Yojana Summary: May 2025 | Current Affairs & Hindu Analysis: Daily, Weekly & Monthly - UPSC PDF Download

Indian Media and Entertainment Industry

India’s Media and Entertainment (M&E) industry is among the fastest-growing sectors globally, driven by factors such as affordable internet access, rising incomes, and the rapid adoption of digital technology. The sector is witnessing an increase in Average Revenue Per User (ARPU) alongside a growing volume of available content.

Advertising Growth

- As per the FICCI-EY report, India’s advertising-to-GDP ratio is expected to rise from 0.38% in 2019 to 0.4% by 2025.

Industry Size and Growth Projections

- 10% Compound Annual Growth Rate (CAGR), reaching Rs. 3.08 trillion by 2026, up from Rs. 2.55 trillion in 2024.

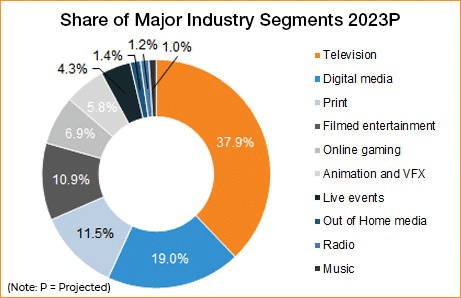

- Traditional media (TV, print, radio, etc.) made up 57% of revenues in 2023; print media is forecasted to increase by 8–10% in FY25 (ICRA).

- Video market (TV + digital): Projected to rise from US$ 13 billion in 2023 to US$ 17 billion by 2028 (Media Partners Asia).

Key Segments and Digital Surge

- Advertising: Expected to reach Rs. 330 billion in 2024, with TV and digital ads each making up 38%. India ranks 8th globally in advertising expenditure and is the fastest-growing among the top ten markets.

- OTT & Video Streaming: This sector is growing at a CAGR of 14.1%, anticipated to hit Rs. 21,032 crore by 2026. In 2023, India had 481.1 million users, including 138.2 million paid subscribers and 130.2 million SVOD accounts (2022). Revenue from international users on Indian OTT platforms increased by 194% from 2021 to 2023.

- AVGC Sector (Animation, VFX, Gaming, Comics): Projected to grow at around 9% CAGR, reaching Rs. 3 lakh crore by 2024. Animation and VFX are expected to increase from US$ 1.3 billion (2023) to US$ 2.2 billion (2026) (CII GT report), raising their share in the M&E industry from 5% to 6%.

- Online Gaming: As the 4th largest M&E segment, India's online gaming market is set to reach US$ 7 billion by 2025. The country had 455 million gamers in 2023, projected to grow to 491 million in 2024, with 90 million paying users. Revenue was US$ 3.8 billion in FY24, reflecting a 23% YoY growth. Mobile gaming time increased by 20% in Q1 FY24.

Other Significant Segments

- Digital Media: Anticipated to generate US$ 10.07 billion in revenue by 2024.

- Smart TVs & Short-form Videos: India is projected to have 40–50 million connected smart TVs by 2025. Approximately 600–650 million users engage with short videos, spending an average of 55–60 minutes per day.

- Music Streaming: Revenue from music streaming is expected to increase from US$ 180 million in 2019 to US$ 445 million by 2026. In 2023, India had 185 million listeners, with only 7.5 million paid subscribers. Major platforms include Gaana (30%), Spotify (26%), JioSaavn (24%), and Wynk (15%).

- DTH Services: Projected to grow from US$ 6.48 billion in 2023 to US$ 7.59 billion by 2029, with a CAGR of 2.8%.

Investments and Developments

- FDI Inflows:. total of Rs. 99,096 crore has been invested in the Information and Broadcasting sector from April 2000 to September 2024.

- Private Equity/Venture Capital Investments: These investments fell by 84% YoY to US$ 575 million in 2023. In the third quarter of 2023, there were 8 deals worth US$ 269 million.

Government Initiatives

The Government of India has implemented various measures to encourage the structured and ethical growth of the Media and Entertainment (M&E) industry:

- FM and Radio Expansion: The Prime Minister launched 100W FM transmitters at 91 locations in April 2023. AIR now operates 615 transmitters, reaching 73.5% of the population.

- International Promotion: India displayed its AVGC capabilities at the Annecy International Animation Festival in France in June 2023.

