UPSC Daily Current Affairs: 9th July 2024 | Current Affairs & Hindu Analysis: Daily, Weekly & Monthly PDF Download

GS2/International Relations

India to Sign, Ratify High Seas Treaty

Source: Indian Express

Why in news?

India has decided to sign and ratify the High Seas Treaty, a global agreement for conservation and protection of biodiversity in the oceans.

The High Seas Treaty, also known as the agreement on Biodiversity Beyond National Jurisdictions (BBNJ), was negotiated in March 2023.

High Seas

- The high seas are the parts of the ocean that are not included in the exclusive economic zones, territorial sea, or internal waters of a State.

- Water beyond 200 nautical miles from the coast of a country is known as high sea.

- High seas are the areas of the ocean for which no one nation has sole responsibility for management.

Ocean and biodiversity

- The high seas comprise 64 per cent of the ocean surface, and about 43 per cent of the Earth.

- These areas are home to about 2.2 million marine species and up to a trillion different kinds of microorganisms.

Ocean and global climate

- Oceans are an integral part of the global climate cycle and perform a range of ecological services including the absorption of carbon dioxide and excess heat.

- This treaty is considered a landmark in the efforts to keep the planet habitable.

Unregulated human activities

- Climate change is already influencing ocean systems and is being influenced by them, exacerbating the pressures on marine biodiversity from unregulated human activities.

- The High Seas Treaty aims to address the challenges of climate change, biodiversity, and pollution.

UNCLOS and concerns regarding biodiversity

- UNCLOS asks countries to protect the ocean ecology and conserve its resources but doesn't provide specific mechanisms or processes to do so.

- The High Seas Treaty is expected to function as an implementation agreement under the UNCLOS, similar to how the Paris Agreement operates under the UNFCCC.

Agreed under the UNCLOS

- This treaty, commonly known as the agreement on biodiversity beyond national jurisdictions (BBNJ), works under the UNCLOS framework.

- UNCLOS is an international treaty that establishes a framework for the use and management of the world's oceans and resources.

Key provisions of the treaty

- Demarcation of marine protected areas (MPAs)

- Sustainable use of marine genetic resources and equitable sharing of benefits

- Initiation of environmental impact assessments for major activities

- Capacity building and technology transfer

Creation of New body

- The treaty will establish a new body to manage the conservation of ocean life and establish marine protected areas in the high seas.

- Once ratified by the requisite number of countries, the treaty will become international law and operate under the UNCLOS framework.

- India has decided to sign and ratify the High Seas Treaty.

- The High Seas Treaty will become one of the implementing instruments under the UNCLOS framework.

- UNCLOS defines the rights and duties of countries and lays down general principles of acceptable conduct in the oceans.

- There are already two similar agreements under UNCLOS: one regulating the extraction of mineral resources from ocean beds and the other concerning the conservation of migratory fish stocks.

GS3/Science and Technology

AXIOM-4

Source: Financial Express

Why in news?

The Indian Space Research Organisation (ISRO) has chosen two out of its four trained Gaganyaan astronauts for the Axiom-4 mission. Only one astronaut will participate, with the mission scheduled for no earlier than October 2024, as stated on the NASA website.

About AXIOM-4 :

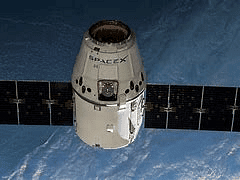

- The Axiom-4 mission is a private spaceflight to the International Space Station (ISS) conducted by Axiom Space in collaboration with NASA.

- It marks the fourth private astronaut mission to the ISS.

- The mission duration is set for fourteen days.

Spacecraft:

- The Axiom-4 mission will use a SpaceX Crew Dragon spacecraft.

Indian Involvement:

- ISRO has shortlisted two Gaganyaan astronauts for the mission out of a total of four.

- These Indian astronauts will undergo training from NASA, international partners, and SpaceX.

