UPSC Daily Current Affairs- 26th September 2023 | Current Affairs & Hindu Analysis: Daily, Weekly & Monthly PDF Download

GS-I

Sarcophagus

Subject: Art and Culture

Why in News?

Archaeologists in Gaza unearth large cemetery containing rare lead sarcophagi.

About Sarcophagus:

- It is an above-ground stone container for a coffin or dead body that often is often decorated with art, inscriptions, and carvings.

- The word sarcophagus comes from the Greek "sarx" meaning "flesh," and "phagien" meaning "to eat," so that sarcophagus literally translates as "eater of flesh."

- First used in Ancient Egypt and Ancient Greece, the sarcophagus gradually became popular throughout the ancient world.

- It carried over through the later years of European society, often used for high status members of the clergy, government, or aristocracy.

- Features:

- They differ in detail from one culture to another.

- They are almost always made of stone, limestone being the most popular, but sometimes of granite, sandstone, or marble.

- They were usually made by being carved, decorated, or constructed ornately.

- Some were built to be freestanding above ground, as a part of an elaborate tomb or tombs. Others were made for burial, or were placed in crypts.

- Archaeological Significance:

- Sarcophagi are important artifacts for archaeologists and historians because they provide insights into the art, culture, and beliefs of the societies that created them.

- The carvings and inscriptions on sarcophagi often contain valuable historical information.

- Example: The most famous Egyptian sarcophagus is perhaps the golden sarcophagus of King Tutankhamun.

Source: Newsonair

How Indians and their Boats fared in the Deep Sea?

Subject: Geography

Why in News?

A groundbreaking 21-meter-long ship, constructed using an age-old technique of stitching wooden planks with ropes, cords, coconut fibers, natural resins, and oils, is scheduled to embark ‘Baliyatra’ from Odisha to Bali, Indonesia.

- The initiative, led by the Govt. of India, aims to rekindle the nation’s rich maritime tradition and heritage.

- This remarkable journey will be manned by a crew from the Indian Navy.

Early Evidence of Maritime Trade

- Ancient Maritime Trade: The presence of maritime trade networks dating back to circa 3300-1300 BCE is supported by evidence from the Indus Valley, Mesopotamia, and coastal sites along the Arabian Sea. The engineering marvel of the dock at Lothal in Gujarat stands as a testament to the Indus civilization’s profound understanding of tides and winds.

- Historical Accounts: Ancient texts, including the Vedas (circa 1500-500 BCE), contain vivid accounts of seafaring adventures and the associated risks. Furthermore, the Jataka Tales (circa 300 BCE-400 CE) and Tamil Sangam literature (circa 300 BCE-300 CE) provide explicit references to maritime activities.

Challenges in Recognizing Maritime Heritage

- Historiographical Biases: Historians have often marginalized India’s maritime heritage in favor of narratives centered on land-based polities. This bias has led to the neglect of India’s maritime contributions.

- Emergence of Deep-Sea Voyages: The 1st century BCE witnessed intensified mid-ocean voyages driven by the Roman Empire’s demand for Eastern commodities, which harnessed monsoon winds and marked a significant turning point in maritime activity.

Ancient Indian Boats and Shipbuilding

- Limited Knowledge: The field of marine archaeology in India remains at an early stage of development, with primary insights derived from boat-building traditions, artistic depictions, and literary sources.

- Traditional Boat-Building Techniques: Indian boat construction traditions favor stitching planks of wood together instead of using nails. These traditions encompass coir-stitched, jong (Southeast Asian), and Austronesian methods, each employing various stitching techniques.

- Wood Selection: Selection of wood types for shipbuilding depended on their suitability for specific ship components. Mangrove wood excelled in creating sturdy dowels, while teak was preferred for planks, keels, stem, and stern posts.

India’s Role in Maritime Trade

- Trade Lake of the Indian Ocean: By the Common Era, the Indian Ocean had evolved into a thriving trade network, with India positioned at its heart. This network facilitated trade connections between India and Europe via the Middle East and Africa in the west, as well as Southeast Asia, China, and Malaysia in the east.

- Evidence of Scale: Estimates indicate the colossal scale of trade, with customs taxes collected from the Red Sea trade route alone contributing significantly to the Roman exchequer.

Uncovering a Hidden Past

- Ongoing Exploration: Recent excavations have provided substantial insights into India’s maritime history. Nevertheless, experts acknowledge that numerous discoveries await on this journey of exploration.

- Need for Investment: Marine archaeology in India requires increased funding and recognition to unlock its full potential and contribute meaningfully to humanity’s understanding of the past.

