UPSC Daily Current Affairs- 29th August 2023 | Current Affairs & Hindu Analysis: Daily, Weekly & Monthly PDF Download

GS-I

Sri Lanka’s first Karnataka cultural festival

Subject: History and Culture

Why in News?

Recently, Sri Lanka hosted its very first Karnataka cultural festival.

Key highlights of the events:-

- Organized by: International Cultural Council of India in collaboration with the Swami Vivekananda Cultural Centre and M.E Global Peace Foundation.

- Venue: Performing Arts University Auditorium, Colombo.

- The event showcased a mesmerizing lineup of performances by performing artists of nearly thirty well-known folk and classical traditions of Karnataka State.

- Performances included: Dances (Academic, traditional, and folk), musical performances, multilingual poetry recitals, Mudra dramas, puppet shows, etc. will be presented at the concert. (Tholpavakoothu)

- The programme featured the essence of Karnataka’s heritage, with the spotlight on talented artists like Madhuri Bondre and her troupe.

- Madhuri Bondre: A prominent Karnataka dancer.

- The event celebrated cultural diversity and marked a significant moment in the shared cultural heritage of India and Sri Lanka.

About Swami Vivekananda Cultural Centre:-

- Established: 1998

- Established at Colombo

- It was formerly known as the Indian Cultural Centre.

- Objective: Building bridges of cultural exchange and interaction between India & and Sri Lanka.

- The Centre is one of the 24 Indian Cultural Centres established by the Indian Council for Cultural Relations (ICCR) to :-

- Revive and strengthen cultural relations and mutual understanding between India and other countries and seek

- Promote India-Sri Lanka cultural cooperation by building on cultural commonalities and

- Create an awareness of Indian culture in all its facets.

Source: AIR

GS-II

Wrestling Federation of India membership suspended on world stage

Subject: Polity and Governance

Why in News?

The United World Wrestling (UWW) has indefinitely suspended the membership of the Wrestling Federation of India (WFI) due to the federation's failure to conduct the necessary elections.

- UWW is the international governing body for the sport of wrestling.

- Its duties include overseeing wrestling at the World Championships and Olympics.

Wrestling Federation of India (WFI):

- About

- Wrestling Federation of India (WFI) is a governing body of wrestling based in New Delhi.

- It promotes wrestling players for the Olympics, Asian Games, National Wrestling Championships, and World Wrestling Championships.

- WFI’s Contract System for Wrestlers:

- In 2018, the WFI rolled out its revolutionary contracts system for the grapplers.

- Under the system, the wrestlers have been placed in four grades –

- Grade A offers financial assistance of 30 lakh rupees;

- Grade B offers a financial assistance of 20 lakh rupees;

- The C category offers support of 10 lakh rupees;

- The D category offers support of 5 lakh rupees.

- The contracts are reviewed after one year.

Background of the case

- India’s Top Wrestlers Protesting

- Veteran Indian wrestler Vinesh Phogat had alleged that WFI President Brij Bhushan has been involved since many years in sexually exploiting women wrestlers.

- She further claimed that several coaches at the national camp in Lucknow have also exploited women wrestlers.

- The wrestlers have also alleged financial mismanagement and arbitrariness in the functioning of the WFI.

- Demands of the protestors

- The wrestlers demanded that:

- an FIR be registered against Brij Bhushan on the basis of their police complaint, and

- he be arrested under the Protection of Children from Sexual Offences (POCSO) Act as one of the complainants is a minor.

- They have also demanded that he should be removed as the WFI president, and that the federation should be dissolved.

- The wrestlers demanded that:

- Formation of Oversight Committee

- In January 2023, the government persuaded the wrestlers to call off their protest by forming an Oversight Committee.

- The six-member committee, headed by boxing legend MC Mary Kom, was given four weeks to come up with its findings. However, it submitted its report only in the first week of April.

- The committee has since been disbanded.

- Election in WFI

- Following the fresh protests, the Government declared the ongoing process for the WFI elections, which were scheduled for May 7th, null and void.

- Later, the federation was supposed to hold elections in June 2023. However, the elections have been repeatedly postponed.

