Funds-Flow and Cash Flow Statement | Commerce & Accountancy Optional Notes for UPSC PDF Download

| Table of contents |

|

| Introduction |

|

| Importance of Cash and Cash Flow Statement |

|

| Sources and Uses of Cash |

|

| Preparation of Cash Flow Statement |

|

| Conclusion |

|

Introduction

- Analyzing the fluctuations in current assets and liabilities, also known as working capital, helps identify whether working capital has increased or decreased. Understanding where the increased working capital is invested or from where funds are released if it decreases is crucial. The profit and loss account provides insights into operational results and their impact on the financial position. To integrate operational impacts from the profit and loss account and the balance sheet, we prepare a statement of changes in financial position. This statement, commonly referred to as a fund flow statement or statement of sources and application of funds, outlines the sources from which funds were received and how they were utilized.

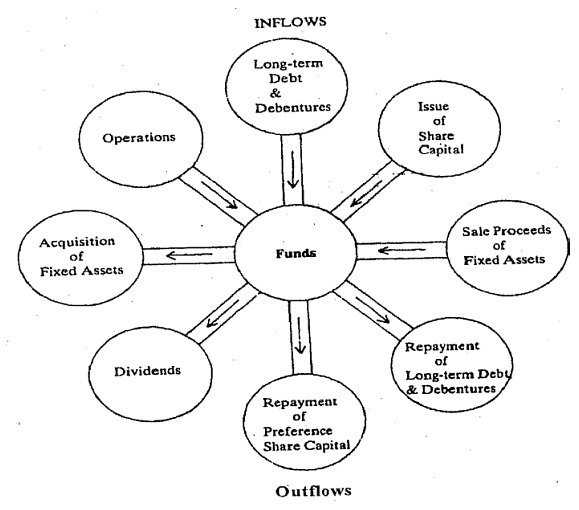

- The fund flow statement delineates the flow of funds throughout the organization, detailing both the sources from which funds were obtained and their intended uses. Typically, it is divided into two main sections: sources of funds or inflows during the period and uses of funds or outflows during the period. The sources of funds section summarizes transactions that increased working capital, while the uses of funds section encompasses transactions that decreased working capital. The fundamental structure of these flows is illustrated as follows:

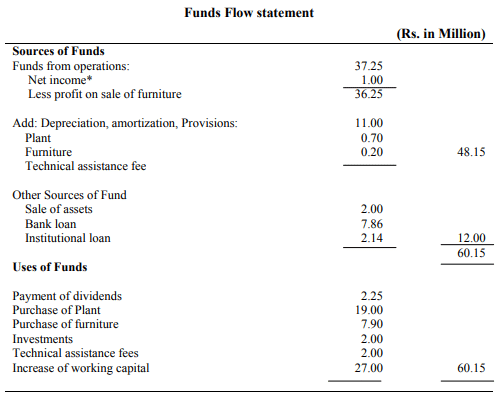

- The fund flow statement provides a concise overview of the consequences of managerial decisions, reflecting policies related to financing, investment, asset acquisition and disposal, profit distribution, and operational success. Extending the illustration presented in 6.2, we can prepare a Fund Flow Statement using data from a comparative balance sheet and profit and loss account. The information required for this statement can largely be derived from these documents.

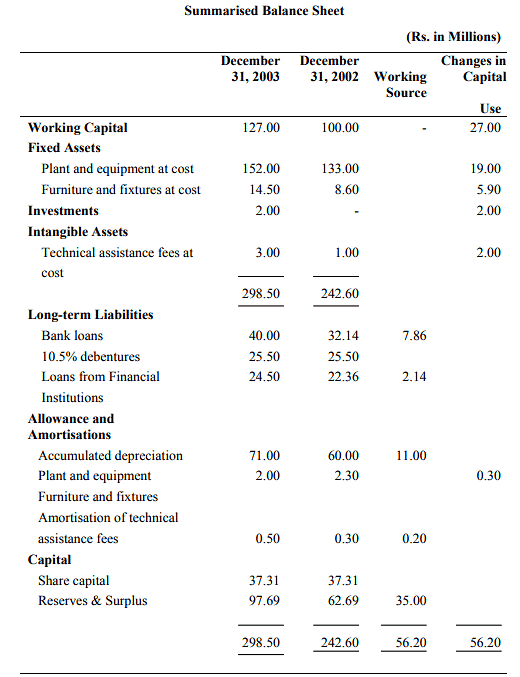

- It's been observed that changes in net working capital result from variations in non-working capital items. This relationship is evident in the summarized balance sheet of TIL (Table 6.2). In the period from January 1 to December 31, 2003, the net working capital increased by Rs. 27 million, indicating that the working capital from non-current sources should exceed non-current uses by this amount.

