Economic Development : June 2025 Current Affairs | Current Affairs & General Knowledge - CLAT PDF Download

World Energy Investment Report 2025

Why in News?

The International Energy Agency (IEA) has published the 10th edition of its World Energy Investment Report, providing vital insights into global trends in energy investment.

Key Takeaways

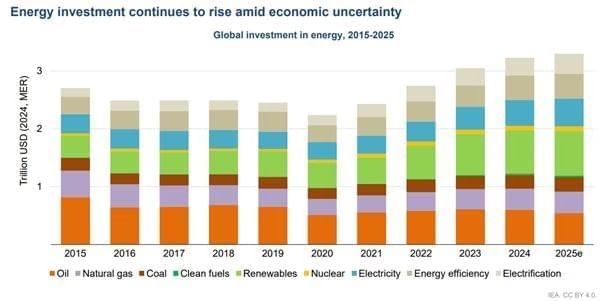

- Global energy investment is expected to reach a record USD 3.3 trillion.

- Investment in clean energy technologies is projected at USD 2.2 trillion, which is twice the amount allocated for fossil fuels (USD 1.1 trillion).

- This increase reflects ongoing efforts to reduce emissions, improve energy security, and utilize cost-competitive electricity solutions.

Additional Details

- Clean Energy Investment: Global expenditure on low-emission power generation has nearly doubled in five years, primarily driven by solar PV. Specifically, solar investments are anticipated to reach USD 450 billion in 2025. Additionally, battery storage is experiencing rapid growth, projected to surpass USD 65 billion this year, while nuclear power investments have grown by 50%, expected to reach USD 75 billion in 2025.

- India's Position: India’s renewable power investments are set to rise from USD 13 billion in 2015 to USD 37 billion in 2025. Fossil fuel investments are also increasing, from USD 41 billion to USD 49 billion, and investments in nuclear and other clean sources will grow from USD 1 billion to USD 6 billion. However, investments in grid and storage have decreased from USD 31 billion to USD 25 billion over the same period.

- Regional Investment Patterns: China is projected to represent over 25% of global energy investments, outpacing all other nations combined, with its total energy spending equating to that of the US and EU combined. Conversely, Africa's investment in clean energy has only marginally increased despite the continent housing 20% of the world’s population, accounting for just 2% of global clean energy investments.

- Fossil Fuel Investments: Oil exploration and production investments are forecasted to decline by 6% in 2025, while LNG investments are on the rise, driven by significant projects in the US, Qatar, and Canada. Meanwhile, coal investments remain robust, with China initiating 100 GW of new coal power in 2024, leading to the highest global approvals since 2015.

- Grid Infrastructure Investment: Investment in generation is set to reach USD 1 trillion in 2025, while grid spending lags behind at only USD 400 billion. This gap is widening as material costs for grid infrastructure have nearly doubled over the past five years due to soaring demand.

This report underscores the significant shifts in global energy investments, particularly highlighting the increasing emphasis on clean energy technologies and the challenges faced by traditional energy sectors.

PM-PRANAM Scheme

Why in News?

The PM-PRANAM scheme has gained attention for its significant achievement in reducing synthetic fertilizer usage. In the fiscal year 2023-24, the scheme has successfully reduced the use of fertilizers by 15.14 lakh tonnes, which has led to considerable savings on subsidies.

Key Takeaways

- The PM-PRANAM scheme was approved in June 2023 to decrease the reliance on chemical fertilizers.

- This initiative is set to operate for a period of three years, from FY 2023-24 to FY 2025-26.

- The overarching goal is to achieve a ₹20,000 crore reduction in fertilizer spending.

Additional Details

- Target Savings: The scheme aims to encourage the balanced use of chemical fertilizers while promoting biofertilizers and organic fertilizers. This approach supports sustainable agricultural practices.

- Tracking Mechanism: The Integrated Fertilisers Management System (iFMS) will monitor fertilizer usage to ensure compliance and effectiveness of the scheme.

- Resource Conservation Technologies: The Centre will allocate 50% of subsidy savings to states, with 70% for developing alternative fertilizer technologies and 30% for rewarding farmers and stakeholders involved in promoting awareness.

- Organic and Alternative Farming: A strong emphasis is placed on transitioning to organic farming to enhance soil health and reduce dependence on synthetic fertilizers.

- Positive Environmental Impact: Funded by savings from existing fertilizer subsidies, this scheme aims to mitigate issues like water contamination and biodiversity loss.

In conclusion, the PM-PRANAM scheme represents a significant step towards sustainable agriculture in India, focusing on reducing chemical fertilizer dependency while enhancing the use of natural alternatives. Its successful implementation could lead to long-term benefits for both the environment and agricultural practices.

Synchronising Irrigation and Cropping

Why in News?

India's agricultural sector has traditionally operated under the assumption that increasing irrigation automatically leads to a shift towards water-intensive crops. However, recent data from 2011-12 to 2022-23 demonstrates that irrigation and cropping decisions are made in conjunction, influenced by immediate factors such as rainfall and market conditions. Understanding this interaction is crucial for enhancing the effectiveness and sustainability of irrigation investments.

Key Takeaways

- Reliable irrigation facilitates a transition from traditional subsistence crops to high-value crops.

- Irrigation enables multiple cropping, enhancing land use efficiency.

- Farmers' decisions are influenced by real-time factors rather than just irrigation infrastructure.

Additional Details

- Irrigation and Cropping Patterns: Reliable irrigation allows farmers to shift from crops like millets to high-value options such as fruits and cash crops like sugarcane and cotton.

- High-Yielding Varieties (HYVs): These varieties require assured water supply, with irrigation playing a key role in their adoption, particularly in Green Revolution regions such as Punjab and Haryana.

- Timing of Irrigation: Effective irrigation is critical when it aligns with the sowing season. Delays in infrastructure can weaken its impact.

- Trends in Irrigation:

- Gross Irrigated Area (GIA) increased from 91.8 million hectares in 2011-12 to 122.3 million hectares in 2022-23.