- The Sports Ministry halted the polls and asked the IOA (Indian Olympic Association) to form an ad-hoc committee to complete the election process within 45 days.

- The IOA appointed Justice (retd.) M.M. Kumar as the returning officer for the WFI elections on June 12 after which the polls were scheduled for July 6.

- In May, both the International Olympic Committee (I0C) and UWW (United World Wrestling) asked the IOA to conduct the WFI polls within the stipulated time frame.

- However, polls could not be held in the stipulated timeframe due to:

- Demand of the protestors that Brij Bhushan’s family members should be stopped from contesting the elections.

- Brij Bhushan himself was not eligible to contest the WFI polls after completing three terms (12 years).

- Disgruntled state associations seeking voting rights filed petitions in the respective High Courts.

- Demand of the protestors that Brij Bhushan’s family members should be stopped from contesting the elections.

- The stays on the elections, first by the Guwahati High Court on June 25 and then by the Punjab and Haryana High Court on August 11 (a day before the latest date fixed for the elections), further caused the delay.

News Summary: Wrestling Federation of India membership suspended on world stage

- The United World Wrestling (UWW) has taken the decision to suspend the membership of the Wrestling Federation of India (WFI) indefinitely.

- It has been suspended due to the postponement of Elections to designations in WFI due to Protests and Legal Battles.

Why did UWW take this decision?

- The UWW Disciplinary Chamber found sufficient grounds to provisionally suspend the WFI due to the prevailing situation for at least six months.

- The absence of an elected president and a board did not comply with UWW regulations and its conditions for membership.

- The Chamber also considered the protection of athletes after the allegations against the former WFI president and the necessity to restore the functioning of the federation as another ground to suspend the national body.

What is the impact?

- Wrestlers and their support personnel will be able to participate in all UWW sanctioned events.

- This includes the World championships to be held in Belgrade in September 2023.

- However, they will not be able to compete in these events with an Indian flag. They will have to compete as 'neutral athletes'under the UWW flag.”

- No national anthem will be played if an Indian wrestler wins a gold medal.

What next?

- Different factions of the WFI need to realise the immense loss the sport has suffered because of the ongoing issue.

- The only way to bail the country out of international embarrassment and give the athletes their right to compete under the Tricolour is to conduct the WFI elections in a free and fair manner.

Source: The Hindu

India’s fiscal federalism

Subject: Polity and Governance

Why in News?

As India transitioned from a planned economy to a market-oriented system and experienced changes like multi-tier fiscal systems and the Goods and Services Tax (GST), the interplay between fiscal policies and federalism requires a fresh perspective.

About Fiscal Federalism:

- It is defined as the division of financial powers as well as the functions between multiple levels of the federal government.

- It has within its ambit the imposition of taxes as well as the division of different taxes between the Centre and the constituent units.

- Similarly, in the case of joint collection of taxes, an objective criterion is determined for the fair division of funds between the entities.

- Usually, there is a constitutional authority like Finance Commission in India for the purpose to ensure fairness in the division.

Need for rethinking India’s Fiscal Federalism

Altered Fiscal Landscape

- There have been some decisions, policies of the central government that have altered the Fiscal landscape. Some of these include:

- The paradigm shift from a planned economy to a market-mediated economic system.

- The transformation of a two-tier federation into a multi-tier fiscal system following the 73rd and 74th Constitutional Amendments.

- The abolition of the Planning Commission and its replacement with NITI Aayog.

- The passing of the Fiscal Responsibility and Budget Management (FRBM) Act.

- The Goods and Services (GST) Act with the GST Council holding the controlling lever.

- The extensive use of cess and surcharges, which affect the size of the divisible pool.

Complex System of Intergovernmental Fiscal Relations

- This complexity has its roots in several factors, including substantial ethnic, social, and economic disparities among regions.

- The long-standing vertical imbalance between the expenditure and revenue-raising responsibilities of the state governments is another problem.

- This imbalance is in part covered by revenue-sharing arrangements.

- States also receive a variety of grants from the center, but even then, states run deficits.

- For these reasons, and because of the clear trends toward structural transformation of the economy away from central planning and increased claims of the states for fiscal autonomy, a comprehensive rethinking is needed.

