Retirement/Death of a Partner (Part - 4) | Accountancy Class 12 - Commerce PDF Download

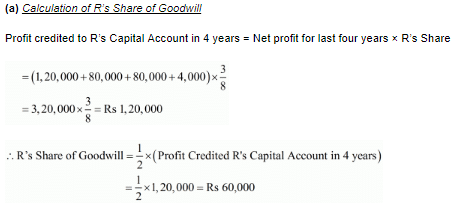

Page No 6.93:

Question 61: P, R and S are in partnership sharing profits 4/8, 3/8 and 1/8 respectively. It is provided in the Partnership Deed that on the death of any partner his share of goodwill is to be valued at one-half of the net profit credited to his account during the last four completed years.

R died on 1st January, 2018. The firm's profits for the last four years ended 31st December, were as:

2014 − ₹ 1,20,000; 2015 − ₹ 80,000; 2016 − ₹ 40,000; 2017 − ₹ 80,000.

(a) Determine the amount that should be credited to R in respect of his share of Goodwill.

(b) Pass Journal entry without raising Goodwill Account for its adjustment.

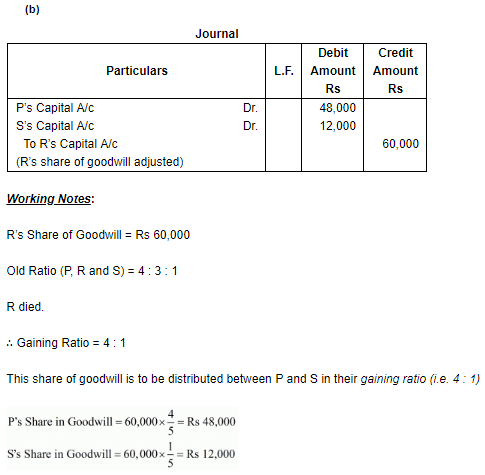

ANSWER:

Page No 6.94:

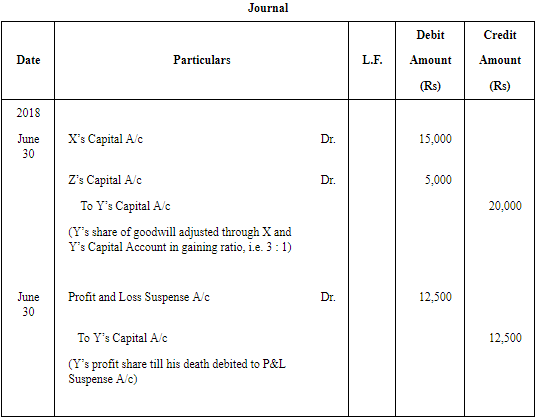

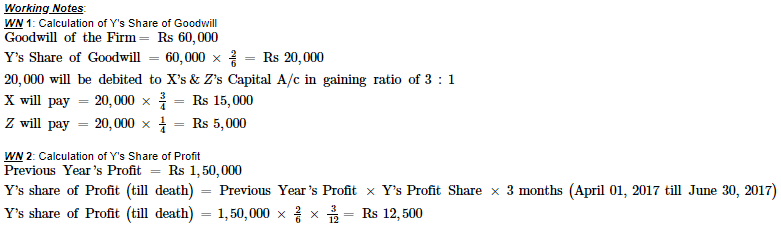

Question 62: X, Y and Z were partners in a firm sharing profit in 3 : 2 : 1. The firm closes its books on 31st March every year. Y died on 30th June, 2018. On Y's death goodwill of the firm was valued at ₹ 60,000. Y's share in the profit of the firm till the date of his death was to be calculated on the basis of previous year's profit which was ₹ 1,50,000.

Pass necessary Journal entries for goodwill and Y's share of profit at the time of his death.

ANSWER:

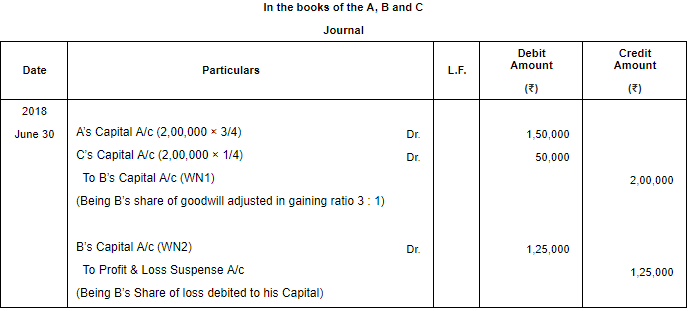

Question 63: A, B and C were partners sharing profits in the ratio of 3 : 2 : 1. The firm closes its books on 31st March every year. B died on 30th June, 2018. On his death, Goodwill of the firm was valued at ₹ 6,00,000. B's share in profit or loss till the date of death was to be calculated on the basis of previous year's profit which was ₹ 15,00,000 (Loss). Pass necessary Journal entries for goodwill and his share of loss.

ANSWER:

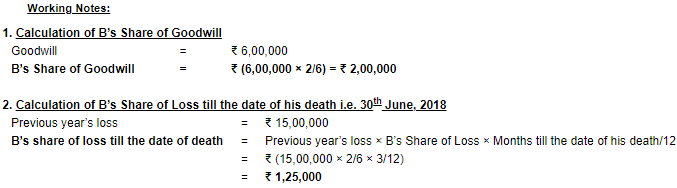

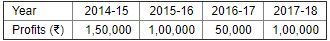

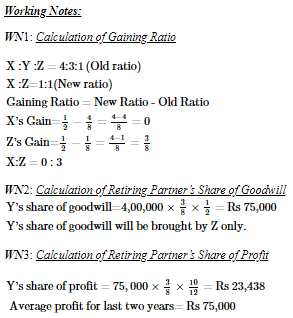

Question 64: X, Y and Z were partners in a firm sharing profits in the ratio of 4 : 3 : 1. The firm closes its books on 31st March every year. On 1st February, 2019, Y died and it was decided that the new profit-sharing ratio between X and Z will be equal. Partnership Deed provided for the following on the death of a partner:

(a) His share of goodwill be calculated on the basis of half of the profits credited to his account during the previous four completed years. The firm's profits for the last four years were:

(b) His share of profit in the year of his death was to be computed on the basis of average profit of past two years.

Pass necessary Journal entries relating to goodwill and profit to be transferred to Y's Capital Account.

ANSWER:

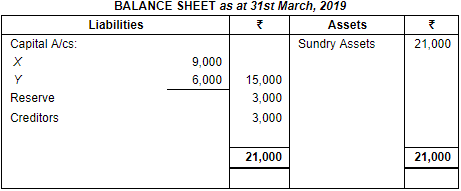

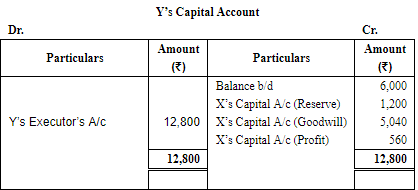

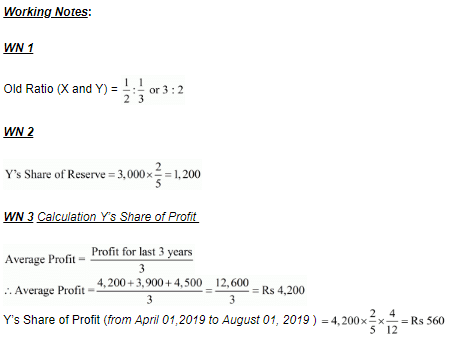

Question 65: X and Y are partners. The Partnership Deed provides inter alia:

(a) That the Accounts be balanced on 31st March every year.

(b) That the profits be divided as: X one-half, Y one-third and carried to a Reserve one-sixth.

(c) That in the event of the death of a partner, his Executors be entitled to be paid:

(i) The Capital to his credit till the date of death.

(ii) His proportion of profits till the date of death based on the average profits of the last three completed years.

(iii) By way of Goodwill, his proportion of the total profits for the three preceding years.

