30-Day Study Plan: Accountancy Class 11 | Accountancy Class 11 - Commerce PDF Download

Welcome to the 30-Day Study Plan for Accountancy Class 11! This plan is designed to help you master the CBSE Class 11 Accountancy syllabus, covering Financial Accounting Part I and Part II. Dedicate 2-3 hours daily to follow this plan, and you will be well-prepared for your exams.

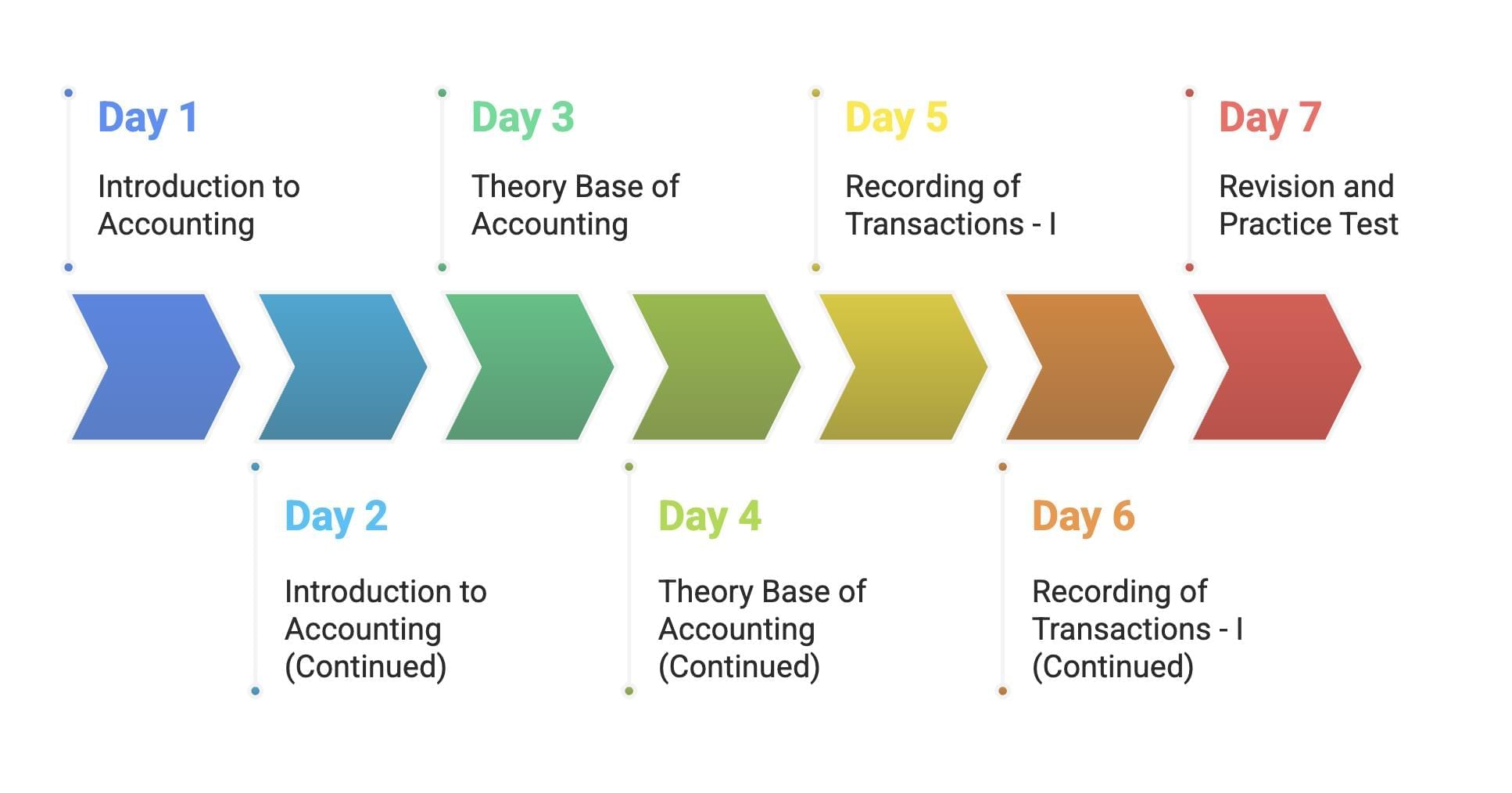

Week 1: Foundations of Accounting

Day 1: Introduction to Accounting

Understand the basics, objectives, and scope of accounting.