- Gross Sown Area (GSA) rose from 195.8 million hectares to 219.4 million hectares during the same period.

- Crop yields improved from 841 kg/acre to 1,009 kg/acre, reflecting a 1.67% average annual growth rate.

Efficient synchronization between irrigation and cropping is essential for optimizing water use, enhancing productivity, and adapting to climate risks. Investments in irrigation infrastructure should align with farmers' real-time cropping needs to ensure sustainability and minimize environmental impacts.

What are the Flaws in Traditional Irrigation Planning?

- Mismatch with Sowing Cycles: Delayed infrastructure projects often miss critical sowing windows, leading to underutilization.

- Top-Down Approach: Centralized planning fails to consider local agro-climatic conditions, leading to ecological costs and groundwater depletion.

- Lack of Input Convergence: Productivity does not increase with irrigation alone; it requires a combination of quality inputs.

- Absence of Real-Time Data Use: Planning often neglects timely weather forecasts and soil moisture data.

- Technological and Financial Barriers: High costs of micro-irrigation systems limit access for poor farmers.

What Reforms are Needed in Irrigation Planning to Ensure Sustainable Cropping?

- Adopt an Agro-Ecological Approach: Shift to region-specific planning based on local conditions.

- Integrate Irrigation with Input Services: Link irrigation investments with access to seeds, fertilizers, and weather advisories.

- Expand Micro-Irrigation: Promote cluster-based, demand-driven subsidies for micro-irrigation tools.

- Rationalise Input Subsidies: Replace blanket subsidies with targeted direct benefit transfers (DBTs).

- Restore Traditional Water Harvesting: Modernize traditional systems while maintaining their ecological integrity.

In conclusion, India's irrigation planning must evolve from a focus on infrastructure to a more integrated, climate-smart approach that responds to the needs of farmers and the environment. This transformation requires policy coherence, technological innovation, and community engagement to secure water, food, and livelihoods in the future.

India’s Renewable Energy Revolution

Why in News?

India has emerged as a global leader in clean energy, adding a remarkable 29 GW of renewable energy in 2024 alone. With an installed capacity of 232 GW and an additional 176 GW under construction, India’s energy transition is significantly contributing to global sustainability efforts, propelled by bold reforms and visionary leadership.

Key Takeaways

- India ranks among the top countries in solar and wind energy capacities globally.

- Solar capacity increased from 2.63 GW in 2014 to 108 GW in 2025, marking a 41-fold rise.

- The target is to achieve 500 GW of non-fossil energy capacity by 2030 and 1,800 GW by 2047.

Additional Details

- Market-Driven Bidding: India replaced feed-in tariffs with transparent bidding processes, resulting in a significant drop in solar tariffs from Rs 10.95/unit in 2010 to Rs 1.99/unit in 2021.

- Flagship Programs: Initiatives such as the PLI Scheme for Solar Manufacturing have doubled India’s solar module manufacturing capacity from 38 GW in March 2024 to 74 GW in March 2025.

- PM Surya Ghar Yojana: This initiative targets 30 GW of decentralized capacity across 1 crore households, with over 10 lakh houses already participating.

- The National Green Hydrogen Mission (NGHM) aims to produce 5 MMT of green hydrogen annually by 2030, supported by investments in Green Energy Corridors.

- Under the Ethanol Blended Petrol (EBP) Programme, ethanol blending in petrol rose from 1.5% in 2013 to 15% in 2024, saving Rs 1.26 lakh crore in foreign exchange.

Challenges Facing the Renewable Energy Sector

- Roadblocks in Transition: Heavy dependence on coal poses hurdles, particularly in states like Jharkhand and Chhattisgarh, where local economies rely on coal-related jobs.

- Financing Gaps: India requires Rs 2 trillion annually for renewable energy capacity, which is half of its entire Union budget for 2023-24.

- Grid Integration Issues: The intermittency of renewable sources presents challenges for grid stability and requires improved energy storage solutions.

- Supply Chain Vulnerabilities: India is heavily reliant on China for solar cells and critical minerals like lithium and cobalt.

- Land Constraints: The demand for land for solar and wind farms often conflicts with agricultural use and urban development.

Accelerating Renewable Energy Adoption

- Optimize Land Resources: Implement floating solar panels in reservoirs and lakes to conserve land and improve energy efficiency.

- Develop Renewable Energy Clusters: Establish Special Economic Zones (RE-SEZs) to streamline clearances and boost clean energy growth.

- Leverage Digital Technologies: Utilize blockchain for peer-to-peer renewable energy trading and invest in smart grids for better energy management.

- Expand Renewable Infrastructure: Install Vertical Axis Wind Turbines (VAWTs) on rooftops and promote decentralized solutions like microgrids.

- Promote Waste-to-Energy Initiatives: Utilize technologies like anaerobic digestion to convert waste into energy.

India’s push for renewable energy positions it as a global clean energy leader. Despite challenges such as financing gaps, innovative approaches can drive progress toward achieving the 500 GW target by 2030. This transition supports sustainable development goals related to affordable energy, climate action, and infrastructure, promoting energy security and sustainable growth.

Reforming Agricultural Subsidies

Why in News?

The Vice President highlighted the potential of direct transfer of agricultural subsidies to significantly enhance farmers' income, estimating that each farmer could receive at least Rs. 35,000 annually if all aid is provided directly rather than through indirect subsidies.

Key Takeaways

- Direct transfers can improve farmers' income.

- Current agricultural subsidies in India include various types targeting different needs.

Additional Details

- Types of Agricultural Subsidies:Various subsidies exist in India to support farmers, including:

- Direct Benefit Transfer (DBT): Provides cash support directly to farmers, e.g., PM KISAN and Rythu Bandhu.

- Input Subsidies: Includes fertilizer and seed subsidies that make essential agricultural inputs affordable.

- Irrigation Subsidy: Financial support for drip and sprinkler systems under PMKSY to promote water conservation.

- Power Subsidy: Free or subsidized electricity for agricultural pumps, with concerns over groundwater depletion.

