UPSC Daily Current Affairs: 2nd February 2025 | Current Affairs & Hindu Analysis: Daily, Weekly & Monthly PDF Download

GS3/Economy

A Union Budget that Ticks Most of the Boxes

Source: The Hindu

Why in News?

The Union Budget for FY26 has been presented amid various domestic and global economic challenges, including a cyclical slowdown in India's economy, characterized by reduced urban consumption, slow job growth, and a still-nascent investment cycle. Despite these challenges, India's macroeconomic fundamentals remain robust, prompting the government to adopt a pragmatic fiscal management approach that balances economic stability with growth.

- The budget emphasizes fiscal discipline with a reduced fiscal deficit target of 4.4% of GDP for FY26.

- Personal income tax reforms are aimed at increasing disposable income and stimulating consumption.

- Capital expenditure allocations remain steady, focusing on long-term economic resilience.

- The budget introduces measures to enhance investment in real estate and support for MSMEs.

Additional Details

- Macroeconomic Stability: The budget prioritizes fiscal prudence, reducing the fiscal deficit from 4.8% of GDP in the current year to 4.4% in FY26, indicating a strategic unwinding of post-pandemic fiscal stimulus.

- Personal Income Tax Reforms: The government has reduced tax burdens for middle-class individuals, which is expected to increase disposable income and encourage spending in sectors like retail and hospitality.

- Real Estate Incentives: Tax benefits for self-occupied properties have been enhanced, allowing claims on two houses, which is anticipated to boost the real estate sector and related industries.

- Potential Risks: There are concerns regarding whether tax cuts will sustainably increase consumption or if savings will be prioritized instead, which could affect future fiscal health.

- Capital Expenditure Outlook: Despite initial concerns over reduced capital expenditure, the budget maintains a capex allocation of 3.1% of GDP, reflecting a commitment to infrastructure development.

- Long-Term Fiscal Strategy: The government aims to transition to a debt-targeting framework by FY27, with plans to reduce central government debt to 49%-51% of GDP by FY31.

The Union Budget for FY26 seeks to balance fiscal consolidation with economic support. By addressing immediate challenges like urban consumption while laying a foundation for long-term resilience, the budget's effectiveness will depend on its execution, especially in fostering private sector investments and job creation.

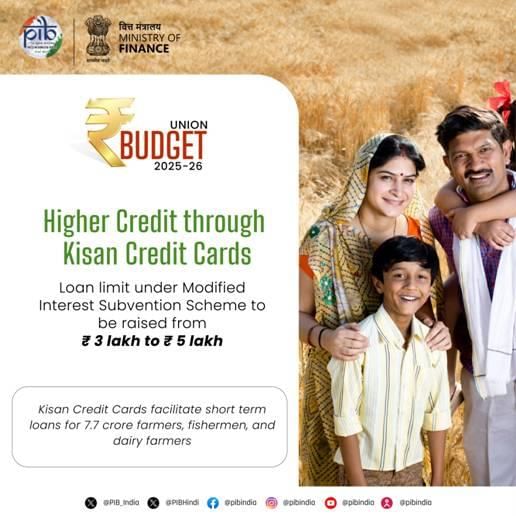

GS3/Economy

Summary of Union Budget 2025-26

Source: The Hindu

Why in News?

Why in News?

The Union Minister for Finance and Corporate Affairs, Smt Nirmala Sitharaman, presented the Union Budget for the fiscal year 2025-26 in the Parliament, outlining key reforms and fiscal strategies aimed at boosting growth and ensuring financial stability.

- Introduction of significant reforms to enhance taxpayer convenience.

- Measures to improve compliance and attract investments.

- Fiscal deficit targets set at 4.4% of GDP for 2025-26.

- New direct tax slabs proposed to provide relief to the middle class.

Additional Details

- Key Reforms: The budget introduced reforms aimed at improving compliance and regulatory environment, including a raise in the FDI limit in insurance from 74% to 100% for companies investing the entire premium in India.

- Fiscal Consolidation: The government reaffirmed its commitment to maintaining fiscal discipline, with revised estimates for the fiscal deficit at 4.8% of GDP for 2024-25 and targeted at 4.4% for 2025-26.

- Middle-Class Tax Relief: No income tax on total income up to ₹12 lakh per annum under the new tax regime, with additional tax relief measures for salaried individuals.

- Investment Promotion: New schemes for international transactions and presumptive taxation for non-residents, along with extended investment deadlines for sovereign wealth and pension funds.

The Union Budget 2025-26 emphasizes the government's focus on growth through reforms and fiscal responsibility, aiming to boost consumption, savings, and overall economic development while enhancing the ease of doing business in India.

GS3/Environment

Inland Mangrove of Guneri

Source: Indian Expres

Why in News?