(d)

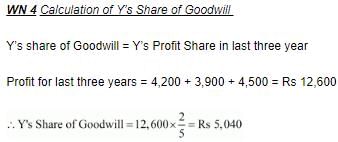

Profits for three years were: 2016-17 − ₹ 4,200; 2017-18 − ₹ 3,900; 2018-19 − ₹ 4,500. Y died on 1st August, 2019. Prepare necessary accounts.

ANSWER:

Page No 6.95:

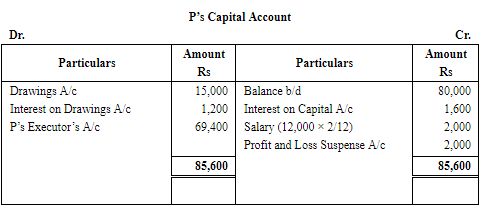

Question 66: P, Q and R were partners in a firm sharing profits in 2 : 2 : 1 ratio. The Partnership Deed provided that on the death of a partner his executors will be entitled to the following:

(a) Interest on Capital @ 12% p.a.

(b) Interest on Drawings @ 18% p.a.

(c) Salary of ₹ 12,000 p.a.

(d) Share in the profit of the firm (up to the date of death) on the basis of previous year's profit.

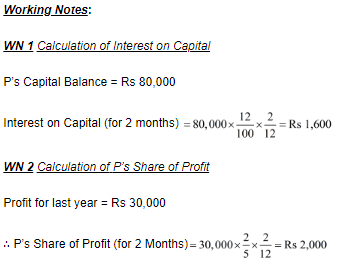

P died on 31st May, 2018. His capital was ₹ 80,000. He had withdrawn ₹ 15,000 and interest on his drawings was calculated as ₹ 1,200. Profit of the firm for the previous year ended 31st March, 2018 was ₹ 30,000.

Prepare P's Capital Account to be rendered to his executors.

ANSWER:

Question 67: Vikas, Gagan and Momita were partners in a firm sharing profits in the ratio of 2 : 2 : 1. The firm closes its books on 31st March every year. On 30th September, 2014 Momita died. According to the provisions of Partnership Deed the legal representatives of a deceased partner are entitled for the following in the event of his/her death:

(a) Capital as per the last Balance Sheet.

(b) Interest on capital at 6% per annum till the date of her death.

(c) Her share of profit to the date of death calculated on the basis of average profit of last four years.

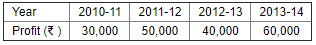

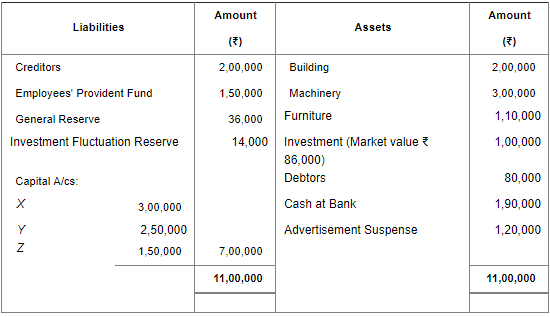

(d) Her share of goodwill to be determined on the basis of three years' purchase of the average profit of last four years. The profits of last four years were:

The balance in Momita's Capital Account on 31st March, 2014 was ₹ 60,000 and she had withdrawn ₹ 10,000 till date of her death. Interest on her drawings was ₹ 300.

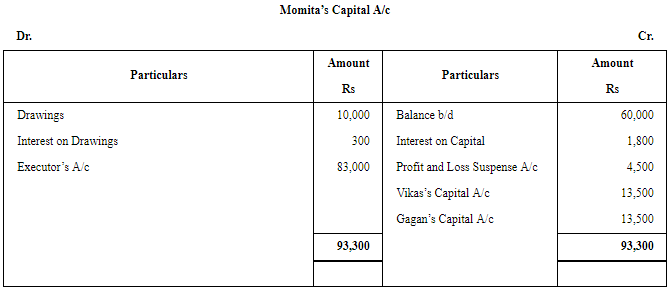

Prepare Momita's Capital Account to be presented to her executors.

ANSWER:

Note: Since, here no information is given regarding the share acquired by Vikas and Gagan, therefore, their gaining ratio is same as their new profit sharing ratio i.e. 2 : 2 or 1 : 1.

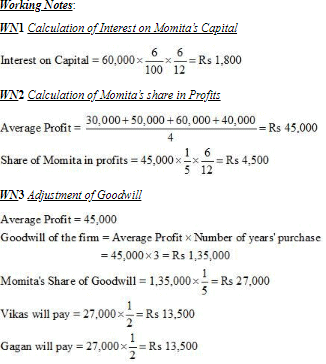

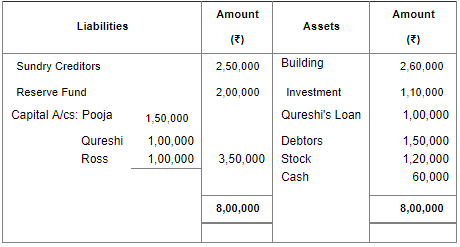

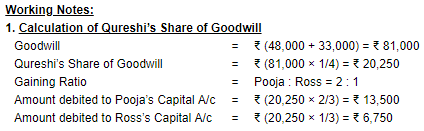

Question 68: On 31st March, 2014, the Balance Sheet of Pooja, Qureshi and Ross, who were partners in a firm was as under:

Qureshi died on 1st July, 2014. The profit-sharing ratio of the partners was 2 : 1 : 1. On the death of a partner, the partnership deed provided for the following:

(i) His share in the profits of the firm till the date of his death will be calculated on the basis of average profits of last three completed years.

(ii) Goodwill of the firm will be calculated on the basis of total profit of last two years.

(iii) Interest on loan given by the firm to a partner will be charged at the rate of 6% p.a. or ₹ 4,000, whichever is more.

(iv) Profits for the last three years were ₹ 45,000; ₹ 48,000 and ₹ 33,000.

Prepare Qureshi's Capital Account to be rendered to his executors.

ANSWER:

Page No 6.96:

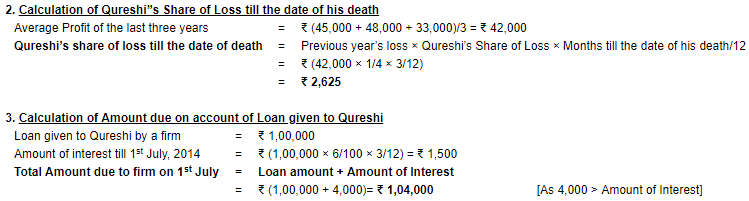

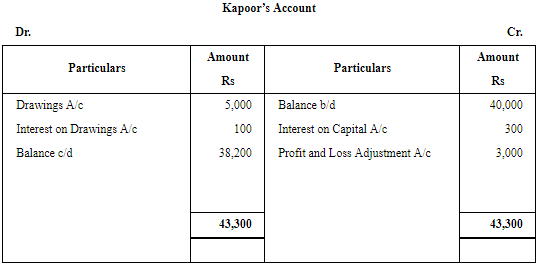

Question 69: Iqbal and Kapoor are in partnership sharing profits and losses in 3 : 2. Kapoor died three months after the date of the last Balance Sheet. According to the Partnership Deed, the legal heir is entitled to the following:

(a) His capital as per the last Balance Sheet.

(b) Interest on above capital @ 3% p.a. till the date of death.

(c) His share of profits till the date of death calculated on the basis of last year's profits.

His drawings are to bear interest at an average rate of 2% on the amount irrespective of the period.

The net profits for the last three years, after charging insurance premium, were ₹ 20,000; ₹ 25,000 and ₹ 30,000 respectively. Kapoor's capital as per Balance Sheet was ₹ 40,000 and his drawings till the date of death were ₹ 5,000.

Draw Kapoor's Capital Account to be rendered to his representatives.