- Read: Chapter Notes - Introduction to Accounting

- Watch: Introduction to Accounting

- Task: Create a mind map summarizing key accounting terms using Mind Map: Introduction to Accounting.

- Practice: Attempt Test: Introduction To Accounting - 1

Day 2: Introduction to Accounting (Continued)

Explore users, types, and qualitative characteristics of accounting information.

- Watch: Types of Accounting Information and Qualitative Characteristics

- Read: NCERT Textbook - Introduction to Accounting

- Task: Write a short note on the advantages and disadvantages of accounting.

- Practice: Solve Worksheet: Introduction to Accounting and check Solutions

Day 3: Theory Base of Accounting

Learn about accounting principles and concepts like GAAP and Business Entity.

- Read: Chapter Notes: Theory Base of Accounting

- Watch: What is GAAP? and Business Entity Concept

- Task: Create flashcards for accounting concepts using Flashcards: Theory Base of Accounting.

- Practice: Attempt Test: Theory Base Of Accounting - 1

Day 4: Theory Base of Accounting (Continued)

Study accrual, conservatism, and materiality concepts.

- Watch: Accrual Concept and Conservatism Concept

- Read: NCERT Textbook - Theory Base of Accounting

- Task: Summarize the role of accounting standards.

- Practice: Solve Worksheet: Theory Base of Accounting and check Solutions

Day 5: Recording of Transactions - I

Understand the accounting equation and journal entries.

- Read: Chapter Notes: Recording of Transactions-I

- Watch: What is Accounting Equation? and How to Journalise?

- Task: Solve 5 journal entry problems.

- Practice: Attempt Test: Journal Entries - 1

Day 6: Recording of Transactions - I (Continued)

Learn about source documents and ledger preparation.

- Watch: What are Source Documents? and What is a Ledger?

- Read: NCERT Textbook - Recording of Transactions-I

- Task: Prepare a ledger for 3 transactions.

- Practice: Solve Worksheet: Recording of Transactions - I and check Solutions

Day 7: Revision and Practice Test

Revise concepts from Days 1-6 and assess your understanding.

- Review: Mind Map: Introduction to Accounting and Mind Map: Theory Base of Accounting

- Task: Revise notes and focus on weak areas.