- Value of Knowledge: Scientific archaeology’s pursuit of India’s deep maritime past offers the potential for immense benefits to humanity. Engaging with this history challenges conventional narratives and represents a subversive yet essential endeavor.

Conclusion

- The forthcoming voyage of the stitched ship symbolizes India’s dedicated efforts to rejuvenate its maritime heritage, shedding light on the forgotten history of Indian seafarers and their remarkable vessels.

- Through exploration and study, India seeks to restore the rightful place of its maritime legacy in the annals of history.

Source: Indian Express

Southwest Monsoon begins early Withdrawal/Retreat

Subject: Geography

Why in News?

India Meteorological Department (IMD) has announced withdrawal of the monsoon.

What is Monsoon Withdrawal/Retreat?

- In India, retreating monsoon is the withdrawal of south-west monsoon winds from North India.

- The withdrawal is gradual and takes about three months.

- With the retreat of the monsoons, the clouds disappear and the sky becomes clear. The day temperature starts falling steeply.

- Monsoon rains weaken all over India except few southeastern states.

- It is helpful in Rabi crop cultivation.

Factors affecting the retreat

Two predominant factors cause the phenomenon:

(1) Land topography

- First, the low mountain range in each region runs from north to south, shielding it from west-bound winds that trigger summer monsoon.

- After summer, the range aids in the ‘orographic lift’ or rising of east-bound air mass from a lower to higher elevation, forming clouds and resulting in rain.

(2) Atmospheric convection

- The second factor is atmospheric convection or vertical movement of air.

- As the earth is heated by the sun, different surfaces absorb different amounts of energy and convection may occur where the surface heats up very rapidly.

- As the surface warms, it heats the overlying air, which gradually becomes less dense than the surrounding air and begins to rise.

- This condition is more favorable from September to February because of the role played by sea surface temperature or water temperature.

Immediate factors influencing withdrawal

- The withdrawal of the monsoon is based on meteorological conditions such as-

- Anti-cyclonic circulation (dry air that is the opposite of a cyclone)

- Absence of rain in the past five days and

- Dry weather conditions over the region

When does it occur?

- The monsoon withdrawal is a long-drawn process and extends into mid-October, though the IMD considers September 30 to be the final day of the season over India.

- The rain after that is categorised as “post-monsoon” rainfall.

Source: The Hindu

GS-II

Five Eyes Alliance

Subject: International Realations

Why in News?

Recently US ambassador to Canada has claimed that “shared intelligence among Five Eyes partners” had informed Prime Minister of the possible involvement of Indian agents in the killing of Khalistan separatist.

About Five Eyes Alliance:

- Est: Post-World War II

- Members states: Australia, Canada, New Zealand, the United Kingdom, and the United States.

- The term “Five Eyes” refers to the five countries’ collective efforts to gather and share signals intelligence (SIGINT) to address common security threats and challenges.

- Objectives:

- Intelligence Sharing: The alliance members collaborate to share signals intelligence, which includes intercepted communications and electronic data, to enhance their collective understanding of global security threats.

- Counterterrorism and National Security: The Five Eyes network focuses on countering terrorism and addressing other national security concerns by exchanging vital intelligence and cooperating on joint operations.

- Cybersecurity and Cyber Threats: Given the growing significance of cyber threats, the alliance works together to monitor and address cyber activities from adversarial nations and non-state actors.

- Information and Technology Sharing: The Five Eyes partners share expertise and technological advancements in the field of intelligence gathering, analysis, and cryptography.

Source: Indian Express

Pradhan Mantri Matsya Sampada Yojana (PMMSY)

Subject: Governance

Why in News?

The Department of Fisheries is installing artificial reef units for coastal states as a sub-activity under ‘Integrated Modern Coastal Fishing Villages’ of Pradhan Mantri Matsya Sampada Yojana (PMMSY).

About Artificial Reefs:

- An artificial reef is a human-made underwater structure that substitutes as a natural reef to form a habitat for marine life.

- They are placed in areas where there is little bottom topography or near coral reefs to attract marine populations.

- They serve to protect coral reefs from human-induced damages as well as supporting biodiversity and healthy ecosystems.

About Pradhan Mantri Matsya Sampada Yojana (PMMSY):

- It is a flagship scheme for focused and sustainable development of the fisheries sector to be implemented from 2020-21 to 2024-25

- Ministry: Fisheries, Animal Husbandry and Dairying

- Objectives:

- To bring about a blue revolution through sustainable and responsible development of the fisheries sector in India.

- To double the incomes of fishers and fish farmers, reducing post-harvest losses from 20-25% to about 10% and the generation of employment opportunities in the sector.

- Implementation: It is implemented as an umbrella scheme with two separate components Central Sector Scheme and Centrally Sponsored Scheme.

