Economic Development: February 2024 Current Affairs | Current Affairs: Daily, Weekly & Monthly - CLAT PDF Download

UPI Services in Sri Lanka and Mauritius

Context

India has introduced its UPI payment services in Sri Lanka and Mauritius, alongside rolling out RuPay card services in Mauritius.

About UPI Payment Services

- UPI is an instant real-time payment system to facilitate multiple bank accounts into a single mobile application (of any participating bank), merging several banking features, seamless fund routing & merchant payments into one hood.

- Launched in : 2016

- UPI Achievement:

- UPI transactions have skyrocketed exceeding 10 billion and

- over 40% of Indian payments are now digital in which upi is leading the head.

About Rupay

- RuPay is a global card payment network from India, with wide acceptance at shops, ATMs, and online.

- The name derived from the words ‘rupee’ and ‘payment’ emphasizes that it is India’s very own initiative for card payment.

- Launched in : It is a financial services and payment services system launched in 2012 and dedicated to the country in 2014.

- By : National Payment Corporation of India(NPCI).

Significance of launch UPI Payment Services Launch in Sri Lanka and Mauritius

- Enhance Cultural and people-to-people linkages with Sri Lanka and Mauritius.

- Strengthen Bilateral Financial & Digital Connectivity.

- It will enhance the development in the Global South.

- Enhance fintech innovation based on mutual benefit.

- Foster Faster and seamless digital transaction experience

- Benefits for Tourists visiting the countries.

Indian Oil Market Outlook to 2030: IEA

Recently, the International Energy Agency (IEA) has published a comprehensive report outlining the Indian oil market outlook up to the year 2030. This report sheds light on various factors that may shape India's role in the global oil market in the coming years, examining energy transition trends, and addressing the implications for the country's energy security.

Recently, the International Energy Agency (IEA) has published a comprehensive report outlining the Indian oil market outlook up to the year 2030. This report sheds light on various factors that may shape India's role in the global oil market in the coming years, examining energy transition trends, and addressing the implications for the country's energy security.

Key Highlights of the Report

- India's Dominance in Oil Demand Growth: The report projects India to emerge as the largest source of global oil demand growth by 2030, surpassing even China by 2027. It is estimated that India's oil demand will increase by approximately 1.2 million barrels per day (bpd) by 2023, constituting over a third of the expected global demand growth of 3.2 million bpd by 2030. By 2030, India's total oil demand is forecasted to reach 6.64 million bpd, compared to 5.48 million bpd in 2023. This growth is attributed to various factors such as robust economic expansion, population growth, and demographic changes.

- Growth in Fuel Demands: Diesel/gasoil is identified as the primary driver of oil demand growth in India, accounting for nearly half of the nation's demand increase and over one-sixth of total global oil demand growth through 2030. Additionally, jet-kerosene demand is expected to grow significantly, albeit from a comparatively lower base. Conversely, petrol demand is projected to grow modestly due to the gradual electrification of India's vehicle fleet. LPG demand is also anticipated to rise due to investments in production facilities.

- Crude Oil Imports: India's reliance on crude oil imports is predicted to surge by over a fourth to 5.8 million bpd by 2030, primarily due to robust oil demand growth coupled with declining domestic production. Currently, India depends on imports to meet over 85% of its oil requirements, positioning it as the third-largest consumer of crude oil globally, following the US and China.

- Investment in Refining Sector: To cater to the escalating domestic oil demand, Indian oil companies are making substantial investments in the refining sector. Over the next seven years, it is anticipated that 1 million barrels per day of new refinery distillation capacity will be added, surpassing any other country worldwide outside of China.

- Role in Global Oil Markets: India is poised to retain its position as a significant exporter of transportation fuels to markets across Asia and the Atlantic Basin. Notably, India's role as a global swing supplier has amplified since 2022, particularly with the increased demand for Asian diesel and jet fuel in European markets.

- Biofuels in Decarbonisation: The report underscores the pivotal role of biofuels in India's efforts to decarbonize the transport sector. India currently ranks as the world's third-largest producer and consumer of ethanol, with its ethanol blending rate reaching around 12%. The country aims to double nationwide ethanol blending in gasoline to 20% by Q4 2026, although achieving this target presents several challenges.

- Efforts in Energy Transition: The uptake of Electric Vehicles (EVs) is expected to play a crucial role in reducing oil demand in the transport sector. It is estimated that new EVs and energy efficiency improvements combined will prevent an additional 480 thousand barrels per day of oil demand by 2030.

Challenges and Recommendations

- Despite these promising developments, the report also highlights certain challenges. Domestic crude oil production is expected to continue declining due to a lack of new discoveries, further exacerbating India's dependence on imports.

- Additionally, enhancing India's capacity to respond to oil supply disruptions is imperative, necessitating improvements in its Strategic Petroleum Reserve (SPR) programmes.

Strategic Petroleum Reserves

- Strategic petroleum reserves (SPRs) play a vital role in ensuring a stable supply of crude oil during geopolitical uncertainties or supply disruptions.