- Practice: Attempt Test: Recording Of Transactions - 1

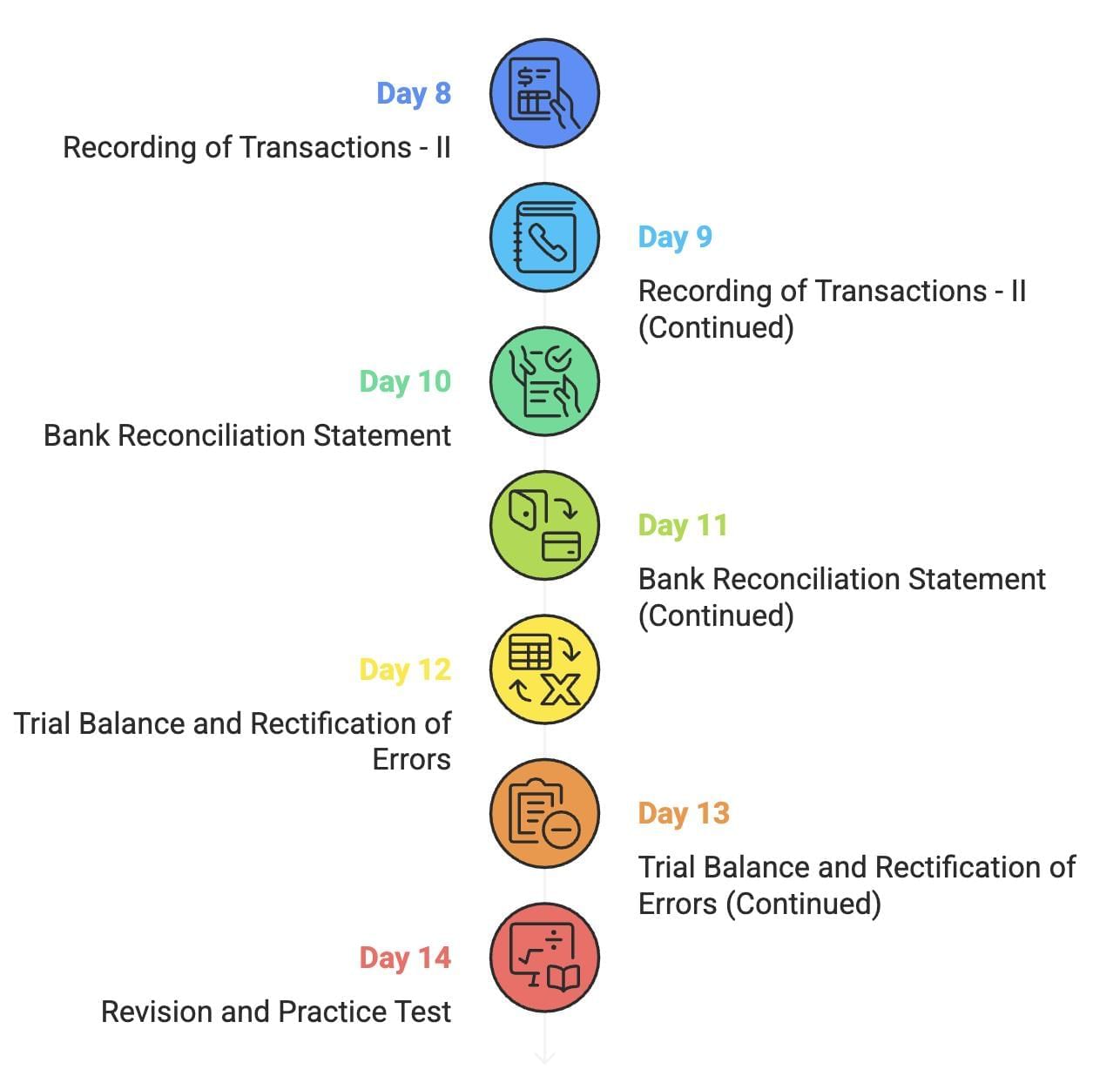

Week 2: Transaction Recording and Subsidiary Books

Day 8: Recording of Transactions - II

Study cash books and balancing accounts.

- Read: Chapter Notes: Recording of Transactions-II

- Watch: Cash Book with Single Column and Balancing the Account

- Task: Prepare a single-column cash book for 5 transactions.

- Practice: Attempt Test: Cash Book - 1

Day 9: Recording of Transactions - II (Continued)

Explore special purpose books like purchase and sales books.

- Read: NCERT Textbook - Recording of Transactions-II

- Watch: Special Purpose Books I - Other Book (Part-1)

- Task: Create a purchase book for 3 transactions.

- Practice: Solve Worksheet: Recording of Transactions - II and check Solutions

Day 10: Bank Reconciliation Statement

Understand the need and preparation of bank reconciliation statements.

- Read: Chapter Notes: Bank Reconciliation Statement

- Watch: Need of Reconciliation and Format of Bank Reconciliation Statement

- Task: Prepare a bank reconciliation statement for a given scenario.