Challenges associated with fiscal federalism:

The share of the States in divisible pool is shrinking despite their carrying a higher burden of expenditure:

- High share of committed expenses: Status of States’ financial health had taken a turn for the worse with the implementation of the Ujwal DISCOM Assurance Yojana, farm loan waivers, as well as the slowdown in growth in 2019-20.

- Pandemic impact has worsened the fiscal positions of State governments.

- Imbalance : According to the 15th Finance Commission’s report, in FY19, the Union government raised 62.7% of the total resources raised by the Union government and States, while States had borne 62.4% of the aggregate expenditure.

- This allocation of taxation powers and expenditure responsibilities results in an imbalance and the gap between the share recommended by the FC and the actual devolution has widened.

- Dependence on centre: The major source of revenue of other States is Central transfers.

- The Constitution grants the Union government more revenue raising powers while the States are tasked to undertake most of the development and welfare related responsibilities.

- Inequality: India’s fiscal federalism driven by political centralisation has deepened socio-economic inequality, belying the dreams of the founding fathers who saw a cure for such inequities in planning.

Suggestive measures:

Empowering the Third Tier

- The panchayat raj institutions and municipalities – merits serious attention.

- The absence of a uniform financial reporting system across all levels of government creates a critical gap.

- Despite referring to them as “institutions of self-government,” policymakers often term them as “local bodies,” failing to provide the necessary support.

- Addressing this gap and ensuring uniform financial reporting systems can fortify the foundation of local democracy.

Curbing Off-Budget Borrowing

- A critical facet of fiscal federalism pertains to reining in off-budget borrowing practices. Off-budget borrowings, unscrutinised and unreported, pose transparency challenges.

- Both the Union and States indulge in such practices, with central public sector undertakings and special purpose vehicles raising resources, burdening governments with repayment liabilities.

- While States adhere to fiscal discipline through Article 293(3) and the FRBM Act, the Union sometimes evades such controls.

- Transparent reporting mechanisms must encompass all levels of government.

Other measures:

- Former Governor of Reserve Bank of India (RBI) C. Rangarajan has underscored the importance of fiscal federalism at various levels in current Indian democracy.

- Distribution of resources was also essential alongside decentralisation of powers for achieving economic growth.

- The government needs to invest resources towards facilitating effective consultation with states as a part of the lawmaking process.

- It is critical that the Union establishes a system where citizens and States are treated as partners and not subjects.

- Recommendations of PV Rajamannar committee of 1971 needs to be considered which suggested that the Finance commission be made a permanent body.

- The present structure of fiscal federalism in India was formed at the time when its economy was much less market oriented than today, with the central government having a large role in regulation, administration, and planning of the economy.

- Therefore, with the dynamics of the emerging fiscal federalism of India, a significant rethinking is must, especially in the context of the 16th Finance Commission.

Source: The Hindu

India – Iran relations

Subject: International Relations

Why in News?

Recently India and Iran have agreed to drop the clause for arbitration in foreign courts concerning the Chabahar port.

- Both sides have agreed to pursue arbitration under rules framed by the UN Commission on International Trade Law (UNCITRAL), which is favoured by India over other international trade arbitration mechanisms.

About India – Iran relationship:

History:

- In the splendid civilization of Mohenjodaro and the Sindh Valley, which flourished between 2500 and 1500 BC, there are visible signs of relationship with the Iranian civilization.

- The ancient relics, earthenware and the marked resemblance in their designs and patterns are strong evidence in favour of this assertion.

- During the middle Ages, there was a fusion of medieval Persian culture in India, especially from the Delhi Sultanate till the period of Mughal Hindustan.

- During colonization, relations between India and the rest of the world were subject to drastic changes, and consequently, contact between Iran and India decreased.

- In the 1990s, both India and Iran supported the Northern Alliance against the Taliban in Afghanistan, the latter of which received overt Pakistani backing and ruled most of the country until the 2001 United States-led invasion.

Political relations:

- India and Iran signed a friendship treaty on March 15, 1950.

- Prime Minister Shri Atal Bihari Vajpayee visited Tehran in 2001 and signed the “Tehran Declaration” which set forth the areas of possible cooperation between the two countries.

