All Exams >

Commerce >

Crash Course of Accountancy - Class 12 >

All Questions

All questions of Retirement of a partner Death of a partner for Commerce Exam

This a MCQ (Multiple Choice Question) based practice test of Chapter 4 - Retirement and Death of a Partner of Accountancy of Class XII (12) for the quick revision/preparation of School Board examinationsQ How can a partner get retirement from the partnership firm?- a)When all existing partners agreed

- b)With the effect of agreement

- c)When a new partner is admitted

- d)Both When all existing partners agreed and With the effect of agreement

Correct answer is option 'D'. Can you explain this answer?

This a MCQ (Multiple Choice Question) based practice test of Chapter 4 - Retirement and Death of a Partner of Accountancy of Class XII (12) for the quick revision/preparation of School Board examinations

Q How can a partner get retirement from the partnership firm?

a)

When all existing partners agreed

b)

With the effect of agreement

c)

When a new partner is admitted

d)

Both When all existing partners agreed and With the effect of agreement

|

Aravind Saha answered |

A partner can get retirement in the following ways:

(1) With the consent of all the partners

(2) Due to ill health

(3) Agreement/contract is over

(4) By giving notice

(1) With the consent of all the partners

(2) Due to ill health

(3) Agreement/contract is over

(4) By giving notice

X, Y and Z are partners sharing profits in the ratio of 1/2, 2/5 and 1/10. What will be the new ratio of X and Y after the retirement of Z.- a)5:4

- b)4:5

- c)3:2

- d)1:1

Correct answer is option 'A'. Can you explain this answer?

X, Y and Z are partners sharing profits in the ratio of 1/2, 2/5 and 1/10. What will be the new ratio of X and Y after the retirement of Z.

a)

5:4

b)

4:5

c)

3:2

d)

1:1

|

Sharmila Sharma answered |

After the retirement of Z, new ratio of X and Y will be 5:4.

Simplifying, 1/2, 2/5, 1/10 , L.C.M. is 10

Ratio will be 5:4:1

Hence , If z will retire then new ratio will be 5:4.

Outgoing partner is not entitled to take _______- a)His Capital account balance

- b)His share of Loss on Revaluation

- c)His share of profit for the period

- d)Complete goodwill of the firm

Correct answer is option 'D'. Can you explain this answer?

Outgoing partner is not entitled to take _______

a)

His Capital account balance

b)

His share of Loss on Revaluation

c)

His share of profit for the period

d)

Complete goodwill of the firm

|

Knowledge Hub answered |

Outgoing partner cannot take complete goodwill of the firm. Outgoing partner is entitled for the followings:

(i) His capital account balance

(ii) His share of profit reserves & gains etc.

(iii) Revaluation profit or loss

(iv) His share of goodwill

Note: outgoing partner is entitled for his share of goodwill only and not the complete goodwill of the firm.

(i) His capital account balance

(ii) His share of profit reserves & gains etc.

(iii) Revaluation profit or loss

(iv) His share of goodwill

Note: outgoing partner is entitled for his share of goodwill only and not the complete goodwill of the firm.

Goodwill given in adjustments (after the balance sheet) will be ____________- a)Used to adjusted the share of retiring partner

- b)Distributed among the gaining partners

- c)Distributed among sacrificing partners

- d)Distributed among all the partners

Correct answer is option 'A'. Can you explain this answer?

Goodwill given in adjustments (after the balance sheet) will be ____________

a)

Used to adjusted the share of retiring partner

b)

Distributed among the gaining partners

c)

Distributed among sacrificing partners

d)

Distributed among all the partners

|

Mohit Yadav answered |

Answer is Correct because remaining partner's have acquired the Sacrificing partner's share or goodwill.(So,gaining partner's pay such amount to sacrificing partner in his ratio in term of goodwill)

A , B and C are partners in a firm sharing profits in the ratio of 5 : 3 : 2. C died on 31st March 2010. What will be the new ratio of A and B:- a)5 : 3

- b)3 : 2

- c)1 : 1

- d)1 : 3

Correct answer is option 'A'. Can you explain this answer?

A , B and C are partners in a firm sharing profits in the ratio of 5 : 3 : 2. C died on 31st March 2010. What will be the new ratio of A and B:

a)

5 : 3

b)

3 : 2

c)

1 : 1

d)

1 : 3

|

Saikat Sharma answered |

Ratio of A and B will be 5:3 (after adjusting the old share and acquired share).

L, M and N are partners sharing ratio 3:2:1. M died and N the son of M is of the opinion that the rightful owner of his father’s share of profit and the profit of the firm be shared between L and N equally. L does not agree to settle the dispute because there is partnership deed which is showing old profit sharing ratio 3:2:1.- a)Distribute profit between L and N in the ratio of 3:2

- b)Distribute profit between L and N in the ratio of 1:11

- c)Distribute profit between L and N equally

- d)Distribute profit between L and N in the ratio of 3:1

Correct answer is option 'D'. Can you explain this answer?

L, M and N are partners sharing ratio 3:2:1. M died and N the son of M is of the opinion that the rightful owner of his father’s share of profit and the profit of the firm be shared between L and N equally. L does not agree to settle the dispute because there is partnership deed which is showing old profit sharing ratio 3:2:1.

a)

Distribute profit between L and N in the ratio of 3:2

b)

Distribute profit between L and N in the ratio of 1:11

c)

Distribute profit between L and N equally

d)

Distribute profit between L and N in the ratio of 3:1

|

Sparsh Sen answered |

The profit should be distributed among the Land N in Ratio 3:1. Profits cannot be shared equally because there is partnership deed and profit should be distributed accordingly.

How sacrificing ratio is differ from gaining ratio on the basis of mode of calculation- a)It is calculated by taking difference between gaining and new ratio

- b)It is calculated by taking difference between new and old ratio

- c)It is calculated by taking difference between old and new ratio

- d)It is calculated by taking difference between old and gaining ratio

Correct answer is option 'B'. Can you explain this answer?

How sacrificing ratio is differ from gaining ratio on the basis of mode of calculation

a)

It is calculated by taking difference between gaining and new ratio

b)

It is calculated by taking difference between new and old ratio

c)

It is calculated by taking difference between old and new ratio

d)

It is calculated by taking difference between old and gaining ratio

|

Sankar Bose answered |

Difference between Sacrificing Ratio and Gaining Ratio

Sacrificing ratio and gaining ratio are two types of ratios that are used in partnership accounting. They are used to calculate the changes in the ownership structure of a partnership due to the admission, retirement or death of a partner.

Sacrificing Ratio

The sacrificing ratio is the ratio in which the old partners sacrifice their share of profits to the incoming partner. It represents the ratio in which the old partners agree to give up their share of profits to the new partner. The sacrificing ratio is calculated by taking the difference between the old ratio and the new ratio.

Formula: Sacrificing Ratio = Old Ratio - New Ratio

Gaining Ratio

The gaining ratio is the ratio in which the incoming partner gains the share of profits from the old partners. It represents the ratio in which the new partner is entitled to share the profits of the partnership. The gaining ratio is calculated by taking the difference between the new ratio and the old ratio.

Formula: Gaining Ratio = New Ratio - Old Ratio

Mode of Calculation

The main difference between the sacrificing ratio and the gaining ratio is the mode of calculation. The sacrificing ratio is calculated by taking the difference between the old ratio and the new ratio, while the gaining ratio is calculated by taking the difference between the new ratio and the old ratio.

Conclusion

In conclusion, the sacrificing ratio and the gaining ratio are two important ratios in partnership accounting. The sacrificing ratio represents the ratio in which the old partners sacrifice their share of profits to the incoming partner, while the gaining ratio represents the ratio in which the incoming partner gains the share of profits from the old partners. The main difference between the two ratios is the mode of calculation. The sacrificing ratio is calculated by taking the difference between the old ratio and the new ratio, while the gaining ratio is calculated by taking the difference between the new ratio and the old ratio.

Sacrificing ratio and gaining ratio are two types of ratios that are used in partnership accounting. They are used to calculate the changes in the ownership structure of a partnership due to the admission, retirement or death of a partner.

Sacrificing Ratio

The sacrificing ratio is the ratio in which the old partners sacrifice their share of profits to the incoming partner. It represents the ratio in which the old partners agree to give up their share of profits to the new partner. The sacrificing ratio is calculated by taking the difference between the old ratio and the new ratio.

Formula: Sacrificing Ratio = Old Ratio - New Ratio

Gaining Ratio

The gaining ratio is the ratio in which the incoming partner gains the share of profits from the old partners. It represents the ratio in which the new partner is entitled to share the profits of the partnership. The gaining ratio is calculated by taking the difference between the new ratio and the old ratio.

Formula: Gaining Ratio = New Ratio - Old Ratio

Mode of Calculation

The main difference between the sacrificing ratio and the gaining ratio is the mode of calculation. The sacrificing ratio is calculated by taking the difference between the old ratio and the new ratio, while the gaining ratio is calculated by taking the difference between the new ratio and the old ratio.

Conclusion

In conclusion, the sacrificing ratio and the gaining ratio are two important ratios in partnership accounting. The sacrificing ratio represents the ratio in which the old partners sacrifice their share of profits to the incoming partner, while the gaining ratio represents the ratio in which the incoming partner gains the share of profits from the old partners. The main difference between the two ratios is the mode of calculation. The sacrificing ratio is calculated by taking the difference between the old ratio and the new ratio, while the gaining ratio is calculated by taking the difference between the new ratio and the old ratio.