- Practice: Attempt Test: Bank Reconciliation Statement - 1

Day 11: Bank Reconciliation Statement (Continued)

Study differences between cash book and pass book.

- Watch: Distinction between Cash Book and Pass Book

- Read: NCERT Textbook - Bank Reconciliation Statement

- Task: Solve 3 numerical problems on bank reconciliation.

- Practice: Solve Worksheet: Bank Reconciliation Statement and check Solutions

Day 12: Trial Balance and Rectification of Errors

Learn the preparation and objectives of trial balance.

- Read: Chapter Notes: Trial Balance and Rectification of Errors

- Watch: Meaning of Trial Balance and Objectives of Preparing the Trial Balance

- Task: Prepare a trial balance for 5 transactions.

- Practice: Attempt Test: Trial Balance

Day 13: Trial Balance and Rectification of Errors (Continued)

Study types of errors and their rectification.

- Watch: Types of Errors and What is Rectification of Errors?

- Read: NCERT Textbook - Trial Balance and Rectification of Errors

- Task: Rectify 3 errors in a given trial balance.

- Practice: Solve Worksheet: Trial Balance and Rectification of Errors and check Solutions

Day 14: Revision and Practice Test

Revise concepts from Days 8-13 and take a practice test.

- Review: Mind Map: Recording of Transactions II and Mind Map: Bank Reconciliation Statement