ANSWER:

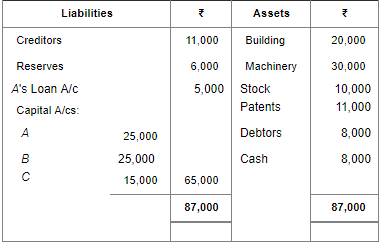

Question 70: A, B and C were partners in a firm sharing profits in the ratio of 5 : 3 : 2. On 31st March, 2018, their Balance Sheet was as follows:

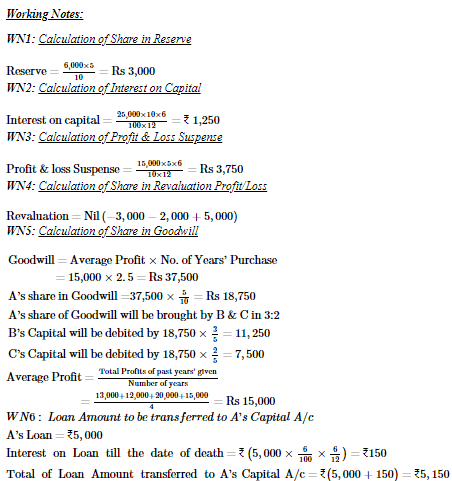

A died on 1st October, 2018. It was agreed among his executors and the remaining partners that:

(i) Goodwill to be valued at 21/2 years' purchase of the average profit of the previous 4 years, which were 2014-15: ₹ 13,000; 2015-16: ₹ 12,000; 2016-17: ₹ 20,000 and 2017-18: ₹ 15,000.

(ii) Patents be valued at ₹ 8,000; Machinery at ₹ 28,000; and Building at ₹ 25,000.

(iii) Profit for the year 2017-18 be taken as having accrued at the same rate as that of the previous year.

(iv) Interest on capital be provided @ 10% p.a.

(v) Half of the amount due to A to be paid immediately to the executors and the balance transferred to his (Executors') Loan Account.

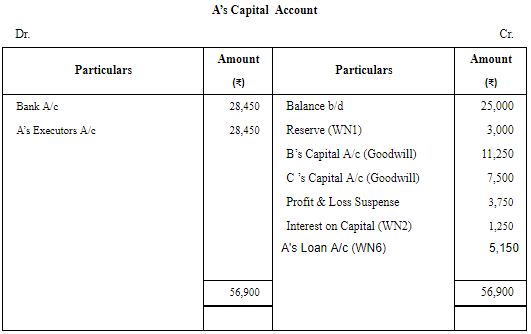

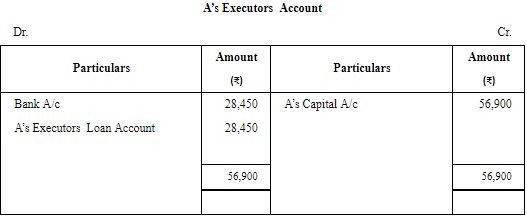

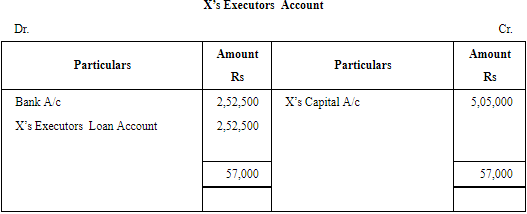

Prepare A's Capital Account and A's Executors' Account as on 1st October, 2018.

ANSWER:

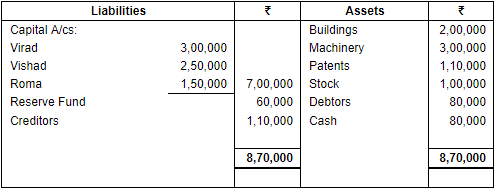

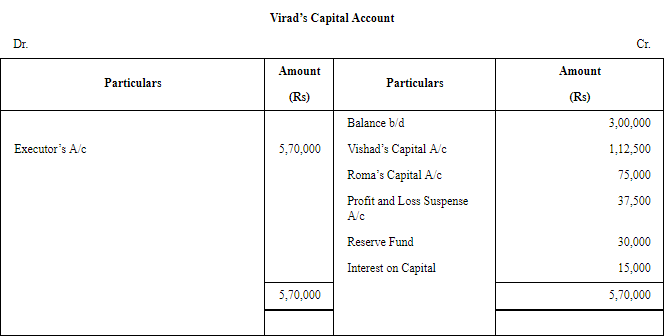

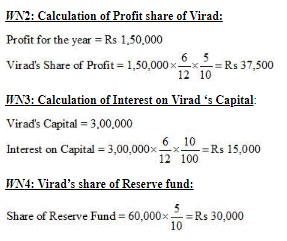

Question 71: Virad, Vishad and Roma were partners in a firm sharing profits in the ratio of 5 : 3 : 2 respectively. On 31st March, 2013, their Balance Sheet was as under:

Virad died on 1st October, 2013. It was agreed between his executors and the remaining partners that:

(i) Goodwill of the firm be valued at 21/2 years purchase of average profits for the last three years. The average profits were ₹ 1,50,000.

(ii) Interest on capital be provided at 10% p.a.

(iii) Profits for the 2013-14 be taken as having accrued at the same rate as that of the previous year which was ₹ 1,50,000.

Prepare Virad's Capital Account to be presented to his Executors as on 1st October, 2013.

ANSWER:

Page No 6.97:

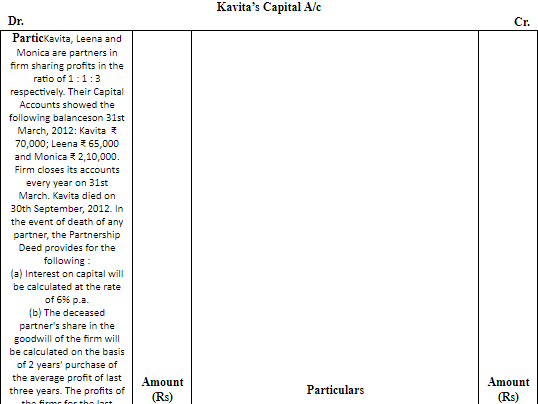

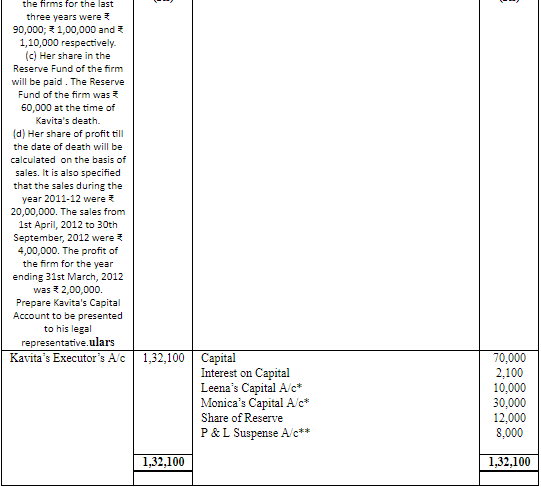

Question 72: Kavita, Leena and Monica are partners in firm sharing profits in the ratio of 1 : 1 : 3 respectively. Their Capital Accounts showed the following balances on 31st March, 2012: Kavita ₹ 70,000; Leena ₹ 65,000 and Monica ₹ 2,10,000. Firm closes its accounts every year on 31st March. Kavita died on 30th September, 2012. In the event of death of any partner, the Partnership Deed provides for the following:

(a) Interest on capital will be calculated at the rate of 6% p.a.

(b) The deceased partner's share in the goodwill of the firm will be calculated on the basis of 2 years' purchase of the average profit of last three years. The profits of the firm for the last three years were ₹ 90,000; ₹ 1,00,000 and ₹ 1,10,000 respectively.

(c) Her share in the Reserve Fund of the firm will be paid. The Reserve Fund of the firm was ₹ 60,000 at the time of Kavita's death.

(d) Her share of profit till the date of death will be calculated on the basis of sales. It is also specified that the sales during the year 2011-12 were ₹ 20,00,000. The sales from 1st April, 2012 to 30th September, 2012 were ₹ 4,00,000. The profit of the firm for the year ending 31st March, 2012 was ₹ 2,00,000.