A, B, and C are partners with capitals of Rs. 1,00,000, Rs. 75,000 and Rs. 50,000. On C’s retirement his share is acquired by A and B in the ration of 6:4. Gaining ratio will be:- a)3:2

- b)2:2

- c)2:3

- d)None

Correct answer is option 'A'. Can you explain this answer?

A, B, and C are partners with capitals of Rs. 1,00,000, Rs. 75,000 and Rs. 50,000. On C’s retirement his share is acquired by A and B in the ration of 6:4. Gaining ratio will be:

a)

3:2

b)

2:2

c)

2:3

d)

None

|

|

Nandini Iyer answered |

As nothing has been mentioned regarding the profit sharing ratio and partnership deed is also silent, so the profit sharing ratio is 1:1:1.

Treatment of General Reserve at the time of retirement is:- a)Credit side of Capital account of all the partners

- b)Debit the gainer partner

- c)Debit side of Capital account of all the partners

- d)Only in Balance SheetAt the time of retirement of a partner, general reserve given in the balance sheet should be credited to all the partners (including outgoing partner) in their old profit sharing ratio.

Correct answer is option 'A'. Can you explain this answer?

Treatment of General Reserve at the time of retirement is:

a)

Credit side of Capital account of all the partners

b)

Debit the gainer partner

c)

Debit side of Capital account of all the partners

d)

Only in Balance SheetAt the time of retirement of a partner, general reserve given in the balance sheet should be credited to all the partners (including outgoing partner) in their old profit sharing ratio.

|

Pallavi Chopra answered |

At the time of retirement of a partner, general reserve given in the balance sheet should be credited to all the partners (including outgoing partner) in their old profit sharing ratio.

Why there is need to calculate New profit share ratio- a)After retirement of a partner, there is no change in the continuing partners’ ratio.

- b)After retirement of a partner, there will be change in the continuing partners’ ratio.

- c)To settle the loan amount due to outgoing partner

- d)Both After retirement of a partner, there will be change in the continuing partners’ ratio. and After retirement of a partner, there is no change in the continuing partners’ ratio.

Correct answer is option 'B'. Can you explain this answer?

Why there is need to calculate New profit share ratio

a)

After retirement of a partner, there is no change in the continuing partners’ ratio.

b)

After retirement of a partner, there will be change in the continuing partners’ ratio.

c)

To settle the loan amount due to outgoing partner

d)

Both After retirement of a partner, there will be change in the continuing partners’ ratio. and After retirement of a partner, there is no change in the continuing partners’ ratio.

|

Uday Chakraborty answered |

When a partner is retired from the firm, there will be change in the ratio of remaining partners. It is necessary to find out the new ratio of existing partners.

New Profit sharing Ratio after retirement of a partner, can be calculated as:- a)New Ratio – Sacrificing Ratio

- b)Old Ratio + Acquired share

- c)Gain Ratio – Sacrificing Ratio

- d)New Ratio – Acquired share

Correct answer is option 'B'. Can you explain this answer?

New Profit sharing Ratio after retirement of a partner, can be calculated as:

a)

New Ratio – Sacrificing Ratio

b)

Old Ratio + Acquired share

c)

Gain Ratio – Sacrificing Ratio

d)

New Ratio – Acquired share

|

Aniket Basu answered |

= Old Ratio + Share of retiring partner/Remaining partners' share

b) New Ratio = Old Ratio - Share of retiring partner/Remaining partners' share

b) New Ratio = Old Ratio - Share of retiring partner/Remaining partners' share

A, B and C are partners sharing profits and losses in the ratio 2:2:1. C dies on 31st March 2007. The profits of the financial year ending 31st March 2007 is Rs. 64,000. The share of the deceased partner in the profits will be: - a)Rs. 9,200

- b)Rs. 12,800

- c)Rs. 3,100

- d)Rs. 6,100

Correct answer is option 'B'. Can you explain this answer?

A, B and C are partners sharing profits and losses in the ratio 2:2:1. C dies on 31st March 2007. The profits of the financial year ending 31st March 2007 is Rs. 64,000. The share of the deceased partner in the profits will be:

a)

Rs. 9,200

b)

Rs. 12,800

c)

Rs. 3,100

d)

Rs. 6,100

|

Srestha Shah answered |

Given data:

- A, B and C are partners sharing profits and losses in the ratio 2:2:1.

- C dies on 31st March 2007.

- The profits of the financial year ending 31st March 2007 is Rs. 64,000.

To find: The share of the deceased partner in the profits.

Solution:

Step 1: Calculate the total profit for the year

Total profit = Rs. 64,000

Step 2: Calculate the share of A and B in the profit

Ratio of A and B's share = 2:2 = 4

Total share of A and B = 4+1 = 5

Share of A = (4/5) * Total profit = (4/5) * Rs. 64,000 = Rs. 51,200

Share of B = (4/5) * Total profit = (4/5) * Rs. 64,000 = Rs. 51,200

Step 3: Calculate the share of C in the profit till his death

As C died on 31st March 2007, his share in the profit will be from 1st April 2006 to 31st March 2007.

Let's assume the year's profit is divided equally into 12 months.

So, C's share in the profit for the year = (1/12) * (1/5) * Total profit = (1/60) * Rs. 64,000 = Rs. 1,066.67

Step 4: Calculate the share of C's legal heir in the profit

As C died, his legal heir will get his share in the profit. As per the Indian Partnership Act, 1932, the legal heir of a deceased partner is entitled to the deceased partner's share in the profits from the date of the last agreed balance sheet till the date of the deceased partner's death.

Here, we are not given the date of the last agreed balance sheet. So, we assume that it is 31st March 2006, i.e. one year before the death of C.

So, C's legal heir's share in the profit = (1/12) * (1/5) * Total profit = (1/60) * Rs. 64,000 = Rs. 1,066.67

Step 5: Calculate the total share of C's legal heir in the profit

Total share of C's legal heir = (C's share till death) + (C's legal heir's share) = Rs. 1,066.67 + Rs. 1,066.67 = Rs. 2,133.34

Therefore, the share of the deceased partner in the profits is Rs. 2,133.34, which is option (B).

- A, B and C are partners sharing profits and losses in the ratio 2:2:1.

- C dies on 31st March 2007.

- The profits of the financial year ending 31st March 2007 is Rs. 64,000.

To find: The share of the deceased partner in the profits.

Solution:

Step 1: Calculate the total profit for the year

Total profit = Rs. 64,000

Step 2: Calculate the share of A and B in the profit

Ratio of A and B's share = 2:2 = 4

Total share of A and B = 4+1 = 5

Share of A = (4/5) * Total profit = (4/5) * Rs. 64,000 = Rs. 51,200

Share of B = (4/5) * Total profit = (4/5) * Rs. 64,000 = Rs. 51,200

Step 3: Calculate the share of C in the profit till his death

As C died on 31st March 2007, his share in the profit will be from 1st April 2006 to 31st March 2007.

Let's assume the year's profit is divided equally into 12 months.

So, C's share in the profit for the year = (1/12) * (1/5) * Total profit = (1/60) * Rs. 64,000 = Rs. 1,066.67

Step 4: Calculate the share of C's legal heir in the profit

As C died, his legal heir will get his share in the profit. As per the Indian Partnership Act, 1932, the legal heir of a deceased partner is entitled to the deceased partner's share in the profits from the date of the last agreed balance sheet till the date of the deceased partner's death.

Here, we are not given the date of the last agreed balance sheet. So, we assume that it is 31st March 2006, i.e. one year before the death of C.

So, C's legal heir's share in the profit = (1/12) * (1/5) * Total profit = (1/60) * Rs. 64,000 = Rs. 1,066.67

Step 5: Calculate the total share of C's legal heir in the profit

Total share of C's legal heir = (C's share till death) + (C's legal heir's share) = Rs. 1,066.67 + Rs. 1,066.67 = Rs. 2,133.34

Therefore, the share of the deceased partner in the profits is Rs. 2,133.34, which is option (B).

A, B and C takes a Joint Life Policy, after five years B retires from the firm. Old profit sharing ratio is 2:2:1. After retirement A and C decides to share profits equally. They had taken a Joint Life Policy of Rs. 2,50,000 with the surrender value Rs. 50,000. What will be the treatment in the partner’s capital account on receiving the JLP amount if joint life premium is fully charged to revenue as and when paid?- a)Rs. 50,000 credited to all the partners in old ratio.

- b)Rs. 2,50,000 credited to all the partners in old ratio

- c)Rs. 2,00,000 credited to all the partners in old ratio

- d)No treatment is required

Correct answer is option 'A'. Can you explain this answer?

A, B and C takes a Joint Life Policy, after five years B retires from the firm. Old profit sharing ratio is 2:2:1. After retirement A and C decides to share profits equally. They had taken a Joint Life Policy of Rs. 2,50,000 with the surrender value Rs. 50,000. What will be the treatment in the partner’s capital account on receiving the JLP amount if joint life premium is fully charged to revenue as and when paid?

a)

Rs. 50,000 credited to all the partners in old ratio.

b)

Rs. 2,50,000 credited to all the partners in old ratio

c)

Rs. 2,00,000 credited to all the partners in old ratio

d)

No treatment is required

|

Sagarika Pillai answered |

's capital account for the surrender value of the policy?

