UPSC Exam > UPSC Notes > Current Affairs & Hindu Analysis: Daily, Weekly & Monthly > The Hindu Editorial Analysis- 24th April 2024

The Hindu Editorial Analysis- 24th April 2024 | Current Affairs & Hindu Analysis: Daily, Weekly & Monthly - UPSC PDF Download

Insuring the future

Why in News?

The Insurance Regulatory and Development Authority of India (IRDAI), the apex regulator of insurance products, has asked companies to enable a wide demographic of citizens to benefit from health insurance. Most significantly, it directs insurance providers to make health insurance available to senior citizens, as those above 65 are currently barred from issuing new policies for themselves.

IRDAI Vision 2047

- Objective: The goal of 'Insurance for All by 2047' is to ensure that every individual has suitable life, health, and property insurance coverage, and every business is backed by appropriate insurance solutions.

- Pillars:

- Insurance customers (Policyholders)

- Insurance providers (insurers)

- Insurance distributors (intermediaries)

- Focus Areas:

- Making the right products available to the right customers

- Establishing a robust grievance redressal mechanism

- Facilitating ease of conducting business in the insurance sector

- Ensuring that the regulatory framework aligns with market dynamics

- Promoting innovation, competition, and distribution efficiencies while integrating technology and transitioning towards a principle-based regulatory system

- Significance:

- Enhanced accessibility to affordable insurance policies covering health, life, property, and accidents for households nationwide

- Quicker claim settlements, sometimes within hours

- Additional benefits like gym or yoga memberships

What is Bima Trinity?

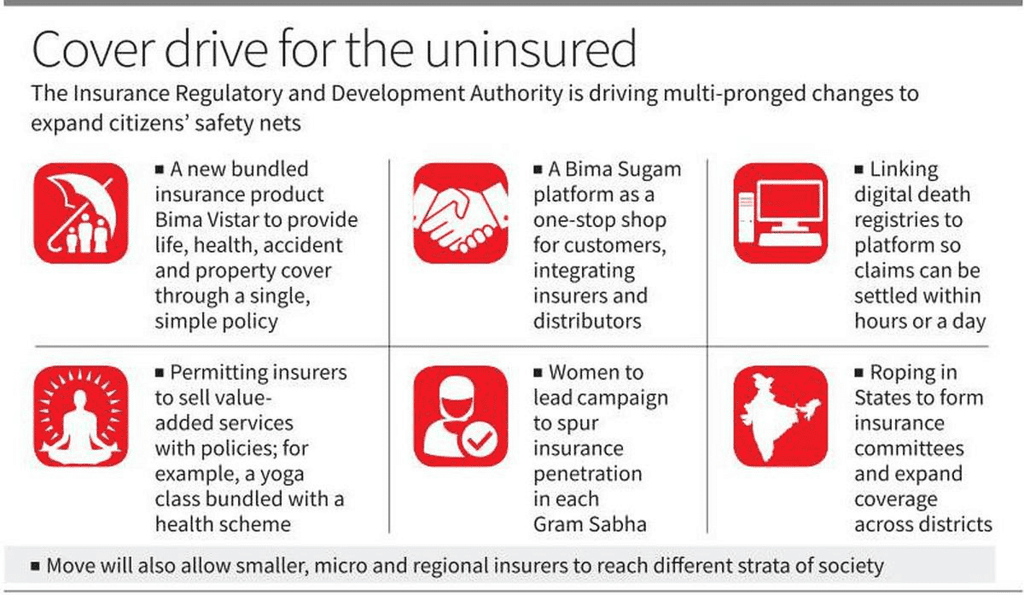

- Bima Sugam: A unified platform merging insurers and distributors to streamline policy purchases, service requests, and claims settlement for customers on a single convenient portal.

- Bima Vistar: A comprehensive bundled policy encompassing life, health, property, and accidents with specific benefits for each risk category, ensuring prompt claim payouts without the need for surveyors.