- Credit & Insurance Subsidies: Programs like PMFBY protect farmers from crop failures.

- Output Subsidies: Minimum Support Price (MSP) guarantees fair prices for select crops.

- Infrastructure & Post-Harvest Subsidies: Funding for cold storage and warehousing to reduce post-harvest losses.

- The fiscal burden on the government has increased significantly, with Rs 3.71 lakh crore allocated for food and fertilizer subsidies in the Union Budget 2025-26.

- Soil degradation and groundwater depletion are significant concerns due to current subsidy structures.

The urgent need for reforms is clear, as India’s agricultural subsidies, while beneficial, must be restructured to balance farmer welfare with environmental sustainability. Transitioning to direct cash transfers, rationalizing MSP, and investing in sustainable practices will enhance food security and ensure farmer prosperity.

Revamping India’s Pharmaceutical Landscape

Why in News?

This editorial discusses the strategic significance of India’s $50 billion pharmaceutical industry, which is exempted from US tariffs. The focus is on its global healthcare role and potential for growth driven by innovation.

Key Takeaways

- India's pharmaceutical market is projected to grow from $50 billion in 2024 to $130 billion by 2030.

- The sector plays a crucial role in providing affordable medicines globally.

- Recent reforms aim to enhance regulatory efficiency and innovation in pharmaceuticals.

Additional Details

- Current Regulatory Framework: The Central Drugs Standard Control Organization (CDSCO) is the apex body ensuring the quality, safety, and efficacy of drugs in India. It oversees new drug approvals and clinical trials.

- Drugs and Cosmetics Act, 1940: This act governs the manufacture and distribution of drugs, ensuring safety and efficacy standards are met.

- National Pharmaceutical Pricing Authority (NPPA): Regulates the prices of essential medicines to keep them affordable for the public.

- Challenges: India faces issues such as quality control, dependence on imports for Active Pharmaceutical Ingredients (APIs), and a talent shortage in the pharma sector.

- Opportunities: The industry can capitalize on cost efficiencies, government support, and rising global demand for generics and biologics.

- Recent Reforms: Initiatives include the National Medical Devices Policy and the Pharmaceutical Technology Upgradation Assistance Scheme to boost innovation.

India's pharmaceutical sector is at a pivotal moment, with the potential to transition from being the 'pharmacy of the world' to a leader in high-value innovation. Strategic reforms in research and development, digital health, and skill enhancement, alongside strong public-private partnerships, will unlock new growth avenues. By focusing on self-reliance and global excellence, India can significantly influence the future of affordable healthcare worldwide.

Revamping India’s BFSI Sector

The Indian banking and financial sectors face challenges such as excessive regulations, non-functional banks, and unequal access. To ensure stability and growth for the economy and society, significant reforms in governance, digital finance, and regulation are necessary.

Since 1991, India’s financial sector has undergone substantial changes, but persistent issues require urgent attention. While previous policies have stabilised and promoted growth in the banking sector, rigid regulations, inefficiencies, and limited financial access continue to hinder progress. Banks grapple with challenges related to non-performing assets (NPAs), governance issues, and the adoption of digital technologies. Additionally, fintech innovations face outdated regulations, slowing down their impact. In light of global economic and financial shifts, India must address systemic gaps, modernise its banks and regulations, and ensure inclusive access to financial services. A robust government, sound regulations, and technological advancements will be crucial in shaping a reliable and contemporary financial system. Implementing significant and anticipated reforms is essential at this juncture to safeguard financial stability and foster growth for the economy and all its citizens. This article delves into the pressing challenges within India’s financial landscape, offers solutions, and outlines a roadmap for a more organised sector.

India’s Financial Sector Reforms

Over the years, India’s financial sector has evolved significantly due to both economic necessities and global influences. Understanding these reforms requires a look at the key phases that have shaped the sector.

Before Liberalization

- Pre-1991 Era. The Indian financial sector was predominantly under government control.

- Nationalization of Banks. In 1969 and 1980, banks were nationalised to ensure financial stability. However, this led to reduced competition and efficiency.

- Regulatory Constraints. Strict limits on interest rates, credit allocation, and foreign investments stifled growth and kept the sector stagnant.

1991 Reforms of Liberation

- Triggering Event. A balance of payments crisis in 1991 prompted a major overhaul of financial policies.

- Key Initiatives. Under the guidance of the Finance Minister, the government introduced reforms such as:

- Allowing private banks to operate.

- Easing credit borrowing.

- Deregulating interest rates.

- Opening up financial services to foreign investors.

- Shift to Market-Driven Dynamics. These reforms marked the beginning of a financial sector driven by market forces.

Reforms in Banking and Capital Markets

- 1990s Changes. The reforms of the 1990s increased competition, leading to the emergence of private banks like HDFC and ICICI.

- RBI Initiatives. The Reserve Bank of India (RBI) implemented measures to:

- Enhance banking efficiency.

- Strengthen banks’ capital bases.

- Improve risk management practices.

- Capital Market Reforms. Establishing the Securities and Exchange Board of India (SEBI) was a crucial part of these reforms, aimed at:

- Protecting investors.

- Increasing market transparency.

Developments in Technology and Fintech

- In the 2000s, banks and fintech firms started to use technology more extensively, leading to significant changes in the financial industry.

- Innovations like electronic fund transfers, online banking, and mobile payments transformed the way financial services were delivered.

- Government initiatives such as Aadhaar-linked banking and the Unified Payments Interface (UPI) encouraged more people to adopt digital financial services, making banking transactions faster and more convenient.

