National Income: Economics | Indian Economy for UPSC CSE PDF Download

Introduction

National Income (NI) is a fundamental concept in economics, acting as a key metric for gauging a country’s economic performance. As an important economic metric of a nation, it influences policy decisions, investment considerations, and socio-economic planning. This article of EduRev aims to study in detail the concept of National Income (NI), its measures including Gross Domestic Product (GDP) and Gross National Product (GNP), methods employed to compute it, and other related concepts.

National Income (NI)

It refers to the aggregate value of all the final goods and services produced in a country in a particular period of time (usually one financial year).

National Income Accounting

It is a bookkeeping system that a national government uses to measure the level of the country’s economic activity in a given time period.

Basic Concepts Related to National Income Accounting

Understanding the concepts of National Income (NI) and National Income Accounting requires understanding some related concepts. These concepts are dealt with in the sections that follow.

Circular Flow of Income

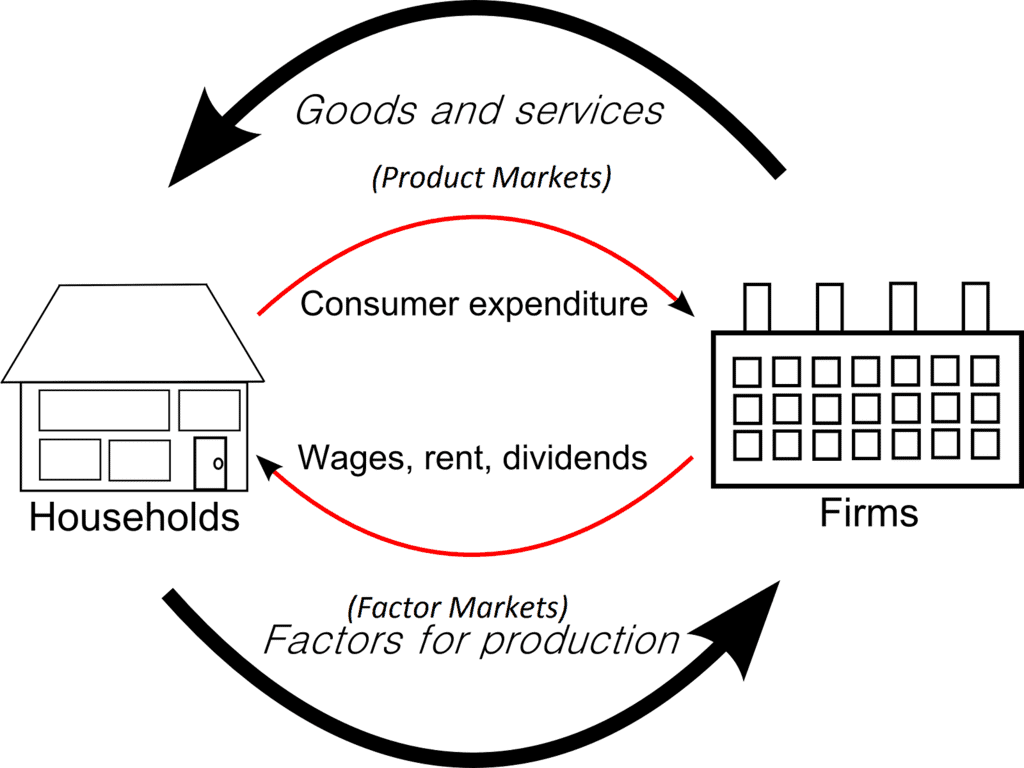

- The circular flow of income model illustrates the exchange of money, goods, and services among economic agents in an economy.

- Money and goods/services move in opposite directions within a closed circuit.

- Key economic activities include production, consumption, and investment.

- Transactions between sectors of the economy facilitate the circular movement of income and expenditure.

- This circular flow of income is characterized by the continuous exchange and movement of money and goods/services.

Domestic/ Economic Territory

- This term denotes the geographic region governed by the Indian government where individuals, goods, and capital can move without hindrance.

- Notably, foreign embassies within India are excluded from this domestic/economic territory, while Indian embassies abroad are considered part of it.