Prepare Kavita's Capital Account to be presented to his legal representative.

ANSWER:

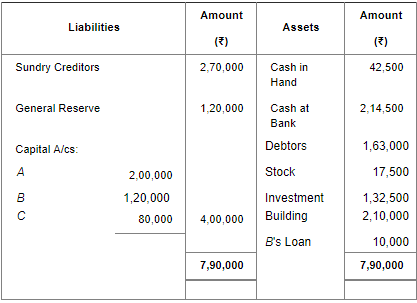

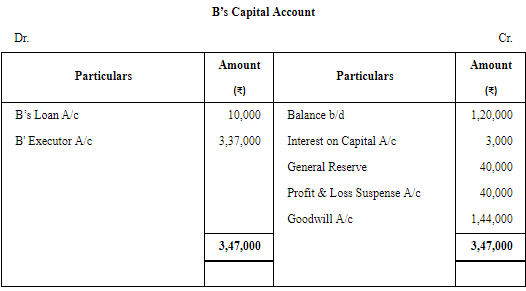

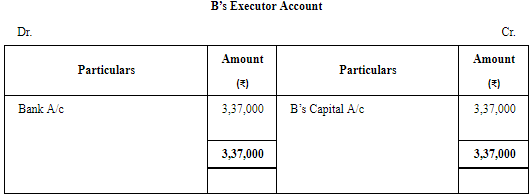

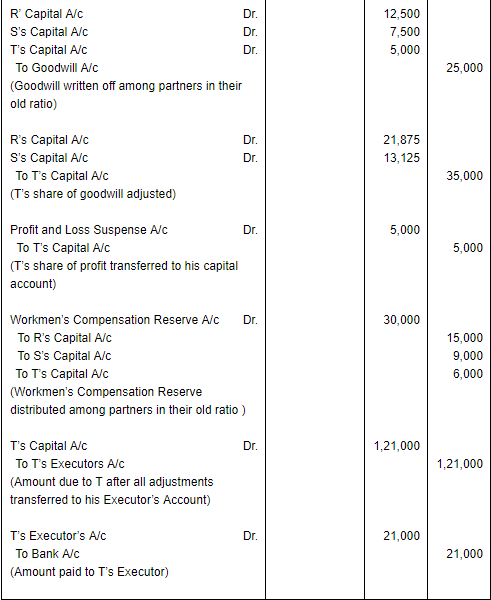

Question 73: A, B and C are partners in a firm sharing profits in the proportion of 3 : 2 : 1. Their Balance Sheet as at 31st March, 2018 stood as follows:

B died on 30th June, 2018 and according to the deed of the said partnership his executors are entitled to be paid as under:

(a) The capital to his credit at the time of his death and interest thereon @ 10% per annum.

(b) His proportionate share of General Reserve.

(c) His share of profit for the intervening period will be based on the sales during that period. Sales from 1st April, 2018 to 30th June, 2018 were as ₹ 12,00,000. The rate of profit during past three years had been 10% on sales.

(d) Goodwill according to his share of profit to be calculated by taking twice the amount of profits of the last three years less 20%. The profit of the previous three years were: 1st Year: ₹ 82,000; 2nd year: ₹ 90,000; 3rd year ₹ 98,000.

(e) The investments were sold at par and his executors were paid out in full.

Prepare B's Capital Account and his Executors' Account.

ANSWER:

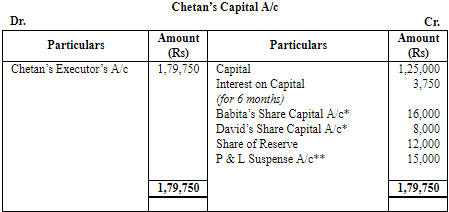

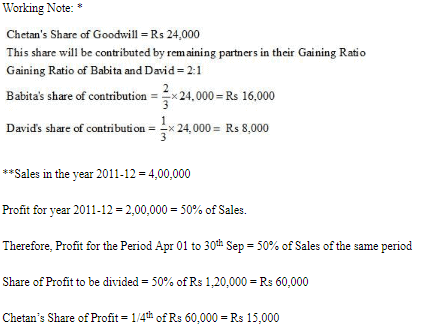

Question 74: Babita, Chetan and David are partners in a firm sharing profits in the ratio of 2 : 1 : 1 respectively. Firm closes its accounts on 31st March every year. Chetan died on 30th September, 2012. There was a balance of ₹ 1,25,000 in Chetan's Capital Account in the beginning of the year. In the event of death of any partner, the Partnership Deed provides for the following:

(a) Interest on capital will be calculated at the rate of 6% p.a.

(b) The executor of deceased partner shall be paid ₹ 24,000 for his share of goodwill.

(c) His share of Reserve Fund of ₹ 12,000, shall be paid to his executor.

(d) His share of profit till the date of death will be calculated on the basis of sales. It is also specified that the sales during the year 2011-12 were ₹ 4,00,000. The sales from 1st April, 2012 to 30th September, 2012 were ₹ 1,20,000. The profit of the firm for the year ending 31st March, 2012 was ₹ 2,00,000.

Prepare Chetan's Capital Account to be presented to his executor.

ANSWER:

Page No 6.98:

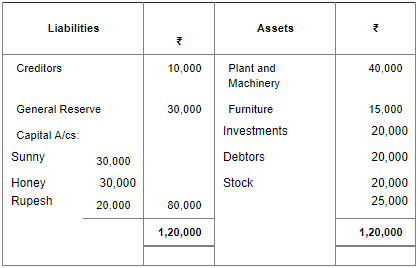

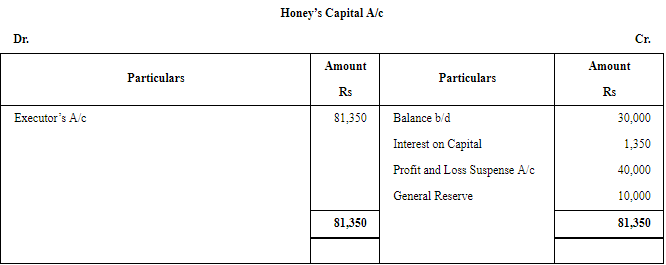

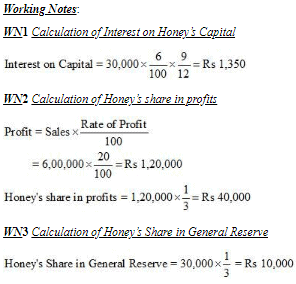

Question 75: Sunny, Honey and Rupesh were partners in a firm. On 31st March, 2014, their Balance Sheet was as follows:

Honey died on 31st December, 2014. The Partnership Deed provided that the representatives of the deceased partner shall be entitled to:

(a) Balance in the Capital Account of the deceased partner.

(b) Interest on Capital @ 6% per annum up to the date of his death.

(c) His share in the undistributed profits or losses as per the Balance Sheet.

(d) His share in the profits of the firm till the date of his death, calculated on the basis of rate of net profit on sales of the previous year. The rate of net profit on sales of previous year was 20%. Sales of the firm during the year till 31st December, 2014 was ₹ 6,00,000.

Prepare Honey's Capital Account to be presented to his executors.