The surrender value of the policy will be credited to the capital account of A, B and C in their profit sharing ratio of 2:2:1. After B's retirement, the new profit sharing ratio will be 3:2 (equal sharing between A and C), so the surrender value will be credited to their capital accounts in the ratio of 3:2.

The entry in the capital accounts will be:

A's capital account: Dr. Rs. 75,000 (3/5 of surrender value)

C's capital account: Dr. Rs. 50,000 (2/5 of surrender value)

To Joint Life Policy account: Cr. Rs. 1,25,000 (total surrender value)

The surrender value of the policy will be credited to the capital account of A, B and C in their profit sharing ratio of 2:2:1. After B's retirement, the new profit sharing ratio will be 3:2 (equal sharing between A and C), so the surrender value will be credited to their capital accounts in the ratio of 3:2.

The entry in the capital accounts will be:

A's capital account: Dr. Rs. 75,000 (3/5 of surrender value)

C's capital account: Dr. Rs. 50,000 (2/5 of surrender value)

To Joint Life Policy account: Cr. Rs. 1,25,000 (total surrender value)

Which of the following is calculated at the time of Retirement of a Partner?- a)Gaining Ratio

- b)Sacrifice of Retiring Partner

- c)Old Ratio

- d)Sacrifice of the employees

Correct answer is option 'A'. Can you explain this answer?

Which of the following is calculated at the time of Retirement of a Partner?

a)

Gaining Ratio

b)

Sacrifice of Retiring Partner

c)

Old Ratio

d)

Sacrifice of the employees

|

Pranav Saha answered |

At the time of retirement of death of a partner we need to calculate the gaining ratio of the existing partners. The main purpose of calculating gaining ratio is to adjust the share of goodwill at the time of retirement or death of a partner.

Gaining ratio is the ratio in which continuing partners have ______ the share from the outgoing partner- a)Sacrificed

- b)Acquired

- c)Acquired and Sacrificed

- d)Both Acquired and Sacrificed

Correct answer is option 'B'. Can you explain this answer?

Gaining ratio is the ratio in which continuing partners have ______ the share from the outgoing partner

a)

Sacrificed

b)

Acquired

c)

Acquired and Sacrificed

d)

Both Acquired and Sacrificed

|

|

Aryan Khanna answered |

When a partner retires from the firm, his share will be acquired by the continuing partners. The ratio in which they acquire the share of retired partner, is known as gaining ratio.

Balances of M/s. Ram, Rahul and Rohit sharing profits and losses in proportion to their capitals, stood as Ram Rs. 3,00,000; Rahul Rs. 2,00,000 and Rohit Rs. 1,00,000. Ram desired to retire form the firm and the remaining partners decided to carry on, Joint life policy of the partners surrendered and cash obtained Rs. 60,000. What will be the treatment for JLP?- a)Rs. 60,000 credited to Revaluation Account

- b)Rs. 60,000 credited to Joint Life Policy Account

- c)Rs. 30,000 debited to Ram’s Capital Account

- d)Either ‘a’ or ‘b’

Correct answer is option 'B'. Can you explain this answer?

Balances of M/s. Ram, Rahul and Rohit sharing profits and losses in proportion to their capitals, stood as Ram Rs. 3,00,000; Rahul Rs. 2,00,000 and Rohit Rs. 1,00,000. Ram desired to retire form the firm and the remaining partners decided to carry on, Joint life policy of the partners surrendered and cash obtained Rs. 60,000. What will be the treatment for JLP?

a)

Rs. 60,000 credited to Revaluation Account

b)

Rs. 60,000 credited to Joint Life Policy Account

c)

Rs. 30,000 debited to Ram’s Capital Account

d)

Either ‘a’ or ‘b’

|

Aarya Sharma answered |

Answer: b) Rs. 60,000 credited to Joint Life Policy Account

Explanation:

When a partner retires or dies, the Joint Life Policy taken on the lives of the partners is surrendered and the cash received is credited to the Joint Life Policy Account. In this case, Ram is retiring and the remaining partners are continuing the business. Therefore, the Joint Life Policy will be surrendered and the cash received of Rs. 60,000 will be credited to the Joint Life Policy Account. This account will then be distributed among the remaining partners in their profit sharing ratio.

Explanation:

When a partner retires or dies, the Joint Life Policy taken on the lives of the partners is surrendered and the cash received is credited to the Joint Life Policy Account. In this case, Ram is retiring and the remaining partners are continuing the business. Therefore, the Joint Life Policy will be surrendered and the cash received of Rs. 60,000 will be credited to the Joint Life Policy Account. This account will then be distributed among the remaining partners in their profit sharing ratio.

L, M and N are partners sharing profit and losses in the ratio of 25:15:9 . M retires. It is decided that the profit sharing ratio between remaining partner will be the same as existing between M and N. Calculate Gaining ratio- a)45:80

- b)45:75

- c)40:75

- d)55:75

Correct answer is option 'B'. Can you explain this answer?

L, M and N are partners sharing profit and losses in the ratio of 25:15:9 . M retires. It is decided that the profit sharing ratio between remaining partner will be the same as existing between M and N. Calculate Gaining ratio

a)

45:80

b)

45:75

c)

40:75

d)

55:75

|

|

Aryan Khanna answered |

Old Share 25 : 15 : 9

L’s share = 25/29

Gain Ratio = 45: 75

L’s share = 25/29

Gain Ratio = 45: 75

X, Y, Z are partners sharing profits and losses equally. They took a joint life policy of Rs. 5,00,000 with a surrender value of Rs. 3,00,000. The firm treats the insurance premium as an expense. Y retired and X and Z decided to share profits and losses in 2:1. The amount of Joint life policy will be transferred as: - a)Credited to X, Y and Z’s Capital accounts with Rs. 1,00,000 each

- b)Credited to X, Y and Z’s capital accounts with Rs. 1,66,667 each

- c)Credited to X, and Z capital accounts with Rs. 2,50,000 each

- d)Credited to Y’s capital account with Rs. 3,00,000 each

Correct answer is option 'A'. Can you explain this answer?

X, Y, Z are partners sharing profits and losses equally. They took a joint life policy of Rs. 5,00,000 with a surrender value of Rs. 3,00,000. The firm treats the insurance premium as an expense. Y retired and X and Z decided to share profits and losses in 2:1. The amount of Joint life policy will be transferred as:

a)

Credited to X, Y and Z’s Capital accounts with Rs. 1,00,000 each

b)

Credited to X, Y and Z’s capital accounts with Rs. 1,66,667 each

c)

Credited to X, and Z capital accounts with Rs. 2,50,000 each

d)

Credited to Y’s capital account with Rs. 3,00,000 each

|

Ameya Menon answered |

's capital accounts in their profit sharing ratio

b)Credited to X and Z's capital accounts in their new profit sharing ratio

c)Credited to Y's capital account

d)Credited to the firm's current account

Answer: b) Credited to X and Z's capital accounts in their new profit sharing ratio

Explanation:

Since Y has retired, the partnership firm is now between X and Z only. They have also decided to share profits and losses in the ratio of 2:1. Therefore, the amount of joint life policy should be transferred to their capital accounts in the new profit sharing ratio. Hence, option b) is the correct answer. Option a) is incorrect because Y is no longer a partner in the firm. Option c) is also incorrect because Y has already received his share of the partnership assets upon retirement. Option d) is incorrect because the joint life policy is a partnership asset and not a current liability of the firm.

b)Credited to X and Z's capital accounts in their new profit sharing ratio

c)Credited to Y's capital account

d)Credited to the firm's current account

Answer: b) Credited to X and Z's capital accounts in their new profit sharing ratio

Explanation:

Since Y has retired, the partnership firm is now between X and Z only. They have also decided to share profits and losses in the ratio of 2:1. Therefore, the amount of joint life policy should be transferred to their capital accounts in the new profit sharing ratio. Hence, option b) is the correct answer. Option a) is incorrect because Y is no longer a partner in the firm. Option c) is also incorrect because Y has already received his share of the partnership assets upon retirement. Option d) is incorrect because the joint life policy is a partnership asset and not a current liability of the firm.

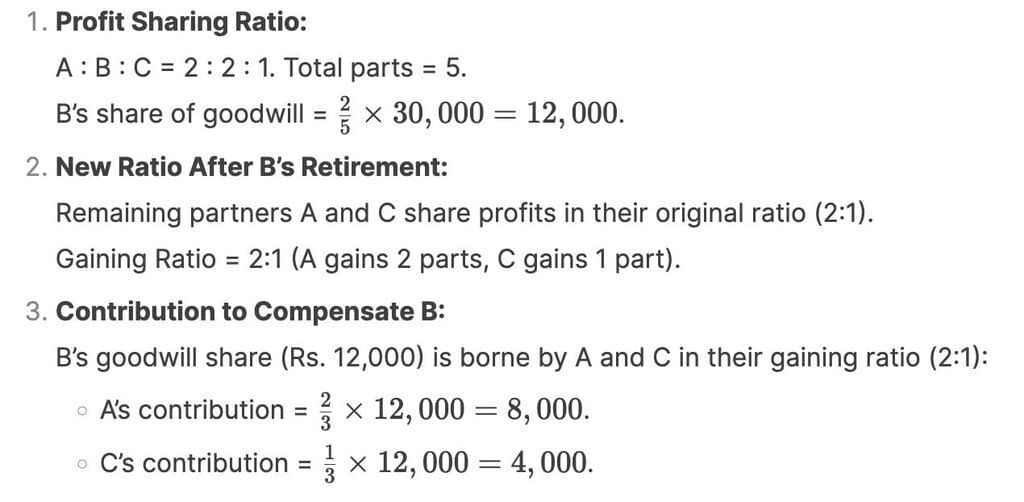

A, B and C are partners sharing profits in the ratio 2:2:1. On retirement of B, goodwill was valued as Rs. 30,000. Find the contribution of A and C to compensate B. - a)Rs. 20,000 and Rs. 10,000

- b)Rs. 8,000 and Rs. 4,000

- c)They will not contribute any thing

- d)Information is insufficient for any comment

Correct answer is option 'B'. Can you explain this answer?