Objectives:

- The mission aims to support commercial activities in space, such as scientific research, technological advancements, and space tourism.

- It seeks to demonstrate the viability of commercial space stations for business and innovation purposes.

Diverse Crew:

- The Axiom-4 mission will carry a diverse crew comprising astronauts from various countries.

Scientific Experiments:

- Throughout the mission, a range of scientific experiments and technological tests will be conducted in the unique microgravity environment of space.

Gaganyaan Mission

- The Gaganyaan Mission is an ongoing Indian project aiming to execute a 3-day manned mission to Low Earth Orbit (LEO) at 400 km altitude with a crew of three members, ensuring their safe return to Earth.

- Its primary goal is to showcase India's capabilities in human spaceflight.

- As part of this program, the Government of India has approved two unmanned missions and one manned mission.

- Upon completion, India will be the fourth country, following the US, Russia, and China, to conduct a manned spaceflight mission.

GS3/Environment

Why Rising Arctic Wildfires Are a Bad News for the World

Source: Indian Express

Why in news?

Smoke from raging wildfires has once again darkened the skies over the Arctic. It is the third time in the past five years that high-intensity fires have erupted in the region, Europe's Copernicus Climate Change Service (C3S) said.

- Wildfires have been a natural part of the Arctic's boreal forest or snow forest and tundra (treeless regions) ecosystems. However, in recent years, their frequency and scale in the regions have increased, primarily due to global warming. More worryingly, these blazing wildfires are fueling the climate crisis.

Arctic wildfires have worsened due to various factors:

- The Arctic warming approximately four times faster than the global average, leading to increased lightning strikes.

- More frequent lightning strikes increase the likelihood of wildfires, with a notable rise in Alaska and the Northwest Territories.

- Soaring temperatures alter the polar jet stream, causing it to stall and bring unseasonably warm weather, leading to heatwaves and more fires.

- Rising temperatures, increased lightning, and heatwaves are expected to worsen, resulting in more Arctic wildfires.

- Arctic wildfires contribute to global warming by releasing greenhouse gases when burning vegetation and organic matter.

- In the Arctic, the concern is not just GHG emissions but the release of carbon stored in permafrost, which is vulnerable to thawing due to wildfires.

- If large-scale thawing occurs, releasing stored carbon, it could breach global warming thresholds, leading to irreversible consequences.

- Arctic changes have global repercussions, emphasizing the need for urgent action to address wildfires and their environmental impacts.

GS3/Economy

Digital Bharat Nidhi (DBN)

Source: Indian Express

Why in news?

The Department of Telecommunications (DoT) on July 4 released draft rules to operationalise the Digital Bharat Nidhi, in a fresh attempt by the central government at increasing telecom connectivity in rural areas. With the Centre notifying parts of the Telecom Act last month, it has also proposed additional rules for the final makeover of the Universal Service Obligation Fund (USOF) as the Digital Bharat Nidhi (DBN) - which would have a relatively wider scope than the USOF.

About Digital Bharat Nidhi

- Digital Bharat Nidhi would replace the erstwhile Universal Service Obligation Fund (USOF), which is a pool of funds generated by a 5 per cent Universal Service Levy charged upon all the telecom fund operators on their Adjusted Gross Revenue (AGR). Since its establishment in 2003, a common criticism of the USOF has been its relative underutilisation.

- The idea is that this money would be used to fund the expansion of telecom networks in remote and rural areas, where private companies may otherwise resist offering their services due to them not being revenue-generating markets.

How the Digital Bharat Nidhi will work

- As per the Telecom Act, contributions made by telecom companies towards the Digital Bharat Nidhi will first be credited to the Consolidated Fund of India (CFI). The Centre will deposit the collected funds to the DBN from time to time.

- Funds collected under the DBN will be used to support universal service through promoting access to and delivery of telecommunication services in underserved rural, remote and urban areas; fund research and development of telecommunication services, technologies, and products; support pilot projects, consultancy assistance and advisory support for improving connectivity; and for the introduction of telecommunication services, technologies, and products.

