Weekly Current Affairs (8th to 14th May 2025) - 2 | Weekly Current Affairs - UPSC PDF Download

| Table of contents |

|

| Stress in Microfinance |

|

| Tapti Basin Mega Recharge Project |

|

| Targeting Higher Growth Rate for India |

|

| Impact of Social Media on Young People |

|

| Digital Banking Units: Progress & Challenges |

|

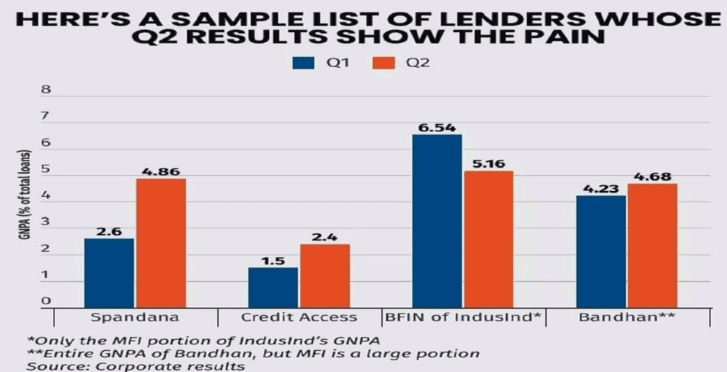

Stress in Microfinance

Why in News?

- India’s microfinance institutions (MFIs) are currently experiencing a significant crisis as gross non-performing assets (NPAs) surged to 16% by March 2025, nearly doubling from 8.8% in 2024. This rise in defaults has led lenders to withdraw, while increasing regulatory interventions raise concerns about the sector’s sustainability.

Key Takeaways

- NPAs in MFIs have increased dramatically, signaling a potential crisis.

- Economic factors and structural issues have contributed to borrower defaults.

- Regulatory pressures are impacting lending practices and liquidity in the sector.

Additional Details

- Cyclical Nature of Microfinance: MFIs typically face crises every 3-5 years, with the current situation reflecting historical trends. Contributing factors include an economic slowdown and natural disasters affecting repayment capabilities.

- Over-Leveraging of Borrowers: Many MFIs have issued loans to borrowers already burdened with debt, leading to an over-leveraged customer base. This issue is exacerbated by borrowers taking loans from multiple sources.

- Weakening of the Joint Liability Group (JLG) Model: The effectiveness of the JLG model, which relies on group accountability for loan repayment, is declining due to changing borrower demographics and increased individual defaults.

- Rising Regulatory Pressure: The Reserve Bank of India (RBI) has implemented stricter norms to stabilize the sector, which has resulted in short-term liquidity challenges for MFIs.

Microfinance, also known as microcredit, provides essential financial services, such as small loans and savings accounts, to underserved populations, particularly in rural areas. It plays a crucial role in empowering marginalized communities, especially women, promoting financial self-sufficiency and socio-economic development.

Importance of Microfinance

- Reduces poverty by granting access to financial resources for income-generating activities.

- Supports small businesses, thereby boosting local economies and employment in rural areas.

- Promotes gender equality through financial empowerment of women.

Current Status of Microfinance in India

- MFIs operate across 28 states and 8 Union Territories, with the sector growing 16% in FY 2023-24.

- By March 2024, the combined portfolio reached Rs 4.08 lakh crore, with top states being Bihar, Tamil Nadu, Uttar Pradesh, Karnataka, and West Bengal, accounting for about 58% of the industry's total.

Addressing the Crisis for Long-Term Sustainability

- Adopt Holistic Triad Model: Implement integrated approaches that combine livelihood promotion, financial services, and institutional development.

- Improve Credit Rating: Focus on economic stability and household income improvement rather than solely on repayment rates.

- Shift Towards Individual Credit Appraisals: Move away from group assessments to individual evaluations to reduce NPAs.

- Use of Technology for Risk Mitigation: Implement real-time data tracking and secure loan management systems to enhance service delivery and risk assessment.

- Revamping Collection Practices: Engage borrowers positively to build trust and improve repayment rates.

- Promoting Financial Literacy: Offer programs to enhance borrowers' understanding of loan management and the consequences of non-repayment.

