Economic Development: February 2025 Current Affairs | Current Affairs & General Knowledge - CLAT PDF Download

Economic Survey 2024-25

Why in News?

The Finance Minister Nirmala Sitharaman tabled the Economic Survey 2024-25 in Parliament. This document outlines a roadmap for reforms and growth, setting the stage for the Union Budget 2025-26.

Key Takeaways

- Projected GDP growth for FY26 is between 6.3% and 6.8%.

- Global economy growth forecast of 3.2% in 2024.

- Inflation remains a concern despite global easing.

- India's agricultural sector shows promise with a 3.8% growth forecast for FY25.

- Non-Performing Assets (NPAs) are at a 12-year low of 2.6% in 2024.

Additional Details

- Global Economic Outlook: The International Monetary Fund (IMF) projects a 3.2% global growth in 2024, with a slowdown in manufacturing due to supply chain disruptions.

- India's Sector Performance:

- Agriculture: Expected to grow at 3.8% in FY25, bolstered by record Kharif production and strong rural demand.

- Industry: Growth projected at 6.2% in FY25, facing challenges from weak global demand.

- Services: Anticipated to be the fastest-growing sector at 7.2% in FY25, driven by IT, finance, and hospitality.

- Monetary Policy Developments: The Reserve Bank of India maintained a repo rate of 6.5% while reducing the Cash Reserve Ratio (CRR), injecting liquidity into the financial system.

- Employment Trends: The unemployment rate decreased from 6% in 2017-18 to 3.2% in 2023-24, indicating a positive trend in job creation.

India's economic fundamentals are strong; however, challenges like global uncertainties, persistent inflation, and the need for investment reforms require careful management and strategic policy interventions.

Union Budget 2025-26

Why in News?

The Union Budget 2025-26 was presented by the Union Finance Minister in Parliament, recognizing four engines of development: agriculture, Micro, Small and Medium Enterprises (MSME), investment, and exports. The budget, themed "Sabka Vikas," aims to stimulate balanced growth across all regions and is aligned with the broad principles of Viksit Bharat.

Key Takeaways

- The budget focuses on development measures for the poor (Garib), youth, farmers (Annadata), and women (Nari).

- It prioritizes initiatives in agriculture, MSMEs, investments, and export promotion.

Additional Details

- 4 Engines of Development:

- Agriculture: Covers 100 low agricultural productivity districts, benefiting 1.7 crore farmers, enhancing irrigation, and post-harvest storage facilities.

- MSMEs: Investment limits increased to expand credit opportunities for small businesses.

- Investment: ₹1 lakh crore allocated to support urban development and infrastructure projects.

- Export Promotion: Establishment of the Export Promotion Mission to enhance international trade.

- The budget emphasizes the importance of sustainable development and social equity.

- The Union Budget 2025-26 lays a foundation for promoting inclusive growth, poverty eradication, quality education, and economic empowerment, focusing on youth, women, farmers, and the middle class.

- If effectively implemented, these measures can accelerate India's transformation into a globally competitive and economically resilient nation.

Mains Question:

Q: Assess how recent Union Budgets have managed the trade-off between fiscal discipline and economic stimulus through taxation, public spending, and deficit management.

Gender Budget 2025-26

Why in News?

The Gender Budget Statement (GBS) signifies a crucial move towards gender-responsive budgeting (GRB), highlighting increased financial allocations and broader participation from various ministries.