For Your Information:

- On June 26, multiple sections of the Telecommunications Act, 2023 came into effect, giving way to the first piece of the larger technology legislative puzzle to fall into place. This is among the three key laws the Centre wants to put together as a comprehensive legal framework for the country's burgeoning tech sector.

GS3/Science and Technology

Hurricane Beryl's Record Early Intensification

Source: Indian Express

Why in news?

Hurricane Beryl became the earliest storm on record during the Atlantic hurricane season to have reached the highest Category 5 classification.

- Earlier this month, it devastated the Caribbean islands, causing intense floods and dangerous winds in Jamaica, Grenada, Saint Vincent and the Grenadines, and northern Venezuela, resulting in at least 11 deaths.

- On July 8, Beryl made landfall in Texas as a Category 1 storm, flooding streets and causing power outages for over two million people in the state.

About:

- A hurricane is a powerful and destructive tropical storm characterized by strong winds, heavy rainfall, and low atmospheric pressure.

Hurricanes are also known as cyclones or typhoons in different parts of the world; the term used depends on the region.

- Atlantic Ocean and eastern North Pacific

- Northwestern Pacific

- South Pacific and Indian Ocean

Key characteristics of hurricanes

- Low Pressure Centre: Hurricanes have a well-defined centre of low atmospheric pressure, known as the eye. The eye is typically calm and clear, with light winds, surrounded by a ring of intense thunderstorms called the eyewall.

- Strong Winds: Hurricanes are known for their powerful winds that can reach sustained speeds of at least 74 miles per hour (119 kilometers per hour) or higher.

- Heavy Rainfall: Hurricanes produce heavy rainfall, which can lead to flooding, landslides, and storm surges (a rise in sea level along the coast caused by the hurricane's winds pushing water toward the shore).

- Formation: Hurricanes form over warm ocean waters when the sea surface temperature is typically above 26 degrees Celsius (79 degrees Fahrenheit). Warm, moist air rises from the ocean's surface, creating an area of low pressure. As the air cools and condenses, it releases heat, which fuels the storm's development.

- Categories: Hurricanes are categorized on the Saffir-Simpson Hurricane Wind Scale based on their maximum sustained wind speeds. The scale ranges from Category 1 (weakest) to Category 5 (strongest), with each category representing a higher wind speed and potential for damage. Category 1 hurricanes bring winds of 119 to 153 kmph, Category 5 hurricanes, which are the strongest, have winds of 252 kmph or higher. Storms that reach Category 3 and higher are considered major hurricanes due to their potential to inflict significant damage.

Beryl's rapid intensification

- Within 24 hours of emerging as a tropical depression with winds of 56.3 kmph on June 28, Beryl transformed into a hurricane.

- Over the next 24 hours, it rapidly intensified to become a Category 4 hurricane.

- At that point, Beryl was the first Category 4 hurricane to form in June.

- The earliest emergence of a Category 4 hurricane was previously seen in the case of Hurricane Dennis in July 2005.

Unprecedented early Category 5 status

- On July 1, Beryl made landfall on Grenada's Carriacou Island as a Category 4 hurricane with sustained winds of over 241 kmph.

- As it travelled through the Caribbean Sea, it continued to gain strength, and became a Category 5 hurricane on July 2.

- This made it the earliest Category 5 hurricane seen during the Atlantic hurricane season on record.

- Beryl was also the strongest July Atlantic hurricane on record, with winds of 265.5 kmph, according to NOAA.

Factors contributing to Beryl's early Category 5 status

- The Atlantic hurricane season, lasting from June to November, typically sees its first major hurricanes in September due to the gradual warming of ocean waters, according to NOAA.

- Hurricane Beryl is unprecedented because it formed as a powerful storm much earlier, attributed to unusually warm ocean temperatures.

- Since 2023, both sea surface temperatures and ocean heat content (OHC) have been at record highs, a trend reflected in this year's OHC being significantly above the 2013-2023 average.

