The Hindu Editorial Analysis - 24th January 2024 | Current Affairs & Hindu Analysis: Daily, Weekly & Monthly - UPSC PDF Download

The Truth About India’s Booming Toy Exports

Why in News?

India’s toy industry, though small in scale, has been a significant topic in policy discussions spanning the era of the “permit license raj” to the current ‘Make in India’ initiative. According to a recent official press release, between 2014-15 and 2022-23, toy exports surged by 239%, while imports saw a decline of 52%, transforming India into a net exporter.

Further Studies on the Growth of India’s Toy Industry:

- An undisclosed case study sponsored by the Department for Promotion of Industry and Internal Trade (DPIIT) and conducted by the Indian Institute of Management Lucknow (IIM-L) attributes this export success to promotional efforts within the ‘Make in India’ framework, initiated since October 2014.

- While the detailed case study remains unpublished and not publicly available, we analyze official statistics to understand the potential factors behind the reported success.

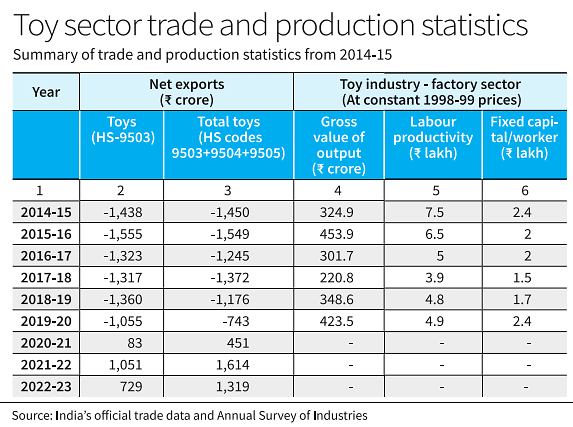

Kindly refer the table given below:

- Examining net exports (exports minus imports) of toys under HS code 9503 and total toys (HS codes 9503+9504+9505) in the table (columns 2 and 3), the trade balance was negative at ₹1,500 crore in 2014-15 but turned positive from 2020-21, marking a reversal after 23 years.

Possible Reasons Behind the Such Feats:

In essence, there are two potential reasons- protectionism or/ and a rise in investments.

Protectionism:

- An increase in import duties might decrease the demand for toys. The implementation of non-tariff barriers could constrict the supply, elevate prices, and consequently diminish demand.

- In February 2020, customs duty on toys (HS code 9503) experienced a threefold increase from 20% to 60%.

- Starting January 2021, non-tariff barriers (NTBs), including a quality control order (QCO) and mandatory sample testing for each import consignment, were introduced, limiting imports.

- Consequently, in the fiscal year 2020-21, imports decreased, leading to a positive shift in net exports. Additionally, considering the disruptive effects of the COVID-19 pandemic on global supply chains during this period, imports were adversely impacted.

- With the restoration of the global supply chain in 2022-23, net exports decreased to ₹1,319 crore from ₹1,614 crore in the preceding year for all toys, as exports moderated and imports surged.

- The decline in net exports is more pronounced (31%) for toys under HS code 9503 despite the high import duty, while it is comparatively more modest (18%) for all toys.

- Notably, in response to the renewed increase in imports, the government took further measures by raising the basic customs duty to 70% in March 2023, up from the previous rate of 60%.

Alternatively, an upswing in investments could expand capacity and enhance labor productivity, thereby boosting competitiveness and exports.

Using Data to Understand the Growth Story and Actual Reason Behind it:

Annual Survey of Industries (ASI):

Scrutinising the data from the Annual Survey of Industries (ASI) spanning the years 2014-15 to 2019-20 revealed that:

- According to the most recent combined figures available for the organized and unorganized sectors in 2015-16, the organized or factory sector constituted 1% of the total number of factories and enterprises.

- It employed 20% of the workforce, utilized 63% of fixed capital, and generated 77% of the total output value.

- Over the six-year period from 2014-15, the ASI data in real terms indicate a negligible increase in fixed capital per worker and gross output value.

- Significantly, labor productivity has consistently decreased from ₹7.5 lakh per worker in 2014-15 to ₹5 lakh in 2019-20 (more recent data is not available).

- Additionally, the growth in exports during the periods pre- and post-2014-15 does not exhibit notable differences.

- Therefore, it becomes challenging to attribute India’s transition to a net toy exporter to an improvement in domestic supply and competitiveness.

- Consequently, it can reasonably be inferred that the transformation in India’s toy trade since 2020-21 is a consequence of escalating protectionist measures.

Advocating Temporary Protectionism:

- Temporary protectionism, aligning with the infant industry argument, can potentially empower domestic industries to make substantial investments, facilitate experiential learning, and improve productivity, thereby enhancing their global competitiveness.

- This protective approach should be coupled with strategic investment policies and the provision of localized, industry-specific public infrastructure.

- This combination aims to initiate a positive cycle of expanding domestic capabilities to effectively confront international competition.

- However, without these essential prerequisites, there is a legitimate concern that protectionism might become deeply rooted in the industry, leading to what Anne Krueger famously termed as “rent-seeking.” India has witnessed past instances of such policy failures.

Conclusion:

In essence, the toy industry transitioned into a net exporter since 2020-21, purportedly facilitated by ‘Make in India’ policies, as suggested by an officially sponsored research. However, as per the available industry and trade data this shift is due to the imposition of increasing tariff and non-tariff barriers. It is possible that the study conducted by IIM-L relies on different evidence to support its argument which can be revealed only when the report is made public for a meaningful policy review.

The need to overhaul a semiconductor scheme

Why in News?