A, B and C are partners sharing profits in the ratio 2:2:1. On retirement of B, goodwill was valued as Rs. 30,000. Find the contribution of A and C to compensate B.

a)

Rs. 20,000 and Rs. 10,000

b)

Rs. 8,000 and Rs. 4,000

c)

They will not contribute any thing

d)

Information is insufficient for any comment

|

KP Classes answered |

A, B and C are partners with profits sharing ratio 4:3:2. B retires and Goodwill Rs. 10,800 was shown in books of account. If A & C shares profits of B in 5:3, then find the value of goodwill shared between A and C.- a)Rs. 1,850 and Rs. 1,950.

- b) Rs. 1,650 and Rs. 1,750.

- c)Rs. 2,000 and Rs. 1,600.

- d) Rs. 1,950 and Rs. 1,650.

Correct answer is option 'A'. Can you explain this answer?

A, B and C are partners with profits sharing ratio 4:3:2. B retires and Goodwill Rs. 10,800 was shown in books of account. If A & C shares profits of B in 5:3, then find the value of goodwill shared between A and C.

a)

Rs. 1,850 and Rs. 1,950.

b)

Rs. 1,650 and Rs. 1,750.

c)

Rs. 2,000 and Rs. 1,600.

d)

Rs. 1,950 and Rs. 1,650.

|

Vaishnavi Joshi answered |

And C decide to share future profits in the ratio of 5:3, find the new profit sharing ratio of A and C.

Initially, the profit sharing ratio of A, B, and C was 4:3:2. When B retires, his share of the goodwill will be distributed between A and C. Let's calculate the amount of goodwill distributed to A and C.

B's share of goodwill = 3/(4+3+2) * 10,800 = Rs. 3,600

Since A and C will now share in the ratio of 5:3, the total profit sharing ratio will be 5+3=8.

Let X be the new profit sharing ratio of A in the new partnership.

Therefore, C's new profit sharing ratio will be (8 - X).

A's share of goodwill = Rs. 3,600 + X/(X+(8-X)) * 7,200

C's share of goodwill = Rs. 3,600 + (8-X)/(X+(8-X)) * 7,200

According to the question, A's share of goodwill is twice that of C's share of goodwill.

Therefore, we can write the equation as:

Rs. 3,600 + X/(X+8-X) * 7,200 = 2 * [Rs. 3,600 + (8-X)/(X+8-X) * 7,200]

Simplifying the above equation, we get:

X = 6

Therefore, the new profit sharing ratio of A and C will be 6:2 or 3:1.

Initially, the profit sharing ratio of A, B, and C was 4:3:2. When B retires, his share of the goodwill will be distributed between A and C. Let's calculate the amount of goodwill distributed to A and C.

B's share of goodwill = 3/(4+3+2) * 10,800 = Rs. 3,600

Since A and C will now share in the ratio of 5:3, the total profit sharing ratio will be 5+3=8.

Let X be the new profit sharing ratio of A in the new partnership.

Therefore, C's new profit sharing ratio will be (8 - X).

A's share of goodwill = Rs. 3,600 + X/(X+(8-X)) * 7,200

C's share of goodwill = Rs. 3,600 + (8-X)/(X+(8-X)) * 7,200

According to the question, A's share of goodwill is twice that of C's share of goodwill.

Therefore, we can write the equation as:

Rs. 3,600 + X/(X+8-X) * 7,200 = 2 * [Rs. 3,600 + (8-X)/(X+8-X) * 7,200]

Simplifying the above equation, we get:

X = 6

Therefore, the new profit sharing ratio of A and C will be 6:2 or 3:1.

Goodwill given in the balance sheet is debited to the partners at the time of retirement in:- a)Gain Ratio

- b)Sacrificing Ratio

- c)New Ratio

- d)Old Ratio

Correct answer is option 'D'. Can you explain this answer?

Goodwill given in the balance sheet is debited to the partners at the time of retirement in:

a)

Gain Ratio

b)

Sacrificing Ratio

c)

New Ratio

d)

Old Ratio

|

|

Vikas Kapoor answered |

At the time of retirement, goodwill given in the balance sheet should be debited to the partners in their old profit sharing ratio (including the outgoing partner).

When the New ratio is deducted with Old Ratio we get:- a)New Ratio

- b)Old Ratio

- c)Sacrifice only

- d)Gain Ratio

Correct answer is option 'D'. Can you explain this answer?

When the New ratio is deducted with Old Ratio we get:

a)

New Ratio

b)

Old Ratio

c)

Sacrifice only

d)

Gain Ratio

|

Raghav Shah answered |

Gaining ratio is calculated by deducting the old ratio from the new ratio. The following formula is used to calculate the gain ratio.

Gaining ratio = New ratio – old ratio

Gaining ratio = New ratio – old ratio

Goodwill Given in the old Balance Sheet will be:- a)Written off by the old partners

- b)Written off by the Sacrificing partners

- c)Distributed by Gainer partners

- d)Credited to old Partners Capital accounts

Correct answer is option 'A'. Can you explain this answer?

Goodwill Given in the old Balance Sheet will be:

a)

Written off by the old partners

b)

Written off by the Sacrificing partners

c)

Distributed by Gainer partners

d)

Credited to old Partners Capital accounts

|

|

Vikas Kapoor answered |

Goodwill given in the old balance sheet will be written off by all the partners (including retiring partner) at the time of retirement of a partner. Goodwill will be written off in the old ratio of all the partners.

A, B and C are partners with profits sharing ratio 4:3:2. B retires and Goodwill Rs. 10,800 was shown in books of account. If A & C shares profits of B in 5:3, then find the value of goodwill shared between A and C. - a)Rs. 1,850 and Rs. 1,950

- b)Rs. 1,650 and Rs. 1,750

- c)Rs. 2,000 and Rs. 1,600

- d)Rs. 1,950 and Rs.1,650

Correct answer is option 'D'. Can you explain this answer?

A, B and C are partners with profits sharing ratio 4:3:2. B retires and Goodwill Rs. 10,800 was shown in books of account. If A & C shares profits of B in 5:3, then find the value of goodwill shared between A and C.

a)

Rs. 1,850 and Rs. 1,950

b)

Rs. 1,650 and Rs. 1,750

c)

Rs. 2,000 and Rs. 1,600

d)

Rs. 1,950 and Rs.1,650

|

Janhavi Basu answered |

Calculation of gaining ratio

Old ratio (A, B and C) = 4 : 3 : 2

B retires from the firm

New artio (A and C ) = 5 : 3

Gaining ratio = New ratio - Old ratio

A's new share = (5/8) - (4/9) = (45 - 32) /72 = 13/72

C's new share = (3/8) - (2/9) = (27 - 16) / 36 = 11/72

gaining ratio = 13 : 11

2. Adjustment of goodwill

C's share of goodwill = (10800 * 3) / 9 = 3600

This share of goodwill is to be debited to remaining partners' capital account in their gaining ratio (i.e., 13 : 11 )

Journal entry for the above will be:

A's capital A/c Dr. 1950

C's capital A/c Dr. 1650

To B's capital A/c 3600

How unrecorded assets are treated at the time of retirement of a partner?- a)Credited to revaluation account

- b)Credited to capital account of retiring partner only

- c)Debited to revaluation account

- d)Credited to partner’s capital account

Correct answer is option 'A'. Can you explain this answer?

How unrecorded assets are treated at the time of retirement of a partner?

a)

Credited to revaluation account

b)

Credited to capital account of retiring partner only

c)

Debited to revaluation account

d)

Credited to partner’s capital account

|

Sai Kulkarni answered |

How unrecorded assets are treated at the time of retirement of a partner?

When a partner retires, any unrecorded assets must be accounted for. The treatment of these assets is as follows:

- Unrecorded assets are credited to the Revaluation Account.

- This process helps in reflecting the true value of the firm's assets.

- The net gain or loss from this revaluation is then transferred to the capital accounts of all partners.

- It is important to distribute this adjustment in the old profit-sharing ratio, including the retiring partner.

In summary, unrecorded assets are recognised through the Revaluation Account, ensuring all partners, including the retiring one, receive their fair share based on the firm's actual asset value.