The increase in NPAs within the microfinance sector indicates a challenging yet cyclical phase driven by internal shortcomings rather than external shocks. The resilience of the sector depends on self-correction, regulatory discipline, and sustained institutional support, making recovery feasible with collective efforts.

Mains Question:

- “The surge in non-performing assets among Microfinance Institutions reflects deeper structural issues in India’s rural credit delivery model.” Critically examine.

Tapti Basin Mega Recharge Project

Why in News?

- Madhya Pradesh (MP) and Maharashtra have entered into a memorandum of understanding (MoU) to collaboratively implement the Tapti (Tapi) Basin Mega Recharge Project in MP. This initiative is recognized as the world’s largest groundwater recharge scheme, designed to ensure optimal utilization of river water resources for irrigation across both states.

Key Takeaways

- The project represents a significant inter-state groundwater recharge initiative between MP and Maharashtra.

- It aims to develop three Tapti River streams originating from Multai, MP.

- This is the third major inter-state river project involving MP, following the Ken-Betwa Link Project and the Parbati-Kalisindh-Chambal Link Project.

Additional Details

- Water Allocation:The project will redirect water from the Tapti River to northeastern Maharashtra for drinking water, as well as to support irrigation in southern and southeastern Madhya Pradesh. The total water usage is projected at 31.13 thousand million cubic feet (TMC), with allocations of:

- 11.76 TMC for Madhya Pradesh

- 19.36 TMC for Maharashtra

- The project involves constructing a diversion weir at the MP-Maharashtra border and developing right and left bank canals in both states.

- Utilization of 3,362 hectares of land in Madhya Pradesh is planned, with no need for displacement or rehabilitation of residents.

- The beneficiary districts include Burhanpur and Khandwa in MP, as well as Akola, Amravati, and Buldhana in Maharashtra, all of which have experienced groundwater stress and irregular rainfall patterns.

This project is a crucial step towards addressing water scarcity issues in the region and enhancing agricultural productivity through improved irrigation practices.

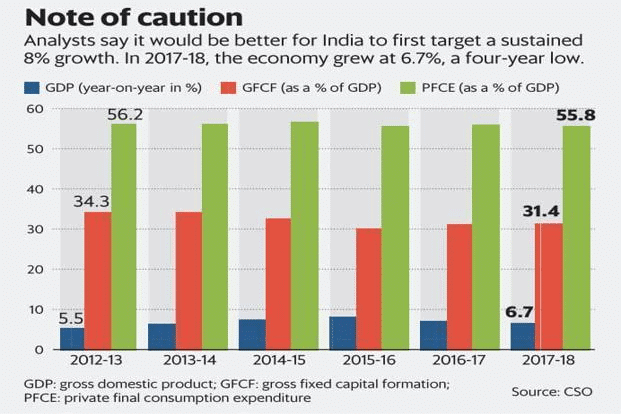

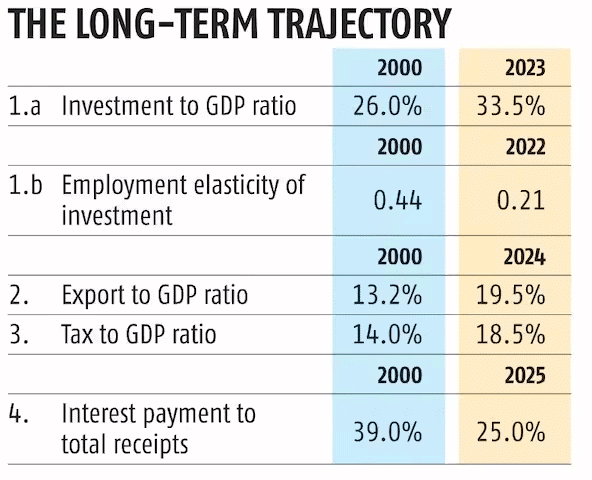

Targeting Higher Growth Rate for India

Why in News?

Why in News?