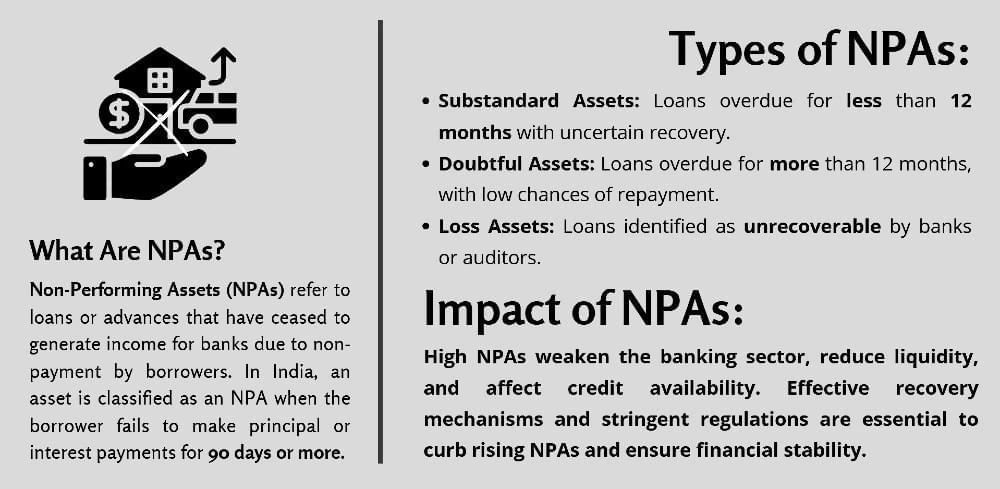

Non-Performing Assets (NPAs)

Current Challenges

- Despite technological advancements, challenges like NPAs, governance issues in banking, and complex regulations persist in the financial sector.

- While previous reforms laid a strong foundation, India's financial sector needs to continue evolving to address global demands and domestic challenges.

Present Scenario of India's Financial Sector

- Thanks to past reforms, India’s financial sector now faces a mix of old and new challenges and opportunities.

- Growth seen in Australia, driven by digital advancements and policy improvements, highlights the need for continued efficiency in India.

Growth and Stability

- The Indian banking sector has witnessed significant growth, primarily due to private banks enhancing their efficiency and digitizing their services.

- However, public sector banks continue to grapple with issues related to non-performing assets, poor management, and a lag in adopting modern technologies.

- Efforts such as bank mergers and recapitalization have been made, but substantial improvement requires comprehensive reforms.

Digital Finance and the Fintech Revolution

- The rise of fintech companies has transformed financial services, leading to the emergence of digital payments, lending platforms, and investment services.

- Innovations like UPI and neo-banking have broadened customer access to financial services.

- However, uncertainties regarding regulatory changes and cybersecurity challenges in the fintech space remain concerns.

Capital Markets

- India has strengthened its capital markets by facilitating foreign investments and enhancing corporate governance.

- Despite record profits in the stock market, vigilance is necessary to monitor market fluctuations, insider trading, and financial fraud.

Financial Inclusion

- The insurance sector is expanding and increasingly adopting digital tools; however, many rural individuals still struggle to obtain and afford insurance.

- Efforts to enhance financial access for all have progressed, yet rural populations and small businesses continue to face challenges related to credit availability and cash management knowledge.

Regulatory Framework and the Financial Sector

- Financial policy formulation has benefitted from the contributions of the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI).

- However, external factors such as the global economy, inflation, and political dynamics necessitate adaptable policy approaches.

While India’s financial sector is undergoing rapid transformation, comprehensive reforms are essential to ensure stability, foster innovation, and promote inclusivity within the financial system.

Core Issues Driving the Sector

- The financial industry in India is still dealing with major problems like complicated rules, bank troubles, gaps in financial inclusion, and economic unpredictability, despite reforms and growth.

- These issues need urgent attention to improve the financial system.

Regulatory Complexities and Policy Ambiguities

- India’s financial sector is overseen by various bodies, mainly the RBI, with SEBI and IRDAI also playing roles.

- However, the presence of different laws and regulations for various parts of the financial system slows down innovation and efficiency.

- Policies, especially those related to technology and finance, often lag behind, hindering progress and creating new challenges.

Challenges in the Public Sector Banking System

- Public Sector Banks (PSBs) are still struggling with high levels of bad loans, organizational management issues, and credit management challenges.

- Attempts to increase capital and merge banks have not resolved the issues of low profitability, limited independence, and political interference in large PSBs.

- Improving the financial stability of these banks depends on better governance and management practices.

Financial Inclusion and Rural Credit Access

- While India has made progress in expanding access to financial services, certain rural populations and small businesses still face challenges in obtaining credit.

- Traditional banks tend to avoid lending to low-income individuals due to perceived risks, forcing many to rely on informal lending sources.

- Enhancing online financial services, improving technological literacy, and increasing the number of banking institutions can help bridge this gap.

Impact of Global Financial Conditions

- India’s financial system is increasingly influenced by global factors such as inflation, interest rate changes, and market fluctuations.

- Geopolitical tensions and the potential for a global recession can significantly affect investment patterns, corporate performance, and overall economic health.

- Strong policy measures are necessary to safeguard the sector from external shocks.

Addressing these critical issues is vital for building a financial system that supports India’s current and future growth.

Need for Policy Reform

- Despite significant growth in its financial sector, India continues to face major challenges that require policy reforms.

- Public sector banks need to be rebuilt to enhance their control and performance by improving accountability, reducing political influence, and facilitating loan repayments.

- Digital transformation is crucial, but outdated regulations and cybersecurity concerns pose challenges.

- Policymakers should update old regulations, encourage collaboration between banks and fintech firms, and implement better cybersecurity measures to promote the use of financial technology.

- Easing regulations by streamlining oversight and reducing bureaucratic hurdles will enhance efficiency and clarity for banks, fintech companies, and investors.

- Rural communities and small businesses still struggle with credit access, necessitating policies that support loans, microfinance institutions, and new banking technologies.

- Promoting financial literacy programs will empower individuals and businesses to make informed financial decisions.

- India must align with global financial standards to ensure stability and resilience, requiring sustainable policies, improved investment regulations, and international collaboration.

- Implementing these reforms is essential for India’s financial development and ensuring consistent and robust financial growth.

Challenges and Reform Implementation

- Implementing changes in the financial sector is crucial for stability and growth, but it faces several challenges.

- Political resistance, bureaucratic hurdles, and complex regulations often slow down important reforms.