Key Takeaways

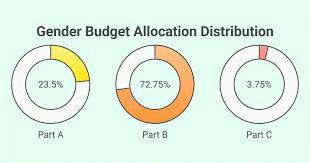

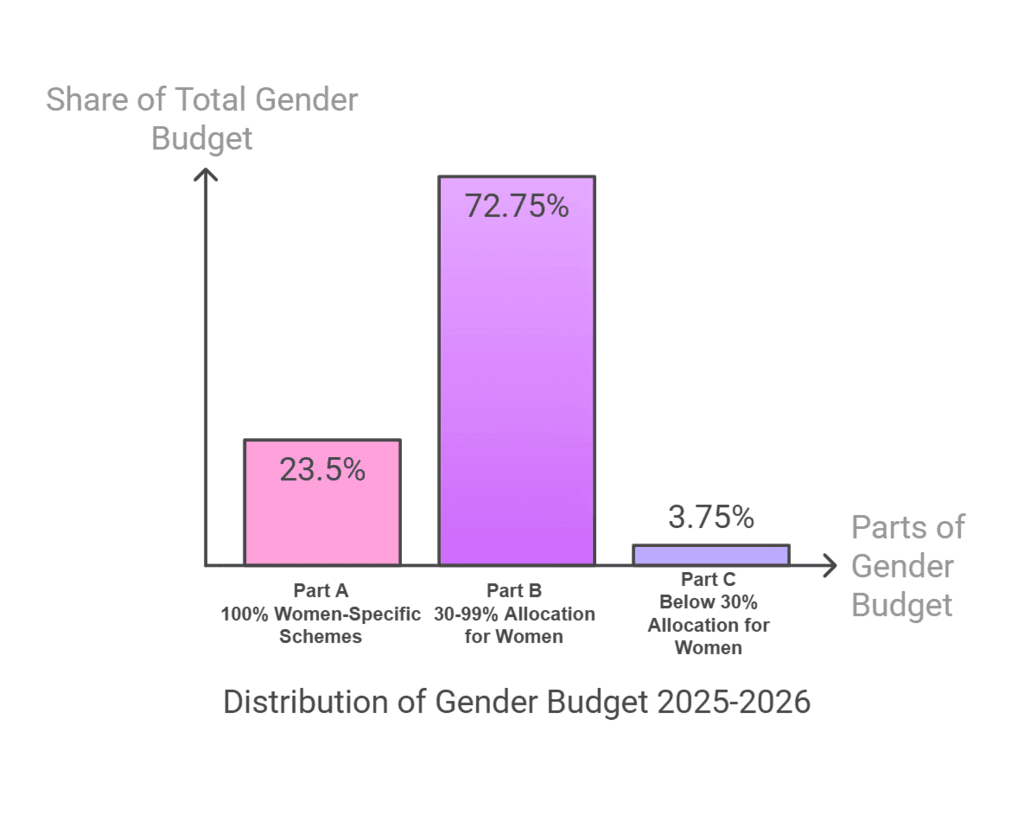

- The Gender Budget for FY 2025-26 stands at Rs 4.49 lakh crore, accounting for 8.86% of the total Union Budget, marking a 37.5% increase from Rs 3.27 lakh crore in FY 2024-25.

- This budget represents India's largest-ever gender budget, enhancing support for women's welfare, education, and economic empowerment, with 49 ministries reporting gender-specific allocations.

Additional Details

- Parts of GBS 2025-26: The Gender Budget is categorized into three distinct parts.

- What is Gender Budgeting in India? Gender budgeting serves as a strategic tool for governments to allocate resources effectively, catering to the unique needs of different genders, ensuring that policies are gender-sensitive.

- Background: India’s commitment to gender equality, highlighted by the ratification of the Convention on the Elimination of All Forms of Discrimination Against Women (CEDAW) in 1993, led to the first GBS in 2005-06, which has been included annually since.

- Need: It is essential for addressing gender inequality, as India ranks 129 out of 146 countries in the 2024 Gender Gap Report.

- Implementation: At the central level, the Ministry of Women and Child Development (MWCD) oversees gender budgeting, while state-level responsibilities lie with various departments.

- Importance: Gender budgeting promotes equality and supports Sustainable Development Goal 5, focusing on gender equality and legal frameworks for women's rights.

Challenges Faced by Gender Budgeting in India

- Ambiguities in Allocation: Unclear methodologies for fund allocation can lead to discrepancies, such as underreporting in significant programs like MGNREGS.

- Concentration of Funds: A substantial portion of the gender budget is concentrated in a few ministries, limiting its broader impact.

- Long-term Schemes: Inclusion of long-term schemes can divert resources from immediate-impact initiatives, hindering women's empowerment.

- Monitoring and Evaluation: Lack of adequate tracking and gender-segregated data poses challenges in assessing needs and outcomes.

- Political Will: Gender budgeting may not always align with political priorities, affecting support and implementation.

Way Forward

- Integration: Gender budgeting should be integrated across all ministries to ensure gender-sensitive allocations in every government initiative.

- Invest in collecting and analyzing gender-specific data to better understand women's needs and policy impacts.

- State GBS: Encourage state governments to enhance their contributions to gender-responsive budgeting.

- Clarification of Reporting Methods: Improve transparency in allocation processes to boost accountability.

- Conduct regular gender audits across ministries to evaluate the effectiveness of fund allocations.

- Capacity Building: Training for government officials and stakeholders on gender budgeting will enhance expertise in incorporating gender perspectives.

In conclusion, the Gender Budget 2025-26 is a pivotal step toward achieving gender equality in India, while addressing existing challenges through effective implementation and monitoring strategies.

Asian Fisheries and Aquaculture Forum

Why in News?

The Union Minister of Fisheries, Animal Husbandry & Dairying recently inaugurated the 14th Asian Fisheries and Aquaculture Forum (AFAF) in New Delhi, highlighting India's role in hosting this significant event.

Key Takeaways

- The AFAF is a global conference held every three years by the Asian Fisheries Society (AFS).

- This year marks India's second time hosting the forum, the first being in Kochi in 2007.

- The theme for the 14th AFAF is “Greening the Blue Growth in Asia-Pacific.”

- India ranks third globally in fish production and fourth in fish exports.

Additional Details

- Asian Fisheries Society (AFS): A non-profit scientific organization founded in 1984, based in Kuala Lumpur, Malaysia, that aims to promote international cooperation in fisheries and aquaculture practices.

- India's Fisheries Sector: India is the world's largest aquaculture nation after China and contributes 7.7% to global fish production. Major fish-producing states include Andhra Pradesh, West Bengal, and Karnataka, with inland fisheries accounting for over 75% of total output.

- Government Initiatives: Key initiatives include the Pradhan Mantri Matsya Sampada Yojana, the Fisheries and Aquaculture Infrastructure Development Fund (FIDF), and the Kisan Credit Card (KCC), which aim to boost the fisheries sector.

- The AFAF serves as a vital platform for scientists, researchers, and industry experts to collaborate on addressing challenges and exploring innovations in fisheries and aquaculture, fostering international cooperation for sustainable practices in the future.

Economic Dynamics of Southern Indian States

Why in News?

Chief Economic Adviser (CEA) V. Anantha Nageswaran emphasized that Southern Indian states should benchmark their economic performance against global standards rather than just other Indian states. This highlights the economic strength of the region and areas requiring improvement.

