The Hindu Editorial Analysis- 2nd June 2025 | Current Affairs & Hindu Analysis: Daily, Weekly & Monthly - UPSC PDF Download

Regulating India’s Virtual Digital Assets Revolution

Why is it News?

There is a significant disparity between the reality of Virtual Digital Assets (VDAs) and the policies governing them, creating challenges for regulators and market participants.

According to the "Geography of Crypto" report by Chainalysis (2024), India has maintained its position as the leading country for grassroots crypto adoption for the second consecutive year. A report from the National Association of Software and Service Companies (NASSCOM) indicates that Indian retail investors invested $6.6 billion in crypto assets and anticipates that the industry will generate over eight lakh jobs by 2030. Additionally, India boasts one of the largest and rapidly growing communities of web3 developers.

Crypto's Resilience Amid Regulatory Challenges

- Surprising Growth. Despite the tumultuous journey of crypto (referred to as Virtual Digital Assets - VDA) within India's regulatory and policy framework, the market continues to thrive.

- Supreme Court Observation (May 2025). The Supreme Court of India expressed concerns regarding the lack of clear and comprehensive crypto regulation, emphasizing that "banning may be shutting your eyes to ground reality."

- Key Issue. This statement underscores the gap between the actual state of VDAs and the policies governing them, posing significant challenges for both regulators and market participants.

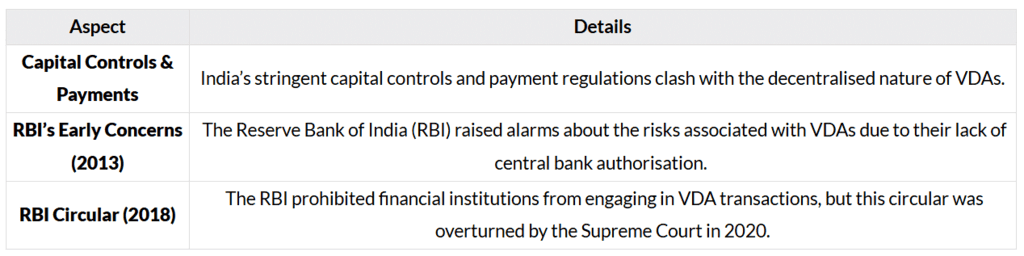

India's Struggles with Decentralised Virtual Digital Assets (VDAs)

Key Issues with Regulatory Framework

Government’s Tax Measures on VDAs (2022)

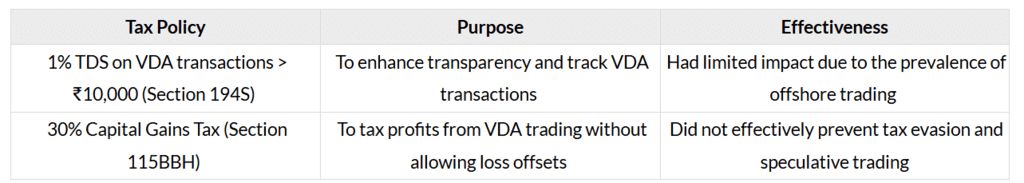

Impact of Offshore Trading & Regulatory Evasion

- Between July 2022 and December 2023, Indians engaged in over ₹1.03 trillion worth of trades on non-compliant offshore platforms.

- Domestic exchanges accounted for only 9% of the total ₹1.12 trillion in VDAs held.

- Offshore trading led to an estimated loss of ₹2,488 crore in uncollected tax revenue.

- From December 2023 to October 2024, offshore trades surged to ₹2.63 trillion.

- Since July 2022, uncollected TDS from offshore trades is projected to exceed ₹60 billion.

- Nine blocked exchanges contribute to over 60% of the offshore trade volume.

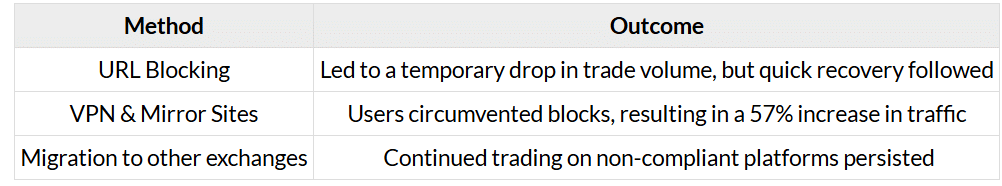

Attempts to Block Non-Compliant Platforms

Global Guidelines vs. India’s Current VDA Policy

Global Standards on VDA Regulation

- International Monetary Fund (IMF). Advocates for comprehensive, risk-based regulation that is aligned internationally.

- Financial Stability Board (FSB). Promotes harmonised regulatory frameworks to ensure financial stability.

- Financial Action Task Force (FATF). Emphasises the importance of anti-money laundering (AML) and counter-terror financing (CTF) controls.

These global frameworks rely on domestic, compliant intermediaries known as Virtual Asset Service Providers (VASPs). VASPs serve as crucial links between regulators and the VDA ecosystem, facilitating the enforcement of regulations, enhancing transparency, and providing insights into real-world challenges.

India’s Policy Challenges

- India’s existing policies inadvertently push VDA users towards offshore, non-compliant platforms.

- This shift undermines India’s ability to manage risks associated with VDAs and results in significant losses in tax revenue.

Indian VASPs: Growing Stronger and More Responsible

Development

- Closer collaboration with Financial Intelligence Unit (FIU-India). This partnership has led to enhanced anti-money laundering (AML) and counter-terror financing (CTF) controls, earning recognition from the Financial Action Task Force (FATF).

