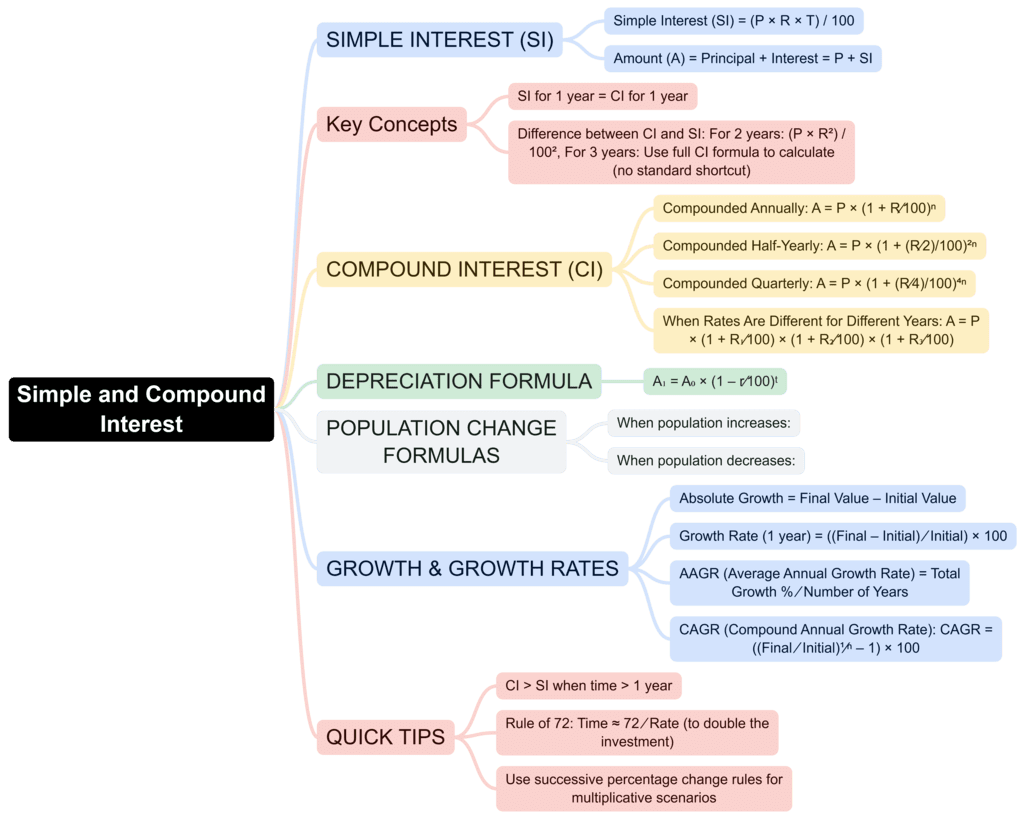

UPSC Exam > UPSC Notes > CSAT Preparation > Mind Map: Simple & Compound Interest

Mind Map: Simple & Compound Interest | CSAT Preparation - UPSC PDF Download

The document Mind Map: Simple & Compound Interest | CSAT Preparation - UPSC is a part of the UPSC Course CSAT Preparation.

All you need of UPSC at this link: UPSC

|

205 videos|258 docs|136 tests

|

FAQs on Mind Map: Simple & Compound Interest - CSAT Preparation - UPSC

| 1. What is the difference between simple interest and compound interest? |  |

Ans. Simple interest is calculated only on the principal amount, which means it doesn't take into account any interest that has previously been added to the principal. For example, if you invest $100 at a simple interest rate of 5% per year, you earn $5 each year. In contrast, compound interest is calculated on the principal plus any interest that has already been added, meaning you earn interest on interest. Using the same example, if that $100 were to earn compound interest at 5%, after one year, you would have $105, and in the second year, you'd earn interest on $105.

| 2. How do you calculate simple interest? |  |

Ans. Simple interest can be calculated using the formula: Interest = Principal × Rate × Time. To find the total interest earned, multiply the principal amount (the initial amount of money), the interest rate (expressed as a decimal), and the time period (in years) for which the money is invested or borrowed.

| 3. How do you calculate compound interest? |  |

Ans. Compound interest can be calculated using the formula: A = P(1 + r/n)^(nt), where A is the amount of money accumulated after n years, including interest, P is the principal amount, r is the annual interest rate (decimal), n is the number of times that interest is compounded per year, and t is the number of years the money is invested or borrowed. The compound interest can then be found by subtracting the principal from the total amount: Compound Interest = A - P.

| 4. What are the advantages of compound interest over simple interest? |  |

Ans. The main advantage of compound interest is that it allows your money to grow at a faster rate compared to simple interest. Because compound interest earns interest on both the principal and the accumulated interest, your investment can increase significantly over time, especially with longer investment periods. This effect is often referred to as "the power of compounding."

| 5. When is it better to use simple interest instead of compound interest? |  |

Ans. Simple interest is typically used for short-term loans or investments, where the duration is brief, and the total interest earned or paid is comparatively small. For example, personal loans or car loans often use simple interest calculations. If the investment period is short, the benefits of compounding may not be significant enough to warrant the complexity of compound interest calculations.

Related Searches