Key Takeaways

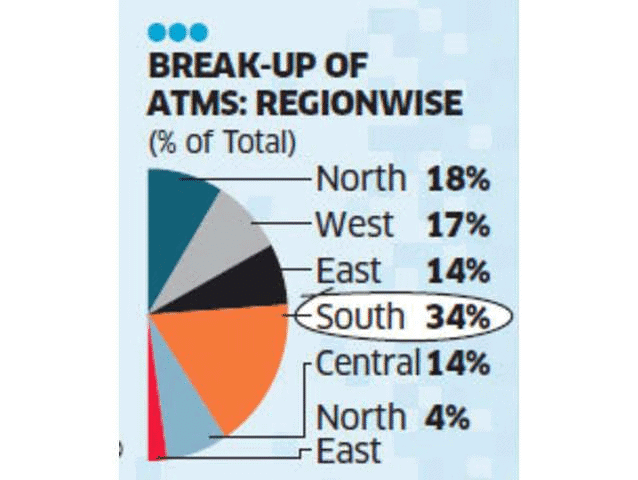

- Southern states contribute 30% to India’s GDP, with Tamil Nadu and Karnataka leading in GSDP growth.

- The South has a higher annual GSDP growth rate of 6.3% compared to 5% for the rest of India.

- Southern India hosts 37.4% of total factories and 33% of India's manufacturing workforce.

Additional Details

- Economic Contribution: Southern Indian states account for 30% of India's GDP, with Tamil Nadu and Karnataka exhibiting strong GSDP growth, following Maharashtra.

- Higher Growth Rate: The Southern region records a 6.3% annual GSDP growth in real terms, compared to the national average of 5%. Per capita GDP is also on the rise, exceeding 5% growth.

- Manufacturing & Investment: The South houses 37.4% of India's total factories, with 25.6% of fixed capital investment coming from this region, demonstrating its manufacturing capabilities.

- Historical Stability: The stability in Southern India has fostered economic and cultural development, creating major trade centers historically.

- Colonial Advantage: The establishment of major cities like Madras and Bombay in the 18th century accelerated trade and urbanization in the South.

- Agricultural Productivity: States like Tamil Nadu and Karnataka have embraced modern farming techniques, leading to diversified agricultural outputs.

- Governance: Reforms in IT and e-governance in states like Telangana and Karnataka have positively impacted economic performance.

- Social Development: Higher literacy rates and better educational infrastructure in Southern states contribute to a more skilled workforce.

- Health and Social Indicators: Southern states excel in healthcare, with Kerala leading in low infant mortality rates and maternal health.

- Natural Factors: Proximity to ports and a moderate climate enhance trade and living conditions in the South.

- Despite the impressive economic performance of Southern states, there are concerns regarding productivity gaps, skill development deficiencies, infrastructure challenges, and regional disparities. Addressing these issues is crucial for sustaining growth and improving overall economic conditions.

What are the Concerns Regarding the Southern States' Economic Growth?

- Productivity Gap in Manufacturing: Despite a strong workforce, the southern region contributes only 26% to total manufacturing output.

- Skill Development Deficiencies: The region excels in intermediate skills but lacks advanced skill levels, limiting innovation in high-value industries.

- Declining Demography: Emigration for better opportunities risks labor shortages, necessitating a migrant policy to sustain growth.

- Infrastructure: Urban congestion and energy challenges need addressing to attract global investments.

- Regional Disparities: Economic growth is uneven, with certain states lagging behind others.

- Climate Change Vulnerability: Southern India faces significant risks from climate change, impacting agriculture and coastal economies.

- Policy Issues: Heavy reliance on financial transfers from the central government affects fiscal autonomy and increases state debt ratios.

Way Forward

- Global Benchmarking: Southern states should aim for global competitiveness, with tech hubs like Bengaluru comparable to California.

- Enhance Productivity: Improve manufacturing productivity and invest in skill upgrades, particularly in high-value sectors.

- Infrastructure Improvement: Strengthen industrial corridors and digital infrastructure to boost trade and attract foreign investment.

- Tourism Potential: Leverage rich cultural heritage and promote sustainable tourism.

- Strengthen Revenue Growth: Enhance tax collection and adopt Production Linked Incentives (PLI) for fiscal sustainability.

- Inclusive Growth: Focus on regional development to reduce disparities and promote balanced economic growth.

By addressing these challenges and leveraging their strengths, Southern states can continue to lead India in economic development and growth.

Mains Question:

Q: Analyze the impact of social development indicators on the economic performance of Southern states.

CSS and Fiscal Federalism

Why in News?

The Centre has reduced the outlay for Centrally Sponsored Schemes (CSS) to states by Rs 91,000 crore (18% of the budget estimate for the schemes) for the financial year 2025-26. This decision follows the discovery of Rs 1.6 lakh crore in unspent funds from previous transfers. Many states view this cut as contrary to the principles of fiscal federalism and have raised concerns about the implications for Article 282 of the Constitution.

Key Takeaways

- The Centre's budget cut for CSS has sparked debates on fiscal federalism.

- Article 282 allows the Union and states to make grants for public purposes beyond legislative jurisdiction.

- Discretionary grants impact states' financial autonomy and may lead to over-reliance on central funding.

Additional Details

- Article 282: This article enables both the Union and the states to provide grants for any public purpose, even if it lies outside their legislative jurisdiction. Unlike tax devolution governed by Articles 270 and 275, these grants are discretionary and not confined to Finance Commission recommendations.

- Judicial Stand: In the Bhim Singh Case (2010), the Supreme Court upheld the Union’s authority to provide discretionary grants beyond Finance Commission recommendations, indicating that such grants can extend to subjects beyond Parliament's legislative competence.

- Challenges to Fiscal Federalism:CSS funding poses several challenges:

- Discretionary funding undermines states' flexibility to meet local needs.

- States face strict conditions on fund utilization, limiting their ability to adapt initiatives.

- Resource expenditure asymmetry shows that while the Union controls 63% of resources, it only spends 38%, placing a heavier burden on states.

- CSS funds require states to provide matching grants, diverting resources from state priorities.