- Response to 2024 $230 million hack. In the wake of this significant security breach, exchanges have taken substantial measures to bolster cybersecurity. These include the establishment of insurance funds and the formulation of industry-wide security guidelines.

- Maturity & Compliance. Indian VASPs are demonstrating a growing willingness to adhere to regulations and act in good faith, reflecting an evolution towards greater responsibility and accountability.

Need for a Framework

VASPs are essential for building a safer digital asset environment. They not only support national value creation and economic growth but also provide a more reliable way for funds to flow under Indian regulatory oversight. The current scenario, where taxes are imposed without clear regulations, needs to be addressed. India requires a balanced, practical, and forward-looking regulatory framework. Urgent measures are necessary to establish comprehensive laws that foster the crypto industry while mitigating risks.

Conclusion

India’s thriving crypto sector underscores the critical need for clear and balanced regulations. While grassroots adoption and the efforts of VASPs drive growth and innovation, existing policies are pushing users towards offshore platforms, leading to potential tax losses and weakened oversight. To safeguard investors and the broader economy, India must implement pragmatic and future-oriented laws that promote industry growth while effectively managing associated risks.

A Sinking Feeling for ‘Brand Bengaluru’

Why is it in the News?

There is a lack of attention towards the issues arising from Bengaluru's rapid 'growth'.

Long-time residents of Bengaluru are feeling overwhelmed by the simultaneous developments in the city. Plans are underway to extend the Namma Metro to surrounding cities, and work has commenced on a suburban rail network. The State government is advocating for a controversial tunnel road network to connect congested areas. Additionally, the city's civic body, the Bruhat Bengaluru Mahanagara Palike (BBMP), is being divided into several corporations in the hope of better management.

Overlooked Existing Issues Amidst New Initiatives

While these projects aim for Bengaluru's future growth, the present problems resulting from the city's rapid expansion are being neglected.

- Severe rain exposes the underlying issues of Bengaluru, where motorists are trapped on flooded roads and residential areas face inundation.

- Families impacted by incidents like submerged underpasses or fallen trees feel exasperated as government assurances seem repetitive.

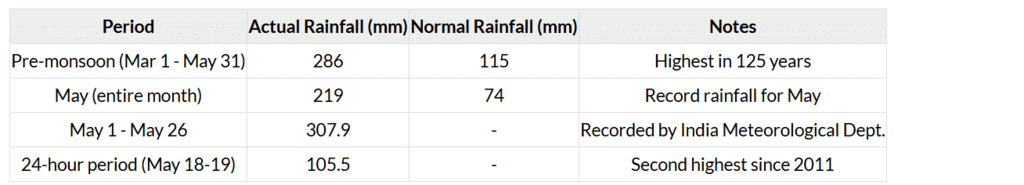

Record-Breaking Rainfall in 2025

Despite preparations for the monsoon, authorities were caught off guard by the intense rainfall.

Increasing Frequency of Severe Weather Events

Extreme weather events are occurring more frequently and with greater intensity worldwide. Bengaluru has faced significant flooding in the years 2015, 2017, 2020, and 2022. Additionally, Karnataka experienced a drought in 2023, leading to a water crisis in 2024.

Neglected Lakes and Rivers

Bengaluru was once home to a vast network of lakes that played a crucial role in flood control by storing excess rainwater. However, as the city expanded, the focus shifted to sourcing water from the Cauvery river. Many lakes were destroyed to make way for real estate developments, stadiums, and bus stands. Rivers such as the Vrushabhavathy remain neglected and polluted.

Inadequate Flood Mitigation Efforts

In 2024, treated water was introduced to some lakes to enhance groundwater levels during the water crisis. However, by the monsoon of 2025, 63 out of 183 lakes under BBMP were already at full capacity, raising concerns about the effectiveness of the city’s flood barriers.

Drainage Problems

Drains in the city are clogged with silt and sewage, which significantly reduces their capacity to handle rainwater. This leads to severe waterlogging on streets. The Karnataka Lokayukta conducted an investigation and found:

- Negligence on the part of officials

- Poor coordination among different agencies

As a result, the Lokayukta issued orders to:

- Expedite the de-silting of drains

- Ensure that drains have an appropriate slope to facilitate water flow

- Remove all encroachments that are blocking the drains

Administrative Changes and Concerns

The Greater Bengaluru Authority (GBA) is set to replace BBMP as the primary governing body for the city. GBA will consolidate all major agencies under one leadership, with the Chief Minister of Karnataka at the helm. However, some activists express concerns that this centralization may lead to a reduction in local control and decision-making power.

Conclusion

The effectiveness of this administrative change in managing the city, particularly in the face of increasing extreme weather events, remains uncertain. If the focus continues to be on extravagant projects rather than addressing core issues, residents may continue to face the same challenges. At this point, it is too early to predict the outcomes.

|

63 videos|5408 docs|1146 tests

|

FAQs on The Hindu Editorial Analysis- 2nd June 2025 - Current Affairs & Hindu Analysis: Daily, Weekly & Monthly - UPSC

| 1. What are virtual digital assets and how are they regulated in India? |  |

| 2. What challenges does India face in regulating virtual digital assets? |  |

| 3. How does the regulation of virtual digital assets impact the tech ecosystem in Bengaluru? |  |

| 4. What steps can the Indian government take to improve the regulation of virtual digital assets? |  |

| 5. What are the potential economic implications of regulating virtual digital assets in India? |  |