- It recognised then Iranian President Mohammad Khatami’s vision of a “dialogue among civilisations” as a paradigm of international relations based on principles of tolerance, pluralism and respect for diversity.

- In 2003, both sides signed “The New Delhi Declaration” which set forth the vision of strategic partnership between India and Iran.

Trade and Commerce:

- The value of India’s exports to Iran saw a remarkable increase in 2022, reaching US$1,847 million, representing a substantial increase of 44 percent.

- At the same time, India’s imports from Iran experienced a significant rise of 60 percent, totaling US$653 million.

- The notable growth in bilateral trade was largely driven by India’s rice exports to Iran, which reached an impressive value of US$1.098 billion, demonstrating a remarkable growth rate of 52 percent.

- Major Indian exports to Iran include rice, tea, fresh fruits, sugar, drugs/pharmaceuticals, artificial jewellery and electrical machinery etc.

- While the major Indian imports from Iran are dry fruits, glass and glassware, inorganic/organic chemicals, natural or cultured pearls, leather, gypsum and precious or semiprecious stones.

- Its dedication to fortifying trade relations with Iran remains resolute due to its geopolitical challenges.

- By actively engaging in strategic dialogues and exploring avenues of cooperation, India aims to forge a mutually beneficial and resilient business environment that transcends external pressures.

- However, in 2023 India had to stop procurement of crude oil from Iran after the US did not continue with sanction waivers to India and several other countries.

Defense cooperation:

- One of the most significant provisions of 2003’s New Delhi Declaration sought to upgrade defense cooperation between Iran and India.

- The wide-ranging partnership involved all three military services: the army, navy, and air force.

- After the Iran-Iraq War, Tehran rebuilt its conventional arsenal by purchasing tanks, combat aircraft, and ships from Russia and China.

- Iran solicited Indian assistance in 1993 to help develop new batteries for three Kilo-class submarines it had purchased from Russia.

- The submarine batteries provided by the Russians were ill suited to the warm waters of the Persian Gulf, and India had substantial experience operating Kilo-class submarines in warm water.

- Iran remains inclined to acquire Indian assistance for other upgrades to its Russian-supplied military hardware, including MiG-29 fighters, warships, and tanks.

- However, despite these initiatives, strategic and defense cooperation between the two countries is relatively low.

- The reason for this is India’s turn to the West.

Cultural relations:

- An Indian Cultural Centre in Tehran was inaugurated in 2013.

- The Cultural Centre was renamed the Swami Vivekananda Cultural Centre (SVCC) in 2018, and was provided a separate premises in 2019.

- The International Day of Yoga was organised in 2018, 2019 and 2020.

- The 550th Birth Centenary of Sri Guru Nanak was also observed.

- The center conducts regular Yoga and Hindi classes.

Indian diaspora:

- There is a high-level commitment in both countries to promote and facilitate people-to-people contacts. I

- Indian pilgrims visit the Shi’a pilgrimage circuit in Iran (Qom, Mashhad, and Hamedan) and Iraq (Najaf and Karbala) every year.

Challenges associated with the bilateral relations:

- USA sanctions: The sanctions imposed by the USA on Iran after Tehran withdrew from the nuclear deal in 2018 may have virtually destroyed India-Iran trade, especially India’s energy imports from Iran.

- Anti-Iran coalition: Ties also appeared to have been hit by New Delhi’s surprise decision to join the Israel-India-UAE-U.S. group, portrayed as an “anti-Iran” coalition, and by perceptions of Iranian support to Yemeni Houthis behind the drone attack on a UAE oil facility where an Indian was among those killed.

- Strategic stakes: Iran also happens to be the entry point for India for trade with the Central Asian countries where India’s geographical approach is limited.

- With the increasing presence of China in Iran, India has been concerned about the strategic stakes of the Chabahar port project.

- The access to the Chabahar port may prove strategically important for India.

- Chinese closer ties with oil producers can bring governance and energy security issues for India.

Way Forward:

If India can extend assertive diplomacy being practiced by it, emphasizing on standing by its neighbours and friends and focusing solely on fulfilling its national interests, it could open a huge potential for cooperation between these two great nations and civilizations.

Therefore, there is a need to look forward toward areas of convergence, where both countries have a mutual understanding of each other’s common interests and further work together to achieve the same.

