PIB Summary - 25th July 2025 | PIB (Press Information Bureau) Summary - UPSC PDF Download

INCOME TAX DAY, 2025

Historical Background

- Income Tax Day: Celebrated annually on July 24 to mark the introduction of income tax in India by Sir James Wilson in 1860, following the 1857 revolt.

- Evolution of Income Tax: The Income Tax Act of 1922 laid the groundwork for a structured tax system, and the Central Board of Revenue Act in 1924 established institutional governance for tax administration.

- Technological Advancements: The income tax system has seen significant technological milestones, including the start of computerization in 1981, leading to the launch of the Centralized Processing Centre (CPC) in 2009.

Importance of Income Tax

- Funding Public Services: Income tax is crucial for financing essential public services such as education, healthcare, defense, and infrastructure development.

- Income Redistribution: It plays a vital role in redistributing income and promoting social justice, helping to reduce economic disparities.

- Economic Self-Reliance: Income tax contributes to enhancing the economic self-reliance of the state and its capacity to provide services.

- Strengthening Democratic Social Contract: The tax system reinforces the social contract between the state and its citizens, where taxpayers receive services in return for their contributions.

- National Development and Fiscal Stability: Income tax is essential for overall national development and maintaining fiscal stability, ensuring that the government has the necessary resources to meet its obligations.

ITR Filing Trends

- Increase in ITR Filings: There has been a significant increase in Income Tax Return (ITR) filings, rising by 36% over five years, from 6.72 crore in FY 2020-21 to a projected 9.19 crore in FY 2024-25.

- Indicators of Growth:This rise indicates several positive trends, including:

- Growing voluntary compliance among taxpayers.

- Expansion of the formal economy.

- Strengthening of digital public infrastructure, facilitating easier and more efficient filing processes.

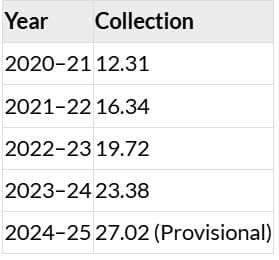

Gross Direct Tax Collection (₹ Lakh Crore)

- Growth Drivers:The growth in gross direct tax collection has been supported by several factors, including:

- Economic rebound following the COVID-19 pandemic.

- Technology-driven tax enforcement measures.

- Improved compliance and analytics capabilities within the tax administration.

Digital Transformation

- PAN System: The Permanent Account Number (PAN) system was introduced in 1972 and upgraded in 1995 to its current format, enhancing tax identification and compliance.

- Centralized Processing Centre (CPC): Launched in 2009, the CPC enabled automated and paperless processing of tax returns, significantly improving efficiency and reducing processing times.

- TRACES: Introduced in 2012, the Tax Deducted at Source (TDS) Reconciliation Analysis and Correction Enabling System (TRACES) facilitates the resolution and reconciliation of TDS mismatches, aiding taxpayers in correcting errors and ensuring compliance.

- TIN 2.0: The new Tax Information Network (TIN) platform offers real-time tax payment credits and faster refund processes, streamlining the taxpayer experience and improving service delivery.

- Demand Facilitation Centre: Located in Mysuru, this centralized platform helps track and resolve tax demands, providing a single point of contact for taxpayers to address issues related to tax demands and assessments.

Project Insight – Data Power

- Comprehensive Taxpayer Profiling:Project Insight aims to build a detailed 360° profile of taxpayers using various data sources, including:

- Goods and Services Tax Network (GSTN) data.

- Bank and brokerage information.

- Financial data warehouses.

- Objectives:The project focuses on several key goals:

- Detecting patterns of tax evasion.

- Enhancing overall tax compliance.

- Facilitating data-driven nudges to encourage voluntary compliance and rectify discrepancies.

Smart, Transparent Tax Systems

- Faceless Assessments: Introduced in 2019, faceless assessments eliminate the need for physical interactions between taxpayers and tax authorities, ensuring a fair and transparent assessment process based on data and documentation.

- e-Verification Scheme: This scheme allows for the fully online resolution of return mismatches, making it easier for taxpayers to correct errors and discrepancies in their filed returns without the need for in-person visits to tax offices.

- AIS and TIS: The Annual Information Statement (AIS) and Tax Information Statement (TIS) provide pre-filled data from multiple sources such as banks, stock brokers, and other financial institutions. This initiative boosts the accuracy of tax filings by reducing errors and omissions, as taxpayers receive comprehensive information about their income and transactions.

NUDGE Campaign – Behavioural Tax Compliance

- Concept of NUDGE: NUDGE stands for Non-Intrusive Usage of Data to Guide and Enable. It is based on principles of behavioural economics and aims to encourage taxpayers to correct their returns voluntarily.

- Components of NUDGE:The campaign uses a combination of data and technology, including:

- AIS and TIS data along with third-party data to identify discrepancies.

- Artificial intelligence and analytics to assess compliance risks and identify taxpayers who may need nudges.

- Field intelligence to gather additional information and context about taxpayers.

- Encouraging Corrections: The NUDGE campaign encourages taxpayers to correct their returns under Section 139(8A) of the Income Tax Act, which allows for the correction of errors in filed returns.

- Updated Return Window: The window for filing updated returns has been extended to four years from the earlier two years, providing taxpayers with more time to rectify errors and discrepancies in their filings.