- India currently possesses a strategic crude oil reserve capacity of 5.33 million tonnes, with plans to expand this capacity under the second phase of its strategic petroleum reserves programme.

About the International Energy Agency (IEA)

- Established in 1974 in response to the oil crisis of the mid-1970s, the IEA is an autonomous agency headquartered in Paris, France. It focuses on energy policies related to economic development, energy security, and environmental protection.

- With 31 member countries, including India as an associate member, the IEA plays a crucial role in providing insights into the international oil market and addressing supply disruptions.

India Becomes Net Exporter of Toys

Why in News?

Recently, India's toy industry has experienced a significant surge in exports, accompanied by a notable drop in imports, resulting in India transitioning into a net exporter of toys. This transformation underscores a remarkable development within the country's manufacturing sector.

Status of India's Toy Industry

- Over the years, India's toy industry has undergone a notable evolution, transitioning from historical regulatory frameworks characterized by the "permit license raj" to contemporary policies like the 'Make in India' initiative.

- Notably, recent studies attribute the industry's success to the proactive measures undertaken as part of the 'Make in India' campaign.

Positive Shift in Trade Balance

- In the realm of trade, India's toy industry has witnessed a favorable turnaround. From a negative trade balance of Rs.1,500 crore in 2014-15, the industry achieved a positive trade balance starting from 2020-21.

- This shift can be primarily attributed to various factors including an increase in import duty from 20% to 60% in February 2020, alongside the imposition of non-tariff barriers like Quality Control Orders (QCO) and mandatory sample testing. Furthermore, disruptions caused by the COVID-19 pandemic also played a role in reshaping trade dynamics.

What Led India to Become a Net Exporter?

- The transition of India into a net exporter of toys can be attributed to a combination of tariff and non-tariff barriers. The significant increase in customs duties on toys from 20% to 60% in February 2020, followed by a further hike to 70% in March 2023, served as a deterrent to toy imports.

- Additionally, non-tariff barriers such as the implementation of quality control measures and mandatory sample testing further restricted imports, thereby stimulating domestic production and fostering the growth of the indigenous toy industry.

- Furthermore, disruptions in the global supply chain due to the COVID-19 pandemic also contributed to reshaping trade dynamics in favor of Indian exports.

Challenges Ahead

- Despite the positive developments, the Indian toy industry faces several challenges that warrant attention.

- These include limited domestic productive capabilities, declining labor productivity, foreign dependence for sourcing raw materials, technological obsolescence, high tax rates, competition from inexpensive imports, and the prevalence of an unorganized and fragmented market structure.

National Action Plan for Toys (NAPT)

- Recognizing the significance of the toy industry, the Government of India launched the National Action Plan for Toys (NAPT) in 2020.

- This comprehensive initiative aims to bolster the Indian toy industry's competitiveness and promote traditional handicrafts and handmade toys, with the overarching goal of establishing India as a global toy manufacturing hub.

Way Forward

- To sustain and enhance India's position as a net exporter of toys, policymakers must strike a delicate balance between protectionist measures and competitiveness.

- This entails evaluating the effectiveness of tariffs and protectionist policies while concurrently fostering an environment conducive to investment, innovation, and overall industry competitiveness.

- Additionally, there is a pressing need to invest in domestic capabilities, enforce quality control measures, develop infrastructure, and support small and medium enterprises (SMEs) within the toy manufacturing sector.

ASI Results for 2020-21 and 2021-22

Why in News?

The Ministry of Statistics and Programme Implementation (MoSPI) has recently unveiled the findings of the Annual Survey of Industries (ASI) covering the periods 2020-21 and 2021-22, denoted as ASI 2020-21 and ASI 2021-22.

What are the Key Highlights From the ASI 2020-21 and ASI 2021-22 Results?

Growth in Gross Value Added (GVA):

- In the year 2020-21, GVA expanded by 8.8% compared to 2019-20, primarily driven by a notable decrease in input (4.1%), which counterbalanced an output decline (1.9%) amidst the pandemic.

- In 2021-22, GVA experienced a significant surge of 26.6% over the preceding year, propelled by robust growth in industrial output, which increased by over 35% in value terms.

- During 2021-22, there was a notable elevation in various key economic indicators such as invested capital, input, output, GVA, net income, and net profit recorded by the sector, surpassing pre-pandemic levels in absolute value terms.

Key Industry Drivers:

- Industries including Manufacture of Basic Metal, Coke & Refined Petroleum Products, Pharmaceutical Products, Motor vehicles, Food Products, and Chemical and Chemical Products emerged as primary growth drivers.

- Collectively, these sectors contributed approximately 56% of the total GVA of the sector, with a GVA growth of 34.4% and output growth of 37.5% compared to 2020-21.

Regional Performance:

- Gujarat maintained its leading position in terms of GVA in 2020-21 and ranked second in 2021-22, whereas Maharashtra secured the top rank in 2021-22 and second in 2020-21.

- Tamil Nadu, Karnataka, and Uttar Pradesh consistently held their positions among the top five states contributing to manufacturing GVA.

