NCERT Solutions for Class 12 Economics - Money and Banking

Q1: What is a barter system? What are its drawbacks?

Ans: Barter system is a system that was used in ancient times to exchange goods. In other words, this system was used to exchange one commodity for another before the monetary system came into existence. For example, if a person having rice wants tea, then he can exchange rice with a person who has tea and needs rice. The economy having the barter system was called ‘C-C economy’, i.e. commodity is exchanged for commodity.

The various drawbacks of the barter system are as follows:

- Problem of double coincidence of wants: Double coincidence of wants implies that needs of two individuals should complement each other for the exchange to take place. For example, in the above case, the second person must need rice in exchange of tea.

- Lack of common unit of value: Under barter system there was no common unit for measuring the value of one good in terms of the other good for the purpose of exchange. For example, a horse cannot be measured in terms of rice in the case of exchange between rice and horse

- Difficulty in wealth storage: It was very difficult to store commodities for future exchange purposes. The perishable goods like grains, milk and meat could not be stored to exchange goods in future. Therefore, wealth storage was a major difficulty of batter system.

- Lack of standard of deferred payments: The future payments could not be met in a C-C economy (barter system) as wealth could not be stored. It was very difficult to pay back loans.

Q2: What are the main functions of money? How does money overcome the shortcomings of a barter system?

Ans: The main functions of money are as follows:

- Medium of exchange: Money acts as a medium of exchange as it facilitates exchange through a common medium, i.e. currency. In other words, money helps in the buying and selling of goods. For example, a person can sell his goods to another for money and that person can use money to purchase goods of his choice. Money solves the problem of double coincidence of wants.

- Unit of value: The values of goods can be measured in terms of money. It is a common medium through which we can calculate the value of each and every good. The value of a good in terms of money is called the price. In barter system the lack of a common denominator for measuring values of goods was a major drawback.

- Store of value: This function explains the importance of money as value storage. This implies that wealth in the form of money can be stored easily as a medium of exchange for future use. For example, money can be stored in banks for meeting emergency and future needs.

- Standard of deferred payments: Payments can easily be made through the medium of money. In other words, it is very difficult to pay back a loan in terms of goods and services. However, with the advent of money the payments of loans or interests can easily be made.

Money overcomes the shortcomings of barter system in the following manner:

- Money solves the problem of double coincidence of wants. For example, if a person needs wheat in exchange of tea, then he/she must search for a person who is ready to trade wheat for tea. Money made the need for such searches redundant.

- In barter system, it was very difficult to measure the value of one good in terms of another. For example, it is difficult to calculate the value of a cow in terms of wheat.

- It was very difficult to store goods, especially perishable goods (fruits, meat, etc.) for the purpose of value storage. Money serves this purpose.

- The contractual or future payments are much difficult to be made in barter system. For example, a worker working on contract basis could not be paid in terms of rice or chairs.

Q3: What is transaction demand for money? How is it related to the value of transactions over a specified period of time?

Ans: Transaction demand for money refers to the demand for money for meeting day to day transactional needs. As money is a liquid asset (easily acceptable or exchangeable), everyone has the tendency to hold money. People earn incomes at distinct points of time but consume throughout the entire period. So, people tend to hold money for transaction purposes.

The relationship between the value of transactions and transaction demand for money can be explained as:

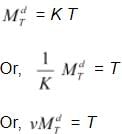

The transaction demand for money in an economy  can be written as

can be written as

Where, ,

,

represents velocity of circulation of money

T = Total value of transactions in the economy over a period of time

K is a positive fraction = Stock of money people are willing to hold at a particular point of time.

= Stock of money people are willing to hold at a particular point of time.

The transaction demand for money is positively related to the total value of transactions and negatively related to the velocity with which money is circulated.

Q4: What are the alternative definitions of money supply in India?

Ans: The alternative definitions of money supply in India can be the four measures of money supply. They are explained as under:

Measures of M1 include:

- Currency notes and coins with the public (excluding cash in hand of all commercial banks) [C]

- Demand deposits of all commercial and co-operative banks excluding inter-bank deposits. (DD),

- Where demand deposits are those deposits which can be withdrawn by the depositor at any time by means of cheque. No interest is paid on such deposits.

- Other deposits with RBI [O.D]

M1 = C + DD + OD Where, Other deposits are the deposits held by the RBI of all economic units except the government and banks. OD includes demand deposits of semi-government public financial institutions (like IDBI, IFCI, etc.), foreign central banks and governments, the International Monetaiy Fund, the World Bank, etc.