The Gujarat government has officially designated the inland mangrove in Guneri village, located in the Kutch district, as the first Biodiversity Heritage Site (BHS) of Gujarat. This recognition highlights the ecological significance of this unique natural habitat.

- The inland mangrove is situated 45 km away from the Asrabian Sea and 4 km from Kori Creek, where seawater does not reach.

- It is characterized by a flat landscape resembling a forest and is free from sludge.

- This site represents one of the last remaining inland mangrove ecosystems in India and is one of only eight known locations worldwide.

Additional Details

- Origin: The inland mangrove is believed to have formed due to marine transgression during the Miocene period or along the banks of the ancient Saraswati River in the Great Rann of Kachchh.

- Studies suggest that inland mangroves thrive in regions with limestone deposits, which facilitate a continuous flow of groundwater essential for sustaining the mangrove ecosystem. The Western Kutch area, including Guneri, has records of limestone deposition.

- The announcement of this site as a BHS was made under the provisions of The Biodiversity Act, 2002, which allows state governments to designate areas as BHS after consulting local bodies.

This designation not only emphasizes the importance of biodiversity conservation but also aims to protect the unique ecosystems found within Gujarat's inland mangrove regions.

GS3/Environment

Key Facts about South Georgia Island

Source: BBC

Why in News?

Why in News?

The world's largest iceberg, A23a, has recently broken away from the Filchner Ice Shelf in Antarctica and is now drifting towards South Georgia Island. This event raises concerns due to the island's ecological significance as a wildlife haven.

- South Georgia Island is a mountainous and largely barren island located in the South Atlantic Ocean.

- It is a part of the British overseas territory known as South Georgia and the South Sandwich Islands.

- With an area of 3,756 square kilometers, the island features over 160 glaciers and high peaks, including Mount Paget, which stands at 2,935 meters (9,629 feet).

- The island experiences a sub-Antarctic climate characterized by cold, wet, and windy conditions throughout the year, although it is milder than Antarctica.

- There are no native or permanent human inhabitants, only temporary researchers, officials, and visitors.

Additional Details

- Biodiversity: The harsh Antarctic climate of South Georgia supports only resilient grasses and tundra plants, with three-fourths of the island covered by perpetual snow.

- The island is home to millions of seabirds, such as king penguins, albatrosses, and petrels, alongside large populations of seals, including fur seals and elephant seals, as well as various whale species.

This island's unique ecosystem and the recent threat posed by the iceberg highlight the importance of monitoring and protecting such ecologically significant areas.

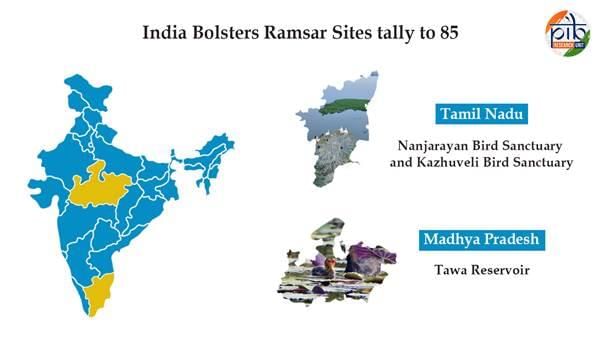

GS3/Environment

New Ramsar Sites in India

Source: Times of India

Why in News?

Why in News?

Recently, four wetlands in India have been designated as Ramsar Convention sites, furthering the country's commitment to the conservation of vital wetland ecosystems.

- Four new Ramsar sites have been added in India: Sakkarakottai Bird Sanctuary, Therthangal Bird Sanctuary, Udhwa Lake, and Khecheopalri Lake.

- These sites are crucial for biodiversity, providing habitats for migratory and resident waterbird species.

Additional Details

- Sakkarakottai Bird Sanctuary: Located in Tamil Nadu, this sanctuary is part of a unique mosaic wetland ecosystem near the Gulf of Mannar, serving as a breeding ground for numerous waterfowl species along the Central Asian flyway.

- Therthangal Bird Sanctuary: Also situated along the Central Asian Flyway, it provides critical breeding and foraging grounds for various waterbirds while playing a significant role in climate regulation and groundwater recharge.

- Udhwa Lake: This wetland in Jharkhand, named after the saint Uddhava from Mahabharata, contains two interconnected water bodies, Patauran and Berhale, and is the first Ramsar designated wetland from Jharkhand.

- Khecheopalri Lake: Found in Sikkim, this sacred lake is revered by both Buddhists and Hindus, known for its tranquil waters believed to be blessed by deities. It is part of the mystical Demazong valley, surrounded by lush forests.

The designation of these sites under the Ramsar Convention underscores their ecological significance and the need for their protection and sustainable management.

