UPSC Daily Current Affairs: 20th September 2024 | Current Affairs & Hindu Analysis: Daily, Weekly & Monthly PDF Download

GS1/History & Culture

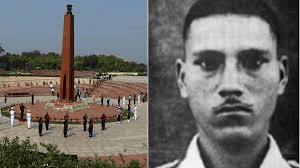

A poem on ‘National War Memorial’ and a chapter on ‘Veer Abdul Hameed’ included in NCERT

Source: India Today

Why in news?

Recently, a poem about the National War Memorial and a chapter on Veer Abdul Hameed have been integrated into the NCERT curriculum for Class VI, as introduced by the Ministries of Defence and Education. This initiative highlights significant historical figures and events, emphasizing their importance in Indian history.

About the National War Memorial

- The National War Memorial was inaugurated on 25th February 2019.

- It serves as a tribute to Indian soldiers who laid down their lives in various conflicts, including wars against Pakistan and China, the 1961 Goa war, and Operation Pawan.

- The memorial is architecturally designed in a C-hexagon layout, featuring the names of fallen soldiers inscribed on its walls.

Designed by Yogesh Chandrasan from WeBe Design Lab, the memorial incorporates several significant elements:

- Amar Chakra (Circle of Immortality): This section includes the 'Eternal Flame', symbolizing the nation's perpetual remembrance of the soldiers.

- Veerta Chakra: This showcases six bronze murals illustrating acts of valour and bravery by Indian soldiers.

- Rakshak Chakra: Representing protection, this part includes trees symbolizing troops safeguarding the nation.

- Tyag Chakra (Circle of Sacrifice): Features concentric granite walls that honour soldiers who have died since India gained independence.

- The memorial also displays busts of 21 soldiers awarded the Param Vir Chakra, India’s highest military honour.

Who was Veer Abdul Hameed?

- Abdul Hamid served in the 4th Grenadiers regiment of the Indian Army.

- He is renowned for his bravery during the Battle of Asal Uttar in the 1965 India-Pakistan war, which occurred near the India-Pakistan border in Punjab.

- On 10th September 1965, he famously destroyed three Pakistani tanks and damaged a fourth near Chima village, showcasing exceptional courage during combat.

- For his valiant efforts, he was posthumously awarded the Param Vir Chakra, India's highest military honour.

- A war memorial, which includes a captured Patton tank, now stands at the site of his death as a tribute to his bravery.

GS2/Polity

SC Dismisses Telecom Companies' Curative Petitions Against Ruling On AGR Dues

Source: Live Law

Why in news?

Recently, the Supreme Court of India dismissed curative petitions filed by major telecom companies, including Vodafone Idea and Bharti Airtel, regarding their Adjusted Gross Revenue (AGR) dues. These companies sought a review of the Court's October 2019 judgment (Vodafone Idea Limited v. Union of India), which held them liable to pay AGR dues.

About

- Telecom operators are mandated to pay a license fee and spectrum charges as a percentage of their revenue to the government.

- The revenue amount used for determining this payment is called the AGR.

Calculation of AGR and Controversy

- The Department of Telecom asserts that revenue calculations should include all income generated by a telecom company.

- This encompasses revenues from non-telecom sources, such as interest on deposits and asset sales.

- The companies argue that AGR should only consist of revenues from telecom services, excluding non-telecom income.

Legal battle over definition of AGR

- Telecom companies and the government have engaged in legal disputes concerning the definition of AGR and its revenue sources.

- In October 2019, the Supreme Court broadened the definition of AGR to align with the government's perspective.

- The Court ruled that all revenues, barring termination fees and roaming charges, should be included in the AGR calculation.

Final Ruling on AGR issue

- On September 1, 2020, the Supreme Court issued a definitive ruling regarding AGR dues.

- Telecom companies were instructed to pay the AGR along with interest and penalties for any overdue payments.

- Providers were required to settle these payments in annual installments from April 1, 2021, to March 31, 2031.

- Failure to make payments would result in automatic penalties and could lead to contempt of court charges.

Steps taken by Government after SC Judgement of 2020

- In September 2021, the Union Cabinet approved a telecom reforms initiative aimed at enhancing liquidity and facilitating business operations.

- Telecom companies were granted the option of a four-year moratorium on their spectrum and AGR dues.

- This means that they could defer payment of principal amounts, interest, and penalties for four years.

- The government also provided a unique opportunity for telecom companies to convert deferred interest into equity after the four-year period.