- Regulatory Reforms:

- TRAI is working to speed up its recommendations to the Ministry of Information and Broadcasting (MIB) regarding broadcasting sector reforms.

- The Cable Television Network (Amendment) Rules, 2021 introduced a three-tier grievance redressal system for citizens concerning TV content.

- The Information Technology (Intermediary Guidelines and Digital Media Ethics Code) Rules, 2021, announced on February 25, 2021, set up a modern regulatory framework for digital media, which includes news publishers and OTT platforms, featuring a three-layer grievance redressal mechanism.

- Institutional Developments:

- The government plans to create a National Centre of Excellence for Animation, Visual Effects, Gaming, and Comics (AVGC) in Mumbai to promote growth in the AVGC sector.

- The Indian Broadcasting Foundation (IBF) broadened its scope in May 2021 to cover digital and OTT platforms, rebranding as the Indian Broadcasting and Digital Foundation (IBDF). IBDF will also establish a Self-Regulatory Body (SRB) under the 2021 IT Rules.

- International Cooperation:

- India and Canada signed an audio-visual co-production agreement to enable collaboration between producers in both countries for creative projects and cultural exchange.

- Prasar Bharati and PSM Maldives signed a cooperation agreement in February 2021 to enhance broadcasting capabilities.

- Support for OTT and Digital Platforms:

- OTT platforms like Netflix, Amazon Prime Video, Disney+ Hotstar, ZEE5, and Voot have adopted a self-regulation code completed in February 2021 by the Digital Entertainment Committee of IAMAI, promoting responsible content creation.

- Content Oversight Expansion:As of November 2020, OTT platforms, films, web series, news, and current affairs on digital platforms are now overseen by the Ministry of Information and Broadcasting.

- Ease of Filming:

- The Film Facilitation Office (FFO) under NFDC, in collaboration with the Ministry of Railways, launched a single-window clearance system to streamline the permission process for filming at railway locations.

Future Prospects

The Media and Entertainment (M&E) sector in India is poised for significant growth, expected to surpass the global average. This expansion is fueled by crucial structural and technological advancements:

- Digital Adoption: The rollout of 5G and future 6G initiatives, especially in rural regions, is set to revolutionize content consumption, opening up new avenues for advertisers and content creators.

- Retail and E-Commerce Advertising: The rise of new players in the food and beverage sector, coupled with increased e-commerce usage and innovative campaigns by local businesses, is anticipated to drive growth in retail advertising.

- Rural Expansion: As urban markets become saturated, rural India is emerging as the next frontier for M&E growth, supported by increasing incomes, better internet access, and growing digital literacy.

WAVES 2025

WAVES (World Audio Visual & Entertainment Summit) is a significant global event focused on the Media and Entertainment (M&E) sector. It is organized by the Ministry of Information and Broadcasting, Government of India.

- The summit brings together industry leaders, innovators, and stakeholders from around the world to address challenges, explore growth opportunities, and promote international cooperation in the M&E industry.

- One of the key initiatives launched during WAVES is the “Create in India Challenge,” aimed at fostering innovation, entrepreneurship, and content creation within India’s vibrant creative ecosystem.

Creative Economy (Orange Economy)

The creative economy encompasses sectors that rely on knowledge and focus on the creation, production, and distribution of creative goods and services across various domains. These domains include:

- Advertising, architecture, design, and fashion

- Performing arts, visual arts, and literature

- Film, music, publishing, and photography

- Software, research and development (R&D), and digital content

In India, the creative industry is valued at USD 30 billion and employs nearly 8% of the national workforce. As of 2023, the industry boasts over 100 million content creators.

Overview of India's Media and Entertainment Sector

- India boasts the fifth largest Media and Entertainment (M&E) industry in the world, following the United States.

- The industry is expected to grow to USD 44.2 billion by 2028.

- This sector is a crucial component of India’s soft power and digital economy, significantly contributing to employment, exports, and innovation.

Harnessing India’s Creative Potential for Economic and Cultural Advancement

Rapid Expansion of the AVGC-XR Sector

- India’s Animation, Visual Effects, Gaming, Comics, and Extended Reality (AVGC-XR) sector is experiencing rapid growth.

- It is poised to become a major hub for content creation within the next 5 to 6 years.

- This transformation is being fueled by government support, a skilled workforce, and improved digital infrastructure.