Market Price (MP)

- Market Price (MP) is the sum paid by a consumer when buying a product from a seller.

- It represents the selling price of a product in the market.

- MP includes indirect taxes, which are added to the selling price.

- Subsidies received are not part of MP as they are deducted from the selling price.

Factor Cost (FC)

- Factor Cost (FC) denotes the expenses borne by a firm for the factors of production used in manufacturing goods and services.

- Put simply, it represents the expenditure associated with producing a good or service.

- FC does not incorporate indirect taxes, as they are unrelated to the production process.

- Subsidies received are included in FC, as they directly contribute to the production process.

Factor Cost (FC) = Market Price – Indirect Taxes + Subsidy

Nominal Price or Current Price

The market price of any good or service in the current year is called the Nominal Price or Current Price. Since inflation is included in the current market price, the Nominal Price or Current Price changes as per the current level of inflation.

Base Price or Constant Price

In order to compare the National Income of various years, it is calculated with reference to a particular year. This reference year is called the Base Year, and the market price of any good or service in the base year is called the Base Price or Constant Price.

Depreciation

Depreciation, also known as the Consumption of Fixed Capital, refers to the loss in value of fixed assets due to wear and tear, accidental damages, and obsolescence.

Net Factor Income from Abroad (NFIA)

Net Factor Income from Abroad (NFIA) is equal to the difference between factor income (rent, wages, interest, and profit) earned by normal residents of India temporarily residing abroad and factor income earned by non-residents temporarily residing in India.

NFIA = Factor Income from Abroad to India – Factor Income from India to Abroad

Transfer Payments

- Transfer Payments refer to those unilateral payments corresponding to which there is no exchange of goods or services.

- Examples: scholarships, gifts, donations, etc.

- Transfer payments are not included in National Income (NI).

Capital Output Ratio (COR)

Capital Output Ratio (COR) refers to the amount of capital (investment) needed to produce one unit of output.

Capital Output Ratio (COR) = Capital/Output

Capital Output Ratio (COR) reflects the level of efficiency in an economy. The higher the COR, the more capital is required to produce, and hence less efficiency is there in the economy, and vice versa.

Incremental Capital Output Ratio (ICOR)

Incremental Capital Output Ratio (ICOR) refers to the additional unit of capital (investment) needed to produce an additional unit of output.

Incremental Capital Output Ratio (ICOR) = Incremental Capital/Incremental Output.

Measures of National Income (NI)

There are various metrics for measuring the NI, such as:

- Gross Domestic Product (GDP)

- Gross National Product (GNP), etc

These measures are discussed in detail in the sections that follow.

Gross Domestic Product (GDP)

- Gross Domestic Product (GDP) quantifies the total output of final goods and services generated within the domestic economy in a year.

- Final Goods and Services: Only the ultimate, not intermediate, goods and services contribute to GDP calculation.

- Within the Domestic Economy: GDP encompasses the production of resident citizens and foreign nationals residing within the geographical boundary.

GDP at Market Price (GDPMP)

- GDP at Market Price (GDPMP) represents the total value of all final goods and services produced within a country's borders in a given fiscal year.

- It encompasses the market value of these goods and services.

- GDPMP incorporates indirect taxes imposed during production processes.

- However, it does not take into account subsidies provided to industries or sectors.

GDP at Factor Cost (GDPFC)

- GDP at Factor Cost (GDPFC) signifies the total worth of income derived from the factors of production: Land, Labor, Capital, and Entrepreneurship.

- It excludes any indirect taxes levied on production processes.

- However, it does include subsidies provided to support industries or sectors.