- Bima Vaahaks: A women-centric workforce operating at the Gram Sabha level, tasked with educating and persuading women about the advantages of comprehensive insurance, particularly Bima Vistar. By addressing concerns and highlighting benefits, Bima Vaahaks empower women and bolster their financial security.

What is the State of Insurance Sector in India?

- Insurance sector in India exhibits a dynamic landscape with evolving trends and emerging opportunities.

- Increasing awareness among the populace about the importance of insurance has led to a significant growth in the sector.

- Technological advancements have revolutionized insurance processes, making them more efficient and accessible to a wider audience.

- Government initiatives and policies have played a crucial role in promoting insurance penetration and financial inclusion across the country.

- According to the Economic Survey 2022-23, life insurance density in the country surged from USD 11.1 in 2001 to USD 91 in 2021. The global insurance premiums in 2021 experienced a 3.4% real terms increase, with the non-life insurance segment showing a 2.6% growth, fueled by rate hardening in commercial lines within developed markets.

- The Indian insurance market, as depicted in the Economic Survey 2022-23, is anticipated to evolve as one of the swiftest-growing markets globally over the next decade.

- As stated by the IRDAI, insurance penetration in India escalated from 3.76% in 2019-20 to 4.20% in 2020-21, showcasing an 11.70% growth rate. Furthermore, the insurance density saw an upsurge from USD 78 in 2020-21 to USD 91 in 2021-22.

- The life insurance penetration in 2021 stood at 3.2%, nearly twice the rate prevalent in emerging markets and slightly surpassing the global average.

- India currently holds the 10th position in the global market and is poised to climb to the 6th position by the year 2032.

What are the Challenges Related to Insurance Sector

- Insufficient Awareness: One of the key challenges in the insurance sector is the lack of awareness among the general population regarding the importance and benefits of insurance. This hampers the penetration of insurance products in the market, leaving individuals vulnerable in times of need.

- Complex Products: Insurance products often come with intricate terms and conditions that can be difficult for consumers to understand. This complexity can lead to misunderstandings, disputes, and dissatisfaction among policyholders.

- Fraudulent Activities: The insurance sector is susceptible to fraudulent activities, including false claims, misrepresentation of information, and scams. Such fraudulent practices not only harm the reputation of insurance companies but also lead to financial losses for both insurers and policyholders.

- Regulatory Changes: The insurance industry is subject to evolving regulations and compliance requirements. Adapting to these changes can be challenging for insurance companies, requiring them to invest resources in staying up-to-date with the latest legal frameworks.

Improving the Insurance Sector in India

- To enhance the insurance sector in India, various measures can be implemented:

- Leveraging Technology: Utilizing advanced technologies to streamline processes and improve services.

- Aligning with Customer Behavior: Understanding and adapting to changing customer preferences.

- Optimizing Data Usage: Making efficient use of data for decision-making and personalized services.

- Simplifying Claims Management: Streamlining the claims process for quicker resolutions.

- Adopting Hybrid Distribution Models: Integrating online and offline channels for better reach.

- Tackling Fraud: Implementing robust systems to detect and prevent fraudulent activities.

- Digitalization Priority:

- Emphasizing digitalization across the value chain to reduce costs and enhance efficiency.

- Supporting Ecosystem Development: Fostering an environment conducive to growth and innovation.

- Employee Upskilling: Enhancing employee skills and productivity through training programs.

- Customer-Centric Approach:

- Aligning with Changing Behavior: Adapting products and services to evolving customer needs.

- Personalized Offerings: Providing tailored insurance products for individual requirements.

- Flexibility Over Mass Offerings: Prioritizing flexibility and customization over generic offerings.

- Managing Perceptions: Building trust and meeting customer expectations effectively.

The document The Hindu Editorial Analysis- 24th April 2024 | Current Affairs & Hindu Analysis: Daily, Weekly & Monthly - UPSC is a part of the UPSC Course Current Affairs & Hindu Analysis: Daily, Weekly & Monthly.

All you need of UPSC at this link: UPSC

|

63 videos|5408 docs|1146 tests

|

Related Searches