Resistance from Stakeholders

- Politicians and government bodies benefiting from the status quo resist changes in the financial sector.

- Public sector banks, influenced by political considerations, fear job losses and loss of control, making them reluctant to privatize.

- Lawmakers may avoid disruptive changes impacting the current economy.

Technological and Cybersecurity Challenges

- Advancing technology is vital for enhancing India’s financial sector, but it brings cybersecurity and data privacy risks.

- Financial institutions need to upgrade security measures to protect against fraud and hacking, but smaller firms struggle with the high costs of new technology and security improvements.

Economic and Market Uncertainties

- Financial, inflationary, and economic challenges complicate reform efforts.

- Unpredictable market changes impact foreign investment policies, banking regulations, and fintech operations, making implementation risky.

- Stable economic policies and investor confidence are essential for successful financial reforms.

Social and Financial Inclusion Challenges

- Despite ongoing efforts, a significant portion of India still lacks access to financial services.

- Changing lending policies and promoting digital banking are necessary, but both sectors need to work together for effective solutions.

Future Directions

- India’s financial system requires comprehensive and transformative reforms to ensure stability and global competitiveness.

- Simplifying regulations, advancing technology, and expanding banking access will greatly benefit the population.

- Enhancing Banking Governance: Public sector banks should focus on transparency and efficiency through robust governance frameworks.

- Improving private ownership, credit assessment, and loan accountability can strengthen the financial stability of weaker banks.

- Accelerating Digital Transformation and Fintech Development: With the rapid growth of fintech in India, a robust regulatory framework is essential to balance innovation and security.

- Streamlining licensing processes for fintech companies, fostering collaboration, and enhancing cybersecurity measures can expedite adoption and mitigate fraud risks.

- Modernizing Financial Regulations:. consistent and simplified approach to financial regulation is necessary for a dynamic financial landscape.

- Reducing bureaucratic hurdles, clarifying regulations, and leveraging technology in finance can enhance efficiency and clarity.

- Expanding Access to Financial Services and Credit: To strengthen rural economies and small businesses, access to reliable credit options must be improved.

- Expanding microfinance access, establishing trustworthy digital payment platforms, and launching targeted financial literacy initiatives will empower the economically disadvantaged to engage more actively in India’s financial ecosystem.

- Aligning with International Financial Standards: India should adopt global best practices in financial policymaking to safeguard against external risks and bolster investor confidence.

- Strengthening economic diplomacy, enhancing international financial cooperation, and maintaining a stable monetary policy can shield the sector from market volatility while ensuring sustained economic growth.

By implementing these reforms, India can build a financial sector that is better prepared, inclusive, and capable of thriving as the global economy evolves.

Conclusion

India’s financial sector is at a critical juncture where impactful reforms are necessary to ensure long-term stability and growth.

- Past policy efforts have yielded positive outcomes, but persistent regulatory challenges, governance issues in banks, and unmet financial needs for certain segments hinder progress.

- Key priorities for establishing a secure financial ecosystem include enhancing transparency, accelerating digital adoption, and streamlining compliance frameworks.

- A combination of policy innovation, technological advancements, and sound financial practices will guide India towards its economic objectives.

- By undertaking substantial reforms, India can elevate its financial sector to better serve the interests of businesses and individuals on the global stage.

- Incremental changes are insufficient; a comprehensive overhaul is required to sustain India’s position as a leading financial powerhouse.

- With strong political will and collaborative efforts among financial institutions, India can create a modern financial architecture that delivers stability, growth, and inclusivity.

Digital Platforms to Enhance India's PDS System

Why in news?

Recently, the Union Minister of Consumer Affairs, Food and Public Distribution launched digital platforms to reform India’s PDS system.

Three Key Digital Platforms launched

- Depot Darpan Portal

- Anna Mitra App

- Anna Sahayata Platform

Depot Darpan Portal

- Purpose: The Depot Darpan Portal is designed for self-assessment and monitoring of foodgrain depots, aiming to enhance transparency, efficiency, and accountability in depot operations.

- Composite Ratings: The portal assigns Composite Ratings to depots using a 5-star system. These ratings are based on a 60:40 ratio, with 60% weight on Operational aspects and 40% on Infrastructure.

- Key Monitoring Aspects: It monitors various factors including storage and transit loss, manpower productivity, and optimized space usage.

- Integration of Technology: The portal integrates advanced technologies such as IoT sensors for real-time environmental and inventory monitoring, and CCTV with live analytics for informed decision-making.

- Smart Warehouses: Pilot smart warehouses are set to roll out nationwide by the end of 2025.

Anna Mitra App

- Purpose: The Anna Mitra App is intended for frontline PDS stakeholders, including Fair Price Shop (FPS) dealers, food inspectors, and district officers.

- Features: The app provides details about stock updates, monthly sales, official alerts, and monitors FPS performance, grievances, and beneficiary data.

- Pilot Rollout: The app has been rolled out on a pilot basis in states such as Assam, Uttarakhand, Tripura, and Punjab.

- Language Availability: The app is available in Hindi and English languages.

Anna Sahayata Platform

- Purpose: The Anna Sahayata Platform is an AI-enabled grievance redressal system specifically for PMGKAY beneficiaries. Its goal is to simplify grievance resolution, making it easy, accessible, and real-time for all beneficiaries.

- Availability: The platform is currently accessible through various channels including WhatsApp, IVRS (Interactive Voice Response System), and Automatic Speech Recognition (ASR).

- Pilot Rollout: The platform has been rolled out on a pilot basis in states such as Gujarat, Jharkhand, Telangana, Tripura, and Uttar Pradesh.

- Language Options: The platform is available in multiple languages including Hindi, Gujarati, Telugu, Bangla, and English.

World Milk Day 2025

World Milk Day 2025 will take place on June 1st, with the theme "Let's Celebrate the Power of Dairy". This day aims to raise awareness about the importance of milk in our daily lives and how the dairy industry supports nutrition, farming communities, and sustainable practices.