ANSWER:

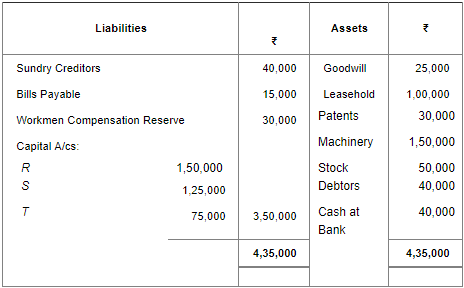

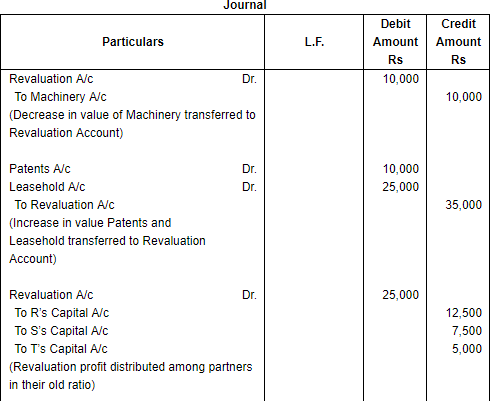

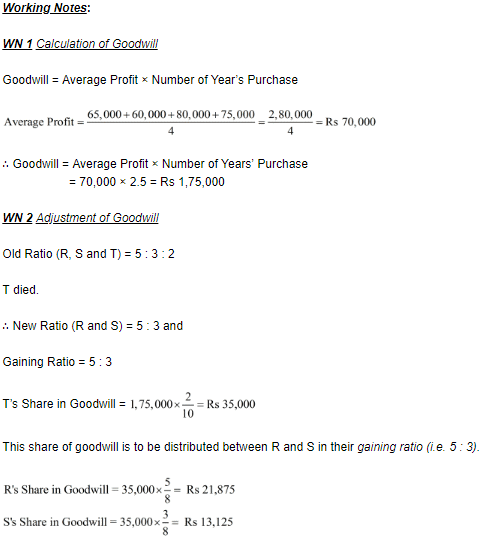

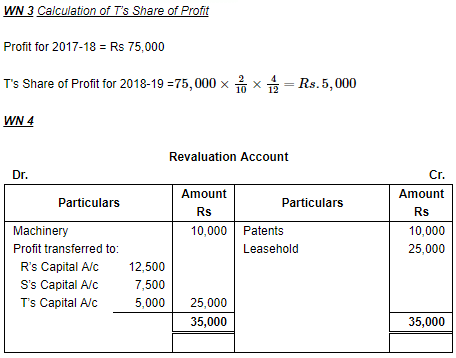

Question 76: R, S and T were partners sharing profits and losses in the ratio of 5 : 3 : 2 respectively. On 31st March, 2018, their Balance Sheet stood as:

T died on 1st August, 2018. It was agreed that:

(a) Goodwill be valued at 2 1/2 years' purchase of average of last 4 years' profits which were:

2014-15: ₹ 65,000; 2015-16: ₹ 60,000; 2016-17: ₹ 80,000 and 2017-18: ₹ 75,000.

(b) Machinery be valued at ₹ 1,40,000; Patents be valued at ₹ 40,000; Leasehold be valued at ₹ 1,25,000 on 1st August, 2018.

(c) For the purpose of calculating T's share in the profits of 2018-19, the profits in 2018-19 should be taken to have accrued on the same scale as in 2017-18.

(d) A sum of ₹ 21,000 to be paid immediately to the Executors of T and the balance to be paid in four equal half-yearly instalments together with interest @ 10% p.a.

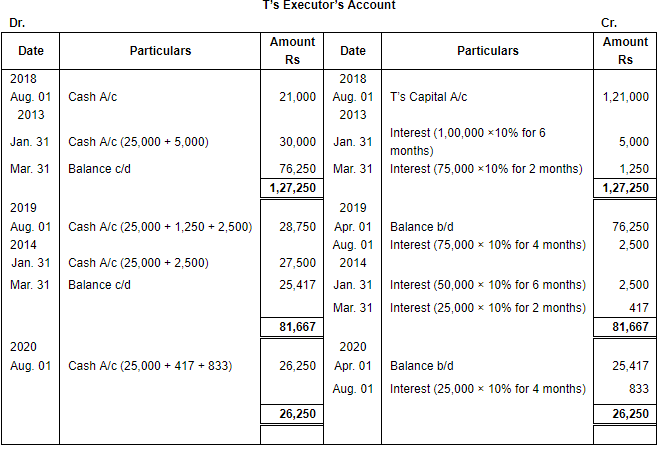

Pass necessary Journal entries to record the above transactions and T's Executors' Account.

ANSWER:

Page No 6.99:

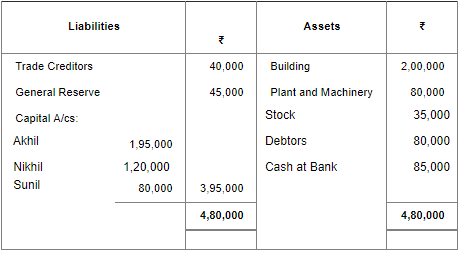

Question 77: Akhil, Nikhil and Sunil were partners sharing profits and losses equally. Following was their Balance Sheet as at 31st March, 2018:

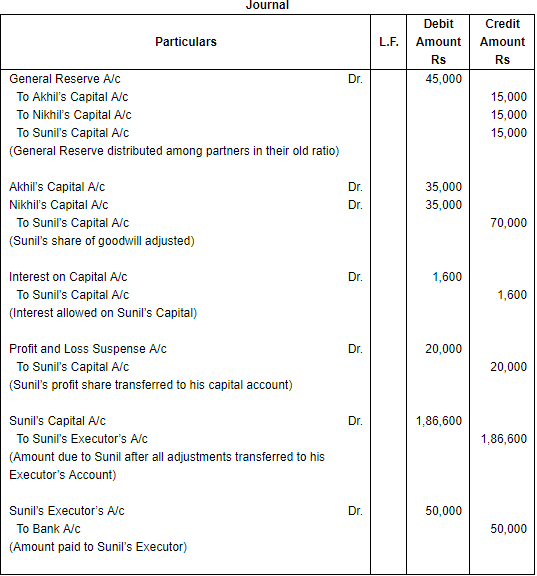

Sunil died on 1st August, 2018. The Partnership Deed provided that the executor of a deceased partner was entitled to:

(a) Balance of Partners' Capital Account and his share of accumulated reserve.

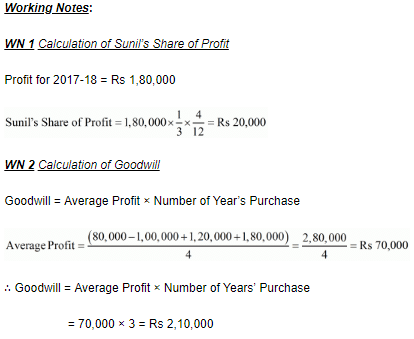

(b) Share of profits from the closure of the last accounting year till the date of death on the basis of the profit of the preceding completed year before death.

(c) Share of goodwill calculated on the basis of three times the average profit of the last four years.

(d) Interest on deceased partner's capital @ 6% p.a.

(e) ₹ 50,000 to be paid to deceased's executor immediately and the balance to remain in his Loan Account.

Profits and Losses for the preceding years were: 2014-15 − ₹ 80,000 Profit; 2015-16 − ₹ 1,00,000 Loss; 2016-17 − ₹ 1,20,000 Profit; 2017-18 − ₹ 1,80,000 Profit.

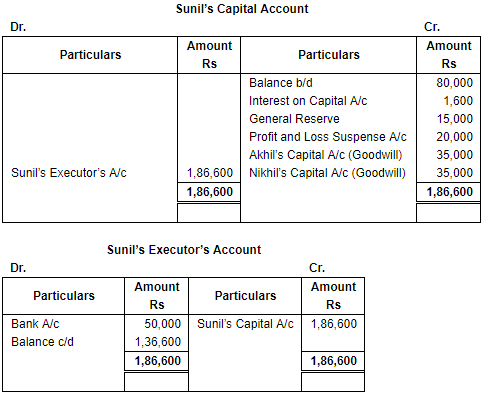

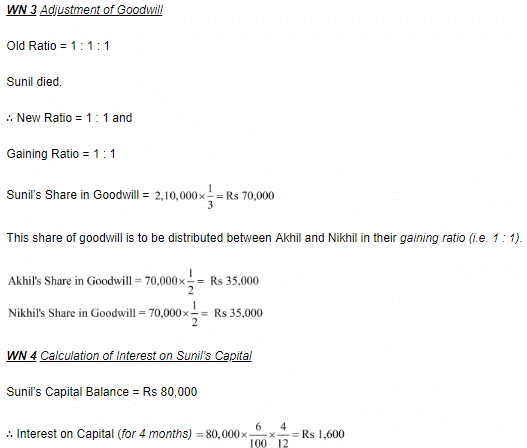

Pass necessary Journal entries and prepare Sunil's Capital Account and Sunil's Executor Account.

