UPSC Exam > UPSC Notes > Current Affairs & Hindu Analysis: Daily, Weekly & Monthly > The Hindu Editorial Analysis- 28th October 2024

The Hindu Editorial Analysis- 28th October 2024 | Current Affairs & Hindu Analysis: Daily, Weekly & Monthly - UPSC PDF Download

Beyond Intoxication

Why in News?

A nine-judge Bench of the Supreme Court of India (SC), in an 8:1 decision, ruled that states have the authority to impose taxes not only on alcoholic beverages but also on 'industrial' alcohol.

- This decision expands states' revenue-generating capabilities, with significant implications for both taxation and federalism.

Background of the Dispute of Taxing Industrial Alcohol:

Background:

Why is the taxation of industrial alcohol controversial?

- Overlapping constitutional entries:

- The issue involved two entries in the Seventh Schedule of the Constitution.

- Entry 8 of List II (State List) allows states to control intoxicating liquors.

- Entry 52 of List I (Union List) gives the Centre the power to manage industries.

- Entry 33 of List III (Concurrent List) gives the Centre authority over any industry that Parliament decides is in the public interest.

- Centre claims its jurisdiction:

- The central government argues that industrial alcohol falls under its control because it is mentioned in the Industries (Development and Regulation) Act, 1951.

- This Act was enacted by Parliament based on the powers outlined in the Union and Concurrent Lists.

The SC’s Verdict on Taxing Industrial Alcohol

Main Question Before the Court:

- The court needed to decide if the term "intoxicating liquor" includes "industrial alcohol."

- States argued they should have the authority to control industrial alcohol due to its possible misuse in making illegal drinks.

Majority Opinion:

- The majority, led by Chief Justice of India (CJI) D Y Chandrachud and eight other justices, sided with the states.

- They stated that "intoxicating liquor" in Entry 8 of List II (State List) should be understood broadly, covering everything from making raw materials to consumption.

- The court confirmed that states have the right to tax both alcoholic drinks and industrial alcohol, as both can cause intoxication or health issues.

- The court rejected the Centre’s claim that industrial alcohol is under its control based on the 1951 Act.

Dissenting Opinion:

- Justice B V Nagarathna disagreed, believing the Centre should keep control over industrial alcohol.

- She argued that industrial alcohol should not be classified as intoxicating liquor, even if it can be misused.

- Her stance was that the Centre's control over industries, as stated in the 1951 Act, should prevent states from regulating industrial alcohol.

Implications of SC’s Verdict on Taxing Industrial Alcohol:

Overturned a Previous Judgment:

- The majority ruling changed the SC's 1990 decision in Synthetics & Chemicals Ltd vs State of Uttar Pradesh, which had said states could not tax industrial alcohol.

- The new ruling confirms that states can make laws to regulate and tax industrial alcohol, even though it is not for drinking.

Impact on States' Revenue:

- The court's decision will greatly affect state finances, as alcohol taxes are a major income source.

- For instance, Karnataka increased its Additional Excise Duty (AED) on Indian-made liquor by 20% in 2023.

- This ruling supports states' ability to manage this important source of revenue.

Federal Balance and Centre-State Relations:

- The ruling focused on the important balance of power between states and the central government.

- The majority pointed out that when constitutional powers overlap, the interpretation that maintains federal balance should be prioritized.

- In this situation, giving states authority over industrial alcohol helps keep that balance, preventing overlapping constitutional powers.

- This decision follows a similar ruling where an 8:1 majority upheld states' rights to charge fees on mineral extraction and tax the land where mines are located.

The Private Sector Holds the Icey to India's e-bus Push

Why in News?