Measures of M2

- M1[C + DD + OD]

- Post office saving deposits

Measures of M3

- M1

- Time deposits of all commercial and co-operative banks.

- Where, Time deposits are the deposits that cannot be withdrawn before the expiry of the stipulated time for which deposits are made. Fixed deposit is an example of time deposit.

Measures of M4

- M3

- Total deposits with the post office saving organization (excluding national savings certificates).

Q5: What is a ‘legal tender’? What is ‘fiat money’?

Ans: Legal tender refers to the currency notes and coins being issued by the monetary authorities of India (RBI and government of India) as a legal medium of payment. Fiat money derives its value only because of government order (fiat). The currency becomes fiat money when the government declares it to be the legal tender. This is not backed by reserves, but by faith or trust. This money does not have intrinsic value, i.e. the real value is not equivalent to the face value printed on the notes and coins.

Q6: What is High Powered Money?

Ans: High powered money is the total liability of the monetary authority of the country. This is also called the monetary base and is created by the RBI. High powered money includes currency (notes and coins), deposits with the government and reserves of commercial banks with RBI. So, to sum up, high powered money is

H = C + R

Where

H − High powered money

C − Currency

R − Cash Reserves of commercial banks

Q7: Explain the functions of a commercial bank.

Ans: Commercial banks perform various functions that are as follows:

Accepting deposits

The basic function of commercial banks is to accept deposits of the customers. These deposits are of the following types:

- Saving Accounts: Saving accounts cater to the needs of those individuals who wish to save a part of their income and earn interest on the amount saved. Account holders of saving accounts can deposit cheques, drafts, etc. However, there is a limit on withdrawal

- Fixed deposit accounts: As the name suggests, fixed deposit accounts imply deposits are kept for fixed periods of time; for example, Rs.500 per month for 5 years. The period has to be decided in advance, while opening the account. Holders of these accounts do not enjoy the cheque facility. Higher the time period, higher will be the interest rate, which is decided by RBI.

- Current deposits accounts: Current deposit accounts are also called ‘demand deposits’ as the depositor can withdraw money at any time through cheques. Businessmen use this account to make many transactions in a single day; however, they do not earn interest on the deposits. Banks provide account statements to the current account holders at regular intervals.

Granting loans and advances

- The second most important function of the commercial banks is to give loans and advances. The rate of interest charged by the banks on loans is higher than the rate of interest paid by the banks on demand deposits and saving deposits.

- Loans granted by commercial banks are generally for long term and are given against securities. Advances are given by a bank only for a short span of time.

Agency functions

The commercial banks perform various agency functions with the prime purpose of acceptance of deposits and granting of loans. Their functions include:

- Transfer of funds − The banks provide easy flow of funds from place to place via mail transfers, demand drafts, etc.

- Collection of funds − The banks also collect funds on behalf of its customers through bills, cheques, etc.

- Banks collect insurance premiums, dividends, interest on debentures, etc.

- Banks assist in the process of tax payment by the accountholders.

- Banks also play the role of trustees or executors.

Discounting bills of exchange

- Commercial Banks provide financial assistance to the business community by discounting bills of exchange. The banks purchase these bills, produced by customers, by deducting interest from the face value of the bill, thus providing easy finances to the business community when required.

Credit creation

- Commercial banks create credit in the economy through demand deposits. Credit creation paves the path for the growth of the economy.

Other functions

- Providing locker facility

- Purchase and sale of foreign exchange

- Issue of gift cheques

- Underwriting of shares and debentures

- Providing information and statistical data useful to customers

Q8: What is money multiplier? How will you determine its value? What ratios play an important role in the determination of the value of the money multiplier?

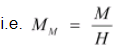

Ans: Money multiplier is the ratio of the stock of money to the stock of high powered money in an economy

Where, MM is the money multiplier

M represents stock of money

H represents high powered money

The value of money multiplier is always greater than 1.

The value of money multiplier can be derived as follows:

We know that M = C + DD = (1 + cdr) DD

Where,

M = Money supply

C = Currency held by people

cdr = Currency deposit ratio

DD = Demand deposits

Let treasury deposits of government be D

We know, High powered money = Currency + Reserve money

Or, H = C + R

= cdr D + rdr D

= D (cdr + rdr) (Taking D common)

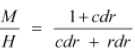

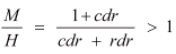

Money multiplier = M/H

So, the ratio of money supply to high powered money M/H becomes

But rdr < 1

So,

The currency deposit ratio (cdr) and the reserve deposit ratio (rdr) play an important role in determining the money multiplier.