- Over-reliance on discretionary CSS grants threatens cooperative federalism, as it diminishes states' autonomy.

In conclusion, the recent budget cuts to CSS funding raise significant concerns regarding fiscal federalism in India. The implications of discretionary grants under Article 282 may adversely affect states' financial independence, necessitating a review and rationalization of the funding mechanisms to strengthen cooperative federalism.

Repo Rate Cut and its Implications

Why in News?

The Reserve Bank of India (RBI) has made a significant change in its monetary policy by lowering the repo rate by 25 basis points (bps) to 6.25%. This is the first rate cut in 57 months and aims to support economic growth amid easing inflation projections.

Key Takeaways

- The repo rate was reduced from 6.5% to 6.25% to stimulate economic activity.

- Inflation is projected to ease to 4.4% this quarter and further to 4.2% in 2025-26.

- Cheaper loans for various sectors can be anticipated due to the repo rate cut.

- This rate cut is the first since May 2020, when it was lowered to 4% during the COVID-19 pandemic.

Additional Details

- Repo Rate: The repo rate is the interest rate at which the central bank lends money to commercial banks. It acts as a key monetary policy tool.

- Digital Security Initiative: The RBI has introduced the ‘bank.in’ domain for Indian banks to enhance trust in digital transactions and reduce cybersecurity threats.

- The RBI has maintained a neutral monetary stance despite the rate cut, focusing on balancing inflation concerns with economic growth.

- Future projections indicate a real GDP growth of 6.4% for the current year and 6.7% for 2025-26, supported by improving employment conditions and stable agricultural output.

- Foreign exchange reserves stand at $630.6 billion, providing a buffer for the economy against external shocks.

The RBI's recent actions signal a major shift in monetary policy towards stimulating growth while maintaining control over inflation. With the introduction of the ‘bank.in’ domain, the RBI is taking steps to secure India's digital financial ecosystem. Market participants are observing these developments closely as they await further signals from the RBI.

Agricultural Initiatives and their Implementation

Why in News?

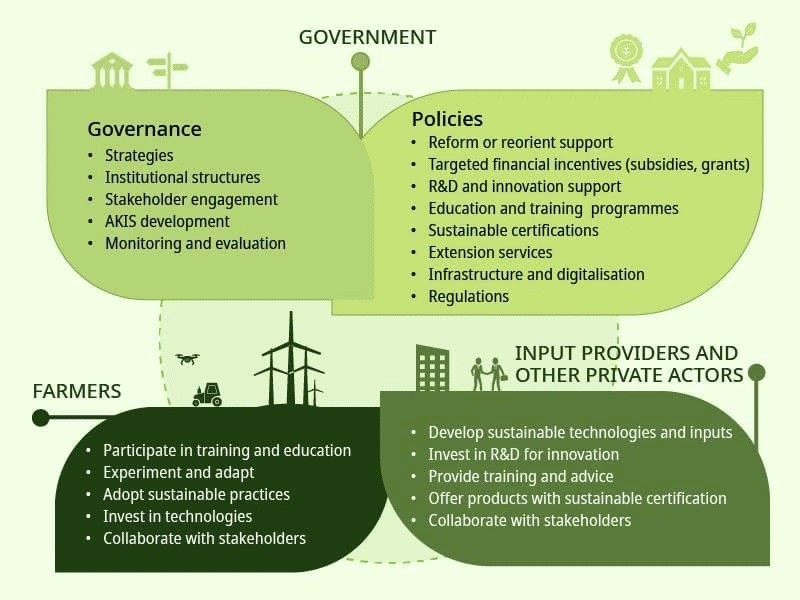

The Ministry of Agriculture and Farmers' Welfare has initiated and is implementing a variety of initiatives aimed at promoting agriculture across India.

Key Takeaways

- The Kisan Credit Card (KCC) scheme provides farmers with easier access to credit.

- Crop insurance schemes have seen significant growth in applications, ensuring coverage for farmers.

- Investment in agricultural mechanization is being prioritized to enhance productivity.

- Digital initiatives are being implemented to create a unified agricultural ecosystem.

Additional Details

- KCC Scheme: The Kisan Credit Card scheme was expanded in 2019 to include animal husbandry, dairying, and fisheries. As of March 2024, there are 7.75 crore operational KCC accounts with a loan outstanding of Rs 9.81 lakh crore.

- Crop Insurance Schemes: The Pradhan Mantri Fasal Bima Yojana (PMFBY) covers pre-sowing to post-harvest losses, while the Resilient Weather-Based Crop Insurance Scheme (RWBCIS) addresses weather-related risks. Applications have grown by 35.12% and 27.50% respectively year-on-year during 2022-23 and 2023-24.

- Agricultural Mechanization: The Sub Mission on Agricultural Mechanization (SMAM) focuses on skill training for equipment selection, operation, maintenance, and energy management through Farm Machinery Training & Testing Institutes (FMTTIs).

- Project VISTAAR: Aims to create a unified digital agriculture ecosystem that enhances scalability, accessibility, and two-way communication with farmers, integrating AI chatbots for real-time support.

- Paramparagat Krishi Vikas Yojana (PKVY): This initiative has covered 14.99 lakh hectares through clusters, benefiting over 25 lakh farmers since its inception in 2015-16.

- Farmer Producer Organizations (FPOs): As of December 2024, 9,268 FPOs have been registered under the Formation and Promotion of 10,000 FPOs scheme, enhancing farmers' access to inputs, credit, and markets.

- Pradhan Mantri Kisan Maandhan Yojana (PMKMY): Enrolling 24.66 lakh farmers as of November 2024, the scheme provides a minimum pension of Rs 3,000 per month after the age of 60.