Employment Trends:

- Despite a slight decline in employment in 2020-21 due to the pandemic, 2021-22 witnessed a robust year-on-year (Y-o-Y) growth of 7.0% in total estimated employment within the sector.

- The estimated number of individuals engaged in the sector in 2021-22 surpassed pre-pandemic levels by more than 9.35 lakh, with the average salary per employee showing a rise of 1.7% in 2020-21 and 8.3% in 2021-22 compared to the respective previous years.

- Tamil Nadu, Gujarat, Maharashtra, Uttar Pradesh, and Haryana emerged as the top five states with the highest number of individuals employed in the manufacturing sector in both 2020-21 and 2021-22.

- Collectively, these states accounted for about 54% of the total manufacturing employment in both years.

What is the Annual Survey of Industries (ASI)?

The Annual Survey of Industries (ASI) serves as the primary source of industrial statistics in India. It was initiated in 1960, with 1959 as the base year, and has been conducted annually, except for 1972, under the Collection of Statistics Act of 1953. Since ASI 2010-11, the survey has been conducted under the Collection of Statistics Act of 2008. This Act was amended in 2017 as the Collection of Statistics (Amendment) Act, 2017, extending its coverage to encompass All India.

- Administration: The ASI is carried out by the National Statistical Office (NSO), a division of the Ministry of Statistics and Programme Implementation (MoSPI). The MoSPI is entrusted with ensuring the coverage and quality of the statistics released.

- Scope and Coverage: The ASI encompasses factories registered under Sections 2(m)(i) and 2(m)(ii) of the Factories Act of 1948, as well as bidi and cigar manufacturing establishments registered under the Bidi & Cigar Workers (Conditions of Employment) Act of 1966. Additionally, it includes electricity undertakings engaged in the generation, transmission, and distribution of electricity, not registered with the Central Electricity Authority (CEA), along with units employing 100 or more workers listed in the Business Register of Establishments (BRE) maintained by the State Governments.

- Data Collection Process: Data for the ASI are collected from selected factories in accordance with the Collection of Statistics Act of 2008, as amended in 2017, along with the rules framed thereunder in 2011.

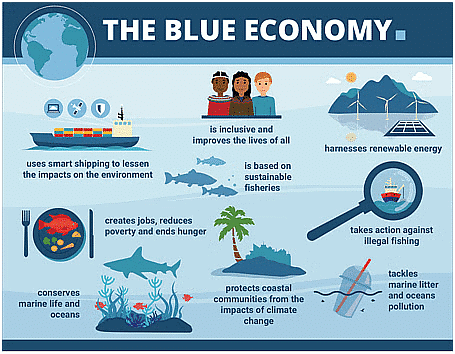

Blue Economy 2.0

Why in News?

The recent presentation of the Interim Budget included a significant emphasis on advancing Blue Economy 2.0 through the introduction of a novel scheme focused on restoration, adaptation measures, coastal aquaculture, and mariculture, employing an integrated and multi-sectoral strategy.

What is the Blue Economy?

- About

- Blue economy refers to the sustainable use of marine resources for exploration, economic growth, improved livelihoods, and transport while preserving the health of marine and coastal ecosystems.

- In India, the blue economy encompasses a wide range of sectors, including shipping, tourism, fisheries, and offshore oil and gas exploration.

- This is reflected in the Sustainable Development Goal (SDG 14), which calls to conserve and sustainably use the oceans, seas and marine resources for sustainable development.

- Necessity for Blue Economy:

- India has a vast coastline of 7500 km, and its exclusive economic zones (EEZ) extend over 2.2 million square km. Also, India is home to 12 major ports, over 200 other ports, 30 shipyards and a comprehensive hub of diverse maritime service providers.

- It advocates the greening of ocean development strategies for higher productivity and conservation of the ocean's health.

- Oceans cover three-quarters of the Earth’s surface, contain 97% of the Earth’s water, and represent 99% of the living area on the planet.

- Growth Prospects:

- The global ocean economy is currently valued at approximately USD 1.5 trillion annually, ranking it as the world's seventh-largest economy. Projections indicate that it will double by 2030, reaching USD 3 trillion.

- The total value of ocean assets, also known as natural capital, has been estimated at USD 24 trillion.

What is Blue Economy 2.0?

About

This is aimed at promoting climate-resilient activities and sustainable development in coastal areas.

- With marine ecosystems facing unprecedented threats from climate change, pollution, and overexploitation, there is an urgent need for coordinated action to safeguard the health and resilience of ocean resources.

Components

- Restoration and Adaptation:

- Central to the scheme are measures aimed at restoration and adaptation, which will involve restoring degraded coastal ecosystems and implementing adaptation strategies to mitigate the effects of rising sea levels and extreme weather events.

- These efforts are crucial for preserving biodiversity, protecting coastal communities, and maintaining the ecosystem services provided by marine habitats.