Milk is a vital source of nutrients like calcium, protein, and vitamins, which are essential for strong bones and overall health. Additionally, dairy farming provides a significant source of income for many families worldwide and contributes to local and global economies. World Milk Day 2025 will emphasize these aspects and celebrate the positive impact of dairy on communities and the environment.

World Milk Day 2025

- World Milk Day is celebrated annually on June 1st to emphasize the significance of milk in our everyday lives.

- It was initiated by the Food and Agriculture Organization (FAO) of the United Nations in 2001 to acknowledge milk as a crucial global food for nutrition and health.

- The day brings together communities, farmers, and industries to recognize the role of dairy in sustainable agriculture and economic growth.

Theme for World Milk Day 2025

- The theme for World Milk Day 2025 is "Let's Celebrate the Power of Dairy."

- This theme aims to highlight how dairy contributes to building stronger communities, promoting healthier lives, and supporting sustainable futures.

- The Global Dairy Platform encourages organizations worldwide to share stories and initiatives that showcase the positive impact of dairy.

Background of World Milk Day

- World Milk Day was established by the Food and Agriculture Organization (FAO) of the United Nations in 2001 to recognize the value of milk as a global food and the dairy sector's impact on health, nutrition, and the economy.

- The date of June 1st was chosen to align with national milk days celebrated by various countries, making it suitable for a global observance.

- Since its inception, World Milk Day has evolved into an international movement, with numerous events, campaigns, and activities taking place worldwide each year.

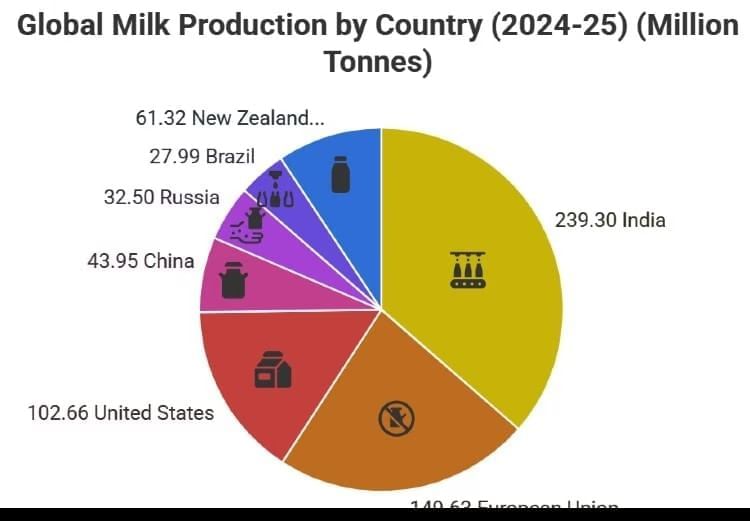

Global Milk Production

- Milk production is crucial for the livelihoods of approximately 150 million households globally, especially in developing countries where small-scale farmers dominate.

- Over the past 30 years, milk production has increased by more than 77%, from 524 million tonnes in 1992 to 930 million tonnes in 2022, making it one of the fastest-growing sectors in global agriculture.

- In 2024, world milk production was expected to reach nearly 979 million tonnes, reflecting a 1.4% increase from the previous year.

Milk Production in India

- India remains the world's largest producer of milk. In the fiscal year 2023-24, milk production in India reached a record 239.3 million tonnes, marking a 4% increase from the previous year.

- This growth is attributed to factors such as an increase in the number of milch animals and supportive government policies, averaging an annual growth rate of 5.7%, significantly higher than the global average of 2%.

World's Largest Milk Producing Country

- India has been the leading milk producer since 1998, contributing around 25% to the global milk supply.

- Between 2014-15 and 2023-24, milk production in India increased by 63.56%, from 146.3 million tonnes to 239.3 million tonnes.

- Per capita milk availability in India has also risen by 48% over the past decade.

- Initiatives such as the National Programme for Dairy Development, Rashtriya Gokul Mission, and Animal Husbandry Infrastructure Development Fund have been implemented to sustain this growth by improving processing infrastructure, breed quality, and promoting dairy entrepreneurship.

World's Largest Milk Consumer Country

- India is not only the largest producer of milk but also one of its top consumers. In 2024, milk consumption in India was estimated at 121.5 million tonnes, reflecting the importance of dairy in the Indian diet.

- However, the European Union (EU-27) bloc is the largest milk consumer by total volume, with domestic consumption of approximately 140.4 million metric tons per year.

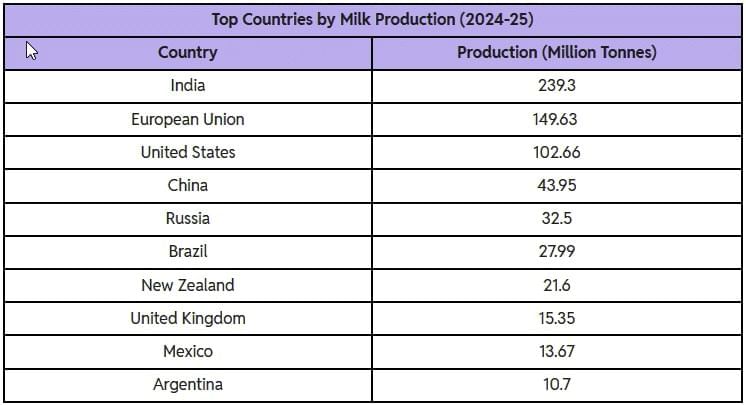

List of Countries by Milk Production

Here is the list of top milk-producing countries as of 2024:

Importance of World Milk Day 2025

- Nutrition Awareness: World Milk Day 2025 will highlight the nutritional benefits of milk, which is rich in essential nutrients like calcium, protein, and vitamins.

- Economic Importance: The day will emphasize the dairy sector's contribution to the economy, particularly in rural areas where dairy farming is a primary source of livelihood.

- Sustainable Development: It will raise awareness about sustainable dairy farming practices that protect the environment and ensure animal welfare.

- Global Unity: World Milk Day promotes international collaboration and knowledge sharing among countries to improve dairy practices worldwide.

