UPSC Daily Current Affairs: 5th February 2025 | Current Affairs & Hindu Analysis: Daily, Weekly & Monthly PDF Download

GS3/Environment

Centre Clears Exploratory Drilling in Hollongapar Gibbon Sanctuary

Source: DTE

Why in News?

Why in News?

Exploratory drilling for oil and gas has been approved within the eco-sensitive zone surrounding the Hollongapar Gibbon Wildlife Sanctuary, raising concerns regarding environmental impacts.

- The Hollongapar Gibbon Wildlife Sanctuary is the only habitat for hoolock gibbons in India.

- It was established in 1997 as Hollongapar Reserve Forest and renamed in 2004, located in Assam.

- The sanctuary features rich biodiversity including various flora and fauna.

Additional Details

- Hollongapar Gibbon Wildlife Sanctuary: The sanctuary is bordered by the Bhogdoi River and consists of plains alluvial semi-evergreen forests and patches of wet evergreen forests.

- Flora:

- Upper canopy: Dominated by Hollong trees (Dipterocarpus macrocarpus), along with Sam, Amari, Sopas, Bhelu, Udal, and Hingori.

- Middle canopy: Features Nahar trees.

- Lower canopy: Composed of evergreen shrubs and herbs.

- Fauna:

- Primates: Includes Hoolock Gibbons, Bengal Slow Loris (the only nocturnal primate in Northeast India), stump-tailed macaques, northern pig-tailed macaques, eastern Assamese macaques, rhesus macaques, and capped langurs.

- Other mammals: Indian elephants, tigers, leopards, jungle cats, wild boars, civets, squirrels, and more.

- About the Hoolock Gibbons: Gibbons are the smallest and fastest apes, found in tropical and subtropical forests across Southeast Asia. They are the only ape species found in India and are known for their high intelligence and strong familial bonds.

- Conservation Status: The hoolock gibbons are classified as Endangered and Vulnerable on the IUCN Red List, and both species are protected under Schedule I of the Wildlife (Protection) Act, 1972.

This recent approval for drilling raises significant environmental concerns regarding the habitat of the hoolock gibbons and other wildlife in the region.

GS3/Economy

The Financial Toxicity of Cancer Care in India

Source: The Hindu

Why in News?

The financial burden associated with cancer care in India is a critical issue that often goes unnoticed. This strain affects not just patients but also their families and future generations, leading to severe economic ramifications.

- The treatment costs for cancer can be exorbitantly high, particularly for advanced therapies.

- Financial toxicity can lead to devastating impacts on families, driving them into poverty.

- Out-of-pocket expenses constitute a significant part of healthcare costs, often exceeding insurance coverage.

Additional Details

- High Treatment Costs: Cancer treatment can be financially burdensome. For instance, a patient diagnosed with oral cancer may incur annual costs of around ₹10 lakh, with total expenses potentially reaching ₹25 lakh over several years. This financial pressure often forces families to deplete savings or liquidate assets.

- Impact on Families: The financial strain extends beyond the patient, as families may need to sell property or skip meals to cover treatment costs, risking a cycle of generational poverty.

- Out-of-Pocket Expenses: A large portion of healthcare expenses is paid out-of-pocket by patients, with outpatient costs accounting for nearly 50% of total healthcare expenditures, which are typically not covered by insurance programs like Ayushman Bharat.

Contributing Factors to Financial Toxicity

- Inadequate Public Health Funding: India's public health expenditure remains below 2% of GDP, leading to insufficient infrastructure in public hospitals, causing delays in diagnosis and treatment for advanced cancer cases.

- Limited Insurance Coverage: Current insurance schemes mainly cover inpatient costs, leaving outpatient diagnostics and follow-up treatments as a financial burden for patients.

- Economic Disparities: Low and middle-income patients face additional challenges in accessing modern treatments due to high costs and limited availability in public health systems.

Steps Taken by the Indian Government

- Health Minister’s Cancer Patient Fund (HMCPF): Established in 2009, this fund offers financial assistance up to ₹5 lakh for cancer treatment at designated Regional Cancer Centers (RCCs), with emergency cases receiving up to ₹15 lakh. It primarily supports patients below the poverty line.