- Expansion of Coastal Aquaculture and Mariculture:

- Blue Economy 2.0 scheme will focus on the expansion of coastal aquaculture and mariculture, which play a vital role in meeting the growing demand for seafood while reducing pressure on wild fish stocks.

- By promoting sustainable aquaculture practices and integrating them with other sectors such as tourism and renewable energy, the scheme aims to create economic opportunities for coastal communities while ensuring the long-term viability of marine resources.

- Integrated and Multi-Sectoral Approach:

- The integrated and multi-sectoral approach adopted by the Blue Economy 2.0 scheme recognises the interconnectedness of various sectors and the need for coordinated action across government departments, industries, and civil society.

- By fostering collaboration and partnership, the scheme seeks to harness the collective efforts of stakeholders to achieve sustainable development goals in coastal areas.

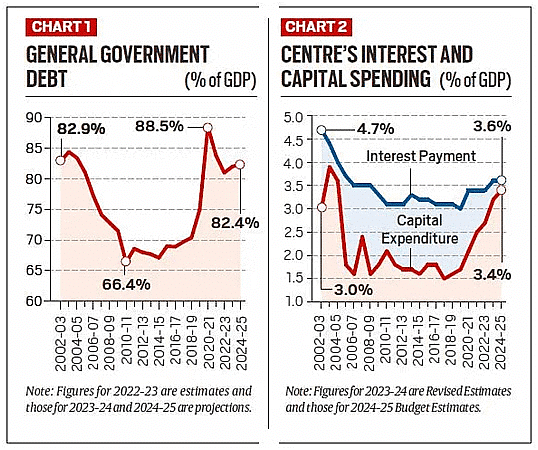

Fiscal Deficit and its Management

Why in News?

In response to India's ongoing fiscal challenges related to national debt, the Ministry of Finance has announced in the Interim Budget 2024-25 its decision to decrease the country's fiscal deficit to 5.1% of Gross Domestic Product (GDP) for the fiscal year 2024-25.

What is Fiscal Deficit?

Concerning Fiscal Deficit and National Debt:

- Fiscal deficit denotes the disparity between a government's revenue and expenditure. When a government's spending surpasses its income, it resorts to borrowing funds or selling assets to cover the deficit.

- Taxation serves as the primary revenue source for governments, with projected tax receipts of Rs 26.02 lakh crore and total revenue estimated at Rs 30.8 lakh crore for 2024-25.

- Conversely, when a government achieves a fiscal surplus, its revenue exceeds expenditure. However, such occurrences are rare, with most governments prioritizing deficit control over achieving surplus or budget equilibrium.

Projections:

- The government anticipates reducing the Fiscal Deficit to below 4.5% of GDP by 2025-26, as outlined in the Budget 2021-22. Revised estimates also indicate a lowered fiscal deficit projection of 5.8% of GDP for 2023-24.

National Debt and Fiscal Deficit:

- National Debt represents the cumulative amount owed by a government to its creditors at a given time. This debt encompasses diverse liabilities, including domestic and foreign loans, as well as obligations to schemes like small savings and provident funds.

- Such liabilities entail interest payments and repayment of principal amounts, imposing substantial financial burdens on government finances. Typically, government debt accumulates over years of fiscal deficits and borrowing to offset these deficits.

- A higher fiscal deficit as a percentage of GDP raises concerns regarding lenders' repayment security.

Trends in National Debt:

- The debt-GDP ratio, which was at 84.4% in 2003-04, has experienced fluctuations under different administrations. Post-2014, there was a notable increase in the debt-GDP ratio, peaking at 88.5% in 2020-21 due to economic disruptions caused by the Covid-19 pandemic.

- Despite marginal improvements in subsequent fiscal years, the ratio remains elevated, projected at 82.4% for 2024-25, posing significant challenges for fiscal management.

How does the Government Fund its Fiscal Deficit?

Borrowing from Bond Market:

- To address its fiscal deficit, the government primarily resorts to borrowing from the bond market, where lenders vie to lend by acquiring government-issued bonds. In the fiscal year 2024-25, the Centre anticipates borrowing a gross sum of Rs 14.13 lakh crore from the market, a figure lower than its borrowing target for 2023-24.

- This expectation stems from the anticipation of funding its expenditures in 2024-25 through increased GST collections. As a government's financial position deteriorates, demand for its bonds decreases, necessitating higher interest rates to attract lenders and consequently raising borrowing costs.

Role of Reserve Bank of India:

- The RBI holds a significant role in the credit market, indirectly facilitating government borrowing. While central banks may not directly procure government bonds from the primary market, they engage in Open Market Operations (OMO) to acquire bonds from private lenders in the secondary market.

- This injection of liquidity by central banks effectively supports government borrowing endeavors. However, central bank interventions through OMO involve the creation of new money, potentially leading to an augmented money supply and inflationary pressures in the economy over time.

Monetary Policy:

- Monetary policy also plays a pivotal role in mitigating costs for government borrowing from the market. Central bank lending rates, which were close to zero in many countries before the pandemic, have surged post-pandemic.

- This surge renders borrowing money more expensive for governments, potentially motivating the Centre's efforts to curtail its fiscal deficit.