GDP at Factor Cost (GDPFC) = GDP at Market Price (GDPMP) – Indirect Taxes + Subsidies

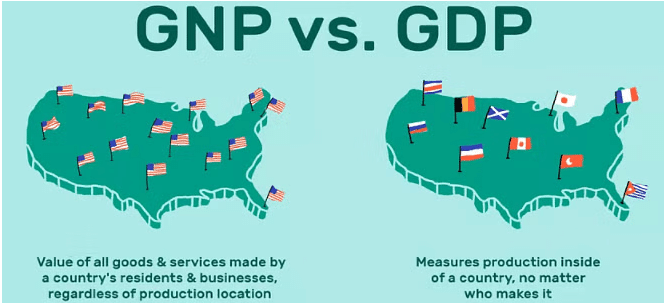

Gross National Product (GNP)

- Gross national product (GNP) estimates the total value of all final goods and services produced within a specific period by assets owned by a country’s citizens.

- Final Goods and Services: Only the end products and services, not the intermediate ones, are included in GNP calculations.

- Owned by a Country’s Citizens: GNP considers the output of both resident and non-resident citizens of the country but excludes that of foreign nationals residing within its geographic boundaries.

GNP = GDP + Factor Income from Abroad to India – Factor Income from India to Abroad.

= GDP + Net Factor Income from Abroad (NFIA)

Difference between GDP and GNP

The major difference between GDP and GNP lies in how the two concepts define the economy. While GDP defines the economy in terms of territory, GNP defines it in terms of citizens.

Thus, GDP measures the aggregate production of final goods and services taking place within the domestic economy. On the other hand, GNP measures the total value of all the final products and services produced by the citizens of a country.

Real GDP Vs Nominal GDP

Real GDP

Real GDP refers to the total value of all goods and services produced by an economy in a given year, expressed in constant prices or base year’s prices.

Real GDP = GDP at Constant Price.

Nominal GDP

Nominal GDP refers to the total value of all goods and services produced by an economy in a given year, expressed in current market prices.

Nominal GDP = GDP at Current Price.

It is to be noted that Nominal GDP includes inflation, while Real GDP does not.

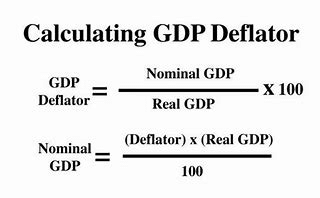

GDP Deflator

The GDP Deflator refers to the ratio of Nominal GDP to Real GDP.

As a ratio of the NI calculated at the Current Price and that at a reference price, the GDP Deflator is an economic measure of inflation.

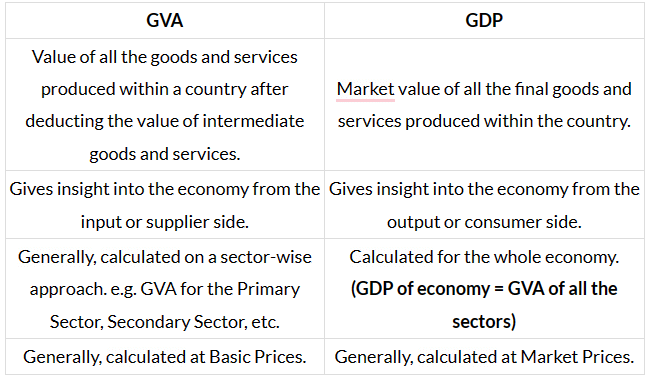

Gross Value Added (GVA)

Gross value added (GVA) is defined as the value of output less the value of intermediate consumption. It represents the contribution of labor and capital to the production process. Thus, the value of GVA can be derived from the GDP as follows:

GVA = GDP – Indirect Taxes + Subsidies

Difference between GVA and GDP

Net National Income (NNI)

Net National Income (NNI) refers to Gross National Income minus the Depreciation of fixed capital assets. Thus, it takes into account the losses due to depreciation.

Prominent metrics for measuring the Net National Income (NNI) are:

- Net Domestic Product (NDP), and

- Net National Product (NNP)

Net Domestic Product (NDP)

Net Domestic Product (NDP) is arrived at by deducting the depreciation from GDP. Thus,

Net Domestic Product = GDP – Depreciation.

Net National Product (NNP)

Net National Product (NNP) is calculated by subtracting the depreciation from GNP. Thus,

Net National Product = GNP – Depreciation.

