UPSC Exam > UPSC Notes > Indian Economy for UPSC CSE > Summary of Union Interim Budget 2024

Summary of Union Interim Budget 2024 | Indian Economy for UPSC CSE PDF Download

Key Facts about the Union Budget 2024

- The budget announcement for the financial year 2024-25 was made by the Union Finance Minister Smt. Nirmala Sitharaman on February 1, 2024.

- The Union Budget 2024 is an Interim Budget and not a Full Budget. This is because the general elections are to be held in the year 2024.

- An Interim Budget, also known as ‘Vote-on-Account’, is usually presented when presenting a Full Budget is not feasible due to special circumstances, such as during an election year or when the regular budget cycle is disrupted.

- A Full Budget consists of a comprehensive financial statement of the government’s finances, including detailed receipts and expenditures for the upcoming fiscal year, as well as the government’s economic policies and priorities. On the other hand, an Interim Budget is a provisional arrangement that allows the government to meet its expenses for a part of the year and usually does not include major policy announcements.

- A Full Budget announcement for the financial year 2024-25 is expected to be made in July after the newly elected government is formed.

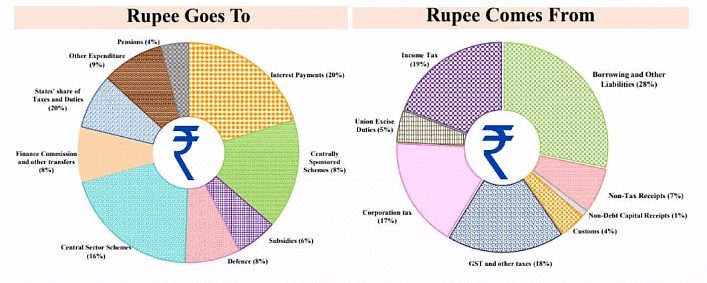

Union Budget 2024 – Key Statistics

Estimated figures of various parameters for the fiscal year 2024-25, as mentioned in the Union Budget 2024, are presented below:

Growth Rate Estimates for 2024-25

- Nominal GDP Growth Rate: 10.5%

Expenditure Estimates for 2024-25

- Total Expenditure: Rs 47,65,768 crore (about 6.1% higher than 2023-24)

- Capital Expenditure: Rs 11,11,111 crore (about 16.9% higher than 2023-24)

- Revenue Expenditure: Rs 36,54,657 crore (about 3.2% higher than 2023-24)

Receipts Estimates for 2024-25

- Total Receipts (other than borrowings): Rs 30,80,274 crore (about 11.8% higher than 2023-24)

- Capital Receipts: Rs 79,000 crore (about 41.1% higher than 2023-24)

- Revenue Receipts: Rs 30,01,275 crore (about 11.2% higher than 2023-24)

- Disinvestment Target for 2024-25: Rs 50,000 crore (lower than last financial year)

Deficits Estimates for 2024-25

- Fiscal Deficit: 5.1% of GDP

- Revenue Deficit: 2.0% of GDP

- Primary Deficit: 1.5% of GDP

Key Highlights of the Interim Union Budget 2024-25

- Vision of Budget 2024: Viksit Bharat by 2047 – a prosperous Bharat in harmony with nature, modern infrastructure and opportunities for all.

- Development Mantra of Budget 2024: ‘Sabka Saath, Sabka Vikas, and Sabka Vishwas’ and the whole of nation approach of “Sabka Prayas”.

- Focus Areas of Budget 2024: The government plans to focus on the upliftment of four major castes – ‘Garib’ (Poor), ‘Mahilayen’ (Women), ‘Yuva’ (Youth) and ‘Annadata’(Farmer).

Major initiatives taken/proposed for their welfare are as follows:

Garib’ (Poor) – Garib Kalyan, Desh ka Kalyan

- Decline in Headcount Ratio: The government assisted 25 crore people out of multi-dimensional poverty in the last 10 years.

- Direct Benefit Transfer: DBT of Rs. 34 lakh crore using PM-Jan Dhan accounts led to savings of Rs. 2.7 lakh crore for the Government.

- PM-SVANidhi: It has provided credit assistance to 78 lakh street vendors, with 2.3 lakh of them receiving credit for the third time.

- PM-JANMAN Yojana: It has aided the development and welfare of Particularly Vulnerable Tribal Groups (PVTG).

- PM-Vishwakarma Yojana: It has been providing end-to-end support to artisans and craftspeople engaged in 18 trades.

‘Yuva’ (Youth) – Empowering the Youth

Ensuring Quality Education

- National Education Policy 2020 is aimed to bring transformational reforms in education.

- PM ScHools for Rising India (PM SHRI) is helping to deliver quality education.

- New Higher Education Institutions (HEIs), including 7 IITs, 16 IIITs, 7 IIMs, 15 AIIMS and 390 universities have been set up.

Skill Development

- 1.4 crore youth have been trained and 54 lakhs youth have been upskilled and reskilled under Skill India Mission

Fostering Entrepreneurship among the Youth

- 43 crore loans have been sanctioned under PM Mudra Yojana.

- Fund of Funds, Start-Up India, and Start-Up Credit Guarantee schemes are making the youth ‘rozgardata’.

