RBI Governors | Current Affairs & General Knowledge - CLAT PDF Download

| Table of contents |

|

| RBI Governors |

|

| Current RBI Governor |

|

| RBI Governor Appointment Procedure |

|

| Term of the RBI Governor |

|

| Qualification of the Governor |

|

| Salaries and allowances |

|

| Governor of RBI |

|

RBI Governors

The Reserve Bank of India (RBI) is India’s Central Banking Institution, which controls the monetary policy of the Indian rupee.

• Started: 1 April 1935 under RBI Act 1934

• Nationalized: 1 January 1949

• Indian Govt. is the biggest borrower of RBI.

• It was established on the recommendation of the Hilton Young Commission.

• It is statutory body and its accounting year is from July to June.

Current RBI Governor

Sanjay Malhotra is the 26th Governor of the Reserve Bank of India, appointed on December 9, 2024, and assuming office on December 11, 2024, for a 3-year term (extendable up to 5 years).

RBI Governor Appointment Procedure

- In India, the appointment process for the RBI Governor is primarily political.

- While there is a formal Appointments Committee responsible for shortlisting candidates, the final decision is made by the Prime Minister's Office in consultation with the finance ministry and the outgoing governor.

- The Financial Sector Regulatory Appointments Search Committee, led by the Cabinet Secretary, proposes candidates for the RBI Governor position.

- If the Governor is not available, a Deputy Governor nominated by them serves as the Chairman of the Central Board.

- In contrast to India's process, central bankers in most countries are appointed by the head of the state.

Term of the RBI Governor

- The Governor and Deputy Governors of the RBI serve for a maximum period of five years.

The Governor (and Deputy Governors) have the possibility of being reappointed or granted an extension as per the RBI Act.

The government can determine the specific term of the Governor when appointing them.

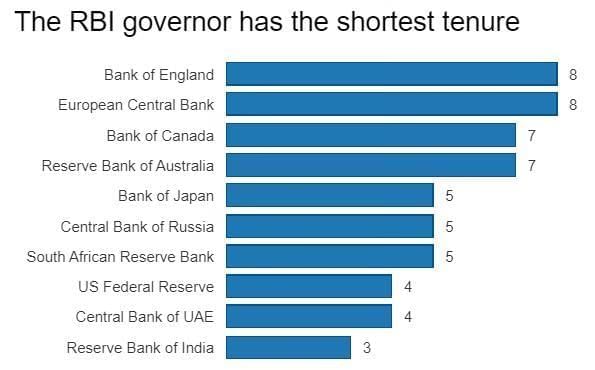

According to a survey conducted by the BIS, central bankers globally typically have an average term of 5-6 years.

Qualification of the Governor

- The RBI Act does not specify any particular qualifications for the governor's position.

- Governors have been selected from diverse educational backgrounds.

- However, most governors have either had experience in economics or financial management within the government, such as serving as the Economic Affairs Secretary or Financial Secretary.

- The qualification for the governorship is more of a customary practice than a formal requirement.

- Traditionally, governors have been appointed from either the civil services or economists.

- This implies that if the civil servant has experience in economic management, they can be appointed as the governor.

Analysis of the profiles of RBI governors from 1934 onwards reveals that out of 25 governors, 14 were civil servants (IAS or ICS/IAAS officers), while only 7 were economists.

Salaries and allowances

- Salaries and allowances of the Governor and Deputy Governors may be determined by the Central Board, with the approval of the Central Government.

- The governor can be removed by the government.

Governor of RBI

|

98 videos|923 docs|33 tests

|

FAQs on RBI Governors - Current Affairs & General Knowledge - CLAT

| 1. Who is the current Governor of the Reserve Bank of India (RBI)? |  |

| 2. What is the appointment procedure for the RBI Governor? |  |

| 3. What is the term length for the RBI Governor? |  |

| 4. What qualifications are required to become the Governor of the RBI? |  |

| 5. What are the salaries and allowances for the RBI Governor? |  |