UPSC Daily Current Affairs - 28th January 2023 | Current Affairs & Hindu Analysis: Daily, Weekly & Monthly PDF Download

GS-I

Benchmark Price’ for Minor millets

Context

Considering the increase in the cultivation of millets, the Centre may soon announce a benchmark price for minor millets produced in various States. The Centre said it would help States to procure and distribute millets through the public distribution system.

- At present, millets such as jowar, bajra and ragi are procured by nine States with the minimum support price announced by the Centre.

- Minor millets are not procured at the moment.

About Minor Millets:

- The minor millets comprise of proso millet (Panicum miliaceum), foxtail millet or (Setariaitalica), little millet (Panicum sumatrense), barnyard millet (Echinochloa colona) and Kodo millet (Paspalum scrobiculatum).

- Minor millets are high energy, nutritious foods comparable to other cereals and some of them are even better with regard to protein and mineral content.

- They are particularly low in phytic acid and rich in dietary fibre, iron, calcium and B vitamins.

- With proper preparation, 30 per cent of minor millets can be gainfully substituted in value added foods belonging to the categories of traditional foods, bakery products, extruded foods and allied mixes for the convenient preparation by rural and town folk at low cost.

- Poroso millet flour is used as a substitute for rice flour in various snack foods.

- Traditionally, finger, Kodo and Poroso millets are brewed by tribal in certain parts of India.

- Popping of finger millet is done on cottage industry level and the popped meal is marketed in polyethylene pouches.

Source: The Hindu

Lakshwadeep Islands

Context

In Lakshadweep, pomp and gaiety marked the Republic Day celebrations in the ten inhabited islands in the archipelago, where people participated in large numbers.

Lakshadweep Islands

- India’s smallest Union Territory Lakshadweep is an archipelago consisting of 36 islands with an area of 32 sq km

- It is known for its exotic and sun-kissed beaches and lush green landscape.

- The name Lakshadweep in Malayalam and Sanskrit means ‘a hundred thousand islands’.

- It is a uni-district Union Territory and the islands were constituted a union territory in 1956.

- It comprises of 12 atolls, three reefs, five submerged banks and ten inhabited islands.

- The principal islands in the territory are Minicoy and those in the Amindivi group.

- The easternmost island lies about 185 miles (300 km) from the coast of the state of Kerala. Ten of the islands are inhabited.

- Capital – Kavaratti

- Aside from an abundance of coconut palms, common trees include banyans, casuarinas, pandani (screw pines), breadfruits, tamarinds, and tropical almonds (genus Terminalia). Betel nut and betel leaf also grow in the islands.

- Among the most notable marine fauna are sharks, bonitos, tunas, snappers, and flying fish. Manta rays, octopuses, crabs, turtles, and assorted gastropods are plentiful. The islands also are home to an array of water birds, such as herons, teals, and gulls.

Climate

- Lakshadweep has a tropical climate and it has an average temperature of 27° C – 32° C.

- April and May are the hottest. Generally the climate is humid warm and pleasant.

- October to March is the ideal time to be on the islands.

- From June to October the South West Monsoon is active with an average rainfall of 10-40 mm.

- Winds are light to moderate from October to March.

Fauna & Flora

- Includes Banana, Vazha,(Musaparadisiaca), Colocassia, Chambu (Colocassia antiquarum) Drumstic moringakkai, wild almond

- Shrubs – Kanni, Punna, Chavok, Cheerani

- Coconut, Thenga – only crop of economic importance in Lakshadweep.

- Sea grass – Thalassia hemprichin and Cymodocea isoetifolia. They prevent sea erosion and movement of the beach sediments.

- The commonly seen vertebrates are cattle and poultry.

- Oceanic birds – Tharathasi and Karifetu (Anous solidus).

- Molluscan forms are also important from the economic point of the islands.

Culture & Heritage

- Kolkali and Parichakali are the two popular folk art forms in the Territory.

- They are an integral part of the cultural milieu except in Minicoy where “LAVA” is the most popular dance form.

- Some of the folk dances have a resemblance with those in North Eastern India.

- For marriages “OPPANA” is a common feature, a song sung by a lead singer and followed by a group of women.