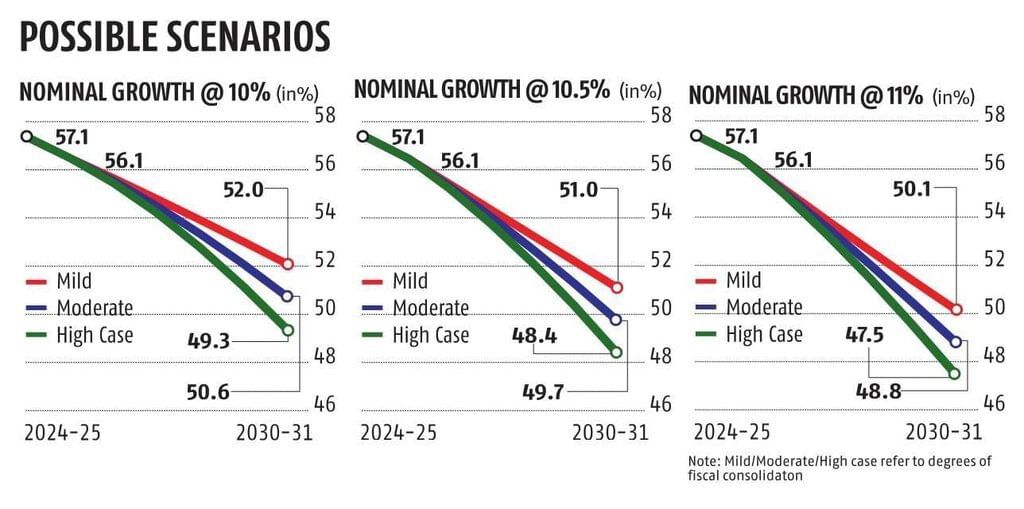

GS3/Economy

Union Budget 2025: India Adopts Debt-GDP Ratio as Key Fiscal Anchor

Source: Indian Express

Why in News?

Why in News?

The central government has announced a strategic shift towards using the “debt-GDP ratio” as the primary fiscal anchor starting from the financial year 2026-27. This decision aims to ensure fiscal sustainability and enhance the management of public finances.

- The debt-GDP ratio will replace the fiscal deficit target as the main fiscal indicator.

- The government aims to reduce the debt-GDP ratio to 50±1% by March 31, 2031.

- This approach aligns with global best practices and focuses on long-term fiscal health.

Additional Details

- Debt-GDP Ratio: This ratio measures a country's national debt in relation to its Gross Domestic Product (GDP) and serves as an indicator of fiscal health, capturing both past and present borrowing trends.

- The central government’s debt-GDP ratio is projected as follows:

- 57.1% in FY 2024-25 (Revised Estimate)

- 56.1% in FY 2025-26

- Declining towards 50% by FY 2031

- The rationale for this shift includes a more reliable measure of fiscal performance, enhanced fiscal transparency, and greater operational flexibility in responding to economic changes.

- Fiscal consolidation strategies will be categorized into mild, moderate, and aggressive approaches based on different nominal GDP growth rates.

The announcement marks a significant shift in India’s fiscal policy, moving from rigid fiscal deficit targets to a more flexible and transparent debt-GDP ratio approach. This strategy aims for long-term fiscal stability, but its success is contingent upon effective fiscal management and favorable global economic conditions. Balancing sustainable debt reduction with adequate investment in development will be crucial for the nation’s economic growth.

GS2/Governance

Bharatiya Bhasha Pustak Scheme

Source: Money Control

Why in News?

The Union Budget for 2025-26 has introduced the Bharatiya Bhasha Pustak Scheme, aimed at providing digital Indian language textbooks to students, promoting accessibility in education.

- The scheme offers digital textbooks and study materials in various Indian languages.

- It targets students in both schools and universities.

- Focuses on enhancing educational resources for diverse linguistic backgrounds.

- It complements previous initiatives like ASMITA, aimed at improving educational infrastructure.

Additional Details

- About Bharatiya Bhasha Pustak Scheme: This new initiative is designed to provide accessible digital learning resources for students, facilitating a better learning experience in their native languages.

- About ASMITA Initiative: ASMITA aims to develop 22,000 books in Indian languages over five years, enhancing the integration of these languages into the education system.

- The project is a collaborative effort between the UGC and the Bharatiya Bhasha Samiti, a high-powered committee under the Ministry of Education.

- Thirteen nodal universities have been designated to lead the effort, supported by member universities from various regions.

- The UGC has established a standard operating procedure (SOP) that outlines the entire book-writing process, from author identification to e-publication.

This scheme represents a significant step towards enriching the learning experience and making educational materials more inclusive for students from different linguistic backgrounds, aligning with the broader goal of enhancing the quality of education across India.