About the news

- The Supreme Court has rejected curative petitions submitted by telecom service providers against its October 2019 ruling.

- The 2019 ruling supported the Department of Telecom's (DoT) efforts to reclaim approximately ₹92,000 crores from these companies.

Background of the present case

- In October 2019, the Supreme Court allowed the Centre's request to recover ₹92,000 crores in AGR dues from telecom companies.

- A three-judge bench upheld the AGR definition set forth by the DoT.

- In January 2020, the Court rejected appeals from Vodafone Idea, Bharti Airtel, and Tata Teleservices to overturn the widened AGR definition.

- In September 2020, the SC mandated telecom companies to pay their AGR dues over a decade, after the DoT proposed a staggered payment plan over 20 years.

- In 2021, the SC dismissed appeals from telecom firms contesting errors in the AGR dues calculations as per the October 2019 judgment.

- In 2023, telecom companies filed curative petitions against the Court's January 2020 ruling that dismissed their review petitions.

- These curative petitions were considered by three senior judges of the Court and were recently dismissed.

No ground to exercise curative jurisdiction

- The SC stated that no valid reasons were presented to warrant the use of curative jurisdiction as per the precedent set in Rupa Ashok Hurra v. Ashok Hurra.

- The Supreme Court established the concept of curative petitions in this landmark case.

- The five-judge bench noted that Article 142 of the Constitution allows the Supreme Court to take necessary actions to ensure complete justice.

- To safeguard the rights of litigants, the Constitution Bench introduced the theory of curative petitions.

- Such petitions are only considered under compelling circumstances, such as:

- Violation of principles of natural justice.

- Judicial bias.

This sector has benefitted immensely

- The Supreme Court highlighted that the telecom sector has greatly benefited from the government's revenue-sharing payment model from 2004 to 2015.

- Despite the financial advantages gained, telecom service providers have sought to avoid paying the agreed license fees based on the defined AGR.

GS2/Governance

FATF on India: Effective Money Laundering system, low prosecution

Source: The Hindu

Why in news?

The Financial Action Task Force (FATF) has positioned India in the "regular follow-up" category for its effective anti-money laundering and counter-terrorism financing system. However, it has emphasized the necessity for substantial enhancements in the prosecution of such cases.

Key Highlights of the FATF Mutual Evaluation Report on India:

- “Regular Follow-up” Category: India is recognized for having an effective system to combat money laundering and terrorist financing, but improvements are needed in prosecuting related cases.

- Financial Institutions: There is a pressing need for improved risk profiling of customers. The Ministry of Corporate Affairs (MCA) requires better monitoring to ensure accurate ownership information.

- Money Laundering Risks: Major sources of money laundering in India include fraud, cyber-enabled fraud, corruption, and drug trafficking. Terror threats are primarily linked to groups like the Islamic State and al-Qaeda in Jammu and Kashmir.

- Non-Profit Organisations (NPOs): India must bolster measures to prevent the misuse of the NPO sector for financing terrorism and enhance outreach efforts to vulnerable NPOs.

- Improvements in Sanctions Framework: There is a need for a more efficient targeted financial sanctions framework to ensure prompt freezing of assets linked to terrorism financing.

- Domestic Politically Exposed Persons (PEPs): The report calls for India to define domestic PEPs under anti-money laundering laws and to improve identification and risk-based measures concerning them.

- Delay in Prosecution: The report highlighted delays in prosecution due to pending review petitions, which hampers the resolution of cases under the Prevention of Money Laundering Act (PMLA).

Challenges faced by the Indian Government:

- Prosecution and Conviction Delays: Although there has been an increase in investigations, the number of prosecutions and convictions remains low, with significant delays in trials, especially under the PMLA.

- Constitutionality Issues: Legal challenges regarding the constitutionality of the PMLA from 2014 to 2022 have disrupted the progress in prosecuting cases of terror financing and money laundering.

- Risk Profiling of Financial Customers: Better risk profiling in financial institutions is essential for more effectively addressing money laundering.

- Inaccurate Ownership Information: There is an ongoing challenge to ensure accurate ownership information in the MCA registry, particularly concerning investments from tax havens.

- Ensuring Non-Profit Security: Better coordination and focused outreach by authorities are required to prevent the abuse of non-profits for terror financing.

- Lack of Definition for Domestic PEPs: While foreign PEPs are defined, a clear definition for domestic PEPs under the PMLA is missing, creating a gap in the anti-money laundering framework.