Balances of A, B and C sharing profits and losses in proportionate to their capitals, stood as follows: Capital Accounts: A Rs. 2,00,000; B Rs. 3,00,000 and C Rs. 2,00,000. A desired to retire form the firm, B and C share the future profits equally, Goodwill of the entire firm be valued at Rs. 1,40,000 and no Goodwill account being raised.- a)Credit Partner’s Capital Account with old profit sharing ratio for Rs. 1,40,000.

- b)Credit Partner’s Capital Account with new profit sharing ratio for Rs. 1,40,000.

- c)Credit A’s Account with Rs. 40,000 and debit B’s Capital Account with Rs. 10,000 and C’s Capital Account with Rs. 30,000.

- d)Credit Partner’s Capital Account with gaining ratio for Rs. 1,40,000.

Correct answer is option 'C'. Can you explain this answer?

Balances of A, B and C sharing profits and losses in proportionate to their capitals, stood as follows: Capital Accounts: A Rs. 2,00,000; B Rs. 3,00,000 and C Rs. 2,00,000. A desired to retire form the firm, B and C share the future profits equally, Goodwill of the entire firm be valued at Rs. 1,40,000 and no Goodwill account being raised.

a)

Credit Partner’s Capital Account with old profit sharing ratio for Rs. 1,40,000.

b)

Credit Partner’s Capital Account with new profit sharing ratio for Rs. 1,40,000.

c)

Credit A’s Account with Rs. 40,000 and debit B’s Capital Account with Rs. 10,000 and C’s Capital Account with Rs. 30,000.

d)

Credit Partner’s Capital Account with gaining ratio for Rs. 1,40,000.

|

|

Pj Commerce Academy answered |

Calculation of A's share in goodwill:

- A's capital = Rs. 2,00,000

- Total capital = Rs. 2,00,000 + Rs. 3,00,000 + Rs. 2,00,000 = Rs. 7,00,000

- A's share in goodwill = (A's capital / Total capital) * Goodwill

= (2,00,000 / 7,00,000) * 1,40,000

= Rs. 40,000

Calculation of B and C's new profit sharing ratio:

- Total capital after A's retirement = Rs. 3,00,000 + Rs. 2,00,000 = Rs. 5,00,000

- B's new capital = Rs. 3,00,000 + Rs. 40,000 = Rs. 3,40,000

- C's new capital = Rs. 2,00,000 + Rs. 40,000 = Rs. 2,40,000

- B and C's new profit sharing ratio = B's new capital : C's new capital

= 3,40,000 : 2,40,000

= 17 : 12

Adjustment entries:

- Credit Partner's Capital Account with old profit sharing ratio for Rs. 1,40,000.

- Credit Partner's Capital Account with new profit sharing ratio for Rs. 1,40,000.

- Credit A's Account with Rs. 40,000.

- Debit B's Capital Account with Rs. 10,000.

- Debit C's Capital Account with Rs. 30,000.

Explanation of adjustment entries:

- The first entry credits Partner's Capital Account with old profit sharing ratio for Rs. 1,40,000. This is to transfer A's share in goodwill to the remaining partners, B and C, in their old profit sharing ratio.

- The second entry credits Partner's Capital Account with new profit sharing ratio for Rs. 1,40,000. This is to adjust the change in profit sharing ratio between B and C after A's retirement.

- The third entry credits A's Account with Rs. 40,000. This is to pay A his share in the goodwill.

- The fourth entry debits B's Capital Account with Rs. 10,000. This is to adjust B's capital as per the new profit sharing ratio.

- The fifth entry debits C's Capital Account with Rs. 30,000. This is to adjust C's capital as per the new profit sharing ratio.

Hence, option C is the correct answer.

- A's capital = Rs. 2,00,000

- Total capital = Rs. 2,00,000 + Rs. 3,00,000 + Rs. 2,00,000 = Rs. 7,00,000

- A's share in goodwill = (A's capital / Total capital) * Goodwill

= (2,00,000 / 7,00,000) * 1,40,000

= Rs. 40,000

Calculation of B and C's new profit sharing ratio:

- Total capital after A's retirement = Rs. 3,00,000 + Rs. 2,00,000 = Rs. 5,00,000

- B's new capital = Rs. 3,00,000 + Rs. 40,000 = Rs. 3,40,000

- C's new capital = Rs. 2,00,000 + Rs. 40,000 = Rs. 2,40,000

- B and C's new profit sharing ratio = B's new capital : C's new capital

= 3,40,000 : 2,40,000

= 17 : 12

Adjustment entries:

- Credit Partner's Capital Account with old profit sharing ratio for Rs. 1,40,000.

- Credit Partner's Capital Account with new profit sharing ratio for Rs. 1,40,000.

- Credit A's Account with Rs. 40,000.

- Debit B's Capital Account with Rs. 10,000.

- Debit C's Capital Account with Rs. 30,000.

Explanation of adjustment entries:

- The first entry credits Partner's Capital Account with old profit sharing ratio for Rs. 1,40,000. This is to transfer A's share in goodwill to the remaining partners, B and C, in their old profit sharing ratio.

- The second entry credits Partner's Capital Account with new profit sharing ratio for Rs. 1,40,000. This is to adjust the change in profit sharing ratio between B and C after A's retirement.

- The third entry credits A's Account with Rs. 40,000. This is to pay A his share in the goodwill.

- The fourth entry debits B's Capital Account with Rs. 10,000. This is to adjust B's capital as per the new profit sharing ratio.

- The fifth entry debits C's Capital Account with Rs. 30,000. This is to adjust C's capital as per the new profit sharing ratio.

Hence, option C is the correct answer.

In the absence of proper agreement, representative of the diseased partner is entitled to the Dead partner’s share in the following items.- a)Profits till date, goodwill, joint life policy, share in revalued assets and liabilities.

- b)Capital, goodwill, joint life policy, interest on capital, share in revalued assets and liabilities

- c)Capital, profits till date, goodwill, interest on capital, share in revalued assets and liabilities

- d)Capital, profits till date, goodwill, joint life policy, share in revalued assets and liabilities

Correct answer is option 'D'. Can you explain this answer?

In the absence of proper agreement, representative of the diseased partner is entitled to the Dead partner’s share in the following items.

a)

Profits till date, goodwill, joint life policy, share in revalued assets and liabilities.

b)

Capital, goodwill, joint life policy, interest on capital, share in revalued assets and liabilities

c)

Capital, profits till date, goodwill, interest on capital, share in revalued assets and liabilities

d)

Capital, profits till date, goodwill, joint life policy, share in revalued assets and liabilities

|

|

Asmit Sharma answered |

Isme smjhna kya hai ???

Joint Life Policy is taken by the firm on the life(s) of ………- a)All the partners jointly.

- b)All the partners severely.

- c)On the life of all the partners and employees of the firm.

- d)‘a’ and ‘b’.

Correct answer is option 'D'. Can you explain this answer?

Joint Life Policy is taken by the firm on the life(s) of ………

a)

All the partners jointly.

b)

All the partners severely.

c)

On the life of all the partners and employees of the firm.

d)

‘a’ and ‘b’.

|

Niharika Joshi answered |

Joint Life Policy

A joint life policy is a type of life insurance policy that covers multiple individuals under a single policy. The policy pays out the sum assured upon the death of any one of the covered individuals. This type of policy is commonly taken by firms to provide financial protection in the event of the death of one or more partners or employees. Let's discuss the options given in the question and understand why the correct answer is option 'D'.

All the partners jointly

- This option suggests that the joint life policy is taken on the lives of all the partners of the firm.

- In this case, the policy would pay out the sum assured upon the death of any one of the partners.

- This ensures that the surviving partners have financial protection in case of the death of a partner, which can help cover any business liabilities or provide for the deceased partner's family.

All the partners severely

- This option suggests that the joint life policy is taken on the lives of all the partners severely.

- It seems that there might be a typographical error in this option, as the word 'severely' does not make sense in the given context. It is likely meant to be 'severally', which means individually or separately.

- If the policy is taken on the lives of all the partners severally, each partner would have their own policy, and the sum assured would be paid out upon their individual deaths.

- This would provide individual financial protection to each partner's family or beneficiaries.

On the life of all the partners and employees of the firm

- This option suggests that the joint life policy is taken on the lives of both the partners and employees of the firm.

- In this case, the policy would pay out the sum assured upon the death of any one of the covered individuals, whether they are partners or employees.

- This type of policy provides comprehensive coverage for all individuals associated with the firm, ensuring financial security for their families or beneficiaries.

a and b

- Option 'D' states that the correct answer is a combination of options 'a' and 'b'.

- This means that the joint life policy is taken on the lives of all the partners jointly, as well as all the partners individually (severally).

- This ensures that both the collective interests of the partnership and the individual interests of each partner are protected through the policy.

Overall, option 'D' is the correct answer as it captures the comprehensive nature of a joint life policy taken by a firm. It covers all the partners jointly and severally, providing financial protection for both the partnership and the individual partners.

A joint life policy is a type of life insurance policy that covers multiple individuals under a single policy. The policy pays out the sum assured upon the death of any one of the covered individuals. This type of policy is commonly taken by firms to provide financial protection in the event of the death of one or more partners or employees. Let's discuss the options given in the question and understand why the correct answer is option 'D'.

All the partners jointly

- This option suggests that the joint life policy is taken on the lives of all the partners of the firm.

- In this case, the policy would pay out the sum assured upon the death of any one of the partners.

