CLAT Exam > CLAT Notes > Current Affairs: Daily, Weekly & Monthly > The Hindu Editorial Analysis- 12th January, 2022

The Hindu Editorial Analysis- 12th January, 2022 | Current Affairs: Daily, Weekly & Monthly - CLAT PDF Download

1. Extending GST compensation as a reform catalyst: The transition to GST is still in progress and an extension will provide comfort to States to help roll out crucial changes

Page 8/Editorial

GS 3: Economy

Context: Goods and Services Tax (GST) in India was a grand experiment in cooperative federalism in which both the Union and the States joined hands to rationalise cascading domestic trade taxes and evolve a value-added tax on goods and services.

- Although the rate structure was presumed to be revenue neutral, the States agreed to forgo their revenue autonomy in favour of tax harmonisation.

- This was in the hope that it would turn out to be a money machine in the medium term due to improved compliance arising from the self-policing nature of the tax.

The Concept of compensation to the states if the above objectives are not met

- Compensation for short term revenue volatility: To allay the fears of States of possible revenue loss by implementing GST in the short term, the Union government promised to pay compensation for any loss of revenue in the evolutionary phase of five years.

- Revenue Neutral system(RNR): The compensation was to be calculated as the shortfall in actual revenue collections in GST from the revenue the States would have got from the taxes merged in the GST. This was estimated by taking the revenue from the merged taxes in 2015-16 as the base and applying the growth rate of 14% every year.

- Compensation cess: To finance the compensation requirements, a GST compensation cess was levied on certain items such as tobacco products, automobiles, coal and solid fuels manufactured from lignite, pan masala and aerated waters.

Performance of the Compensation system

- In the first two years, the amount of compensation to be paid to the States was modest and the compensation cess was sufficient to meet the requirements. In fact, the cess collections exceeded the compensation requirements by ₹21,466 crore in 2017-18 and ₹25,806 crore in 2018-19.

- In 2018-19, the shortfall in the payment requirement from the cess collections was ₹24,947 crore which could be met from the surpluses of the previous two years kept as balance in the compensation fund.

- However, in 2020-21, due to the most severe lockdown following the novel coronavirus pandemic, the loss of revenue to States was estimated at ₹3 lakh-crore of which ₹65,000 crore was expected to accrue from the compensation cess.

- Of the remaining ₹2.35 lakh-crore, the Union government decided to pay ₹1.1 lakh-crore by borrowing from the Reserve Bank of India under a special window and the interest and repayment were to be paid from the collections from compensation cess in the future.

The mistrust between centre and states

- Inability of the centre to pay the compensation.

- Not continuing compensation: The agreement to pay compensation for the loss of revenue was for a period of five years which will come to an end by June 2022; But given the uncertainties of the time, states are keen that the compensation scheme should continue for another five years.

Core issues with GST currently

- Misuse of Input tax credits/Fake invoices: the technology platform could not be firmed up for a long time due to which the initially planned returns could not be filed. This led to large-scale misuse of input tax credit using fake invoices. The adverse impact on revenue collections due to this was compounded by the pandemic-induced lockdowns.

- States have no other source of revenue: This is the only major source of revenue for the States and considering their increased spending commitments to protect the lives and livelihoods of people, they would like to mitigate revenue uncertainty to the extent they can.

- The Finance commission report have already been submitted: They have no means to cushion this uncertainty for the Finance Commission which is supposed to take into account the States’ capacities and needs in its recommendations has already submitted its recommendations; the next Commission’s recommendations will be available only in 2026-27.

Further, The structure of GST needs significant changes.

- Large exemption list is a problem: Notably, almost 50% of the consumption items included in the consumer price index are in the exemption list; broadening the base of the tax requires significant pruning of these items.

- Bringing Petroleum into its fold: sooner or later, it is necessary to bring petroleum products, real estate, alcohol for human consumption and electricity into the GST fold.

- The present structure is far too complicated with:

- four main rates (5%, 12%, 18% and 28%)

- special rates on precious and semi-precious stones and metals

- Cess on ‘demerit’ and luxury items at rates varying from 15% to 96% of the tax rate applicable which have complicated the tax enormously.

- Multiple rates complicate the tax system, cause administrative and compliance problems, create inverted duty structure and lead to classification disputes.

Way Forward

- Thus, extending the compensation payment for the loss of revenue for the next five years is necessary not only because the transition to GST is still underway but also to provide comfort to States to partake in the reform.

- GST is the most important source of revenue to States and any revenue uncertainty from that source will have a severe adverse effect on public service delivery.

- Reforming the structure to complete the process of transition to a reasonably well-structured GST is important not only to enhance the buoyancy of the tax in the medium term but also to reduce administrative and compliance costs to improve ease of doing business and minimise distortions.