- Gramin Krishi Mausam Sewa (GKMS): 130 Agromet Field Units (AMFUs) disseminate weather and crop-related information through various channels, including mobile apps.

Despite these initiatives, Indian agriculture faces challenges such as fragmented land holdings, low adoption of modern technology, significant post-harvest losses, and irrigation challenges. Addressing these issues through innovative methods and supporting agri-tech startups could enhance productivity and farmer livelihoods in the future.

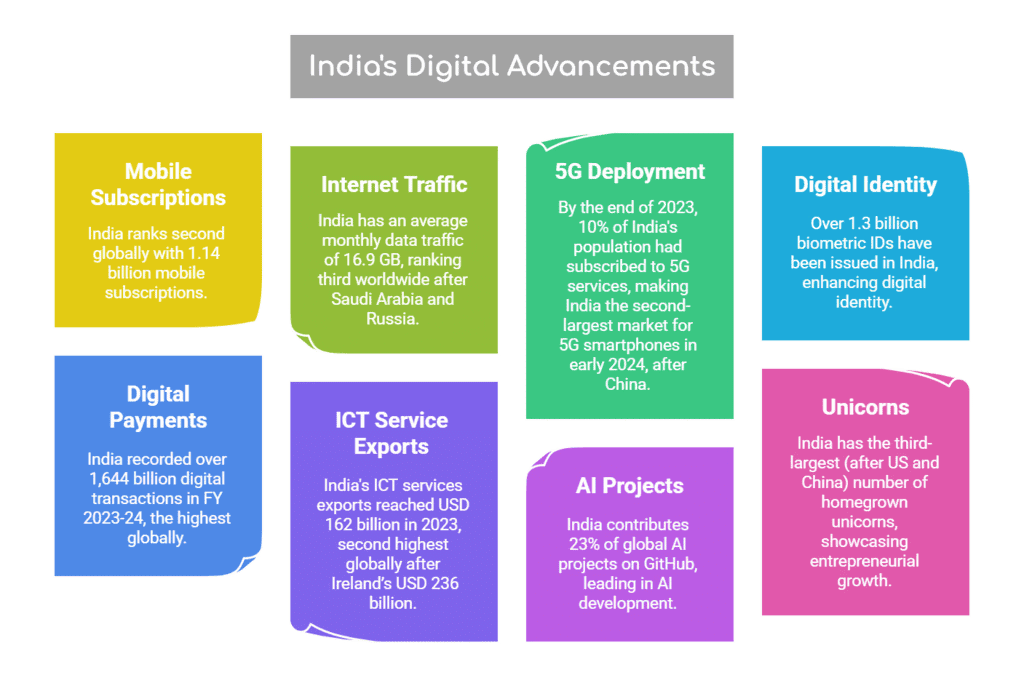

State of India’s Digital Economy (SIDE) Report 2024

Why in News?

The State of India’s Digital Economy Report 2024, released by the Indian Council for Research on International Economic Relations (ICRIER) and based on research from the Ministry of Electronics and Information Technology (MeitY), offers a comprehensive overview of the current status and future potential of India’s digital economy.

Key Takeaways

- India ranks as the 3rd largest digitalized economy globally, following the US and China.

- Positioned 12th among G20 nations for individual user digitalization, highlighting a need for improvement.

Contribution of Digital Economy

- In the fiscal year 2022-23, the digital economy contributed 11.74% to India’s GDP.

- Projected growth to 13.42% by 2024-25.

- The sector currently employs 2.55% of the workforce, with productivity rates five times higher than the overall economy.

- By 2029-30, it is forecasted to contribute 20% of GDP, surpassing both agriculture and manufacturing.

Sectoral Breakdown

- The traditional ICT sector remains the largest segment within the digital economy.

- Emerging industries such as Big Tech and digital platforms account for nearly all Gross Value Added (GVA).

State-Level Disparities

- States like Karnataka, Maharashtra, Telangana, Gujarat, and Haryana show significantly higher levels of digitalization compared to less affluent states.

Key Drivers of Digital Economy Growth in India

- Expanding Digital Infrastructure: Initiatives like BharatNet provide high-speed internet to rural areas, while the rollout of 5G enhances digital adoption.

- Rising Smartphone Penetration: Affordable devices and low-cost data have made India a mobile-first economy, improving access to online services.

- Global Capability Centers (GCCs): India hosts 55% of the world’s GCCs, delivering crucial services in IT support and business processes.

- Startup Ecosystem and Innovation: Programs like Start-Up India have bolstered funding for tech startups, with Indian startups raising USD 30.4 billion in 2024.

- Digital Financial Inclusion: Efforts such as UPI and Jan Dhan accounts are significantly improving financial access, especially in rural regions.

In conclusion, India's digital economy is a major catalyst for economic growth and job creation. The ongoing digitalization of traditional sectors and the emergence of digital platforms are reshaping industries and generating new employment opportunities. With increasing digital literacy and the adoption of innovative technologies, India is set to lead the way in digital transformation, promoting sustainable and inclusive economic growth.

Agriculture Development in India

Why in News?

The Union Budget 2025-26 has positioned agriculture as the primary engine for India's development journey, announcing various measures aimed at enhancing agricultural growth and productivity. The Economic Survey 2024-25 indicates that the agriculture sector has experienced robust growth, averaging 5% annually from 2016-17 to 2022-23. However, the launch of the National Mission on High-Yielding Seeds has raised concerns regarding the risks of monocultures and the potential loss of crop diversity.

Key Takeaways

- The agriculture sector has shown an average growth of 5% annually.

