UPSC Exam > UPSC Notes > PIB (Press Information Bureau) Summary > PIB Summary- 10th February, 2024

PIB Summary- 10th February, 2024 | PIB (Press Information Bureau) Summary - UPSC PDF Download

FAME India Scheme

Why in News?

The Ministry of Heavy Industries has increased the scheme outlay of FAME India scheme Phase II from ₹10,000 crore to ₹11,500 crore.

About FAME-II

- FAME India is a part of the National Electric Mobility Mission (NEMM) Plan. Main thrust of FAME is to encourage electric vehicles by providing subsidies.

- NEMM intends to allow hybrid and electric vehicles to become the first choice for the purchasers so that these vehicles can replace the conventional vehicles and thus reduce liquid fuel consumption in the country from the automobile sector.

- The scheme covers Hybrid & Electric technologies like Mild Hybrid, Strong Hybrid, Plug in Hybrid & Battery Electric Vehicles.

- Monitoring Authority: Department of Heavy Industries, the Ministry of Heavy Industries and Public Enterprises.

- Under this scheme, demand incentives will be availed by buyers (end users/consumers) upfront at the point of purchase and the same shall be reimbursed by the manufacturers from Department of Heavy Industries, on a monthly basis.

Fame India Scheme has four focus areas:

- Technology development

- Demand Creation

- Pilot Projects

- Charging Infrastructure

Revamped FAME-II scheme

- The Centre has made a partial modification of the FAME-II, including increasing the demand incentive for electric two-wheelers to Rs. 15,000 per KWh from an earlier uniform subsidy of Rs 10,000 per KWh for all EVs, including plug-in hybrids and strong hybrids except buses.

- The government has also capped incentives for electric two-wheelers at 40% of the cost of vehicles, up from 20% earlier.

- It will bring down the prices of electric two-wheelers nearer to the IC (internal combustion engine) vehicles and remove one of the biggest blocks of the high sticker price of electric two-wheelers.

- Together with the other important factors like extremely low running cost, low maintenance and zero emission, such price levels will surely spur a substantial demand for electric two-wheelers.

FDI in Defence Sector

Why in News?

As per the information provided by the Defence Minister, so far, Rs 5,077 crore worth of FDI has been reported by companies operating in the defence sector.

Details

- In May 2001, the Defence sector was opened up for private sector participation.

- In 2020, the Foreign Direct Investment (FDI) limit in defence sector was enhanced up to 74% through the Automatic Route for companies seeking new defence industrial license and up to 100% through the Government Route

- Further, th e Government promotes co-development and co-production of niche defence technologies with Foreign Original Equipment Manufacturers (OEMs) to encourage FDI in the defence sector.

About Foreign Direct Investment (FDI)

- Foreign Direct Investment (FDI) is an investment in the form of a controlling ownership in a business in one country by an entity based in another country. It is thus distinguished from a Foreign Portfolio Investment by a notion of direct control.

- FDI may be made either “inorganically” by buying a company in the target country or “organically” by expanding the operations of an existing business in that country.

- Broadly, FDI includes “mergers and acquisitions, building new facilities, reinvesting profits earned from overseas operations, and intra company loans”. In a narrow sense, it refers just to building a new facility, and lasting management interest.

FDI in India

- Foreign Direct Investment (FDI) is a major driver of economic growth and an important source of non-debt finance for the economic development of India.

- It has been the endeavor of the Government to put in place an enabling and investor friendly FDI policy. The intent all this while has been to make the FDI policy more investor friendly and remove the policy bottlenecks that have been hindering the investment inflows into the country.

- The steps taken in this direction during the last six years have borne fruit as is evident from the ever-increasing volumes of FDI inflows being received into the country. Continuing on the path of FDI liberalization and simplification, Government has carried out FDI reforms across various sectors.

FDI Routes in India

- Foreign investment was introduced in 1991 under Foreign Exchange Management Act (FEMA), driven by then FM Manmohan Singh.

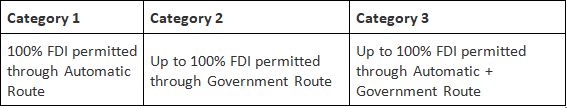

- There are three routes through which FDI flows into India. They are described in the following table:

- Automatic route: By this route, FDI is allowed without prior approval by Government or RBI.

- Government route: Prior approval by the government is needed via this route. The application needs to be made through Foreign Investment Facilitation Portal, which will facilitate the single-window clearance of FDI application under Approval Route.

- Global Depository Receipts – GDR

- Foreign Depository Receipts – FDR

- Foreign Currency Convertible Bonds – FCCB

- Foreign institutional investors – FII

Government Measures to Promote FDI

- Factors such as favourable demographics, impressive mobile and internet penetration, massive consumption and technology uptake, played an important role in attracting the investments.

- Launch of Schemes attracting investments, such as, National technical Textile Mission, Production Linked Incentive Scheme, Pradhan Mantri Kisan SAMPADA Yojana, etc.

- The government has elaborated upon the initiatives under the Atmanirbhar Bharat to encourage investments in different sectors.

- As a part of its Make in India initiative to promote domestic manufacturing, India deregulated FDI rules for several sectors over the last few years.

The document PIB Summary- 10th February, 2024 | PIB (Press Information Bureau) Summary - UPSC is a part of the UPSC Course PIB (Press Information Bureau) Summary.

All you need of UPSC at this link: UPSC

Related Searches