What is the Legislation Related to Fiscal Management in India?

- Fiscal Responsibility and Budget Management (FRBM) Framework: Enacted in 2003, the FRBM Act established ambitious objectives for debt reduction, aiming to restrict general government debt to 60% of GDP by 2024-25.

- However, subsequent fiscal paths have veered off from these goals, resulting in the Centre's outstanding debt exceeding the initially envisaged thresholds. The FRBM Review Committee Report has proposed a debt-to-GDP ratio of 60% for the combined general government by 2023, allocating 40% for the Central Government and 20% for the State Governments.

Why is it Important to Worry About Fiscal Deficit?

Impact on Inflation:

- There is a strong direct relationship between the government’s fiscal deficit and Inflation in the country.

- When a country’s government runs a persistently high fiscal deficit, this can eventually lead to higher inflation as the government will be forced to use fresh money issued by the central bank to fund its fiscal deficit.

- The fiscal deficit in 2020 reached a high of 9.17% of GDP during the pandemic. It has since decreased significantly and is expected to reach 5.8% in 2023-24.

Fiscal Discipline Improves Ratings:

- A lower fiscal deficit indicates better government fiscal discipline. This can lead to higher ratings for Indian government bonds.

- When the government relies more on tax revenues and borrows less, it boosts lender confidence and lowers borrowing costs.

Management of Public Debt:

- A high fiscal deficit can also adversely affect the ability of the government to manage its overall public debt.

- In December 2023, the IMF warned that India’s public debt could rise to more than 100% of GDP in the medium term due to risks.

- A lower fiscal deficit may help the government to more easily sell its bonds overseas and access cheaper credit from the international bond market.

What can be Done to Manage Fiscal Deficit and National Debt in India?

- Fiscal Responsibility and Consolidation: Maintaining adherence to fiscal consolidation objectives, as delineated in the FRBM Act, remains paramount. It is imperative for the government to progressively diminish the fiscal deficit-to-GDP ratio to ensure the sustainability of public finances. The implementation of judicious fiscal policies, encompassing rationalisation of expenditures, enhancement of revenue streams, and subsidy reforms, holds the key to reducing reliance on borrowing and ameliorating fiscal imbalances.

- Revenue Enhancement: Augmenting revenue mobilisation necessitates bolstering tax administration and compliance to broaden the tax base and enhance revenue collection. Exploring opportunities to diversify revenue sources, such as introducing levies on luxury goods, wealth, or environmental taxes, is essential for sustainable fiscal management.

- Expenditure Rationalisation: A comprehensive review of government expenditures is imperative to pinpoint inefficiencies and allocate resources judiciously, particularly in critical sectors like healthcare, education, and infrastructure. Measures to curtail non-essential spending and subsidies while ensuring targeted assistance for vulnerable segments of society are crucial components of expenditure rationalisation efforts.

- Debt Management Strategies: Developing a sound debt management strategy is vital for optimizing borrowing costs and minimizing refinancing risks. Diversifying the investor base and financing sources, including domestic and international markets, is necessary to mitigate exposure to market volatility.

- Long-Term Structural Reforms: Undertaking structural reforms aimed at enhancing the efficiency and competitiveness of the economy is imperative. This includes initiatives such as labor market reforms, ease of doing business initiatives, and governance reforms. Addressing structural bottlenecks and challenges in key sectors like agriculture, manufacturing, and services is essential for unlocking growth potential and bolstering fiscal sustainability.

Guidelines on State Guarantees on Borrowings

The Reserve Bank of India (RBI) has issued new guidelines to mitigate the risks linked with state guarantees. A working group appointed by the RBI has proposed various measures to tackle the challenges associated with state government guarantees. These measures aim to establish a consistent framework for managing risks and liabilities tied to such guarantees.

Definition of Guarantee

- A 'guarantee' refers to a contingent liability of a State, safeguarding the lender/investor from borrower default. It involves three parties: the 'creditor,' the 'principal debtor,' and the 'surety' (State governments).

- Guarantees are provided to shield against debt default, with the guarantor pledging accountability for the debt or default of the principal debtor.

|

Download the notes

Economic Development: February 2024 Current Affairs

|

Download as PDF |

Expansion of Guarantee Definition

- The working group suggests broadening the term 'guarantee' to encompass all instruments creating an obligation on the guarantor (State) to make future payments on behalf of the borrower, irrespective of their names.

- No differentiation should be made between conditional or unconditional, financial or performance guarantees when evaluating fiscal risk.

Restrictions on Granting Guarantees

- State guarantees should not be used to secure financing via State-owned entities, substituting budgetary resources.

- Guarantees should not create direct liability on the State.

- Adherence to Government of India guidelines is advised, including limits on guarantees and restrictions on providing guarantees to private sector entities.

Risk Assessment

- States should assign appropriate risk weights before extending guarantees, categorising them into high, medium, or low risk based on default records.

Ceiling on Guarantees Issuance

- A ceiling on guarantees issuance is deemed necessary to manage potential fiscal stress.