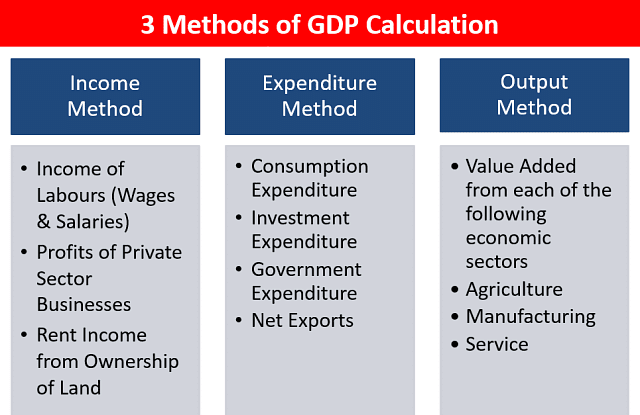

Methods of Computing National Income (NI)

National Income (GDP or GNP) can be calculated by 3 methods: Income Method, Expenditure Method, and Production Method.

Income Method

- This method calculates National Income (NI) by aggregating the incomes earned by all individuals within an economy.

- Individuals generate income by providing their own services and utilizing their property, such as land and capital, in the production process.

Therefore,

National Income (NI) = Employee compensation + Corporate profits + Proprietors’ Income + Rental income + Net Interest

Product or Value Added Method

- This method is also known as the "Output Method".

- National Income (NI) is calculated by summing up the values of output produced or services provided by various sectors of the economy throughout the year.

- When determining output values, only the value added by each firm in the production process is considered, utilizing the concept of value-added.

Expenditure Method

- This method is alternatively known as the "Total Outlay Method".

- It operates on the assumption that the income received by an individual is either expended on consumer goods and services or saved and invested.

Therefore,

National Income (NI) = Personal Consumption Expenditure (C) + Investments (I) + Government Expenditure (G) + Exports (X) – Imports (I)

New GDP Series

The Ministry of Statistics and Programme Implementation (MoSPI) launched a new series of GDP in 2019.

Major changes that have been made to the methodology of GDP calculation are as follows:

- Change in Base Year: The base year has been changed from 2004-05 to 2011-12.

- Factor Costs Replaced with Market Prices: The old series of GDP used Factor Costs for calculating GDP. The new series used market prices for calculating GDP.

- Widening of Data Pool: Previous data was sampled from the Annual Survey of Industries (ASI), which comprised about two lakh factories. The new database draws from the five lakh odd companies registered with the Ministry of Corporate Affairs (MCA21).

- While the earlier data gave only a factory-level picture, the new data looks at the enterprise level.

These changes have led to a significant change in the GDP figures. For example, India’s GDP growth rate for the financial year 2013-14 was 4.7% as per the old methodology, and 6.9% as per the new methodology.

Difficulties in Estimating NI

Major problems faced while estimating NI can be studied under two heads – Conceptual Difficulties and Statistical or Practical Difficulties.

Conceptual Difficulties

The conceptual problem relates to how and what is to be included and what is not in the measurement of National Income (NI). Though the concept of NI implies that everything that is produced should be reckoned, by definition, we consider only those things that are exchanged for money or carry some price.

In order to mitigate these difficulties, certain guidelines have been laid down about the process of National Income estimation, and about what components have to be included.

Statistical or Practical Difficulties

- The lack of adequate statistical data due to flaws in extrapolation, and ineffective training of illiterate statistical staff, makes the task of National Income estimation more acute and difficult.

- Multiple counting is also an important problem while calculating NI.

- India is a country with large regional diversities. Thus, different languages, customs, etc., also create a problem in computing the estimates.

Shortcomings of GDP

- Inequality: GDP doesn't reflect the distribution of wealth, so it doesn't indicate whether everyone benefits from economic growth.

- Non-Market Transactions: Volunteer work and other non-market activities aren't included in GDP.

- Black Markets and Illegal Activities: GDP figures can be distorted by unrecorded economic activities.

- Barter Trade: In economies where barter trade is prevalent, GDP may underestimate economic activity.

- Environmental Losses: GDP ignores environmental damage, undermining the idea of sustainable growth.