- Ayushman Bharat – Pradhan Mantri Jan Arogya Yojana (PM-JAY): This scheme provides health coverage up to ₹5 lakh per family annually for secondary and tertiary care, including cancer treatments, targeting low-income families across India.

- State-Specific Schemes:Various states have introduced their initiatives, such as:

- Arogyasri Scheme in Andhra Pradesh offers free cancer treatment for families with an annual income below ₹5 lakh.

- Free Chemotherapy in Odisha provides chemotherapy treatment at district hospitals for economically disadvantaged cancer patients.

- Financial Assistance in Punjab offers up to ₹1.5 lakh for eligible residents undergoing cancer treatment.

Strategies to Mitigate Financial Toxicity

- Strengthening Public Healthcare: Increasing government investment in public health is essential to improve access to affordable cancer care, with successful models in states like Delhi and Kerala needing broader implementation.

- Supportive Measures for Non-Medical Costs: Implementing initiatives such as discounted travel for cancer patients can alleviate some financial burdens associated with non-medical expenses.

- Role of Nonprofits and CSR: Nonprofit organizations are vital in reducing out-of-pocket expenses. Enhanced funding from corporate social responsibility initiatives could enable these organizations to extend their reach.

- Promoting Philanthropy: Encouraging contributions from wealthier individuals could provide essential funding for cancer care initiatives focused on assisting low-income patients.

- Policy Advocacy: Advocating for policies that address gaps in insurance coverage and ensure equitable access to cancer treatments is crucial for long-term reduction of financial toxicity.

In conclusion, addressing the financial toxicity of cancer care in India requires a multifaceted approach that includes governmental action, community support, and policy changes to ensure that all patients have access to the care they need without facing insurmountable financial barriers.

GS3/Science and Technology

GARBH-Ini: India’s First Ferret Research Facility

Source: PIB

Why in News?

The inauguration of India’s first Ferret Research Facility, GARBH-Ini, took place at the Translational Health Science and Technology Institute (THSTI) in Faridabad. This initiative aims to enhance vaccine development and boost research on infectious diseases.

- GARBH-Ini serves as a crucial data repository focused on maternal and child health.

- The facility is part of a larger program designed to support extensive research through a significant pregnancy cohort dataset.

- It encourages collaboration among top research institutions and hospitals across India.

Additional Details

- Data Repository: GARBH-Ini is one of South Asia's largest datasets, encompassing clinical data, medical images, and bio-specimens from over 12,000 subjects, including pregnant women, newborns, and postpartum mothers.

- Aims: The facility aims to enhance maternal and neonatal healthcare research by providing large-scale data accessibility, supporting global studies, and developing predictive tools for complications such as preterm birth.

- Features:

- Comprehensive data repository for extensive research.

- Advanced access allows researchers to study pregnancy outcomes and postnatal development.

- Secure data usage protocols ensuring ethical research practices.

- Facilitates collaboration on common healthcare challenges.

- Supports policy-making by leveraging data for maternal health improvements.

The establishment of GARBH-Ini signifies a monumental step in Indian healthcare research, providing vital resources for improving maternal and child health outcomes, and fostering international collaborations for transformative studies.

GS2/International Relations

How Beggar-Thy-Neighbor Policies Can Make Global Trade Come to a Standstill

Source: The Hindu

Why in News?

In 2025, the United States imposed a 25% tariff on imports from Canada and Mexico, along with a 10% tariff on Chinese goods. This action exemplifies modern beggar-thy-neighbor policies, which can significantly impact global trade dynamics.

- Beggar-thy-neighbor policies prioritize national economic interests at the expense of other nations.

- Protectionist measures such as tariffs can lead to retaliatory actions, escalating trade wars.

- Historically, extensive protectionism has resulted in significant declines in global trade volumes.

Additional Details

- Beggar-Thy-Neighbor Policy: These are protectionist economic strategies aimed at improving a country's economic situation by adversely affecting other nations. They often involve tariffs, quotas, or currency devaluation, leading to negative repercussions for trading partners.