- Task: Identify and work on challenging topics

- Practice: Attempt Test: Rectification Of Errors - 1

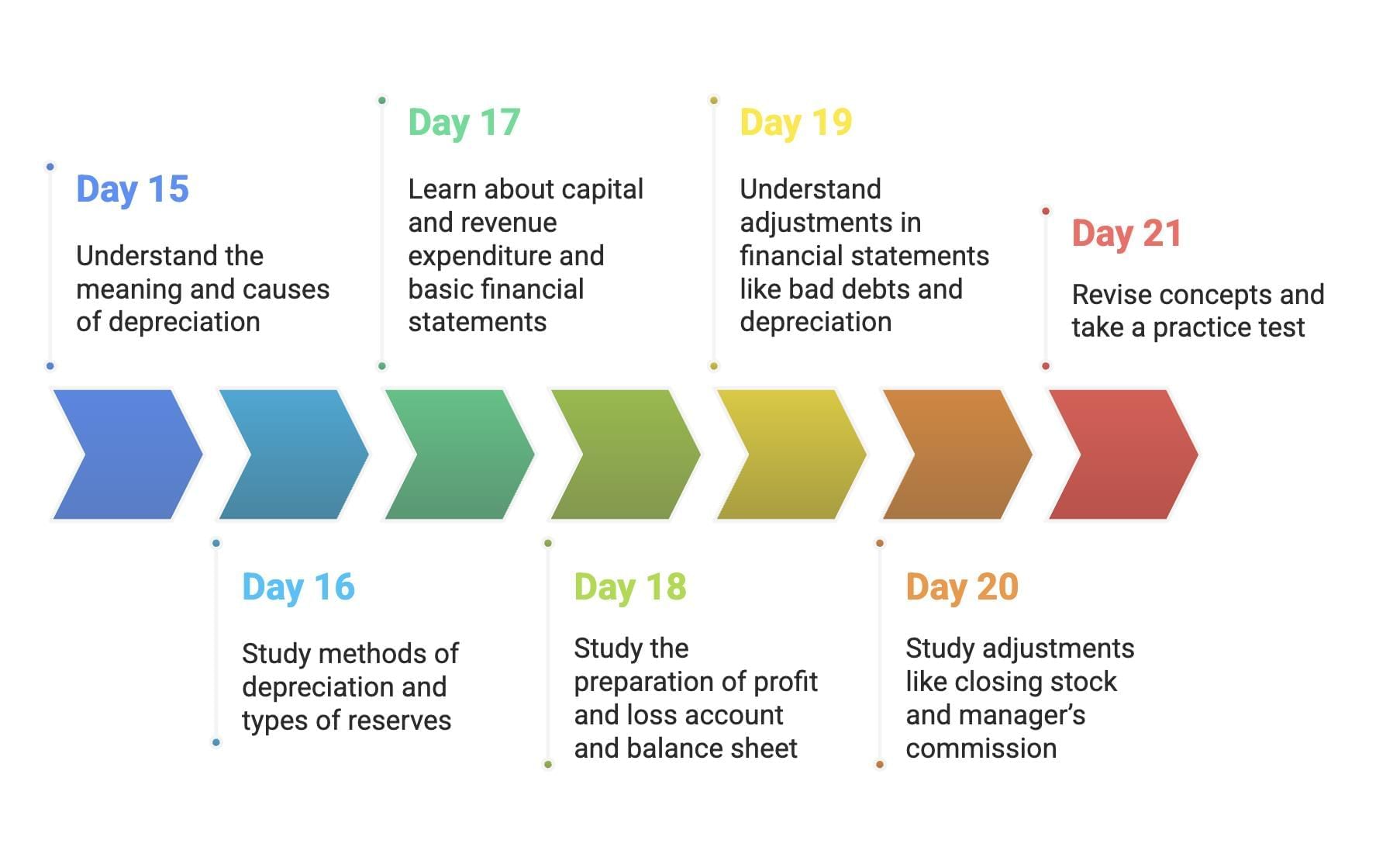

Week 3: Advanced Accounting Concepts

Day 15: Depreciation, Provisions and Reserves

Understand the meaning and causes of depreciation.

- Read: Chapter Notes: Depreciation, Provisions and Reserves

- Watch: Meaning of Depreciation and Causes of Depreciation

- Task: Calculate depreciation using the straight-line method for 2 assets.

- Practice: Attempt Test: Depreciation Provisions And Reserves - 1

Day 16: Depreciation, Provisions and Reserves (Continued)

Study methods of depreciation and types of reserves.

- Watch: Methods of Recording Depreciation and Types of Reserves

- Read: NCERT Textbook - Depreciation, Provisions and Reserves

- Task: Compare straight-line and written-down value methods.

- Practice: Solve Worksheet: Depreciation, Provisions and Reserves and check Solutions

Day 17: Financial Statements - I

Learn about capital and revenue expenditure and basic financial statements.

- Read: Chapter Notes - Financial Statements - I

- Watch: Distinction between Capital and Revenue Expenditure and Financial Statements - 1

- Task: Prepare a trading account for a given dataset.

- Practice: Attempt Test: Financial Statements Of Sole - 1

Day 18: Financial Statements - I (Continued)

Study the preparation of profit and loss account and balance sheet.

- Watch: Financial Statements - 2

- Read: NCERT Textbook - Financial Statements - I

- Task: Prepare a balance sheet for a sole proprietorship.

- Practice: Solve Worksheet: Financial Statements - I and check Solutions

Day 19: Financial Statements - II

Understand adjustments in financial statements like bad debts and depreciation.

- Read: Chapter Notes - Financial Statements - II

- Watch: Bad Debts, Provision for Bad and Doubtful Debt and Adjustment: Depreciation

- Task: Solve 3 adjustment entries for bad debts.

- Practice: Attempt Test: Financial Statements - II

Day 20: Financial Statements - II (Continued)

Study adjustments like closing stock and manager’s commission.

- Watch: Adjusting for Closing Stock and Manager’s Commission

- Read: NCERT Textbook - Financial Statements - II

- Task: Prepare financial statements with 3 adjustments.

- Practice: Solve Worksheet: Financial Statements - II and check Solutions

Day 21: Revision and Practice Test

Revise concepts from Days 15-20 and take a practice test.

- Review: Mind Map: Depreciation Provisions and Reserves and Mind Map: Financial Statements I

- Task: Identify and work on challenging topics.