- Atmospheric scientists highlight that the depth of the warm water, extending 100 to 125 meters, prevents cooler water from surfacing, thus sustaining Beryl's intensity.

GS3/Economy

Employment Rate Rises from 3.2% in FY23 to 6% in FY24

Source: Mint

Why in News?

According to the Reserve Bank of India’s data, India’s employment rate grew by 6 per cent in the fiscal year ended March 31, 2024 from a growth of 3.2 per cent in 2022-23.

About the RBI’s Latest Report:

- The RBI recently released data from its Measuring Productivity at the Industry Level-the India KLEMS Database

- KLEMS stands for Capital (K), Labour (L), Energy (E), Material (M) and Services (S).

- The database is part of a research project supported by the Reserve Bank to analyse productivity performance in the Indian economy at disaggregated industry level.

- The database covers 27 industries comprising the entire Indian economy

- The database also provides these estimates at the broad sectoral levels (agriculture, manufacturing and services) and at the all-India levels.

Key Takeaways from the Latest Data

- India's total employment stood at 643.3 million in 2023/24 versus 596.7 million in FY23.

- Unemployment Rate (UR) in urban areas decreased from 6.8 per cent during January–March 2023 to 6.7 per cent in January–March 2024 for persons of age 15 years and above.

- Female Unemployment Rate declined from 9.2 per cent to 8.5 per cent for the same period.

- Labour Force Participation Rate (LFPR) in urban areas has shown an increasing trend from 48.5 per cent to 50.2 per cent for the same period.

- There was an increasing trend in Worker Population Ratio (WPR) for persons of age 15 years and above from 45.2 per cent to 46.9 per cent for the same period.

Key Terms of the Report

- Labour Force Participation Rate:

- The labour force consists of persons who are of age 15 years or older, and belong to either of the following two categories: Employed, Unemployed and are willing to work and are actively looking for a job

- There is a crucial commonality between the two categories — they both have people demanding jobs. This demand is what LFPR refers to.

- Employment Rate:

- The employment rate is the percentage of employed persons in relation to the comparable total population.

- Unemployment Rate:

- The unemployment rate is the percentage of adults who are in the labour force but who do not have jobs.

- Periodic Labour Force Survey:

- The National Statistics Organisation (NSO) had launched the Periodic Labour Force Survey (PLFS) in April 2017.

- It was launched as part of efforts to get a better sense of the job situation and provide reliable and timely data

- The PLFS is designed with two major objectives for measurement of employment and unemployment.

- First, to measure the dynamics in labour force participation and employment status in the short time interval of three months for only the urban areas in the Current Weekly Status (CWS).

- Second, for both rural and urban areas, to measure the labour force estimates on key parameters in both usual status and Current Weekly Status.

GS3/Economy

PLI Scheme for White Goods

Source: Economic Times

Why in news?

According to the Department for Promotion of Industry and Internal Trade (DPIIT), the government will reopen the application window for the production-linked incentive (PLI) scheme for white goods.

What are White Goods?

White goods or consumer durables encompass significant household appliances, including -

- Air conditioners (ACs), LED lights, dishwashers,

- Clothes dryers, drying cabinets,

- Freezers, refrigerators,

- Kitchen stoves, water heaters, microwave ovens, induction cookers, and

- Washing machines.

What are PLI Schemes?

- The PLI Schemes are a strategic initiative by the Government of India, aligned with the vision of ‘Atmanirbhar Bharat’ (or Self-Reliant India).

- The core objectives of the PLI Schemes are to:

- Improve efficiency, foster economies of scale within the manufacturing sector,

- Position Indian manufacturers as globally competitive, thereby facilitating their integration into global value chains, and

- Foster domestic manufacturing as a catalyst for India’s economic growth and employment generation.

What is the PLI Scheme for White Goods?

- The PLI Scheme for White Goods involves significant financial allocations, with a total outlay of INR 1.97 trillion (over US$26 billion) for 13-14 key sectors.