- The proposed ceiling is set at 5% of Revenue Receipts or 0.5% of GSDP for incremental guarantees issued during a year.

Disclosures

- The RBI may recommend banks/NBFCs to disclose credit extended to State-owned entities backed by state government guarantees.

- Availability of data from both issuers and lenders is expected to enhance transparency and credibility.

China’s Shifting Economic Landscape

Why in News?

China's economy faced significant challenges in 2023, registering one of its slowest growth rates in over three decades as it was battered by a crippling property crisis, sluggish consumption, shifting demographic trends and global turmoil.

What are the Major Factors Contributing to Economic Challenges in China?

- Economic Status: China's National Bureau of Statistics (NBS) reported a 5.2% growth in GDP, reaching 126 trillion yuan in 2023.

- Despite exceeding the target and outperforming the 3% recorded in 2022, this growth represents the slowest performance since 1990, excluding pandemic years.

- Deflation for three consecutive months added to the economic headwinds.

Factors Contributing to Economic Challenges:

- Lack of Jobs for Youth: More than 1 in 5 people between 16 and 24 were unemployed in May 2023 highlighting challenges in job creation for the youth.

- The working-age population between 15 to 59 years, which is seen as being productive in an economy, has now fallen to 61% of the total population.

- Demographic Trends: China's population has been declining since 2016, reflecting a falling Total Fertility Rate (TFR) and challenges in overcoming the legacy of the one-child policy.

- Despite policy changes allowing up to 3 children, demographic trends have not reversed.

- Unsteady Real Estate Market: The real estate market, traditionally a significant contributor to China's economy, faces financial challenges with major firms like Evergrande and Country Garden experiencing difficulties.

What are the Other Challenges Related to China in Global Context?

- Environmental degradation: China is the world's largest source of greenhouse gas emissions. Air pollution is responsible for about 2 million deaths in China per year (WHO).

- Tense Relations with the United States: The ongoing trade war, competition for technological dominance, and differences in values create significant tension between China and the US, impacting the global balance of power.

- The US and its allies are increasingly decoupling from China in key technological areas, like semiconductors.

- South China Sea Disputes: China's territorial claims in the South China Sea are contested by several countries, raising concerns about regional stability and freedom of navigation.

- Human Rights Concerns: China has faced international scrutiny and criticism regarding human rights issues, particularly concerning the treatment of ethnic minorities such as the Uighurs in Xinjiang.

How India is Transitioning Amid the Economic Turmoil in China?

- Demographic Advantage: India's working-age population is projected to constitute 68.9% of the total population by 2030, in stark contrast to China's ageing population.

- Evolving Manufacturing and Transportation Landscape: Initiatives such as the India Semiconductor Mission and dedicated industrial corridors like the Delhi-Mumbai Industrial Corridor are bolstering infrastructure and drawing investments to India.

- Foxconn, a major Apple supplier, is relocating a substantial portion of iPhone production from China to India.

- Business-Friendly Environment: Programs like Make in India and the production-linked incentive scheme offer crucial support for businesses.

- The PLI scheme for electronics has successfully lured major players such as Samsung, Pegatron, Rising Star, and Wistron.

- Thriving Domestic Market: As the world's fifth-largest economy (by nominal GDP), India presents significant opportunities for locally manufactured goods, attracting multinational corporations to integrate India into their production processes.

- H&M, for instance, sources from Indian garment manufacturers.

- Emphasis on Sustainability and ESG: With a goal to achieve 50% renewable energy capacity by 2030, India is attracting companies committed to green manufacturing.

- Tesla, for example, plans to enter the Indian electric vehicle market in 2024.

- Global Recognition and Dependability: India's membership in the IMEC corridor and its leadership in the International Solar Alliance are enhancing its trade appeal and global reputation as a reliable investment destination.

What are the Challenges Hindering India’s Progress?

- Infrastructure Constraints: Despite ongoing improvement, India's infrastructure, including power grids, logistics networks, and transportation systems, lags behind China's, potentially hindering manufacturing competitiveness and attracting investment.

- Skilled Workforce Shortage: While demographics offer a large working-age population, a significant portion lacks the specific skills (Skill India Report: Only 5% Indians formally skilled) required for high-value manufacturing, necessitating heavy investment in upskilling and vocational training.

- Lack of Desired Ease of Doing Business: While initiatives like Make in India aim to improve, India still ranks lower than China in global ease of doing business rankings, requiring further measures to simplify processes and reduce red tape.

- Lack of R&D Push: Despite advancements, India continues to trail in research and development capabilities, allocating only 0.6-0.7% of its GDP to R&D, in stark contrast to China's 2.56% investment.

Way Forward

- Upskill the Workforce: India needs to focus on vocational training and skilling programs aligned with industry needs, creating a readily available pool of qualified workers for high-value manufacturing.

- Streamline Regulations and Bureaucracy: Implementing reforms to simplify procedures, reducing red tape, and expediting business approvals can enhance India's ease of doing business.