- Domestic Economic Boost: Proponents argue that such policies protect local industries, potentially reducing unemployment by encouraging consumer purchases of domestic products.

- National Security Concerns: Supporters claim that certain industries require protection from foreign competition to ensure national security and a robust domestic economy.

- Escalating Trade Wars: The U.S.-China Trade War illustrates how such policies can provoke retaliatory actions that disrupt global supply chains and reduce international trade volumes.

- Historical Context: The Smoot-Hawley Tariff Act of 1930 raised tariffs significantly, leading to retaliatory measures from other nations and contributing to a sharp decline in global trade during the Great Depression.

- Global Economic Impact: Critics point out that protectionist measures can lead to higher consumer prices and reduced innovation, as seen in India’s License Raj period, which stifled competition and technological advancement.

- Countries Engaging in Such Policies: The U.S. has imposed substantial tariffs under the "America First" policy, while China has been accused of currency manipulation to maintain its trade advantages.

- India's Approach: India has also adopted measures akin to beggar-thy-neighbor policies, such as raising tariffs on imports and regulating Chinese investments following geopolitical tensions.

In conclusion, while beggar-thy-neighbor policies may provide short-term economic relief for some countries, they pose significant risks for global trade stability and can lead to widespread economic consequences. A balanced approach that combines protectionism with open trade practices is essential for sustainable economic growth.

GS2/International Relations

US-China Trade Tension Escalates

Source: Indian Express

Why in News?

The trade tensions between the United States and China have intensified recently. US President Donald Trump postponed the implementation of 25% tariffs on Mexico and Canada, temporarily halting the North American trade conflict. However, in response to US tariffs, China has retaliated by investigating Google for antitrust violations and imposing new tariffs on US coal, LNG, oil, and agricultural equipment. Additionally, Trump suggested that tariffs on the EU might be forthcoming due to perceived trade imbalances, raising concerns about a wider global trade conflict, particularly affecting businesses and trade partnerships, including India.

- Trump's trade war with China began during his first term, leading to retaliatory measures and the Phase One Deal.

- India emerged as a significant beneficiary from the trade diversions caused by US tariffs on China.

- High tariffs have implications for US consumers, potentially increasing household costs and impacting inflation.

Additional Details

- Trump's Trade War with China: During his first term, Trump initiated a trade war that resulted in retaliatory tariffs and the Phase One Deal on January 15, 2020. This deal aimed for structural reforms and increased purchases by China, although subsequent analyses indicated that China failed to meet its commitments.

- Impact on India: The tariffs on Chinese goods have opened opportunities for India to enhance its exports to the US, particularly in the electronics sector, where India’s share of US imports has seen a tenfold increase since 2017.

- US Inflation Effects: The tariffs are expected to raise costs for American consumers, potentially exceeding $1,200 annually per household, while also affecting the competitiveness of US manufacturers.

- Automotive Industry Impacts: Tariffs on parts from Mexico and Canada are increasing production costs for US-made cars, leading consumers to prefer imports from countries not affected by the tariffs.

- Risk of Escalation: If US consumers shift towards cheaper foreign cars, it could prompt further US tariffs on imports, escalating the global trade war.

Overall, the current trade tensions and tariffs not only pose challenges for the US economy but also present opportunities and hurdles for international trade dynamics, particularly for countries like India looking to expand their market share amidst these shifts.

GS2/International Relations

India-US Immigration Tensions: Deportations, Diplomacy, and Challenges

Source: Financial Express

Why in the News?

Days before Prime Minister Narendra Modi’s expected visit to the U.S., the Donald Trump administration has initiated the process of deporting illegal Indian immigrants, which has raised serious concerns about bilateral relations and the welfare of Indian nationals in the U.S.

- The U.S. has intensified its immigration enforcement, particularly targeting undocumented Indian migrants.

- India has agreed to accept deported individuals, contingent upon verifying their nationality.

- Prime Minister Modi's visit will focus on immigration discussions and diplomatic ties.

Additional Details

- Mass Deportations: The Trump administration has ramped up efforts to deport undocumented immigrants, with 20,407 undocumented Indians currently under scrutiny and 17,940 facing final removal orders from U.S. immigration courts.

