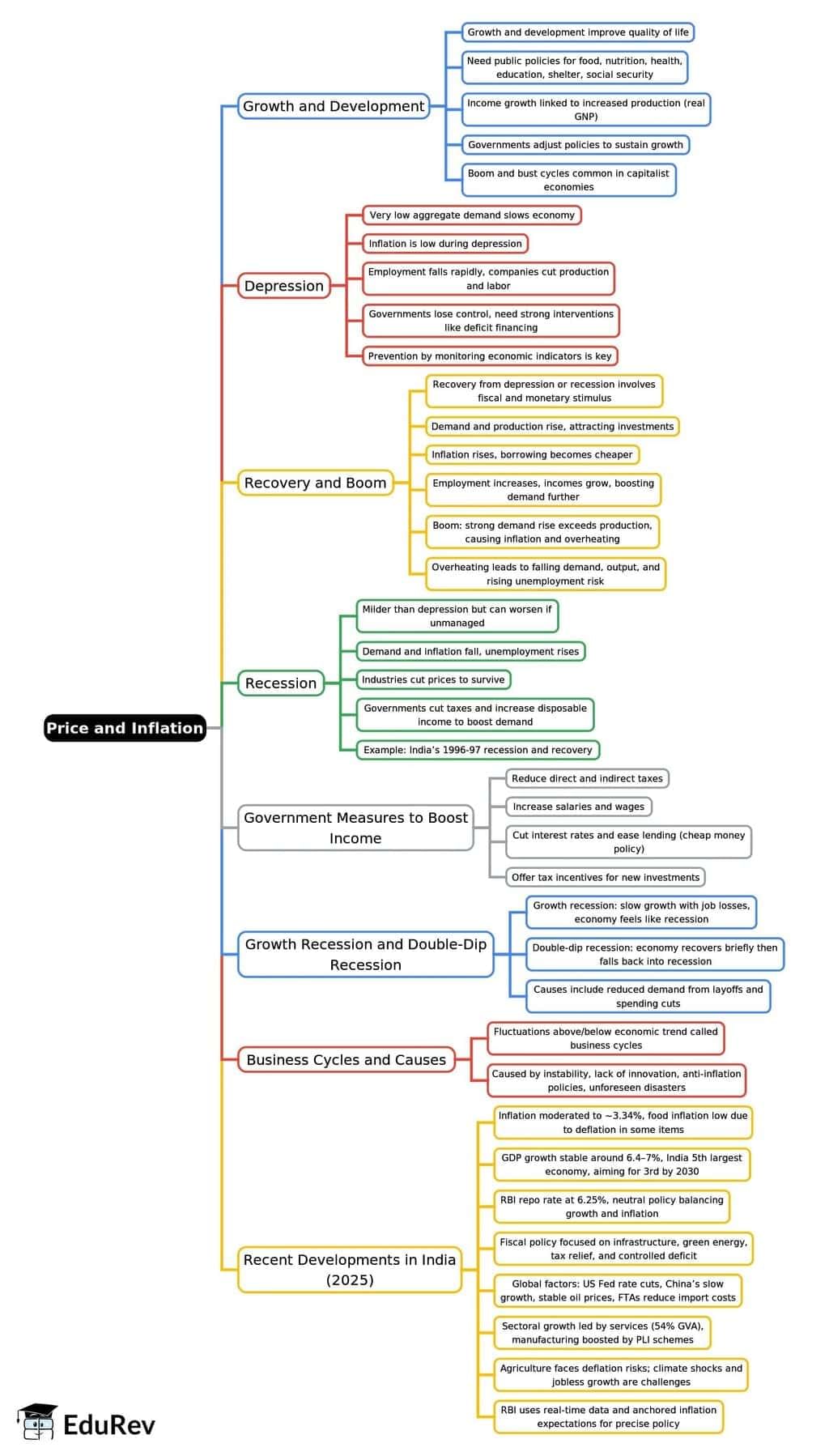

Price and Inflation - 2

The document Mind Map: Price and Inflation | Indian Economy for UPSC CSE is a part of the UPSC Course Indian Economy for UPSC CSE.

All you need of UPSC at this link: UPSC

|

138 videos|431 docs|128 tests

|

FAQs on Mind Map: Price and Inflation - Indian Economy for UPSC CSE

| 1. What is the relationship between price and inflation? |  |

Ans. The relationship between price and inflation is fundamentally tied to the general increase in prices of goods and services over time. Inflation is measured by the rate at which the general level of prices for goods and services rises, leading to a decrease in purchasing power. When inflation occurs, each unit of currency buys fewer goods and services. This correlation implies that as inflation rises, the prices of commodities typically increase, affecting consumers' purchasing decisions and overall economic activity.

| 2. What are the different types of inflation? |  |

Ans. There are several types of inflation that economists recognize, including demand-pull inflation, cost-push inflation, and built-in inflation. Demand-pull inflation occurs when the demand for goods and services exceeds supply, leading to price increases. Cost-push inflation results from an increase in the cost of production, such as wages or raw materials, causing producers to raise prices. Built-in inflation is linked to adaptive expectations, where businesses increase prices in anticipation of rising costs, creating a cycle of wage increases and price hikes.

| 3. How does inflation impact the economy? |  |

Ans. Inflation impacts the economy in various ways, both positively and negatively. Positive effects include encouraging spending and investment, as consumers and businesses are more likely to purchase now rather than later if they expect prices to rise. However, high inflation can erode purchasing power, leading to decreased consumer spending and savings. It can also create uncertainty in the economy, affecting long-term investments and savings. Additionally, inflation can disproportionately affect low-income households, as they spend a larger portion of their income on essential goods and services that may be subject to higher price increases.

| 4. What measures can governments take to control inflation? |  |

Ans. Governments can adopt several measures to control inflation, including monetary policy adjustments and fiscal policy changes. Central banks may increase interest rates to reduce money supply and curb inflation, making borrowing more expensive and encouraging savings. Additionally, governments can implement fiscal policies such as reducing public spending or increasing taxes to decrease overall demand in the economy. Supply-side strategies, such as improving productivity and increasing the supply of goods and services, can also help mitigate inflationary pressures.

| 5. What is hyperinflation, and how does it differ from regular inflation? |  |

Ans. Hyperinflation is an extreme and rapid form of inflation, typically defined as an inflation rate exceeding 50% per month. Unlike regular inflation, which occurs at manageable levels and can be influenced by economic policies, hyperinflation is often the result of a collapse in the confidence of a currency, leading to a loss of value and skyrocketing prices. This condition can destabilize economies, leading to social unrest and significant challenges in everyday transactions, as seen historically in cases like Zimbabwe and Germany during the Weimar Republic.

Related Searches