Source: The Hindu

GS-III

ASTRA missile

Subject: Defence

Why in News?

Recently, the Indigenous ASTRA missile was tested from Tejas aircraft.

Light Combat Aircraft Tejas:-

- It is a single-engine multirole light combat aircraft.

- Historical Background:-

- The Light Combat Aircraft (LCA) programme was started by the Government of India in 1984 when they established the Aeronautical Development Agency (ADA) to manage the LCA programme.

- Designed and developed by: India’s HAL (Hindustan Aeronautics Limited).

- It replaced the ageing Mig 21 fighter planes.

- It is the second supersonic fighter jet that was developed by HAL (the first one being HAL HF-24 Marut).

- It is the lightest and smallest multi-role supersonic fighter aircraft in its class.

- It is designed to carry a range of air-to-air, air-to-surface, precision-guided, and standoff weaponry.

About ASTRA missile:-

- Designed and developed by: the Defense Research and Development Laboratory (DRDL), Research Centre Imarat (RCI), and other laboratories of DRDO.

Type:-

- It is an indigenous Beyond Visual Range (BVR) missile.

- Beyond Visual Range (BVR): A class of missiles that can target and eliminate aerial threats beyond the reach of direct visual observation, enhancing the aircraft’s combat range and effectiveness.

- It is an air-to-air missile.

Salient features:-

- It can engage and destroy highly maneuvering supersonic aerial targets.

- It is an Indian family of all-weather beyond-visual-range air-to-air missiles.

- The missile is intended for use by both the Indian Air Force (IAF) and the Indian Navy.

- It boasts advanced air combat capabilities.

- It can engage multiple high-performance targets

Significance:-

- The missile will help in reducing the dependency on foreign sources.

- It can neutralize adversary airborne assets without exposing adversary air defense measures.

- It’s technologically and economically superior to many such imported missiles.

Source: The Indian Express

SEBI’s Amendments to boost REITs and InvITs

Subject: Economy

Why in News?

The Securities and Exchange Board of India (SEBI) has recently approved crucial changes to the regulations governing real estate investment trusts (REITs) and infrastructure investment trusts (InvITs), aimed at enhancing their appeal to investors.

- These investment vehicles function similarly to mutual funds, pooling capital to invest in real estate or infrastructure projects.

What are REITs and InvITs?

| Real Estate Investment Trusts (REITs) | Infrastructure Investment Trusts (InvITs) | |

| Structure | Investment trusts owning real estate properties | Investment trusts owning revenue-generating infrastructure projects |

| Regulation | Regulated by SEBI | Regulated by SEBI |

| Assets | Commercial real estate properties (no residential) | Operational infrastructure projects |

| Units | Units issued to investors, traded on stock exchanges | Units issued to investors, traded on stock exchanges |

| Distribution | Mandatory distribution of a significant portion of income as dividends | Mandatory distribution of a certain percentage of cash flows as dividends |

| Tax Benefits (Dividends) | Dividend distribution exempt from DDT | Dividend distribution exempt from DDT |

| Taxation (Investor’s Dividends) | Taxable as per investor’s income tax slab | Taxable as per investor’s income tax slab |

| Asset Focus | Commercial properties: office buildings, malls, etc. | Operational infrastructure projects |

| Purpose | Income generation and capital appreciation | Income generation and capital appreciation |

| Project Type | Income-generating properties | Operational brownfield projects |

| Examples in India | Embassy Office Parks REIT, Mindspace Business Parks REIT | IndiGrid Trust, IRB InvIT Fund, Sterlite Power Grid Ventures InvIT |

Importance of REITs and InvITs

- Investment Pooling: REITs and InvITs operate as investment pooling vehicles, allowing sponsors to invest in real estate or infrastructure projects.

- Affordable Ownership: REITs offer retail investors access to income-generating real estate properties that would otherwise be unaffordable.

- Direct Investment: InvITs enable both individual and institutional investors to directly invest in infrastructure projects, spanning transport, energy, and communication sectors.

Performance of REITs and InvITs

- Growing Popularity: Since their launch in 2019, REITs have gained traction, demonstrating resilience during challenges such as the pandemic.