- North Eastern & Himalayan States: 90% Central share and 10% State share.

- Other States: 60% Central share and 40% State share.

- Achievements:

- As of 2023, under PMMSY, projects worth Rs 14,654.67 crore have been approved from 2020-21 to 2022-23.

- The fish production reached an all-time high of 25 MMT during FY 2021-22 with marine exports touching Rs. 57,586 Crores.

Source: PIB

GS-III

Climate finance must get beyond greenwishing and greenwashing

Subject: Economy

Why in News?

As we move from UN Climate Week to CoP-28, we need to stop ‘greenwishing’ and ‘greenwashing’ and start thinking about the instruments that will enable the private sector to channel more capital toward climate resilience and sustainable development.

About “The Three Greens”: Greenwashing, Greenwishing, and Greenhushing

- Greenwashing: Greenwashing refers to the deceptive practice of making false or exaggerated claims about the environmental friendliness of a company’s products, services, or practices.

- Example: Starbucks introduces straw-less lid citing it will help reduce environmental footprint.

- However, it contained more plastic than the old lid and straw combined together.

- Greenwishing: It refers to organisations expressing a desire to be more environmentally responsible without taking concrete actions to achieve those goals.

- It’s like making a wish for sustainability without any tangible actions directed in the required direction.

- Greenhushing: It implies a situation where an organisation intentionally downplays their positive environmental achievements.

- It might involve not publicising sustainable practices for various reasons, such as modesty, fear of criticism, or reducing external communication.

About Climate Finance and its significance:

- Climate finance refers to local, national or transnational financing—drawn from public, private and alternative sources of financing—that seeks to support mitigation and adaptation actions that will address climate change.

- The Convention, the Kyoto Protocol and the Paris Agreement call for financial assistance from Parties with more financial resources to those that are less endowed and more vulnerable.

- It is critical to addressing climate change because large-scale investments are required to significantly reduce emissions, notably in sectors that emit large quantities of greenhouse gases.

Need for practical and accessible investment solutions to fight climate change:

- Climate change affects all living beings: It is impacting both poor and rich countries, creating an urgent need for broad-based resilience and adaptation strategies.

- Potential of private sector resources: Scalable solutions require substantial commitments from the private sector, with many current climate-centric investments being illiquid and tightly wound up in private-equity funds.

- Inclusion of ordinary investors: Many current climate investments are inaccessible to ordinary investors and savers who are the most exposed to climate-driven food, water, and energy insecurity.

- Requirement of diversified solutions: Diversified, liquid, and profitable investment solutions like ETFs in climate-resilient sectors can mobilize capital effectively and are essential for inclusivity, including the unbanked global population.

Challenges associated with the climate finance:

- Unachieved goals: The UNFCCC Standing Committee on Finance (SCF) released a report on the progress made by developed countries towards achieving the goal of mobilising $100 billion per year.

- According to the report, it is widely accepted that:

- The $100 billion goal has not been achieved in 2020, and an earlier effort to mobilise private finance by the developed countries has met with comprehensive failure.

- Demands of developing countries: Developing countries have for a long time insisted that a significant portion of climate finance should come from public funds as private finance will not address their needs and priorities especially related to adaptation.

- Climate finance already remains skewed towards mitigation and flows towards bankable projects with clear revenue streams.

- Private climate finance: The OECD 2020 data shows that the mobilisation of private climate finance has underperformed against the expectations of developed countries.

- Many investors associate climate-centric investments with ‘social impact’ and reduced profitability.

- Contradictory claims: Many developed countries and multilateral development banks have emphasised the importance of private finance mobilised in their climate finance strategies, including by de-risking and creating enabling environments.

- According to the reports, these efforts have not yielded results at the scale required to tap into the significant potential for investments by the private sector and deliver on developed countries’ climate ambition.

- According to the report, it is widely accepted that:

Way Forward: Suggestive measures

- Need of significant private-sector resources: While the public sector has an important role to play in climate financing, scalable solutions require significant commitments of private-sector resources.

- CoP-28 offers an opportunity to rethink how we deliver such market solutions, and how we can harness digital innovation to scale up promising models.

- Mobilising capital: The solution is to create climate investments that are profitable, liquid and accessible to all.

- To mobilize capital at scale, we must draw on the global savings of individual investors as well as institutions such as pension funds, insurers, and sovereign funds.

- Seeking for reliable returns: Carefully selected Real Estate Investment Trusts (REITs) and exposure to greenfield developments through ETFs are two ways to secure reliable returns from climate-adaptation efforts.