Demography

- As per details from Census 2011, Lakshadweep has population of 64 Thousands of which male and female are 33,123 and 31,350 respectively

- The total population growth in this decade was 6.30 percent while in previous decade it was 17.19 percent.

Source: Newsonair

GS-II

What is the Indus Water Treaty?

Context

India recently issued a notice to Pakistan for modification of the Indus Waters Treaty (IWT).

About Indus Water Treaty:

- It was signed in September 1960 between India and Pakistan.

- The treaty was brokered by the World Bank, which too is a signatory to the treaty.

- The treaty fixed and delimited the rights and obligations of both countries concerning the use of the waters of the Indus River system.

- It gives control over the waters of the three "eastern rivers' -- the Beas, Ravi, and Sutlej -- to India, while control over the waters of the three "western rivers' ' -- the Indus, Chenab, and Jhelum -- to Pakistan.

- The treaty allows India to use the western river waters for limited irrigation use and unlimited non-consumptive use for such applications as power generation, navigation, floating of property, fish culture, etc.

- It lays down detailed regulations for India in building projects over the western rivers.

Source: The Hindu

MSMEs for a Resilient Global Supply Chain

Context

Recently, the Union Ministry of Commerce and Industry, Consumer Affairs, Food and Public Distribution and Textiles held the fourth Plenary Session of B20 India Inception Meeting on Building Resilient Global Value Chains in Gandhinagar, Gujrat.

About MSMEs:

- MSMEs or Micro, Small, and Medium Enterprises are businesses that are defined by their investment and turnover levels. They are considered an important sector of the economy as they create jobs, generate income, and promote entrepreneurship.

Classification of MSMEs:

- Based on their Investment and turnover levels:

- Based on the nature of activities and sectors

- Manufacturing Enterprise: Manufacturing of goods pertaining to any industry specified in the first schedule of the industries (Development and Regulation) Act, 1951

- Service Enterprise: Providing or rendering of services and covered under ‘Services’ sector as defined in the Micro, Small and Medium Enterprises Development (MSMED) Act, 2006.

Advantages of MSMEs: MSMEs play a crucial role in the global value chain and their support and integration is vital for a resilient global supply chain.

- MSMEs flourish around a larger unit or anchor, an example given is that when a large company such as Apple sets up a manufacturing plant, thousands of MSME units flourish in the ecosystem as mini value chain suppliers to Apple.

- Diversification: MSMEs can help diversify an economy by creating new industries and markets.

- Regional development: These are often based in specific regions, which can promote development in those areas.

- Flexibility: MSMEs have more flexibility than larger companies in terms of decision-making and the ability to pivot their business models.

- Economic development: They play a crucial role in the economic development of a country by providing goods and services, generating income, and creating opportunities for people to improve their standard of living.

- Innovation: These are often more adaptable and innovative than larger companies, which can lead to new products, processes, and business models.

- Reduced risk: MSMEs typically have lower startup costs and are less risky investments than larger companies.

- Lower regulatory burden: MSMEs typically have to navigate fewer regulations than larger companies, making it easier for them to start and operate their business.

- Easier access to credit: They have easier access to credit than larger companies.

Issues associated with the MSMEs:

- Lack of skilled labour: MSMEs often struggle to find skilled workers, which can make it difficult for them to grow and expand their businesses.

- Bureaucratic red tape: MSMEs have to navigate a complex web of regulations and bureaucratic procedures, which can be time-consuming and costly.

- Competition from larger companies: MSMEs in India often have to compete with larger, more established companies, which can make it difficult for them to succeed in the market.

- Access to finance: MSMEs often struggles to access capital due to a lack of collateral or credit history or access to formal financial institutions.

- Lack of infrastructure: MSMEs often lack access to basic infrastructure, such as electricity and transportation, which can make it difficult for them to operate their businesses.

- Lack of technological know-how: MSMEs often lack the technical knowledge and expertise to modernize their operations and stay competitive in the market.

- Issues with supply chain and logistics: MSMEs face issues with supply chain and logistics, which can make it difficult for them to get their products to market in a timely and cost-effective manner.

- Lack of formalization: Many MSMEs in India are unregistered or operate informally, which can make it difficult for them to access government support and benefits.

- Lack of marketing and networking opportunities: MSMEs in India often lack the resources and networks to effectively market their products and services, which can make it difficult for them to reach new customers and grow their businesses.