The currency deposit ratio (cdr) is the ratio of the money (currency) held by public to that they hold in bank deposits.

That is,

The reserve deposit ratio (rdr) is the proportion of the total deposits kept by the commercial banks as reserve.

Q9: What are the instruments of monetary policy of RBI?

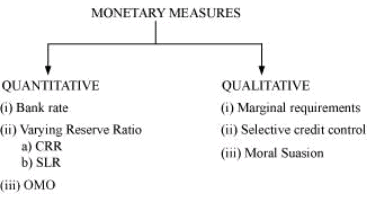

Ans: The monetary policy (credit policy) of RBI involves the two instruments given in the flow chart below:

Quantitative Measures

Quantitative measures refer to those measures that affect the variables, which in turn affect the overall money supply in the economy.

Instruments of quantitative measures:

1. Bank rate − The rate at which central bank provides loan to commercial banks is called bank rate. This instrument is a key at the hands of RBI to control the money supply.

Increase in the bank rate will make the loans more expensive for the commercial banks; thereby, pressurising the banks to increase the rate of lending. The public capacity to take credit will gradually fall leading to the fall in the volume of credit demanded. The reverse happens in case of a decrease in the bank rate. The increased lending capacity of banks as well as increased public demand for credit will automatically lead to a rise in the volume of credit.

2. Varying reserve ratios

The reserve ratio determines the reserve requirements, wherein banks are liable to maintain reserves with the central bank.

The three main ratios are:

(i) Cash Reserve Ratio (CRR)

It refers to the minimum amount of funds that a commercial bank has to maintain with the Reserve Bank of India, in the form of deposits. For example, suppose the total assets of a bank are worth Rs.200 crores and the minimum cash reserve ratio is 10%. Then the amount that the commercial bank has to maintain with RBI is Rs.20 crores. If this ratio rises to 20%, then the reserve with RBI increases to Rs.40 crores. Thus, less money will be left with the commercial bank for lending. This will eventually lead to considerable decrease in the money supply. On the contrary, a fall in CRR will lead to an increase in the money supply.

(ii) Statuary Liquidity Ratio (SLR)

SLR is concerned with maintaining the minimum reserve of assets with RBI, whereas the cash reserve ratio is concerned with maintaining cash balance (reserve) with RBI. So, SLR is defined as the minimum percentage of assets to be maintained in the form of either fixed or liquid assets with RBI. The flow of credit is reduced by increasing this liquidity ratio and vice-versa. In the previous example, this can be understood as rise in SLR will restrict the banks to pump money in the economy, thereby contributing towards decrease in money supply. The reverse case happens if there is a fall in SLR, as it increases the money supply in the economy.

3. Open Market Operations (OMO)

Open Market operations refer to the buying and selling of securities in an open market, in order to affect the money supply in the economy. The selling of securities by RBI will wipe out the extra cash balance from the economy, thereby limiting the money supply, whereas in the case of buying securities by RBI, additional money is pumped into the economy stimulating the money supply.

Qualtative Measures

The measures that affect the credit qualitatively are

1. Marginal Requirements

The commercial banks’ function to grant loan rests upon the value of security being mortgaged. So, the banks keep a margin, which is the difference between the market value of security and the loan value. For example, a commercial bank grants loan of Rs.80,000 against security of Rs.1,00,000. So, the margin is calculated as 1,00,000 − 80,000 = 20,000. When the central bank decides to restrict the flow of money, then the margin requirement of loan is raised and vice-versa in the case of expansionary credit policy.

2. Selective Credit Control (SCC’s)

An instrument of the monetary policy that affects the flow of credit to particular sectors positively and negatively is known as selective credit control. The positive aspect is concerned with the increased flow of credit to the priority sectors. However, the negative aspect is concerned with the measures to restrict credit to a particular sector.

3. Moral Suasions

A persuasion technique followed by the central bank to pressurise the commercial banks to abide by the monetary policy is termed as moral suasion. This involves meetings, seminars, speeches and discussions, which explains the present economic scenario and thereby persuading the commercial banks to adapt the changes needed. In other words, this is an unofficial monetary policy that exercises the power of talk.

Q10: Do you consider a commercial bank ‘creator of money’ in the economy’?

Ans: Commercial banks play the important role of ‘money creator’ in the economy. They have the capacity to generate credit through demand deposits. These demand deposits make credit more than the initial deposits.