- Quality of Life: GDP includes negative events like disasters and illness, which don't necessarily improve well-being.

- Happiness Level: GDP doesn't measure happiness or factors like leisure time.

Alternatives to GDP

Due to shortcomings of GDP to measure the welfare and well-being of the people, several other indicators have been proposed and are being used. Some of these indices are discussed below.

Genuine Progress Indicator (GPI)

- Genuine Progress Indicator (GPI) is a metric that has been suggested to replace, or supplement GDP as a measure of economic growth.

- It measures whether the environmental impact and social costs of economic production and consumption in a country are negative or positive factors in overall health and well-being.

Gross National Happiness (GNH)

- Gross National Happiness (GNH) attempts to measure the sum total not only of economic output but also of net environmental impacts, the spiritual and cultural growth of citizens, mental and physical health, and the strength of the corporate and political systems.

- The term was first coined by Jigme Singye Wangchuck, the King of Bhutan in the early 1970s.

Gross Sustainable Development Product (GSDP)

- Gross Sustainable Development Product (GSDP) measures the economic impacts of environmental and health degradation or improvement; resource depletion, depreciation; the impact of people’s activity on the environment; quality of environment, etc.

- It has been developed by the Global Community Assessment Centre and the Society for World Sustainable Development.

Human Development Index (HDI)

- Human Development Index (HDI) is a summary measure of average achievement in key dimensions of human development, viz:

- Health: Measured through – Life expectancy at birth

- Education: Measured through – Mean years of schooling, and Expected years of schooling

- Standard of Living: Measured through – Gross National Income per capita on a PPP basis.

- It was developed by Indian Economist Amartya Sen and Pakistani economist Mahbub ul Haq.

- It is published annually by the United Nations Development Programme (UNDP) as part of its Human Development Report.

Social Progress Index (SPI)

- The Social Progress Index (SPI) measures the extent to which countries provide for the social and environmental needs of their citizens.

- It focuses exclusively on indicators of social outcomes, rather than measuring inputs.

- It has been developed by the Social Progress Imperative.

Human Capital Index (HCI)

- The Human Capital Index seeks to measure the amount of human capital that a child can expect to attain by the age of 18.

- It measures three components:

- Survival: Measured by under-5 mortality rates.

- Expected Years of Quality-Adjusted School:Combines information on the following two aspects of education.

- Quality: Measured by harmonizing test scores from major international student achievement testing programs

- Quantity: Measured by the number of years of school that a child can expect to obtain by age 18 given the prevailing pattern of enrollment rates across grades in respective countries.

- Health: Measured using two indicators – adult survival rates, and rate of stunting for children under age 5 years.

Green GDP

Green GDP is a term used generally for expressing GDP after adjusting for environmental damages such as biodiversity loss, climate change impacts, etc. Thus, it is an indicator of economic growth with environmental factors taken into consideration.

In summary, National Income (NI) serves as a holistic gauge of a nation's economic health, going beyond mere numerical representation. Despite its limitations, current NI metrics are pivotal in informing governmental policies, business strategies, and individual choices. However, there's a growing recognition of the need for more inclusive measures that account for social welfare and environmental sustainability. Therefore, ongoing research and development efforts are essential to evolve NI metrics towards a more comprehensive understanding of progress.

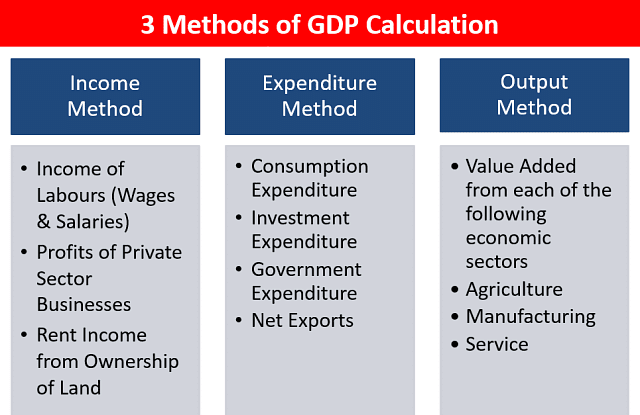

Methods of Computing National Income (NI)

National Income (GDP or GNP) can be calculated by 3 methods: Income Method, Expenditure Method, and Production Method.