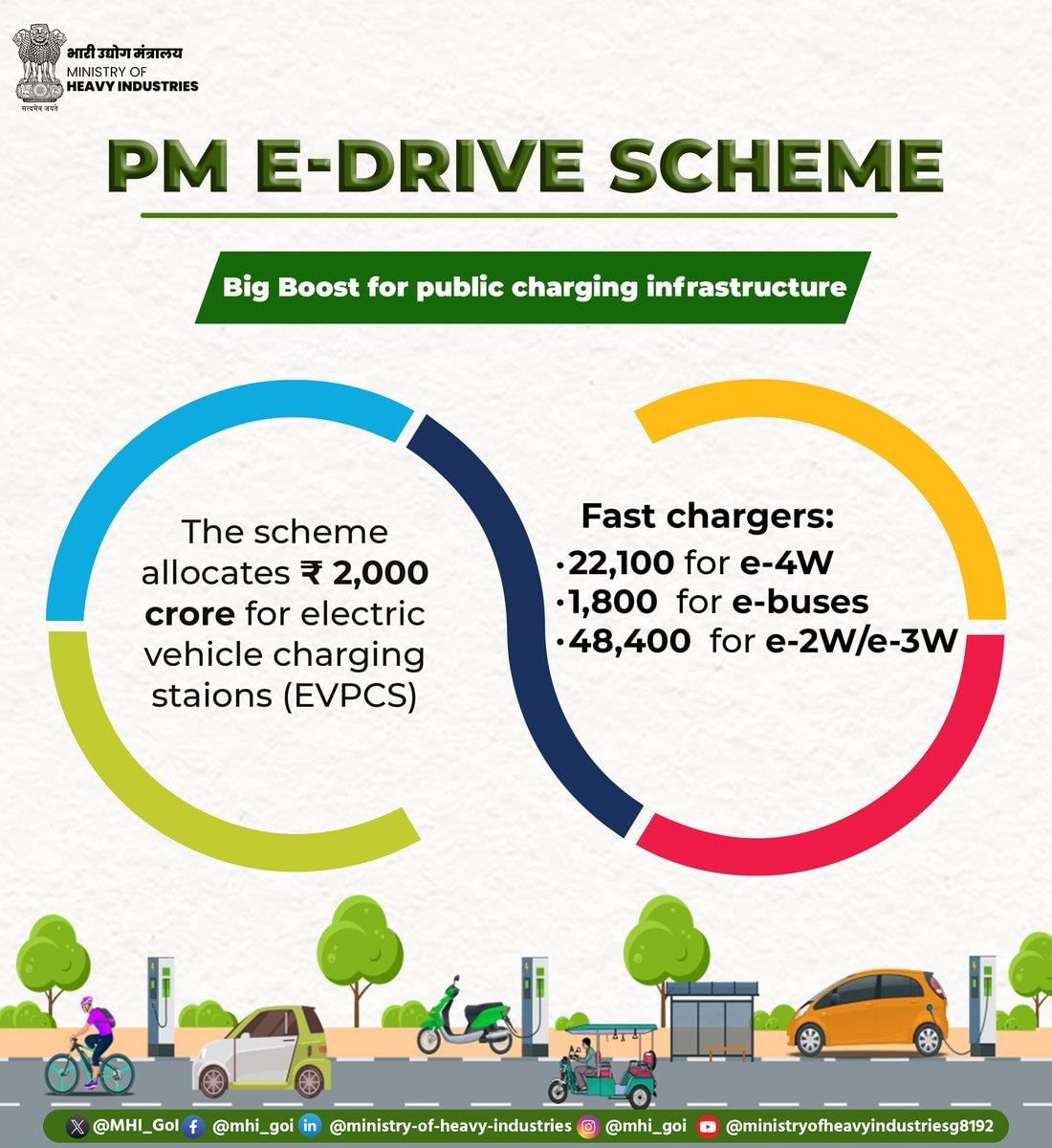

Recently, the Union Cabinet chaired by the Prime Minister India has approved the proposal of the Ministry of Heavy Industries (MHI) for implementation of a scheme titled 'PM E-DRIVE Scheme'.

About PM E-DRIVE Scheme:

The PM E-DRIVE scheme has a budget of Rs 10,900 crore for two years to promote electric mobility in India.

Components of the Scheme

- Subsidies and Demand Incentives: The scheme sets aside Rs 3,679 crore to encourage the purchase of electric two-wheelers (e-2Ws), three-wheelers (e-3Ws), electric ambulances, trucks, and other new types of electric vehicles.

- E-Vouchers for EV Buyers: Buyers of electric vehicles will receive an e-voucher under the scheme to access demand incentives. This e-voucher will be linked to their Aadhaar and sent to their registered mobile number after they make a purchase.

- E-Ambulance Deployment: A budget of Rs 500 crore is designated to introduce electric ambulances. This initiative aims to offer safe and eco-friendly transportation for patients. Performance and safety standards for these e-ambulances will be created in collaboration with the Ministry of Health and Family Welfare (MoHFW), Ministry of Road Transport and Highways (MoRTH), and other relevant parties.

- Incentives for E-Trucks: This component allocates Rs 500 crore to encourage the use of electric trucks, which significantly contribute to air pollution. Individuals with a scrapping certificate from authorized MoRTH Vehicle Scrapping Centres (RVSFs) will qualify for these incentives.

- Charging Infrastructure: To help reduce concerns about running out of power and to support the growth of electric vehicles, Rs 2,000 crore will be invested in setting up public charging stations (EVPCS) in cities with high electric vehicle usage and along selected highways.

The document The Hindu Editorial Analysis- 28th October 2024 | Current Affairs & Hindu Analysis: Daily, Weekly & Monthly - UPSC is a part of the UPSC Course Current Affairs & Hindu Analysis: Daily, Weekly & Monthly.

All you need of UPSC at this link: UPSC

|

38 videos|5264 docs|1112 tests

|

Related Searches