- Boost Innovation and Technology: Increasing R&D investments, foster collaboration between academia and industry, and promoting entrepreneurship can cultivate a robust innovation ecosystem in India.

- Diplomatic Dialogue and Conflict Resolution: India can take advantage of this time to engage in constructive diplomatic dialogue with China to address outstanding border issues and foster better relations on various fronts, including trade, economic partnerships, and cultural exchanges, benefiting both nations and the broader global community.

Economics of the Food System Transformation

Why is it Important?

Recently, the Food System Economics Commission released a report titled "The Economics of the Food System Transformation," stressing the urgent need for a sustainable overhaul of current food systems.

- The Commission comprises scientists from various countries and academic disciplines, aiming to address food system security challenges and advocate necessary policy changes.

Understanding Food Systems

Food systems, as defined by the Food and Agriculture Organisation (FAO), involve all actors engaged in the production, processing, distribution, consumption, and disposal of food products, alongside their broader economic, societal, and natural contexts.

Key Findings of the Report

- Current Costs and Impacts: Existing food systems globally incur costs far surpassing their contributions to development, necessitating an estimated annual investment of USD 500 billion for sustainability. This investment constitutes a modest portion (0.2–0.4%) of global GDP but promises substantial benefits outweighing the costs.

- Challenges in Current Food Systems: The present global food system entails hidden environmental, health, and social expenses exceeding USD 10 trillion as of 2020. If current trends persist, over 640 million people, including 121 million children, may suffer from hunger and malnutrition by 2050.

- Impact on Climate Change: Current food systems are projected to contribute a third of global greenhouse gas emissions, leading to a 2.7°C temperature rise by the century's end. Climate change threatens food production, increasing the likelihood of extreme weather events.

- Pathways to 2050: The report contrasts two pathways: Current Trends (CT) and Food System Transformation (FST), illustrating the consequences of each by 2050. Transforming food systems can significantly benefit economies while addressing health and climate challenges. Pursuing the FST pathway could lead to substantial economic gains, with food systems becoming net carbon sinks by 2040, aiding in limiting global warming to below 1.5°C.

Recommendations

- Financial Support: Urges policymakers to lift financing barriers in lower-income countries to unlock the global benefits of food system transformation. Emphasises the importance of comprehensive and sustainable pathways for transforming food systems.

Enhancing Global Food System Sustainability

- Reducing Food Waste: Encourage circular food systems to redistribute surplus food efficiently and minimise waste. Implement policies incentivising businesses and consumers to reduce food waste.

- Optimising Production Processes: Promote smart farming practices utilising technology for efficient resource management. Invest in sustainable agriculture techniques such as hydroponic farming and resilient crop varieties.

- Advocating Sustainable Practices: Advocate for regenerative agriculture and precision farming to enhance soil health and reduce resource usage. Support farmers in transitioning to sustainable and organic farming methods.

- Encouraging Sustainable Consumption: Promote plant-based diets and educate consumers about their environmental impact. Support local and sustainable food markets to encourage consumption of locally produced goods.

- Investing in Research and Innovation: Allocate resources to research climate-resilient crops and innovative solutions for food system challenges. Support initiatives focusing on sustainable agricultural practices.

- Empowering Local Communities: Back community-led initiatives for sustainable agriculture and provide resources for smallholder farmers. Ensure local communities have a say in food production and distribution decision-making processes.

Interim Budget 2024-2025

Why in News?

Recently, the Interim Budget 2024-25 was tabled in the parliament. It envisions 'Viksit Bharat' by 2047, with all-round, all-pervasive, and all-inclusive development.

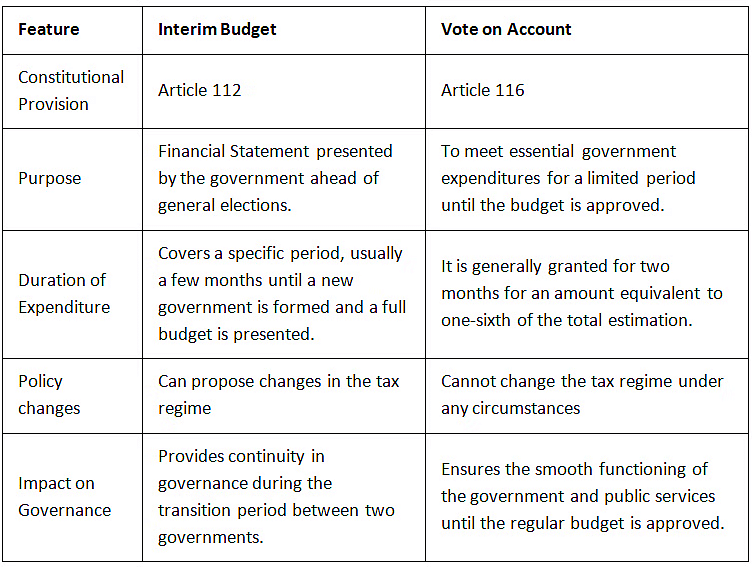

What is an Interim Budget?