Overview of the Sector and Its Growth Potential

- India is home to more than 4,000 Animation, Visual Effects, Gaming, and Comics (AVGC) studios. These studios are mainly found in major cities like Mumbai, Bengaluru, Pune, Hyderabad, and Chennai, but there is also a growing presence of studios in smaller towns.

- The sector is deeply rooted in India’s rich cultural heritage, diverse art forms, and the presence of skilled artists. This foundation is driving recognition of the sector’s potential for creating value and jobs.

- The industry is currently expanding at an impressive annual rate of 25–35% in certain segments. It currently employs around 2.6 lakh professionals and is projected to generate 23 lakh direct jobs by 2032.

- Revenue in the sector is anticipated to grow significantly, from USD 3 billion to over USD 26 billion by 2030. Although India currently holds only 0.5% of the global AVGC-XR market, government forecasts suggest this could increase to 5% (USD 40 billion) by 2025, potentially adding 160,000 new jobs each year.

- Emerging job roles within the sector are expected to include content developers, animators, pre- and post-production artists, pre-visualization artists, and compositors.

Challenges in the AVGC-XR Sector

- Lack of Authentic Data: The unavailability of trustworthy data on job figures, the size of the industry, and educational institutions complicates policy planning and investment decisions.

- Skill Gap in Education and Employment: The sector needs a highly specialised workforce, including animators, developers, designers, product managers, and localisation experts. However, the current academic curriculum does not match industry needs, resulting in a shortage of skilled workers.

- Infrastructure Constraints:Poor training infrastructure leads to inadequate teaching and low-quality workforce output, which negatively affects the industry's productivity and growth.

- Limited Focus on R&D: There is a lack of dedicated research efforts, leading to low innovation and minimal academic exploration of future trends in AVGC-XR technologies.

- No Apex Academic Institution: Unlike fields like engineering or design with IITs and NIDs, the AVGC sector lacks a national-level institution to promote academic excellence, encourage innovation, and standardise skills.

- Funding Limitations: Startups and innovators find it hard to obtain funds due to a shortage of targeted financing for advancing AVGC-XR, hindering domestic production and technological progress.

- Weak Indigenous IP Creation: Most of India's AVGC output is outsourced foreign work; there is a deficiency of globally recognised Indian intellectual property (IP). To compete globally, local content creation should be encouraged through tax incentives and other benefits.

Government Initiatives

- Integration of Creative Arts in Education through NEP 2020: The National Education Policy (NEP) 2020 aims to incorporate creative arts and design into the curriculum starting from Class 6. This initiative is designed to provide students with early exposure to skills related to Animation, Visual Effects, Gaming, and Extended Reality (AVGC-XR). Currently, around 5,000 schools, including those under the Central Board of Secondary Education (CBSE) and various state boards, have begun implementing AVGC-XR learning. There are plans to expand this initiative nationwide, making animation a more prevalent and accessible medium for families.

- Establishment of AVGC Promotion Task Force: The Union Budget for 2022–23 introduced the AVGC Promotion Task Force, aimed at recommending measures to boost domestic capabilities and enhance global standing in the AVGC sector. States like Karnataka, Maharashtra, and Telangana have developed proactive policies tailored to their specific needs, often in collaboration with industry groups such as the Federation of Indian Chambers of Commerce and Industry (FICCI), the Association of Bangalore Animation Industry (ABAI), and the Society for Animation and Gaming in Karnataka (SAIK). These initiatives are designed to foster regional growth in the AVGC sector.

Future Directions

- Skill Development and Educational Reform: There should be a continued emphasis on skill development programs, both in formal settings like schools and colleges and in informal settings such as vocational training. These programs should be tailored to meet the real needs of industries, ensuring that the workforce is job-ready.

- Collaboration Between Academia and Industry: Strengthening the collaboration between educational institutions and industry is crucial to align the curriculum with real-world requirements. Activities like guest lectures, internships, and industry-supported projects can help bridge this gap.

- Promotion of Local Intellectual Properties: India should promote the creation of local content and support the development of globally relevant Indian narratives to enhance its cultural influence.

- Establishment of a National AVGC Institute:. national institute, similar to the Indian Institutes of Technology (IITs) or National Institutes of Design (NIDs), should be established to promote research, innovation, training, and startup incubation in the AVGC-XR sector.

- Dedicated AVGC Funding Mechanism: There is a need for a specific AVGC fund created through collaboration between the government and private sector to support startups, research and development, intellectual property creation, and infrastructure improvement through low-interest loans and grants.