The process of money creation can be explained by taking an example of a bank XYZ. A depositor deposits Rs.10,000 in his savings account, which will become the demand deposit of the bank. Based on the assumption that not all customers will turn up at the same day to withdraw their deposits, bank maintains a minimum cash reserve of 10 % of the demand deposits, i.e. Rs.1000. It lends the remaining amount of Rs.9000 in the form of credit to other customers. This further creates deposits for the bank XYZ. With the cash reserve of Rs.1000, the credit creation is worth Rs.10,000. So, the credit multiplier is given by:

Credit multiplier = 1/CRR = 1/10% = 10

The money supply in the economy will increase by the amount (times) of credit multiplier.

Q11: What role of RBI is known as ‘lender of last resort’?

Ans: When a commercial bank faces financial crisis and fails to obtain funds from other sources, then the central bank plays the vital role of ‘lender of last resort’ and provides them with the financial assistance in the form of credit. This role of the central bank saves the commercial bank from bankruptcy. Thus, the central bank plays the role of guarantor for the commercial banks and maintains a sound and healthy banking system in the economy.

Old NCERT Questions

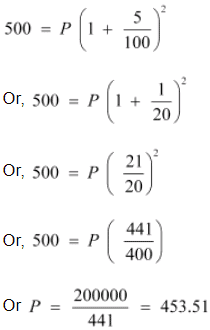

Q1: Suppose a bond promises Rs.500 at the end of two years with no intermediate return. If the rate of interest is 5 per cent per annum what is the price of the bond?

Ans: Let the price of bond be Rs.P

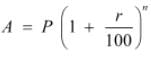

We know that,

It is given that

A = Rs.500

r = 5%

n = 2 years

Substituting the values in the formula

So, P = Rs 453.51

Therefore, Price of the bond is Rs.453.51.

Q2: Why is speculative demand for money inversely related to the rate of interest?

Ans: People have the tendency to hold wealth by means of property, bullion, bonds, etc. A person holding bonds can confront various fluctuations in the market in the form of capital gains or capital losses. The demand for money in order to meet these speculative needs is defined as speculative demand for money. Interest rate represents the opportunity cost of holding the money. The speculative demand for money is inversely related to the interest rate. When interest rate on securities is very high then people expect interest rates to fall in future. This implies that in future bond prices will rise indicating capital gain to the bond holders. To maximise the capital gain, more people will convert their cash balances into bonds, thereby leading to a low speculative demand for money. On the contrary, when interest rates are low, people expect interest rates to rise in future, then bond prices will fall in the future, indicating capital loss to the bondholders. Hence, to minimise the capital loss, people tend to convert bonds into money, resulting in high speculative demand for money. This shows that the speculative demand for money is inversely related to the interest rate.

Q3: What is `liquidity trap’?

Ans: Liquidity trap is a situation in which speculative demand function is infinitely elastic; it is explained as follows:

The price of a bond has an inverse relationship with the market interest rate. If the interest rate is very high and people expect it to fall in the future, then the bond prices will rise being inversely related to the interest rate. In order to earn capital gains in future, people will purchase bonds (as bonds are cheaper) and hence the speculative demand for money will become low. On the contrary, if the interest rate is low and people expect it to rise in future, then the bond prices will fall and in order to avoid capital loss, people will sell their bonds and convert their bonds into idle cash balances. Liquidity trap is an extreme case of the latter situation. When the interest rates are very low, then everyone expect interest rates to go up in future. Thus, to avoid capital loss, everybody prefers to maintain cash balance and not bond. Consequently, the speculative demand for money is infinitely elastic. In this situation, if the additional money is pumped into the economy, then, this will only satisfy the thirst for money, without increasing the demand for bonds. Pumping additional money in this situation will further exaggerate the condition as this will further reduce the interest rate below rmin.

The relationship between speculative demand for money and the rate of interest is given as

In the above diagram, interest rate is represented on the vertical axis and speculative demand on the horizontal axis. When r = r min, the economy is in liquidity trap, where thespeculative demand for money is infinite elastic.

|

139 videos|431 docs|128 tests

|

FAQs on NCERT Solutions for Class 12 Economics - Money and Banking

| 1. What is the role of money in the banking system? |  |

| 2. How do banks create money through the process of credit creation? |  |

| 3. What are the functions of a central bank in the economy? |  |

| 4. How do commercial banks differ from central banks in terms of their functions? |  |

| 5. What are the different types of banking services offered to customers by commercial banks? |  |