The mid-term appraisal of the semiconductor Design-Linked Incentive (DLI) scheme is due soon. Since its announcement, the DLI scheme has approved only seven start-ups, markedly short of its target of supporting 100 over five years. This impact assessment, therefore, presents an opportunity for policymakers to appraise and revamp the scheme.

Semiconductor manufacturing in India

- Invest India agency estimates electronics manufacturing to be worth $300 billion by 2025-26.

- While finished product facilities have been growing, fabs for chipsets and displays are rarer.

- Ministry of Electronics and Information Technology is set to announce the first semiconductor manufacturing fab soon.

- Semiconductor Industry Association (SIA) suggests India to leverage its strength in the electronics manufacturing value chain.

- Foundry companies require high investments while OSAT generate better margins.

- Outsourced Semiconductor Assembly and Test (OSAT) set-ups take care of less capital-intensive parts of chipmaking and run specialized tests.

- Many chip facilities tend to be captive units of large companies.

Importance of semiconductor manufacturing

- Semiconductor fabrication units turn raw elements like silicon into integrated circuits used in practically all electronic hardware.

- Fabs are highly capital-intensive undertakings costing billions of dollars for large facilities.

- Fabs require a highly reliable and high-quality supply of water, electricity, and insulation from the elements, reflecting the high degree of precision, cost, and capital needed to make sophisticated circuits.

- Countries have spotted strategic value in cornering segments of the value chain for fabs.

- China has pulled ahead of Taiwan last year in terms of global sales from fabs.

- The US passed the CHIPS Act to provide subsidies and investments to manufacturers opening fabs and making semiconductors in the US.

- US also pushed some restrictions and sanctions on the Chinese semiconductor industry.

India’s advantages in semiconductor manufacturing

- India has an advantage in semiconductor manufacturing as a large portion of semiconductor design engineers globally are either Indian or Indian-origin.

- Chipmaking firms such as Intel and NVIDIA have large facilities in India that are already flush with Indian talent working on design problems.

- China is losing control over this advantage in the face of sanctions and an ageing population.

- Experts believes that without a sustainable pipeline of high calibre talent, China’s goals for the semiconductor sector will not be achievable.

Various challenges

- Huge Investments involved: Semiconductor Fabrication facility requires many expensive devices to function. Complex tools and equipment are required to test quality and move silicon from location to location within the ultra-clean confines of the plant.

- Economy of scale: In semiconductor fabrication, a high volume of production is required to be maintain so as to meet the increasing demand of the marketplace, at the same time, a strong financial backing as Indian market is very much uncertain about financial fluctuations.

- Requirement highly skilled labour: Semiconductor fabrication is a multiple-step sequence of photolithographic and chemical processing steps during which electronic circuits are gradually created on a wafer made of pure semiconducting material. This actually requires high skills.

- Scarcity of raw materials: From a value-chain perspective, it needs silicon, Germanium & Gallium arsenide and Silicon carbide which are not available in India and needs to be imported.

- Uncertain Indian market: A semiconductor fabrication facility in India cannot independently rely on Indian customers for their entire sales structure. They have to maintain overseas customer base to balance inflections from Indian market due to market trends, government policies etc.

- Disposal of hazardous waste: Many toxic materials are used in the fabrication process such as arsenic, antimony, and phosphorus. Hazardous impact on the environment by the industry may act as an impediment to India’s commitment to mitigate climate change.

Policy initiatives in India

- Make in India:This aims to transform India into a global hub for Electronic System Design and Manufacturing (ESDM).

- PLI scheme:In December 2021 the Centre sanctioned ₹76,000 crore under the production-linked incentive (PLI) scheme to encourage the manufacturing of various semiconductor goods within India.

- DLI scheme:It offers financial incentives, design infrastructure support across various stages of development and deployment of semiconductor design for Integrated Circuits (ICs), Chipsets, System on Chips (SoCs), Systems & IP Cores and semiconductor linked design.

- Digital RISC-V (DIR-V) program: It intends to enable the production of microprocessors in India in the upcoming days achieving industry-grade silicon and design wins by December 2023.

- India Semiconductor Mission (ISM):The vision is to build a vibrant semiconductor and display design and innovation ecosystem to enable India’s emergence as a global hub for electronics manufacturing and design

Way forward

To ensure greater resilience in a volatile world, India needs to undertake the following measures to sustain the domestic and global semiconductor demand:

- Policy framework: As foundry setup is highly Capital intensive, it must be supported with a solid long term plan and financial backing. This backing is required from the entrepreneur & the government both.

- Fiscal sustenance: In text of Indian Government as tax holiday, subsidy, zero duty, financial investment etc. will play an important role in promoting the Fab along with the semiconductor industry in India; this will put further pressure on already large Fiscal Deficit.

- Support Infrastructure: World class, sustainable infrastructure, as required by a modern Fab be provided, with swift transportation, large quantity of pure water, uninterrupted electricity, communication, pollutant-free environment etc.

Conclusion

- India’s electronic manufacturing incentive programs are geared towards breaking new ground in ambitious plans connected to popular brands such as Apple.

- The Indian government is working to create an ecosystem that will facilitate sustainable growth and fiscal feasibility in the semiconductor industry.

- The electronics value chain must be an international undertaking among like-minded nations with common values to be effective.

|

38 videos|5288 docs|1117 tests

|

FAQs on The Hindu Editorial Analysis - 24th January 2024 - Current Affairs & Hindu Analysis: Daily, Weekly & Monthly - UPSC

| 1. What is the current status of India's toy exports? |  |

| 2. What is the significance of overhauling a semiconductor scheme? |  |

| 3. How can India's toy exports be improved? |  |

| 4. What are the challenges faced by India's toy exporters? |  |

| 5. What is the impact of India's booming toy exports on the domestic market? |  |