- India’s Gross Domestic Product (GDP) growth has primarily remained around 6% from 2000 to 2025, with a notable exception of a brief 8% growth period between 2006 and 2010. This situation is often termed the "6% GDP growth trap." To transcend this barrier, India requires comprehensive structural reforms, significant investments in technology, development of human capital, and a commitment to sustainability.

Key Takeaways

- IMF projects India's GDP growth at 6.2% for 2025 and 6.3% for 2026, positioning it as the fastest-growing major economy.

- Foreign exchange reserves reached USD 688.13 billion in May 2025, approaching the all-time high.

- Operational airports increased from 74 in 2014 to 159 in 2025, with 50 new airport projects planned by 2030.

- Capacity utilization in manufacturing hit 75.3% in 2025, indicating strong industrial activity.

- Overall unemployment rate improved slightly to 4.9% in 2024.

Current State of the Indian Economy

- GDP Growth: Projected at 6.2% for 2025 and 6.3% for 2026.

- Foreign Investment & Forex Reserves: Reserves reached USD 688.13 billion in May 2025.

- Infrastructure: Operational airports increased significantly.

- Manufacturing: High capacity utilization suggests robust demand.

- Employment: Gradual improvement in overall unemployment rates.

Challenges to Higher GDP Growth Rate

- Low Investment and Job Creation: Investment-to-GDP ratio fell from 39-42% (2006-2010) to 33% in 2023.

- Fiscal Constraints: A significant portion (25%) of government revenue goes to interest payments, limiting investment capacity.

- Infrastructure Gaps: High logistics costs and trade barriers hinder economic efficiency.

- Social Inequities: Economic growth is concentrated in urban areas, with wealth disparities persisting.

- Global Factors: Economic growth affected by geopolitical tensions and reliance on foreign investment.

Key Drivers of Growth

- Domestic Demand & Consumption: A large consumer base fuels demand across various sectors.

- Infrastructure & Capital Expenditure: Significant allocations for infrastructure projects are stimulating growth.

- Digital Economy & Fintech: The digital economy's contribution to GDP is notable, with increasing transaction volumes.

- Manufacturing Growth: Schemes promoting high-value manufacturing are enhancing sectoral performance.

- Services Sector: Continued strength in IT and fintech reinforces growth potential.

Steps for Higher GDP Growth

- Boost Private Investment: Focus on labor-intensive industries and incentivize domestic manufacturing.

- Reform Fiscal Policy: Increase the tax-to-GDP ratio and streamline tax processes.

- Expand Exports: Enhance trade access and remove barriers to improve competitiveness.

Measures for Sustained Economic Growth

A comprehensive policy approach combining investment incentives, trade reforms, and prudent fiscal management is essential for India to escape the 6% growth trap. Achieving a sustained growth rate of over 8% is crucial for poverty alleviation and enabling a larger segment of the population to transition into the middle class.

Mains Question: What are the key challenges hindering India's economic growth, and what strategic measures should be adopted to achieve a sustained higher growth rate?

Impact of Social Media on Young People

Why in News?

Why in News?

- The rise of social media has raised significant concerns regarding its effect on youth identity and mental health. As young individuals increasingly seek online validation, issues such as anxiety and distorted self-image are becoming more prevalent, highlighting the necessity for a critical evaluation of its influence on their lives.

Key Takeaways

- Social media connects youth’s sense of self to online validation.

- Concerns about anxiety and self-image issues are rising among young people.

Additional Details

- Significance of Social Media:

Social media platforms disrupt traditional media by enabling citizens to share real-time news and opinions. This was evident during the Covid-19 pandemic when healthcare professionals used Twitter to voice concerns over oxygen shortages.

- Impact on Indian Society:

During the Lok Sabha elections 2024, politicians utilized social media for direct engagement and policy announcements. Additionally, movements like MeTooIndia showcased how social media amplifies marginalized voices.

- Economic Influence:

Social media bolsters India's digital economy, aiding small businesses and startups. The creator economy has surged from 962,000 creators in 2020 to 4.06 million in 2024, contributing 8% to the workforce.

Social media also facilitates e-commerce growth, as seen with brands like Patanjali and boAt, which gained visibility through effective marketing strategies. Furthermore, it promotes digital payments, enhancing economic formalization.