Government of India Initiatives for strengthening MSMEs:

- Comprehensive Economic Partnership Agreement (CEPA): It will help MSMEs of both India and UAE to leverage benefits of the District as export hub initiative of the government.

- Harmonizing value chain: Government to focus on integrating India’s value chains with the rest of the world and creating logistics that are easier and faster is crucial to make it easier for international companies to include India in their value chains.

- Quality assurance: Government to focus on creating Quality as the most important factor in the success story of India through steps including- setting global benchmarks, harmonizing Indian standards with global standards, and consumers becoming more demanding of quality.

- Under this initiative, every district for their unique products and identify the specialty of districts by knowing which district exports which products.

- This initiative is expected to help in promoting local products and in turn, boost the local economy.

- Pradhan Mantri MUDRA Yojana (PMMY)

- Prime Minister’s Employment Generation Programme (PMEGP)

- Stand Up India: The scheme provides financial assistance to scheduled caste (SC), scheduled tribe (ST) and women entrepreneurs for setting up new enterprises.

- Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE): This scheme provides collateral-free credit to micro and small enterprises through a credit guarantee mechanism.

Way Forward:

- Infrastructure development: Improving infrastructure in areas where MSMEs are concentrated, such as by building roads, providing electricity and water supply, and improving transportation.

- Access to finance: The government can work to improve access to finance for MSMEs by providing credit guarantees, offering tax incentives for lending to MSMEs, and encouraging banks and other financial institutions to lend to MSMEs.

- Simplifying regulations: The government can simplify regulations and procedures for MSMEs, such as by streamlining registration and compliance processes and reducing the bureaucratic burden on MSMEs.

- Skilled labor: Taking steps to improve the availability of skilled labor by investing in vocational education and training programs, and encouraging workers to acquire new skills.

- Support for innovation: The government can help MSMEs to innovate by providing funding, mentorship, and other forms of support to help them develop new products and services.

The government can support the adoption of new technologies by MSMEs by providing subsidies, tax incentives, and other forms of financial assistance to help them modernize their operations. To become a trusted and resilient partner in global value chains, the government is focusing on creating an ecosystem that is simpler, faster, and promotes ease of doing business for MSMEs.

Source: NewsOnAir

GS-III

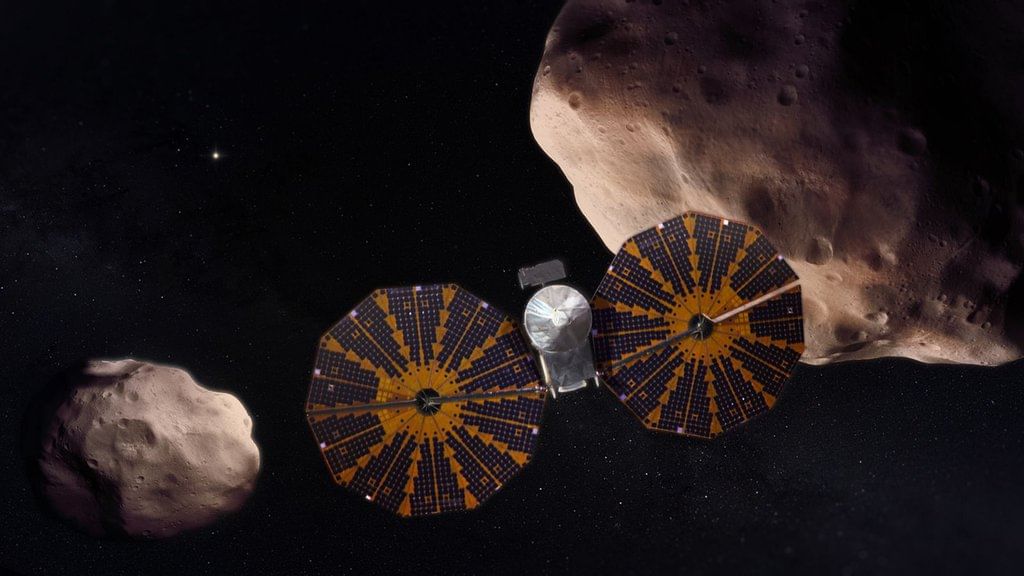

Lucy Mission

Context

NASA recently announced that it is adding a new target for the Lucy mission as the spacecraft goes on its more than 6-billion-kilometre-long journey to study the Jupiter trojan asteroids..