ANSWER:

Page No 6.99:

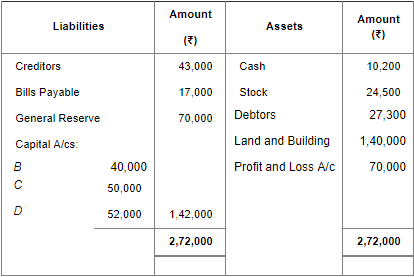

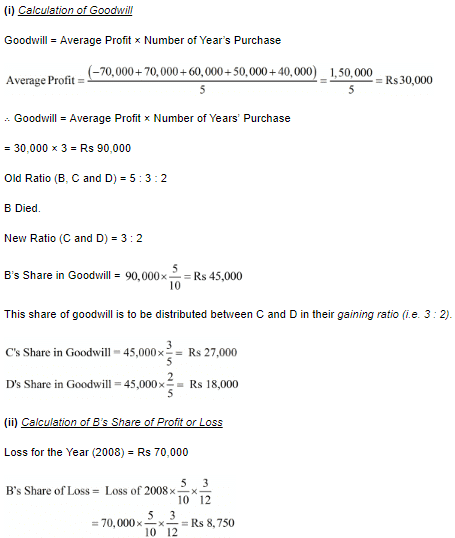

Question 78: B, C and D were partners in a firm sharing profits in the ratio of 5 :3 : 2. On 31st December, 2008, their Balance Sheet was as follows:

B died on 31st March, 2009. The Partnership Deed provided for the following on the death of a partner:

(a) Goodwill of the firm was to be valued at 3 years' purchase of the average profit of last 5 years. The profits for the years ended 31st December, 2007, 31st December, 2006, 31st December, 2005, and 31st December, 2004 were ₹ 70,000; ₹ 60,000; ₹ 50,000 and ₹ 40,000 respectively.

(b) B's share of profit or loss till the date of his death was to be calculated on the basis of the profit or loss for the year ended 31st December, 2008.

You are required to calculate the following:

(i) Goodwill of the firm and B's share of goodwill at the time of his death.

(ii) B's share in the profit or loss of the firm till the date of his death.

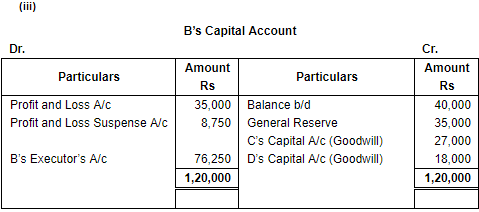

(iii) Prepare B's Capital Account at the time of his death to be presented to his Executors.

ANSWER:

Page No 6.100:

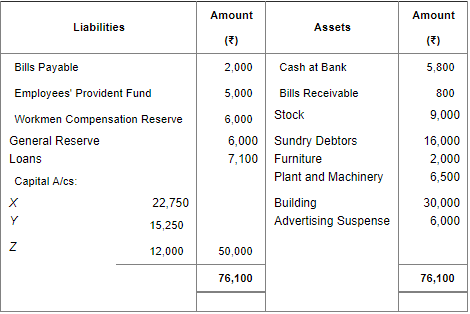

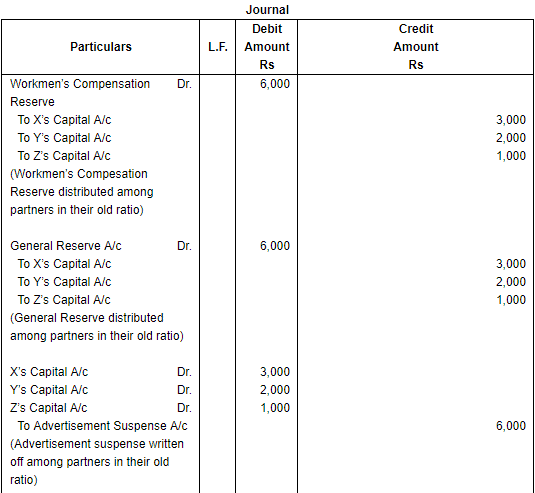

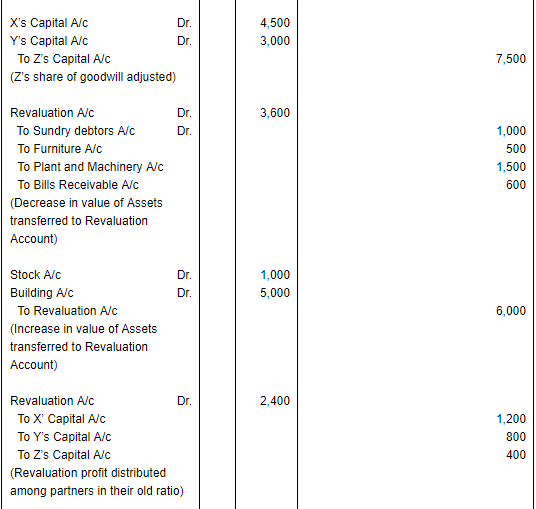

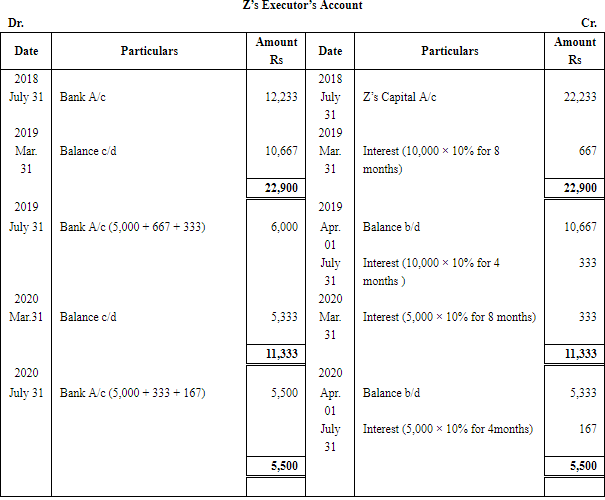

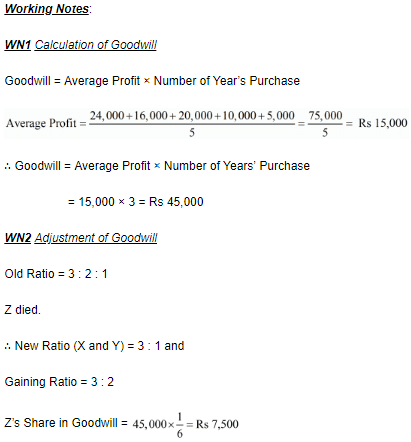

Question 79: The Balance Sheet of X, Y and Z as at 31st March, 2018 was:

The profit-sharing ratio was 3 : 2 : 1. Z died on 31st July, 2018. The Partnership Deed provides that:

(a) Goodwill is to be calculated on the basis of three years' purchase of the five years' average profit. The profits were: 2017-18: ₹ 24,000; 2016-17: ₹ 16,000; 2015-16: ₹ 20,000 and 2014-15: ₹ 10,000 and 2013-14: ₹ 5,000.

(b) The deceased partner to be given share of profits till the date of death on the basis of profits for the previous year.

(c) The Assets have been revalued as: Stock ₹ 10,000; Debtors ₹ 15,000; Furniture ₹ 1,500; Plant and Machinery ₹ 5,000; Building ₹ 35,000. A Bill Receivable for ₹ 600 was found worthless.

(d) A Sum of ₹ 12,233 was paid immediately to Z's Executors and the balance to be paid in two equal annual instalments together with interest @ 10% p.a. on the amount outstanding.

Give Journal entries and show the Z's Executors' Account till it is finally settled.