- The National Mission on High-Yielding Seeds aims to boost productivity.

- Concerns about monoculture and crop diversity have been highlighted.

Additional Details

- National Mission on High Yielding Seeds:This initiative seeks to enhance agricultural productivity by developing high-yielding seeds that are more resilient to pests and climate stress. It focuses on:

- Creating new seed varieties with improved productivity and resistance.

- Ensuring easy access for farmers to high-yielding seeds.

- Seed Varieties: The mission aims to increase the availability of over 100 new seed varieties, including 23 cereals, 11 pulses, and 7 oilseeds.

- Makhana Board in Bihar: A board will be established to enhance production, processing, and marketing of Makhana, supporting farmers through FPOs and government schemes.

- Food Processing: A National Institute of Food Technology, Entrepreneurship and Management will be set up in Bihar to promote food processing activities in Eastern India.

- Gene Bank: A second Gene Bank will be established, housing 10 lakh germplasm lines for future food and nutritional security.

- Mission for Cotton Productivity: A five-year initiative focusing on improving cotton farming productivity and sustainability while promoting extra-long staple varieties.

- Sustainable Fisheries: A framework will be created for sustainable fisheries in the EEZ and High Seas, particularly in the Andaman & Nicobar and Lakshadweep Islands.

- Prime Minister Dhan-Dhaanya Krishi Yojana: This scheme aims to enhance agricultural productivity in 100 low-productivity districts, benefiting 1.7 crore farmers through crop diversification, sustainable practices, and improved irrigation.

- Mission for Self-reliance in Pulses: A six-year mission will be initiated to achieve self-sufficiency in pulse production, focusing on crops like Tur, Urad, and Masur.

- Rural Prosperity and Resilience Programme: A multi-sectoral initiative aimed at addressing under-employment in agriculture, prioritizing rural women and young farmers.

- Grameen Credit Score: Public Sector Banks will develop a framework to address the credit needs of SHG members and rural populations.

- Kisan Credit Cards (KCC): The loan limit under the Modified Interest Subvention Scheme will increase from Rs 3 lakh to Rs 5 lakh for KCC holders, supporting around 7.7 crore farmers, fishermen, and dairy farmers.

In conclusion, the initiatives announced in the Union Budget 2025-26 aim to bolster agricultural productivity and sustainability in India, addressing both immediate needs and long-term goals for the sector.

Infrastructure Development in India

Why in News?

India has witnessed significant advancements in infrastructure development over the last decade, which serves as the foundation for economic growth. The total capital expenditure in infrastructure is projected to rise to Rs 11.2 lakh crore for the fiscal year 2025-26, an increase from Rs 10 lakh crore in 2023-24.

Key Takeaways

- The National Monetisation Plan aims to monetise assets worth Rs 1 lakh crore over the next five years (2025-30).

- An Urban Challenge Fund of Rs 1 lakh crore will be established to develop cities as growth hubs.

- Indian Railways plans 100% electrification of its network by FY 2025-26.

- New fund of Rs 25,000 crore for the shipbuilding industry to promote competition.

- Extension of the UDAN scheme to increase regional connectivity.

- SWAMIH Fund will expedite the completion of 1 lakh incomplete housing units.

Additional Details

- Infrastructure Financing: The government will provide certainty in the taxation of Alternative Investment Funds (AIFs) in infrastructure projects.

- Railways: India aims to become the largest cargo-carrying railway globally, targeting indigenous production of high-speed bullet trains.

- Shipbuilding: Large ships will gain infrastructure status, leading to reduced financial costs.

- Aviation Sector: The revamped UDAN scheme will connect 120 new destinations, serving an additional 40 million passengers.

- Housing: The SWAMIH Fund aims to facilitate the completion of pending housing projects with contributions from various sectors.

Overall, India's infrastructure development has seen substantial growth across multiple sectors such as highways, railways, and civil aviation. The government's initiatives aim to enhance infrastructure further, which is essential for driving economic growth and improving the quality of life for its citizens.

Mains Question:

Q: How can infrastructure development contribute to the overall socio-economic well-being of India?

Balancing Energy Transition & Security

Why in News?

The Economic Survey 2024-25 emphasizes the ongoing significance of coal as a dependable and cost-effective energy source for India’s energy security and economic progress. Additionally, the Union Budget 2025-26 introduced several initiatives aimed at bolstering the renewable energy sector.

Key Takeaways

- Coal remains vital for India's energy security and economic development.

- Renewable energy initiatives were announced in the recent Union Budget.

What is Energy Security?

- Definition: Energy security is the capacity to sustain a reliable, sustainable, and affordable energy system that fulfills the requirements of individuals, industries, and governments.

- Components:

- Availability: Consistent energy supply from diverse sources to meet demand.

- Accessibility: Infrastructure ensuring energy delivery to all, including remote areas.

- Affordability: Stable and cost-effective energy prices for consumers and businesses.

- Sustainability: Clean and efficient energy use for long-term environmental balance.

- Importance:

- Essential for daily energy demands and key sectors like agriculture and manufacturing.

- Supports economic growth and industrial productivity.

- Helps maintain political stability by preventing unrest due to energy shortages.

- Facilitates sustainable development by ensuring clean energy for the future.

- Contributes to food security by impacting agriculture and food production.

Factors Affecting Energy Security

- Physical Factors: Regions rich in fossil fuels typically have better energy security, while others face scarcity challenges.

- Costs: Depletion of non-renewable resources increases extraction costs and energy prices.

- Technology: Advances can make renewable energy viable, but environmental impacts must be addressed.

- Political Factors: Geopolitical tensions and conflicts can disrupt energy supplies.