- An Interim Budget is presented by a government that is going through a transition period or is in its last year in office ahead of general elections.

- The purpose of the interim budget is to ensure the continuity of government expenditure and essential services until the new government can present a full-fledged budget after taking office.

What is the Difference Between Interim Budget and Vote on Account?

What are the Major Highlights of the Interim Budget 2024-25?

- Capital Expenditure:

- An announcement was made regarding an 11.1% increase in the capital expenditure outlay for 2024-2025.

- The capital expenditure is now set at Rs 11,11,111 crore, constituting 3.4% of the GDP.

- Economic Growth Projections:

- The GDP growth for FY 2023-24 real GDP growth is projected at 7.3%, aligning with the RBI's revised growth projection. The International Monetary Fund upgraded India's growth projection to 6.3% for FY 2023-24.

- It also anticipates India becoming the third-largest economy in 2027.

- Revenue and Expenditure Estimates (2024-25):

- Total Receipts are estimated at Rs 30.80 lakh crore, excluding borrowings.

- Total Expenditure is projected at Rs 47.66 lakh crore.

- Tax Receipts are estimated at Rs 26.02 lakh crore.

- GST Collections reached ₹1.65 lakh crore in December 2023, crossing the ₹1.6 lakh crore benchmark for the seventh time.

- Fiscal Deficit and Market Borrowing:

- Fiscal deficit is estimated at 5.1% of GDP in 2024-25, aligning with the goal of reducing it below 4.5% by 2025-26 (announced in budget 2021-22).

- Gross and net market borrowings through dated securities in 2024-25 are estimated at Rs 14.13 and 11.75 lakh crore, respectively.

- Taxation:

- The Interim Budget maintains the existing rates for direct and indirect taxes, including import duties. For Corporate Taxes, it stands at 22% for existing domestic companies, 15% for certain new manufacturing companies.

- No tax liability for taxpayers with income up to ₹7 lakh under the new tax regime. Certain tax benefits for Start-Ups and investments extended by one year up to March 31, 2025.

- Priorities:

- Emphasizing the focus on the Poor, Women, Youth, and Farmer. Successful movement of 25 crore people out of multidimensional poverty. Credit assistance provided to 78 lakh street vendors under PM-SVANidhi. Disbursement of 30 crore Mudra Yojana loans to women entrepreneurs. 43% of female enrollment in STEM courses.

- Assistance to 1 crore women through 83 lakh SHGs, fostering 'Lakhpati Didis.' 28% increase in female enrollment in higher education over a decade. Training of 1.4 crore youth under the Skill India Mission. Fostering entrepreneurial aspirations with 43 crore loans sanctioned under PM Mudra Yojana.

- Direct financial assistance provided to 11.8 crore farmers under PM-KISAN. Crop insurance extended to 4 crore farmers through Fasal Bima Yojana. Integration of 1,361 mandis under eNAM for streamlined agricultural trade.

Major Development Plans

- Infrastructure:

- Railways: Implementation of three major economic railway corridor programs.

- Aviation: Expansion of existing airports and comprehensive development of new airports under the UDAN scheme.

- Urban Transport: Promotion of urban transformation via Metro rail and NaMo Bharat.

- Clean Energy Sector:

- Viability gap funding for wind energy.

- Establishment of coal gasification and liquefaction capacity of 100 million tonnes by 2030.

- Phased mandatory blending of CNG, PNG, and compressed biogas.

- Housing Sector:

- Government plans to subsidize the construction of 30 million affordable houses in rural areas.

- Housing for Middle Class scheme to be launched to promote middle class to buy/built their own houses.

- Healthcare Sector:

- Encouraging Cervical Cancer Vaccination for girls (9-14 years).

- U-WIN platform for immunization efforts of Mission Indradhanush to be rolled out.

- Expanding the Ayushman Bharat scheme to include all ASHA workers, Anganwadi workers, and helpers.

- Agricultural Sector:

- Encouraging the use of 'Nano DAP' for various crops across all agro-climatic zones.

- Formulating policies to support dairy farmers and combat Foot and Mouth Disease.

- Strategizing for AtmaNirbharta (self-reliance) in oilseeds, covering research, procurement, value addition, and crop insurance.

- Fishery Sector:

- Establishing a new department, 'Matsya Sampada,' to address the needs of fishermen.

- For States Capex:

- Continuation of the fifty-year interest-free loan scheme for capital expenditure to states was announced.

- A total outlay of Rs 1.3 lakh crore, with a provision of Rs 75,000 crore for fifty-year interest-free loans to support state-led reforms.

- Special attention will be paid to the eastern region to make it a powerful driver of India's growth.

- Others:

- Establishment of a corpus of Rs 1 lakh crore with a fifty-year interest-free loan to encourage research and innovation in sunrise domains.

- Aiming to boost private sector participation in research and innovation.

- Forming a high-powered committee to address rapid population growth and demographic shifts, providing comprehensive recommendations aligned with the goal of 'Viksit Bharat.'

|

1095 docs|744 tests

|