- All sectors approved under the PLI Schemes adhere to a broad framework centered around new and emerging technologies.

- The scheme was approved by the Union Cabinet on 7th April, 2021 (and was notified by the DPIIT on 16th April, 2021).

- The scheme is to be implemented over a 7-year period (from FY 2021-22 to FY 2028-29) and has an outlay of ₹6,238 crore.

Key Points of the PLI Scheme for White Goods:

- The scheme is designed to create a complete component ecosystem for Air Conditioners and LED Lights Industry in India.

- It aims to make India an integral part of the global supply chains.

- With the launch of this scheme, domestic value addition (for the white goods) is expected to grow from the current 15-20% to 75-80%.

- So far, 66 applicants with committed investment of Rs. 6,962 crores have been selected as beneficiaries under the scheme.

Leading Brands Benefiting from the PLI White Goods Scheme:

- Leading consumer durable brands such as Daikin, Panasonic, Havells, and Syska are among the beneficiaries of the PLI White Goods Scheme.

GS-III/Environment and Ecology

Kaziranga National Park

Source: Business Standard

Why in news?

The recent floods in Assam's Kaziranga National Park have been devastating for the wildlife. This flood event is considered the worst in recent years, surpassing the 2017 catastrophe where over 350 animals perished due to floods and vehicle collisions while migrating through animal corridors to higher grounds.

About Kaziranga National Park:

- Kaziranga National Park is situated in the Golaghat, Karbi Anglong, and Nagaon districts of Assam, India.

- Located on the southern banks of the Brahmaputra River, the park is renowned for hosting two-thirds of the global population of Indian rhinoceroses and holds the status of a UNESCO World Heritage Site.

- The park's diverse ecosystem includes significant breeding populations of elephants, wild water buffalo, and swamp deer.

GS2/Polity

Taxing the Ultra Rich

Source: Times of India

Why in news?

French economist Gabriel Zucman has proposed an annual 2% tax on individuals with wealth exceeding $1 billion to spark a global conversation on increasing contributions from undertaxed billionaires to address global inequality.

What is the proposal?

- Zucman suggests an internationally coordinated minimum tax standard for ultra-high-net-worth individuals, proposing that those with over $1 billion in wealth pay an annual tax equal to 2% of their total assets.

- This tax could potentially generate $200-$250 billion yearly from about 3,000 individuals, and extending it to those with a net worth surpassing $100 million could add $100-$140 billion in global tax revenue annually.

What is the rationale for such a tax?

- Global billionaires currently benefit from very low effective tax rates, ranging between 0% and 0.5% of their wealth, as per the Global Tax Evasion Report 2024.

- The wealth of the top 0.0001% households has surged significantly since the mid-1980s, with their share of global wealth increasing at a faster pace compared to average income and wealth growth rates.

- Zucman emphasizes the necessity of progressive taxation to support democratic societies, enhance social cohesion, and facilitate funding for public goods, services, and climate crisis mitigation.

Why propose such a tax now?

- Current tax systems globally are inadequate in effectively taxing the wealthiest individuals, leading to a disproportionate tax burden on other social groups and hindering the redistribution of gains from globalization.

- Advancements in curbing bank secrecy and the establishment of a common minimum corporate tax for large multinational companies have created a conducive environment for implementing such a tax on billionaires.

|

44 videos|5283 docs|1115 tests

|

FAQs on UPSC Daily Current Affairs: 9th July 2024 - Current Affairs & Hindu Analysis: Daily, Weekly & Monthly

| 1. What is the significance of India signing and ratifying the High Seas Treaty? |  |

| 2. How do rising Arctic wildfires impact the world? |  |

| 3. What is the Digital Bharat Nidhi (DBN) and its implications? |  |

| 4. How does Hurricane Beryl's record early intensification affect weather patterns? |  |

| 5. What is the PLI Scheme for White Goods and its objectives? |  |