- Practice: Attempt Test: Financial Statements - 2

Week 4: Specialized Topics and Exam Preparation

Day 22: Accounting for Bills of Exchange

Learn the basics of bills of exchange and their accounting treatment.

- Read: Accounting for Bills of Exchange (Part - 1)

- Watch: Accounting for Bills of Exchange (Part - 2)

- Task: Journalize 3 bill of exchange transactions.

- Practice: Solve NCERT Solution (Part - 1) - Bills of Exchange

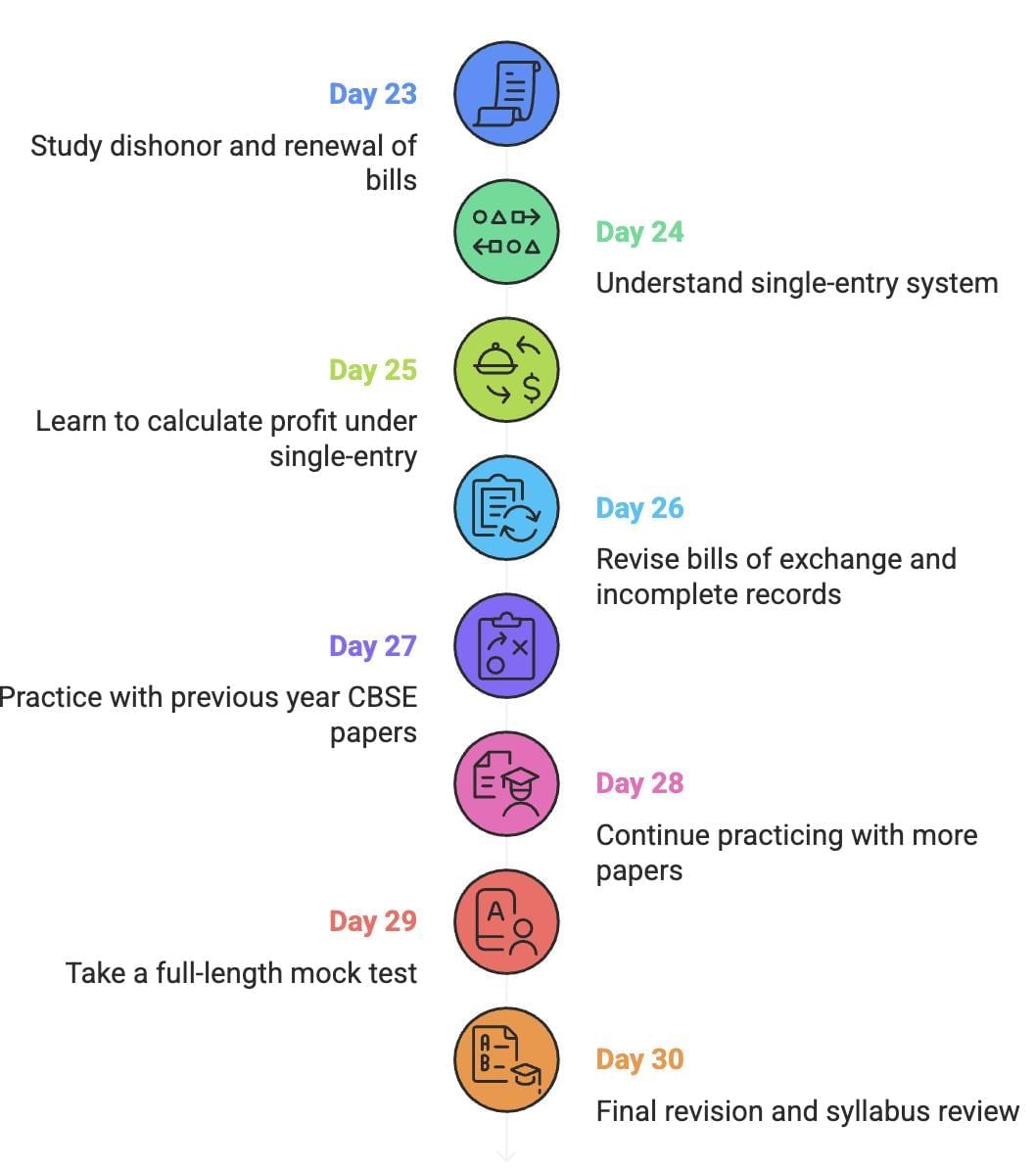

Day 23: Accounting for Bills of Exchange (Continued)

Study dishonor and renewal of bills.