Income Method

- This method calculates National Income (NI) by aggregating the incomes earned by all individuals within an economy.

- Individuals generate income by providing their own services and utilizing their property, such as land and capital, in the production process.

Therefore,

National Income (NI) = Employee compensation + Corporate profits + Proprietors’ Income + Rental income + Net Interest

Product or Value Added Method

- This method is also known as the "Output Method".

- National Income (NI) is calculated by summing up the values of output produced or services provided by various sectors of the economy throughout the year.

- When determining output values, only the value added by each firm in the production process is considered, utilizing the concept of value-added.

Expenditure Method

- This method is alternatively known as the "Total Outlay Method".

- It operates on the assumption that the income received by an individual is either expended on consumer goods and services or saved and invested.

Therefore,

National Income (NI) = Personal Consumption Expenditure (C) + Investments (I) + Government Expenditure (G) + Exports (X) – Imports (I)

New GDP Series

The Ministry of Statistics and Programme Implementation (MoSPI) launched a new series of GDP in 2019.

Major changes that have been made to the methodology of GDP calculation are as follows:

- Change in Base Year: The base year has been changed from 2004-05 to 2011-12.

- Factor Costs Replaced with Market Prices: The old series of GDP used Factor Costs for calculating GDP. The new series used market prices for calculating GDP.

- Widening of Data Pool: Previous data was sampled from the Annual Survey of Industries (ASI), which comprised about two lakh factories. The new database draws from the five lakh odd companies registered with the Ministry of Corporate Affairs (MCA21).

- While the earlier data gave only a factory-level picture, the new data looks at the enterprise level.

These changes have led to a significant change in the GDP figures. For example, India’s GDP growth rate for the financial year 2013-14 was 4.7% as per the old methodology, and 6.9% as per the new methodology.

Difficulties in Estimating NI

Major problems faced while estimating NI can be studied under two heads – Conceptual Difficulties and Statistical or Practical Difficulties.

Conceptual Difficulties

The conceptual problem relates to how and what is to be included and what is not in the measurement of National Income (NI). Though the concept of NI implies that everything that is produced should be reckoned, by definition, we consider only those things that are exchanged for money or carry some price.

In order to mitigate these difficulties, certain guidelines have been laid down about the process of National Income estimation, and about what components have to be included.

Statistical or Practical Difficulties

- The lack of adequate statistical data due to flaws in extrapolation, and ineffective training of illiterate statistical staff, makes the task of National Income estimation more acute and difficult.

- Multiple counting is also an important problem while calculating NI.

- India is a country with large regional diversities. Thus, different languages, customs, etc., also create a problem in computing the estimates.

Shortcomings of GDP

- Inequality: GDP doesn't reflect the distribution of wealth, so it doesn't indicate whether everyone benefits from economic growth.

- Non-Market Transactions: Volunteer work and other non-market activities aren't included in GDP.

- Black Markets and Illegal Activities: GDP figures can be distorted by unrecorded economic activities.

- Barter Trade: In economies where barter trade is prevalent, GDP may underestimate economic activity.

- Environmental Losses: GDP ignores environmental damage, undermining the idea of sustainable growth.

- Quality of Life: GDP includes negative events like disasters and illness, which don't necessarily improve well-being.

- Happiness Level: GDP doesn't measure happiness or factors like leisure time.

Alternatives to GDP

Due to shortcomings of GDP to measure the welfare and well-being of the people, several other indicators have been proposed and are being used. Some of these indices are discussed below.

Genuine Progress Indicator (GPI)

- Genuine Progress Indicator (GPI) is a metric that has been suggested to replace, or supplement GDP as a measure of economic growth.

- It measures whether the environmental impact and social costs of economic production and consumption in a country are negative or positive factors in overall health and well-being.