By celebrating World Milk Day, we acknowledge the significance of milk in our lives and the efforts of those who ensure its availability.

India Meets Fiscal Deficit Target of 4.8% for FY25

The Government of India has achieved its fiscal deficit target of 4.8% of GDP for the financial year 2024-25, according to provisional data from the Controller General of Accounts (CGA).

Key Highlights of FY25 Fiscal Performance

- Fiscal Deficit: The fiscal deficit for 2024-25 was ₹15.77 lakh crore, aligning with the government’s revised estimates of 4.8% of GDP.

- Total Revenue: The central government’s total revenue reached ₹30.78 lakh crore.

- Net Tax Revenue: Net tax revenue was ₹24.99 lakh crore, representing 97.7% of the government’s target.

- Disinvestment: The government generated ₹10,131 crore from disinvestment of public sector undertakings, contributing to miscellaneous capital receipts but falling short of targets.

- Total Expenditure: Government expenditure totaled ₹46.55 lakh crore, 97.8% of the revised estimate.

- Capital Expenditure: Spending on long-term assets like infrastructure reached ₹10.52 lakh crore.

- Revenue Expenditure: Revenue expenditure was ₹36.03 lakh crore.

Understanding Fiscal Deficit

Fiscal Deficit refers to the situation where the total budget expenditure (both revenue and capital) exceeds the total budget receipts (revenue and non-debt creating capital receipts) during a fiscal year. It is calculated as:

Fiscal Deficit = Total Expenditure – (Revenue Receipts + Non-Debt Creating Capital Receipts)

Implications of Fiscal Deficit

- Inflationary Pressure: High fiscal deficits can lead to inflation as governments may resort to printing money to finance the deficit.

- Crowding Out Effect: When the government borrows a significant portion of available funds from financial markets, it can crowd out private investment by reducing access to credit for businesses and individuals.

- Reduced Fiscal Space:. high fiscal deficit limits the government’s ability to respond to economic shocks or crises effectively.

- Difficulty in Borrowing: Worsening government finances can lead to decreased demand for government bonds, forcing the government to offer higher interest rates to attract lenders.

Benefits of Lower Fiscal Deficit

- Improved Credit Ratings: Consistent reduction of the fiscal deficit can enhance international credit ratings, leading to lower borrowing costs in global markets.

- Reduced Debt Servicing: Lower interest payments on debt can free up funds for essential development projects such as infrastructure, education, and healthcare.

- Improved Balance of Payments: Decreased reliance on foreign borrowing can help stabilize the exchange rate and improve the current account balance.

- Enhanced Investor Confidence:. lower fiscal deficit signals fiscal discipline, which can attract greater foreign and domestic investments.

Recommendations of the NK Singh Committee

- Debt to GDP Ratio: The Committee recommended using debt as the primary target for fiscal policy, suggesting a debt to GDP ratio of 60% by FY23, with a 40% limit for the center and a 20% limit for the states.

- Fiscal Deficit to GDP Ratio: The Committee proposed a fiscal deficit to GDP ratio of 2.5% by FY23.

- Fiscal Council: The establishment of an autonomous Fiscal Council was recommended, with the role of preparing multi-year fiscal forecasts, recommending changes to fiscal strategy, improving fiscal data quality, and advising on deviations from fiscal targets.

- Deviations: The Committee suggested clearly specifying the grounds for government deviations from fiscal targets, ensuring that other circumstances are not used as excuses.

RBI Annual Report 2024-25

The Reserve Bank of India (RBI) has published its Annual Report for the financial year 2024-25. This report, required by law, provides a detailed overview of the Indian economy, the RBI's financial performance, trends in banking and digital payments, and plans for the future. It highlights the RBI's commitment to economic stability, digital transformation, and risk management in a changing global landscape.

RBI’s Financial Performance and Balance Sheet

The RBI’s balance sheet showed solid growth this year. As of March 31, 2025, it stood at ₹76.25 lakh crore, up from ₹70.47 lakh crore a year ago. This represents an increase of 8.21%, showing the central bank’s expanding role in managing the economy.

Assets Growth:

- A 52.09% increase in gold holdings played a major role in this expansion.

- Domestic investments also rose by 14.32%, reflecting strong policy support.

- Foreign investments grew more modestly at 1.70%, affected by global uncertainties.

Liabilities Side:

- The increase came largely from a rise in currency in circulation, higher balances in revaluation accounts, and market-related operations.

Income and Expenditure:

- RBI’s total income reached ₹3.38 lakh crore, a 22.77% increase from the previous year’s ₹2.76 lakh crore.

- Expenditure also rose, reaching ₹69,714 crore, which is 7.76% more than last year.

- Despite this, the RBI transferred a record surplus of ₹2.69 lakh crore to the Central Government, showcasing effective financial management.

- It also added ₹44,861 crore to its Contingency Fund, which is used during financial emergencies.

Currency Circulation and the Shift to Digital Payments

Cash Trends:

- The currency-to-GDP ratio declined to 11.2%, indicating a smaller share of the economy using physical cash.

- Despite this, currency in circulation grew by 5.8%, reflecting continued demand for cash, particularly in rural areas.

- The ₹500 note remained the most used denomination, both in volume and value.

Digital Payment Growth:

- Retail digital payments saw a significant increase of 17.9% in value and 35% in volume, demonstrating the wider adoption of digital payment platforms, especially UPI.

- The Digital Rupee (CBDC) also experienced substantial growth, with its circulation value increasing by 334% to ₹1,016.5 crore.

Foreign Investment and Corporate Bond Markets

Foreign Portfolio Investment (FPI) in Corporate Bonds:

- In FY25, FPI in corporate bonds increased by 11.4%, reaching ₹1.21 lakh crore.

- The percentage of the limit used for FPI in corporate bonds slightly declined to 15.8% from 16.2%. This decline was not due to reduced interest but because of a higher investment cap.

- This trend indicates continued confidence from foreign investors and suggests there is more room for investment in Indian corporate bonds.