- Watch: Accounting for Bills of Exchange (Part - 3)

- Read: NCERT Textbook - Bills of Exchange

- Task: Solve 3 problems on bill dishonor.

- Practice: Solve NCERT Solution (Part - 3) - Bills of Exchange

Day 24: Accounts from Incomplete Records

Understand single-entry system and its conversion to double-entry.

- Read: Accounts From Incomplete Records Single Entry System (Part - 1)

- Watch: Accounts From Incomplete Records Single Entry System (Part - 2)

- Task: Prepare a statement of affairs for a single-entry system.

- Practice: Solve Accounts From Incomplete Records Single Entry System (Part - 3)

Day 25: Accounts from Incomplete Records (Continued)

Learn to calculate profit under the single-entry system.

- Watch: Accounts From Incomplete Records Single Entry System (Part - 3)

- Task: Solve 2 problems on profit calculation using single-entry.

- Practice: Solve numerical problems from Accounts From Incomplete Records (Part - 1)

Day 26: Revision of Specialized Topics

Revise bills of exchange and incomplete records.

- Review: Accounting for Bills of Exchange (Part - 1) and Accounts From Incomplete Records (Part - 1)

- Task: Summarize key concepts in your own words.

- Practice: Solve mixed problems from NCERT solutions for bills and incomplete records.

Day 27: Previous Year Papers

Practice with previous year CBSE Accountancy papers to understand the exam pattern.

- Solve: Class 11 Accountancy Previous Year Paper - 1

- Solve: Class 11 Accountancy Previous Year Paper - 2

- Task: Analyze mistakes and review related concepts.

Day 28: Previous Year Papers (Continued)

Continue practicing with more previous year papers.

- Solve: Class 11 Accountancy Previous Year Paper - 3

- Solve: Class 11 Accountancy Previous Year Paper - 4

- Task: Time yourself to improve speed and accuracy.

Day 29: Mock Test and Revision

Take a full-length mock test and revise weak areas.

- Solve: Class 11 Accountancy Previous Year Paper - 5

- Task: Revise all mind maps and notes.

- Practice: Focus on numerical problems from financial statements and depreciation.

Day 30: Final Revision and Syllabus Review

Revise all topics and review the syllabus to ensure complete coverage.

- Review: Syllabus: Accountancy for Class 11

- Task: Revise all flashcards and mind maps.

- Practice: Solve mixed questions from Previous Year Questions (PYQs)

Tips for Effective Preparation

- Stay Consistent: Dedicate 2-3 hours daily and follow the schedule diligently.

- Use Visual Aids: Leverage mind maps and flashcards to reinforce concepts like journal entries and depreciation methods.

- Practice Numericals: Solve worksheets and tests regularly to master accounting calculations.

- Revise Actively: Summarize concepts in your own words and practice past papers to enhance retention.

- Stay Positive: Take short breaks, stay motivated, and maintain a positive mindset to avoid burnout.

|

60 videos|154 docs|35 tests

|

FAQs on 30-Day Study Plan: Accountancy Class 11 - Accountancy Class 11 - Commerce

| 1. What are the basic principles of accounting that students should focus on during their studies? |  |

| 2. How can students effectively record transactions in subsidiary books? |  |

| 3. What advanced accounting concepts should students be aware of for their exams? |  |

| 4. What specialized topics might be included in the syllabus, and how can students prepare for them? |  |

| 5. What are some effective study tips for preparing for an accountancy exam? |  |