- While the summarized balance sheet shows the net change in each account, it doesn't distinguish between increases and decreases separately. For instance, the value of furniture and fixtures increased by a net amount of Rs. 5.90 million. This increase represents an application of funds. However, it's important to note that this account serves as both a source and an application of funds. We purchased new furniture and fixtures worth Rs. 7.90 million (a use of funds) and sold existing furniture and fixtures with an original cost of Rs. 2 million, on which accumulated depreciation amounted to Rs. 1 million (a source of funds). Since the purchase transaction outweighed the sale transaction in terms of amount, the net result was a "use of funds".

Notes:

- Furniture and fixtures costing Rs. 2 million with an accumulated depreciation of Rs. 1 million is sold for cash at Rs. 2 million.

- Dividend paid during the year amounted to Rs. 2.25 million.

If we are to construct a statement showing sources and uses of funds during the year, we need additional information. Some of this additional information is available from the profit and loss account and the appropriation of net income. Some other information like sales proceeds of assets will have to be obtained from other records of the company.

Net income has been obtained by deducting the previous year's balance of Reserves and Surplus from the current year's balance i.e. 97.69 minus 62.69= 35 million. To this, the proposed dividend for the current year of Rs. 2.25 million has been added (as it must have been taken into account while determining the net income to be transferred to Reserves and Surplus.

Importance of Cash and Cash Flow Statement

- The significance of cash and cash flow cannot be overstated in managing the financial health of a business. Cash, encompassing both physical currency and cash equivalents, serves as a crucial resource that can be accessed as needed. Daily obligations and liabilities of a business must be fulfilled through cash or check payments. It's vital to differentiate between "Profit" and "Cash", as profit alone cannot cover operational expenses such as creditor payments, utilities, taxes, or dividends. Failure to meet these commitments promptly, even with a healthy working capital and profitable operations, can have disastrous consequences for a business.

- While the balance sheet and profit and loss account provide insights into financial position and performance, they do not directly capture cash flows related to operating, financing, and investing activities. Cash planning is essential to ensure the availability of adequate cash to meet business needs. This involves determining cash inflows and outflows, which can be managed through a cash flow statement.

- The cash flow statement, a crucial tool for short-term planning and coordination, presents a comprehensive overview of cash movements and sources available for acquiring cash when needed. Comparing actual cash flow with projected cash flow helps identify trends and assess the success or failure of cash planning efforts.

- Although cash flow and fund flow statements share similarities, they differ in their focus and scope. While both statements analyze changes in financial position over a specific period, the term "fund" in the fund flow statement encompasses a broader meaning. Fund flow statements examine changes in the fund's position and their impact on working capital, whereas cash flow statements specifically track cash and cash equivalents. The cash flow statement begins with opening cash balances, detailing cash inflows and outflows, and ends with closing balances. In contrast, fund flow statements do not include opening and closing balances and focus on changes in working capital. Increases in current assets or decreases in current liabilities impact working capital, while changes in these items affect cash flow.

Sources and Uses of Cash

A business engages in various activities that either generate or consume cash. These activities can be broadly categorized into three main types: Operating activities, Investing activities, and Financing activities. Here's a brief overview of each category:

- Operating activities: These encompass cash inflows and outflows directly related to the core operations of the business. Inflows typically include revenue from sales, as well as interest and dividends received. Outflows consist of operating expenses such as payments to suppliers, wages, interest, and taxes. Changes in current assets (e.g., receivables, inventory) and current liabilities (e.g., accounts payable, wages payable, interest payable, taxes payable) also reflect operating activities.

- Investing activities: This category involves transactions related to long-term assets like land, buildings, machinery, and investments. Acquiring such assets results in cash outflows, while disposing of them generates cash inflows.

- Financing activities: These activities pertain to raising and repaying funds for the business. Cash inflows typically arise from sources like issuing stocks or bonds, obtaining loans, or receiving capital contributions from owners. Conversely, cash outflows occur when repaying loans or redeeming stocks or bonds.

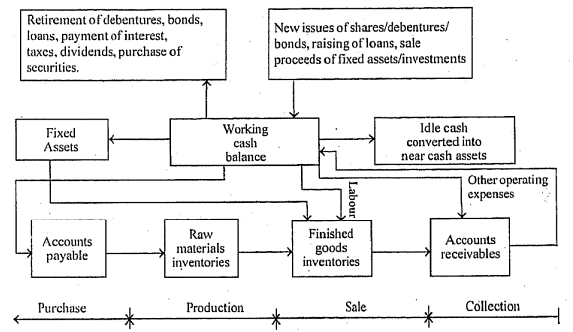

- The Cash Cycle: In order to deal with the problem of cash management we must have an idea about the flow of cash through a firm's accounts. The entire process of this cash flow is known as Cash Cycle. This has been illustrated in Figures and 6.3. Cash is used to purchase materials from which goods are produced. Production of these goods involves use of funds for paying wages and meeting other expenses.