- Green commodities: An orderly transition to a more resilient future requires massive investments not only in energy, food and water assets, but also in the metals and critical minerals used in renewable energy and electric vehicles (EVs).

- These include commodities such as soy, wheat, copper, rare-earth elements, cobalt, lithium, and so forth.

- Climate-aligned portfolio: A climate-aligned portfolio should include assets that provide a hedge against inflation and geo-economic risks, such as short-term and inflation-indexed sovereign bonds and gold.

- Greater investments in inflation-proof sovereign assets will allow governments to do more to finance the green transition.

Source: Mint

Polyethylene Terephthalate (PET)

Subject: Science and Technology

Why in News?

Newly discovered deep-sea enzyme breaks down PET plastic.

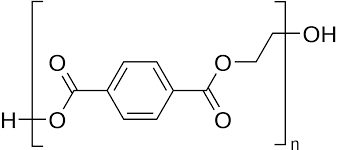

About Polyethylene Terephthalate (PET):

- It is the most commonly used thermoplastic polymer in the world.

- It belongs to the family of polyesters.

- Production:

- PET is produced by the polymerization of ethylene glycol and terephthalic acid.

- When heated together under the influence of chemical catalysts, ethylene glycol and terephthalic acid produce PET in the form of a molten, viscous mass that can be spun directly to fibres or solidified for later processing as plastic.

- Properties:

- It is highly flexible, colorless and semi-crystalline resin in its natural state.

- It shows good dimensional stability, resistance to impact, moisture, alcohols and solvents.

- It exhibits excellent electrical insulating properties.

- It is very lightweight, which reduces transportation costs.

- It has good gas (oxygen, carbon dioxide) and moisture barrier properties.

- It is recyclable. It can be commercially recycled by thorough washing and re-melting, or by chemically breaking it down to its component materials to make new PET resin.

- Applications:

- It is widely used for packaging foods and beverages, especially convenience-sized soft drinks, juices and water.

- The polymer finds use in fabrics, and the textile industry.

- It is also used in films to mold parts for automotive, electronics, etc.

- PET's insulating properties and resistance to moisture make it suitable for various electrical and electronic components, such as insulation for electrical wires and connectors.

Source: The Hindu

RBI asks for SARFAESI Act Compliance

Subject: Economy

Why in News?

The RBI has issued a directive requiring commercial banks and Non-Banking Financial Companies (NBFCs), collectively referred to as Regulated Entities (REs), to disclose borrower information.

- This disclosure pertains to borrowers whose secured assets have been repossessed under the Securitisation and Reconstruction of Financial Assets and Enforcement of Securities Interest Act, 2002 (SARFAESI Act).

What is the SARFAESI Act?

- Objective: The SARFAESI Act, introduced in 2002, is formally known as the Securitisation and Reconstruction of Financial Assets and Enforcement of Securities Interest Act. Its primary objective is to protect financial institutions against loan defaults.

- Empowering Banks: The Act empowers banks to seize, manage, or sell securities pledged as collateral for loans, facilitating the recovery of bad debts without the need for court intervention.

- Broad Application: The SARFAESI Act applies nationwide and covers all types of assets, whether movable or immovable, provided as security to lenders.

Aim of the SARFAESI Act

The SARFAESI Act serves two key purposes:

- Efficient NPA Recovery: It streamlines and expedites the recovery of non-performing assets (NPAs) for financial institutions and banks.

- Asset Auction: It enables financial organizations and banks to auction residential and commercial assets in cases of borrower default.

Why was such a Law needed?

- Pre-SARFAESI Era: Before the enactment of the SARFAESI Act in December 2002, financial institutions and banks faced complex procedures for recovering bad debts.

- Legal Complexity: Lenders had to navigate legal complexities, resorting to civil courts or designated tribunals to secure ‘security interests’ for recovering defaulted loans, resulting in slow and cumbersome debt recovery.

Powers Granted to Banks under the Law

- Default Trigger: The SARFAESI Act comes into play when a borrower defaults on payments for more than six months.

- Notice Period: The lender is required to issue a notice to the borrower, providing them with a 60-day window to clear their outstanding dues.

- Asset Possession: If the borrower fails to comply within the stipulated period, the financial institution gains the right to take possession of the secured assets and manage, transfer, or sell them.

- Appellate Avenue: The defaulter has the option to appeal to an appellate authority established under the law within 30 days of receiving a notice from the lender.

SARFAESI Act: Applicability

The SARFAESI Act primarily deals with various legal aspects related to:

- Registration of asset reconstruction companies.

- Acquisition of rights or interest in financial assets.

- Measures for asset reconstruction.

- Resolution of disputes.

Source: The Hindu

|

38 videos|5288 docs|1117 tests

|