- New Growth Linked - RNR: It has been pointed out by many including the Fifteenth Finance Commission that the compensation scheme of applying 14% growth on the base year revenue provided for the first five years was far too generous. The rate of growth of reference revenue for calculating compensation can be linked to the growth of GSDP in States to ensure the comfort of minimum certainty on the revenue.

- Cooperation of States is necessary to carry out the required reforms. They would be unwilling to agree to rationalise rates unless the compensation payment for the revenue loss is continued.

2. Treating the planet well can aid progress: An integrated perspective is necessary as social and environmental problems cannot be addressed in isolation anymore

Page 8/Editorial

GS 3: Environment

Context: The 2020 Human Development Report of the United Nations Development Programme (UNDP), titled “The Next Frontier – Human Development and the Anthropocene” proposed a planetary pressure-adjusted Human Development Index (HDI).

About the Human Development Report

- UNDP took up computation of the HDI driven by the vision of Mahbub ul Haq and articulated by Amartya Sen in 1990.

- HDR Office releases five composite indices each year:

- Human Development Index (HDI),

- Inequality-Adjusted Human Development Index (IHDI),

- Gender Development Index (GDI),

- Gender Inequality Index (GII),

- Multidimensional Poverty Index (MPI).

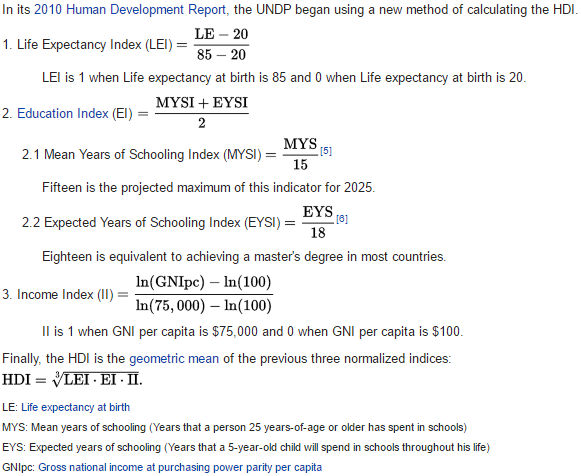

Calculation of HDI

- There have been adjustments such as inequality-adjusted HDI.

Newer approach to HDI

- The concept of the planetary boundary was introduced by a group of scientists across the world, led by J. Rockström of the Stockholm Resilience Centre in 2009. This was to highlight that human-induced environmental change can irrevocably destabilise the long-term dynamics of the earth system, thereby disrupting the life-supporting system of the planet.

- Anthropogenic threats to HDI: biodiversity loss, climate change, land system/land-use change, disruption of biogeochemical cycles, and scarcity of freshwater availability are a threat and increase the vulnerability of society.

- Planetary pressure adjusted HDI, or PHDI: It is conceptualized to communicate to the larger society the risk involved in continuing with existing practices in our resource use and environmental management, and the retarding effect that environmental stress can perpetuate on development.

- This adjustment has been worked out by factoring per capita carbon dioxide (CO2) emission (production), and per capita material footprint. The average per capita global CO2 emission (production) is 4.6 tonnes and the per capita material footprint is 12.3 tonnes.

Impact on HDI when planetary pressure is adjusted

- The world average of HDI in 2019 came down from 0.737 to 0.683.

- The global ranking of several countries was altered, in a positive and negative sense, with adjustment of planetary pressure.

- Switzerland is the only country in the group of high human development countries whose world rank has not changed with adjustment of planetary pressure, although the HDI value of 0.955 has come down to 0.825 after the necessary adjustment.

- Among 66 very high human development countries, 30 countries recorded a fall in rank values ranging from minus 1 for Germany and Montenegro to minus 131 for Luxembourg. It succinctly brings out the nature of planetary pressure generated by the developed countries and indirectly indicates their responsibility in combating the situation.

- In the case of India, the PHDI is 0.626 against an HDI of 0.645 with an average per capita CO2 emission (production) and material footprints of 2.0 tonnes and 4.6 tonnes, respectively.

- India gained in global rankings by eight points (131st rank under HDI and 123rd rank under PHDI), and its per capita carbon emission (production) and material footprint are well below the global average.

- Kerala has an exemplary achievement in human development with an HDI value of 0.775, well above the all-India average.

Challenges in India, SDGs

- Nevertheless, India’s natural resource use is far from efficient, environmental problems are growing, and the onslaught on nature goes on unabated with little concern about its fallout — as evident from a number of ongoing and proposed projects.

- India has 27.9% people under the Multidimensional Poverty Index ranging from 1.10% in Kerala to 52.50% in Bihar, and a sizable section of them directly depend on natural resources for their sustenance.