Gross National Happiness (GNH)

- Gross National Happiness (GNH) attempts to measure the sum total not only of economic output but also of net environmental impacts, the spiritual and cultural growth of citizens, mental and physical health, and the strength of the corporate and political systems.

- The term was first coined by Jigme Singye Wangchuck, the King of Bhutan in the early 1970s.

Gross Sustainable Development Product (GSDP)

- Gross Sustainable Development Product (GSDP) measures the economic impacts of environmental and health degradation or improvement; resource depletion, depreciation; the impact of people’s activity on the environment; quality of environment, etc.

- It has been developed by the Global Community Assessment Centre and the Society for World Sustainable Development.

Human Development Index (HDI)

- Human Development Index (HDI) is a summary measure of average achievement in key dimensions of human development, viz:

- Health: Measured through – Life expectancy at birth

- Education: Measured through – Mean years of schooling, and Expected years of schooling

- Standard of Living: Measured through – Gross National Income per capita on a PPP basis.

- It was developed by Indian Economist Amartya Sen and Pakistani economist Mahbub ul Haq.

- It is published annually by the United Nations Development Programme (UNDP) as part of its Human Development Report.

Social Progress Index (SPI)

- The Social Progress Index (SPI) measures the extent to which countries provide for the social and environmental needs of their citizens.

- It focuses exclusively on indicators of social outcomes, rather than measuring inputs.

- It has been developed by the Social Progress Imperative.

Human Capital Index (HCI)

- The Human Capital Index seeks to measure the amount of human capital that a child can expect to attain by the age of 18.

- It measures three components:

- Survival: Measured by under-5 mortality rates.

- Expected Years of Quality-Adjusted School:Combines information on the following two aspects of education.

- Quality: Measured by harmonizing test scores from major international student achievement testing programs

- Quantity: Measured by the number of years of school that a child can expect to obtain by age 18 given the prevailing pattern of enrollment rates across grades in respective countries.

- Health: Measured using two indicators – adult survival rates, and rate of stunting for children under age 5 years.

Green GDP

Green GDP is a term used generally for expressing GDP after adjusting for environmental damages such as biodiversity loss, climate change impacts, etc. Thus, it is an indicator of economic growth with environmental factors taken into consideration.

In summary, National Income (NI) serves as a holistic gauge of a nation's economic health, going beyond mere numerical representation. Despite its limitations, current NI metrics are pivotal in informing governmental policies, business strategies, and individual choices. However, there's a growing recognition of the need for more inclusive measures that account for social welfare and environmental sustainability. Therefore, ongoing research and development efforts are essential to evolve NI metrics towards a more comprehensive understanding of progress.

Recent Developments

As of May 2025, India’s national income accounting has evolved significantly to reflect structural changes, policy reforms, and global economic trends. These developments are critical for UPSC students to understand, as they impact GDP estimates, sectoral contributions, and economic policy analysis. Below are the key updates, with insights for prelims and mains preparation.

Updated Economic Data and Trends

- India’s nominal GDP in 2024–25 is estimated at ~$4.8 trillion (Economic Survey 2024–25), making it the 5th-largest economy globally, surpassing the UK in 2022. Real GDP growth was 6.7% in 2023–24 and is projected at 6.5–7% for 2024–25, reflecting robust domestic demand and export growth.

- Sectoral contributions have shifted: services contribute ~57%, industry ~26%, and agriculture ~15% to GDP (NAS 2025). The services sector, driven by IT and fintech, remains dominant, while manufacturing grows under Production-Linked Incentive (PLI) schemes.

- UPSC Relevance: Prelims may test GDP rankings or growth rates. Mains answers should cite recent data to discuss India’s economic trajectory or sectoral transformation.

Methodological Advancements

- New Base Year: MoSPI adopted a new base year, likely 2020–21, replacing 2011–12, to capture post-COVID consumption patterns and digital economy growth. This increased GDP estimates by 8–10% due to better coverage of services and informal sectors.

- Enhanced Data Sources: The MCA21 database now integrates GST returns and UPI transaction data, improving accuracy. Surveys like the Periodic Labour Force Survey (PLFS) refine income method estimates.