- Rising Interest: InvITs have a broader scope, with multiple listings, including IRB InvIT Fund and Embassy Office Parks Reit.

- Assets Under Management: As of the beginning of 2023, REITs and InvITs registered with Sebi managed assets exceeding ₹3.5 trillion.

Sebi’s Amendments Explained

- Unit Holder Nomination Rights: Sebi has granted board nomination rights to unit holders of InvITs and REITs, allowing them greater influence.

- Minimum Unit Holding Change: The minimum unit holding requirement for sponsors has been revised, enhancing flexibility.

- “Self-Sponsored Investment Managers”: Sebi introduced the concept of self-sponsored investment managers, enabling them to assume Reit sponsor responsibilities.

Importance of the Changes

- Enhanced Corporate Governance: These amendments are designed to bolster corporate governance and streamline the functioning of InvITs and REITs.

- Retail Unit Holder Rights: The changes empower retail unit holders by giving them a voice and ensuring accountability through the Stewardship Code.

- Sponsor Commitment: Sponsors are now required to maintain a minimum number of units throughout the lifespan of the Reit or InvIT.

- Self-Sponsored Investment Managers: This concept provides flexibility for Reit sponsors and potential exit options.

Source: Indian Express

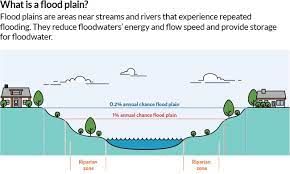

Why Zoning of Flood Plains is important?

Subject: Environment

Why in News?

Punjab has been grappling with severe floods for over a month, predominantly affecting villages along rivers like Sutlej, Beas, Ravi, and Ghaggar.

- These areas, known for their fertile flood plains, have been hit the hardest due to floods exacerbated by encroachments and construction.

Flood Plains and their Significance

- Flood plains adjacent to rivers serve as natural defences against inland flooding. Maintained without concrete encroachments, they absorb excess water, safeguarding other regions.

- Properly managed flood plains also aid in recharging groundwater levels and maintaining the water table.

What is Zoning of Flood Plains?

- Zoning of flood plains refers to the practice of categorizing and regulating different areas within flood-prone regions based on their vulnerability to flooding and the intensity of flood events.

- This aims to manage land use and construction activities in these areas to minimize the risks associated with flooding, protect communities and infrastructure, and maintain the natural functions of flood plains.

- It involves designating specific zones within flood-prone regions and establishing regulations and guidelines for development, construction, and land use in each zone.

Current Scenario: No Zoning in Punjab

- National Green Tribunal (NGT): NGT guidelines state that construction should not occur within 500 meters of a river’s central lining.

- Punjab’s Lag: Despite NGT’s directives and the need for floodplain zoning, Punjab has yet to initiate the process. Encroachments persist, putting riverside villages at perpetual risk.

Impact of Inaction: People and Ecosystems Affected

- Risk to People and Property: Unregulated construction leads to increased flood risks further inland, causing greater harm during floods.

- Environmental Impact: Concretization of flood plains delays water drainage and affects soil fertility and quality.

Flood Prone Districts and National Issue

- Districts at Risk: Many districts including Ropar, Ludhiana, Ferozepur, Patiala, and more fall within flood plains, magnifying the need for preparedness.

- Nationwide Challenge: While only four states have adopted flood plain zoning in principle, implementation has been insufficient. Even those that adopted zoning have not effectively delineated and demarcated flood plains.

Activists’ Advocacy

- Activists’ Concerns: Environmental activists and NGOs in Punjab have been advocating for flood plain zoning to mitigate risks.

- Urgent Implementation: Immediate initiation and completion of flood plain zoning are crucial to safeguard lives, property, and ecosystems from devastating floods.

Conclusion

- The recent floods in Punjab underline the urgency of flood plain zoning to avert catastrophe.

- By adopting effective zoning measures, the state can shield its citizens and environment from the damaging impacts of unchecked construction and flooding.

- It is imperative that Punjab takes swift action to implement flood plain zoning and thereby protect its vulnerable regions from the perpetual threat of floods.

Source: The Hindu

|

38 videos|5293 docs|1118 tests

|