- This ensures that the surviving partners have financial protection in case of the death of a partner, which can help cover any business liabilities or provide for the deceased partner's family.

All the partners severely

- This option suggests that the joint life policy is taken on the lives of all the partners severely.

- It seems that there might be a typographical error in this option, as the word 'severely' does not make sense in the given context. It is likely meant to be 'severally', which means individually or separately.

- If the policy is taken on the lives of all the partners severally, each partner would have their own policy, and the sum assured would be paid out upon their individual deaths.

- This would provide individual financial protection to each partner's family or beneficiaries.

On the life of all the partners and employees of the firm

- This option suggests that the joint life policy is taken on the lives of both the partners and employees of the firm.

- In this case, the policy would pay out the sum assured upon the death of any one of the covered individuals, whether they are partners or employees.

- This type of policy provides comprehensive coverage for all individuals associated with the firm, ensuring financial security for their families or beneficiaries.

a and b

- Option 'D' states that the correct answer is a combination of options 'a' and 'b'.

- This means that the joint life policy is taken on the lives of all the partners jointly, as well as all the partners individually (severally).

- This ensures that both the collective interests of the partnership and the individual interests of each partner are protected through the policy.

Overall, option 'D' is the correct answer as it captures the comprehensive nature of a joint life policy taken by a firm. It covers all the partners jointly and severally, providing financial protection for both the partnership and the individual partners.

A, B and C are partners sharing profits in the ratio of 2:2:1. On retirement of B, goodwill was valued as Rs. 30,000. Find the contribution of A and C to compensate B: - a)Rs. 20,000 and Rs. 10,000

- b)Rs. 8,000 and Rs. 4,000

- c)No contribution

- d)Rs. 15,000 and Rs. 15,000

Correct answer is option 'B'. Can you explain this answer?

A, B and C are partners sharing profits in the ratio of 2:2:1. On retirement of B, goodwill was valued as Rs. 30,000. Find the contribution of A and C to compensate B:

a)

Rs. 20,000 and Rs. 10,000

b)

Rs. 8,000 and Rs. 4,000

c)

No contribution

d)

Rs. 15,000 and Rs. 15,000

|

Muskan Singh answered |

Correct option is B Rs.8,000 and Rs.4,000.

On retirement of B, total goodwill of the firm is Rs. 30000

B's share of goodwill = Rs. 30000 * (2/5) = Rs. 12000

Contributions by A and C to compensate B will be in their gaining ratio i.e.,2 : 1

A's contribution = Rs. 12000 * (2/3) = Rs. 8000

B's contribution = Rs. 12000 * (1/3) = Rs. 4000

On retirement of B, total goodwill of the firm is Rs. 30000

B's share of goodwill = Rs. 30000 * (2/5) = Rs. 12000

Contributions by A and C to compensate B will be in their gaining ratio i.e.,2 : 1

A's contribution = Rs. 12000 * (2/3) = Rs. 8000

B's contribution = Rs. 12000 * (1/3) = Rs. 4000

New Ratio – Old Ratio = ?- a)New ratio of continuing partners

- b)Sacrificing ratio

- c)Both Sacrificing ratio and New ratio of continuing partners

- d)Gain Ratio

Correct answer is option 'D'. Can you explain this answer?

New Ratio – Old Ratio = ?

a)

New ratio of continuing partners

b)

Sacrificing ratio

c)

Both Sacrificing ratio and New ratio of continuing partners

d)

Gain Ratio

|

Pallavi Chopra answered |

At the time of retirement or death of a partner, gain ratio of remaining partners is calculated as follows:

New Ratio – Old Ratio = Gain Ratio

New Ratio – Old Ratio = Gain Ratio

When the goodwill is raised at its full value and written off at retirement of a partner, the remaining partners share goodwill in ______.- a)Old profit sharing Ratio

- b)New profit sharing Ratio

- c)Gaining Ratio

- d)Equally.

Correct answer is option 'C'. Can you explain this answer?

When the goodwill is raised at its full value and written off at retirement of a partner, the remaining partners share goodwill in ______.

a)

Old profit sharing Ratio

b)

New profit sharing Ratio

c)

Gaining Ratio

d)

Equally.

|

|

Ankita answered |

Gaining Ratio, Option C

A, B and C are partners sharing profit in the ratio of 1/2 : 3/10 : 1/5 .Calculate the new profit sharing ratio between A and C ,If B retires- a)3:2

- b)2:5

- c)5:2

- d)4:1

Correct answer is option 'C'. Can you explain this answer?

A, B and C are partners sharing profit in the ratio of 1/2 : 3/10 : 1/5 .Calculate the new profit sharing ratio between A and C ,If B retires

a)

3:2

b)

2:5

c)

5:2

d)

4:1

|

Pallavi Chopra answered |

New Ratio of A and C will be 5:2

Old Ratio = 1/2, 3/10 and 1/5 i.e. 5:3:2

Share of B = 3/10

Remaining = 5:2

Old Ratio = 1/2, 3/10 and 1/5 i.e. 5:3:2

Share of B = 3/10

Remaining = 5:2

A, B and C are partners sharing profits and losses in the ratio 9:4:3. They took joint life policy of Rs. 25,000 for A, Rs. 20,000 for B and Rs. 51,000 for C. what is the share of C in the JLP amount?- a)Rs. 18,000

- b)Rs. 25,000

- c)Rs. 51,000

- d)Rs. 20,000

Correct answer is option 'C'. Can you explain this answer?

A, B and C are partners sharing profits and losses in the ratio 9:4:3. They took joint life policy of Rs. 25,000 for A, Rs. 20,000 for B and Rs. 51,000 for C. what is the share of C in the JLP amount?

a)

Rs. 18,000

b)

Rs. 25,000

c)

Rs. 51,000

d)

Rs. 20,000

|

Snehal Das answered |

Given, A:B:C = 9:4:3 and the joint life policy amounts are Rs. 25,000, Rs. 20,000 and Rs. 51,000 respectively.

To find the share of C in the JLP amount, we need to calculate the total JLP amount and then find the share of C in it.

Total JLP amount = Rs. 25,000 + Rs. 20,000 + Rs. 51,000 = Rs. 96,000

Now, we need to find the share of each partner in the JLP amount based on their profit sharing ratio.

Share of A = (9/16) x Rs. 96,000 = Rs. 54,000

Share of B = (4/16) x Rs. 96,000 = Rs. 24,000

Share of C = (3/16) x Rs. 96,000 = Rs. 18,000

Therefore, the share of C in the JLP amount is Rs. 18,000. Hence, option C is the correct answer.

To find the share of C in the JLP amount, we need to calculate the total JLP amount and then find the share of C in it.

Total JLP amount = Rs. 25,000 + Rs. 20,000 + Rs. 51,000 = Rs. 96,000

Now, we need to find the share of each partner in the JLP amount based on their profit sharing ratio.

Share of A = (9/16) x Rs. 96,000 = Rs. 54,000

Share of B = (4/16) x Rs. 96,000 = Rs. 24,000

Share of C = (3/16) x Rs. 96,000 = Rs. 18,000

Therefore, the share of C in the JLP amount is Rs. 18,000. Hence, option C is the correct answer.

The balance of joint life policy account as shown in the balance sheet represents: - a)Surrender value of a policy

- b)Annual premium of JLP

- c)Total premium paid by the firm

- d)Amount receivable on the maturity of the policy

Correct answer is option 'A'. Can you explain this answer?

The balance of joint life policy account as shown in the balance sheet represents:

a)

Surrender value of a policy

b)

Annual premium of JLP

c)

Total premium paid by the firm

d)

Amount receivable on the maturity of the policy

|

Snehal Das answered |

Balance of joint life policy account represents surrender value of a policy

Explanation:

Joint life policy is an insurance policy that covers the lives of two individuals. The policy pays out on the death of the first person, and then ceases to exist. The balance of joint life policy account as shown in the balance sheet represents the surrender value of a policy.

Surrender value is the amount payable to the policyholder when the policy is surrendered before maturity. Surrendering a policy means terminating the policy prematurely and receiving the cash value of the policy. The surrender value is calculated based on the premiums paid and the duration of the policy.

The balance of joint life policy account represents the amount of money that the insurance company has set aside to pay out the surrender value of the policy. This amount is included in the balance sheet as an asset of the company.

The other options listed in the question, such as annual premium, total premium paid by the firm, and amount receivable on the maturity of the policy, are not relevant to the balance of joint life policy account. The balance of joint life policy account only represents the surrender value of the policy.

In summary, the balance of joint life policy account as shown in the balance sheet represents the amount of money set aside by the insurance company to pay out the surrender value of a joint life policy.

Explanation:

Joint life policy is an insurance policy that covers the lives of two individuals. The policy pays out on the death of the first person, and then ceases to exist. The balance of joint life policy account as shown in the balance sheet represents the surrender value of a policy.

Surrender value is the amount payable to the policyholder when the policy is surrendered before maturity. Surrendering a policy means terminating the policy prematurely and receiving the cash value of the policy. The surrender value is calculated based on the premiums paid and the duration of the policy.

The balance of joint life policy account represents the amount of money that the insurance company has set aside to pay out the surrender value of the policy. This amount is included in the balance sheet as an asset of the company.

The other options listed in the question, such as annual premium, total premium paid by the firm, and amount receivable on the maturity of the policy, are not relevant to the balance of joint life policy account. The balance of joint life policy account only represents the surrender value of the policy.