ANSWER:

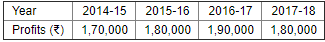

Question 80: X, Y and Z were partners in a firm sharing profits and losses in the 5 : 4 : 3. Their Balance Sheet on 31st March, 2018 was as follows:

X died on 1st October, 2018 and Y and Z decide to share future profits in the ratio of 7 : 5. It was agreed between his executors and the remaining partners that:

(i) Goodwill of the firm be valued at 2 1/2 years' purchase of average of four completed years' profit which were:

(ii) X's share of profit from the closure of last accounting year till date of death be calculated on the basis of last years' profit.

(iii) Building undervalued by ₹ 2,00,000; Machinery overvalued by ₹ 1,50,000 and Furniture overvalued by ₹ 46,000.

(iv) A provision of 5% be created on Debtors for Doubtful Debts.

(v) Interest on Capital to be provided at 10% p.a.

(vi) Half of the net amount payable to X's executor was paid immediately and the balance was transferred to his loan account which was to be paid later.

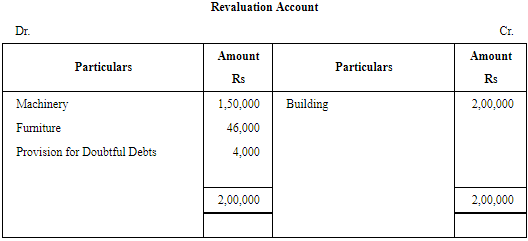

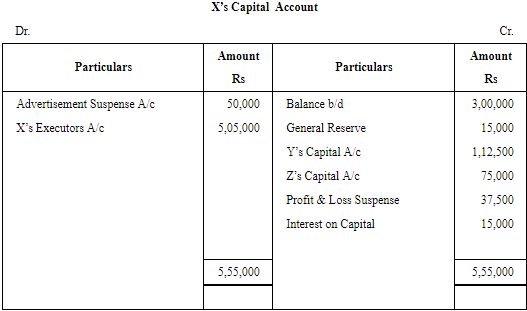

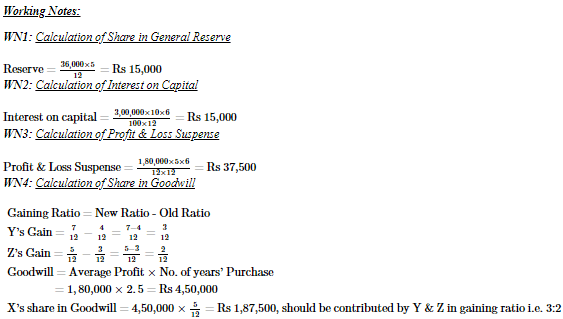

Prepare Revaluation Account, X's Capital Account and X's Executor's Account as on 1st October, 2018.

ANSWER:

Page No 6.101:

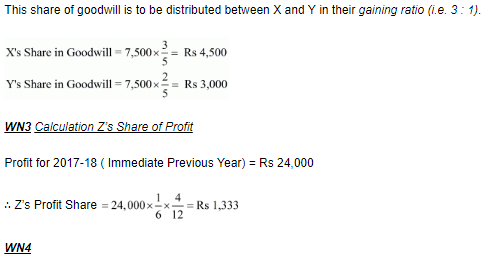

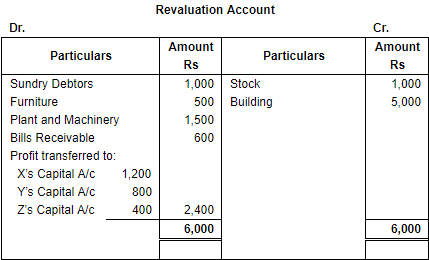

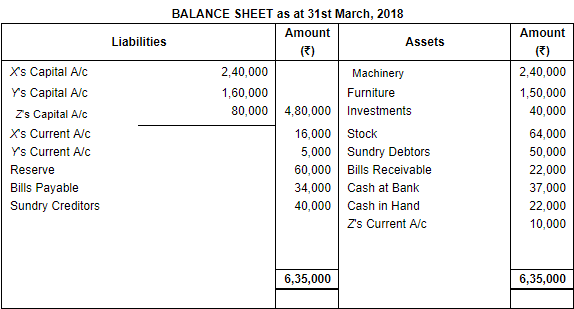

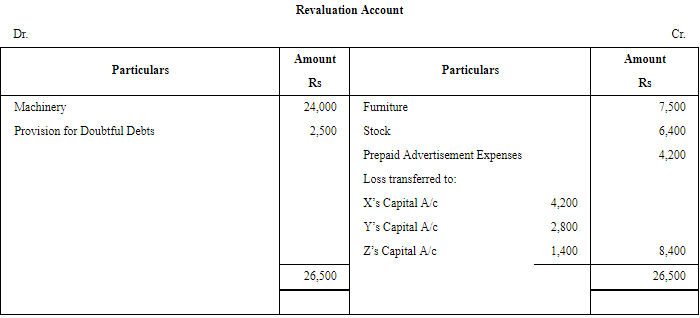

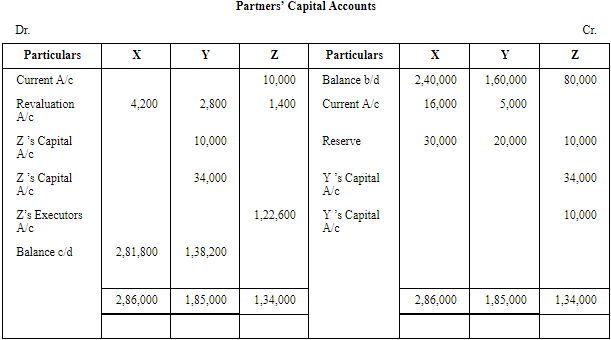

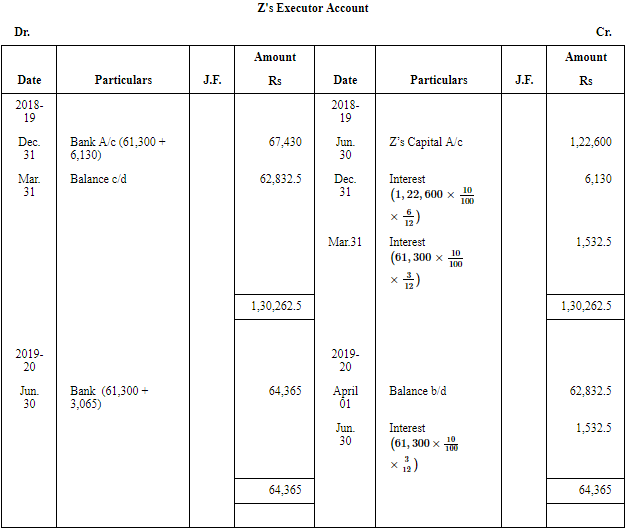

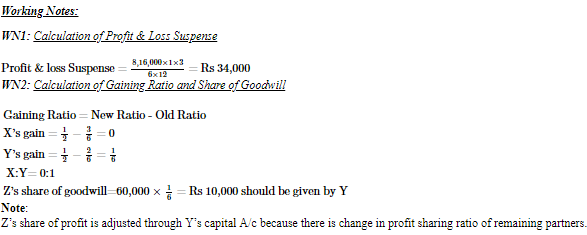

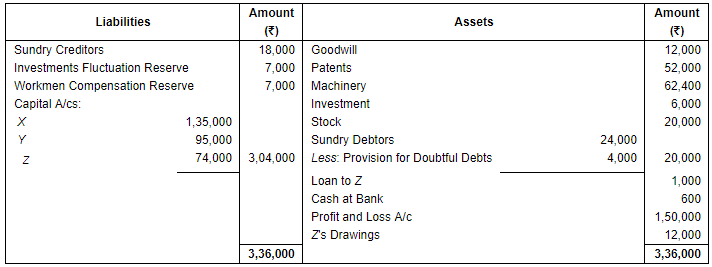

Question 81: X, Y and Z were partners in a firm sharing profits and losses in the ratio of 3 : 2 : 1. Z died on 30th June, 2018. The Balance Sheet of the firm as at that 31st March, 2018 is as follows:

The following decisions were taken by the remaining partners:

(a) A Provision for Doubtful Debts is to be raised at 5% on Debtors.