- Latest Developments: Recently, military aircraft such as C-17s have been used to deport Indian nationals, including 205 individuals from Texas, primarily from Gujarat and Punjab.

- Immigration Policy Changes: The Trump administration has declared illegal immigration a national emergency, implementing strict measures including enhanced deportation strategies and the closure of legal protections established under the previous administration.

- India’s Diplomatic Response: India has conveyed its stance on deportation, emphasizing the need for nationality verification and expressing concern over potential impacts on legal migration pathways for students and professionals.

The ongoing immigration tensions highlight the delicate balance between enforcing immigration laws and maintaining diplomatic relations, with both countries navigating the complexities of migration policies that affect large communities.

GS2/International Relations

India-Indonesia Ties as a Beacon for Global Relations

Source:

The Hindu

Why in News?

The recent visit of Indonesian President Prabowo Subianto as the chief guest at India’s 76th Republic Day celebrations has highlighted the significant and strategic partnership between India and Indonesia. This visit not only reinforced their strong bilateral ties but also emphasized their shared history and collaboration in economic and security matters, crucial for shaping the Indo-Pacific region and global geopolitical dynamics.

- The historical relationship between India and Indonesia is rooted in their shared struggles for independence.

- Economic cooperation and trade form a vital part of their bilateral relationship, with ambitions to expand trade significantly.

- Security and strategic cooperation have been strengthened through various agreements, particularly in maritime security.

- Both countries play essential roles in global geopolitics, maintaining relations with major powers like the US.

Additional Details

- Historical Foundations: The ties date back to the independence movements of the 20th century, with India gaining independence in 1947 and Indonesia in 1945, internationally recognized in 1949.

- Symbolic Gesture: The invitation to Sukarno, Indonesia's first president, as the chief guest at India’s first Republic Day in 1950 marked the beginning of formal diplomatic relations.

- Economic Potential: Bilateral trade currently stands at around $30 billion, with a goal to quadruple this figure over the next decade, focusing on sectors like energy, agriculture, healthcare, manufacturing, and technology.

- Security Cooperation: The 2018 Comprehensive Strategic Partnership has enhanced defence ties, particularly in countering terrorism and addressing cybersecurity threats.

In conclusion, the enduring partnership between India and Indonesia, now spanning 76 years, continues to evolve through trade, security, and strategic cooperation. Their collaboration is vital for not only enhancing their individual prosperity and security but also for contributing to a more stable and sustainable global environment.

GS1/History & Culture

Gyan Bharatam Mission

Source: The Hindu

Why in News?

Why in News?

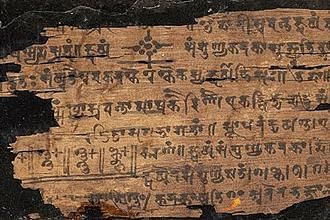

The Union Budget 2025-26 has introduced the Gyan Bharatam Mission, which is a comprehensive initiative aimed at surveying, documenting, and conserving India’s manuscript heritage.

- The Gyan Bharatam Mission is a nationwide initiative focused on the preservation of manuscript heritage.

- The mission aims to cover over one crore manuscripts to ensure systematic preservation of ancient texts.

- It seeks to revive and expand the National Manuscripts Mission (NMM) that was originally established in 2003.

- The mission addresses the previous challenges faced by the NMM, including inadequate funding and structural issues.

- This initiative aligns with India's broader cultural conservation goals.

- The mission is expected to create a centralized repository for India's rich textual and intellectual heritage.

Additional Details

- Survey and Documentation: The mission will survey and document manuscripts across various institutions and private collections.

- Digitization: The initiative will digitize rare texts, facilitating research and preservation.

- Conservation Techniques: It will restore and conserve fragile manuscripts using modern preservation techniques.

- Budget Allocation: Funding for the NMM has been raised from ₹3.5 crore to ₹60 crore to support these efforts.

- Digital Preservation: The project will utilize AI-driven archiving, metadata tagging, and translation tools for easier access to manuscripts.