Budget 2025–26: Major Tax Reforms

- New Tax Regime: Introduces a new tax regime with no tax up to ₹12 lakh and NIL tax up to ₹12.75 lakh for salaried individuals, considering a ₹75,000 standard deduction. This aims to increase disposable income for the middle class and stimulate spending and investment.

- Simplification Measures:

- Updated return window extended to four years, allowing taxpayers more time to correct errors.

- Self-occupied property benefit expanded to two properties, up from one.

- Charitable trust registration validity extended to ten years, simplifying compliance for trusts.

- National Savings Scheme (NSS) withdrawals post-August 29, 2024, made fully tax-exempt, enhancing the attractiveness of NSS investments.

- TDS/TCS Rationalization:

- Interest limit for senior citizens increased from ₹50,000 to ₹1 lakh, providing greater tax relief.

- Rent TDS threshold raised from ₹2.4 lakh to ₹6 lakh per year, reducing compliance burden for landlords.

- TCS on foreign remittance increased from ₹7 lakh to ₹10 lakh, simplifying compliance for outbound remittances.

- Delay in TCS payment decriminalized, easing penalties for delayed payments.

- Income Tax Bill, 2025: Aims to replace the outdated Income Tax Act of 1961, retaining the basic structure but simplifying language, removing redundant clauses, and aligning with the vision of Viksit Bharat 2047.

Final Strategic Takeaways

- Data-Driven Tax System: The current tax system is built on data analytics, tech-based convenience, and behavioural nudges, ensuring efficiency and accuracy in tax administration.

- Policy Shift: There has been a shift from fear-based scrutiny to trust and facilitation in tax administration, promoting a more cooperative relationship between taxpayers and authorities.

- Inclusive and Transparent Ecosystem: The reforms aim to create an inclusive, transparent, and citizen-centric tax ecosystem, where taxpayers feel supported and engaged in the compliance process.

EXPORT PROMOTION MISSION

Introduction

The Export Promotion Mission, announced in the Union Budget 2025–26, aims to enhance export competitiveness, particularly for Micro, Small, and Medium Enterprises (MSMEs). This initiative is a collaborative effort involving the Ministry of Commerce and Industry, the Ministry of MSME, and the Ministry of Finance, with the Department of Commerce leading the charge.

Key Objectives of the Mission

Improve Access to Export Credit. The mission seeks to facilitate better access to export credit for MSMEs, enabling them to finance their export activities more effectively.

Cross-Border Factoring. It aims to introduce cross-border factoring to simplify global receivables financing, making it easier for MSMEs to manage their international sales.

Address Non-Tariff Barriers. The mission will assist MSMEs in navigating and overcoming non-tariff barriers in international markets, ensuring smoother access to foreign markets.

Nationwide Implementation. A crucial objective is to ensure that the benefits of the mission reach MSMEs across the country, promoting inclusive growth.

Supporting Government Initiatives for MSME Exports

The mission is designed to complement various government initiatives aimed at supporting MSME exports.

International Cooperation Scheme (Ministry of MSME)

- This scheme offers financial assistance to MSMEs for participating in international trade fairs and exhibitions abroad, helping them showcase Indian MSME products on the global stage.

- Support to MSMEs in Andhra Pradesh (Last Two Years)

- Financial Year 2023–24: ₹9,31,127 released to support 5 MSMEs.

- Financial Year 2024–25: ₹6,76,026 released to support 2 MSMEs.

These efforts reflect the ongoing commitment to promoting MSME visibility and competitiveness in global markets.

E-Commerce Export Hubs (ECEHs) – DGFT Pilot

- Piloted by the Directorate General of Foreign Trade (DGFT), the E-Commerce Export Hubs initiative aims to empower traditional artisans and MSMEs to expand their exports through e-commerce.

- Key Features

- End-to-end support for cross-border e-commerce exports.

- Streamlined regulatory and logistics processes.

- Faster customs clearance and simplified returns management.

This initiative is designed to make MSME exports simpler, scalable, and focused on digital-first approaches.

Parliamentary Acknowledgement

- The information about the Export Promotion Mission was shared in a written reply in the Lok Sabha, highlighting the government’s commitment to transparency and policy coordination.

- It reflects the ongoing efforts to uplift MSMEs and enhance their export capabilities.

Strategic Takeaways

- Complementing "Make in India for the World". The mission aligns with India’s broader vision of promoting domestic manufacturing for global markets.

- Addressing MSME Challenges. By targeting financial, logistical, and regulatory challenges, the mission aims to create a conducive environment for MSME exports.

- Export-led Growth and MSME Integration. The mission supports national goals of export-led growth and the global integration of MSMEs.

- Digital Commerce Transformation. It aligns with the ongoing transformation towards digital commerce, enhancing the capacity of MSMEs to engage in cross-border e-commerce.

- Future Export Infrastructure. The combination of e-commerce hubs and credit reforms is expected to pave the way for next-generation export infrastructure tailored for MSMEs.

FAQs on PIB Summary - 25th July 2025 - PIB (Press Information Bureau) Summary - UPSC

| 1. What is the significance of Income Tax Day in relation to export promotion? |  |

| 2. How does the government support export promotion through taxation policies? |  |

| 3. What are the key components of an export promotion mission? |  |

| 4. How do income tax regulations affect exporters? |  |

| 5. What role does the PIB play in export promotion? |  |