In summary, the balance of joint life policy account as shown in the balance sheet represents the amount of money set aside by the insurance company to pay out the surrender value of a joint life policy.

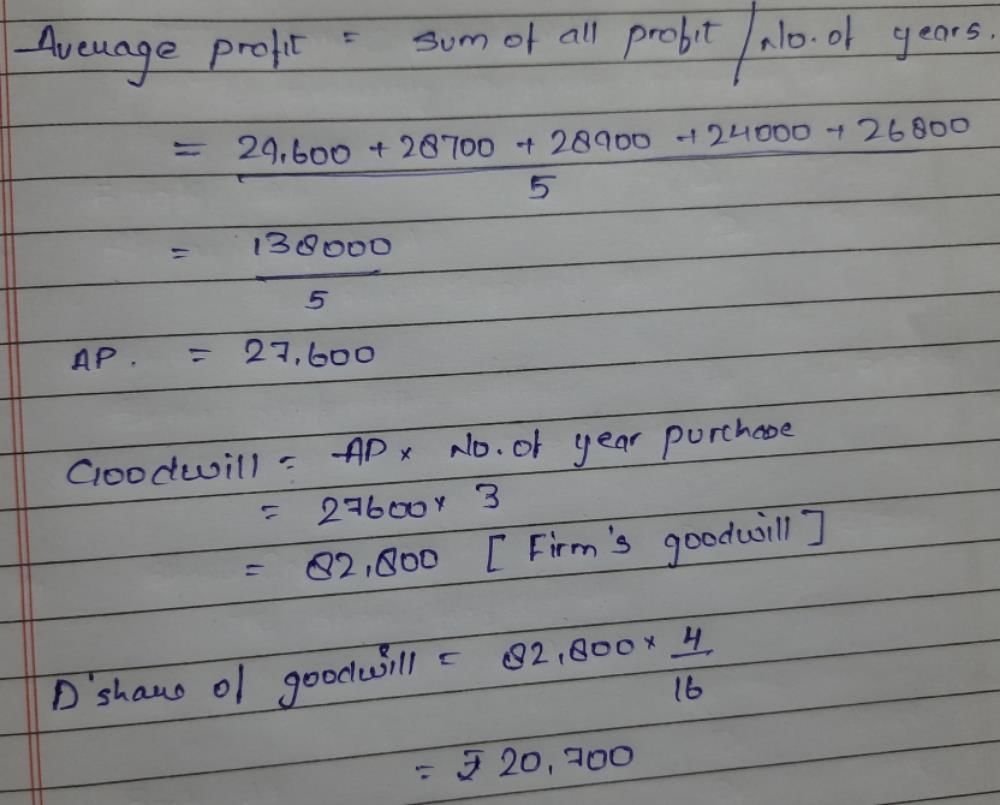

R, J and D are the partners sharing profits in the ratio 7:5:4. D died on 30th June 2006. It was decided to value the goodwill on the basis of three year’s purchase of last five years average profits. If the profits are Rs. 29,600; Rs. 28,700; Rs. 28,900; Rs. 24,000 and Rs. 26,800. What will be D’s share of goodwill?- a)Rs. 20,700.

- b)Rs. 27,600.

- c)Rs. 82,800.

- d)Rs. 27,000.

Correct answer is option 'A'. Can you explain this answer?

R, J and D are the partners sharing profits in the ratio 7:5:4. D died on 30th June 2006. It was decided to value the goodwill on the basis of three year’s purchase of last five years average profits. If the profits are Rs. 29,600; Rs. 28,700; Rs. 28,900; Rs. 24,000 and Rs. 26,800. What will be D’s share of goodwill?

a)

Rs. 20,700.

b)

Rs. 27,600.

c)

Rs. 82,800.

d)

Rs. 27,000.

|

Shrish Jaiswal answered |

A, B and C were partners sharing profits and losses in the ratio of 3:2:1. A retired and Goodwill of the firm is to be valued at Rs. 24,000 and Goodwill Account is to be raise which is not appearing in the balance sheet. What will be the treatment for goodwill?- a)Credited to Revaluation Account at Rs. 24,000.

- b)Credited to partners capital account Rs. 24,000 in profits sharing ratio.

- c)Only A’s capital account credited with Rs. 12,000.

- d)Only A’s capital account credited with Rs. 24,000.

Correct answer is option 'B'. Can you explain this answer?

A, B and C were partners sharing profits and losses in the ratio of 3:2:1. A retired and Goodwill of the firm is to be valued at Rs. 24,000 and Goodwill Account is to be raise which is not appearing in the balance sheet. What will be the treatment for goodwill?

a)

Credited to Revaluation Account at Rs. 24,000.

b)

Credited to partners capital account Rs. 24,000 in profits sharing ratio.

c)

Only A’s capital account credited with Rs. 12,000.

d)

Only A’s capital account credited with Rs. 24,000.

|

Sameer Basu answered |

Treatment for Goodwill

The treatment for goodwill in this scenario would be to credit it to the partners' capital accounts in the profits sharing ratio. Option B is the correct answer.

Explanation:

Under the given scenario, A, B, and C are partners sharing profits and losses in the ratio of 3:2:1. Goodwill of the firm is valued at Rs. 24,000, and it is not appearing in the balance sheet. In such cases, the treatment for goodwill is as follows:

1. Goodwill Account: Goodwill is an intangible asset that represents the reputation, customer base, and other non-physical attributes of a business. It is valued in monetary terms and should be recorded in the books of accounts. However, since it is not appearing in the balance sheet, the first step is to raise a Goodwill Account by crediting it with the value of goodwill, i.e., Rs. 24,000.

2. Revaluation Account: Revaluation Account is used to record the adjustments made to the assets and liabilities of the firm when there is a change in the partnership. However, in this scenario, there is no mention of any revaluation of assets or liabilities. Hence, the option of crediting Goodwill to the Revaluation Account at Rs. 24,000 (Option A) is not applicable.

3. Partners' Capital Accounts: The final step in the treatment of goodwill is to distribute it among the partners' capital accounts. As per the profits sharing ratio of 3:2:1, the amount of Rs. 24,000 should be divided in the same ratio.

- A's capital account will be credited with Rs. (24,000 * 3/6) = Rs. 12,000

- B's capital account will be credited with Rs. (24,000 * 2/6) = Rs. 8,000

- C's capital account will be credited with Rs. (24,000 * 1/6) = Rs. 4,000

Hence, the correct treatment for goodwill in this scenario would be to credit it to the partners' capital accounts in the profits sharing ratio, as mentioned in option B.

The treatment for goodwill in this scenario would be to credit it to the partners' capital accounts in the profits sharing ratio. Option B is the correct answer.

Explanation:

Under the given scenario, A, B, and C are partners sharing profits and losses in the ratio of 3:2:1. Goodwill of the firm is valued at Rs. 24,000, and it is not appearing in the balance sheet. In such cases, the treatment for goodwill is as follows:

1. Goodwill Account: Goodwill is an intangible asset that represents the reputation, customer base, and other non-physical attributes of a business. It is valued in monetary terms and should be recorded in the books of accounts. However, since it is not appearing in the balance sheet, the first step is to raise a Goodwill Account by crediting it with the value of goodwill, i.e., Rs. 24,000.

2. Revaluation Account: Revaluation Account is used to record the adjustments made to the assets and liabilities of the firm when there is a change in the partnership. However, in this scenario, there is no mention of any revaluation of assets or liabilities. Hence, the option of crediting Goodwill to the Revaluation Account at Rs. 24,000 (Option A) is not applicable.

3. Partners' Capital Accounts: The final step in the treatment of goodwill is to distribute it among the partners' capital accounts. As per the profits sharing ratio of 3:2:1, the amount of Rs. 24,000 should be divided in the same ratio.

- A's capital account will be credited with Rs. (24,000 * 3/6) = Rs. 12,000

- B's capital account will be credited with Rs. (24,000 * 2/6) = Rs. 8,000

- C's capital account will be credited with Rs. (24,000 * 1/6) = Rs. 4,000

Hence, the correct treatment for goodwill in this scenario would be to credit it to the partners' capital accounts in the profits sharing ratio, as mentioned in option B.

R, J and D are the partners sharing profits in the ratio 7:5:4. D died on 30th June 2006. It was decided to value the goodwill on the basis of three year’s purchase of last five years average profits. If the profits are Rs. 29,600; Rs. 28,700; Rs. 28,900; Rs. 24,000 and Rs. 26,800. What will be D’s share of goodwill?- a)Rs. 20,700

- b)Rs. 27,600

- c)Rs. 82,800

- d)Rs. 27,000

Correct answer is option 'A'. Can you explain this answer?

R, J and D are the partners sharing profits in the ratio 7:5:4. D died on 30th June 2006. It was decided to value the goodwill on the basis of three year’s purchase of last five years average profits. If the profits are Rs. 29,600; Rs. 28,700; Rs. 28,900; Rs. 24,000 and Rs. 26,800. What will be D’s share of goodwill?

a)

Rs. 20,700

b)

Rs. 27,600

c)

Rs. 82,800

d)

Rs. 27,000

|

Tarun Chaudhary answered |

(29600+28700+28900+24000+26800) /5=27600

goodwill on the basis of 3 year purchase=27600×3=82800.