Why Coal is Important for India's Energy Security?

- Large Coal Reserves: India possesses 10% of the world's coal reserves but only 0.7% of its natural gas, making coal a crucial and affordable energy source.

- Economic Viability: Substantial investments in coal-based power plants since the 2010s mean that shutting them down prematurely would waste these investments.

- Climate Financing: At UNFCCC COP 29, developed nations pledged only USD 300 billion annually, which is short of the USD 1 trillion needed, compelling India to maintain its coal reliance and potentially adjust climate targets.

Challenges with Renewable Energy

- High investments needed for grid integration.

- Battery storage issues to manage energy intermittency.

- Limited land availability in densely populated areas for renewable installations.

- Dependence on critical minerals not abundantly available in India for renewable technology.

- Geopolitical vulnerabilities due to reliance on imported materials and technologies.

Lessons from Developed Nations

- Energy transitions have often been driven by commercial interests and emissions reduction efforts in developed economies.

- For instance, France expanded its nuclear capacity in the 1970s during oil embargos, while the EU launched the REPowerEU plan in 2022 to lessen dependence on Russian gas.

- The US's approval of a major oil-drilling project in Alaska in 2023 indicates that even developed countries still rely on fossil fuels.

Congestion Costs

The transition to renewable energy has introduced congestion costs, which have led to increased electricity prices in various countries. Congestion costs arise from limited transmission or distribution capacity, resulting in inefficiencies in electricity delivery.

What are Union Budget Announcements in the Renewable Energy Sector?

- Customs Duty Exemption: Cobalt powder, lithium-ion battery scraps, lead, zinc, and 12 other critical minerals are exempt from basic customs duty. In July 2024, 25 critical minerals unavailable domestically were exempted from customs duties.

- National Critical Minerals Mission (NCMM): An allocation of Rs 410 crore for technology development, skilled workforce creation, and financing mechanisms for clean energy.

- Nuclear Energy Mission: A budget of Rs 20,000 crore has been set aside for developing indigenous Small Modular Reactors (SMRs), aiming to operationalize at least five SMRs by 2033, with private sector involvement in the Bharat Small Reactors (BSR) project.

What are the Initiatives Shaping India’s Energy Transition?

- Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles (FAME)

- Pradhan Mantri Sahaj Bijli Har Ghar Yojana (SAUBHAGYA)

- Green Energy Corridor (GEC)

- National Solar Mission (NSM)

- National Biofuels Policy and SATAT

- International Solar Alliance (ISA)

In conclusion, India's energy transition needs to be both gradual and strategic, ensuring a balance between the adoption of renewables and maintaining energy security. While coal continues to play a critical role, investments in renewable energy, nuclear power, and critical minerals are essential. By learning from global experiences, India aims to achieve energy affordability, stability, and self-reliance while progressing towards its net-zero goal by 2070.

Main Question

Q: Discuss the challenges and opportunities in India's shift towards a low-carbon energy future.

Strengthening Regulatory Bodies

Why in News?

Experts are emphasizing the necessity to study the impact of regulatory bodies such as the Securities and Exchange Board of India (SEBI) to incorporate their influence into decision-making processes. They argue that these regulatory bodies must clearly articulate their decisions to ensure stakeholders' satisfaction, not only in practice but also in perception.

Key Takeaways

- Regulatory bodies are crucial for monitoring and regulating economic sectors.

- There are two main types: statutory regulatory bodies and self-regulatory bodies.

- Challenges include lack of independence, financial autonomy, and inadequate stakeholder engagement.

Additional Details

- Regulatory Bodies: Organizations established to monitor specific sectors of the economy, ensuring fair practices and protecting public interests. Examples include SEBI for capital markets and RBI for banking.

- Need for Regulatory Bodies: They protect consumer interests, enforce standards, promote market stability, and uphold legal compliance.

- Types: Statutory regulatory bodies (like SEBI) are established by an act of Parliament, while self-regulatory bodies (like the Bar Council of India) are formed by members of the profession.

- Functions: They ensure fair practices, prevent fraud, set health and safety standards, and uphold transparency.

- Examples:

- Reserve Bank of India (RBI): Oversees banking and financial stability.

- Insurance Regulatory and Development Authority of India (IRDAI): Regulates the insurance sector.

- Central Electricity Regulatory Commission: Regulates electricity tariffs.

- Issues: Challenges like lack of independence and autonomy, ineffective appointment processes, inadequate parliamentary accountability, and a fragmented regulatory framework hinder their effectiveness.

To enhance accountability, transparency, and effectiveness in decision-making, it is crucial for regulatory bodies to be accountable to Parliament's Standing Committee, undergo regular audits, and involve stakeholders in their processes. Furthermore, collaborating with research institutions and adopting international best practices can significantly improve their operations.

Mutual Credit Guarantee Scheme for MSMEs

Why in News?

The Government of India has recently approved the launch of the Mutual Credit Guarantee Scheme for MSMEs (MCGS-MSME) to enhance credit access for Micro, Small, and Medium Enterprises (MSMEs).