The Gyan Bharatam Mission represents a significant step towards the preservation of India's manuscript heritage, ensuring that ancient texts are systematically documented and conserved for future generations.

GS2/International Relations

The U.S.’s WHO Exit: A Chance to Reshape Global Health

Source: The Hindu

Why in News?

The recent withdrawal of the United States from the World Health Organization (WHO) highlights the need for countries in the Global South to support WHO and take collaborative actions to redefine the global health agenda. The U.S. was the largest contributor to WHO, providing about 18% of its budget, which raises concerns regarding the future of critical health programs.

- The U.S. withdrawal jeopardizes vital health initiatives, especially those targeting tuberculosis, HIV/AIDS, and pandemic preparedness.

- It may lead to a significant disruption in WHO's ability to coordinate global health responses effectively.

- The absence of U.S. leadership could create a power vacuum, allowing other countries, particularly China, to exert more influence within WHO.

- Low-income countries may experience a heightened negative impact due to reduced funding from WHO, exacerbating existing health inequalities.

Additional Details

- Disruption of Funding and Programs: The U.S. contributes approximately $1 billion annually to WHO, essential for programs like immunization and disease control. The withdrawal is likely to halt ongoing efforts to tackle critical health challenges such as HIV/AIDS and polio eradication.

- Weakened Global Health Response: Without U.S. support, WHO’s ability to respond to health crises will be significantly diminished, impacting disease surveillance and emergency operations in outbreak-prone regions.

- Impact on Global Health Leadership: The lack of U.S. involvement could lead to increased influence from other nations, notably China, shifting the dynamics of international health collaboration.

- Repercussions for Low-Income Countries: Communities in low-income nations heavily rely on WHO for essential health services. The U.S. withdrawal signals a deprioritization of global health initiatives, worsening existing disparities.

In light of the U.S. exit, WHO may need to explore reforms such as diversifying funding sources, strengthening accountability, and improving governance practices. Additionally, India has a unique opportunity to enhance its leadership role within WHO, boost domestic healthcare capabilities, and collaborate with emerging economies to address shared health challenges effectively.

GS3/Science and Technology

Revitalizing India's Nuclear Energy Sector - The Need for Reform

Source: Forbes

Why in News?

Finance Minister Nirmala Sitharaman recently announced amendments to two significant atomic Acts (the Atomic Energy Act, 1962 and the CLNDA, 2010) aimed at revitalizing India's nuclear energy sector. This reform is timely, coinciding with a global resurgence in nuclear energy interest.

- India's nuclear power capacity stagnates at approximately 8,200 MW, significantly lower than the expansions seen in countries like China and South Korea.

- Current targets set by the Finance Minister aim for a nuclear power capacity of 1,00,000 MW by 2047, necessitating legal reforms.

- Challenges include historical constraints, regulatory issues, and inadequate private sector participation in nuclear energy development.

Additional Details

- Nuclear Non-Proliferation Treaty (NPT): Introduced in 1970, it restricted technology transfers, putting India at a disadvantage compared to nations with nuclear capabilities.

- Impact of CLNDA, 2010: This Act has hindered foreign and private investments by making suppliers liable for nuclear accidents, which diverges from global norms.

- Structural issues in the Atomic Energy Act, 1962 have created a governmental monopoly over nuclear energy development, limiting private investment and innovation.

- Lessons from reforms in the space sector suggest that allowing private sector participation could enhance nuclear energy production, as seen with companies like Tata and Godrej.

In conclusion, amending the Atomic Energy Act and the CLNDA is essential to unlocking India's nuclear potential. Encouraging private sector involvement and establishing investment-friendly liability laws are crucial steps in achieving India's ambitious nuclear energy targets by 2047. A transformed nuclear sector is poised to significantly bolster India's energy security and contribute to its green transition.

GS3/Economy

Budget 2025-26 Removes 7 Custom Duties for Industrial Goods

Source: Indian Express

Why in News?

The Budget for 2025-26 has proposed the removal of 7 customs tariff rates for industrial goods, continuing the trend set in the previous year's budget. This adjustment will reduce the total number of tariff rates to just 8, including one zero rate, thereby creating a more transparent and predictable customs duty structure.