About Lucy Mission:

- NASA’s Lucy mission is the first spacecraft launched to explore the Trojan asteroids, a population of primitive asteroids orbiting in tandem with Jupiter.

- Lucy was successfully launched Oct. 16, 2021, and will visit eight asteroids over 12 years — one asteroid in the main belt between Mars and Jupiter, and seven Trojan asteroids leading and trailing Jupiter in its orbit.

What are Trojan Asteroids?

- Asteroids sharing an orbit with a planet, but which are located at the leading (L4) and trailing (L5) Lagrangian points, are known as Trojan asteroids.

- These asteroids occupy a stable Lagrangian point in a planet’s orbit around the Sun.

- Trojan Asteroids are some of the oldest remnants from the formation of our solar system 5 billion years ago.

- There are currently over 4,800 known Trojan asteroids associated with Jupiter.

- They orbit the Sun in two loose groups: one group leading ahead of Jupiter in its orbit, the other trailing behind at the same distance from the Sun as Jupiter.

- Due to the combined gravitational influences of the Sun and Jupiter, these Trojan asteroids have been trapped on stable orbits (around what is known as the Lagrange Points) for billions of years.

What is a Lagrange point?

- Lagrange Points are positions in space where the gravitational forces of a two body system like the Sun and the Earth produce enhanced regions of attraction and repulsion.

- The Lagrange Points are positions where the gravitational pull of two large masses precisely equals the centripetal force required for a small object to move with them.

- These can be used by spacecraft to reduce fuel consumption needed to remain in position.

Source: Indian Express

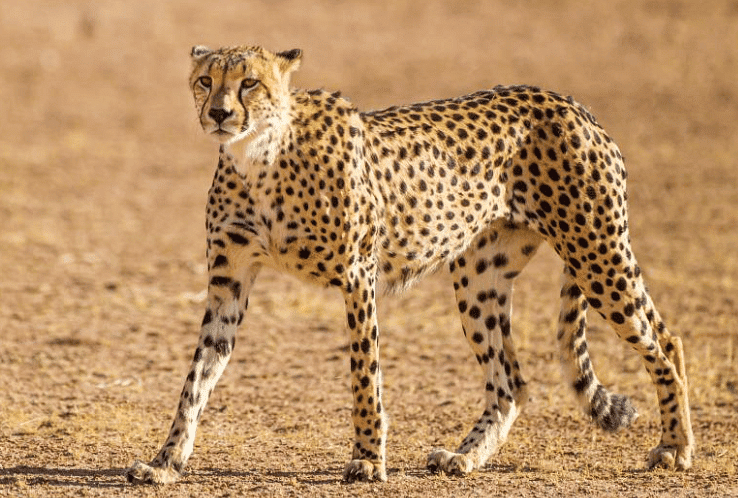

Cheetah Reintroduction Plan: India-South Africa sign pact, 12 cheetahs to be brought to Kuno

Context

An MoU on cooperation in reintroduction of cheetahs to Kuno National Park in Madhya Pradesh next month, has been signed between India and South Africa.

About the Species (Acinonyx Jubatus Venaticus):

- The Cheetah (a carnivore) is the world’s fastest land animal historically ranging throughout most of Sub-Saharan Africa and extending eastward to India.

- It plays an important part in the ecosystem by maintaining prey species healthy (by killing the weak and old) and control the population of prey, thus, helping plants-life by preventing overgrazing.

- Today, Cheetahs are found in only 9% of their historic range, occurring in a variety of habitats such as savannahs in the Serengeti, arid mountain ranges in the Sahara and hilly desert terrain in Iran.

- Namibia has the largest population of Cheetahs in the world, earning it the title "The Cheetah Capital of the World."

- Currently, Cheetahs (African) are listed as Vulnerable on the International Union for Conservation of Nature (IUCN) Red List, as there are fewer than 7,100 adult and adolescent Cheetahs in the wild.

- The Convention on International Trade in Endangered Species (CITES) lists them as an Appendix 1 species.