- Fast-Tracking Trials: Although there's recognition of the need to expedite trials in money laundering and terrorism financing cases, progress in this area remains slow.

Way Forward:

- Strengthen Legal and Institutional Framework: India should establish clear definitions for domestic Politically Exposed Persons (PEPs) within anti-money laundering laws and enhance targeted financial sanctions to enable timely asset freezing.

- Enhance Risk Management and Monitoring: Financial institutions ought to improve risk profiling and enforce stricter Know Your Customer (KYC) processes, while the MCA should ensure accurate ownership data, especially for investments from tax havens.

- Mains PYQ:

Discuss how emerging technologies and globalization contribute to money laundering. Elaborate measures to tackle the problem of money laundering both at national and international levels. (UPSC IAS/2021)

GS3/Economy

White Revolution 2.0

Source: The Hindu

Why in News?

The Ministry of Cooperation has launched an initiative aimed at empowering women farmers and creating job opportunities within the dairy cooperative sector.

What is White Revolution 2.0?

- Objective: Aiming to transform India’s dairy sector by empowering women farmers, increasing milk production, and modernizing dairy infrastructure.

- Target: The goal is to boost milk procurement from the current 660 lakh litres per day to 1,000 lakh litres per day.

- Funding:

- Initial funding of ₹40,000 per Multi-Purpose Primary Agricultural Credit Society (PACS) provided by the National Dairy Development Board.

- Total budget outlay of ₹70,125 crore will be supported fully by the government.

Provisions and Features

- Women Empowerment: Emphasis on empowering women in the dairy sector and reinforcing women's cooperatives.

- Increase in Milk Procurement: The initiative aims to enhance procurement by 50% over the next five years.

- Cooperative Infrastructure: Establishment or enhancement of 100,000 new and existing cooperative societies, including district cooperative societies and Primary Agricultural Credit Societies.

- RuPay Kisan Credit Cards: A nationwide rollout for dairy farmers, featuring micro-ATMs at cooperative societies.

- Computerisation of Primary Agricultural Credit Societies: A total of 67,930 PACS will be computerized for improved management.

Significance

- Leadership Opportunities: This initiative will create leadership roles for women in the dairy industry, promoting gender equality.

- Boost to Rural Economy: Strengthening cooperatives and increasing milk procurement is expected to enhance rural livelihoods.

- Improved Infrastructure: The introduction of modern technology, micro-ATMs, and computerized systems will increase operational efficiency.

- Job Creation: The expansion of cooperatives and adoption of modern practices are projected to generate jobs for 130 million farmers.

- Malnutrition Reduction: The initiative aims to improve the quality of dairy products to help combat malnutrition.

- Cooperative Modernisation: A focus on integrating Artificial Intelligence and advanced technologies into dairy operations.

- Dairy Exports Boost: Enhanced production and quality are expected to improve India’s dairy export capabilities.

PYQ:

[2017] Explain various types of revolutions that have occurred in agriculture since India's independence. Discuss how these revolutions have contributed to poverty alleviation and food security in India.

GS3/Economy

Why US Fed cut interest rates, how India could be impacted?

Source: Indian Express

Why in News?

The United States Federal Reserve, which oversees the nation's monetary policy, has recently decided to reduce its key interest rate, known as the Federal Funds Rate, by 0.5%, or 50 basis points. This decision is significant and warrants a closer look at the reasons behind it and the potential implications for India.

Reasons for the Fed's Rate Cut

- The Federal Reserve's decision to lower interest rates aims to tackle rising unemployment concerns amidst stabilizing inflation.

- Following a series of aggressive rate increases to combat high inflation spurred by post-COVID recovery and geopolitical events like the Russia-Ukraine war, inflation has started to moderate, approaching the Fed's target of 2%.

- Recent unemployment data suggested that the ongoing restrictive monetary policy could negatively impact the labor market, prompting the Fed's action.

Prospects for the US Economy

- Optimistic Projections: Despite earlier fears that persistent inflation could trigger a recession, the Fed's current strategy might successfully lead to a 'soft landing', whereby inflation decreases without derailing economic stability.

- GDP Growth: The Summary of Economic Projections (SEP) anticipates GDP growth to hover around 2% in the coming years, indicating a steady economic outlook.

- Unemployment Rates: Although the unemployment rate has slightly increased to 4.4%, it remains manageable with expectations of gradual improvement.

- Risks Ahead: Potential shifts in policy, particularly with the upcoming presidential election, could disrupt the economic forecast, especially if trade tariffs are introduced.