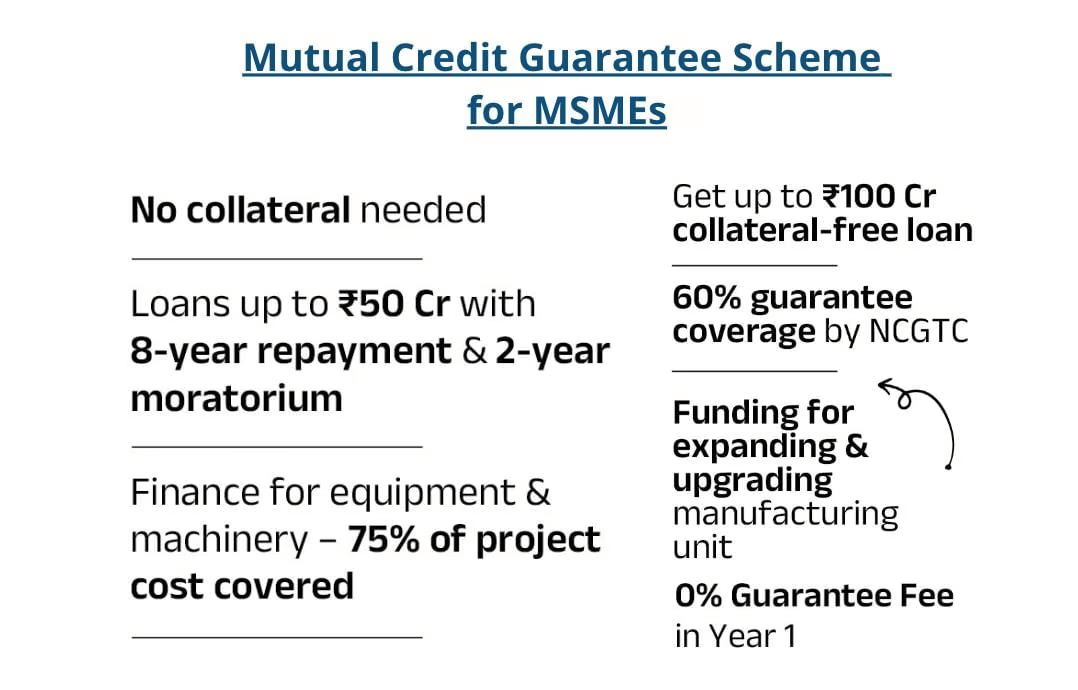

Key Takeaways

- The scheme aims to provide a guarantee for loans to MSMEs, thereby reducing the risk perceived by lenders.

- Targeted towards MSMEs that possess a valid Udyam Registration Number.

- Loan limits can go up to Rs 100 crore for the purchase of equipment or machinery.

- The National Credit Guarantee Trustee Company Ltd (NCGTC) offers a 60% guarantee coverage to Member Lending Institutions (MLIs).

- At least 75% of the project costs must be allocated for the scheme.

- The scheme will be operational for 4 years or until the cumulative guarantee issued reaches Rs 7 lakh crore, whichever comes first.

Additional Details

- Significance:

- It boosts the manufacturing sector by enhancing credit availability, which is crucial since MSMEs contribute 17% to India's GDP.

- Supports the Make in India initiative by aiming to increase the manufacturing sector's share to 25% of GDP.

- Facilitates collateral-free loans to help MSMEs expand their operations.

- Promotes employment growth, potentially creating millions of job opportunities in the manufacturing sector.

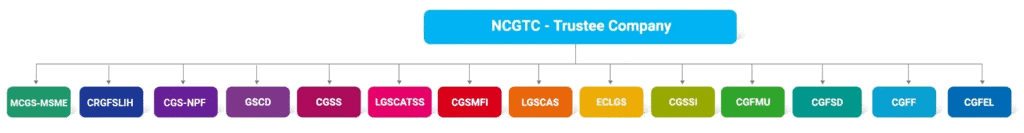

- About NCGTC:

The National Credit Guarantee Trustee Company Ltd (NCGTC) is a dedicated body created to manage and operate various credit guarantee trust funds. It helps borrowers access finance by sharing lending risks with lenders.

Established in March 2014 under the Indian Companies Act, 1956, NCGTC has a paid-up capital of Rs 10 crore and is wholly owned by the Government of India, operating under the Department of Financial Services, Ministry of Finance.

- NCGTC currently oversees 14 dedicated credit guarantee trust schemes, including MCGS-MSME and the Credit Guarantee Fund for Micro Units (CGFMU), along with the Emergency Credit Line Guarantee Scheme (ECLGS).

This initiative is a significant step towards improving the financial landscape for MSMEs in India, ensuring they have the necessary support to thrive and contribute to the economy.

Injecting Liquidity in Economy

Why in News?

The Reserve Bank of India (RBI) has recently announced measures aimed at injecting over Rs 1.5 lakh crore into the economy to enhance money liquidity.

Key Takeaways

- Money Liquidity: This term refers to the availability of cash and easily accessible funds within the economy, which significantly influences both spending and investment.

- Liquidity Shortfall: The liquidity deficit was primarily caused by the RBI's foreign exchange sales intended to stabilize the rupee amid outflows from foreign institutional investors (FIIs).

Additional Details

- Government Bond Buyback: This process involves the central bank or government repurchasing bonds from the market before their maturity date. This action injects liquidity by compensating bondholders, which increases the availability of funds in the banking system.

- Repo Auction: This is a liquidity adjustment mechanism where banks bid for funds at their desired borrowing rates, and the RBI accepts the lowest bids until the required amount is disbursed.

- US Dollar-Rupee Swap Auction: This auction facilitates a temporary exchange of currencies, thereby enhancing market liquidity. Borrowing dollars helps stabilize the domestic currency and mitigates liquidity drain by reducing the need for rupee sales in the forex market.

- Potential Repo Rate Cut: The injection of sufficient liquidity may lead to a possible cut in the repo rate during the upcoming monetary policy review, ensuring that any future rate cuts effectively lower interest rates for borrowers.

In summary, the RBI's measures to inject liquidity are crucial for stabilizing the economy, enhancing fund availability, and potentially influencing future monetary policy decisions.

|

98 videos|923 docs|33 tests

|