- India was first to point out: The twin challenges of poverty alleviation and environmental safeguarding that former Prime Minister Indira Gandhi first articulated in her lecture during the Stockholm conference on the human environment in 1972 still remain unattended.

- It is now well established that there are interdependencies of earth system processes including social processes, and their relationships are non-linear and dialectic.

- Therefore, the central challenge is to nest human development including social and economic systems into the ecosystem, and biosphere building on a systematic approach to nature-based solutions that put people at the core.

The Idea of sustainable development

- The adoption of 17 SDG with a specific target to meet by 2030. The SDGs have acquired high priority in the context of the issue of climate change and its impact on society. Human-induced climate change has emerged as an important issue of global deliberations.

- Link between environment and poverty: The Sixth Assessment Report (AR6) of the Intergovernmental Panel on Climate Change (IPCC) 2021 laid stress on limiting global temperature rise at the 1.5° C level and strengthening the global response to the threat of climate change, sustainable development, and efforts to eradicate poverty. This was reaffirmed in the Conference of Parties (COP) 26 at Glasgow in 2021.

- ‘No poverty’ and ‘Zero hunger’ are the first and second SDGs.

India's performance on SDG

- According to NITI Aayog (2020-21), out of 100 points set for the grade of Achiever, India scored 60 (Performer grade, score 50-64) for no poverty and 47 (Aspirant grade, score 0-49) for zero hunger, with wide State-level variations.

- India’s score in the SDGs of 8, 9, and 12 (‘Decent work and economic growth’; ‘Industry, Innovation and Infrastructure’ and ‘Responsible Consumption and Production’, respectively) — considered for working out planetary pressure — are 61 (performer), 55 (performer) and 74 (front runner), respectively.

- Better awareness now: There is now widespread awareness about the environment and several initiatives both at the level of the government and the community.

Way forward

- An Integrated approach: Social and environmental problems cannot be addressed in isolation anymore;

- Local level involvement: It is now essential to consider people and the planet as being a part of an interconnected social-ecological system. This can be conceived and addressed at the local level, for which India has constitutional provisions in the form of the 73rd and 74th Amendments.

- Use of technology to aid recovery: The remarkable advances in earth system science and sustainability research along with enabling technology of remote sensing and geographic information system have helped to document and explain the impact of human activities at the ground level and stimulate new interdisciplinary work encompassing the natural and social sciences. They also provide insights into how to mitigate these impacts and improve life.

- Reorientation of the planning process, adoption of a decentralised approach, a plan for proper institutional arrangements, and steps to enable political decisions.

The document The Hindu Editorial Analysis- 12th January, 2022 | Current Affairs: Daily, Weekly & Monthly - CLAT is a part of the CLAT Course Current Affairs: Daily, Weekly & Monthly.

All you need of CLAT at this link: CLAT

|

844 docs|613 tests

|

FAQs on The Hindu Editorial Analysis- 12th January, 2022 - Current Affairs: Daily, Weekly & Monthly - CLAT

| 1. What is GST and why is its extension important for states? |  |

Ans. GST stands for Goods and Services Tax, which is a comprehensive indirect tax levied on the supply of goods and services across India. Its extension is important for states because it helps in the smooth transition to the new tax regime and provides comfort to states in implementing crucial changes.

| 2. How can treating the planet well aid progress? |  |

Ans. Treating the planet well can aid progress by ensuring sustainable development. An integrated perspective is necessary as social and environmental problems cannot be addressed in isolation anymore. By taking care of the planet, we can protect natural resources, mitigate climate change, and create a healthier and safer environment for future generations.

| 3. What are the challenges faced in the transition to GST? |  |

Ans. The transition to GST faces several challenges, including technical glitches in the GST Network, lack of awareness among businesses, and resistance from some sectors to adapt to the new tax system. There are also concerns about revenue loss for states and the need for compensation mechanisms.

| 4. How does GST benefit the economy? |  |

Ans. GST benefits the economy in several ways. It simplifies the tax structure by replacing multiple indirect taxes with a single tax, thereby reducing compliance costs for businesses. It promotes a seamless flow of goods and services across states, leading to increased efficiency and productivity. It also helps in curbing tax evasion and black money, leading to a more transparent and formal economy.

| 5. What are the environmental and social implications of neglecting the planet? |  |

Ans. Neglecting the planet can have severe environmental and social implications. It can lead to environmental degradation, loss of biodiversity, and depletion of natural resources. This, in turn, can result in climate change, water scarcity, and food insecurity. Socially, neglecting the planet can impact the well-being and livelihoods of communities, especially those dependent on natural resources. It can also exacerbate social inequalities and contribute to conflicts over scarce resources.

|

Explore Courses for CLAT exam

|

|

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.

Related Searches