(b) While Machinery to be decreased by 10%, Furniture and Stock are to be appreciated by 5% and 10% respectively.

(c) Advertising Expenses ₹ 4,200 are to be carried forward to the next accounting year and, therefore, it is to be adjusted through the Revaluation Account.

(d) Goodwill of the firm is valued at ₹ 60,000.

(e) X and Y are to share profits and losses equally in future.

(f) Profit for the year ended 31st March, 2018 was ₹ 8,16,000 and Z's share of profit till the date of death is to be determined on the basis of profit for the year ended 31st March, 2018.

(g) The Fixed Capital Method is to be converted into the Fluctuating Capital Method by transferring the Current Account balances to the respective Partners' Capital Accounts.

Prepare the Revaluation Account, Partners' Capital Accounts and prepare C's Executors's Account to show that C's Executors were paid in two half-yearly instalments plus interest of 10% p.a. on the unpaid balance. The first instalment was paid on 31st December, 2018.

ANSWER:

Page No 6.102:

Question 82: X, Y and Z are partners in a firm sharing profits and losses in the ratio of 5 : 3 : 2. Their Balance Sheet as at 31st March, 2018 was as follows:

Z died on 1st April, 2018, X and Y decide to share future profits and losses in ratio of 3 : 5. It was agreed that:

(i) Goodwill of the firm be valued 21/2 years' purchase of average of four completed years' profits which were: 2014-15——₹ 1,00,000; 2015-16——₹ 80,000; 2016-17——₹ 82,000.

(ii) Stock is undervalued by ₹ 14,000 and machinery is overvalued by ₹ 13,600.

(iii) All debtors are good. A debtor whose dues of ₹ 400 were written off as bad debts paid 50% in full settlement.

(iv) Out of the amount of insurance premium debited to Profit and Loss Account, ₹ 2,200 be carried forward as prepaid insurance premium.

(v) ₹ 1,000 included in Sundry Creditors is not likely to arise.

(vi) A claim of ₹ 1,000 on account of Workmen Compensation to be provided for.

(vii) Investment be sold for ₹ 8,200 and a sum of ₹ 11,200 be paid to executors of Z immediately. The balance to be paid in four equal half-yearly instalments together with interest @ 8% p.a. at half year rest.

Show Revaluation Account, Capital Accounts of Partners and the Balance Sheet of the new firm.

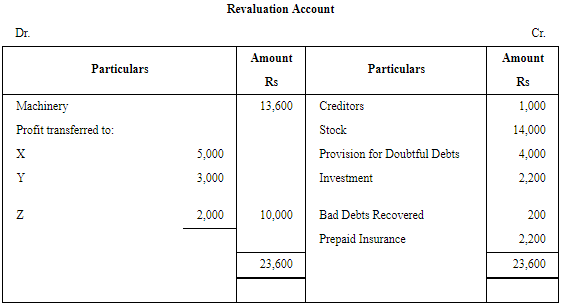

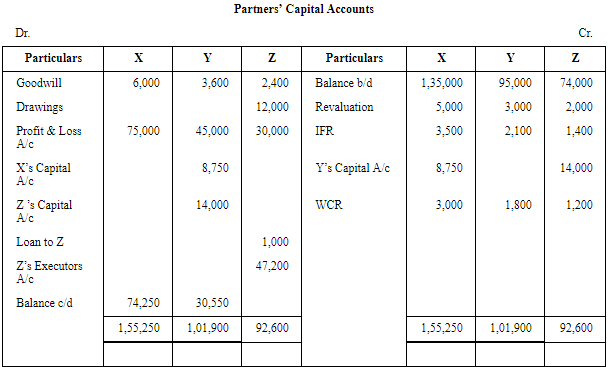

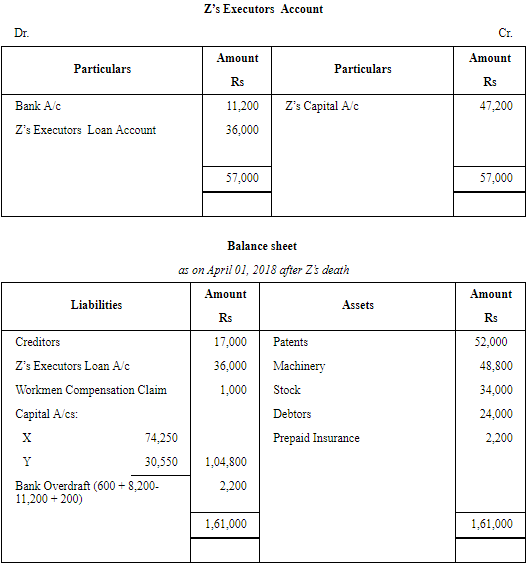

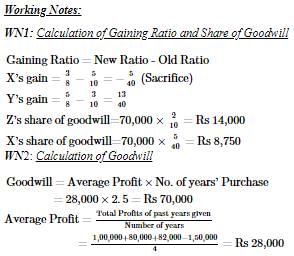

ANSWER:

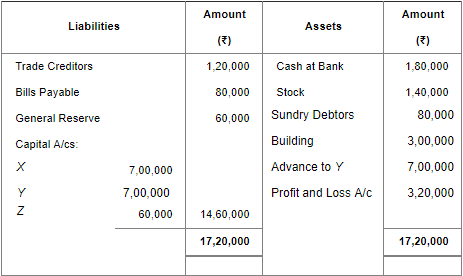

Question 83: X, Y and Z were partners in a firm sharing profits in the ratio of 2 : 2 : 1. On 31st March, 2018, their Balance Sheet was as follows:

Y died on 30th June, 2018. The Partnership Deed provided for the following on the death of a partner:

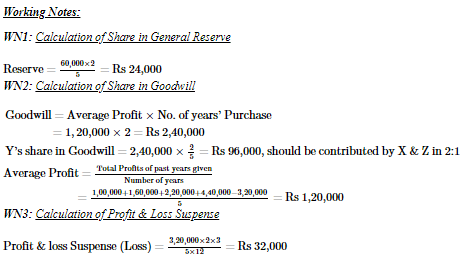

(i) Goodwill of the business was to be calculated on the basis of 2 times the average profit of the past 5 years. Profits for the years ended 31st March, 2018, 31st March, 2017, 31st March, 2016, 31st March, 2015 and 31st March, 2014 were ₹ 3,20,000 (Loss); ₹ 1,00,000; ₹ 1,60,000; ₹ 2,20,000 and ₹ 4,40,000 respectively.

(ii) Y's share of profit or loss from 1st April, 2018 till his death was to be calculated on the basis of the profit or loss for the year ended 31st March, 2018.

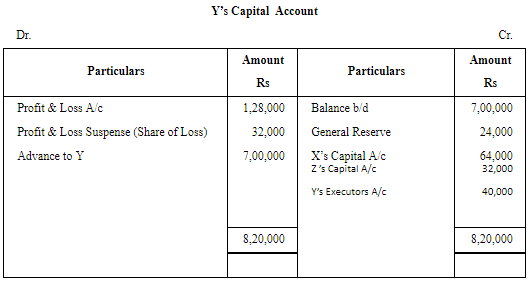

You are required to calculate the following:

(a) Goodwill of the firm and Y's share of goodwill at the time of his death.

(b) Y's share in the profit or loss of the firm till the date of his death.

(c) Prepare Y's Capital Account at the time of his death to be presented to his executors.

ANSWER:

|

42 videos|199 docs|43 tests

|

FAQs on Retirement/Death of a Partner (Part - 4) - Accountancy Class 12 - Commerce

| 1. What is the difference between retirement and death of a partner? |  |

| 2. How can retirement or death of a partner impact a business? |  |

| 3. What steps can be taken to prepare for the retirement or death of a partner? |  |

| 4. How can businesses ensure financial stability during the retirement or death of a partner? |  |

| 5. What legal considerations should be taken into account when dealing with the retirement or death of a partner? |  |