- A corpus of rupees one lakh crore will be established with a 50-year interest-free loan for long-term financing of research and innovation in sunrise domains.

Promoting Sports

- India witnessed the highest-ever medal tally in the Asian Games and Asian Para Games in 2023.

- At present, India has more than 80 chess grandmasters, much higher than just around 20 in 2010.

‘Annadata’ (Farmers) – Welfare of Farmers

- Direct financial assistance has been provided to around 11.8 crore farmers under PM-KISAN SAMMAN Yojana.

- Under PM Fasal BimaYojana, crop insurance has been given to approximately 4 crore farmers.

- Under the Electronic National Agriculture Market (e-NAM), integrated 1361 mandis have been helping around 1.8 crore farmers market their produce.

Mahilayen’ (Women) – Momentum for Nari Shakti

- 30 crore Mudra Yojana loans have been given to women entrepreneurs.

- Enrolment of females in higher education has gone up by around 28%.

- In STEM courses, girls and women constitute 43% of the total enrolments in STEM courses. This one of the highest in the world.

- Over 70% of houses under PM Awas Yojana have been given to women from rural areas.

Budget 2024 Strategy for Amrit Kaal

Sustainable Development

Commitment to meet ‘Net Zero’ by 2070

- Viability gap funding for wind energy

- Setting up of coal gasification and liquefaction capacity

- Phased mandatory blending of CNG, PNG and compressed biogas

- Financial assistance for procurement of biomass aggregation machinery

Rooftop solarization

- 1 crore households will be enabled to obtain up to 300 units of free electricity per month

Promotion of Electric Mobility

- Adoption of e-buses for public transport network

- Strengthening e-vehicle ecosystem by supporting manufacturing and charging

Other Measures

- New scheme of biomanufacturing and bio-foundry to be launched to support environment-friendly alternatives.

Infrastructure and Investment

- Budget 2024-25 has announced the identification and implementation of three Economic Railway Corridors under the PM GatiShakti for enabling multi-modal connectivity, including

- energy, mineral, and cement corridors

- port connectivity corridors

- high traffic density corridors

- Promotion of foreign investment via bilateral investment treaties to be negotiated.

- Expansion of existing airports and comprehensive development of new airports under the UDAN scheme.

- Promotion of urban transformation via Metro Rail and NaMo Bharat.

Inclusive Development

- Aspirational Districts Programme to assist States in faster development and employment generation.

Health

- Encourage Cervical Cancer Vaccination for girls (9-14 years)

- Saksham Anganwadi and Poshan 2.0 to be expedited for improved nutrition delivery, early childhood care and development

- U-WIN platform for immunization efforts of Mission Indradhanush to be rolled out

- Health cover under Ayushman Bharat scheme to be extended to all ASHA, Angawadi workers and helpers

Housing

- Pradhan Mantri Awas Yojana (Grameen) close to achieving target of 3 crore houses, additional 2 crore targeted for next 5 years

- Housing for Middle Class scheme to be launched to promote middle class to buy/built their own houses

Tourism

- States will be encouraged to undertake development of iconic tourist centres to attract business and promote opportunities for local entrepreneurship

- Long-term interest free loans to be provided to States to encourage development

- Projects for port connectivity, tourism infrastructure, and amenities will be taken up in islands, including Lakshadweep

Agriculture and Food Processing

- Government will promote private and public investment in post-harvest activities

- Application of Nano-DAP to be expanded in all agro-climatic zones

- Atmanirbhar Oilseeds Abhiyaan-Strategy to be formulated to achieve atmanirbharta for oilseeds

- Comprehensive programme for dairy development to be formulated

- Implementation of Pradhan Mantri Matsaya Sampada Yojana to be stepped up to enhance aquaculture productivity, double exports and generate more employment opportunities

- 5 Integrated Aquaparks to be set up

Union Budget 2024 – Taxation

Direct Taxes

- Direct Tax Collections more than trebled in last 10 years

- Number of return filers swelled to 2.4 times

- Reduction in the average processing time of returns from 93 days (2013-14) to 10 days (2023-24) led to faster refunds.

Indirect Taxes

- Average monthly Gross GST collections doubled to ₹1.66 lakh crore in FY24 Increase in tax buoyancy of

- State revenue from 0.72 (2012-16) to 1.22 in the post-GST period (2017-23)

- A significant decline in import release time since 2019 at Inland Container Depots, Air Cargo Complexes as well as Sea Ports.

Tax Proposals

- Continuity in taxation: Certain tax benefits to Start-ups and investments made by sovereign wealth funds/pension funds, tax exemption of some IFSC units earlier expiring on 31st March 2024 extended up to 31st March 2025.

Retention of same tax rates:

- For direct and indirect taxes, including import duties

- For Corporate Taxes – 22% for existing domestic companies, 15% for certain new manufacturing companies

- No tax liability for taxpayers with income up to ₹7 lakh under the new tax regime

The document Summary of Union Interim Budget 2024 | Indian Economy for UPSC CSE is a part of the UPSC Course Indian Economy for UPSC CSE.

All you need of UPSC at this link: UPSC

|

108 videos|431 docs|128 tests

|

Related Searches