5 uux

- Historically, Asiatic Cheetahs had a very wide distribution in India, occurring from as far north as Punjab to Tirunelveli district in southern Tamil Nadu, from Gujarat and Rajasthan in the west to Bengal in the east.

- Thus, the Cheetah’s habitat was very diverse - scrub forests, dry grasslands, savannas and other arid and semi-arid open habitats.

What were the Causes of Extinction of Cheetahs in India?

- The big cat population got completely wiped out in the early 1950s, mainly due to over-hunting and habitat loss.

- Records of Cheetahs being hunted (sport hunting, capturing during Mughal period) go back to the 1550s.

- However, the final phase of its extinction coincided with British colonial rule (the British declared a bounty for killing it in 1871).

What is the Cheetah Reintroduction Plan?

- Discussions to bring the Cheetah back to India were initiated in 2009 by the Wildlife Trust of India.

- Under the ‘Action Plan for Reintroduction of Cheetah in India’, 50 cheetahs will be brought from African countries to various national parks over 5 years.

- Recommended sites:

- Kuno Palpur National Park (KNP) in Madhya Pradesh: Amongst the surveyed sites of the central Indian states, KNP has been rated the highest, because of its suitable habitat and adequate prey base.

- It is assessed to be capable of supporting 21 Cheetahs and is likely the only wildlife site in the country where villages have been completely relocated from within the park.

- Kuno also provides the possibility of harbouring four of India's big cats - tiger, lion, leopard and Cheetah, enabling them to coexist as they have in the past.

- The other sites recommended are - Nauradehi Wildlife Sanctuary, Madhya Pradesh; Gandhi Sagar Wildlife Sanctuary - Bhainsrorgarh Wildlife Sanctuary complex, Madhya Pradesh; Shahgarh bulge in Jaisalmer, Rajasthan; Mukundara Tiger Reserve, Rajasthan.

- Kuno Palpur National Park (KNP) in Madhya Pradesh: Amongst the surveyed sites of the central Indian states, KNP has been rated the highest, because of its suitable habitat and adequate prey base.

Why are Cheetahs Coming from Southern Africa?

- Reasons behind re-introducing cheetah from southern Africa:

- The locally extinct Cheetah-subspecies of India is found in Iran and is categorised as critically endangered.

- Since it is not possible to source the critically endangered Asiatic Cheetah from Iran, India decided to source Cheetahs from Southern Africa.

- Southern African Cheetahs have the highest observed genetic variety among extant Cheetah lineages, which is critical for a founding population stock.

- Furthermore, Southern African Cheetahs have been determined to be the ancestors of all other Cheetah lineages, making them suitable for India's reintroduction programme.

- Challenges of bringing back Cheetahs:

- Based on the evidence available, it is impossible to conclude that the choice to bring the African Cheetah into India is scientifically sound.

- As a result, the Supreme Court of India (in 2020) permitted an experimental release of Cheetahs in a suitable habitat.

Source: The Hindu

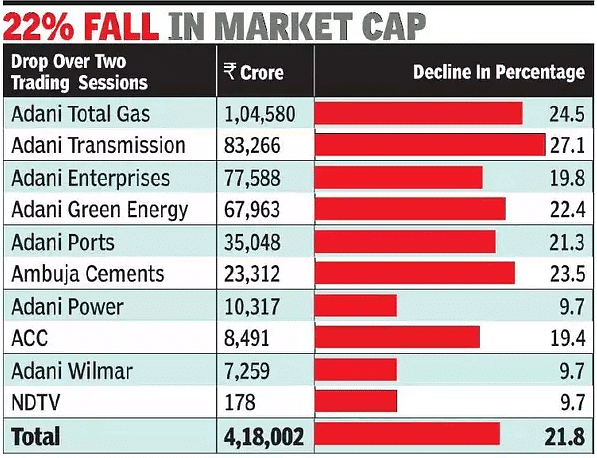

Adani Group Stocks hammered; Investors lose Rs 4.2L crore in 2 days

Recently, a US-based investment research firm, Hindenburg Research, published a research report on the Adani Group.

- The report claims that the Adani Group is holding a short position on the Adani stocks, signalling that the shares of Adani Group are overpriced and will dip in value soon.