Impact on India

- Increased Foreign Investments: The reduction in US interest rates may motivate foreign investors to borrow more in the US and subsequently invest in India via stocks, bonds, or foreign direct investment (FDI), thus enhancing capital inflow.

- Rupee Strengthening: As US interest rates decline, the US dollar could weaken against the Indian rupee, which may strengthen the rupee. This scenario could pose challenges for Indian exporters but benefit importers.

- RBI’s Interest Rate Decisions: While the Fed's rate cuts influence global markets, India's Reserve Bank (RBI) might not directly mirror these changes due to differing inflation targets and mandates. The RBI's priorities include controlling inflation and fostering GDP growth over focusing solely on unemployment figures.

Way Forward for India

- Encourage Capital Inflows: India should leverage the lower US interest rates to attract foreign investments by improving the ease of doing business and promoting growth in critical sectors such as infrastructure, technology, and manufacturing.

- Maintain Monetary Stability: The RBI should carefully evaluate global trends while prioritizing domestic economic conditions when making interest rate adjustments, focusing on inflation control, financial stability, and sustainable GDP growth.

- Mains PYQ: Do you agree with the view that steady GDP growth and low inflation have left the Indian economy in good shape? Provide reasons to support your argument. (UPSC IAS/2016)

GS3/Science and Technology

Amoebic Meningoencephalitis

Source: The Hindu

Why in News?

This year, Kerala has experienced a notable increase in cases linked to free-living amoebae (FLA) found in freshwater bodies such as ponds, lakes, and rivers. Additionally, Kerala has reported a variety of amoebic infections, including those caused by Vermamoeba vermiforis and Acanthamoeba.

What is Primary Amoebic Meningoencephalitis (PAM)?

- PAM is primarily triggered by Naegleria fowleri, often called the "brain-eating amoeba."

- This organism is known for damaging brain tissue, which leads to significant swelling and is often fatal.

- An amoeba is classified as a unicellular organism capable of changing its shape by extending and retracting pseudopods.

- Optimal growth conditions for Naegleria fowleri include high temperatures, with survival possible at up to 115°F (46°C).

- The amoeba typically enters the body through the nose during activities such as swimming in warm freshwater, ultimately reaching the brain and causing severe harm.

- PAM is categorized as non-communicable, meaning it cannot be spread from person to person.

Symptoms:

- Common symptoms include headache, fever, nausea, vomiting, stiff neck, confusion, seizures, hallucinations, and coma.

- According to the US Centers for Disease Control and Prevention (CDC), most individuals diagnosed with PAM can succumb to the illness within 1 to 18 days after the onset of symptoms, with a typical progression leading to coma and death in about 5 days.

Diagnosis and Treatment:

- Currently, there are no proven effective treatments available for PAM.

- Diagnosis is primarily conducted through PCR testing of cerebrospinal fluid, though this can be difficult due to the infrequency of PAM cases.

- Treatment adheres to CDC recommendations, which involve medication options such as miltefosine, Azithromycin, and Amphotericin B. Recently, miltefosine was acquired by the State Health Department from Germany.

- Medical treatment generally includes a combination of drugs, specifically amphotericin B, azithromycin, fluconazole, rifampin, miltefosine, and dexamethasone.

GS3/Environment

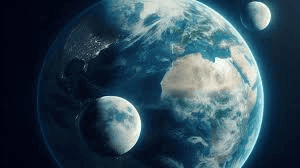

Why Earth will temporarily get a ‘Mini-Moon’ in September?

Source: Indian Express

Why in News?

In a unique astronomical event, Earth is set to experience the presence of a small asteroid, which will create a temporary “mini-moon” for a duration of two months.

What is a Mini-Moon?

- A mini-moon is a small asteroid that becomes temporarily captured by Earth's gravitational field.

- Unlike the Earth's permanent moon, mini-moons orbit the planet for a limited time before they escape back into space.

- These celestial bodies typically remain in orbit for a few months to a few years before being ejected.

Rarity of Mini-Moons

- Mini-moons are an uncommon phenomenon; most asteroids either pass by Earth or burn up in the atmosphere instead of being captured.

- They are usually small in size, often measuring just a few meters in diameter.

- For instance, the current mini-moon is approximately 33 feet (10 meters) long.

- These asteroids are challenging to detect and are often identified through advanced telescopic surveys, such as NASA’s Asteroid Terrestrial-impact Last Alert System (ATLAS).