How is Social Media Regulated in India?

- Information Technology Act, 2000: This act serves as the primary law for electronic governance, providing a liability exemption for intermediaries.

- Intermediary Guidelines and Digital Media Ethics Code (2021): These guidelines mandate online safety measures, content moderation, and education on privacy and copyright.

- Judicial Stand: The Shreya Singhal v. Union of India case highlighted the importance of freedom of expression, while K.S. Puttaswamy v. Union of India established a fundamental right to privacy.

What Concerns are Associated with Social Media?

- Mental Health Deterioration: Increased anxiety, depression, and loneliness can stem from the pressure to achieve constant validation and fear of missing out.

- Ethical Concerns: Social media can distort identity, promoting curated self-presentation over authentic self-development.

- Parental Disconnect: Many parents lack awareness of their children's digital experiences, leading to secrecy and disconnection.

- Child Exploitation: Young influencers face scrutiny and performance pressure, which can confuse their identities.

- Cyberbullying: Anonymity in social media can lead to harassment and exploitation.

What Measures can Address the Challenges of Social Media for Young People?

- Social Media Policy for Youth Protection: Platforms should adjust algorithms to prioritize educational content for users under 18.

- Enforce Ethical Design Standards: Prohibit the amplification of harmful content and prioritize user safety.

- Digital Literacy: Incorporate cyber safety courses in school curricula to raise awareness.

- Strengthen Governance & Accountability: Implement the DPDP Act, 2023 to penalize misuse of children’s data.

- Promote Mental Health Awareness: Introduce tools for well-being and support initiatives like mental health helplines.

In conclusion, the growing influence of social media necessitates urgent regulation and ethical platform design to safeguard young users. While it presents opportunities for innovation, unchecked use can lead to significant harm. A collaborative approach involving parental engagement is essential to ensure meaningful digital experiences.

Mains Question: Examine how social media serves as both a tool for empowerment and a threat to mental health.

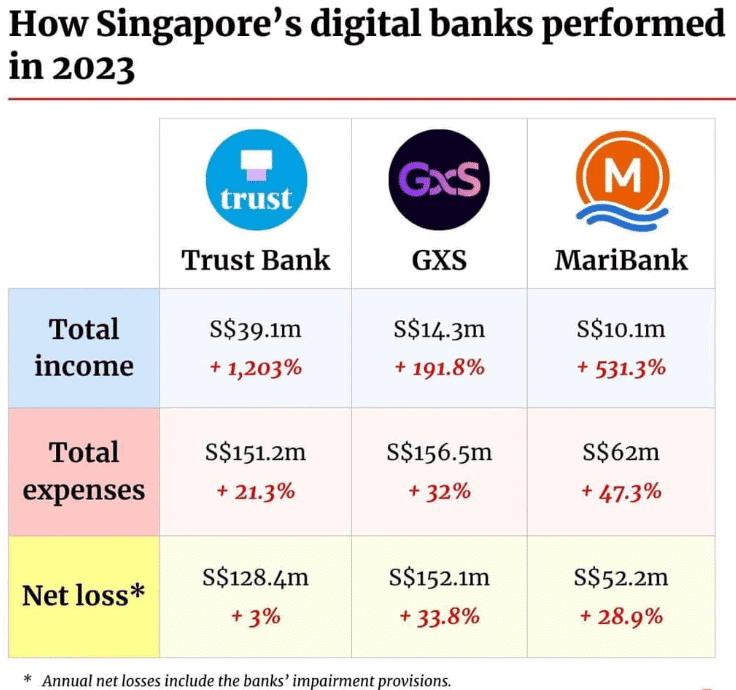

Digital Banking Units: Progress & Challenges

Why in News?