GS3/Science and Technology

Onchocerciasis Elimination in Niger

Source: Indian Express

Why in News?

Why in News?

The World Health Organization (WHO) has recently recognized Niger for successfully meeting the criteria for the elimination of onchocerciasis, a significant achievement in public health.

- Onchocerciasis is known as "river blindness" and is classified as a neglected tropical disease (NTD).

- It is caused by the parasitic worm Onchocerca volvulus.

- Transmission occurs via the bite of an infected blackfly of the genus Simulium.

- Effective treatment involves population-based administration of ivermectin.

- Niger is the first country in Africa to be verified free of onchocerciasis by WHO.

Additional Details

- Symptoms: The disease can cause severe itching, disfiguring skin conditions, and visual impairment, leading to permanent blindness.

- Geographical Impact: It primarily affects rural populations in sub-Saharan Africa and Yemen, with some endemic areas in Latin America.

- Treatment Strategy: The main strategy for elimination is through mass drug administration (MDA) with a target of at least 80% therapeutic coverage.

- Previous countries verified free of onchocerciasis include Colombia (2013), Ecuador (2014), Mexico (2015), Guatemala (2016), and recently Niger (2025).

Onchocerciasis remains a pressing health issue, particularly in impoverished communities. The successful elimination in Niger highlights the effectiveness of coordinated health strategies and underscores the importance of continued efforts to combat neglected tropical diseases globally.

GS3/Economy

National Geospatial Mission

Source: India Today

Why in News?

In the Budget for the fiscal year 2025-26, the Finance Minister introduced the National Geospatial Mission, highlighting the government's commitment to enhancing infrastructure through advanced geospatial technologies.

- The mission will utilize the existing PM Gati Shakti framework.

- It aims to develop foundational geospatial infrastructure and data.

- Focus areas include modernizing land records and improving urban planning.

- The initiative seeks to resolve land disputes and optimize land use.

- It targets benefits for both government agencies and private sector stakeholders.

Additional Details

- Geospatial Data: This refers to information tied to specific locations on the Earth's surface, essential for effective planning and resource management.

- The creation of a robust geospatial database aims to enhance the efficiency and transparency of land reforms, facilitating smoother processes.

- Private stakeholders, including geospatial and drone companies, are expected to see increased demand for their services as a result of this initiative.

The National Geospatial Mission is poised to make a significant impact on urban development and land management, aligning with the government's broader objectives of improving accountability and efficiency in public services.

GS3/Economy

Viksit Bharat and the Budget’s Play with Numbers

Source: The Hindu

Why in News?

Why in News?

The Budget 2025-26 presents significant challenges for the Narendra Modi government in its third term, particularly in tackling issues such as slowing economic growth, increasing income disparity, and declining domestic demand. The government's attempts to balance fiscal consolidation with populist measures have led to contradictions in its policies, especially regarding corporate incentives, tax concessions, and social welfare spending. It is crucial to critically evaluate the key aspects of the budget and its potential implications.

- Economic Survey 2024-25 highlights declining consumption demand and rising income disparity.

- Government projects a fiscal deficit reduction while offering tax concessions to middle-income groups.

- Corporate profits are at a 15-year high, but this has not translated into increased capital investments.

- Global economic conditions are impacting domestic demand and investment negatively.

Additional Details

- Declining Consumption Demand: The Economic Survey indicates that rising income disparity is leading to subdued demand. Wealth is concentrated in large corporations, which have seen profits soar while wage growth remains modest, affecting the purchasing power of lower- and middle-income groups.

- End of Credit-Fuelled Consumption: Past credit expansion has boosted household spending temporarily, but increasing household debt and high interest rates are now curtailing discretionary spending.

- Inflationary Pressures: Persistent inflation in essential commodities has eroded real disposable incomes, pushing consumers to prioritize essential spending over discretionary purchases.

- Fiscal Conservatism: Despite substantial revenue sources, the government has opted for fiscal restraint, leading to spending cuts particularly in capital-intensive sectors, which may adversely affect growth.

- Corporate Behaviour: High corporate profits have not led to increased investments, as many companies are retaining cash and avoiding new job creation due to uncertainties in future demand.

- Foreign Investment Risks: The budget proposes raising the FDI ceiling in the insurance sector to attract more investment, but this could lead to prioritization of profits over consumer welfare, alongside potential legal disputes with transnational corporations.

In conclusion, the Budget 2025-26 aims to balance economic recovery with fiscal discipline. However, its contradictions are evident as it prioritizes corporate incentives and middle-class tax benefits over necessary structural reforms. The effectiveness of this approach in reviving economic growth or exacerbating existing structural issues remains uncertain.

|

51 videos|5377 docs|1138 tests

|