Significance of Mini-Moons

- Mini-moons provide a valuable opportunity for scientists to study near-Earth objects, improving our understanding of asteroids and their behavior.

- They may contain precious minerals or water, making them potential targets for future space missions aimed at resource extraction.

- Research on mini-moons can enhance our knowledge of Earth's gravitational influence and its interactions with various space objects.

PYQ:

[2011] What is the difference between asteroids and comets?

1. Asteroids are small rocky planetoids, while comets consist of frozen gases held together by rocky and metallic materials.

2. Asteroids are primarily found in the region between the orbits of Jupiter and Mars, whereas comets are usually located between Venus and Mercury.

3. Comets exhibit a visible glowing tail, in contrast to asteroids, which do not display such features.

Which of the statements given above is/are correct?

(a) 1 and 2 only

(b) 1 and 3 only

(c) 3 only

(d) 1, 2 and 3

GS3/Economy

Food Processing Sector Reforms in Last 10 Years

Source: Indian Express

Why in News?

While addressing the 3rd edition of World Food India 2024, the Indian PM stated that the government has implemented numerous reforms over the past decade to enhance the food processing sector. He also mentioned that the Global Food Regulators Summit organized by FSSAI will bring together international regulators (including WHO and FAO) and domestic institutions to discuss crucial topics like food safety, quality standards, and best practices.

Food Processing Sector in India:

Scenario:

Food processing in India is recognized as a 'Sunrise sector' that plays a vital role in connecting Indian farmers with consumers in both domestic and international markets. Key segments of the food processing industry include:

- Processed fruits and vegetables

- Ready-to-eat/cook (RTE/RTC)

- Mozzarella cheese

- Processed marine products

- Edible oils

- Beverages

- Dairy products

This sector has experienced significant growth, averaging an annual growth rate of around 7.3% from 2015 to 2022. It accounts for approximately 12.22% of employment generated in all registered factory sectors, engaging about 2.03 million individuals. The unregistered food processing sector employs an additional 5.1 million workers, representing 14.18% of the unregistered manufacturing workforce.

Growth drivers:

- Agri-commodity hub: India's diverse agro-climatic conditions provide a vast raw material base that supports the food processing industries.

- Natural resources: India has access to abundant natural resources that give it a competitive advantage in food processing.

- Leading producer: India is the largest producer of milk and spices and ranks among the top in fruits, vegetables, poultry, and meat production.

- Consumer base: A large consumer market and robust economy, coupled with favorable policies like One District, One Product (ODOP), foster growth.

Future prospects:

The food processing sector in India is projected to expand significantly, with estimates suggesting a market size increase from US$ 866 billion in 2022 to US$ 1,274 billion by 2027. This growth is driven by changing lifestyles and food habits, fueled by rising disposable incomes and urbanization.

Steps Taken by the Government (MoFPI) to Boost Food Processing Sector in India:

- PM Kisan SAMPADA Yojana (PMKSY): A comprehensive initiative aimed at creating modern infrastructure and efficient supply chain management from farm to retail.

- PM Formalisation of Micro food processing Enterprises (PMFME) Scheme: This scheme is designed to enhance existing micro-enterprises operating in the unorganized segment of the food processing industry.

- Production Linked Incentive Scheme for Food Processing Industry (PLISFPI): Aims to boost domestic manufacturing and exports while supporting food manufacturing entities with specified sales. Allows 100% FDI in the sector and provides complete profit exemption for the first five years.

- The One District One Product (ODOP) scheme: Launched under PMFME, it focuses on value chain development and infrastructure support, with 713 districts approved for 137 unique products.

- The Mega Food Park (MFP) scheme: Follows a cluster approach to establish modern food processing units within specific agricultural zones; 41 projects have been approved, with 24 operational as of December 2023.

- Operation Greens: Initiated to enhance Farmer Producer Organizations (FPOs), agri-logistics, processing facilities, and management, initially focusing on Tomato, Onion, and Potato (TOP) value chains since 2018; now extended to all fruits and vegetables (TOTAL) as part of the "Aatmanirbhar Bharat Package."

Challenges:

- Lack of modern infrastructure: Many SMEs in the food processing sector struggle with outdated facilities and technology.

- Inefficient supply chains: Inadequate storage and transport facilities hinder the sector's efficiency.

- Access to credit: Limited financing options make it challenging for SMEs to enter the market and compete with larger companies.

Impact of these issues:

These challenges impede the ability of SMEs to thrive and compete effectively against more established firms.