D's share of goodwill = (82800×4) /16=20700.

goodwill on the basis of 3 year purchase=27600×3=82800.

D's share of goodwill = (82800×4) /16=20700.

Retirement or death of a partner will create a situation for the continuing partners, which is known as:- a)Dissolution of firm

- b)Liquidation

- c)Reconstitution

- d)Both Dissolution of firm and Liquidation

Correct answer is option 'C'. Can you explain this answer?

Retirement or death of a partner will create a situation for the continuing partners, which is known as:

a)

Dissolution of firm

b)

Liquidation

c)

Reconstitution

d)

Both Dissolution of firm and Liquidation

|

Pallavi Chopra answered |

Retirement or death of a partner will create a situation for the continuing partners, which is known as Reconstitution.

On death of a partner, his executor is paid the share of profits of the dying partner for the relevant period. This payment is recorded in Profit & Loss ……… Account.- a)Adjustment.

- b)Appropriation.

- c)Suspense.

- d)Reserve.

Correct answer is option 'C'. Can you explain this answer?

On death of a partner, his executor is paid the share of profits of the dying partner for the relevant period. This payment is recorded in Profit & Loss ……… Account.

a)

Adjustment.

b)

Appropriation.

c)

Suspense.

d)

Reserve.

|

Sounak Jain answered |

On death of a partner, his executor is paid the share of profits of the dying partner for the relevant period. This payment is recorded in Profit & Loss Account.

Explanation:

Explanation:

Which of the following is effect of the retirement of a partner?- a)The combined share of remaining partners increases

- b)The combined share of remaining partners decreases

- c)The combined share of remaining partners remains same

- d)Both The combined share of remaining partners decreases and The combined share of remaining partners remains same

Correct answer is option 'A'. Can you explain this answer?

Which of the following is effect of the retirement of a partner?

a)

The combined share of remaining partners increases

b)

The combined share of remaining partners decreases

c)

The combined share of remaining partners remains same

d)

Both The combined share of remaining partners decreases and The combined share of remaining partners remains same

|

Mansi Mukherjee answered |

The main effect of retirement of a partner is that the combined share of remaining partners increases.

A, B and C are partners sharing profits equally. A retires and goodwill appearing in the books at Rs. 3,000 is valued at Rs. 6,000. A will get credit of :- a)Rs. 2,000

- b)Rs. 3,000

- c)Rs. 500

- d)Rs. 1,000

Correct answer is option 'D'. Can you explain this answer?

A, B and C are partners sharing profits equally. A retires and goodwill appearing in the books at Rs. 3,000 is valued at Rs. 6,000. A will get credit of :

a)

Rs. 2,000

b)

Rs. 3,000

c)

Rs. 500

d)

Rs. 1,000

|

Divya Dasgupta answered |

Valuation of Goodwill on Retirement of a Partner

- Goodwill is an intangible asset that represents the value of a firm's brand name, reputation, customer base, and other such factors that contribute to its earning capacity.

- When a partner retires from a partnership firm, the goodwill of the firm needs to be revalued to account for the change in the partnership.

- The amount by which the revalued goodwill exceeds its book value is known as the 'Gaining Ratio'.

- The gaining ratio represents the new profit sharing ratio among the remaining partners.

- The retiring partner is entitled to a share of the excess goodwill in proportion to their profit-sharing ratio in the old firm.

Calculation of Credit to Retiring Partner

- In this case, the partners A, B, and C share profits equally, i.e. in the ratio of 1:1:1.

- A retires, and the goodwill appearing in the books at Rs. 3,000 is valued at Rs. 6,000.

- The gaining ratio is calculated as follows:

Gaining Ratio = New Profit Sharing Ratio - Old Profit Sharing Ratio

= (B:C) - (A:B:C)

= (1:1)/(1:1:1)

= 1:1 - 1:1:1

= 0:1:1

- The retiring partner A is entitled to a share of the excess goodwill in proportion to their profit-sharing ratio in the old firm, i.e. 1/3.

- Therefore, A's credit will be calculated as follows:

Credit to Retiring Partner = Gaining Ratio x Excess Goodwill x Retiring Partner's Profit-Sharing Ratio

= 0:1:1 x (6,000 - 3,000) x 1/3

= 0 x 3,000 x 1/3

= 0

- Hence, the credit to retiring partner A is Rs. 0, which means that they are not entitled to any share of the excess goodwill.

- Goodwill is an intangible asset that represents the value of a firm's brand name, reputation, customer base, and other such factors that contribute to its earning capacity.

- When a partner retires from a partnership firm, the goodwill of the firm needs to be revalued to account for the change in the partnership.

- The amount by which the revalued goodwill exceeds its book value is known as the 'Gaining Ratio'.

- The gaining ratio represents the new profit sharing ratio among the remaining partners.

- The retiring partner is entitled to a share of the excess goodwill in proportion to their profit-sharing ratio in the old firm.

Calculation of Credit to Retiring Partner

- In this case, the partners A, B, and C share profits equally, i.e. in the ratio of 1:1:1.

- A retires, and the goodwill appearing in the books at Rs. 3,000 is valued at Rs. 6,000.

- The gaining ratio is calculated as follows:

Gaining Ratio = New Profit Sharing Ratio - Old Profit Sharing Ratio

= (B:C) - (A:B:C)

= (1:1)/(1:1:1)

= 1:1 - 1:1:1

= 0:1:1

- The retiring partner A is entitled to a share of the excess goodwill in proportion to their profit-sharing ratio in the old firm, i.e. 1/3.

- Therefore, A's credit will be calculated as follows:

Credit to Retiring Partner = Gaining Ratio x Excess Goodwill x Retiring Partner's Profit-Sharing Ratio

= 0:1:1 x (6,000 - 3,000) x 1/3

= 0 x 3,000 x 1/3

= 0

- Hence, the credit to retiring partner A is Rs. 0, which means that they are not entitled to any share of the excess goodwill.

Claim of the retiring partner is payable in the following form.- a)Fully in cash.

- b)Fully transferred to loan account to be paid later with some interest on it.

- c)Partly in cash and partly as loan repayable later with agreed interest.

- d)Any of the above method

Correct answer is option 'D'. Can you explain this answer?

Claim of the retiring partner is payable in the following form.

a)

Fully in cash.

b)

Fully transferred to loan account to be paid later with some interest on it.

c)

Partly in cash and partly as loan repayable later with agreed interest.

d)

Any of the above method

|

Divey Sethi answered |

Claim of the retiring partner is payable in the following form:

There are several options for the payment of the retiring partner's claim:

A: Fully in cash

- The retiring partner's claim is paid in full with cash.

- This option provides immediate liquidity to the retiring partner.

B: Fully transferred to loan account to be paid later with some interest on it

- The retiring partner's claim is transferred to a loan account.

- The payment is deferred and the retiring partner will receive the amount with interest at a later date.

- This option allows for flexibility in managing the cash flow of the partnership.

C: Partly in cash and partly as loan repayable later with agreed interest

- The retiring partner's claim is divided into two parts.

- A portion is paid in cash immediately, while the remaining amount is transferred to a loan account to be repaid later with interest.

- This option provides both immediate liquidity and the opportunity to earn interest on the remaining amount.

D: Any of the above methods

- The retiring partner's claim can be paid using any combination of the above methods.

- The specific payment method can be determined through negotiation and agreement between the retiring partner and the remaining partners.

In conclusion, the retiring partner's claim can be paid in various forms, including full cash payment, transfer to a loan account, or a combination of cash and loan repayment. The choice of payment method depends on factors such as liquidity needs, cash flow management, and agreement between the partners.

There are several options for the payment of the retiring partner's claim:

A: Fully in cash

- The retiring partner's claim is paid in full with cash.

- This option provides immediate liquidity to the retiring partner.

B: Fully transferred to loan account to be paid later with some interest on it

- The retiring partner's claim is transferred to a loan account.

- The payment is deferred and the retiring partner will receive the amount with interest at a later date.

- This option allows for flexibility in managing the cash flow of the partnership.

C: Partly in cash and partly as loan repayable later with agreed interest

- The retiring partner's claim is divided into two parts.

- A portion is paid in cash immediately, while the remaining amount is transferred to a loan account to be repaid later with interest.

- This option provides both immediate liquidity and the opportunity to earn interest on the remaining amount.

D: Any of the above methods

- The retiring partner's claim can be paid using any combination of the above methods.

- The specific payment method can be determined through negotiation and agreement between the retiring partner and the remaining partners.

In conclusion, the retiring partner's claim can be paid in various forms, including full cash payment, transfer to a loan account, or a combination of cash and loan repayment. The choice of payment method depends on factors such as liquidity needs, cash flow management, and agreement between the partners.

A, B, and C were partners in a firm sharing profits and losses in the ratio of 2:2:1, respectively, with capital balances of Rs. 50,000 for A and B, and Rs. 25,000 for C. B declared to retire from the firm, and the balance in reserve on that date was Rs. 15,000. If the goodwill of the firm was valued at Rs. 30,000 and the profit on revaluation was Rs. 7,050, what amount will be transferred to the loan account of B?- a)Rs. 50,820

- b)Rs. 70,820

- c)Rs. 25,820

- d)Rs. 58,820

Correct answer is option 'B'. Can you explain this answer?