Currency Printing and Counterfeit Notes

Currency Printing:

- In FY25, the RBI spent ₹6,373 crore on printing currency, marking a 25% increase from the previous year.

- The rise in expenditure was driven by higher demand for new banknotes and the need to replace old or damaged notes.

Counterfeit Notes:

- There was a notable increase in counterfeit ₹500 notes, with cases rising by 37.3%.

- Counterfeit ₹200 notes also saw an increase of 13.9%.

- While other denominations experienced a decrease in counterfeiting cases, the overall rise in counterfeit notes remains a concern for the RBI.

- In response to this threat, the RBI is enhancing security features on banknotes to prevent counterfeiting.

Economic Growth and Inflation Outlook

Economic Growth:

- The RBI is optimistic about India’s economic growth, projecting a real GDP growth of 6.5% for FY26.

- This growth is expected to be supported by increased consumer spending, strong government capital expenditure, and a growing services sector.

- The health of India’s banking and corporate sectors is also seen as a positive contributor to economic growth.

Inflation Expectations:

- The RBI aims to maintain inflation around 4%.

- Achieving this target depends on factors such as normal monsoon seasons, a strong food supply, and stable global oil prices.

- However, the report highlights potential risks to inflation from climate change, geopolitical tensions, and disruptions in global trade.

Cybersecurity and Digital Banking Reforms

Cybersecurity Measures:

- In February 2025, the RBI proposed the introduction of a new internet domain, ‘bank.in’. This initiative aims to ensure that users access only verified banking websites, thereby enhancing online security.

- The primary goal of this measure is to reduce the risks of phishing, identity theft, and online fraud targeting banking customers.

UPI Innovations:

- The RBI has introduced the ‘UPI Circle’ feature, which allows trusted individuals to make payments directly from a user's account, adding a layer of convenience and trust.

- Small Finance Banks have been granted permission to offer pre-approved credit lines through UPI, facilitating easier access to short-term loans for customers.

- Additionally, the RBI is working on connecting the UPI system with international payment platforms, which will simplify the process of foreign remittances for users.

Gold Reserves and Exchange Rate Management

Gold Reserves:

- The RBI significantly increased its gold holdings by 54.13 metric tonnes, bringing the total value of its gold reserves to ₹4.32 lakh crore. This represents a 57.12% increase.

- The rise in gold reserves was attributed to new purchases, higher global gold prices, and a depreciation of the Indian rupee.

Exchange Rate Management:

- The RBI continues to manage the Indian rupee's exchange rate by intervening in the foreign exchange market.

- These interventions aim to prevent sharp volatility in the rupee's value, ensuring stability in the currency.

Banking Sector Health and Frauds

Fraud Cases:

- There was a decrease in the number of bank fraud cases reported. However, the total value of frauds tripled to ₹36,014 crore.

- This increase in value was primarily due to the reporting of old fraud cases (legacy cases) that were not recorded earlier.

- Specifically, 122 frauds worth over ₹18,000 crore were identified and reported, contributing significantly to the increase in total fraud value.

Urban Cooperative Banks (UCBs):

- UCBs have shown notable improvement in various aspects:

- Credit growth has increased, indicating a positive trend in lending.

- Capital strength of UCBs has improved, enhancing their financial stability.

- Non-performing assets (bad loans) have decreased, reflecting better asset quality and risk management.

Regulatory Framework:

- The RBI has extended the Risk-Based Supervision and Prompt Corrective Action (PCA) frameworks to cover more UCBs.

- This extension aims to boost transparency and ensure that UCBs adhere to regulatory standards, contributing to the overall health of the banking sector.

Household Savings and Capital Market Activity

Household Financial Savings:

- Gross financial savings as a percentage of income increased to 11.2%, up from 10.7% in the previous year.

- Net financial savings also improved, rising to 5.1%. This indicates that households are managing their finances better and setting aside more savings.

Stock Market Trends:

- Companies raised a total of ₹2.2 lakh crore through Qualified Institutional Placements (QIPs) and preferential share offerings.

- An additional ₹2.1 lakh crore was raised through Initial Public Offerings (IPOs), Follow-on Public Offerings (FPOs), and rights issues.

- These figures reflect high investor confidence and a trend of growing corporate expansion in the stock market.

Promoting INR in Global Trade

To enhance the Indian Rupee's (INR) role in international trade, the RBI has implemented several initiatives:

- Allowing Non-Resident Indians (NRIs) and foreign individuals to hold INR accounts abroad.

- Signing Local Currency Settlement (LCS) agreements with countries such as the UAE, Indonesia, Maldives, and Mauritius. These agreements facilitate trade in local currencies, reducing dependence on the US dollar.

- Planning to connect the RBI's forex platform FX-Retail with the National Payments Corporation of India’s (NPCI) Bharat Connect, simplifying access to forex trading.

India’s International Trade Outlook

Despite facing global challenges such as rising geopolitical tensions, protectionist trade policies, and tariff uncertainties, India’s trade position is bolstered by various factors:

- 14 Free Trade Agreements (FTAs) in place.

- 6 Preferential Trade Agreements (PTAs) established.

- Ongoing negotiations for new trade agreements with the USA, EU, Oman, and Peru.

These agreements and ongoing discussions are expected to protect Indian exports and support economic growth.

Fast Facts: RBI at a Glance

- Established: April 1, 1935

- Legal Authority: RBI Act, 1934

- Governor (2025): Sanjay Malhotra

- Headquarters: Mumbai, Maharashtra

|

98 videos|923 docs|33 tests

|

FAQs on Economic Development : June 2025 Current Affairs - Current Affairs & General Knowledge - CLAT

| 1. What is the PM-PRANAM Scheme and its objectives? |  |

| 2. How does India plan to synchronize irrigation and cropping? |  |

| 3. What are the key components of India’s Renewable Energy Revolution? |  |

| 4. What reforms are being proposed for agricultural subsidies in India? |  |

| 5. How is digital technology being utilized to enhance India's Public Distribution System (PDS)? |  |