- UPSC Relevance: Understand base year impacts for prelims (e.g., higher GDP figures). For mains, analyze how methodological changes affect comparability across years.

Policy Reforms and Structural Changes

- GST 2.0: By 2025, GST slabs are streamlined (e.g., 3-tier structure), and petroleum may be included, increasing tax collections and formalizing economic activity, thus boosting GDP.

- Atmanirbhar Bharat and PLI Schemes: These initiatives have spurred manufacturing (e.g., electronics, solar panels), raising industry’s GDP share. Exports grew 10% annually, per RBI 2024–25.

- UPSC Relevance: Prelims may ask about PLI sectors or GST reforms. Mains requires linking policies to national income growth and formalization.

Digital Economy Contributions

- The digital economy contributes ~10–12% to GDP (NITI Aayog 2024), driven by UPI (handling 50% of global financial transactions by volume), e-commerce, and gig platforms like Swiggy.

- Challenges include underreporting gig worker incomes and valuing data-driven services. MoSPI is developing “digital GDP” metrics to address this.

- UPSC Relevance: Prelims may test UPI’s economic impact. Mains answers should discuss digital economy measurement challenges and its role in growth.

Post-COVID Economic Recovery

- India’s GDP contracted 6.6% in 2020–21 but rebounded with 8.7% growth in 2021–22 and ~7% in 2022–23 (NAS 2025). Stimulus measures (e.g., MSME credit guarantees, infrastructure spending) boosted consumption and investment.

- Services and manufacturing led the recovery, while agriculture remained resilient. Supply chain disruptions eased by 2023, aiding export-led growth.

- UPSC Relevance: Prelims may ask about recovery metrics. Mains requires analyzing stimulus policies’ impact on national income components.

Climate-Adjusted National Income

- MoSPI and NITI Aayog are piloting Green GDP metrics, adjusting for environmental costs (e.g., pollution, resource depletion). India’s renewable energy capacity is ~200 GW in 2025, targeting 500 GW by 2030.

- Green GDP estimates suggest conventional GDP overstates growth by 2–3% due to unaccounted environmental losses (COP27 commitments).

- UPSC Relevance: Prelims may test renewable energy targets. Mains answers should discuss Green GDP’s role in sustainable development.

Inequality and Income Distribution

- Studies (World Inequality Database 2024) show the top 1% hold ~40% of India’s wealth, with Gini coefficient rising to 0.36. Policies like PM-KISAN and Ayushman Bharat aim to address this.

- Inequality distorts national income distribution, affecting consumption and social stability.

- UPSC Relevance: Prelims may test inequality metrics. Mains requires linking inequality to inclusive growth policies.

Global Economic Context

- India aims for a $5 trillion economy by 2027, leveraging the China+1 strategy to attract manufacturing FDI. Global trade tensions (e.g., US-China) and geopolitical events (e.g., Russia-Ukraine) impact India’s export competitiveness.

- India’s G20 presidency in 2023 emphasized inclusive growth, influencing global GDP accounting standards.

- UPSC Relevance: Prelims may ask about India’s economic ranking. Mains answers should contextualize India’s growth within global trends.

In summary, National Income (NI) serves as a holistic gauge of a nation's economic health, going beyond mere numerical representation. Despite its limitations, current NI metrics are pivotal in informing governmental policies, business strategies, and individual choices. However, there's a growing recognition of the need for more inclusive measures that account for social welfare and environmental sustainability. Therefore, ongoing research and development efforts are essential to evolve NI metrics towards a more comprehensive understanding of progress.

|

108 videos|430 docs|128 tests

|

FAQs on National Income: Economics - Indian Economy for UPSC CSE

| 1. What is the difference between Gross Domestic Product (GDP) and Gross National Product (GNP)? |  |

| 2. How is Net National Product (NNP) calculated at Market Price? |  |

| 3. What is the significance of measuring National Income at Factor Cost (National Income)? |  |

| 4. How is Personal Income different from Disposable Income? |  |

| 5. What are some of the difficulties in measuring National Income accurately? |  |