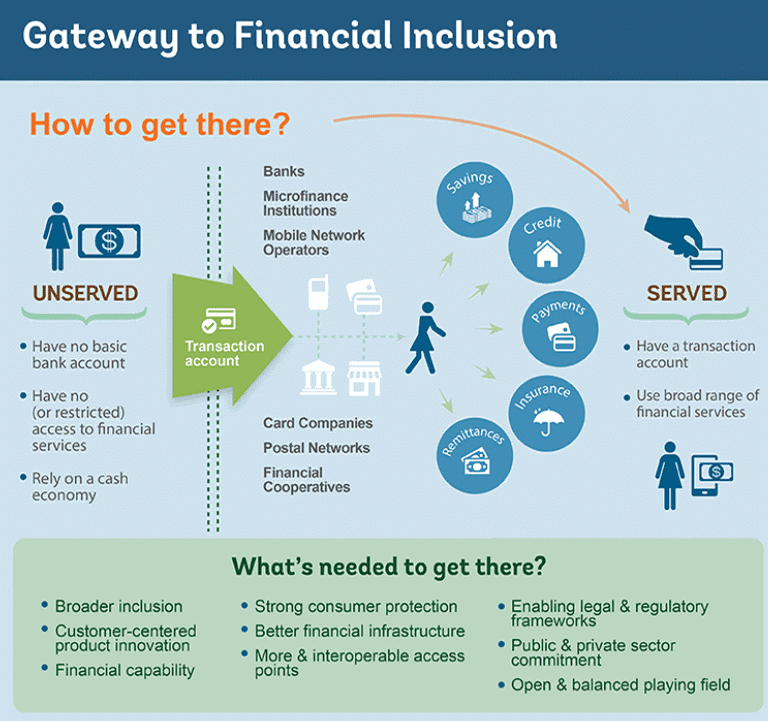

- Digital Banking Units (DBUs) were launched in 2022 to extend digital financial services to the remotest parts of the country. However, they have experienced limited expansion due to challenges such as high operational costs and low digital adoption, raising concerns about their effectiveness and long-term sustainability.

Key Takeaways

- DBUs aim to enhance financial inclusion.

- They offer a range of digital banking services.

- DBUs face significant operational and planning challenges.

Additional Details

- What is a Digital Banking Unit (DBU): A DBU is a specialized fixed-point business unit designed to provide digital banking products through self-service platforms available 24/7. They were introduced across 75 remote districts of India to commemorate India's 75th year of Independence.

- Services Offered: DBUs provide various services including ATMs, cash deposit machines, passbook and internet kiosks, bill payments, and account openings through e-KYC (Know Your Customer).

- RBI Mandate for DBUs: According to RBI regulations, DBUs must be physically distinct from existing bank branches and should feature advanced technologies such as Interactive Teller Machines and Service Terminals.

- Challenges Faced by DBUs:

- Ineffective Planning: Banks were given only 45 days to establish DBUs without considering local needs and digital readiness.

- High Operational Costs: The requirement for costly infrastructure in low-traffic areas has deterred expansion.

- Low Digital & Financial Literacy: Limited digital skills, particularly among senior citizens, hinder the effectiveness of DBUs.

- Connectivity & Strategic Integration Issues: Many remote areas lack stable internet and power, disrupting operations.

- Steps to Enhance Effectiveness:

- Decentralised, Demand-Based Expansion: Establish DBUs based on local demand and digital literacy to ensure sustainability.

- Strengthening Digital Literacy Programs: Utilize initiatives like PMGDISHA to improve digital skills in underserved areas.

- Infrastructure Support: Invest in connectivity improvements and backup power solutions to support DBU operations.

- Enhancing Customer Support: Include human assistance for onboarding and problem resolution, and offer multilingual interfaces.

- Focus on Financial Products and Services: Ensure access to government schemes like PMSBY, PMJJBY, and easy digital loans.

In summary, while DBUs are positioned to enhance financial inclusion, addressing their operational challenges and adapting to local contexts is crucial for their long-term success.

|

287 docs|142 tests

|

FAQs on Weekly Current Affairs (8th to 14th May 2025) - 2 - Weekly Current Affairs - UPSC

| 1. What are the primary causes of stress in microfinance institutions? |  |

| 2. How does the Tapti Basin Mega Recharge Project aim to address water scarcity? |  |

| 3. What strategies can be implemented to target a higher growth rate for India? |  |

| 4. What is the impact of social media on young people's mental health? |  |

| 5. What are the main challenges faced by digital banking units in the current landscape? |  |