Road ahead:

With the increasing demand for processed food domestically and internationally, alongside supportive government initiatives, the food processing sector is poised for significant growth. Collaborative efforts among stakeholders—including government entities and private players—are crucial to realizing the sector's full potential and enhancing its contribution to India's GDP and economic development.

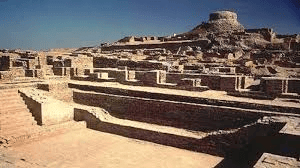

GS1/History & Culture

100 Years of Harappan Civilization

Source: Money Control

Why in News?

It has been 100 years since the discovery of the Harappan Civilization, announced by John Marshall on September 20, 1924.

Harappa: Remains of a Civilization

- The Harappan Civilization, also known as the Indus Valley Civilization, thrived between 2600 BCE and 1900 BCE, with earlier settlements tracing back to 3200 BCE.

- Its origins are linked to Mehrgarh in Balochistan, which dates back to 7000 BCE.

- It is recognized as one of the three earliest civilizations alongside Egypt and Mesopotamia.

- The civilization extended across more than 1.5 million square kilometers, encompassing parts of present-day India, Pakistan, and Afghanistan.

- Key remains of the civilization include:

- Well-planned cities featuring a grid layout and fortified structures.

- Advanced drainage systems with underground sewers indicating a focus on hygiene.

- Granaries and warehouses that point to organized trade and food storage practices.

- Seals crafted from steatite, often engraved with animals and an undeciphered script, suggesting a complex administrative system.

- Craftsmanship in pottery, bead making, terracotta figurines, metal artifacts, and weaving.

- Water management systems like reservoirs and wells, showcasing advanced hydraulic engineering.

The Discoverers:

- Daya Ram Sahni excavated Harappa in 1921-22, uncovering seals, pottery, and beads.

- Rakhal Das Banerji excavated Mohenjo-daro in 1922, finding similar items, including seals and copper artifacts.

- Both archaeologists noted the resemblance between objects from Harappa and Mohenjo-daro, even though the sites are 640 km apart.

About the Mohenjo-daro Site:

- Mohenjo-daro is one of the largest cities of the Harappan Civilization, located in the Sindh province, discovered in the early 1920s.

- The city exemplifies ancient urban planning:

- Great Bath: A significant structure thought to be used for ritual bathing or religious ceremonies, recognized as one of the earliest public water tanks.

- Storage Facilities: Massive facilities near the citadel indicate an organized system for storing food for the community.

- Citadel and Lower Town: The city was divided into a raised area for the ruling elite and a lower town for commoners, both featuring well-designed streets and residential complexes.

- Drainage Systems: Covered drainage systems with individual toilets connected to a centralized network illustrate an advanced public sanitation system.

- Residential Buildings: Homes constructed from uniform mud bricks, often multi-storied, featuring courtyards and bathrooms. The standardization of brick sizes (ratio 1:2:4) reflects a high level of organization.

- Artefacts discovered at Mohenjo-daro include:

- Seals featuring animal motifs and the undeciphered Harappan script, likely used for administrative or trade purposes.

- Pottery and tools made of bronze and copper.

- Terracotta figurines, jewelry, and toys indicating a highly developed artistic culture.

- Weights and measures based on a uniform standard, suggesting a standardized economic system.

- The city's streets were aligned north-south and east-west, intersecting at right angles for efficient transportation, including bullock carts.

- Mohenjo-daro is believed to have established trade links, as evidenced by artefacts with Mesopotamian connections.

PYQ:

[2013] Which of the following characterizes/characterize the people of Indus Valley Civilization?

1. They possessed great palaces and temples.

2. They worshipped both male and female deities.

3. They employed horse-drawn chariots in warfare.

Select the correct statement/statements using the codes given below:

(a) 1 and 2 only

(b) 2 only

(c) 1, 2 and 3

(d) None of the statements given above is correct

|

38 videos|5293 docs|1118 tests

|

FAQs on UPSC Daily Current Affairs: 20th September 2024 - Current Affairs & Hindu Analysis: Daily, Weekly & Monthly

| 1. What is the significance of the National War Memorial in India? |  |

| 2. Who was Veer Abdul Hameed and why is he significant in Indian history? |  |

| 3. What are the key reforms in the food processing sector in India over the last decade? |  |

| 4. How does the FATF's evaluation impact India's economic policies? |  |

| 5. What are the implications of the US Fed cutting interest rates for India? |  |