Figure: The Cash Cycle

Figure: Details of the Cash Cycle

Goods are either sold for cash or credit, with pending bills being settled at a later date in the latter case. Consequently, the firm receives immediate or deferred cash for the goods it sells, perpetuating the cycle.

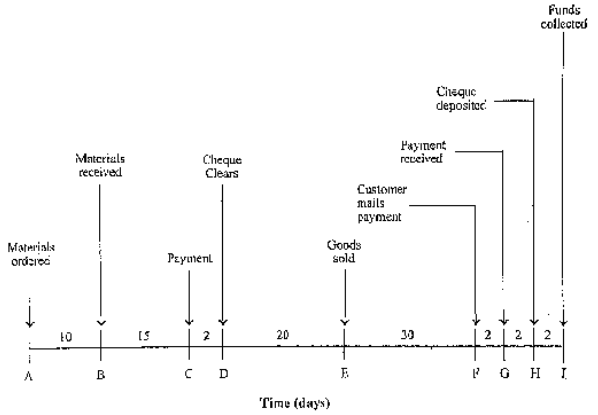

While the Figure provides a general overview of cash flow channels in a business, the Figure illustrates the timing of these flows. The diagram conveys several key points:

- Raw materials are received 10 days after ordering.

- Goods are manufactured for sale within 37 days (from point B to E).

- Payment for purchased materials can be delayed up to 17 days (from points B to D), assuming a 2-day collection period for checks.

- Cash from goods sold is received 32 days after the sale (from point E to G).

- Recovery of cash spent until point D occurs after 56 days (from points D to J).

The management of these inflows and outflows is further discussed in detail in Unit 16 of Block No. 5.

Preparation of Cash Flow Statement

To begin, two consecutive balance sheets and the operating statement (profit and loss account) linking the two balance sheets are required.

- There are two methods to prepare a cash flow statement. The first method, known as the "Profit basis" statement, involves starting with the operating cash balance, adding or subtracting the profit or loss from operations, adjusting for changes in current assets and liabilities, and accounting for additions and reductions in other assets, shareholders' funds, and long-term liabilities to determine the closing cash balance. Alternatively, the "Cash basis" statement only considers cash receipts and disbursements, excluding non-cash items like depreciation and preliminary expenses written off.

- Preparing a cash flow statement on a cash basis is straightforward and can be done by students independently. However, we will focus on the "Profit basis" cash flow statement for further examination.

The steps involved in preparing a "Profit basis" cash flow statement are outlined below:

- Begin with the closing cash balance from the first of the two balance sheets, which serves as the opening cash balance for the cash flow statement.

- Determine the net profit figure, either directly provided or calculated by preparing an "Adjusted Profit and Loss account" using balances from both balance sheets.

- Adjust the increase or decrease in each current asset and liability item to the "Profit from operation" figure to derive the "Cash from operation."

- Add the "Cash from operation" to the opening cash balance. Also include cash flow from other sources such as non-current assets and liabilities (e.g., equity and debenture issue, term loan issuance) and deduct cash outflow for various uses (e.g., redemption of preference shares/debentures, term loan retirement, purchase of fixed assets).

- Ensure that the balance derived in step 4 matches the closing cash balance in the second balance sheet.

- Increases and decreases in assets and liabilities can be categorized under operational, investment, and financing activities for clarity.

Conclusion

- Beginning with the organization's fund requirements, we endeavored to track the origins and applications of funds. We examined key sources of funds, such as operations, sale of fixed assets, long-term borrowings, and issuance of new capital. Similarly, significant uses of funds were identified, including acquisition of fixed assets, dividend payments, loan repayments, and capital redemption. Through this process, we gained insight into where funds are utilized and their respective sources. Additionally, we learned how to conduct fund flow analysis using published accounting data.

- Furthermore, we discussed the distinction between cash and funds, as well as between cash flow statements and fund flow statements. Emphasis was placed on the significance of cash and the cash flow statement. Our exploration focused on both the cash flow statement based on the "cash basis" and the "profit basis." We gained an understanding of how to analyze cash flows using accounting data and ultimately present the findings in the format of a cash flow statement.

|

196 videos|219 docs

|

FAQs on Funds-Flow and Cash Flow Statement - Commerce & Accountancy Optional Notes for UPSC

| 1. What is the importance of the Cash Flow Statement in financial analysis? |  |

| 2. How are Cash Flow Statements prepared? |  |

| 3. What are some common sources of cash for a business? |  |

| 4. Can a business have a positive net income but still face cash flow issues? |  |

| 5. How does the Cash Flow Statement differ from the Funds-Flow Statement? |  |