- The removal of 7 customs tariff rates aims to simplify the customs duty system.

- This change follows similar adjustments made in the Budget 2023-24.

- Only 8 tariff rates will remain, enhancing clarity in customs duties.

What is Customs Duty?

- Customs Duty: A tax imposed on goods when they cross international borders, regulating their movement.

- This duty helps protect a country's economy, jobs, and environment by controlling imports and exports.

- It also prevents illegal trade, ensures fair competition, and generates government revenue.

Legal Framework

- The Customs Act, 1962 defines and regulates customs duty in India.

- The Central Board of Indirect Taxes and Customs (CBIC) under the Ministry of Finance oversees customs duties.

Types of Customs Duties in India

- Basic Customs Duty (BCD): Levied on imported goods (0-100%).

- Countervailing Duty (CVD): Imposed to balance foreign subsidies (0-12%).

- Social Welfare Surcharge (SWS): A 10% surcharge to support welfare projects.

- Anti-Dumping Duty: Imposed on goods sold below market price to prevent unfair trade practices.

- Compensation Cess: Levied on items like tobacco and pollution-causing goods.

- Integrated GST (IGST): Imposed on imports at rates of 5%, 12%, 18%, or 28%.

- Safeguard Duty: Applied when excessive imports harm domestic industries.

- Customs Handling Fee: A 1% charge for customs processing.

Customs Duty Calculation

Customs duty is calculated based on several factors, including:

- Product value

- Origin and composition

- International trade agreements

Key Changes Announced to Customs Tariffs

- Tariff rates have been reduced from 15 to 8.

- The Social Welfare Surcharge was removed on 82 items.

- 36 new life-saving medicines have been exempted from duty, with a 5% duty applied to six more drugs.

- Full BCD exemption on 35 EV battery capital goods, 28 mobile battery items, and key minerals like cobalt and lithium.

- A 10-year duty exemption for shipbuilding materials has been introduced.

- The duty on Ethernet Switches has been cut from 20% to 10%.

- A 20% export duty on crust leather has been removed, and the handicraft export timeline has been extended to one year.

- The duty on frozen fish paste has been reduced from 30% to 5% to enhance seafood exports.

- Customs assessments are now limited to 2 years, with quarterly importer reporting instead of monthly.

How India is Protecting Its Economy from Trade War Impact

- Engaging in rupee-based trade settlements with countries like Russia, UAE, and Sri Lanka to reduce dependence on the dollar.

- Stockpiling essential imports such as semiconductors, rare earth metals, and crude oil.

- Attracting companies shifting from China through Production Linked Incentives (PLI) for manufacturing.

- Implementing paperless customs clearance and using AI-driven trade monitoring and blockchain documentation for smoother trade.

- Strengthening global trade alliances through initiatives like the Indo-Pacific Economic Framework (IPEF) and Supply Chain Resilience Initiative (SCRI) with Japan and Australia.

Previous Year Question (PYQ)

[2018] Consider the following statements:

- 1. The quantity of imported edible oils is more than the domestic production of edible oils in the last five years.

- 2. The Government does not impose any customs duty on all the imported edible oils as a special case.

Which of the statements given above is/are correct?

- (a) 1 only

- (b) 2 only

- (c) Both 1 and 2

- (d) Neither 1 nor 2

This summary highlights the significant changes in customs duties as outlined in the Budget 2025-26, aiming to promote transparency and support the Indian economy amid global trade challenges.

|

51 videos|5377 docs|1138 tests

|

FAQs on UPSC Daily Current Affairs: 5th February 2025 - Current Affairs & Hindu Analysis: Daily, Weekly & Monthly

| 1. What is the significance of the exploratory drilling cleared in the Hollongapar Gibbon Sanctuary? |  |

| 2. How does cancer care financial toxicity affect patients in India? |  |

| 3. What role does GARBH-Ini play in ferret research in India? |  |

| 4. What are the consequences of beggar-thy-neighbor policies on global trade? |  |

| 5. How are India-US immigration tensions influencing bilateral relations? |  |