Conclusion

- India's AVGC-XR sector is a blend of digital innovation, cultural expression, and economic opportunity.

- By addressing key challenges through:

- Policy reforms

- Educational improvements

- Funding

- Intellectual property support

- India has the potential to become a global leader in AVGC content creation.

- This positive outlook should be backed by specific examples or data to ensure credibility.

- Including statistics or references to current success stories can reinforce this vision.

- Such an approach can lead to:

- Increased employment opportunities

- Higher exports

- Enhanced cultural capital within the digital economy

Investment Prospects in the Media & Entertainment Sector

The Media & Entertainment (M&E) sector in India is poised for substantial transformation. Driven by a burgeoning digital economy, a youthful demographic, and supportive government initiatives, the sector is rapidly evolving into a promising landscape for investment.

- India is on track to become a global powerhouse in content creation, fueled by increasing foreign direct investment (FDI) and a focus on original content and creativity.

Market Dynamics and Growth Catalysts

The thriving M&E sector in India is a result of widespread digital accessibility, boasting 971 million internet users and 690 million smartphone users. This digital proliferation has spurred extensive content creation and consumption. Entertainment has emerged as the fifth-largest category in monthly per capita consumption, with a notable impact from the 377 million Gen-Z individuals, who contribute 48% of India’s Out-of-Home (OOH) entertainment spending. India is anticipated to secure its position as:

- The second-largest mobile gaming market in terms of downloads.

- Home to the second-largest anime fanbase.

- The third-largest video market globally.

In 2024, emerging media and OOH entertainment are projected to account for 41% and 14% of industry revenues, respectively, underscoring their pivotal roles in the sector’s growth.

FDI Landscape and Investment Scope

Foreign Direct Investment (FDI) limits in various sectors range from 26% to 100%, depending on the specific content or activity involved.

- 100% FDI is permitted in sectors such as films, gaming, animation, visual effects (VFX), and advertising.

- Since the year 2000, the media sector has attracted a total of USD 11.5 billion in FDI, with a significant focus on film, print, and radio industries.

- In 2024, the new media segment achieved a remarkable milestone with Rs 876 billion in merger and acquisition (M&A) deal value.

Growth of Gaming and Esports in India

India’s Gaming Market

- The gaming market in India was valued at USD 2–3 billion in 2024 and is expected to grow to USD 9.2 billion by FY29, with a compound annual growth rate (CAGR) of 20%.

- In FY24, 23 million new gamers joined, bringing the total number of gamers in India to 590 million.

- The Average Revenue Per Paying User (ARPPU) increased from USD 8 in FY20 to USD 22 in FY24 and is projected to reach USD 4.3 billion from in-app purchases (IAPs) by FY29.

VC/PE Investment Trends

- $1 billion was invested in 2024, representing a 25% year-on-year increase.

- Around 50 venture capital (VC) funds, including Sequoia, Accel, and Tiger Global, have invested in Indian gaming startups.

- Mobile gaming received 60% of the investments, while esports and real-money gaming accounted for 30% and gaming technology made up 10%.

Global Partnerships

- Major companies like Sony (India Hero Project) and Krafton (India Gaming Incubator) have launched programs to support Indian game developers.

- Imports of gaming consoles and machines doubled, reaching USD 75.15 million in FY24 compared to USD 37.64 million in FY23.

- Gaming arcades now make up 48% of all indoor amusement centres (IACs) in India.

Investment Potential in Esports

Growth of India’s Esports Market:

- Expected to rise from USD 40 million in 2023 to USD 100 million by 2025.

- Currently has 1.8 million players and 20 professional teams participating in global events such as the Commonwealth Esports Championship and the Hangzhou Asian Games.

Opportunities for Infrastructure Development:

- There is a significant opportunity for investment in areas like athlete training facilities, LAN gaming centres, esports cafés, and arenas.

- State governments in Madhya Pradesh, Tamil Nadu, Kerala, Uttar Pradesh, Bihar, Nagaland, and Meghalaya are investing in both soft and hard infrastructure to nurture local esports ecosystems.

- Companies like Krafton and Nodwin are organizing grassroots tournaments to foster talent.

Animation & VFX: A Growing Creative Force

The Animation & VFX sector is projected to reach a value of USD 1.2 billion by 2024. Here are two key trends:

- Rising Anime Popularity in India. India has become the 2nd largest anime fanbase in the world, following China. This surge in anime consumption is attracting global companies like Crunchyroll.