About Adani Group:

- It is one of the largest group of companies in India which specialises in infrastructure projects in coal, ports, cement, green energy and even edible oil.

- It has made the news in India lately because of its rapid expansion in the cement industry (buying majority stake in Ambuja Cement and ACC Ltd.) as well as news media (buying around 30% shares of NDTV).

- Its owner, Mr Gautam Adani has been one of the top 4 richest persons in the world for some time now.

About Hindenburg Research:

- Hindenburg Research is a US-based research team that offers services in forensic financial research, with a focus on equity, credit and derivatives analysis.

- Their fundamental research often includes studying and reporting on companies with accounting irregularities, unethical practices in business/related-party transactions, bad management etc.

- Its primary method for investment is said to be short-selling.

- Short selling basically involves borrowing an asset now in order to sell it, only to buy it back at a lower price and then return the borrowed asset.

- The view taken basically is bearish one.

Hindenburg’s Report on Adani Group:

- The report claimed that the Adani Group were pulling the “largest con in corporate history”.

- They also revealed that they were holding a short position on the Adani stocks, signalling their belief that the shares are overpriced and will dip in value soon.

Key points in the Hindenburg Research report on Adani Group:

- Overvalued Shares –

- The report cites data from FactSet and Hindenburg’s own analysis to claim that the Adani shares are highly overvalued by conventional metrics.

- Debt-Fuelled Business –

- 5 out of the 7 key listed companies mentioned have reported a current ratio of less than 1.

- This means that the total amount of current assets is less than the total amount of current liabilities in those companies.

- This is not a healthy financial practice as this means that the companies are unlikely to have adequate assets to pay off their liabilities in the short run.

- Promoters Pledging their Stocks –

- This means that the promoters of the company have taken on additional debt on the basis of the shares that they own.

- As seen above, the share prices are claimed to be already high and so is the debt – therefore, promoters pledging stocks to take on more debt is not a healthy financial practice in such a context.

- Doubts regarding the Management team –

- The report claims that some members of the management have a questionable past which includes allegations of fraud, duty evasions, scams etc.

- Excess Promoter Control of Shares –

- In addition to the already high proportion of promoter holding in shares (close to 74% in multiple cases), significant portions of the remaining public shares are also controlled by shell companies that have ties with the Adani group.

- Many of these companies have a large majority of their shares invested solely in firms under the Adani Group.

- Pumped up Demand –

- The preceding point also hints at deliberate pumping of the Adani stock prices through excessive buying pressure from companies that seem to be biased towards (or perhaps connected with) the Adani Group itself.

- It is claimed that the delivery volume of Adani stocks may have been high because of possible wash trading.

- Wash trading is the practice of buying/selling of a share by the same or related entities to pump up the trading volume numbers.

- Inadequate Compliance –

- The report claims that one of the firms hired to book run the Adani Green Energy has had past problems with the SEBI.

- Moreover, one of the independent auditors hired to audit Adani Enterprise and Adani Total gas seems to be too small a company.

- It comprises of professionals too young to be able to handle the auditing of such a large array of companies.

Impact of this report

- Impact on the Adani Group

- Seven listed companies in the Adani Group lost over $10.73 billion dollars in market capitalisation on 25th January i.e., after the release of the Hindenburg report.

- It also wiped off over $25 billion of the personal net worth of Mr Gautam Adani to below $100 billion and relegated him to 7th richest in the world, from 3rd earlier this week.

- Systemic risk

- No Adani Group company has ever defaulted on their debt repayments so far.

- Moreover, the bank debt component in the total debt of the Adani group has only fallen (from 86% in FY16 to less than 40% in FY22).

- This means any potential issue in the repayment is less likely to have any impact on the banking system.

- But the experts believe that liberal investments were made by state entities like LIC, SBI and other public sector banks in the Adani Group.

- Since, share prices have fallen, these entities may have exposed the county’s financial system to heavy risks.

- Reinforces distrust around corporate governance practices in India

- The current report may reinforce distrust around corporate governance practices in India Inc.

- If one of India’s largest companies is facing this crisis of governance, people may become suspicious and raise questions.

- The current report may reinforce distrust around corporate governance practices in India Inc.

Source: The Hindu

|

38 videos|5293 docs|1118 tests

|