- Expanding Opportunities. There are new opportunities in IP-related content, merchandising, and immersive experiences. Additionally, there is a growing domestic demand for VFX in Indian cinema and advertising.

- VFX Budgets in Indian Films. 30% of big-budget Indian film budgets are now allocated to VFX, while mid-budget films invest about 15% on VFX.

- Global Engagement by Indian Studios. Studios such as DNEG, Prime Focus, and Prana Studios are involved in global projects, including those in Hollywood.

Push for Infrastructure and AVGC Policy

To attract global players, the sector requires high-quality infrastructure, as evidenced by successful initiatives in:

- Dubai Media City

- Dutch Games Garden (Netherlands)

- SEF Arena for Esports (Riyadh)

Several Indian states, including Madhya Pradesh, Karnataka, Kerala, Rajasthan, and Maharashtra, are in the process of developing AVGC parks and media cities as part of their state AVGC strategies. This development is expected to create opportunities for:

- Media firms

- Architectural firms

- Public-Private Partnership (PPP) investments

Government Initiatives and Policy Support

Since 2022, the Indian government has launched several significant schemes to promote the Media and Entertainment (M&E) sector.

- Central Incentive Scheme: Foreign companies involved in creating or filming content in India can benefit from this scheme, which offers incentives of up to USD 3.5 million.

- Film Incentives: To date, 16 films have been incentivized under this scheme.

- Establishment of the Inter-ministerial AVGC Task Force: Introduced in the Budget for 2022-23, this Task Force aims to capture 5% of the global Animation, Visual Effects, Gaming, and Comics (AVGC) market, which is projected to be worth USD 40 billion, and to generate 2 million jobs by 2030.

- National Centre of Excellence for AVGC: In September 2023, the Union Cabinet approved the establishment of this Centre in Mumbai, following the recommendations of the AVGC Task Force.

Conclusion

The M&E sector in India is diversifying beyond traditional entertainment, with significant growth in areas such as mobile gaming, esports, animation, VFX, and outdoor entertainment. This evolution presents unprecedented investment opportunities. The foundation for India’s emergence as a global creative hub is being laid by robust digital infrastructure, proactive policy support, and a focus on intellectual property (IP) creation.

Now is an opportune moment for global investors to explore and capitalize on the emerging opportunities in India’s creative sector.

Press in India – Growth and Diversity of Print Media

- Growth in Publications: The number of registered publications has significantly increased from 1.18 lakh in 2017 to 1.48 lakh in 2022-23, indicating the sector's adaptability and ongoing interest. In the year 2022-23 alone, 2,318 new periodicals were registered.

- Language Distribution: Hindi dominates the print media landscape with over 57,000 periodicals by 2022-23 and the highest circulation of approximately 20 crores. English follows with around 20,000 periodicals, although its circulation has slightly declined, possibly due to the shift towards digital media. Regional languages such as Marathi, Urdu, Telugu, Gujarati, and Malayalam are also experiencing significant growth in circulation, reflecting a strong readership and literacy across different states.

- Regional Trends: Uttar Pradesh leads with the highest number of registered periodicals (approximately 21,660), closely followed by Maharashtra (around 20,488). These states also demonstrate high compliance rates in submitting annual statements, indicating a robust print media environment.

- Challenges and Closures: Although some periodicals ceased operations (34 in 2022-23), this decline is minor compared to previous years, showcasing resilience against financial difficulties and changing audience preferences.

- New Publications: There remains a strong demand for new titles, with over 14,000 applications in 2022-23 and approximately 4,772 new titles approved, highlighting the ongoing vitality and entrepreneurial spirit within the print media sector.

|

63 videos|5397 docs|1142 tests

|

FAQs on Yojana Summary: May 2025 - Current Affairs & Hindu Analysis: Daily, Weekly & Monthly - UPSC

| 1. What are the key investment opportunities in the Indian Media and Entertainment sector by 2025? |  |

| 2. How is the growth of print media characterized in India? |  |

| 3. What role does creativity play in the economic and cultural rise of India’s Media and Entertainment industry? |  |

| 4. What trends are shaping the future of the Media and Entertainment industry in India? |  |

| 5. How can investors navigate the challenges in the Indian Media and Entertainment sector? |  |